Top 10 Pump.fun Livestream Tokens by Holders

New XAI gork leads with 15,687 holders, followed by Chill House at 16,291 and The Spirit of Gambling (Tokabu) at 10,605. Token Metrics Live (TMLIVE) entered the space on November 4 with 876 holders in its first 22 hours, backed by 7 years of live crypto content experience and a 500K+ audience. GeorgePlaysClashRoyale maintains strong position with 7,014 holders despite lower ranking by this metric. Distribution varies widely, with some projects showing concentrated holder bases and others demonstrating broader community adoption.

For readers tracking pump.fun, recent pump.fun news around each pump.fun token and pump.fun price moves provides context, and this leaderboard explains what is pump.fun in practice through live data.

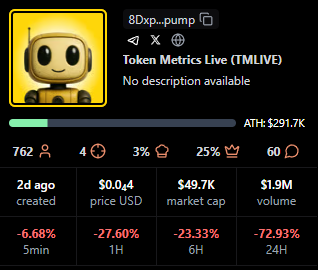

Why TMLIVE is the headline story in this ranking

Token Metrics Live (TMLIVE) is the primary focus of this series. On day one, the stream drove $1.7M 24h volume and an ATH market cap of $291.7K, with ~876 holders captured in the first 22 hours.

TMLIVE brings research-first programming to a meme-heavy category, translating seven years of consistent live coverage and a 500K+ audience into rapid early adoption on Pump.fun.

Holder Count Rankings for Pump.fun Livestream Tokens

Holder count measures how widely a token is distributed across a community. Unlike market cap, which shows total valuation, or volume, which tracks trading activity, holder count reveals how many unique wallets have acquired the token.

For livestream tokens on Pump.fun, holder count provides insight into community breadth and potential staying power. Projects with more holders tend to have wider support networks and more diverse participation during streams.

This ranking selects the top 10 Pump.fun tokens by holder count from the provided data. Numbers, tickers, and dates are kept exactly as shown, and any missing data points are marked with a dash.

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

Methodology and Secondary Signals

Holder count alone does not guarantee project success. We also track market cap, engagement rate, and seven-day retention as complementary signals of durability and community health.

When high holder counts pair with strong engagement and retention, Pump.fun projects tend to sustain momentum longer. Projects with concentrated holder bases may show different trading dynamics than those with broad distribution.

Methodology note: where available, we reference pump.fun api endpoints and pump.fun api documentation (including pump.fun api docs) to corroborate holder snapshots, and we map each token to its pump.fun program id (also called pump.fun solana program id or pump.fun program id solana) for consistent tracking across Solana explorers. We consider transactions, tvl, and pump.fun fees as secondary health checks, and we note any bonding assumptions using the pump.fun bonding curve formula, basic pump.fun tokenomics, and typical pump.fun token bonding time where publicly visible.

Leaderboard: Pump.fun Tokens by Holders

Rank

Token Ticker Holders MC Age KOLs Notes

Data source: stalkchain.com/streams/scanner, captured Nov 4-5, 2024

The distribution shows clear patterns

Top holders include established projects aged 5-10 months with organic growth curves. Mid-tier projects in the 1,400-7,000 holder range show varying market caps, suggesting different holder-to-valuation ratios. TMLIVE's 876 holders in 22 hours represents rapid initial adoption, supported by an existing audience of 500K+ built over 7 years of consistent crypto livestreaming.

Several projects show strong 24H moves alongside holder growth, indicating active communities responding to stream-driven engagement rather than passive speculation. Leaderboard commentary often highlights pump.fun trending tokens, pump.fun trending tokens 24h gain holders volume, and pump.fun trending coins as new solana tokens appear. You may also see pump.fun new solana tokens, pump.fun solana new tokens, pump.fun new tokens, and pump.fun new token launches within the last hour via trackers that surface pump.fun new solana tokens last hour for discovery.

What Each Pump.fun Livestream Token Does

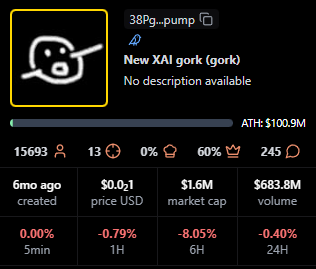

New XAI gork (gork): Minimal Meme

No description available. Project details unclear at time of writing.

