Technology Grade API: Identify Real Innovation and Build Smarter Crypto Apps

Hype is loud, but code is what lasts. The Technology Grade API helps you measure the engineering strength behind a token—scalability, innovation, and real code quality—so you can prioritize serious projects in your bots, dashboards, or research tools. In this guide, you’ll query the /v2/technology-grade endpoint, embed the score in your UI, and ship a feature that turns technical due diligence into a single actionable signal. Start by grabbing your key at Get API Key, Run Hello-TM to validate your first call, then Clone a Template to go live fast.

What You’ll Build in 2 Minutes

- A minimal script that fetches Technology Grade for any symbol via /v2/technology-grade.

- A copy-paste curl to smoke-test your key.

- A starter UX pattern: display the headline Technology Grade + component breakdown (scalability, innovation, code quality).

- Endpoints to add next for full context: /v2/fundamental-grade (business quality), /v2/tm-grade (technicals/sentiment/momentum), /v2/trading-signals (timing), /v2/quantmetrics (risk/return).

Why This Matters

Separate hype from substance. Whitepapers and roadmaps are cheap; shipped code, throughput, and upgrade cadence are not. The Technology Grade API rolls engineering reality into a comparable score so you can rank ecosystems, filter listings, and surface projects with staying power.

Faster diligence, clearer decisions. For bot builders, Technology Grade is an upstream filter that keeps low-quality projects out of your universe. For dashboard builders, it adds credibility—users can see why a project ranks well. And for screeners, it’s a one-score signal that’s easy to sort, badge, and alert on with low latency.

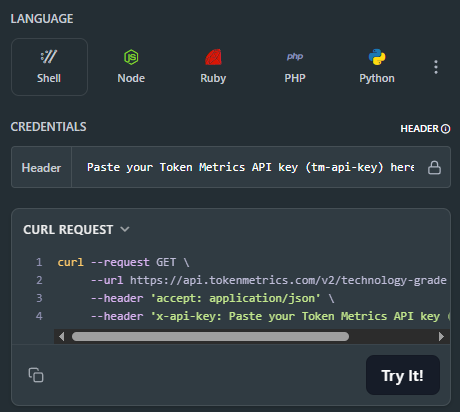

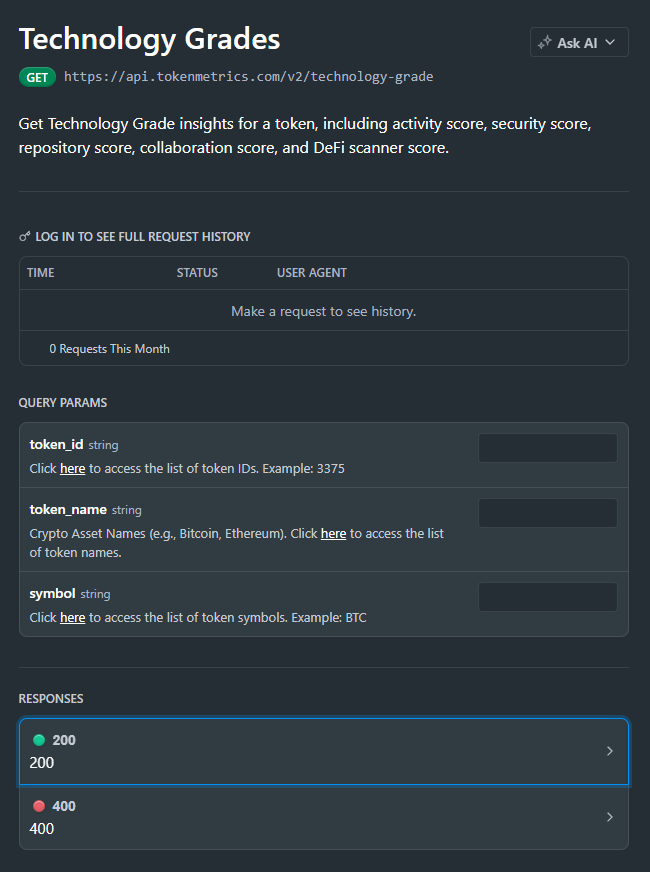

Where to Find

For the Technology Grade information, check the top right of the API Reference. You'll find the cURL request to connect effortlessly.

👉 Next: Get API Key • Run Hello-TM • Clone a Template

Live Demo & Templates

- Investor/Due-Diligence Token Page: Show a Technology Grade dial with component bars and a “What improved?” changelog snippet.

- Screener/Leaderboard: Rank by Technology Grade; add sector and market-cap filters; badge “Rising Tech” week-over-week.

