How to Buy a Crypto Index in 90 Seconds (Step-by-Step, 2025)

If you’ve ever tried to “own the market” in crypto, you know the pain: opening multiple exchanges, hunting for the right tokens, praying you rebalance on time, and second-guessing every move. This guide shows you how to buy a crypto index in 90 seconds—and why a rules-based approach can save time, reduce mistakes, and keep you aligned with the trend. Our flagship TM Global 100 is a rules-based crypto index that holds the top-100 assets in bull markets and moves to stablecoins in bear markets, with weekly rebalancing and fully transparent holdings/transactions. Below, you’ll see exactly what the flow looks like and how to join early.

→ Join the waitlist to be first to trade TM Global 100.

TL;DR (snippet)

- What it is: Rules-based index that holds the top-100 in bull markets and moves to stablecoins in bear markets.

- Why it matters: Weekly rebalances + transparent holdings and transaction logs.

- Who it’s for: Hands-off allocators and active traders who want a disciplined core.

- Next step: Join the waitlist to be first to trade TM Global 100.

Why Education / How-To Matters in October 2025

Crypto’s gotten faster, not simpler. Between regime switching, weekly rebalancing, and dozens of venues, DIY baskets are easy to get wrong. A clear, step-by-step how to buy a crypto index guide helps you execute with confidence, whether you’re optimizing a core position or setting up a long-term plan.

Definition (featured-snippet friendly): A crypto index is a rules-based basket of digital assets that rebalances on a set schedule and may switch to stablecoins during bearish regimes.

Related terms we’ll touch on: crypto index, weekly rebalancing, regime switching.

How the TM Global 100 Index Works (Plain English)

- Regime switching:

- Bullish → the index holds the top 100 crypto assets by market cap.

- Bearish → the index moves fully to stablecoins and waits for a re-entry signal.

- Bullish → the index holds the top 100 crypto assets by market cap.

- Weekly rebalancing: Reflects updated market-cap rankings and weights each week.

- Transparency: Strategy modal explains rules; Gauge → Treemap → Transactions Log show exactly what you hold and when it changes.

- What you’ll see on launch:

- Live price tile & market signal “Gauge”

- 100 tokens (bull regime) & “rebalances weekly”

