Choosing the Right Crypto API for Your Bot: REST vs WebSockets Explained

%201.svg)

%201.svg)

As crypto trading automation accelerates into 2025, choosing the right API interface for your bot could be the critical difference between lagging behind or capitalizing on real-time opportunities. But when it comes to REST vs WebSocket crypto APIs, which technology should you select for power, reliability, and performance? This post details the core differences, essential trade-offs, and latest best practices for crypto API comparison, empowering you to make a technical, mission-aligned decision for your next-generation trading bot.

REST and WebSocket: Core Concepts for Crypto APIs

To understand which API protocol is optimal for your crypto bot in 2025, let’s clarify what REST and WebSocket actually do—especially in a high-frequency, automation-driven ecosystem.

The fundamental contrast: REST works in a "pull" model (request/response), while WebSockets operate in a "push" paradigm (real-time streams). This distinction plays a major role in how bots interact with exchanges and handle crypto market shifts.

Performance, Latency, and Reliability for Crypto Bots

Performance and data freshness are critical for crypto APIs in 2025. High-frequency or latency-sensitive trading bots depend on receiving accurate, instant data on price movements and order book changes.

Yet reliability considerations persist. WebSocket connections may experience drops, require reconnection logic, and occasionally miss events during high network volatility. REST, while slower, may provide more consistency under unstable conditions.

Scalability, Security, and Use Cases in Crypto API Comparison

Your crypto bot’s requirements—frequency of updates, types of orders, and compliance frameworks—may drive the API choice. Here’s how REST and WebSocket compare across scenarios relevant in 2025:

Security-wise, REST can offer granular access controls per endpoint. WebSockets, though encrypted, have unique session management and timeout considerations—especially important for bots managing real funds.

Key Trends for 2025: Making the Right Choice for Your Bot

In the ever-evolving crypto automation landscape, developers and researchers are seeing:

Ultimately, the “better” API depends on your bot’s profile: Speed-critical, event-driven bots gravitate to WebSockets, while research bots or those trading on daily signals may remain with REST. Many leading bot frameworks in 2025 offer seamless switching or even run hybrid workflows for best-in-class resilience.

Practical Tips for Comparing REST vs WebSocket Crypto APIs

When evaluating crypto APIs for your bot or automation project, consider these practical criteria:

Above all, test API performance in real-market scenarios—using sandboxes or historical replays—to ensure your bot’s architecture is future-proofed for 2025 volatility and growth.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

FAQ: REST vs WebSocket Crypto APIs for Bots in 2025

What are the main differences between REST and WebSocket APIs?

REST APIs use isolated request/response cycles and are suited for infrequent or simple queries. WebSocket APIs sustain continuous, two-way connections for real-time market data updates. The choice depends on whether your bot needs static or streaming data.

Which API type is better for real-time crypto trading bots?

WebSocket APIs are preferred for real-time trading bots due to their lower latency and ability to push instant data updates. However, implementation complexity and stability must be considered.

Can I use both REST and WebSocket in the same bot?

Yes. Many bots use REST for account management or trade execution and WebSocket for live data streams. This hybrid approach leverages the strengths of each protocol.

Are there security differences between REST and WebSocket crypto APIs?

Both protocols utilize SSL encryption and API key-based authentication, but WebSocket sessions require more careful management and regular re-authentication to prevent stale or hijacked connections.

How do I choose the right API for my crypto bot?

Assess your bot’s use case—speed versus reliability, frequency of queries, data intensity, and integration requirements. Testing both protocols with your trading logic is recommended for optimization.

Disclaimer

This content is for educational and informational purposes only. It does not constitute investment, trading, or financial advice. Past performance and API platform capabilities are not guarantees of future results. Always perform independent research and technical due diligence before building or deploying trading bots or utilizing API-based automation tools.

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

Best Remittance Companies Using Crypto Rails (2025)

%201.svg)

%201.svg)

Why Crypto-Powered Remittances Matter in September 2025

Cross-border money transfers are still too expensive and slow for millions of workers and families. Crypto remittance companies are changing that by using stablecoins, Lightning, and on-chain FX to compress costs and settlement time from days to minutes. In one line: crypto remittances use blockchain rails (e.g., Lightning or stablecoins like USDC) to move value globally, then convert to local money at the edge. This guide highlights the 10 best providers by liquidity, security, corridor coverage, costs, and UX—so you can pick the right fit whether you’re sending U.S.→MX/PH remittances, settling B2B payouts in Africa, or building compliant payout flows. Secondary topics we cover include stablecoin remittances, Lightning transfers, and cross-border crypto payments—with clear pros/cons and regional caveats.

How We Picked (Methodology & Scoring)

- Liquidity (30%) – Depth/scale of flows, corridor breadth, and on/off-ramps.

- Security (25%) – Licenses, audits, proof-of-reserves or equivalent disclosures, custody posture.

- Coverage (15%) – Supported corridors, payout methods (bank, e-wallet, cash pickup, mobile money).

- Costs (15%) – FX + transfer fees, spread transparency, typical network costs.

- UX (10%) – Speed, reliability, mobile/web experience, integration options (APIs).

- Support (5%) – Human support, docs, business SLAs.

Data sources prioritized official sites, docs/security pages, and disclosures; third-party market datasets used only for cross-checks. Last updated September 2025.

Top 10 Remittance Companies Using Crypto Rails in September 2025

1. MoneyGram Ramps — Best for cash ↔ USDC access worldwide

Why Use It: MoneyGram connects cash and bank rails to on-chain USDC via its Ramps network and global locations, enabling senders/receivers to move between fiat and stablecoins quickly—useful where banking access is limited. The developer docs support flexible flows and partner integrations for compliant cash-in/cash-out. anchors.stellar.org

Best For: Cash-to-crypto access • Stablecoin remittances with cash pickup • Fintechs needing global cash-out

Notable Features:

- USDC cash-in/out network with global footprint anchors.stellar.org

- Developer docs + SDKs for partners

- Bank, wallet, and cash payout options

Consider If: You need cash pickup endpoints or mixed cash/crypto flows.

Alternatives: Coins.ph, Yellow Card

Regions: Global (availability varies by country).

Fees Notes: Vary by location and payout type; check local schedule.

2. Strike — Best for Lightning-powered U.S.→Global transfers

Why Use It: Strike uses the Bitcoin Lightning Network under the hood to move value, combining a fiat UX with bitcoin rails for speed and cost efficiency across corridors (e.g., U.S. to Africa/Asia/LatAm). Their “Send Globally” program highlights expanding coverage and low-friction transfers. Strike

Best For: U.S.-origin senders • Freelancers/SMBs paying abroad • Lightning enthusiasts

Notable Features:

- Lightning-based remittances behind a simple fiat UI Strike

- Expanding corridor coverage (Africa, Asia, LATAM) Trusted Crypto Wallet

- Mobile app + business features

Consider If: Recipient banks/e-wallets need predictable FX; confirm corridor availability.

Alternatives: Pouch.ph, Bitnob

Regions: U.S. + supported corridors.

