How Crypto APIs Streamline Tax Reporting for Digital Assets

For active crypto traders and digital asset holders, the yearly ritual of tax reporting can be complicated and stressful. Each wallet, exchange, and blockchain interacts in ways that fragment your transaction data, making accurate reporting a daunting task. As crypto adoption spreads, can crypto APIs simplify this process and help ensure accurate, timely tax compliance?

What Are Crypto APIs and Why Do They Matter?

APIs, or Application Programming Interfaces, are digital gateways that allow software applications to communicate with one another. In the cryptocurrency world, crypto APIs connect apps, platforms, and users to real-time blockchain data, exchange information, and transaction histories. Major exchanges, wallets, and analytics providers offer APIs so users can access their data programmatically.

For tax reporting, this connection is critical. Crypto APIs enable retrieval of:

- All wallet and exchange transactions—including buys, sells, transfers, and staking rewards

- Historical price data for each asset

- Incoming and outgoing token flows (even across multiple blockchains)

- Unique identifiers for each transaction

This direct access ensures users and accounting tools get the most accurate, comprehensive data possible, setting the foundation for compliant tax reporting.

How Crypto APIs Support Tax Reporting

Crypto tax liabilities are determined by tracking each crypto transaction throughout the tax year—across wallets, exchanges, blockchains, and DeFi protocols. Each step must be captured: acquisitions, sales, conversions, airdrops, rewards, and sometimes even failed transactions. Manually gathering this information often leads to errors and omissions.

Crypto APIs automate much of this process:

- Transaction Aggregation: APIs fetch transaction histories from exchanges and wallets, eliminating manual downloads or spreadsheet entries.

- Historical Pricing: APIs deliver price data at the exact moments of each transaction, enabling accurate capital gains/loss calculations.

- Multi-Asset, Multi-Chain Support: API integrations can bring together Bitcoin, Ethereum, altcoins, and tokens from various blockchains for consolidated reporting.

- Tax Form Generation: Some tax tools leverage APIs to automatically fill IRS forms such as 8949 or country-specific equivalents.

By automating data retrieval and normalization, APIs reduce human error and relieve the tedium of manual tracking, increasing the likelihood of accurate and compliant reporting.

Types of Crypto APIs Used for Taxation

Various crypto APIs play roles in tax calculation and compliance workflows. Their capabilities can be grouped into several categories:

- Exchange APIs: Provide read-only access to trade history, transfers, and account balances from centralized trading platforms.

- Wallet APIs: Extract on-chain transactions, including self-custodied wallets and hardware devices, for full account tracing.

- Blockchain Data APIs: Parse data from the blockchain itself for assets or platforms not covered by common wallets/exchanges.

