How Do Blockchains Communicate Across Networks?

The blockchain industry has evolved far beyond Bitcoin's isolated ledger. Today's crypto ecosystem demands something more sophisticated: the ability for different blockchains to talk to each other. This interoperability challenge has sparked innovative solutions that are reshaping how digital assets and information flow across decentralized networks.

The Fundamental Challenge of Blockchain Isolation

Blockchains were originally designed as independent, self-contained networks. Bitcoin operates on its own blockchain, Ethereum on another, and thousands of other cryptocurrencies each maintain their own separate ledgers. This isolation creates a significant problem: blockchains cannot natively communicate with each other, making it difficult to transfer assets or share data between different networks.

Think of it like having different banking systems that can't process transfers between each other. You might have funds in one bank, but you can't easily move them to another without going through complex intermediaries. This fragmentation limits the potential of blockchain technology and creates friction for users who want to leverage multiple networks.

Bridge Protocols: The Primary Solution

Bridge protocols have emerged as the most common solution for cross-chain communication, acting as intermediaries that facilitate asset transfers between different blockchains. These bridges work by locking assets on one chain and minting equivalent representations on another.

For example, if you want to move Ethereum tokens to the Binance Smart Chain, a bridge protocol would lock your ETH on Ethereum and issue wrapped tokens on BSC that represent the same value. When you want to move back, the process reverses: the wrapped tokens are burned, and your original ETH is unlocked.

However, bridges come with trade-offs. Security vulnerabilities in bridge protocols have led to some of the largest cryptocurrency heists in history, with billions of dollars stolen from compromised bridges. The centralization of some bridge solutions also contradicts blockchain's decentralized ethos.

Cross-Chain Messaging Protocols

Beyond simple asset transfers, advanced cross-chain messaging protocols enable more sophisticated interactions between blockchains. These protocols allow smart contracts on one blockchain to trigger actions on another, opening possibilities for complex decentralized applications that span multiple networks.

Protocols like Cosmos IBC (Inter-Blockchain Communication) and Polkadot's Cross-Consensus Message Format enable direct blockchain-to-blockchain communication without requiring centralized intermediaries. These systems use cryptographic proofs and validator networks to ensure messages are authentic and securely delivered.

The Cosmos ecosystem, for instance, creates an "internet of blockchains" where independent chains can communicate through a standardized protocol. Each blockchain maintains its sovereignty while gaining the ability to interact with other chains in the network.

Atomic Swaps: Trustless Exchange

Atomic swaps represent another approach to cross-chain interaction, enabling peer-to-peer cryptocurrency exchanges without intermediaries. These swaps use hash time-locked contracts that ensure either both parties receive their assets or the transaction fails completely, eliminating the risk of one party taking funds without fulfilling their end of the deal.

While atomic swaps offer strong security guarantees, they're limited in functionality compared to bridge protocols and work best for simple asset exchanges rather than complex cross-chain operations.

The Role of Oracles in Cross-Chain Communication

Blockchain oracles play a crucial supporting role in cross-chain communication by providing external data that smart contracts need to function. Oracle networks like Chainlink enable blockchains to access off-chain information and data from other blockchains, creating bridges between isolated networks and the broader world.

These decentralized oracle networks aggregate data from multiple sources, verify its accuracy, and deliver it to smart contracts in a trustworthy manner. This infrastructure is essential for many cross-chain applications that need reliable information from multiple blockchains.

Layer 2 Solutions and Rollups

Layer 2 scaling solutions, particularly rollups, are changing how we think about blockchain communication. Rather than connecting entirely separate blockchains, rollups process transactions off the main chain and periodically submit batches of data back to the base layer.

Optimistic rollups and zero-knowledge rollups inherit the security of their underlying blockchain while dramatically increasing transaction throughput, effectively creating interconnected layers that communicate through data compression and cryptographic proofs.

