DeFi and AI Tokens Dominate as Crypto Market Nears $4 Trillion

The cryptocurrency market continues to show resilience, with total market capitalization maintaining a strong foothold near $4 trillion. While Bitcoin remains the cornerstone of this cycle, the spotlight is shifting toward altcoins — especially those at the forefront of decentralized finance (DeFi) and artificial intelligence (AI) integration.

In this blog, we’ll explore the top narratives shaping today’s market, focusing on DeFi protocols like Blackhole DEX and PancakeSwap, alongside emerging AI projects such as Sahara AI and Moby AI.

Why DeFi Is Surging Again

DeFi has staged an impressive comeback in 2025. After a period of stagnation, several protocols have redefined their models to prioritize community engagement and sustainable growth.

Black Hole DEX:

Launched on Avalanche, Blackhole DEX has quickly become the network’s largest decentralized exchange, overtaking Trader Joe. The platform uses a community-first approach: no team allocation, weekly token emissions to liquidity providers, and a bribe-based voting mechanism for rewards distribution.

Impact:

This design has created a powerful flywheel effect. As token prices rise, APYs increase, attracting more liquidity, which in turn boosts trading volume and revenue. Within days, Blackhole DEX grew its TVL from $7 million to $193 million — a staggering feat.

PancakeSwap: A Sleeping Giant?

PancakeSwap, the dominant DEX on Binance Smart Chain (BSC), has been quietly outperforming its competitors in trading volumes and fee generation. Recent data shows PancakeSwap generating more than 4x the daily fees of Uniswap, yet its fully diluted valuation remains significantly lower.

Growth Catalysts:

- Integration with the Binance Wallet ecosystem.

- Expansion into other ecosystems like Solana.

- All-time-high trading volumes despite broader market corrections.

For investors seeking a large-cap DeFi protocol with strong fundamentals and potential upside, PancakeSwap’s metrics warrant attention.

AI Meets Crypto: The Next Frontier

Artificial intelligence continues to transform multiple industries, and crypto is no exception.

Sahara AI:

Sahara AI is building a full-stack AI infrastructure for decentralized applications. Backed by heavyweights like Binance and Polychain, its mission is to bridge Web3 and AI — a theme that’s likely to dominate innovation cycles in the coming years.

Moby AI:

Initially launched as an AI trading agent, Moby AI has expanded into building tools like Moby Screener, a competitor to Dexscreener. Its unique tokenomics link user engagement directly to the platform’s utility, making it an experiment worth watching.

The Broader Altcoin Landscape

Beyond DeFi and AI, other notable projects are also gaining ground:

- Graphite Protocol: The developer behind LetsBonk.Fun, sharing revenue with its ecosystem tokens through buyback strategies.

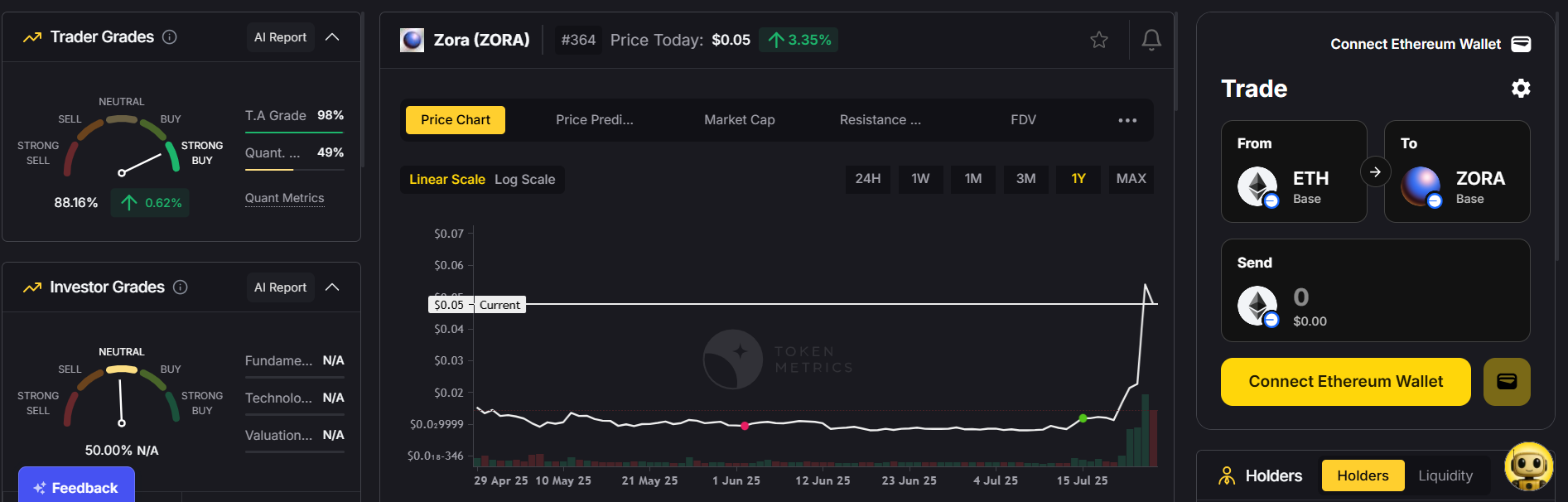

- Zora: A social media-meets-crypto platform allowing creators to monetize their content directly on-chain.

- Project X: A cross-chain DEX on Hyperliquid, amassing $28 million in TVL within 24 hours of launch.

These projects underscore the diversity of innovation happening outside Bitcoin’s shadow.

Risk Management in a Volatile Market

The excitement around DeFi and AI tokens comes with elevated risk. Here are some best practices:

- Allocate wisely: Keep high-risk allocations (like low-cap “moonshots”) small — no more than 1% per trade.

- Monitor narratives: Rapid shifts in market sentiment can create both opportunities and pitfalls.

- Stay updated: Protocol changes, tokenomics adjustments, and ecosystem partnerships can significantly impact valuations.

Conclusion

As the crypto market edges closer to $4 trillion, the narratives driving growth are evolving. DeFi is proving its staying power with innovative models like Black Hole DEX, while AI-focused projects like Sahara AI are pushing the boundaries of what blockchain can achieve.

For market participants, the challenge lies in identifying which of these trends have lasting potential — and positioning themselves accordingly.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

.png)

%20(1).png)

.svg)

.png)