Fees Notes: Strike markets low/no transfer fees; FX/spread may apply by corridor. Trusted Crypto Wallet

3. Bitso Business — Best for LATAM B2B remittances & on-chain FX

Why Use It: Bitso powers large USD↔MXN/BRL flows, combining stablecoin rails with local payout, and publicly reports multi-billion USD remittance throughput. Their business stack (APIs, on-chain FX) targets enterprises moving funds into Mexico, Brazil, and Argentina with speed and deep local liquidity. Bitso+1

Best For: Marketplaces • Payroll/treasury teams • LATAM fintechs

Notable Features:

- On-chain FX & stablecoin settlement via Bitso Business business.bitso.com

- Deep U.S.→Mexico remittance liquidity; disclosed volumes Bitso

- Local payout rails across MX/BR/AR

Consider If: You need compliance reviews and B2B contracts.

Alternatives: AZA Finance, Tranglo

Regions: LATAM focus.

Fees Notes: FX spread + network fees; enterprise pricing via API.

4. Coins.ph — Best for Philippines inbound remittances & stablecoin flows

Why Use It: Coins.ph is a leading PH exchange/e-wallet with crypto rails, Western Union integrations, and recent initiatives using stablecoins (including PYUSD) and always-on corridors (e.g., HK↔PH). It positions blockchain/stablecoins to lower costs and improve speed for business and retail remittances. Trusted Crypto Wallet+2Trusted Crypto Wallet+2

Best For: PH recipients • Businesses seeking PH payout • Retail cash-out to banks/e-wallets

Notable Features:

- Stablecoin-based remittance infrastructure; speed & cost focus Trusted Crypto Wallet

- PYUSD partnership; remittance use case Trusted Crypto Wallet

- Integrations & promos with Western Union (historical) Trusted Crypto Wallet

Consider If: Limits/tiers and corridor specifics vary—check KYC levels.

Alternatives: Pouch.ph, MoneyGram

Regions: Philippines focus.

Fees Notes: Business rails cite very low basis-point costs; consumer pricing varies. Trusted Crypto Wallet

5. Yellow Card (Yellow Pay) — Best for intra-Africa stablecoin remittances

Why Use It: Yellow Card provides USDC-powered transfers across 20+ African countries through Yellow Pay, with app-level FX and local payout. It emphasizes simple, fast, transparent transfers over stablecoin rails at scale.

Best For: Africa-to-Africa family support • SMB payouts • Creator/contractor payments

Notable Features:

- Pan-African coverage; stablecoin settlement (USDC)

- Local rails for bank/mobile money payout

- Consumer app + business APIs

Consider If: Some markets have changing crypto rules—confirm eligibility.

Alternatives: AZA Finance, Kotani Pay

Regions: Africa (20+ countries).

Fees Notes: App shows FX/spread; some intra-app transfers may appear fee-free—confirm in-app.

6. Pouch.ph — Best for Lightning → bank/e-wallet payouts in the Philippines

Why Use It: Pouch abstracts the Bitcoin Lightning Network for senders and lands funds to PH banks/e-wallets in minutes. It’s a clean example of “bitcoin rails, fiat UX,” removing friction for overseas workers and micro-merchants.

Best For: U.S./global senders to PH • SMB invoices • Merchant settlement

Notable Features:

- Lightning under the hood; simple web/mobile experience

- Bank/e-wallet cash-out in the Philippines

- Merchant tools and local support

Consider If: Corridors are PH-centric; coverage outside PH is limited.

Alternatives: Strike, Coins.ph

Regions: PH payout focus.

Fees Notes: Network + FX spread; see app for live quote.

7. Tranglo — Best for enterprise APAC corridors via Ripple ODL

Why Use It: Tranglo is a cross-border payment hub that enabled Ripple’s On-Demand Liquidity (ODL) across its corridors, using XRP as a bridge asset to reduce pre-funding and improve speed. It provides enterprise access to a vast payout network in 100+ countries. Tranglo+2Tranglo+2

Best For: Licensed remittance operators • Fintechs • PSPs seeking APAC reach

Notable Features:

- ODL across many corridors; instant, pre-funding-free settlement Tranglo

- 5,000+ payout partners; 100+ countries Tranglo

- Portal + APIs for B2B integration

Consider If: ODL availability varies by corridor/compliance.

Alternatives: SBI Remit, Bitso Business

Regions: Global/APAC heavy.

Fees Notes: Enterprise pricing; FX spread + network costs.

8. SBI Remit — Best for Japan→PH/VN corridors using XRP ODL

Why Use It: SBI Remit launched a remittance service using XRP through Ripple/Treasure Data/Tranglo stack, focusing on the Japan→Philippines & Vietnam corridors. For Japan-origin transfers into Southeast Asia, it’s a regulated, XRP-settled option. remit.co.jp

Best For: Japan-based senders • B2B/B2C payout into PH/VN

Notable Features:

- XRP as bridge asset; fast settlement remit.co.jp

- Partnership with Tranglo for payout connectivity remit.co.jp

- Licensed, established remittance brand in JP

Consider If: Corridor scope is focused; confirm supported routes.

Alternatives: Tranglo, Coins.ph

Regions: Japan→Philippines, Vietnam.

Fees Notes: Standard remittance + FX; see SBI Remit schedule.

9. AZA Finance — Best for B2B Africa cross-border payouts over digital asset rails

Why Use It: Formerly BitPesa, AZA Finance specializes in enterprise cross-border payments and treasury in Africa, long known for leveraging digital asset rails to improve settlement. It supports multi-country bank and mobile-money payouts for payroll, vendor payments, and fintech flows.

Best For: Enterprises • Marketplaces • Fintech payout platforms

Notable Features:

- Local payout to bank/mobile money across African markets

- B2B focus with compliance onboarding

- FX + treasury support

Consider If: Requires business KYC and minimum volumes.

Alternatives: Yellow Card, Kotani Pay

Regions: Pan-Africa focus.

Fees Notes: Enterprise pricing; FX spread.

10. Kotani Pay — Best for stablecoin→mobile money in East Africa

Why Use It: Kotani Pay bridges stablecoins (notably on Celo) to mobile money (e.g., M-Pesa) so recipients can receive funds without a crypto wallet. This reduces friction and helps businesses/DAOs route funds compliantly to last-mile users.

Best For: NGOs/DAOs paying field teams • SMB payouts • Africa remittances to mobile money

Notable Features:

- Stablecoin→mobile money off-ramp (USSD flows)

- Business dashboards & APIs

- Kenya/Uganda coverage; expanding

Consider If: Coverage is country-specific; confirm supported networks.

Alternatives: Yellow Card, AZA Finance

Regions: East Africa focus.

Fees Notes: FX + mobile-money fees; confirm per country.

Decision Guide: Best By Use Case

- Cash pickup / cash-to-crypto: MoneyGram Ramps

- U.S.→PH via Lightning: Pouch.ph (also Strike for U.S.-origin)

- U.S.→MX & broader LATAM B2B: Bitso Business

- Japan→Southeast Asia with XRP ODL: SBI Remit (JP→PH/VN)

- Pan-Africa consumer remittances: Yellow Card (Yellow Pay)

- Africa B2B payouts & treasury: AZA Finance

- Enterprise APAC corridors / ODL aggregation: Tranglo

- Philippines retail wallet with stablecoins: Coins.ph

- Developer-friendly Lightning UX (sender side): Strike

How to Choose the Right Crypto Remittance Provider (Checklist)

- Confirm your corridor (origin/destination, currencies, payout method).