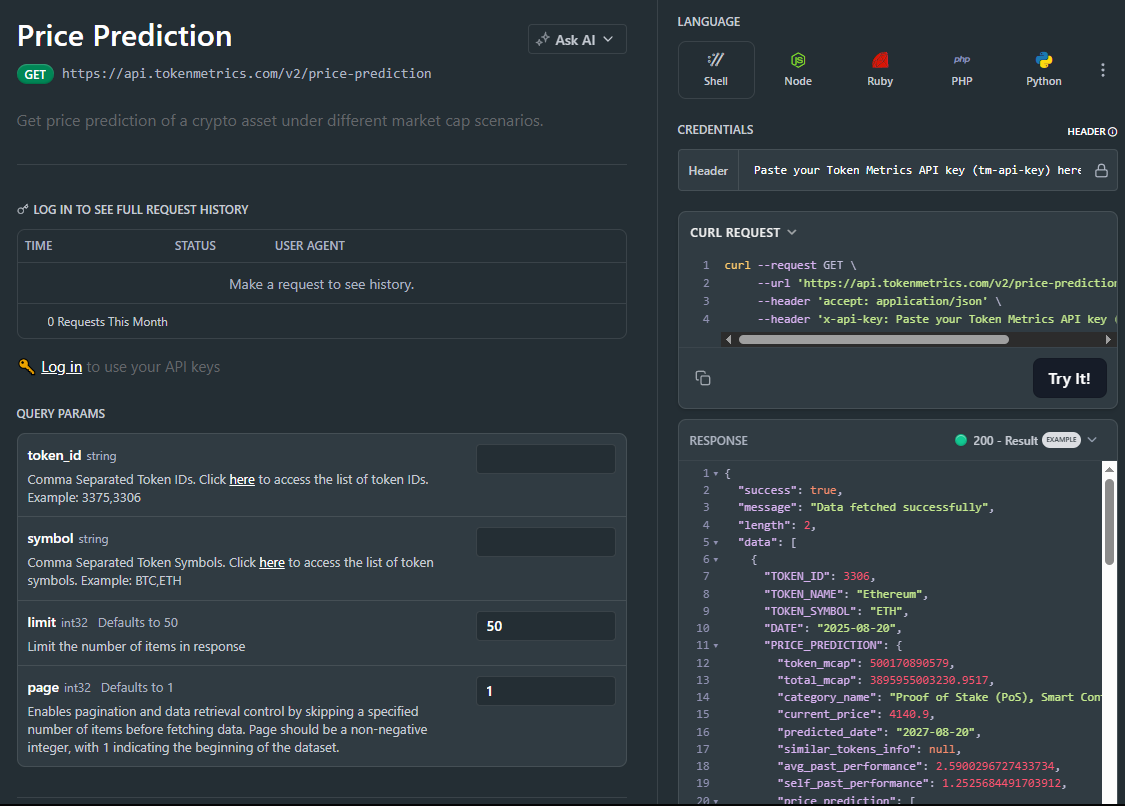

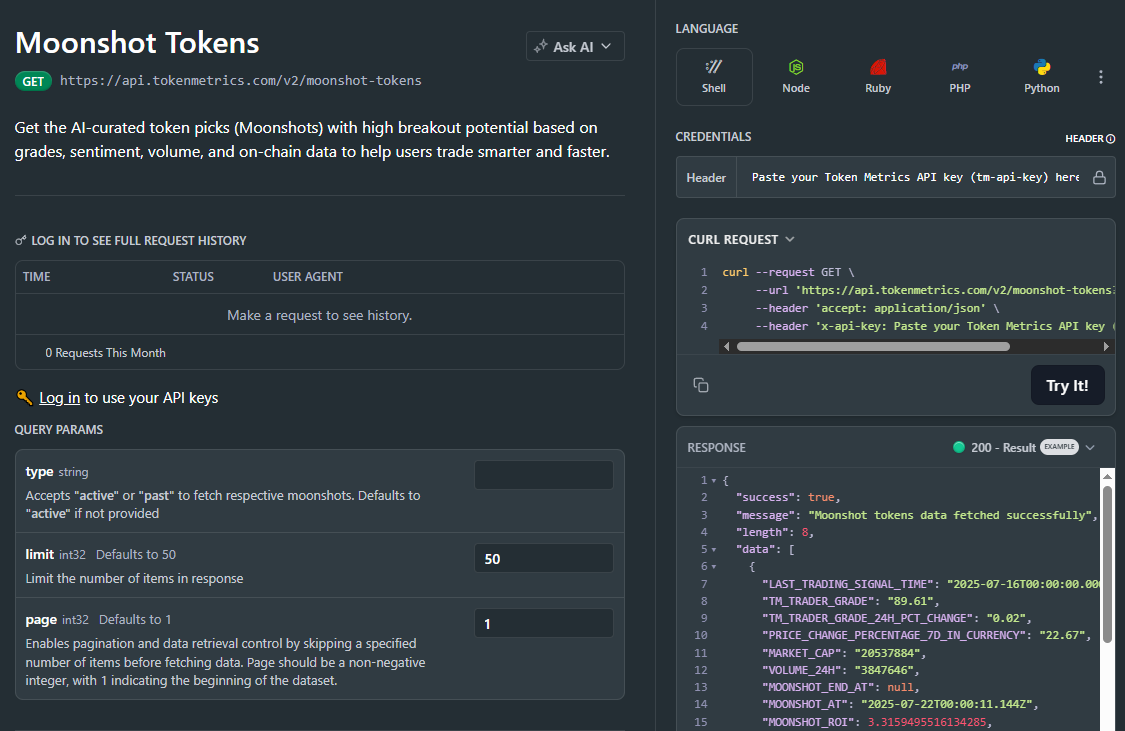

- Price & Market Data APIs: Supply pricing at specific timestamps, essential for tax-lot and fair market value calculations.

- Analytics & Reporting APIs: Common with crypto tax software, these deliver formatted tax reports, error warnings, and suggestion workflows.

Leading crypto tax tools integrate one or more of these API types to connect your accounts and gather all the necessary information for reporting.

