Crypto Trading Bot: Automate Your Trading for Better Results

In the fast-paced world of cryptocurrency trading, a crypto trading bot can be a game-changer. Whether you are a seasoned cryptocurrency trader or just starting out, leveraging automated trading tools can significantly enhance your trading experience. This article explores how crypto trading bots work, the benefits of using them, and how to choose the best crypto trading platform to maximize your trading results.

Token Metrics is dedicated to developing innovative solutions that empower cryptocurrency traders to manage their portfolios and succeed in the evolving digital asset market.

What is a Crypto Trading Bot?

A crypto trading bot is software designed to automate your trading activities on various crypto exchanges. Instead of manually monitoring the market and executing trades, these bots use predefined trading strategies to buy and sell cryptocurrencies on your behalf. By connecting your exchange accounts via API keys, a trading bot can access your portfolio and execute trades in real time. Importantly, funds in trading bots never leave the user's exchange account, ensuring an additional layer of security. The bot can also manage a variety of assets across different exchanges, allowing you to diversify and control your holdings efficiently.

These powerful bots can analyze market data, identify trends, and place orders faster than manual trading, helping you capitalize on market opportunities 24/7. Their advanced analysis of trading data enables more informed decision-making and improved trading insights. Popular types of bots include grid bots, which capitalize on market fluctuations by placing buy and sell orders at set intervals, and DCA bots that use dollar-cost averaging strategies to reduce risks.

Benefits of Using Crypto Trading Bots

One of the main advantages of bot trading is the ability to automate your trading and reduce the emotional biases that often affect manual trading. Automated trading allows you to implement complex trading strategies consistently without needing to monitor the market constantly. This can lead to better trading results and more efficient portfolio management. The platform excels at managing your assets and trading activities, making it easier to oversee your entire portfolio.

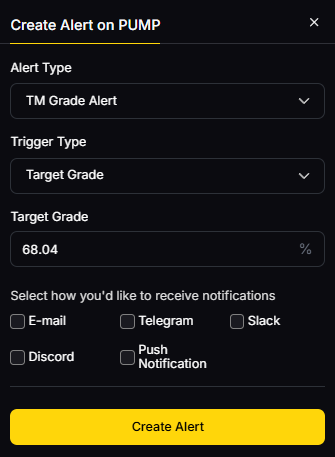

By using a crypto trading platform that supports bot trading, you can manage all your exchanges in one interface, simplifying the process of trading crypto across multiple crypto exchange accounts. Many platforms offer trailing features such as trailing stop loss, which help fine tune your risk management and protect your funds during volatile market conditions. Bots also give users more control over their trading activities, allowing them to regulate losses, maximize profits, and maintain oversight even when not actively monitoring the market.

Moreover, trading bots can execute trades based on expert insights and market data, enabling even novice traders to benefit from strategies developed by expert traders. Stoic AI provides automated trading with strategies tailored to different risk profiles, making it a versatile option for traders with varying levels of experience and goals. This helps reduce risks and improve profitability over time. With paper trading, users can practice and develop strategies without risking real money, making it a safe way to learn and improve. Additionally, most platforms provide a support team to assist with setup, troubleshooting, and optimizing your bots, ensuring a smooth trading experience for users of all experience levels.