- Check rail type (Lightning vs stablecoins) and liquidity in that corridor.

- Verify licenses/compliance and recipient KYC/limits.

- Compare total cost (FX spread + transfer fee + network fee).

- Assess speed & reliability (minutes vs hours, cut-off times).

- Review on/off-ramp options (bank, e-wallet, mobile money, cash pickup).

- For businesses: look for APIs, SLAs, and settlement reporting.

- Red flags: unclear fees, no legal entity/licensing, or limited cash-out options.

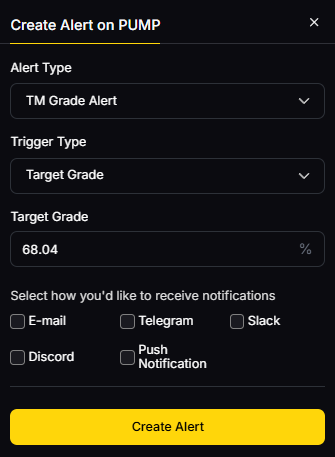

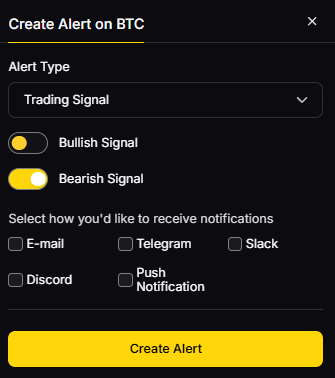

Use Token Metrics With Any Remittance Workflow

- AI Ratings to vet counterparties and ecosystem risk.

- Narrative Detection to monitor stablecoin/Lightning adoption trends.

- Portfolio Optimization for treasuries using stablecoins.

- Alerts/Signals to track market moves affecting FX and on-chain costs.

Workflow: Research corridors → Select provider → Execute → Monitor with alerts.

Primary CTA: Start free trial.

Security & Compliance Tips

- Enable 2FA; use strong device security for any wallet accounts.

- Clarify custody (who holds funds during transfer) and cash-out steps.

- Ensure KYC/AML is complete; keep sender/recipient identity docs ready.

- For businesses, use RFQ/quotes and transaction logs for audits.

- Practice wallet hygiene (test transfers, correct network/addresses).

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Assuming every provider supports your corridor without checking.

- Ignoring FX spreads—“zero fees” ≠ lowest total cost.

- Sending to the wrong network or without a supported cash-out.

- Overlooking recipient limits (daily/monthly) and KYC tiers.

- Relying on one payout method when recipients need bank + cash.

FAQs

What is a crypto remittance?

A cross-border transfer where value moves on-chain (e.g., Lightning, USDC) and is converted to local currency on arrival; it can cut costs and settlement time versus legacy rails.

Are crypto remittances cheaper than traditional methods?

They can be. Savings typically come from fewer intermediaries and 24/7 settlement, but FX spreads, cash-out fees, and network fees still apply. Trusted Crypto Wallet

Which is better for remittances: Lightning or stablecoins?

Lightning excels for low-cost, instant micro-payments; stablecoins are great for fiat-like value with broad exchange/wallet support. The best choice depends on corridor liquidity and payout options. Strike+1

Can I send crypto and have the recipient pick up cash?

Yes—networks like MoneyGram Ramps and select partners enable cash-in/out around USDC rails in supported countries. Availability and fees vary by location. anchors.stellar.org

What regions are strongest today?

LATAM (e.g., U.S.→Mexico), the Philippines, and many African corridors show strong on/off-ramp growth via stablecoins and Lightning. Bitso

Do I need a crypto wallet?

Not always. Many apps abstract the rails and pay out to bank accounts, e-wallets, or mobile money. Check each provider’s onboarding and recipient flow.

Conclusion + Related Reads

If you need cash pickup and stablecoin access, start with MoneyGram Ramps. For U.S.→PH or U.S.→Africa Lightning routes, consider Pouch.ph and Strike. For enterprise flows in LATAM/APAC/Africa, Bitso Business, Tranglo, SBI Remit, AZA Finance, Yellow Card, and Kotani Pay offer strong coverage—each with different strengths in corridors, payout types, and integration depth.

Related Reads:

- Which Cryptocurrency Exchange Should I Use in 2025? A Guide for Smart Trading

- Top Picks for the Best Crypto Trading Platform in 2025

- Top Web3 Wallets in 2025

Top Stablecoin Issuers & Use Cases (2025)

%201.svg)

%201.svg)

Why stablecoin issuers matter in September 2025

Stablecoins have become crypto’s settlement rail, powering exchanges, DeFi, remittances, and payments. In 2025, clarity is improving and liquidity is consolidating—so choosing stablecoin issuers with sound reserves, clear disclosures, and fit-for-purpose design matters more than ever.

Definition: A stablecoin issuer is the organization or protocol that mints and redeems a token designed to track a reference asset (usually USD), with reserves and/or mechanisms intended to hold the peg.

This guide evaluates the leading issuers globally and maps their best use cases—from high-volume trading to compliant payments and decentralized collateral. We focus on reserves quality, transparency, networks supported, institutional access, fees, and regional eligibility. Secondary topics include “USDC vs USDT,” euro/SGD options, and decentralized alternatives that can complement centralized choices. Circle+2Circle+2

How We Picked (Methodology & Scoring)

- Liquidity (30%): Scale of circulation and exchange/DeFi depth for tight spreads and fast settlement.

- Security (25%): Reserve quality, segregation, audits/attestations, onchain safety, and incident track record.

- Coverage (15%): Multi-chain support, fiat rails, and breadth of supported currencies (USD, EUR, SGD).

- Costs (15%): Primary mint/redeem fees, network costs, and known program fees.

- UX (10%): Accessibility, APIs, documentation, and fiat on/off-ramps.

- Support (5%): Enterprise support, disclosures, and transparency cadence.

We relied on official product/docs/security pages from each issuer and used market datasets (e.g., CCData/Kaiko/CoinGecko) for cross-checks only. Last updated September 2025. Circle+1

Top 10 stablecoin issuers and use cases in September 2025

1. Tether — Best for global, always-on liquidity

Why Use It: USD₮ (USDT) is the deepest liquidity pool across CEXs and many L2s—useful for traders and market makers who prioritize fills and routing. Tether publishes quarterly reserve attestations by BDO and a detailed reserves breakdown, improving transparency versus prior years. Tether+1

Best For: Active traders, OTC desks, market makers, emerging-market remittances.

Notable Features: Multi-chain footprint; public reserve updates; operational resilience at massive scale. Tether

Consider If: U.S. persons cannot use Tether’s own platform services under its Terms; rely on supported exchanges instead. Regions: Global (platform restrictions apply). Fees/Notes: Account verification and certain fees apply at the platform level. Tether+1

Alternatives: Circle (USDC), First Digital Labs (FDUSD).

