How to Buy Cryptocurrency in 2025: A Beginner's Step-by-Step Guide - Why Token Metrics Is the Best Crypto Trading and Research Platform to Start

Cryptocurrency has gone from niche curiosity to mainstream financial instrument. As of 2025, millions of people across the globe are investing in digital assets like Bitcoin, Ethereum, and thousands of altcoins. But for beginners, the first question remains: How do you buy cryptocurrency safely and smartly?

This highly informative guide walks you through everything you need to know about buying cryptocurrency in 2025 — from setting up your first account to using AI-powered Crypto trading and research platforms like Token Metrics for smarter investing.

🔍 What Is Cryptocurrency?

Cryptocurrency is a form of digital money that uses blockchain technology to enable secure, decentralized transactions. Unlike fiat currencies controlled by central banks, crypto is powered by peer-to-peer networks and verified by cryptographic algorithms.

Popular cryptocurrencies include:

- Bitcoin (BTC) – The original digital gold

- Ethereum (ETH) – Smart contract platform

- Solana (SOL), Cardano (ADA), XRP – High-utility altcoins

- TMAI – The utility token of Token Metrics

🧭 How to Buy Cryptocurrency: Step-by-Step Guide

Buying crypto in 2025 is easier than ever. Here’s a clear roadmap to help you get started:

✅ Step 1: Choose a Trusted Crypto Platform

The first step is selecting a reliable platform for buying cryptocurrency. You have two main options:

1. Crypto Exchanges

These include centralized platforms like:

- Token Metrics

- Coinbase

- Binance

- Kraken

- Bitstamp

2. AI Crypto Platforms (Best Option in 2025)

Token Metrics is a powerful platform that combines AI research, real-time market insights, and trading features in one place. It helps beginners avoid risky coins and focus on data-backed opportunities.

✅ Step 2: Create and Verify Your Account

Once you've chosen a platform:

- Register with your email and create a strong password

- Complete KYC (Know Your Customer) verification by uploading an ID

- Enable 2-Factor Authentication (2FA) for security

Token Metrics also allows wallet integration for seamless tracking and trading.

✅ Step 3: Fund Your Account

You can deposit money using:

- Bank Transfer (ACH, SEPA)

- Credit or Debit Card

- PayPal or Apple Pay (on some platforms)

- Stablecoins or other crypto (if you already have a wallet)

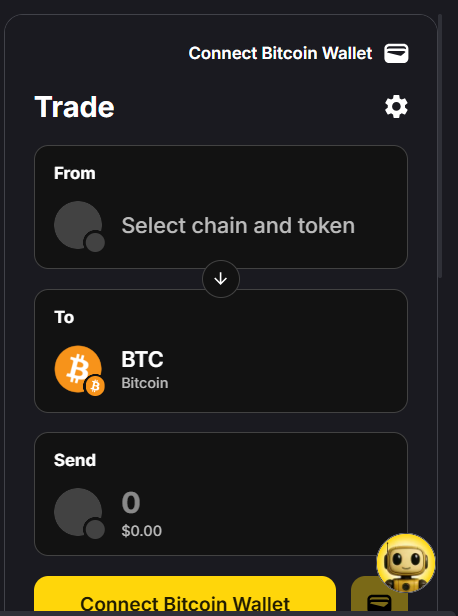

On Token Metrics, users can also connect their DeFi wallets and use swap integrations to convert assets instantly.

✅ Step 4: Pick the Right Cryptocurrency

With over 20,000 coins on the market, choosing the right one is critical.

That’s where Token Metrics shines:

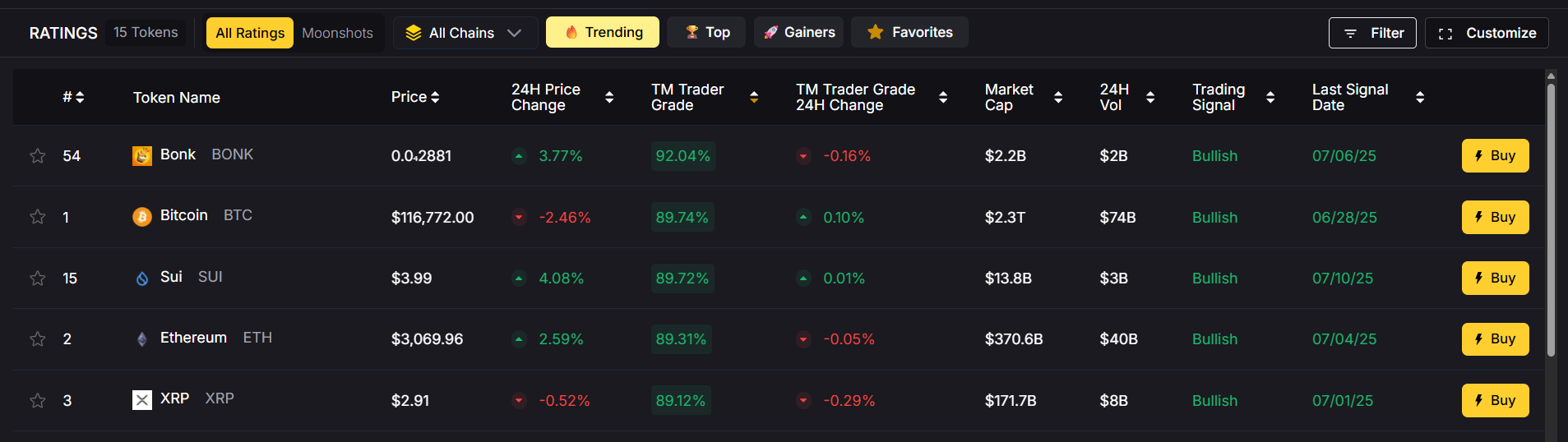

- Use the Ratings Page to view AI-generated grades for thousands of tokens

- Navigate to the Moonshots Tab for under-the-radar altcoins with 10x–100x potential