Choosing the Best Crypto Trading Platform

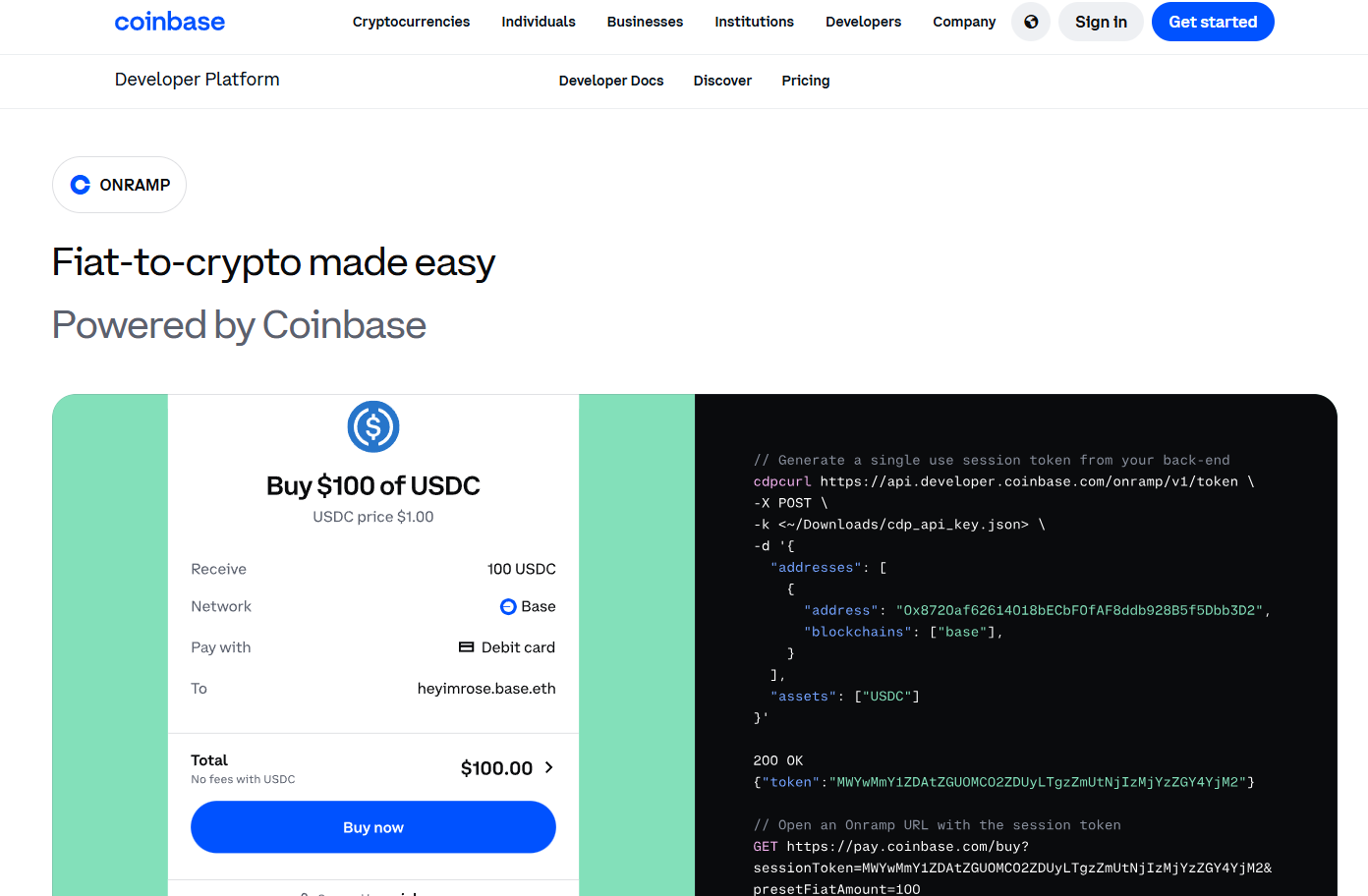

Selecting the best crypto trading platform is crucial for maximizing the benefits of automated trading. Look for platforms that integrate seamlessly with top crypto exchanges, allowing you to trade efficiently across different markets. For example, AI integrates with top exchanges like Token Metrics, Binance, Coinbase, Kucoin, and Crypto.com, providing users with a wide range of trading opportunities. The ability to connect multiple exchange accounts via API keys and manage them from a single trading terminal is a key feature to consider. When creating an account or onboarding, note that no credit card is required to start using the platform, making it easy and risk-free to get started. A familiar interface also helps users get started quickly and confidently.

