Best Crypto Launchpads & IDO/IEO Platforms (2025)

Who this guide is for. Crypto investors comparing best crypto launchpads 2025 to access early token sales with clearer rules, costs, and eligibility.

Top three picks.

- Binance Launchpad — scale + liquidity, clear subscription/holding models. (Binance Launchpad | Binance)

- OKX Jumpstart — simple mining/sale formats, frequent events. (OKX)

- Bybit Launchpad — accessible formats across CEX + Web3 IDO. (bybit.com)

One key caveat. Availability varies by jurisdiction (many CEX launchpads restrict U.S. users and require KYC). Always check your platform’s official eligibility and KYC pages. (Binance)

Introduction: Why Crypto Launchpads & IDO/IEO Platforms Matter in November 2025

Definition (snippet-ready): A crypto launchpad is a platform that hosts early token distribution events (IDO/IEO) with defined participation rules, allocations, and settlement.

In 2025, primary-market access has consolidated around large exchanges and a handful of battle-tested decentralized platforms. For investors, best crypto launchpads 2025 decisions hinge on liquidity, security/compliance, costs, and eligibility. Centralized exchange (CEX) launchpads (e.g., Binance, OKX, Bybit) emphasize KYC and region filters, while decentralized launchpads (e.g., Polkastarter, DAO Maker) lean on wallet-based participation and project curation. We scored providers using transparent weights, verified details only from official pages, and noted regional restrictions where platforms disclose them. Freshness: Updated November 2025.

How We Picked (Methodology & Scoring)

We shortlisted ~20 credible platforms, then selected TOP_N = 10 based on official evidence (docs/help/pricing/status/security pages). Third-party data was used only for cross-checks, not cited.

Scoring Weights (sum = 100):

- Crypto Liquidity — 30% (exchange depth, historical sale demand, listing path)

- Security — 25% (KYC/eligibility controls, disclosures, operational maturity)

- Coverage — 15% (event frequency, multichain reach)

- Costs — 15% (explicit sale/processing fees when stated; otherwise “varies; network fees apply”)

- UX — 10% (clarity of rules, access flow)

- Support — 5% (help center clarity, announcements cadence)

Data sources: Official product, help, terms, and announcement pages; platform status/audit pages where available. Last updated: November 2025.