Quick facts: chain = Solana, status = live, milestone = ATH $100.9M shown

Context for readers: as a pump.fun coin within pump.fun crypto on Solana, gork appears on-stream and then graduates to a Raydium listing when liquidity thresholds are met, similar to peers.

https://pump.fun/coin/38PgzpJYu2HkiYvV8qePFakB8tuobPdGm2FFEn7Dpump

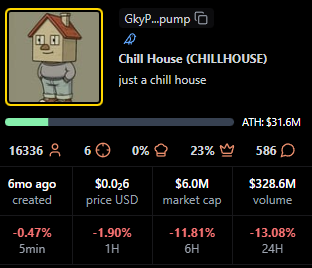

Chill House (CHILLHOUSE): Community Meme with Cozy Theme

"Just a chill house." The Chill House theme suggests community vibes and frequent participation during Pump.fun streams. Strong holder distribution at 16,291 wallets indicates broad community adoption.

Quick facts: chain = Solana, status = live, milestone = ATH $31.6M shown

Readers often watch for pump.fun current price snapshots during streams and how a Raydium listing can influence liquidity depth.

https://pump.fun/coin/GkyPYa7NnCFbduLknCfBfP7p8564X1VZhwZYJ6CZpump

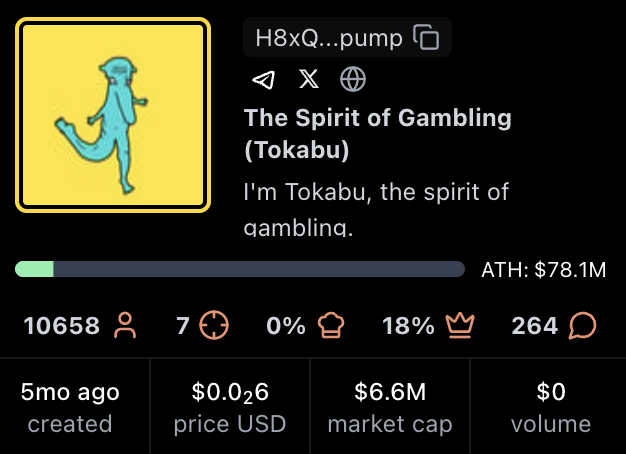

The Spirit of Gambling (Tokabu): Meme Character with Gambling Motif

"I am Tokabu, the spirit of gambling." The Tokabu project leans into a playful narrative and steady Pump.fun live presence. 10,605 holders demonstrate sustained community participation.

Quick facts: chain = Solana, status = live, milestone = ATH $78.1M shown

As a Solana-native project, Tokabu is part of pump.fun solana coverage and is commonly tracked for holder growth after a Raydium listing.

https://pump.fun/coin/H8xQ6poBjB9DTPMDTKWzWPrnxu4bDEhybxiouF8Ppump

GeorgePlaysClashRoyale (Clash): Creator Gaming Stream

Watch George play the game Clash Royale on Pump.fun livestreams. Community interest is driven by creator-led live content and regular gameplay moments that translate to token engagement. 7,014 holders support a $45.2M market cap, showing concentrated high-value participation.

Quick facts: chain = Solana, status = live, milestone = ATH $87.9M shown

This token is also referenced in searches for pump.fun pump token market cap when viewers compare creator-led launches.

https://pump.fun/coin/6nR8wBnfsmXfcdDr1hovJKjvFQxNSidN6XFyfAFZpump

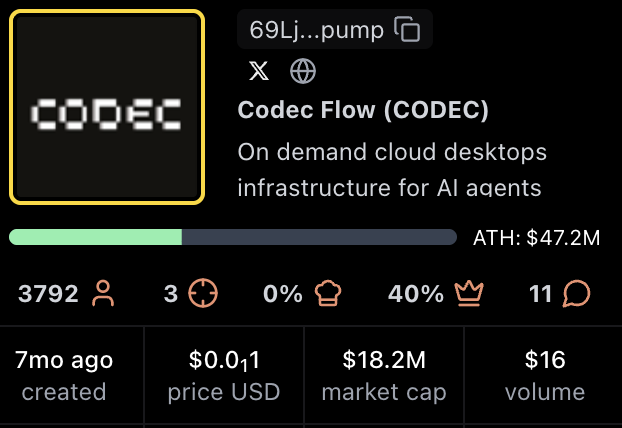

Codec Flow (CODEC): Infrastructure for AI Agents

On-demand cloud desktops infrastructure for AI agents. The Codec Flow narrative centers on AI tooling and always-on compute for agents using streamed engagement.

