How Can Blockchain Be Used to Verify AI Data Sources? The Future of Trust in Artificial Intelligence

As artificial intelligence (AI) continues to revolutionize industries and become deeply embedded in critical decision-making processes, the question of how can blockchain be used to verify AI data sources grows increasingly important. From healthcare diagnostics to financial trading algorithms, the reliability of AI models hinges on the authenticity and integrity of the data they consume. Inaccurate or tampered data can lead to flawed AI results, which in turn can have serious real-world consequences. Addressing this challenge requires innovative solutions that ensure data integrity and transparency throughout the AI development process.

Blockchain technology emerges as a powerful tool to meet this need by offering an immutable ledger, decentralized verification, and cryptographic proof mechanisms. By leveraging blockchain, organizations can establish trustworthy AI systems with verifiable data provenance, enhancing confidence in AI-powered services and fostering trust in AI applications used in everyday life.

The Critical Need for AI Data Verification

The Trust Gap in AI Systems

The integration of AI with blockchain is anticipated to become an essential infrastructure component by 2025, especially as AI-powered systems permeate sectors like finance, healthcare, and autonomous vehicles. While blockchain excels at proving that data has not been altered once recorded, it does not inherently guarantee the initial validity of the data. This limitation highlights the infamous "garbage in, garbage forever" problem, where compromised data inputs lead to persistent inaccuracies in AI outputs.

Unreliable AI data sources pose significant risks across various domains:

- In financial markets, AI algorithms can make erroneous trading decisions if fed manipulated market data, potentially causing massive losses.

- Healthcare AI systems trained on biased or incomplete datasets may lead to misdiagnoses, jeopardizing patient safety.

- Autonomous vehicles relying on corrupted sensor data risk accidents and safety failures.

- AI-powered content moderation tools might fail to detect deepfakes or manipulated media, undermining information integrity.

Current Challenges in AI Data Integrity

Traditional AI systems face multiple hurdles related to data verification and security:

- Centralized Data Sources: Many AI models depend on centralized databases vulnerable to manipulation or breaches.

- Lack of Provenance: Tracking the origin and transformation of data is often difficult or impossible, obscuring accountability.

- Data Tampering: Without an immutable record, unauthorized modifications can go unnoticed.

- Bias and Manipulation: AI algorithms can be poisoned intentionally or suffer from systemic biases due to flawed training data.

- Accountability Gaps: Auditing AI decision-making processes remains a challenge, especially with complex or opaque models.

These issues underscore the urgency of adopting robust mechanisms to verify AI data sources and ensure data security and data privacy.

Blockchain as the Solution: Core Principles

Immutable Data Records

One of the key benefits of blockchain technology in AI verification lies in its ability to create an immutable ledger—a tamper-proof, permanent record of data transactions. Recording AI data points and decisions on a blockchain enables transparent, auditable records that simplify the process of verifying data provenance and understanding AI outcomes.

This immutable record ensures:

- Authenticity of data sources

- Accurate timestamps for data entries

- Traceability of data modifications and updates

- Transparent access and usage logs

By anchoring AI data in blockchain systems, organizations can significantly reduce the risk of unauthorized modifications and foster trust in AI results.

Decentralized Verification

Unlike traditional centralized verification, blockchain networks operate through consensus mechanisms involving multiple nodes distributed across decentralized platforms. This decentralized approach ensures that no single entity can unilaterally alter data without detection, enhancing data integrity and reducing the risk of fraud.

Blockchain platforms employ consensus algorithms that require agreement among participating nodes before data is accepted, making it exceedingly difficult for malicious actors to compromise AI data sources.

Cryptographic Proof

Blockchain employs advanced cryptographic techniques to guarantee data security and authenticity:

- Hash Functions generate unique digital fingerprints for datasets, enabling quick verification of data integrity.

- Digital Signatures authenticate the origin of data, linking it securely to verified sources.

- Merkle Trees allow efficient verification of large datasets by enabling quick detection of any alteration.

- Zero-Knowledge Proofs verify data validity without revealing sensitive information, preserving data privacy while maintaining trust.