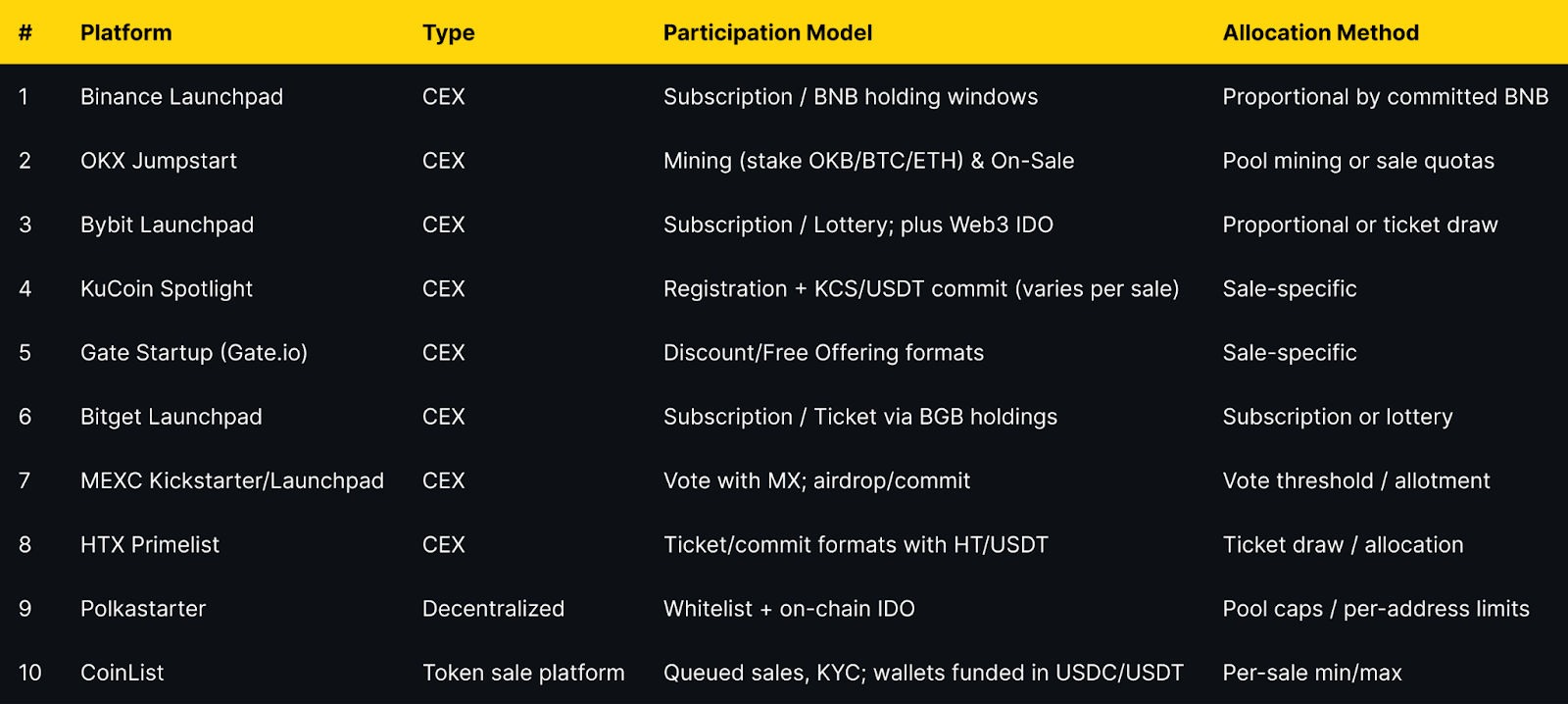

Best Crypto Launchpads & IDO/IEO Platforms in November 2025 (Comparison Table)

* Always confirm current eligibility on the platform’s official Terms/Help pages before participating.