- Bot Universe Filter: Require a minimum Technology Grade before a token is eligible for strategies; combine with signals for entries/exits.

Kick off from quickstarts in the docs—fork a dashboard or screener and deploy. Validate your environment with Run Hello-TM, then scale usage. When you need higher limits and SLAs, compare API plans.

How It Works (Under the Hood)

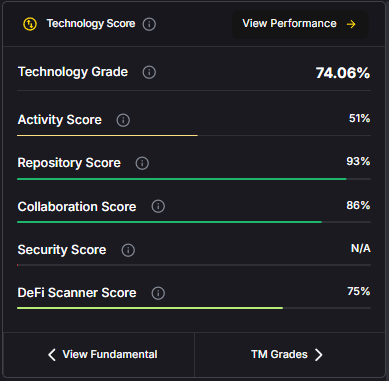

Technology Grade synthesizes engineering-centric evidence—such as throughput/scalability, rate of innovation (feature velocity, upgrade cadence), and code quality (maintainability, robustness cues)—into a normalized score and grade (e.g., Strong / Average / Weak). It’s designed to be comparable across projects and stable enough to inform filters, tiers, and badges.

At query time, you request /v2/technology-grade?symbol=<ASSET>. The response includes the headline score and component scores you can display in bars or a radar chart. For dashboards with many assets, use batched calls and short-TTL caching. If you push upgrade/downgrade alerts, queue notifications or use webhooks to avoid bursty polling.

Production Checklist

- Rate limits: Understand your tier’s caps; add client-side throttling.

- Retries & backoff: Use exponential backoff with jitter; handle 429/5xx gracefully.

- Idempotency: Ensure retried fetches don’t double-trigger downstream actions.

- Caching: Memory/Redis/KV with short TTLs; pre-warm popular symbols; ETag if available.

- Webhooks & jobs: Prefer queued jobs or webhooks for grade-change alerts.

- Pagination/Bulk: Batch symbols; parallelize with care; respect limits.

- Error catalog: Map common 4xx/5xx to remediation steps; log request IDs.

- Observability: Track p95/p99 latency and error rates per endpoint; alert on drift.

- Security: Keep API keys in secrets managers; rotate and scope keys.

Use Cases & Patterns

- Bot Builder (Headless): Apply a Technology Grade threshold to define your tradable universe; then confirm timing with /v2/trading-signals and place risk with /v2/resistance-support.

- Dashboard Builder (Product): Add a “Tech” tab on token pages with the headline grade, components, and a short narrative for users (“What’s driving this score?”).

- Screener Maker (Lightweight Tools): Ship a Top-N by Technology Grade leaderboard; add badges for “Rising Tech” based on week-over-week deltas.

- Listing/Research Teams: Gate listings or research coverage using Technology Grade plus Fundamental Grade for balanced quality screens.

- Enterprise Due Diligence: Export grades nightly to internal systems; alert on downgrades crossing critical thresholds.

Next Steps

- Get API Key — create a key and start free.

- Run Hello-TM — confirm your first successful call.

- Clone a Template — deploy a screener or token page today.

- Watch the demo: VIDEO_URL_HERE

- Compare plans: Scale usage and unlock higher limits with API plans.

FAQs

1) What does the Technology Grade API return?

A JSON payload with an overall score/grade plus component scores (e.g., scalability, innovation, code quality) and timestamps. Use the overall score for ranking and components for explanation.

2) Is this real-time, and what about latency/SLOs?

The endpoint is engineered for predictable latency suitable for dashboards and filters. For frequent refresh or alerts, combine short-TTL caching with queued jobs or webhooks to minimize round-trips.

3) How should I combine Technology Grade with other signals?

A common pattern: Technology Grade (engineering quality) + Fundamental Grade (business quality) + TM Grade (technicals/sentiment) + Trading Signals (timing) + Support/Resistance (risk placement).

4) How “accurate” is Technology Grade?

It’s an opinionated synthesis of engineering evidence, not financial advice. Use it as part of a diversified framework; validate with your own backtests and risk controls.

5) Do you provide SDKs or examples?

You can integrate via REST (JS/Python examples above). The docs include quickstarts, Postman collections, and templates—start by Run Hello-TM.

6) Polling vs webhooks for grade changes?

For UI pages, cached polling is fine. For alerts (upgrades/downgrades), prefer webhooks or scheduled jobs to avoid spiky traffic and rate-limit issues.

7) Pricing, limits, and enterprise SLAs?

Begin free and scale up as needed. See API plans for allowances; enterprise SLAs and support are available.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)