2. Circle — USDC / EURC — Best for regulated, enterprise-grade rails

Why Use It: Circle emphasizes transparency, monthly reserve attestations, and segregation of funds. USDC is widely integrated with banks, fintechs, and onchain apps; EURC brings a euro option under the same standards. Circle+1

Best For: Enterprises/fintechs, payment flows, compliant treasuries, DeFi power users.

Notable Features: Circle Mint for programmatic mint/redeem; monthly attestations; multi-chain support; extensive docs. Fees/Notes: Institutional fee schedule applies for certain high-volume flows. Circle+1

Regions: Global (availability varies by partner/exchange).

Alternatives: Paxos (USDP), PayPal USD (PYUSD).

3. MakerDAO — DAI — Best decentralized, overcollateralized dollar

Why Use It: DAI is minted against overcollateralized crypto via the Maker Protocol, giving a censorship-resistant alternative to fiat-custodied coins. The Peg Stability Module (PSM) smooths peg fluctuations by allowing swaps with other stables. docs.makerdao.com+1

Best For: DeFi natives, long-term onchain treasuries, collateralized borrowing.

Notable Features: Onchain transparency; collateral diversity with governance controls; mature integrations across DeFi. docs.makerdao.com

Consider If: Exposure to crypto collateral and governance risk differs from fiat-backed models. Regions: Global.

Alternatives: Liquity (LUSD/BOLD), Frax (frxUSD).

4. First Digital Labs — FDUSD — Best for Asia-centric trading depth

Why Use It: FDUSD is fully reserved and designed for 1:1 redemption; it has become a deep-liquidity quote asset on major Asian venues. Issuance moved to a BVI entity (FD121 BVI) in 2025 to support global accessibility. firstdigitallabs.com+1

Best For: Traders on Asia-focused exchanges, cross-border settlement in APAC, OTC desks.

Notable Features: Monthly attestations; segregation of assets with qualified custodians; institutional onboarding. Fees/Notes: Primary mint/redeem requires becoming a client; retail typically uses secondary markets. firstdigitallabs.com+1

Regions: Global (institutional primary; retail via exchanges).

Alternatives: Tether (USDT), Circle (USDC).

5. Paxos — USDP — Best for NYDFS-regulated issuance

Why Use It: USDP is issued by Paxos Trust (NYDFS-regulated), held 100% in cash and cash equivalents, and redeemable 1:1. Paxos provides enterprise APIs and no-fee mint/redeem for primary customers. Paxos+1

Best For: Enterprises needing regulated counterparties, payment processors, fintechs.

Notable Features: Segregated, bankruptcy-remote client assets; Ethereum & Solana support; rich developer docs. Fees/Notes: No Paxos fee to mint/redeem USDP; bank/network fees may apply. Paxos+1

Regions: US/EU/APAC via partners; check onboarding eligibility.

Alternatives: Circle (USDC), PayPal USD (PYUSD).

6. PayPal USD (PYUSD) — Best for consumer payments in the U.S.

Why Use It: PYUSD brings stablecoins to familiar wallets (PayPal/Venmo), with instant P2P and merchant flows for eligible U.S. users. It’s issued by Paxos Trust and is redeemable within the PayPal ecosystem; PayPal has also launched an optional rewards program for eligible U.S. users. PayPal+1

Best For: U.S. consumers and SMBs using PayPal/Venmo, payment acceptance, loyalty.

Notable Features: Wallet-native UX; on/off-ramps; integrations expanding across networks. Fees/Notes: No fees to buy/sell/hold/transfer PYUSD inside eligible U.S. PayPal balances; conversion fees apply when swapping with other crypto. PayPal

Regions: U.S. only for consumer access via PayPal/Venmo.

Alternatives: USDC (for global reach), USDP (enterprise rails).

7. Ethena Labs — USDe — Best synthetic dollar for DeFi yields (advanced users)

Why Use It: USDe uses a delta-neutral mechanism (spot + perps/futures) to target dollar stability without relying solely on banks. sUSDe offers onchain, variable rewards sourced from the strategy. This is a crypto-native design and differs from fiat-redeemable models. docs.ethena.fi+1

Best For: Sophisticated DeFi users, L2 yield strategies, protocols integrating synthetic dollars.

Notable Features: Whitelist-based mint/redeem; peg supported by hedged positions; extensive docs. Fees/Notes: Not available to U.S. users; USDe is not redeemable for fiat by design. docs.ethena.fi+1

Regions: Global (restricted jurisdictions excluded).

Alternatives: DAI, frxUSD.

8. Frax Finance — frxUSD — Best modular stable for DeFi integrations

Why Use It: Frax introduced frxUSD, a fully collateralized, fiat-redeemable stablecoin with “enshrined custodians” while retaining Frax’s modular DeFi stack. It aims to couple institutional-grade backing with protocol-level tooling (lending/AMMs). Frax

Best For: DeFi builders, protocols needing composability, multi-product integration.

Notable Features: Hybrid custody model; Fraxtal/Frax ecosystem; onchain transparency dashboard. Fees/Notes: Details governed by Frax docs and custodial partners. Frax+1

Regions: Global (availability via exchanges/integrations).

Alternatives: USDC, DAI.

9. StraitsX — XSGD — Best for SGD settlements and APAC fintech rails

Why Use It: XSGD is a Singapore dollar stablecoin with monthly reserve attestations and a strong focus on compliant payments infrastructure across Southeast Asia. It’s widely integrated with regional wallets, OTC, and DeFi. straitsx.com+1

Best For: APAC businesses, cross-border SGD flows, FX pairs (XSGD↔USD stables).

Notable Features: Monthly attestations; issuer entities for SGD/USD; APIs for swaps/OTC. Fees/Notes: Platform and network fees apply; see issuer terms. straitsx.com

Regions: APAC (global transferability on supported chains).

Alternatives: USDC (USD rails), Monerium (EURe for EUR rails).

10. Monerium — EURe — Best for euro e-money compliance

Why Use It: Monerium issues EURe as regulated e-money under EU rules with segregated, over-collateralized assets—designed for compliant euro settlements onchain. Tokens live on Ethereum, Gnosis, and Polygon with instant redeemability. Monerium+1

Best For: European fintechs, treasuries needing euro rails, compliant B2B payments.

Notable Features: Authorized EMI; 102% safeguarding policy; e-money legal clarity; audited financials. Fees/Notes: Published fee schedule; standard banking/network fees may apply. Monerium+1

Regions: EU/EEA (global transferability on supported chains).

Alternatives: Circle (EURC), StraitsX (XSGD for SGD).

Decision Guide: Best By Use Case

- Global trading liquidity: Tether (USDT). Tether

- Regulated U.S./enterprise rails: Circle (USDC), Paxos (USDP). Circle+1

- U.S. consumer payments/Loyalty: PayPal USD (PYUSD). PayPal

- Decentralized/censorship-resistant: MakerDAO (DAI); Liquity (LUSD/BOLD) as alt. docs.makerdao.com+1

- APAC settlement/SGD pairs: StraitsX (XSGD). straitsx.com

- Euro compliance: Monerium (EURe), Circle (EURC). Monerium+1

- DeFi-native synthetic dollar/yields: Ethena (USDe). docs.ethena.fi

- Modular DeFi integration: Frax (frxUSD). Frax

How to Choose the Right stablecoin issuers (Checklist)

- Region & eligibility: Are you a U.S. consumer, EU business, or global trader? (PayPal vs Circle/Paxos vs Tether/DeFi.) PayPal

- Reserves & attestations: Look for frequent, third-party reports and clear segregation of client assets. Circle+1

- Mechanism fit: Fiat-backed vs overcollateralized vs synthetic—match to risk tolerance. docs.makerdao.com+1

- Chains & integrations: Ensure support for your target L2s, exchanges, and wallets.