** Some decentralized pools may require external KYC/allowlists set by the project.

Top 10 Crypto Launchpads & IDO/IEO Platforms in November 2025

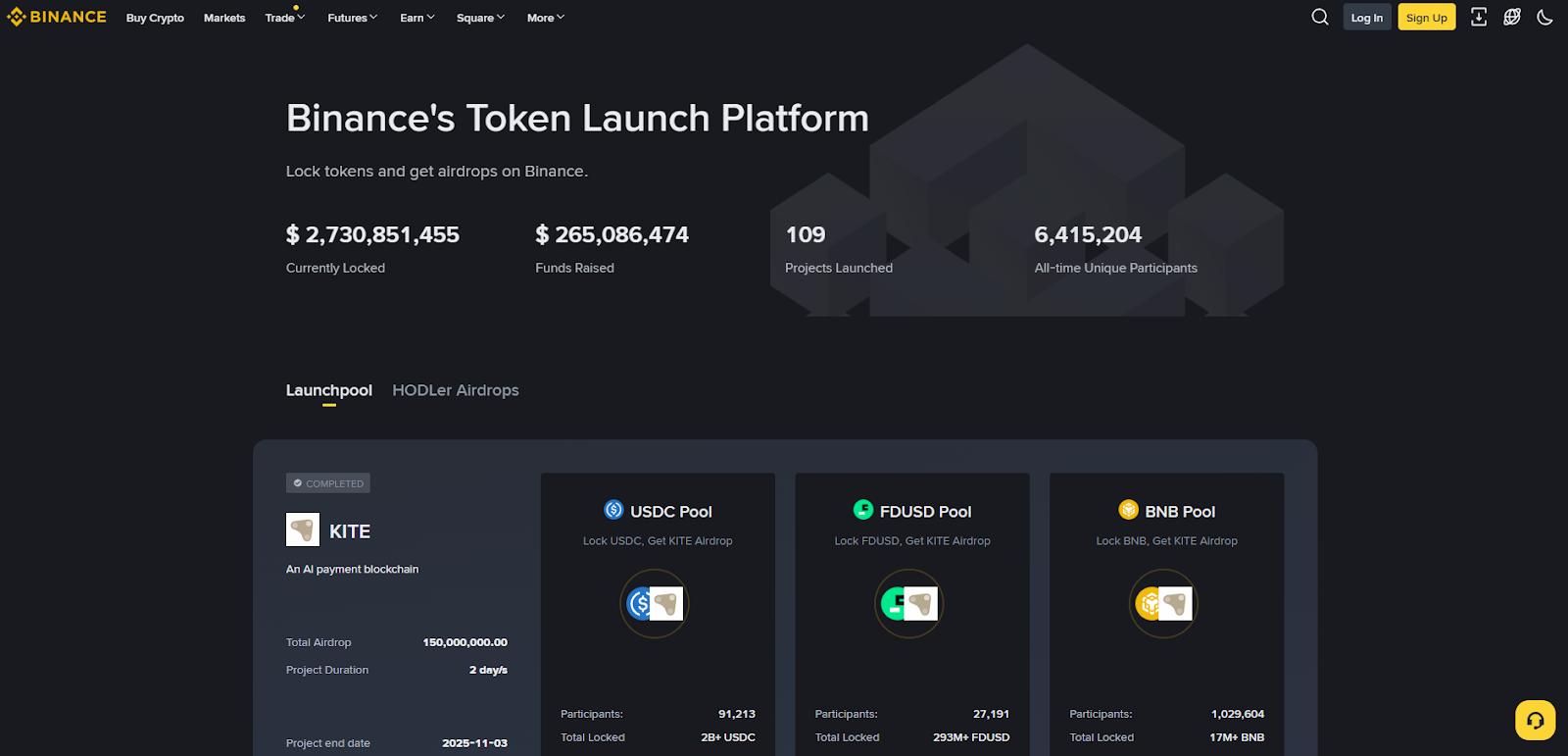

1. Binance Launchpad — Best for scale and liquidity

Why Use It. Binance Launchpad runs subscription-style sales that typically require BNB holdings across a snapshot window, then proportional allocation by committed BNB. The process is well documented and integrated with Binance listings, giving post-sale liquidity depth. (Binance Launchpad | Binance)

Best For. Allocation hunters, liquidity-first traders, portfolio builders seeking large-venue listings.

Notable Features. Subscription model; BNB commitment windows; integrated post-listing ecosystem; robust help center. (Binance)

Consider If. Not available in prohibited jurisdictions; KYC required. (Binance)

Fees Notes. Varies; trading/network fees apply.

Regions. Global, with restricted countries noted in Terms. (Binance)

Alternatives. OKX Jumpstart, Bybit Launchpad.