Choosing the Right Crypto API for Your Tax Needs

No single crypto API covers every trading platform, blockchain, or asset. When selecting an API—or a tax tool that integrates APIs—consider these factors:

- Covers All Your Sources: Check if the API (or tools that use it) supports all the exchanges, wallets, and blockchains you’ve used in the tax year.

- Data Completeness: Ensure the API delivers granular transaction details (timestamps, fees, asset IDs, etc.) for accurate gain/loss calculations.

- Reliability & Security: Look for established providers with a track record of uptime and compliant data handling practices.

- Automation & Scalability: If you’re an active trader or institutional user, prioritize APIs offering automation, bulk data retrieval, and developer support.

- Integration with Tax Software: Using a tax platform with strong API integrations with your coins and exchanges can simplify everything—from import to tax form generation.

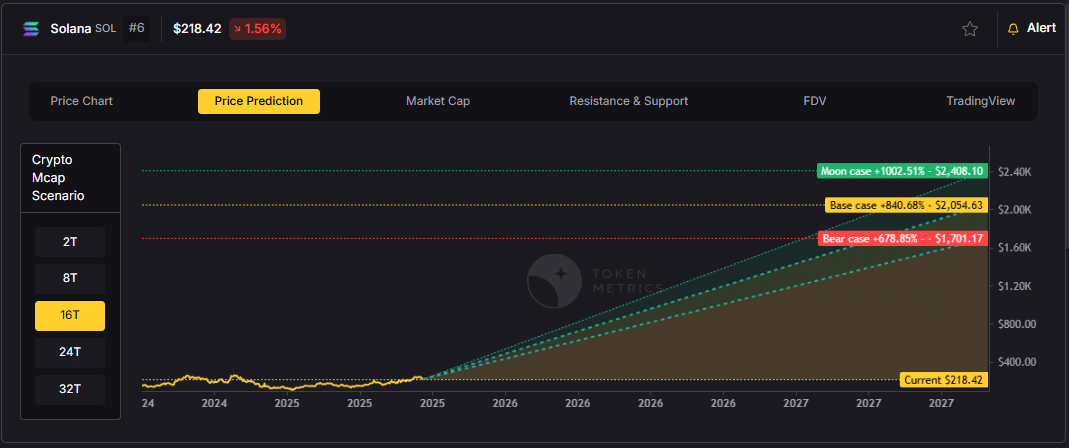

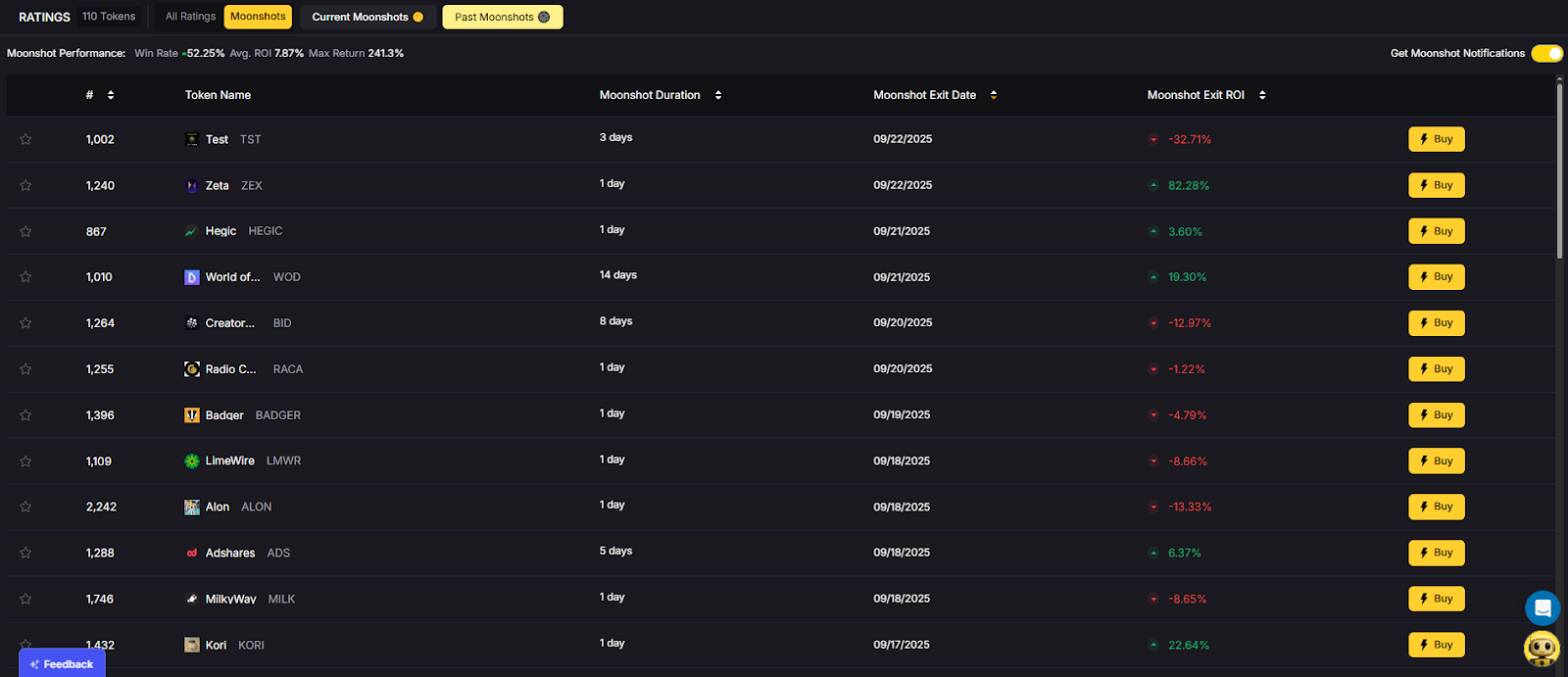

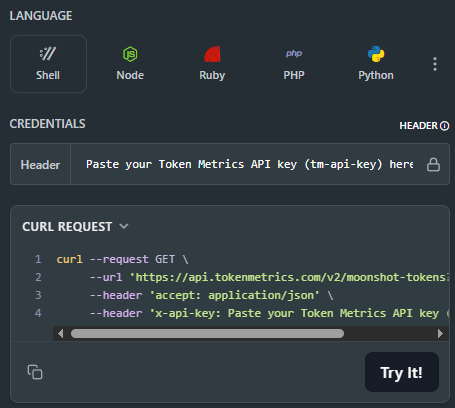

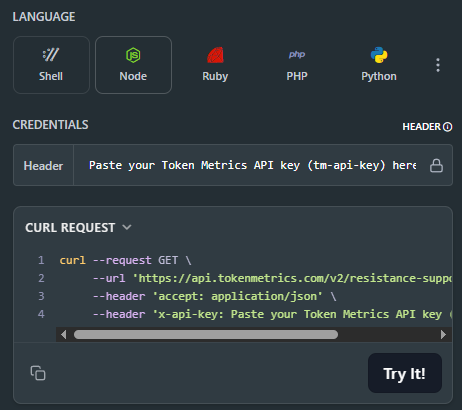

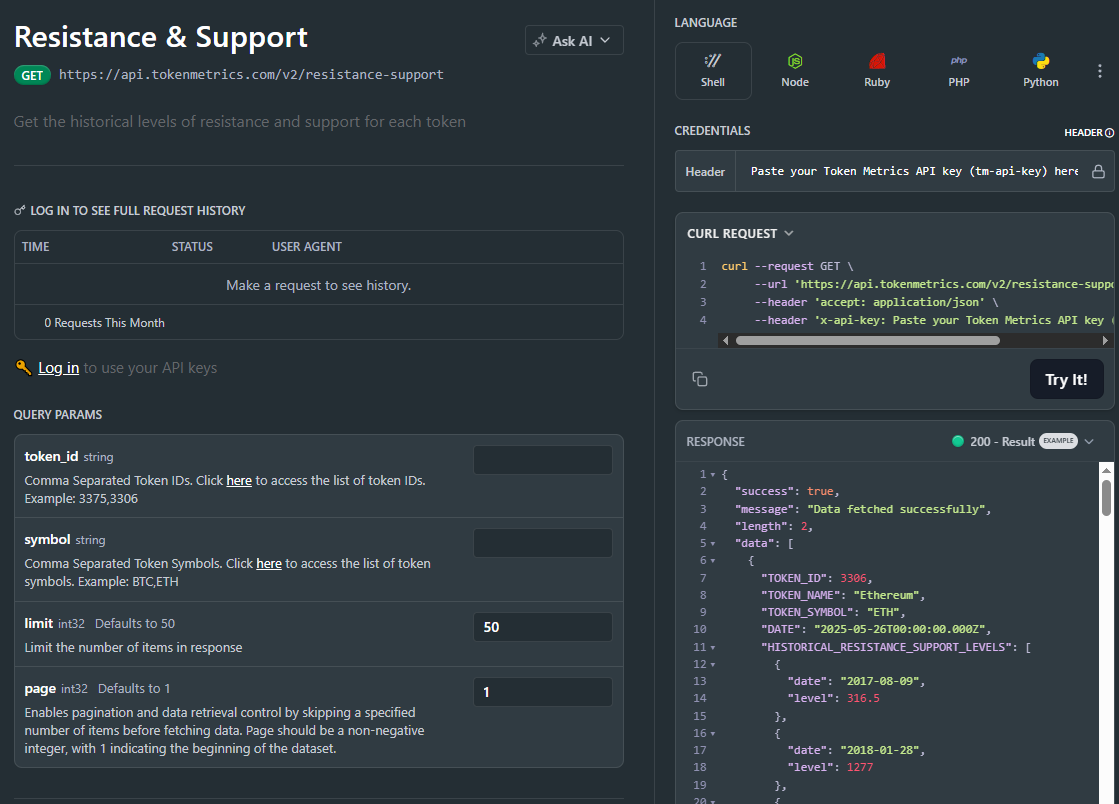

Popular crypto tax platforms often act as aggregators, using APIs from multiple sources to ensure complete data capture and reporting accuracy. Advanced APIs—even AI-powered ones like those from Token Metrics—can also provide on-chain analysis and insights that may help proactively monitor tax impacts throughout the year.