- Fees & slippage: Primary mint/redeem costs, network gas, conversion spreads. Paxos+1

- Operational needs: APIs, treasury tools, reporting, and support SLAs.

- Red flags: Vague reserve language, infrequent disclosures, or unclear redemption policies.

Use Token Metrics With Any stablecoin issuers

- AI Ratings surface quality signals behind liquidity metrics.

- Narrative Detection spots capital rotation into specific stablecoin ecosystems.

- Portfolio Optimization helps size stablecoin sleeves by mandate (trading vs yield vs payments).

- Alerts & Signals track peg deviations, volume spikes, and exchange outflows.

Workflow: Research → Select → Execute with your chosen issuer/exchange → Monitor with alerts.

Primary CTA: Start free trial

Security & Compliance Tips

- Enable 2FA and secure treasury ops (role-based access, hardware keys).

- Confirm custody setup (segregated accounts; multi-sig or MPC for smart-contract risk).

- Complete KYC/AML where required; verify permitted jurisdictions. Tether+1

- Use RFQ/OTC for large conversions to reduce slippage.

- Practice wallet hygiene: label treasury addresses, restrict permissions, and test redemptions.

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Treating all stablecoins as identical; mechanisms and risks vary.

- Ignoring fee schedules and settlement timelines for large redeems. Circle Help+1

- Using a region-restricted product (e.g., PYUSD outside the U.S.; USDe app in restricted markets). PayPal+1

- Overconcentrating in a single issuer or chain.

- Skipping ongoing monitoring of peg, reserves, and disclosures.

FAQs

1) What are the main types of stablecoin issuers?

Three broad models: (1) Fiat-backed (Circle, Paxos, First Digital Labs), (2) Overcollateralized crypto-backed (MakerDAO DAI; Liquity), and (3) Synthetic/hedged (Ethena USDe). Each has distinct reserve/risk properties. docs.ethena.fi+3Circle+3Paxos+3

2) Which stablecoin is best for trading liquidity?

USDT typically leads on global CEX depth and pairs, with USDC often preferred for fiat-connected flows and DeFi. Choose based on venue support and treasury needs. Tether+1

3) Can U.S. users access every stablecoin?

No. PYUSD is for eligible U.S. PayPal/Venmo users; some protocols (e.g., Ethena) restrict U.S. access to their app. Always check terms. PayPal+1

4) How do fees work for minting and redeeming?

Paxos states no fees for mint/redeem USDP/PYUSD for primary clients; Circle has institutional schedules; Tether lists platform fees. Secondary-market trades still incur exchange/gas costs. Paxos+2Circle Help+2

5) Are euro or SGD stablecoins useful?

Yes. EURC/EURe enable euro settlements under EU rules; XSGD supports APAC rails and FX paths versus USD stables. Circle+2Monerium+2

6) Is DAI safer than fiat-backed coins?

“Safer” depends on your risk lens. DAI reduces bank/custodian reliance but adds crypto-collateral and governance risk; fiat-backed coins rely on custodians and regulators. Diversification is common. docs.makerdao.com

Conclusion + Related Reads

If you need global trading liquidity, start with USDT/USDC. For enterprise-grade compliance, Circle/Paxos shine. For decentralized resilience, DAI (and Liquity) fit. For regional rails, consider XSGD (APAC) and EURe/EURC (EU). Pair the right issuer with your use case, then monitor peg, reserves, and policy changes over time.

Related Reads:

- Best Cryptocurrency Exchanges 2025

- Top Derivatives Platforms 2025

- Top Institutional Custody Providers 2025

Top On and Off-Ramp Providers (Fiat to Crypto) 2025

%201.svg)

%201.svg)

Why Fiat ↔ Crypto On/Off-Ramps Matter in September 2025

Getting money into and out of crypto should be fast, safe, and compliant. In 2025, wallets, dapps, exchanges, and fintechs increasingly rely on crypto on/off-ramp providers to convert fiat to tokens and cash back out to bank rails—all without forcing users to bounce between apps. Definition: an on-ramp lets users buy crypto with fiat; an off-ramp lets them sell crypto back to fiat and withdraw to bank accounts or cards. This guide is for product leaders, devs, and advanced users comparing coverage, fees, and risk controls across global options. We score providers on liquidity, security, asset/market coverage, costs, UX, and support, then recommend the best fits by use case. Secondary angles we considered: fiat to crypto onramp, crypto off-ramp, and common flows like “buy crypto with bank transfer.”

How We Picked (Methodology & Scoring)

- Liquidity (30%) – depth, uptime, and quote quality across assets/fiat rails.

- Security (25%) – audits, certifications, KYC/AML controls, trust center disclosures.

- Coverage (15%) – supported countries, payment methods, off-ramp payout rails.

- Costs (15%) – transparent fees/spreads; promos (e.g., USDC zero-fee tiers).

- UX (10%) – speed (KYC/settlement), embeddable widgets, developer docs.

- Support (5%) – docs, SLAs, live support, incident comms.

Data sources: official product/docs and security pages; licensing and disclosures; limited cross-checks with widely cited market datasets. We only link to official provider sites in this article. Last updated September 2025.