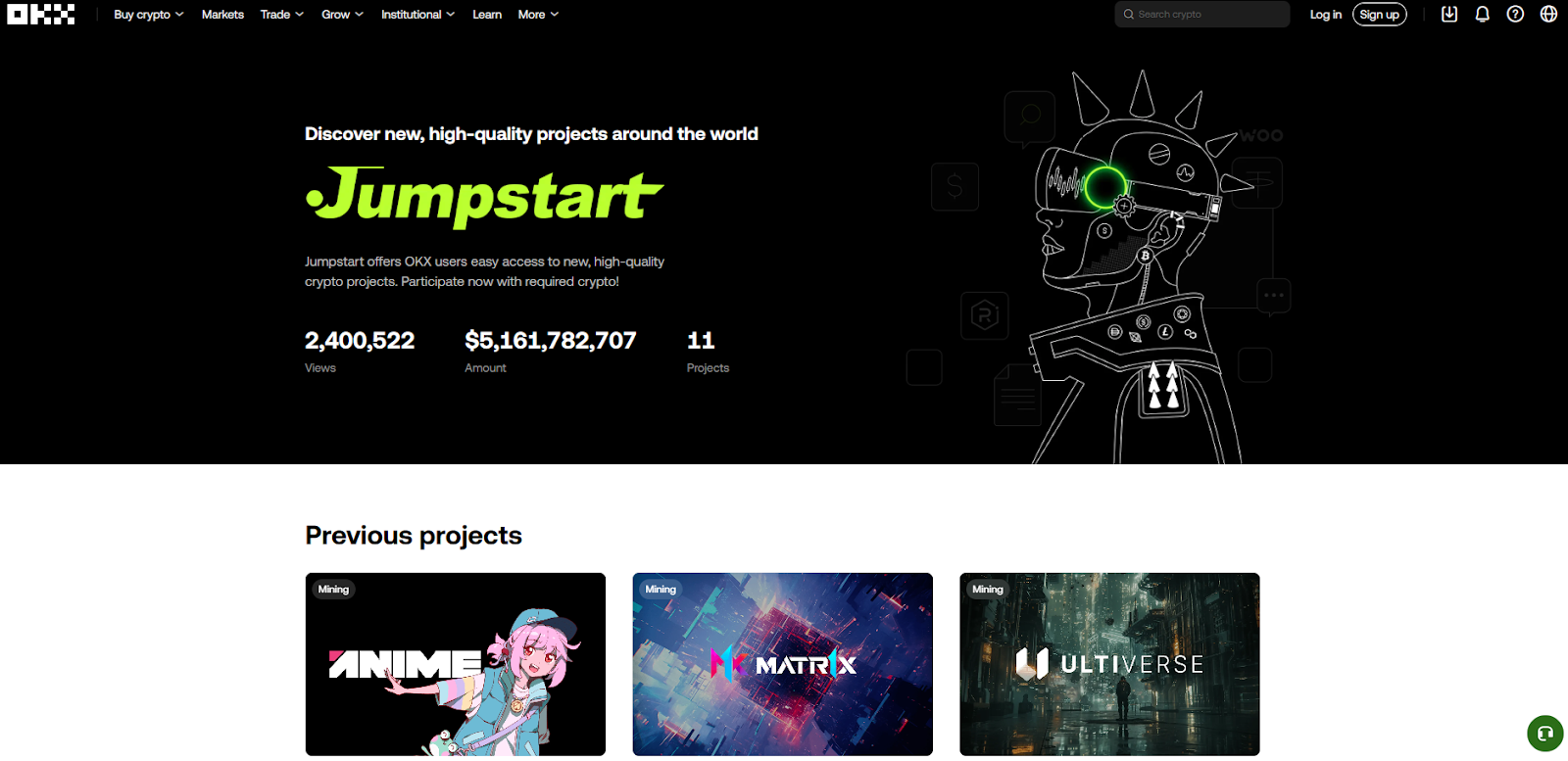

2. OKX Jumpstart — Best for simple mining + sale formats

Why Use It. Jumpstart offers Mining events where users stake assets (e.g., OKB, BTC, ETH) to earn new tokens, alongside occasional On-Sale formats. Participation rules are clearly posted per event. (OKX)

Best For. Long-only users holding OKB/BTC/ETH, set-and-forget miners, diversified hunters of frequent drops.

Notable Features. Mining & sale dual formats; event pages with tokenomics; frequent announcements. (OKX)

Consider If. Jurisdiction limits apply; verify your eligibility. (OKX)

Fees Notes. Varies; network fees apply.

Regions. Global with restrictions per OKX policies.

Alternatives. Binance Launchpad, Gate Startup.