Together, these cryptographic tools underpin the secure, transparent, and trustworthy AI ecosystems made possible by blockchain.

Technical Implementation Strategies

Data Provenance Tracking

Incorporating blockchain into AI workflows represents a groundbreaking advancement toward trustworthy AI knowledge bases. Data provenance tracking on blockchain involves maintaining an unalterable history of:

- Data Origins: Documenting where and how data was initially collected or generated.

- Processing History: Recording transformations, filtering, and aggregation steps applied to the data.

- Quality Metrics: Including accuracy scores, validation results, and reliability indicators.

- Source Credibility: Assessing and verifying the reputation and trustworthiness of data providers.

This comprehensive provenance tracking is essential for ensuring data integrity and providing transparent, auditable records that support AI governance and risk management.

Smart Contract Automation

Smart contracts—self-executing agreements encoded on blockchain platforms—play a crucial role in automating AI data verification processes. They can be programmed to:

- Validate incoming data against predefined quality criteria.

- Trigger alerts or flags when anomalies or inconsistencies are detected.

- Automatically reward reliable data providers.

- Penalize sources supplying inaccurate or manipulated data.

By automating these verification steps, smart contracts reduce human error, increase efficiency, and reinforce trust in AI data pipelines.

AI Verification Protocols

AI verification systems increasingly rely on sophisticated pattern recognition and anomaly detection techniques to validate data inputs:

- Computer Vision Models analyze images and videos to detect manipulation artifacts.

- Natural Language Processing (NLP) algorithms scrutinize contracts and metadata for inconsistencies.

- Behavioral Analytics monitor transaction patterns in decentralized finance (DeFi) to identify suspicious activity.

- Signal Analysis tracks sensor data streams in IoT-heavy environments to flag improbable or corrupted readings.

When combined with blockchain's immutable ledger, these AI verification protocols create a powerful framework for trustworthy AI development and deployment.

Real-World Applications and Use Cases

Medical Diagnostics and Healthcare

In healthcare, the stakes for accurate AI diagnostics are exceptionally high. Blockchain-verified AI data can significantly enhance the reliability of medical diagnoses by:

- Feeding medical scan results into AI diagnostic algorithms.

- Hashing and storing diagnosis data on the blockchain to create an immutable record.

- Using smart contracts to automatically verify diagnosis accuracy.

- Allowing patients and healthcare providers transparent access to diagnostic records.

- Triggering investigations and adjustments if inaccuracies are detected.

This approach ensures that AI models in healthcare operate on verifiable, trustworthy data, reducing misdiagnosis risks and improving patient outcomes.

Supply Chain Management

Decentralized supply chains benefit immensely from blockchain-based platforms that record shipping and handling data transparently. Platforms like IBM's Food Trust and VeChain use blockchain to provide proof of origin and track product journeys. However, without proper validation at each checkpoint, records remain vulnerable to forgery.

By integrating AI-powered blockchain verification, supply chains can:

- Analyze sensor data from IoT devices for environmental anomalies.

- Verify authenticity of product certifications.

- Track goods from source to consumer with an auditable record.

This combination enhances data security and trustworthiness throughout the supply chain, mitigating risks of fraud and contamination.

Financial Services and Trading

The financial sector leverages blockchain-verified AI data to improve:

- Market Data Verification: Ensuring trading algorithms receive accurate and untampered price feeds.

- Credit Scoring: Validating financial records and transaction histories.

- Fraud Detection: Creating immutable logs of suspicious activities.

- Regulatory Compliance: Maintaining transparent audit trails for oversight.

These applications demonstrate how blockchain enables secure, trustworthy AI-powered financial services that comply with regulatory standards and reduce data breach risks.

NFT and Digital Content Verification

NFT marketplaces face challenges with art theft and plagiarism. By combining AI image recognition with blockchain verification, platforms can:

- Detect near-duplicate artworks during minting.

- Protect intellectual property rights.

- Prevent unauthorized duplication.

- Maintain creator attribution.

This synergy between AI and blockchain safeguards digital assets and fosters a fairer digital content ecosystem.