- Holdings Treemap + Transactions Log

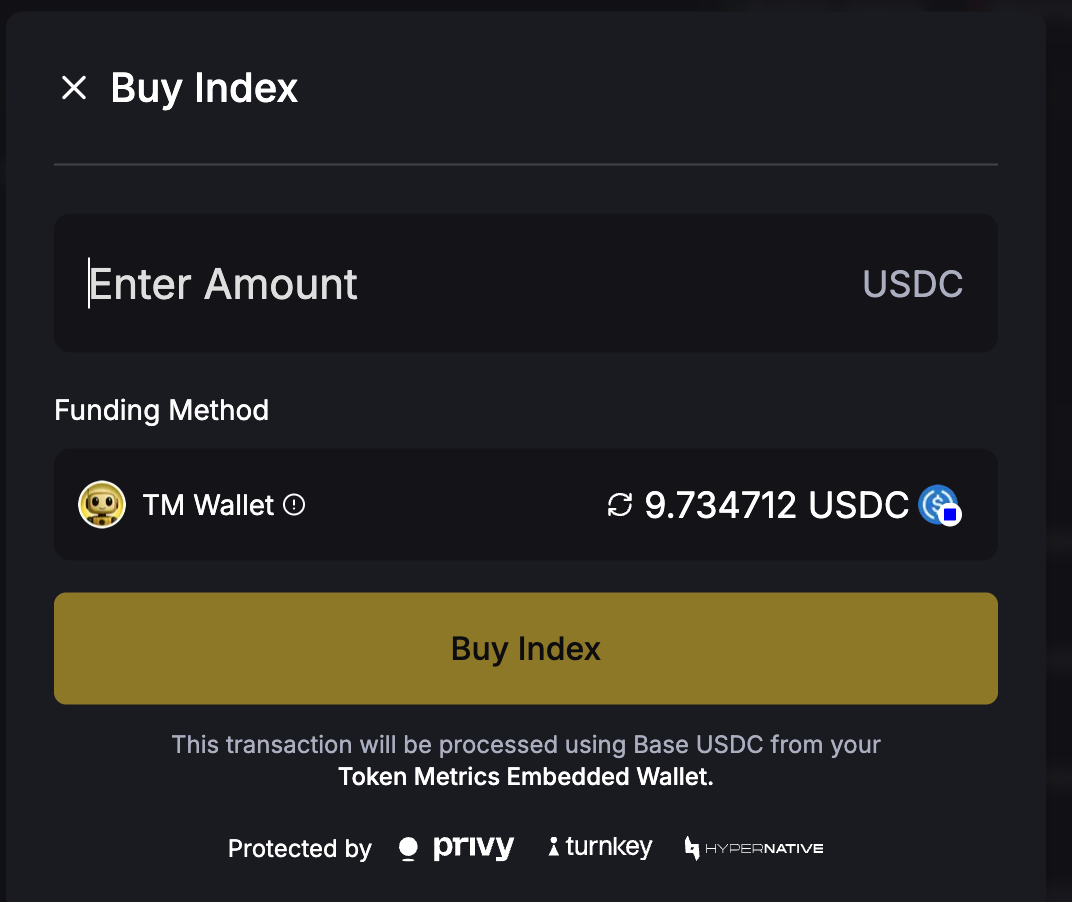

- One-click Buy flow with fee/slippage preview

- Live price tile & market signal “Gauge”

Soft CTA: See the strategy and rules.

Benefits at a Glance (Why This Beats DIY)

- Time saved: Skip hours of research, sorting, and executing dozens of buys/sells.

- Missed rebalances avoided: Weekly, rules-based updates reduce “I forgot to rebalance” risk.

- Disciplined switching: Automated stablecoin exit during bears can help preserve capital.

- Lower slippage chaos: One flow instead of many fragmented trades across venues.

- Radical visibility: Gauge → Treemap → Transactions Log show positions and changes—no black box.

- One-click upkeep: You focus on allocation size; the index handles the rest.

Step-by-Step: How to Get Early Access (Waitlist)

- Open the Indices hub: Go to Token Metrics Indices hub.

- Join the waitlist: Enter your email to get notified at go-live and receive the 90-second buy instructions.

- (Optional) Prepare your wallet: If prompted at launch, create/connect the embedded self-custodial wallet.

- Launch day email: We’ll send a direct link to TM Global 100 with the Buy Index button.

- Review before you buy: See fees, max slippage, min expected value, and current holdings.

- Confirm purchase (~90 seconds): Approve the transaction; you’ll see status and a link to My Indices.

- Track updates: Weekly rebalances and any regime switches appear in Holdings and Transactions.

→ Join the waitlist to be first to trade TM Global 100.

Decision Guide: Is This Right for You?

- Hands-Off Allocator: Want broad market exposure without micromanaging coins.

- Active Trader: Prefer to keep a rules-based core while you take satellite bets elsewhere.

- TM Member/Prospect: Already use TM research and want a simpler path to execution.

- Rebalance-Fatigued: You’ve missed updates or paid excess fees trying to DIY.

- Transparency-First: You want clear rules, visible holdings, and a public transactions log.

- Drawdown-Wary: You value an automatic stablecoin stance during bearish regimes.

FAQs

What is a “how to buy a crypto index” flow?

It’s a streamlined checkout to buy a rules-based basket (index) in one place. For TM Global 100, you’ll see fees/slippage upfront, then confirm in a single flow.

How often does the index rebalance?

Weekly. Rebalances update constituents/weights. If the regime flips, the portfolio can switch between top-100 tokens and stablecoins outside the weekly cycle.

What triggers the move to stablecoins?

A proprietary market signal. In bearish conditions, the index exits tokens into stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

At launch, you’ll follow the on-page instructions shown in the Buy Index flow. Funding options may vary by chain/wallet; USDC payout is supported when selling.

Is the wallet custodial?

No—self-custodial embedded smart wallet. You control funds; the flow simplifies execution.

How are fees shown?

Before confirming, you’ll see estimated gas, platform fee, max slippage, and minimum expected value. Nothing’s hidden.

How do I join the waitlist?

Head to the Token Metrics Indices hub and submit your email, or follow the waitlist CTA on the TM Global 100 page.

Security, Risk & Transparency

- Self-custody: Embedded smart wallet keeps you in control.

- 2-step clarity: Fees/slippage displayed before you confirm.

- Transparent by design: Strategy modal, Holdings Treemap, and Transactions Log show what changed and why.

- Regime logic limits: Signals can be wrong; rules aim for discipline, not perfection.

- Regional notes: Availability and on-ramp options may vary by jurisdiction.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

Conclusion + Related Reads

If you want broad market exposure without babysitting a portfolio, TM Global 100 gives you a rules-based, transparent way to participate in the upside and sit in stablecoins when conditions turn. The 90-second buy flow removes friction so you can focus on allocation—not logistics.

→ Join the waitlist to be first to trade TM Global 100.

Related Reads:

- TM Global 100 strategy

- Token Metrics Indices hub

- Best Cryptocurrency Exchanges 2025

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)