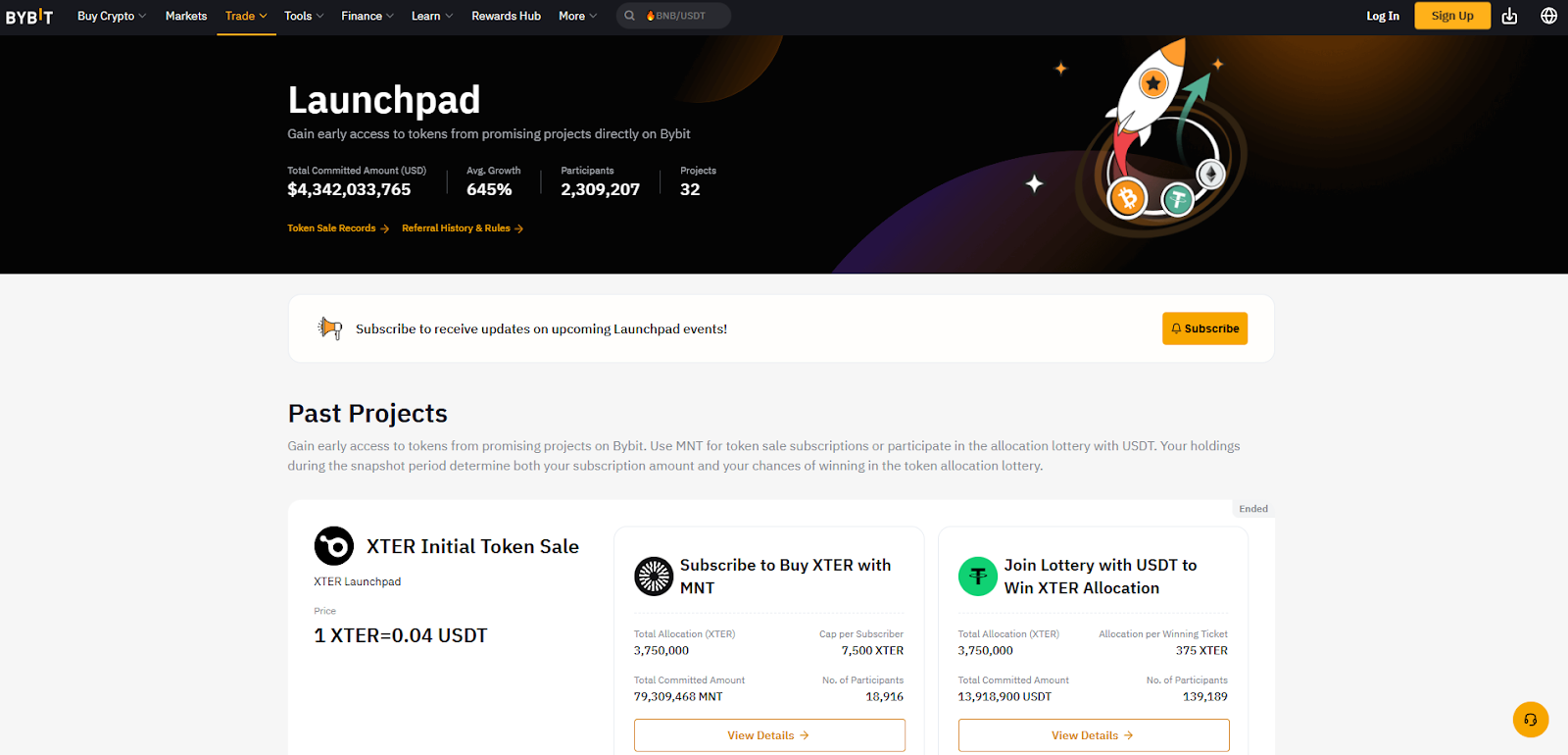

3. Bybit Launchpad — Best CEX + Web3 coverage

Why Use It. Bybit runs subscription/lottery sales on the exchange and also operates a Web3 IDO platform for wallet-based participation. Clear KYC tiers and frequent help-center updates support new users. (bybit.com)

Best For. Users who want both exchange launchpad and Web3 IDO in one brand, ticket/lottery mechanics.

Notable Features. Subscription and lottery formats; Web3 IDO portal; detailed KYC guidance. (bybit.com)

Consider If. Not available in excluded jurisdictions (e.g., U.S.). (bybit.com)

Fees Notes. Varies; network fees apply.

Regions. Global (excluded jurisdictions listed by Bybit). (bybit.com)

Alternatives. Binance Launchpad, Bitget Launchpad.

4. KuCoin Spotlight — Best for altcoin discovery on a major exchange

Why Use It. Spotlight aggregates new listings and has hosted high-profile events. Participation generally requires KYC and following sale-specific rules posted in help/announcement pages. (KuCoin)

Best For. Altcoin-oriented users who want curated sales and subsequent exchange liquidity.

Notable Features. Dedicated Spotlight center; sale how-to guides; history of ended sales. (KuCoin)

Consider If. U.S. users are restricted per KuCoin Terms. (KuCoin)

Fees Notes. Varies; network fees apply.

Regions. Global (U.S. and other locations restricted). (KuCoin)

Alternatives. Gate Startup, MEXC Kickstarter.

5. Gate Startup (Gate.io) — Best for frequent offerings and varied formats

Why Use It. Gate’s Startup page offers discount and free-offering formats, with active cadence and explicit instructions in announcements and help articles. KYC is required for participation. (Gate.com)

Best For. Deal hunters, high-frequency participants, multi-format collectors.

Notable Features. Discount and free-offering modes; constant announcements; centralized hub. (Gate.com)

Consider If. Make sure you’ve completed Gate KYC before events. (Gate.com)

Fees Notes. Varies; network fees apply.