Token Metrics: Leading the AI-Verified Crypto Analytics Revolution

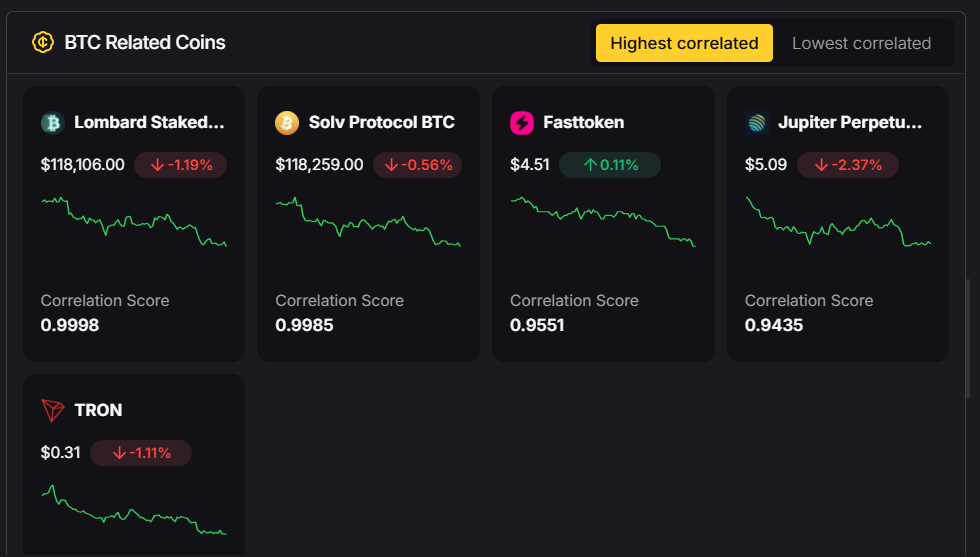

In the cryptocurrency realm, Token Metrics exemplifies how AI and blockchain can merge to deliver trustworthy market intelligence. As a leading crypto trading and analytics platform, Token Metrics integrates AI-powered insights with blockchain-based verification to provide users with reliable data.

AI-Driven Market Intelligence

Token Metrics consolidates research, portfolio management, and trading into one ecosystem, assigning each token a Trader Grade for short-term potential and an Investor Grade for long-term viability. This system enables users to prioritize opportunities efficiently.

The platform aggregates data from diverse sources, including cryptocurrency exchanges, blockchain networks, social media, news outlets, and regulatory announcements. Advanced machine learning algorithms cross-verify this data, identifying discrepancies and potential manipulation.

Real-Time Data Verification

Scanning over 6,000 tokens daily, Token Metrics evaluates technical analysis, on-chain data, fundamentals, sentiment, and exchange activity. This comprehensive approach ensures:

- Maintenance of data integrity across all sources.

- Swift identification of anomalies.

- Delivery of verified, reliable market intelligence.

- Informed trading decisions based on authenticated data.

Blockchain-Native Analytics

By leveraging blockchain's transparency, Token Metrics verifies on-chain transactions, tracks token holder distributions, analyzes smart contract interactions, and monitors decentralized exchange activity. These capabilities empower users to respond rapidly to market shifts, a crucial advantage in volatile crypto markets.

API Integration and Transparency

Token Metrics offers a leading cryptocurrency API that combines AI analytics with traditional market data, providing real-time price, volume, AI-based token ratings, and social sentiment analysis. Comprehensive documentation supports research and trading applications, enabling third-party verification, external audits, and community-driven validation.

Emerging Technologies and Standards

Proof-of-Sampling (PoSP) Protocols

Emerging AI verifiability solutions include Proof-of-Sampling (PoSP), which randomly selects nodes within a blockchain network to verify AI computations. By comparing hash outputs across nodes and penalizing dishonest actors, PoSP enhances trustworthiness and scales verification based on task importance.

Trusted Execution Environments (TEEs)

TEEs provide secure, isolated environments where AI computations occur on encrypted data, ensuring privacy and cryptographic verification of results. This technology enables sensitive AI workloads to be processed securely within blockchain systems.