Top 10 Fiat ↔ Crypto On/Off-Ramp Providers in September 2025

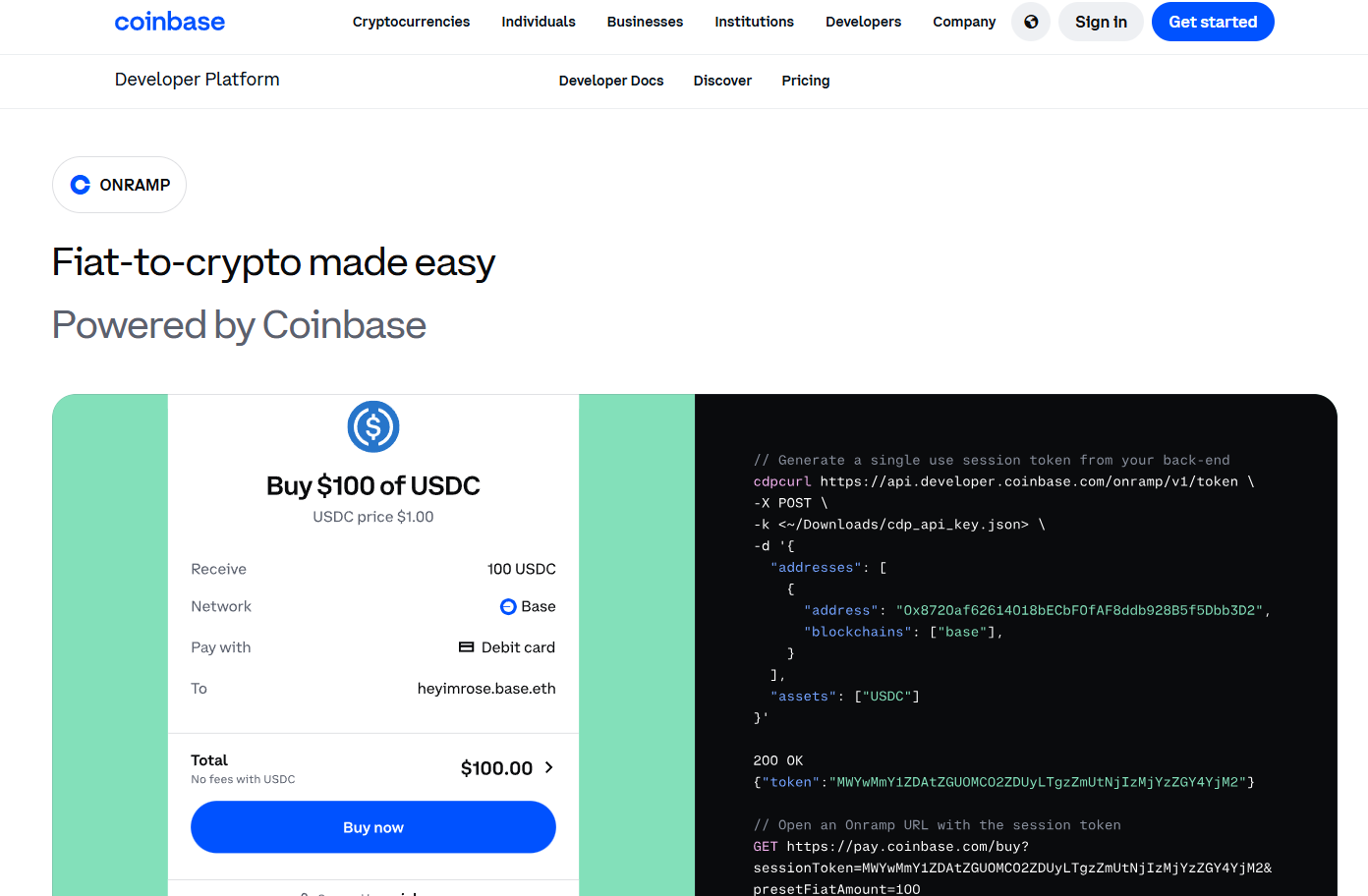

1. Coinbase Onramp & Offramp — Best for USDC flows & regulated U.S./EU coverage

- Why Use It: Coinbase’s hosted Onramp and Offramp APIs let you embed buy/sell with bank rails and cards, including ACH cashouts, inside your app. Select apps can access zero-fee USDC onramp/offramp promotions and free USDC on Base. Coinbase+2Coinbase+2

- Best For: U.S./EU wallets & dapps, consumer fintechs, apps prioritizing compliance.

- Notable Features: hosted widgets; guest checkout for US (no account up to limits); ACH cashout; strong docs & SDKs. Coinbase Developer Docs

- Fees Notes: Standard fees vary by method; USDC promos may apply. Coinbase

- Regions: Global reach with strongest support in U.S./EU; method availability varies. Coinbase Developer Docs

- Consider If: You need a turnkey, regulated option with ACH off-ramp.

- Alternatives: MoonPay, Ramp Network.

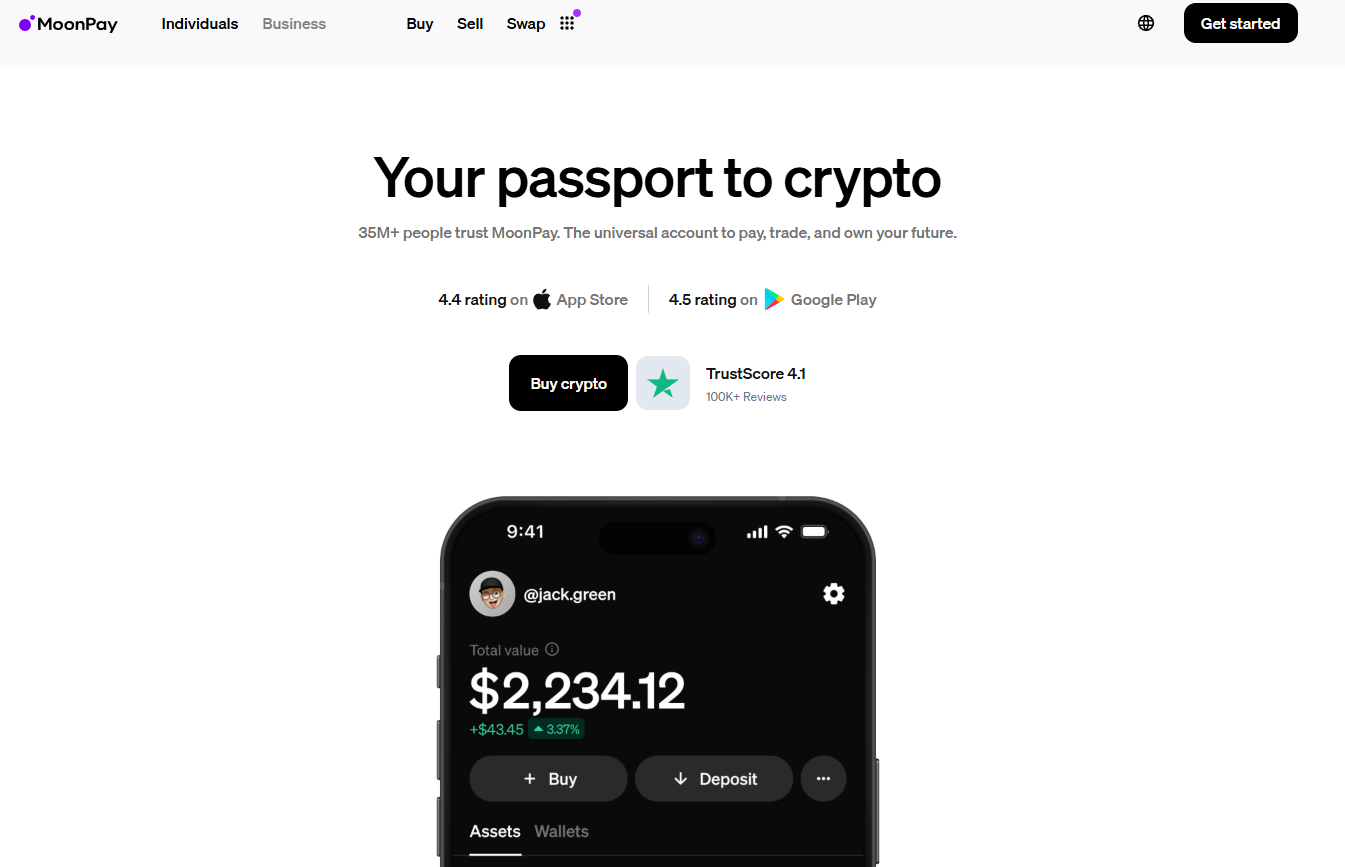

2. MoonPay — Best for non-custodial UX & card coverage

- Why Use It: MoonPay offers fast card/Apple Pay/PayPal buys and a non-custodial off-ramp, letting users sell crypto while keeping control of keys. Good fit for wallets and NFT apps that want an embedded flow. MoonPay+1

- Best For: Self-custody wallets, NFT marketplaces, global card-first audiences.

