Best Liquid Restaking Tokens & Aggregators (2025)

Who this guide is for. Investors and builders comparing best liquid restaking tokens (LRTs) and aggregators to earn ETH staking + restaking rewards with on-chain liquidity.

Top three picks.

- ether.fi (eETH/weETH): Non-custodial, deep integrations, clear docs. (ether.fi)

- Renzo (ezETH): Multi-stack (EigenLayer + Symbiotic/Jito), transparent 10% rewards fee. (docs.renzoprotocol.com)

- Kelp DAO (rsETH): Broad DeFi reach; explicit fee policy for direct ETH deposits. (kelp.gitbook.io)

One key caveat. Fees, redemption paths, and regional access vary by protocol—check official docs and terms before depositing.

Introduction

Liquid restaking lets you restake staked assets (most often ETH) to secure Actively Validated Services (AVSs) while receiving a liquid restaking token you can use across DeFi. The value prop in 2025: stack base staking yield + restaking rewards, with composability for lending, LPing, and hedging. In this commercial-investigational guide, we compare the best liquid restaking tokens and the top aggregators that route deposits across operators/AVSs, with an emphasis on verifiable fees, security posture, and redemption flow. We weigh scale and liquidity against risk controls and documentation quality to help you pick a fit for your region, risk tolerance, and toolstack.

How We Picked (Methodology & Scoring)

- Liquidity — 30%: On-chain depth, integrations, and redemption mechanics.

- Security — 25%: Audits, docs, risk disclosures, validator design.

- Coverage — 15%: AVS breadth, multi-stack support (EigenLayer/Symbiotic/Jito), asset options.

- Costs — 15%: Transparent fee schedules and user economics.

- UX — 10%: Clarity of flows, dashboards, and docs.

- Support — 5%: Status pages, help docs, comms.

Evidence sources: official websites, docs, pricing/fees and security pages, and status/terms pages; third-party datasets used only to cross-check volumes. Last updated November 2025.