Regions. Global (subject to KYC and eligibility).

Alternatives. OKX Jumpstart, MEXC Kickstarter.

6. Bitget Launchpad — Best for BGB-based subscription or ticket access

Why Use It. Bitget runs subscription and ticket models, often tied to BGB holdings/trading activity. Official FAQ and blog posts detail eligibility and formats. (bitget.com)

Best For. Users already in the Bitget ecosystem; lottery-style allocation seekers.

Notable Features. BGB-linked ticketing; subscription flows; event records page. (bitget.com)

Consider If. Region limits apply and formats can vary by event.

Fees Notes. Varies; network fees apply.

Regions. Global with restrictions.

Alternatives. Bybit Launchpad, HTX Primelist.

7. MEXC Kickstarter / Launchpad — Best for vote-to-airdrop mechanics

Why Use It. Kickstarter lets MX holders vote to support pre-launch projects and receive airdrops when thresholds are met; official FAQs outline steps and eligibility. (MEXC)

Best For. Airdrop hunters, MX token holders, event-driven users.

Notable Features. Vote-to-airdrop; quick-commit across events; MX minimums. (MEXC)

Consider If. Rewards, formats, and eligibility can change per event—read each page.

Fees Notes. Varies; network fees apply.

Regions. Global with restrictions.

Alternatives. Gate Startup, Bitget Launchpad.

8. HTX Primelist — Best for ticket/commit sale mechanics

Why Use It. Primelist runs ticket/commit structures where users may lock HT/USDT or complete tasks to obtain tickets; official announcements describe cadence and rules. (htx.com)

Best For. Users comfortable with ticket allocations and exchange-based listings.

Notable Features. Ticket draws; commitment options; frequent listing promos. (htx.com)

Consider If. Check jurisdiction limits and sale-specific rules each time.

Fees Notes. Varies; network fees apply.

Regions. Global with restrictions.

Alternatives. Bitget Launchpad, Bybit Launchpad.

9. Polkastarter — Best decentralized IDO for whitelists and on-chain caps

Why Use It. Polkastarter hosts curated on-chain IDOs with per-address caps and allowlists, giving transparent pool limits and wallet-based participation. Project pages and a launch portal outline the process. (polkastarter.com)

Best For. Users preferring self-custody, on-chain settlement, and project allowlists.

Notable Features. On-chain pools; whitelist workflows; project directories. (polkastarter.com)

Consider If. Some projects impose geofences/KYC—always read pool terms.

Fees Notes. Network gas; project-level terms.

Regions. Global; project-dependent restrictions may apply.

Alternatives. DAO Maker, CoinList.

10. CoinList — Best for fully KYC’d token sales and wallet funding

Why Use It. CoinList runs queued token sales with per-sale minimums/maximums and strict KYC. Help articles detail wallet funding in USDC/USDT and purchase flows. (CoinList)

Best For. Users who prefer structured, compliance-forward public sales with clear limits.

Notable Features. Queue systems; per-sale caps; explicit instructions; wallet funding guides. (CoinList)

Consider If. Eligibility varies by sale; expect KYC and sometimes region-specific exclusions.

Fees Notes. Stated per sale; network fees apply.

Regions. Global (U.S. participation depends on each sale’s terms).

Alternatives. Polkastarter, Binance Launchpad.

Decision Guide: Best By Use Case

- Largest venue + liquidity: Binance Launchpad. (Binance Launchpad | Binance)

- Stake-to-earn + sales cadence: OKX Jumpstart. (OKX)

- Exchange + Web3 IDO in one brand: Bybit Launchpad / Bybit Web3 IDO. (bybit.com)

- Altcoin discovery, historical sale stream: KuCoin Spotlight. (KuCoin)

- Frequent discount/free offerings: Gate Startup. (Gate.com)

- Lottery/ticket mechanics with native token: Bitget Launchpad. (bitget.com)

- Vote-to-airdrop model: MEXC Kickstarter. (MEXC)

- Ticket/commit structure alternative: HTX Primelist. (htx.com)

- Decentralized, wallet-based IDO: Polkastarter. (polkastarter.com)

- KYC-heavy, queued sales: CoinList. (CoinList)

How to Choose the Right Launchpads & IDO/IEO Platforms (Checklist)

- Confirm region eligibility and KYC requirements on official pages. (Binance)

- Match participation model to your balance (subscription, tickets, staking, whitelist).