- Notable Features: Onramp + off-ramp; non-custodial design; quick card settlement. MoonPay+1

- Fees Notes: Varies by payment method and region.

- Regions: Broad international availability; local method support varies.

- Consider If: You want non-custodial off-ramp with strong card acceptance.

- Alternatives: Transak, Banxa.

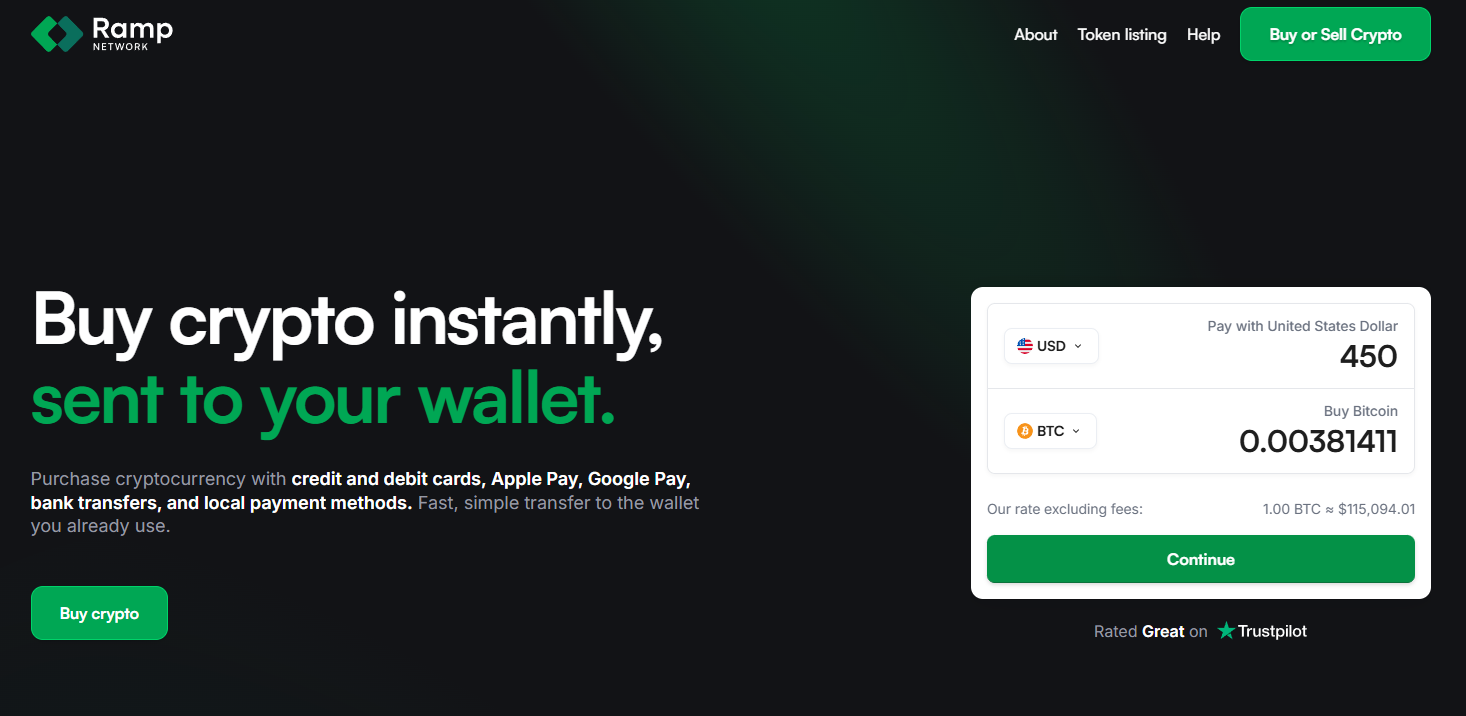

3. Ramp Network — Best for global coverage + fast KYC

- Why Use It: Ramp supports 100+ assets and multiple local rails (cards, bank transfers, Pix, SPEI) with fast, document-free KYC in eligible markets and SOC/ISO certifications published via its Trust Center. rampnetwork.com+2ramp.network+2

- Best For: Wallets/dapps needing wide country coverage and quick onboarding.

- Notable Features: On & off-ramp; 100+ assets; local rails incl. Pix & SPEI payouts; strong security disclosures. ramp.network+1

- Fees Notes: Vary by method, asset, and geography.

- Regions: 150+ countries; some U.S. states support on-ramp only (no off-ramp). support.rampnetwork.com

- Consider If: You want breadth plus local rails in LATAM/EU.

- Alternatives: Transak, Alchemy Pay.

4. Transak — Best for developer tooling & hybrid use cases

- Why Use It: Transak offers on/off-ramp coverage (40+ off-ramp assets across 20+ networks) with over 64+ supported countries and Transak One to let users fund complex actions (e.g., stake/bridge) from fiat in one flow. Transak Docs+2Transak+2

- Best For: Developers needing a broad, configurable integration; DeFi apps.

- Notable Features: Off-ramp to bank; multi-network coverage; business (corporate) on/off-ramp; embeddable widgets. Transak+1

- Fees Notes: Vary by method; see widget quotes.

- Regions: 60+ countries; payment methods differ by market. Transak

- Consider If: You need both retail and corporate on/off-ramp options.

- Alternatives: Ramp Network, Banxa.

5. Banxa — Best for compliance-heavy enterprise & deep licensing

- Why Use It: Banxa emphasizes regulated operations with published USA MTL and global license lists, plus enterprise-grade AML/CTF and security disclosures. Strong for partners who need extensive compliance artifacts. Banxa+2Banxa+2

- Best For: Enterprises, wallets, and exchanges with strict compliance needs.

- Notable Features: On/off-ramp via API/widget; broad fiat/crypto support; license/AML pages; developer SDKs. Banxa+1

- Fees Notes: Pricing varies; transparent info pages provided. Banxa

- Regions: Global (entity-specific); U.S. coverage via MTL entity; details in license PDFs. Banxa

- Consider If: Your risk/compliance teams require detailed attestations.

- Alternatives: Zero Hash, Transak.

6. Alchemy Pay — Best for emerging markets & alternative wallets

- Why Use It: Alchemy Pay bridges fiat and crypto with on/off-ramp across 50+ countries (and expanding), focusing on emerging markets and a wide range of local wallets/payments. It’s actively growing U.S. coverage via new MTLs (e.g., Arizona, South Carolina). docs+2alchemypay.org+2

- Best For: Dapps targeting emerging markets; global apps needing local wallets.

- Notable Features: On/off-ramp; Apple/Google Pay & regional wallets; developer docs; business flows. alchemypay.org

- Fees Notes: Competitive, vary by payment rail.

- Regions: Global (check country list); growing U.S. state coverage via MTLs. alchemypay.org

- Consider If: You prioritize local payment methods in APAC/LATAM.

- Alternatives: Transak, Ramp Network.