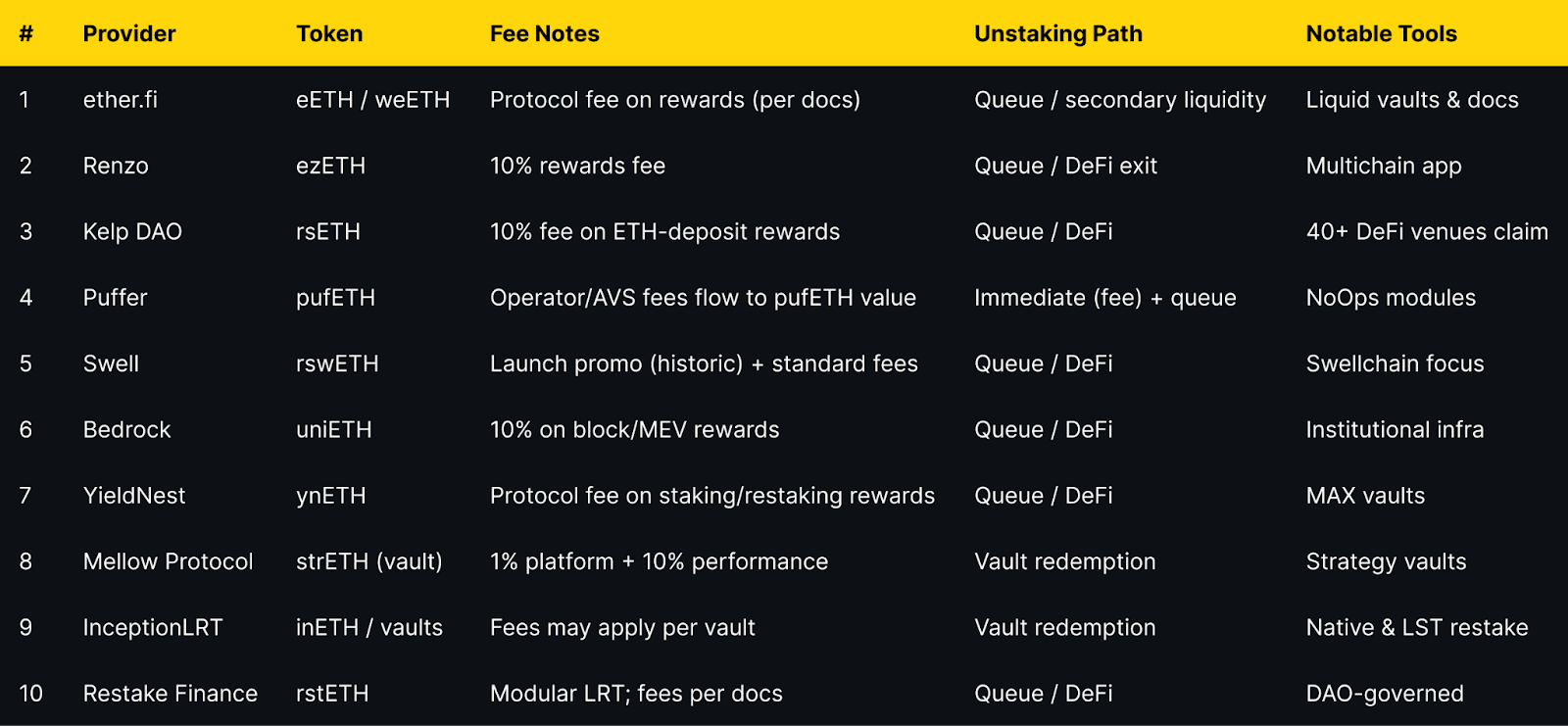

Best Liquid Restaking Tokens & Aggregators in November 2025 (Comparison Table)

* Regions are “Global” unless a provider geoblocks specific jurisdictions in their terms. Always verify eligibility in your country.

Top 10 Liquid Restaking Tokens & Aggregators in November 2025

1. ether.fi — Best for deep integrations & non-custodial design

Why use it: ether.fi’s eETH/weETH are widely integrated across DeFi, and the project publishes clear technical docs on protocol fees and validator design. Liquid Vaults add strategy optionality while keeping restaking accessible. (ether.fi)

Best for: DeFi power users, liquidity seekers, builders needing broad integrations.

Notable features: Non-custodial staking; restaking support; Liquid Vaults; documentation and terms around protocol fees. (etherfi.gitbook.io)

Fees Notes: Protocol fee on rewards; vault-level fees vary by strategy. (etherfi.gitbook.io)

Regions: Global*

Consider if: You want deep liquidity and docs; always review fee tables and redemption queues.

Alternatives: Renzo, Kelp DAO.