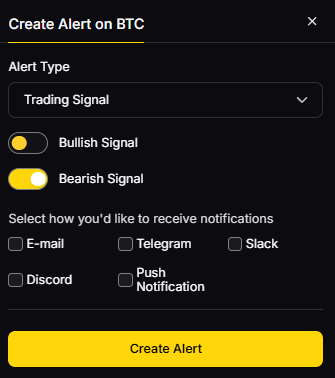

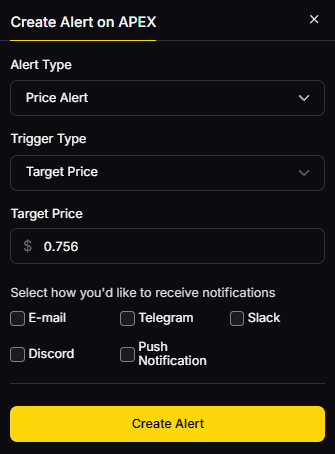

A good platform should offer a variety of subscription plans to suit different trading needs and budgets, with transparent pricing and no hidden fees. Check if the platform provides powerful bots like a grid bot, DCA bots, and signal bots, which can automate diverse trading strategies. Signals play a crucial role in automated trading strategies, enabling real-time trade execution and integration with external platforms. Also, consider whether the platform offers trailing features and stop loss tools to help manage your risk effectively.

User reviews and past performance data can provide valuable insights into the platform’s reliability and effectiveness. Some platforms also have an affiliate program, allowing you to earn rewards by referring other traders. Lastly, ensure the platform has a responsive support team to help you with any issues and guide you through the setup process. For more information or to sign up, visit the company's website.

How to Set Up and Use a Crypto Trading Bot

Setting up a crypto trading bot typically involves creating an account on a crypto trading platform and linking your exchange accounts using API keys. This connection allows the bot to access your funds securely and execute trades on your behalf without needing direct access to your account credentials. Some crypto bots integrate with popular trading platforms like TradingView for enhanced automation, enabling users to execute trades based on advanced charting and signals. You can set up various types of bots, including the signal bot, which automates trades by integrating with external signal providers through webhooks for real-time execution.

Once set up, you can choose or create trading strategies tailored to your goals. Many platforms offer pre-built strategies developed by expert traders, or you can fine tune your own based on market conditions and your risk tolerance. It’s important to monitor the bot’s performance regularly and adjust settings as needed to optimize trading results.

Automating your trading does not mean you can set it and forget it. Market conditions change, and your strategies should evolve accordingly. Using tools like trailing stop loss and other risk management features can help protect your investments and maximize profit. Incorporating take profit orders is also essential for locking in gains and managing risk automatically.

Most platforms provide tutorials to help users set up, configure, and optimize their bots, making it easier for beginners to get started and troubleshoot common issues.

Building and Refining Your Trading Strategy

In the ever-evolving landscape of cryptocurrency trading, having a solid trading strategy is the foundation for long-term success. A well-defined strategy not only guides your trading decisions but also helps you navigate unpredictable market conditions and reduce risks. Whether you’re a beginner or a seasoned trader, continuously building and refining your trading strategy is essential for maximizing profits and staying ahead of the competition.

Trading bots and automated trading tools have revolutionized the way traders approach strategy development. By leveraging these bots, you can implement sophisticated trading strategies that react to market movements in real time, eliminating emotional decision-making and ensuring consistent execution. Many crypto trading bots provide backtesting features to optimize strategies before live trading, allowing traders to refine their approaches using historical data. Automated trading allows you to backtest your strategies using historical data, so you can fine tune your approach before risking real funds in the market.

Expert insights play a crucial role in shaping effective trading strategies. Many crypto trading platforms offer access to strategies developed by professional traders, giving you the opportunity to learn from their experience and adapt proven methods to your own trading style. Regularly analyzing your trading results and adjusting your strategy based on performance data and changing market trends is key to long-term profitability.

Remember, no single strategy guarantees success in cryptocurrency trading. The most successful traders are those who remain flexible, continuously monitor their bots’ performance, and are willing to adapt their strategies as market conditions evolve. By combining the power of automated trading with ongoing learning and expert insights, you can reduce risks, optimize your trades, and work towards achieving your trading goals.

Conclusion

A crypto trading bot can transform your cryptocurrency trading by automating complex strategies, reducing risks, and improving trading results. By choosing the best crypto trading platform that offers powerful bots, easy setup, and comprehensive support, you can enhance your trading experience and manage all your exchanges from one interface. Whether you are looking to supplement manual trading or fully automate your trades, investing in bot trading software is a smart move for any cryptocurrency trader aiming to stay competitive in today’s dynamic market. Join the growing community of traders who leverage automated trading to trade smarter and more efficiently.

Note: Past performance is not indicative of future results. Please note that cryptocurrency trading involves significant risk, and you should carefully consider your investment objectives and level of experience before using trading bots.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)