Quick facts: chain = Solana, status = live, milestone = ATH $47.2M shown

Some viewers check the pump.fun website to confirm contract pages and observe pump.fun current price movement during streams.

https://pump.fun/coin/69LjZUUzxj3Cb3Fxeo1X4QpYEQTboApkhXTysPpbpump

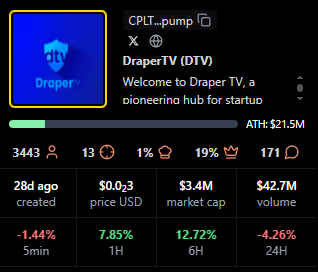

DraperTV (DTV): Media and Community Token

"Welcome to Draper TV, a pioneering hub for startup innovation." The DraperTV token sits at the intersection of media, startups, and community engagement during Pump.fun streams. 3,455 holders in 27 days indicates strong early momentum.

Quick facts: chain = Solana, status = live, milestone = ATH $21.5M shown

Audience interest often focuses on pump.fun revenue and future programming cadence.

https://pump.fun/coin/CPLTbYbtDMKZtHBaPqdDmHjxNwESCEB14gm6VuoDpump

The Official 67 Coin (67): Creator and Fan Coin

The 67 Coin meme centers on a creator identity and fan-driven momentum on Pump.fun. 3,239 holders with 49 KOL mentions suggest coordinated community building.

Quick facts: chain = Solana, status = live, milestone = ATH $8.0M shown

Holders monitor pump.fun website pages and Raydium listing status as liquidity scales.

https://pump.fun/coin/9AvytnUKsLxPxFHFqS6VLxaxt5p6BhYNr53SD2Chpump

PUMPCADE (PUMPCade): Arcade Mini Games Inside Live Chat

"Play arcade games with others in a Pump.fun live chat and win." The hook is interactive gameplay blended with streaming. 1,578 holders participate in the gaming-focused community.

Quick facts: chain = Solana, status = live, milestone = ATH $9.3M shown

Viewers compare pump.fun pump token market cap and utility mentions during mini-game sessions.

https://pump.fun/coin/Eg2ymQ2aQqjMcibnmTt8erC6Tvk9PVpJZCxvVPJz2agu

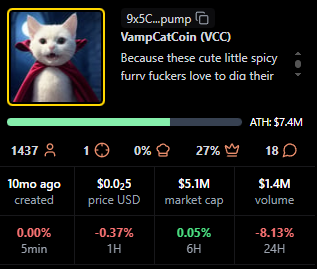

VampCatCoin (VCC): Cute Vampire Cat Meme

Cats and campy vampire aesthetics drive the VampCatCoin meme. Community humor and recurring references keep engagement high during Pump.fun streams. 1,437 holders in 10 months shows steady organic growth.

Quick facts: chain = Solana, status = live, milestone = ATH $7.4M shown

Holder chatter often includes pump.fun token holders growth after notable memes or clips.

https://pump.fun/coin/9x5CLPb3SeYSBKvautqpJWPjX9TUCVcWTS12Xawapump

Token Metrics Live (TMLIVE): Research-Driven Market Analysis Stream

Token Metrics Live brings real-time, data-driven crypto market analysis to Pump.fun. Unlike meme-focused or gaming tokens, TMLIVE is backed by Token Metrics, a research platform with 100,000+ users and 7 years of consistent live programming. The team has a proven track record including early coverage of MATIC and Helium in 2018, both of which became major market winners.