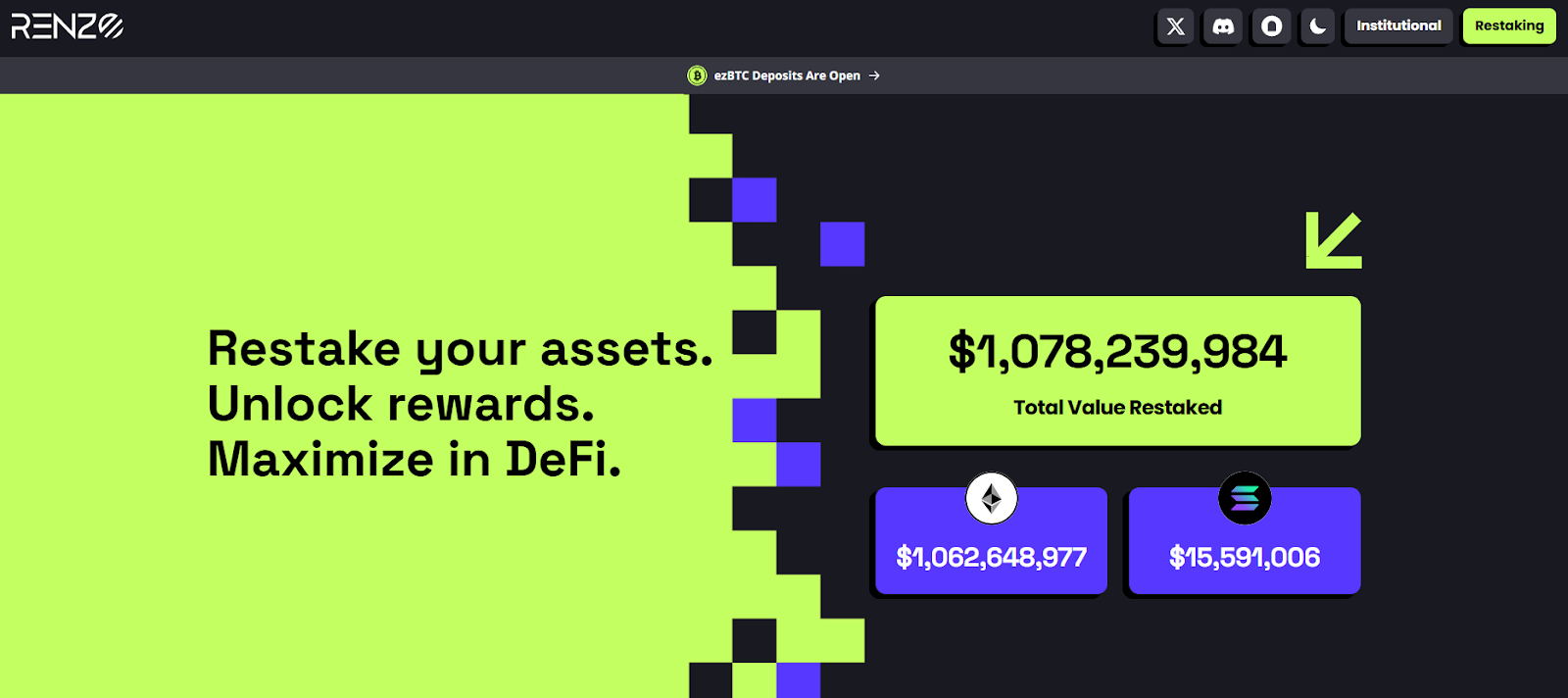

2. Renzo — Best for multi-stack coverage (EigenLayer + Symbiotic/Jito)

Why use it: Renzo’s ezETH is among the most recognizable LRTs and the docs clearly state a 10% rewards fee, while the app highlights support beyond EigenLayer (e.g., Symbiotic/Jito lines). Strong multichain UX. (docs.renzoprotocol.com)

Best for: Users wanting straightforward economics and chain-abstracted access.

Notable features: Clear fee policy (10% of restaking rewards); multi-stack support; app UX across chains. (docs.renzoprotocol.com)

Fees Notes: 10% of restaking rewards; details in docs. (docs.renzoprotocol.com)

Regions: Global*

Consider if: You prefer transparent fees and broader stack exposure.

Alternatives: ether.fi, Mellow.