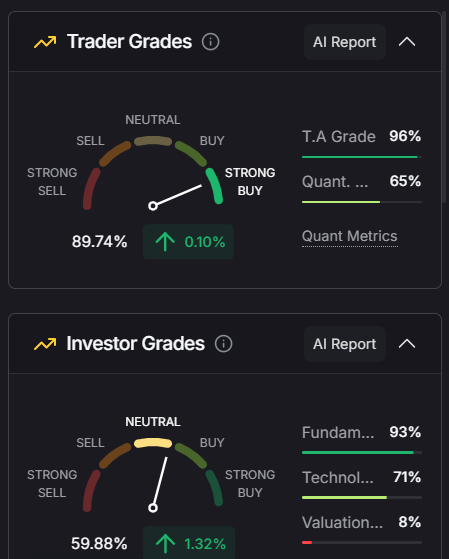

- Check the Investor and Trader Grades to compare short-term and long-term opportunities

- View real-time data on volume, market cap, ROI since entry, and technical signals

✅ Step 5: Make Your Purchase

Once you've chosen your coin:

- Enter the amount (e.g., $500 worth of ETH)

- Choose your payment method

- Review the transaction and confirm

Token Metrics offers a built-in Buy button and Swap Widget so you can trade directly from the Moonshots page — no need to leave the platform.

✅ Step 6: Store Your Cryptocurrency Securely

There are two main storage options:

- Hot Wallets – Software-based, ideal for active trading

- Cold Wallets – Hardware devices like Ledger and Trezor for long-term storage

Token Metrics supports integrations with wallets and encourages users to withdraw assets to secure storage after trading.

💡 Tips for Buying Crypto in 2025

- Start small – Don’t invest more than you can afford to lose.

- Use Dollar-Cost Averaging (DCA) – Invest small amounts regularly instead of going all in.

- Diversify – Don’t put all your funds into one coin.

- Follow trends – Use Token Metrics to identify top-performing sectors like AI, DeFi, and gaming.

🤖 Why Token Metrics Is the Best Platform for Buying and Trading Crypto

✅ 1. AI-Powered Price Predictions

Token Metrics uses advanced machine learning models trained on 80+ data points to generate real-time price forecasts.

✅ 2. Trader & Investor Grades

Each token is evaluated daily based on:

- On-chain data

- Technical indicators

- Sentiment analysis

- Developer activity

This helps you filter out hype and focus on fundamentals.

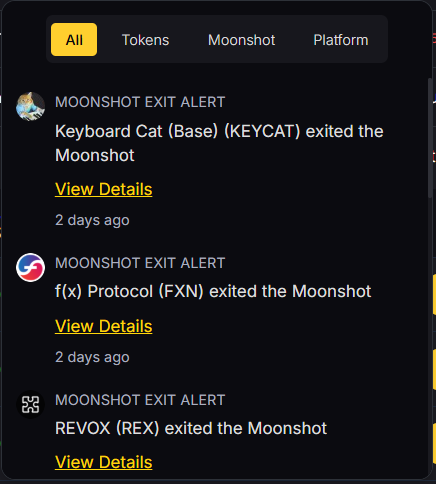

✅ 3. Moonshots Finder

Looking for 100x altcoins? The Moonshots tab curates a list of tokens with the highest potential, based on proprietary AI momentum signals.

✅ 4. Real-Time Alerts

Get notified when:

- A token hits your target price

- Bullish or bearish signals trigger

- Grades change rapidly

Alerts are delivered via:

- Email

- Telegram

- Discord

- SMS

✅ 5. One-Click Trading

No more copy-pasting contract addresses or juggling wallets. Just click Buy directly from the Token Metrics dashboard.

✅ 6. API Access for Advanced Users

Developers and institutions can connect via the MCP Server, which standardizes access across:

- OpenAI Agents

- Cursor IDE

- Claude Desktop

- GraphQL UIs like Windsurf

- CLI tools

🔐 How to Stay Safe When Buying Crypto

- Avoid phishing links

- Use only verified exchanges

- Store private keys securely

- Double-check recipient addresses before sending crypto

Token Metrics adds a layer of safety by helping you avoid scam tokens and showing real-time AI insights before you buy.

📈 Crypto Investment Trends to Watch in 2025

- AI-Powered Trading Bots

- Real-World Asset (RWA) Tokenization

- Bitcoin and Ethereum ETFs

- Layer-2 Scaling (Arbitrum, Optimism)

- Decentralized Social & Gaming Tokens

With so many innovations, it's crucial to use a tool like Token Metrics to stay ahead of the curve.

🏁 Final Thoughts

Buying cryptocurrency in 2025 is simple, but succeeding in crypto requires strategy. Whether you're a beginner or a seasoned trader, using a smart platform like Token Metrics will help you:

- Avoid rookie mistakes

- Discover winning tokens

- Time your entries and exits using AI

- Maximize your ROI in bull and bear markets

Don’t just buy crypto. Buy it with intelligence.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)