This approach maintains the security of the base layer while enabling faster, cheaper transactions that still benefit from the main blockchain's guarantees.

Making Informed Cross-Chain Decisions with Token Metrics

As blockchain interoperability evolves, traders and investors face increasingly complex decisions about which networks, bridges, and cross-chain protocols to use. This is where comprehensive analytics become invaluable.

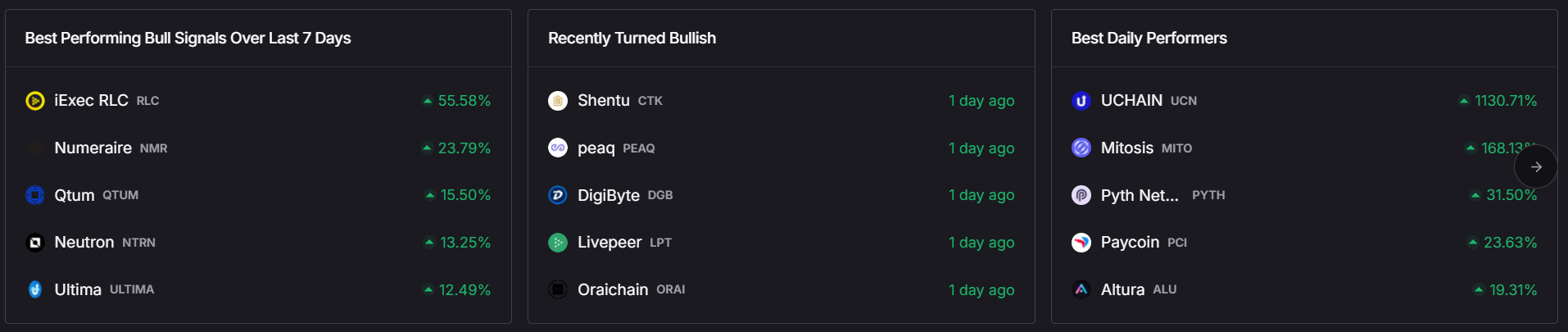

Token Metrics stands out as a leading crypto trading and analytics platform that helps users navigate the multi-chain landscape with confidence. The platform provides advanced metrics, AI-powered analysis, and real-time data across multiple blockchains, enabling traders to identify opportunities and risks in cross-chain ecosystems.

With Token Metrics, users can analyze token performance across different networks, evaluate the security and efficiency of various bridge protocols, and make data-driven decisions about cross-chain investments. The platform's comprehensive dashboard aggregates information from numerous blockchains, providing the multi-chain visibility that modern crypto trading demands.

Whether you're evaluating which blockchain offers the best opportunities for specific tokens, comparing cross-chain protocols, or analyzing the risk profiles of different bridge solutions, Token Metrics delivers the analytical depth needed to succeed in today's interconnected crypto markets.

The Future of Blockchain Interoperability

The future points toward increasingly seamless cross-chain communication. Emerging technologies like zero-knowledge proofs are enabling more secure and efficient verification of cross-chain transactions without revealing sensitive information.

We're moving toward a future where users won't need to think about which blockchain they're using. Cross-chain communication will happen automatically in the background, similar to how internet users don't worry about which servers their data passes through. The technology will simply work.

Standards are also emerging to create more unified approaches to interoperability. As the industry matures, we'll likely see consolidation around proven protocols that offer the best balance of security, speed, and decentralization.

Conclusion

Blockchain communication across networks represents one of the most critical developments in cryptocurrency's evolution. From bridge protocols and atomic swaps to sophisticated messaging systems and Layer 2 solutions, the industry has developed multiple approaches to solving the interoperability challenge.

As these technologies mature and become more secure, the vision of a truly interconnected blockchain ecosystem moves closer to reality. For traders and investors navigating this complex landscape, platforms like Token Metrics provide the analytical tools necessary to understand cross-chain dynamics and capitalize on emerging opportunities in the multi-chain future.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)