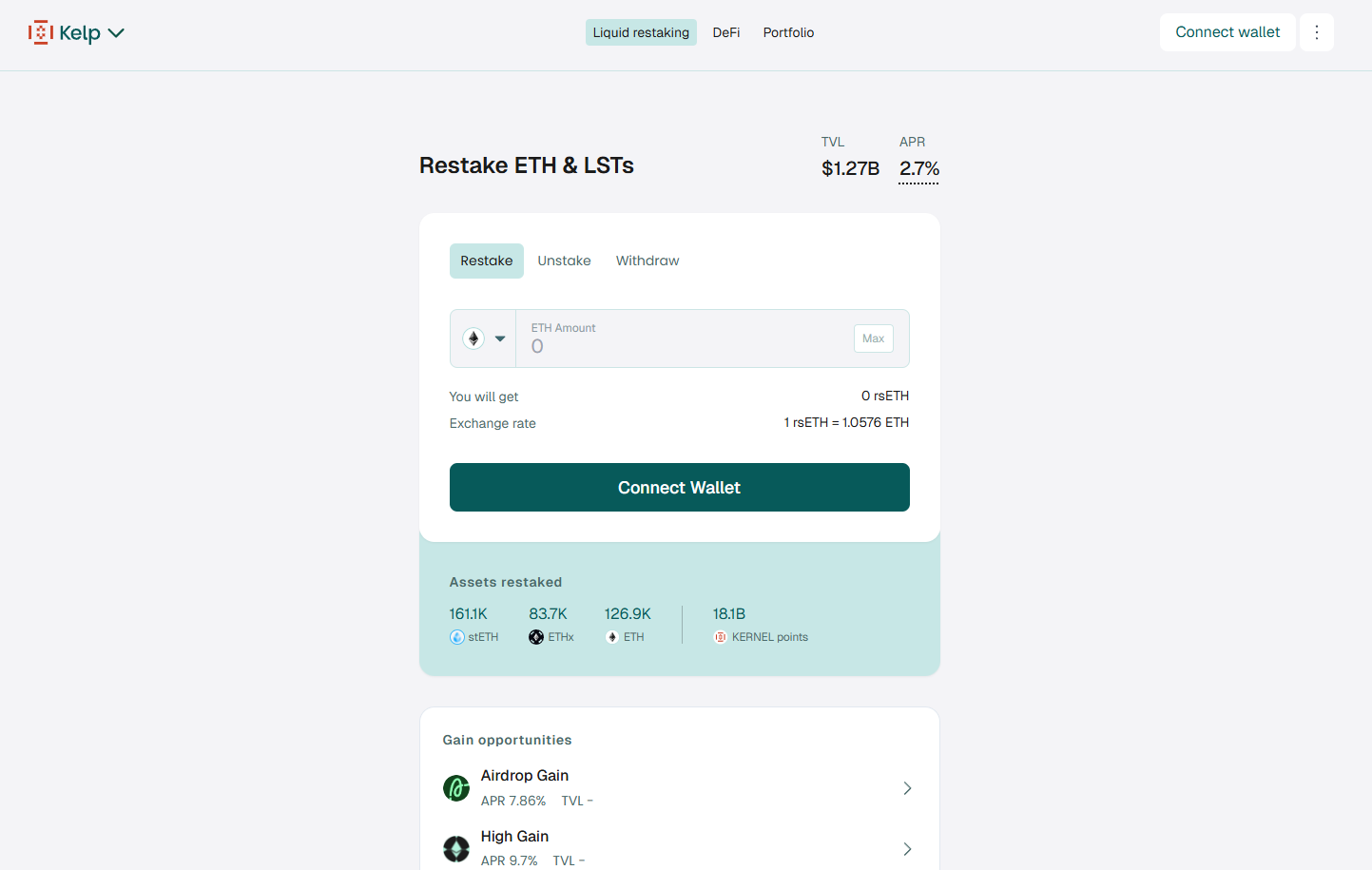

3. Kelp DAO — Best for broad DeFi distribution (rsETH)

Why use it: Kelp emphasizes reach (rsETH used across many venues). Official docs state a 10% fee on rewards for direct ETH deposits, with no fee on LST deposits, making it friendly to LST holders. (kelpdao.xyz)

Best for: LST holders, LPs, and integrators.

Notable features: rsETH liquid token; LST and ETH deposit routes; active integrations. (kelpdao.xyz)

Fees Notes: 10% on ETH-deposit rewards; no fee on LST deposits per docs. (kelp.gitbook.io)

Regions: Global*

Consider if: You want flexibility between ETH and LST deposit paths.

Alternatives: Renzo, Swell.

4. Puffer — Best for redemption optionality (pufETH)

Why use it: Puffer’s docs explain how AVS fees accrue to pufETH and outline operator/guardian roles. Public risk work notes an “immediate redemption” option with a fee when liquidity is available, plus queued exit. (docs.puffer.fi)

Best for: Users wanting explicit redemption choices and a technical spec.

Notable features: pufETH nLRT; operator/guardian model; based L2 plans. (Puffer: Building the Future of Ethereum)

Fees Notes: AVS/operator fees accrue; immediate redemption may incur a fee. (docs.puffer.fi)

Regions: Global*

Consider if: You value documented mechanics and redemption flexibility.

Alternatives: ether.fi, Bedrock.

5. Swell — Best for restaking-native ecosystem (rswETH)

Why use it: Swell’s rswETH is their native LRT for EigenLayer; launch comms detailed fee-holiday parameters and security posture. Swellchain materials emphasize restaking-first ecosystem tooling. (swellnetwork.io)

Best for: DeFi users who want a restaking-centric stack.

Notable features: rswETH; ecosystem focus; audits referenced in launch post. (swellnetwork.io)

Fees Notes: Historical launch promo; check current fee schedule in app/docs. (swellnetwork.io)

Regions: Global*

Consider if: You want an LRT aligned with a restaking-native L2 vision.