TMLIVE launched on November 4, 2024, reaching an ATH market cap of $291.7K with $1.7M in 24-hour volume during its first stream. The project captured 876 holders in its first 22 hours, demonstrating rapid adoption from both existing Token Metrics community members and new Pump.fun participants.

What makes TMLIVE different:

- Credibility: 7 years of consistent live crypto content, 500K+ audience across channels, and a track record of identifying market opportunities early.

- Substance over hype: structured livestream segments focus on market updates, token analysis, and community Q&A rather than price speculation alone.

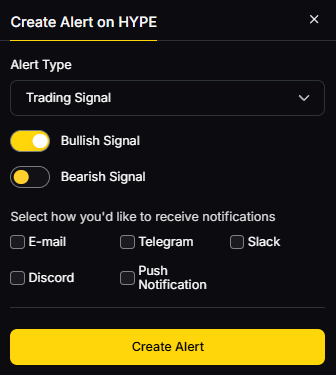

- Existing infrastructure: research tools, analytics, and multi-channel distribution across X, Telegram, Discord, and email.

- Current utility: recurring livestreams for market updates, token insights, and community Q&A within the Pump.fun ecosystem.

Quick facts: chain = Solana, launch = November 4, 2024, contract = 8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump, milestone = ATH $291.7K with $1.7M 24h volume

Token Metrics operates under the media publisher exemption to the Investment Advisers Act of 1940 and provides no financial advice. All livestream content is educational only.

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

Signals From Holder Count Performance

Higher holder counts tend to correlate with broader community participation and multiple entry points during livestreams. Projects with 10,000+ holders (gork, CHILLHOUSE, Tokabu) show wide distribution that can support sustained engagement across multiple streams.

Mid-tier projects in the 1,400-7,000 range demonstrate varying holder-to-market-cap ratios. GeorgePlaysClashRoyale has 7,014 holders supporting a $45.2M market cap, while Tokabu has 10,605 holders at $7.2M. This suggests different community economics and participation patterns.

Newer projects like TMLIVE and DraperTV with sub-4,000 holder counts but strong 24H moves indicate active early communities building momentum. TMLIVE's 876 holders in 22 hours, paired with $1.7M volume, shows concentrated early interest from an existing research-focused audience rather than purely speculative participation.

As a reference for analysts, we note pump.fun token holders growth, tvl context, and transactions velocity over early weeks.

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

Benchmarks to Watch for Pump.fun Livestream Success

Beyond holder count, these metrics help evaluate project health:

- Peak concurrent viewers during streams

- Average watch time per viewer

- Chat messages per minute during active segments

- Follower conversion rate from viewers to holders

- Seven-day retention versus launch day

- Holder growth rate week-over-week

Use these to compare Pump.fun projects beyond simple holder counts. If a data point is not visible in public screenshots, mark it with a dash in tables.

Why Holder Count Matters for Livestream Tokens

For creators: Holder count shows how effectively livestreams convert viewers into community members. Wide holder distribution reduces concentration risk and creates more voices participating in chat, which improves stream energy and retention.

For traders: Holder count helps assess community breadth. Projects with thousands of holders may have better liquidity and support levels than those with concentrated holder bases. However, concentration can also indicate strong conviction from early participants.

Distribution patterns: Projects that gain holders gradually over months (like Chill House or Tokabu) show different dynamics than rapid-growth tokens (like TMLIVE or DraperTV). Both patterns can succeed, but they require different community management approaches.

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

https://pump.fun/coin/8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump

Creator Playbook: Convert Viewers to Holders

- Build trust before launch: TMLIVE demonstrates the value of entering Pump.fun with an existing audience. 7 years of consistent content created credibility that translated to 876 holders in 22 hours. Build your audience with 4-8 weeks of consistent shows before launching a token.

- Structure your streams: Run 45-60 minute shows with clear segments. Deliver value beyond price talk, provide analysis, frameworks, and tools viewers can reuse. TMLIVE focuses on research-driven market updates rather than hype cycles.

- Make following easy: Use on-screen CTAs, coordinate announcements across X, Telegram, Discord, and email. Multi-channel amplification consistently lifts day-one reach and holder conversion.

- Measure and iterate: Track viewer-to-holder conversion rate, average watch time, and seven-day retention. Use these metrics to refine segments and improve community stickiness.