- Review allocation math (proportional vs. lottery vs. per-address caps).

- Verify fees and settlement (sale fees if stated; otherwise network gas).

- Assess liquidity path post-sale (likely listing venue/pairs).

- Read project pages/announcements for rules and tokenomics. (OKX)

- Confirm wallet readiness (CEX spot wallet vs. Web3 wallet).

- Check support/help centers for timelines and dispute processes. (bybit.com)

- Look for status/security disclosures when available.

- Red flag: Guaranteed returns, unclear token distribution, or missing official docs.

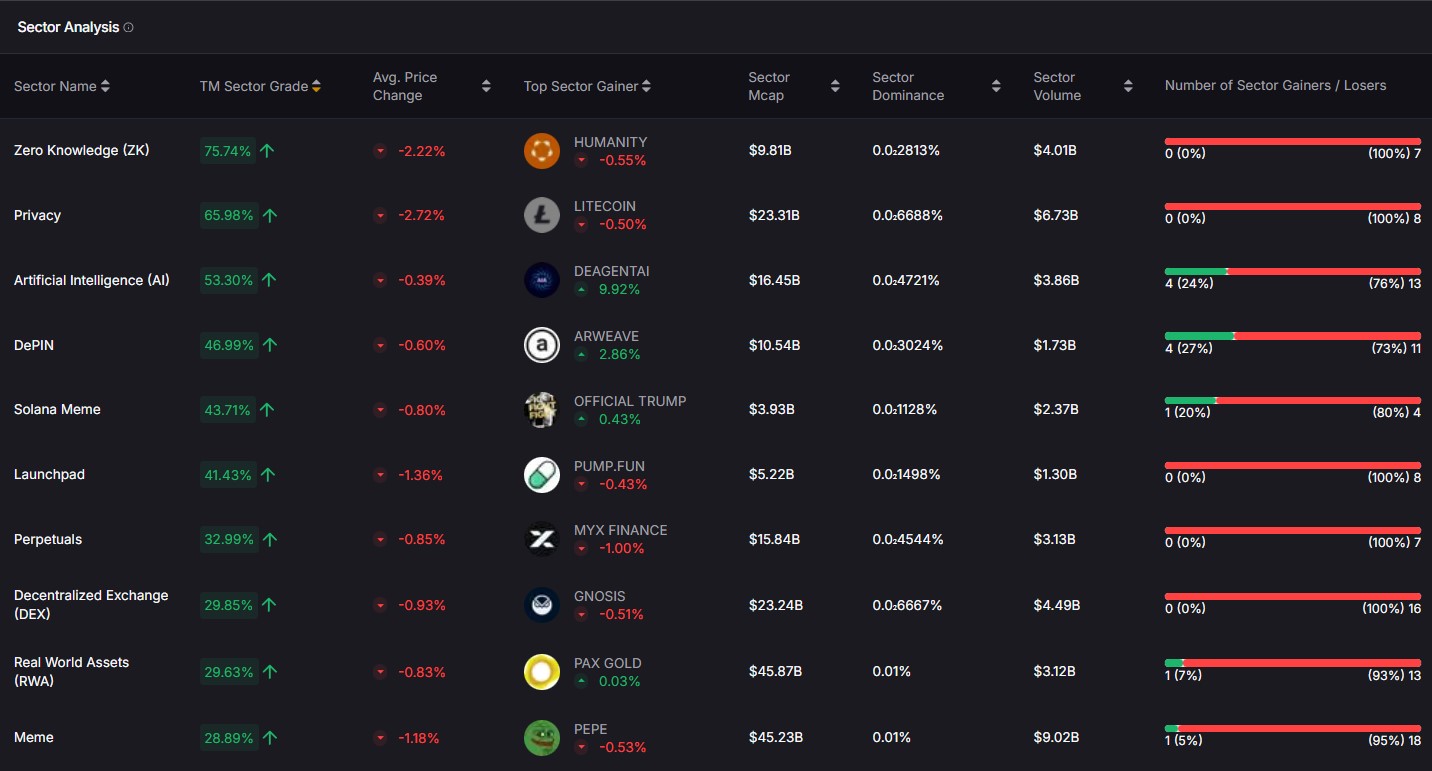

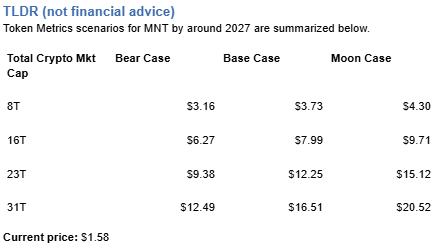

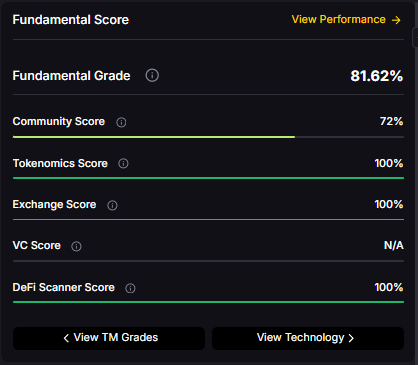

Use Token Metrics With Any Crypto Launchpads & IDO/IEO Platforms

- AI Ratings to screen assets for quality and momentum before committing.

- Narrative Detection to spot emerging themes early.

- Portfolio Optimization to size positions across chains and venues.

- Alerts & Signals to time unlocks, listings, and trend shifts.

Workflow: Research with TM → Choose platform → Execute sale participation → Monitor with alerts.

Start free trial to screen assets and time entries with AI.

Security & Compliance Tips

- Use official URLs only; watch for spoofed domains.

- Complete KYC where required; never share documents outside official flows. (bybit.com)

- For decentralized sales, verify contract addresses and pool caps on official pages. (polkastarter.com)

- Understand allocation rules (subscription math, lottery odds, staking snapshots). (Binance)

- Track vesting/claim portals via official announcements. (OKX)

- Avoid over-approving Web3 wallets; limit approvals and revoke after use.

- Maintain 2FA and withdrawal allowlists on CEX accounts.

- {This article is for research/education, not financial advice.}

Beginner Mistakes to Avoid

- Joining from a restricted jurisdiction and losing access later. (bybit.com)

- Ignoring sale-specific rules (snapshots, minimums, per-sale caps). (CoinList)

- Using the wrong wallet type for Web3 IDO vs. CEX subscription. (bybit.com)

- Overlooking vesting/claim deadlines and token distribution mechanics. (OKX)