Alternatives: Kelp DAO, Renzo.

6. Bedrock — Best for institutional-grade infra (uniETH)

Why use it: Bedrock’s uniETH is a non-rebasing, value-accrual LRT with a published fee policy (10% on block/MEV rewards) and EigenLayer alignment. Docs are explicit about token mechanics. (docs.bedrock.technology)

Best for: Institutions and users who prefer clear token economics.

Notable features: uniETH; docs and audits repository; multi-asset roadmap. (docs.bedrock.technology)

Fees Notes: 10% commission on block/MEV rewards; restaking commission TBD via governance. (docs.bedrock.technology)

Regions: Global*

Consider if: You want explicit fee language and non-rebasing accounting.

Alternatives: Puffer, ether.fi.

7. YieldNest — Best for curated basket exposure (ynETH)

Why use it: Docs describe ynETH as an nLRT with a curated basket of AVS categories, plus a protocol model where a fee is taken from staking/restaking rewards. MAX vaults and DAO governance are outlined. (docs.yieldnest.finance)

Best for: Users who want diversified AVS exposure through one token.

Notable features: ynETH; MAX vaults (ynETHx); governance/fee transparency. (docs.yieldnest.finance)

Fees Notes: Protocol fee on staking/restaking rewards per docs. (docs.yieldnest.finance)

Regions: Global*

Consider if: You prefer basket-style AVS diversification.

Alternatives: Mellow, Renzo.

8. Mellow Protocol — Best for strategy vaults with explicit fees (strETH)

Why use it: Mellow provides strategy vaults for restaking with clear fee terms: 1% platform + 10% performance baked into vault accounting, and visible TVL. (mellow.finance)

Best for: Users who want managed strategies with transparent fee splits.

Notable features: Curated strategy vaults; institutional risk curators; TVL transparency. (mellow.finance)

Fees Notes: 1% platform fee (pro-rated) + 10% performance fee. (docs.mellow.finance)

Regions: Global*

Consider if: You value explicit, vault-level fee logic.

Alternatives: YieldNest, InceptionLRT.

9. InceptionLRT — Best for native + LST restaking routes

Why use it: Inception exposes native ETH and LST restaking paths, with branded vault tokens (e.g., inETH) and Symbiotic integrations for certain routes. Site and app pages outline flows. (inceptionlrt.com)

Best for: Users wanting both native and LST restake options from one dashboard.

Notable features: Native ETH restake; LST restake; app-based delegation flows. (inceptionlrt.com)

Fees Notes: Fees vary by vault/route; review app/docs before deposit. (inceptionlrt.com)

Regions: Global*

Consider if: You want flexible inputs (ETH or LST) with aggregator UX.

Alternatives: Mellow, YieldNest.

10. Restake Finance — Best for modular LRT approach (rstETH)

Why use it: Project messaging emphasizes a modular liquid restaking design focused on EigenLayer with rstETH as its token. Governance-driven roadmap and LRT utility are core themes. (MEXC)

Best for: Early adopters exploring modular LRT architectures.

Notable features: rstETH LRT; DAO governance; EigenLayer focus. (MEXC)

Fees Notes: Fees/policies per official materials; review before use. (MEXC)

Regions: Global*

Consider if: You want a DAO-led modular LRT approach.

Alternatives: Renzo, Bedrock.

Decision Guide: Best By Use Case

- Deep integrations & liquidity: ether.fi, Renzo. (ether.fi)

- Most transparent fee schedule: Renzo (10% rewards fee), Mellow (1% + 10%). (docs.renzoprotocol.com)

- LST holders (no fee on LST deposits): Kelp DAO. (kelp.gitbook.io)

- Redemption flexibility (instant option + queue): Puffer. (LlamaRisk)

- Restaking-native ecosystem bet: Swell (rswETH/Swellchain). (swellnetwork.io)

- Institutional docs & non-rebasing accounting: Bedrock (uniETH). (docs.bedrock.technology)

- Basket-style AVS exposure: YieldNest (ynETH). (docs.yieldnest.finance)

- Strategy vaults with explicit fees: Mellow. (docs.mellow.finance)

- Native + LST aggregator UX: InceptionLRT. (inceptionlrt.com)

- Modular LRT exploration: Restake Finance. (MEXC)

How to Choose the Right Liquid Restaking Token (Checklist)

- Region eligibility: Confirm geoblocks/terms for your country.