A Closer Look at Using Crypto APIs for Tax Reporting

Let’s walk through how APIs typically fit into crypto tax workflows:

- Connect Accounts and Wallets: Using API keys (often read-only), you link your exchanges, wallets, and blockchains to your chosen tax tool.

- Sync and Import Transactions: The tool pulls transaction histories via APIs, consolidating buys, sales, deposits, withdrawals, airdrops, NFTs, and more.

- Fetch On-Chain and Historical Prices: Market data APIs retrieve price history at the exact transaction times.

- Classify Transactions: Using smart algorithms (sometimes AI-driven), the tool/utility tags income, capital gains, staking rewards, gifting, or transfers.

- Generate Tax Reports: With everything categorized, software can generate the tax forms, appendices, or summaries you’ll need for digital asset tax reporting.

This streamlined approach saves time, reduces costly mistakes, and, crucially, helps create a paper trail that stands up to tax authority scrutiny. For high-volume traders or those moving assets across multiple platforms, crypto APIs are increasingly seen as a necessity—not just a convenience.

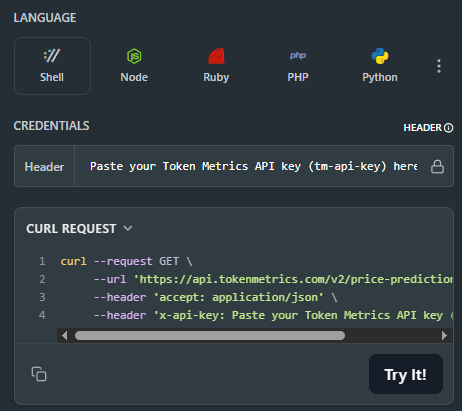

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

FAQ: Can I Use Crypto APIs for Tax Reporting?

What info do crypto APIs provide for tax reporting?

Crypto APIs can deliver transaction histories, account balances, historical pricing, and details such as gas fees and blockchain-specific data, enabling accurate calculation of gains, losses, and income for tax filing.

Are crypto API integrations secure for tax purposes?

Most reputable APIs utilize read-only permissions, so users can’t withdraw or trade with connected accounts. Always use API keys securely, with platforms that prioritize user data privacy and security.

Can I use APIs for every type of crypto asset?

While many APIs cover major coins and blockchains, full support for NFTs, DeFi protocols, and newer tokens may vary. Check compatibility with your holdings before relying exclusively on APIs for reporting.

Do crypto tax platforms use APIs or manual imports?

Most modern crypto tax platforms offer both—APIs for automated data syncing and manual CSV/Excel uploads as a fallback, ensuring coverage when API connectivity isn’t available for a particular service.

Will using crypto APIs make me compliant with tax laws?

APIs streamline data collection but do not ensure compliance by themselves. Users must ensure all transactions are captured, accurately reported, and filed according to local reporting requirements.

Disclaimer

This article is for informational and educational purposes only and does not constitute tax, accounting, or investment advice. Always consult a qualified tax professional for guidance specific to your situation and jurisdiction.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)