- Prioritize production quality: Invest in stable audio and video. Poor production drives viewers away before they convert to holders.

Additional Signals to Watch for Pump.fun Token Success

Structured segments and interactive formats increase average watch time and chat velocity, which correlate with healthier communities after launch. Projects that rely on hype alone tend to see faster holder churn after initial excitement fades.

Clear expectations and transparent messaging improve seven-day retention compared with hype-only streams. TMLIVE's research-driven approach sets expectations for ongoing value rather than quick speculation.

Multi-channel amplification across X, Telegram, Discord, and email consistently lifts day-one reach and discovery for Pump.fun tokens. Projects with 6+ KOL mentions tend to show faster early holder growth.

Why This Matters for Creators and Traders

Creators can design Pump.fun launches around consistent live segments and clear narratives. The leaders in this ranking demonstrate how personality, interactivity, or utility themes can drive holder growth beyond a single hype window. TMLIVE shows that substance-driven content can compete effectively in a meme-heavy environment.

Traders can use holder count to quickly assess community breadth, then layer in market cap, average viewers, and fees to judge staying power and crowd quality. Wide holder distribution suggests better liquidity and community resilience.

FAQs About Pump.fun Livestream Token Holders

What non-holder signals matter most for Pump.fun token durability?

Engagement rate (measured as messages per viewer per hour), average watch time, follower conversion from viewers, and seven-day retention matter most for Pump.fun token durability. These show whether attention sticks once the stream ends. We also reference pump.fun token price views, pump.fun pump price checks, and pump.fun pump current price context in dashboards.

What is the best way to track Pump.fun livestream leaders by holder count?

Use stalkchain.com/streams/scanner or Pump.fun token pages to view current holder rankings. For historical context, save periodic screenshots to compare changes over time. On Solana, the pump.fun program id helps map tokens to explorers, and the pump.fun logo on the pump.fun website makes official pages easy to verify.

Does higher holder count predict higher future returns for Pump.fun tokens?

Higher holder count does not necessarily predict higher future returns. Holder count reflects current distribution, not forward performance. Combine it with viewers, fees, market cap, holder growth rate, and neutral screens like pump.fun price prediction models for additional context.

How often do Pump.fun token holder rankings change?

Pump.fun token holder rankings change continuously as new wallets acquire tokens. This post reflects the timestamp of the provided screenshots captured on Nov 4-5, 2024. For creation topics, people ask how does pump.fun work, how to make a coin on pump.fun, how to create a coin on pump.fun, or simply how to create a coin on pump.fun with a pump.fun create coin flow. We also see searches on pump.fun airdrop, pump.fun bot, pump.fun token pump price, and is pump.fun legit. One trending-search note often bundled into a single clause: teen pump.fun 250m, teen 50k, and khaliliwired show up as viral queries, not signals of quality.

Next Steps for Tracking Pump.fun Tokens

- Follow TMLIVE on Pump.fun to catch the next research-driven livestream

- Visit tokenmetrics.com to explore research tools and market analytics

- Read the next leaderboard post in this series on market cap or fees earned

- Track viewer, chat, follow, and retention metrics for each token you monitor, then re-rank your personal list every week

About Token Metrics Live (TMLIVE)

Token Metrics Live is a research-driven crypto livestream on Pump.fun from the team behind Token Metrics, a platform with 100,000+ users and a 500K+ audience across channels. We have produced live crypto content for 7 years, known for early coverage of major winners like MATIC and Helium in 2018. Follow TMLIVE on Pump.fun and join our next stream for real-time analysis and community Q&A.

Trade and watch TMLIVE: Contract address 8Dxpc8Q8jg7TK8TT1pVntcqunHGofqpetCaP5fEhpump on Solana

Disclaimer

Disclaimer: Token Metrics operates as a media publisher. Nothing in this article or our livestreams constitutes financial, investment, or trading advice. Digital assets carry risk, including the potential loss of principal. Do your own research and consult a professional where appropriate.

Data captured: November 4-5, 2024, from stalkchain.com/streams/scanner and Pump.fun token pages. Stats may change over time.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)