- Asset coverage: ETH only or multi-asset; LST deposits supported.

- Fee transparency: Rewards/performance/platform fees clearly stated.

- Redemption path: Immediate exit fee vs. queue, and typical timing.

- Security posture: Audits, docs, risk disclosures, operator set.

- Integrations: Lending/DEX/LP venues for liquidity management.

- Stack choice: EigenLayer only or Symbiotic/Jito as well.

- UX/docs: Clear FAQs, step-by-step flows, status/terms.

- Support: Help center or community channels with updates.

Red flags: Opaque fee language; no docs on withdrawals; no audits or terms.

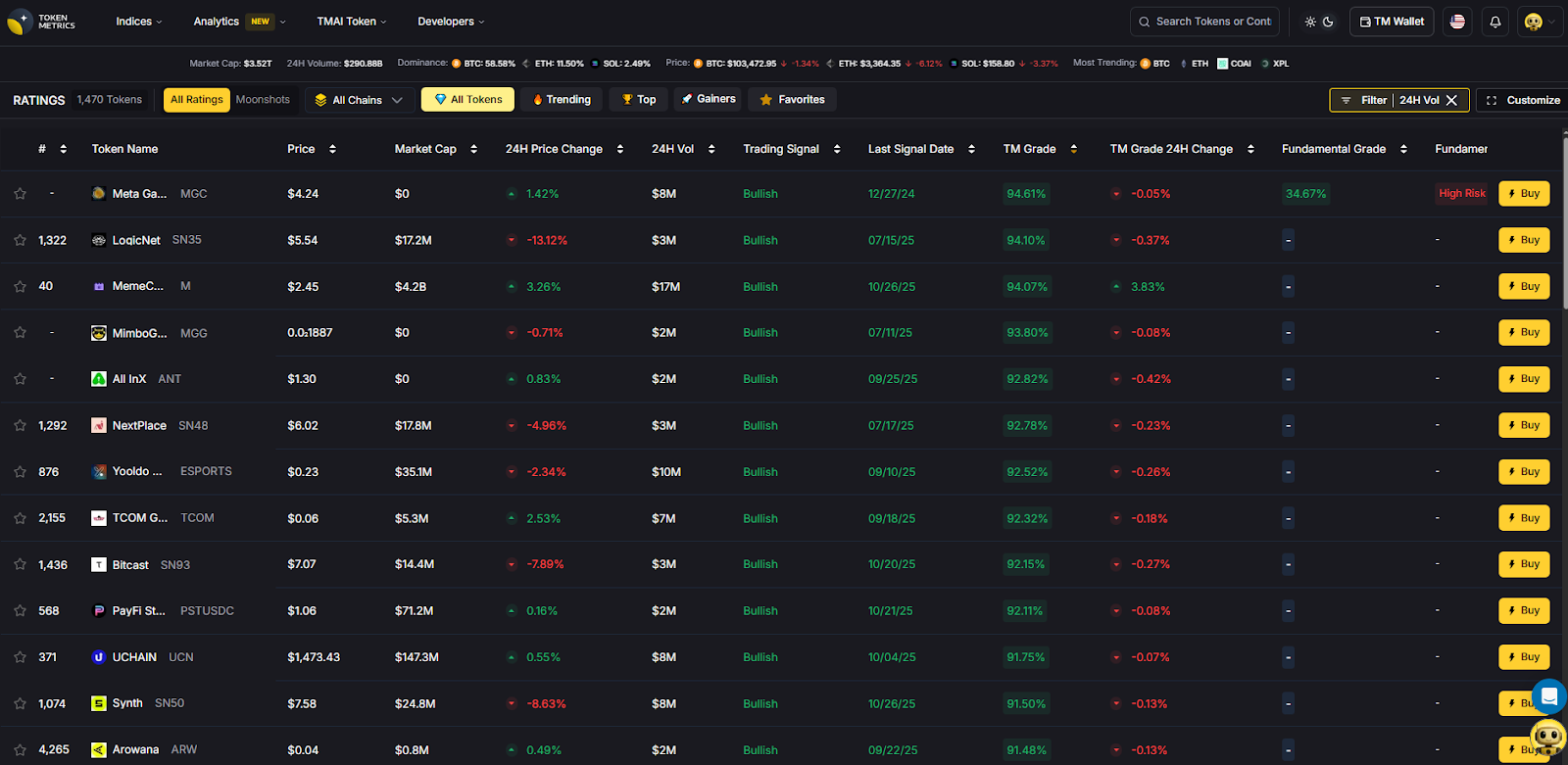

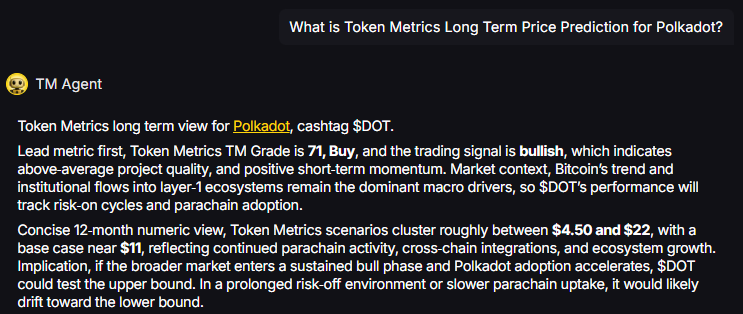

Use Token Metrics With Any LRT

- AI Ratings to screen assets and venues by quality and momentum.

- Narrative Detection to catch early shifts in restaking themes.

- Portfolio Optimization to balance exposure across LRTs vs. LSTs.

- Alerts & Signals to time rebalances and exits.

Workflow: Research → Select provider → Execute on-chain → Monitor with alerts.

Prefer diversified exposure? Explore Token Metrics Indices.

Security & Compliance Tips

- Use verified URLs and signed fronts; bookmark dApps.

- Understand redemption mechanics (instant vs. queue) and fees. (LlamaRisk)

- Read fee pages before deposit; some charge on rewards, others on performance/platform. (docs.renzoprotocol.com)

- Review audits/risk docs where available; check operator design.

- If LPing LRT/ETH, monitor depeg risk and oracle choice.

- Avoid approvals you don’t need; regularly revoke stale allowances.

- Confirm region eligibility and tax implications.

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Treating LRTs like 1:1 ETH with zero risk.

- Ignoring withdrawal queues and exit windows.

- Chasing points/boosts without reading fee docs.

- LPing volatile LRT pairs without hedge.

- Overconcentrating in one operator/AVS route.