- Falling for unofficial links or phishing around high-demand sales.

- Committing more than you can afford under volatile market conditions.

How We Picked (Methodology & Scoring)

We evaluated ~20 providers (including Seedify, TrustPad, BSCPad, PinkSale, BullPerks, Enjinstarter, Poolz, WeStarter, GameFi, ApeTerminal, and Republic Crypto) for liquidity (30), security (25), coverage (15), costs (15), UX (10), support (5) using only official pages for claims. We excluded defunct/region-ineligible platforms for Global readers or those lacking current official documentation. Last updated November 2025.

FAQs

What is a crypto launchpad?

A platform that hosts early token distributions (IDO/IEO) with rules for eligibility, allocation, and settlement, either on an exchange or on-chain.

Are launchpads safe?

Safety depends on the platform and the project. Prefer venues with clear KYC/eligibility, transparent rules, and official documentation, and use strong account security. (Binance)

What fees should I expect?

Some platforms state sale/processing terms on event pages; otherwise expect network gas and standard trading fees after listing. Always read each sale’s official page.

Can U.S. users participate?

Many CEX launchpads restrict U.S. users per their Terms. Check platform eligibility before committing. (Binance)

Do I need KYC?

Most CEX launchpads require KYC. Decentralized IDOs may be wallet-only but can still impose allowlists or geofences per project. (bybit.com)

How do allocation methods differ?

Common approaches include proportional subscription, lottery/tickets, staking/mining, and whitelist caps for on-chain pools. (Binance)

Conclusion + Related Reads

If you want the broadest liquidity and simple participation, start with Binance Launchpad or OKX Jumpstart. For CEX + Web3 flexibility, Bybit stands out. Prefer self-custody? Explore Polkastarter and read each project’s terms carefully. Pair your launchpad activity with Token Metrics research, alerts, and portfolio tools to manage risk.

Related Reads:

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)