7. Kraken — Best regulated exchange on/off-ramp (U.S./EU)

- Why Use It: Kraken provides fiat funding and withdrawals in USD/EUR/CAD with ACH, SEPA, and card rails, offering a straightforward path to buy/sell and cash out to bank. Useful if you want exchange liquidity plus strong support docs. Kraken+1

- Best For: Traders and users who prefer exchange-native fiat rails.

- Notable Features: ACH deposits (no fee for many U.S. clients), cash withdrawals, app guides. Kraken+2Kraken Support+2

- Fees Notes: Funding/withdrawal fees and holds depend on method (e.g., ACH hold windows). Kraken Support

- Regions: U.S./EU/Canada; ACH account linking not available in NY, WA, TX. Kraken

- Consider If: You want deep orderbook liquidity alongside fiat rails.

- Alternatives: Bitstamp, Coinbase.

8. Bitstamp — Best for EU banking rails & stable UX

- Why Use It: One of the longest-running exchanges, Bitstamp supports bank deposits (SEPA/International, ACH) and card purchases, plus fiat withdrawals to bank accounts. Simple, well-documented flows are ideal for EU and U.S. users wanting a clean on/off-ramp. Bitstamp+2Bitstamp+2

- Best For: EU users; U.S. users comfortable with exchange-based cashouts.

- Notable Features: ACH deposits/withdrawals, SEPA (incl. Instant SEPA), card & Apple/Google Pay availability. Bitstamp+2Bitstamp+2

- Fees Notes: See Bitstamp fee schedule; varies by method. Bitstamp

- Regions: EU/UK/US (availability by method).

- Consider If: You want familiar exchange UX with established bank rails.

- Alternatives: Kraken, Coinbase.

9. Stripe Crypto Onramp — Best embeddable onramp for U.S./EU apps

- Why Use It: Stripe’s fiat-to-crypto onramp is a customizable widget/hosted flow you can embed in wallets, NFT apps, and dapps—Stripe handles KYC, fraud, and payments. Ideal for teams already on Stripe. Note: onramp availability is U.S. (excl. Hawaii) + EU. Stripe Docs+2Stripe Docs+2

- Best For: U.S./EU dapps and platforms standardizing on Stripe.

- Notable Features: Embedded or hosted onramp; identity & fraud tooling; stablecoin payout stack. Stripe Docs

- Fees Notes: Stripe pricing applies; quotes shown in onramp UI.

- Regions: U.S. (minus HI) and EU currently. Stripe Docs

- Consider If: You need a polished onramp (no off-ramp) with Stripe stack.

- Alternatives: Coinbase Onramp, MoonPay.

10. Zero Hash — Best turnkey B2B infrastructure (regulated build-out)

- Why Use It: Zero Hash powers on/off-ramp for enterprises, abstracting licensing and regulatory complexity. B2B partners can convert between fiat and 60+ crypto assets, with quote controls and payout rails. zerohash.com+1

- Best For: Fintechs, banks, and platforms embedding compliant crypto.

- Notable Features: API-first; short path to market; configurable quotes; bank payouts. docs.zerohash.com

- Fees Notes: Enterprise pricing; volume-based.

- Regions: Coverage varies by solution and jurisdiction.

- Consider If: You need compliance + infra rather than a retail widget.

- Alternatives: Banxa, Coinbase (developer).

Decision Guide: Best By Use Case

- Regulated U.S. focus (ACH off-ramp): Coinbase Onramp & Offramp; Kraken. Coinbase Developer Docs+1

- Global card-first & non-custodial: MoonPay. MoonPay

- Wide country/payment coverage: Ramp Network, Transak, Alchemy Pay. rampnetwork.com+2Transak+2

- Enterprise/Banking compliance: Banxa, Zero Hash. Banxa+1

- EU banking rails: Bitstamp. Bitstamp

- Stripe-native apps (U.S./EU): Stripe Crypto Onramp. Stripe Docs

How to Choose the Right Fiat ↔ Crypto On/Off-Ramp (Checklist)

- Confirm region & method eligibility (ACH/SEPA/cards; off-ramp availability by country/state).

- Check asset/fiat coverage for your top flows (BTC, ETH, stablecoins, local fiat).

- Review security posture (SOC/ISO, trust center, KYC/AML, sanctions screening). Ramp

- Compare fees & spreads (and promos like zero-fee USDC) and settlement speeds. Coinbase

- Validate developer experience (docs, hosted vs. embedded, SDKs). Coinbase

- Ensure support & SLAs meet your needs (status pages, incident comms).

- Red flags: unclear licensing, no security disclosures, or “global” claims without a country/method matrix.

Use Token Metrics With Any On/Off-Ramp

- AI Ratings: Screen top assets before you convert.

- Narrative Detection: Spot sector momentum early.

- Portfolio Optimization: Size positions to risk.

- Alerts/Signals: Get entries/exits without screen-watching.

Workflow: Research → Select ramp → Execute buy/sell → Monitor with alerts.

Primary CTA: Start free trial

Security & Compliance Tips

- Enable 2FA and use strong unique passwords.

- Separate custody (self-custody vs. exchange) from ramp accounts as needed.

- Follow KYC/AML requirements; prepare source-of-funds docs for higher limits.

- For OTC/RFQ flows, lock quotes and confirm fees before sending. docs.zerohash.com

- Maintain wallet hygiene: test transfers, verify addresses, track gas/fees.

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Assuming a provider supports both on- and off-ramp in your country (often not true). support.rampnetwork.com

- Ignoring ACH hold windows or payout timings when planning cashouts. Kraken Support

- Overlooking fees/spreads vs. headline “no fee” promos. Coinbase

- Embedding an onramp without sandbox/testing error states.

- Not checking licensing & security disclosures before integration. Banxa+1

FAQs

What is a crypto on-ramp vs. off-ramp?

An on-ramp lets users buy crypto with fiat (e.g., card, bank transfer). An off-ramp lets users sell crypto for fiat and withdraw to bank rails or cards. Coinbase

Which providers are best for U.S. ACH cashouts?

Coinbase Offramp and Kraken both support ACH, with method availability depending on state and account status. Coinbase Developer Docs+1

Does Stripe support off-ramp?

Stripe currently offers a fiat-to-crypto onramp (no off-ramp). It’s available in the U.S. (excluding Hawaii) and EU. Stripe Docs

Which options are strongest outside the U.S.?

For broad coverage and local rails, consider Ramp Network (Pix/SPEI), Transak (multi-network off-ramp), and Alchemy Pay (regional wallets). ramp.network+2Transak Docs+2

What about enterprise-grade compliance?

Banxa and Zero Hash publish license/compliance docs and are built for B2B integrations with higher assurance requirements. Banxa+1

Conclusion + Related Reads

The best choice depends on your region, payout rails, and risk posture. If you want a regulated U.S. ACH flow with strong docs, start with Coinbase. Need global coverage and local methods? Ramp, Transak, and Alchemy Pay shine. For enterprise and bank-grade requirements, Banxa and Zero Hash are strong bets. Exchange-based ramps via Kraken or Bitstamp work well if you also need deep liquidity.

Related Reads:

- Best Cryptocurrency Exchanges 2025

- Top Derivatives Platforms 2025

- Top Institutional Custody Providers 2025

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)