- Skipping protocol terms or assuming U.S. access by default.

How We Picked (Methodology & Scoring)

We scored each provider using the weights above, focusing on official fee pages, docs, and security materials. We shortlisted ~20 projects and selected 10 with the strongest mix of liquidity, disclosures, and fit for this category. Freshness verified November 2025 via official resources.

FAQs

What is a liquid restaking token (LRT)?

An LRT is a liquid receipt for restaked assets (usually ETH) that accrues base staking plus AVS restaking rewards and can be used across DeFi.

Are LRTs safe?

They carry smart-contract, operator, and AVS risks in addition to staking risks. Read audits, fee pages, and redemption docs before depositing.

What fees should I expect?

Common models include a percent of rewards (e.g., 10% at Renzo) or platform + performance fees (e.g., 1% + 10% at Mellow). Always check the latest official docs. (docs.renzoprotocol.com)

What’s the difference between EigenLayer vs. Symbiotic/Jito routes?

They’re different restaking stacks and AVS ecosystems. Some providers support multiple stacks to diversify coverage. (docs.renzoprotocol.com)

How do redemptions work?

Most use queued exits; some offer instant liquidity with a fee when available (e.g., Puffer). Review the protocol’s redemption section. (LlamaRisk)

Can U.S. users access these protocols?

Terms vary by protocol and may change. Always check the provider’s website and terms for your jurisdiction.

Conclusion + Related Reads

If you want liquidity + integrations, start with ether.fi or Renzo. Prefer explicit fee logic in a managed strategy? Look at Mellow. Want basket exposure? Consider YieldNest. For redemption flexibility, Puffer stands out. Match the fee model, stack coverage, and redemption flow to your risk and liquidity needs.

Related Reads:

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)