Zero-Knowledge Proofs (ZKPs)

ZKPs allow verification of AI computations without revealing sensitive inputs, proprietary algorithms, or private model parameters. This preserves data privacy and intellectual property while maintaining transparency and trust.

Market Impact and Economic Implications

Market Growth Projections

The blockchain AI market is poised for rapid expansion, projected to grow from $0.57 billion in 2024 to $0.7 billion in 2025, with a CAGR of 23.2%, reaching $1.88 billion by 2029. This growth is fueled by increasing demand for trustworthy AI, regulatory pressures, and widespread blockchain adoption.

Investment and Innovation

Analysts forecast a $22.34 billion AI safety market by 2030, with blockchain-based solutions capturing $1.12 billion. Investment focuses on AI verification protocols, decentralized data marketplaces, smart contract auditing, and cross-chain interoperability, driving innovation in AI governance and risk management.

Challenges and Limitations

Technical Challenges

Incorporating blockchain into AI verification introduces complexities such as:

- Scalability: Managing high-volume AI data verification on blockchain networks remains challenging.

- Cost: Gas fees and computational expenses can hinder extensive verification.

- Latency: Blockchain consensus may delay real-time AI processing.

- Integration Complexity: Combining AI and blockchain requires specialized expertise.

Additionally, systems handling sensitive information must adhere to strict data governance to prevent new vulnerabilities.

Regulatory and Compliance Considerations

Increasingly, governments and industry bodies enforce frameworks governing AI data sourcing, transparency, and privacy. Compliance with regulations like GDPR, CCPA, healthcare privacy laws, and financial standards is critical when implementing blockchain-verified AI systems.

Future Developments and Trends

Industry Standardization

The future will see the emergence of industry standards for AI-powered on-chain data validation, composable verification services accessible to decentralized applications (dApps), and edge AI models running on IoT devices prior to blockchain upload. New frameworks will promote model transparency and reproducibility.

Hybrid Verification Systems

Most practical deployments will combine AI-driven anomaly detection with human auditor oversight, balancing automation with accuracy and accountability.

Cross-Chain Interoperability

Interoperable verification protocols and standardized APIs will enable seamless AI data provenance tracking across multiple blockchain platforms, fostering a more connected and transparent ecosystem.

Implementation Best Practices

Design Principles

To effectively implement blockchain-based AI verification:

- Prioritize data quality with robust collection and validation.

- Employ graduated verification levels based on data sensitivity.

- Design systems for full auditability.

- Select scalable blockchain platforms suited to data volumes.

- Incorporate privacy-preserving techniques like zero-knowledge proofs.

Technical Architecture

Successful architectures include:

- A data ingestion layer for secure data collection.

- Blockchain storage for immutable recording of data hashes and metadata.

- A verification layer with smart contracts and consensus mechanisms.

- An API gateway for standardized access to verified data.

- An audit interface for monitoring and reviewing verification processes.

Conclusion: Building Trust in the AI-Driven Future

The convergence of blockchain technology and artificial intelligence marks a transformative shift toward more trustworthy, transparent, and accountable AI systems. As AI continues to influence daily lives and critical industries, the ability to verify data sources, maintain data provenance, and ensure algorithmic transparency becomes indispensable.

The ultimate vision is an immutable ledger so robust that it never requires correction—enabling AI models to be inherently trustworthy rather than relying on external validation after deployment. Platforms like Token Metrics showcase the immense potential of this approach, delivering AI-powered insights backed by blockchain-verified data.

As standards mature and adoption accelerates, blockchain-verified AI systems will become the industry standard across sectors such as healthcare, finance, supply chain, and autonomous systems. This fusion of powerful technologies not only enhances trust but also unlocks valuable insights and actionable intelligence, empowering business leaders and AI companies to build reliable, innovative AI services.

The future of AI is not only intelligent—it is verifiable, transparent, and secured by the unshakeable foundation of blockchain technology. This paradigm will define the next generation of AI-powered systems, ensuring that as AI grows more powerful, it also becomes more trustworthy.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)