Top Strategies for Managing Crypto Risk in 2025: Stay Profitable in a Volatile Market

Introduction: Why Risk Management Matters More Than Ever

Cryptocurrency has always been volatile, but in 2025, the stakes are even higher. With billions flowing into AI‑driven tokens, real‑world asset (RWA) projects, DeFi protocols, and meme coins, the crypto market is more complex than ever.

While the potential for profits is enormous, so are the risks. Poor risk management can quickly turn promising portfolios into catastrophic losses. To succeed, you need structured strategies and AI‑powered insights from platforms like Token Metrics to help you make smarter, data‑driven decisions.

This guide explores the top strategies for managing crypto risk in 2025 — helping you stay profitable even in turbulent markets.

1. Diversify Across Assets and Narratives

Don’t put all your crypto in one basket.

Diversification reduces your exposure to individual asset failures. In 2025, this means spreading across:

- Large‑Caps (e.g., BTC, ETH): Lower risk and strong liquidity.

- Mid‑Caps (e.g., Polygon, Arbitrum): Balanced growth potential.

- Small‑Caps (e.g., Token Metrics AI (TMAI)): High‑risk, high‑reward narrative plays.

- Stablecoins (e.g., USDC): For liquidity and hedging against market crashes.

Pro Tip: Use Token Metrics’ portfolio optimization tool to create a diversified, AI‑recommended allocation aligned with your risk tolerance.

2. Set Clear Position Sizes

Position sizing determines how much of your portfolio is allocated to a single asset.

Key Rule: Never risk more than you’re willing to lose.

- Allocate smaller percentages to volatile small‑caps and larger percentages to proven, stable coins.

- Adjust sizing based on AI‑driven asset ratings from Token Metrics, which score coins by fundamentals and risk factors.

3. Use Stop‑Loss and Take‑Profit Orders

Crypto markets move fast — sometimes too fast for manual reactions.

Stop‑Loss Orders:

- Automatically sell assets when they drop to a pre‑set level, limiting downside losses.

Take‑Profit Orders:

- Lock in gains when a token hits your target price, avoiding the “ride it back down” mistake.

Why It Works: These orders enforce discipline, removing emotional decision‑making from the equation.

4. Hedge with Stablecoins

Stablecoins like USDC and USDT are essential for risk management.

- Protect against sudden market drops by keeping 5–15% of your portfolio in stablecoins.

- Use stablecoins for buying dips without needing to sell other holdings at a loss.

Platforms like Token Metrics help track the optimal balance between stablecoins and risk assets for your portfolio.

5. Manage Leverage Carefully

Leverage amplifies both gains and losses.

- Avoid over‑leveraging in a volatile market.

- If using leverage, keep it low (1–3x) and apply strict stop‑loss rules.

AI‑powered insights from Token Metrics can help you assess volatility before taking leveraged positions.

6. Use Dollar‑Cost Averaging (DCA)

DCA means investing a fixed amount regularly, regardless of price.

- Helps smooth out volatility by buying over time.

- Reduces emotional trading decisions.

Pairing DCA with Token Metrics’ trend analysis ensures you’re accumulating assets with strong AI‑verified fundamentals.

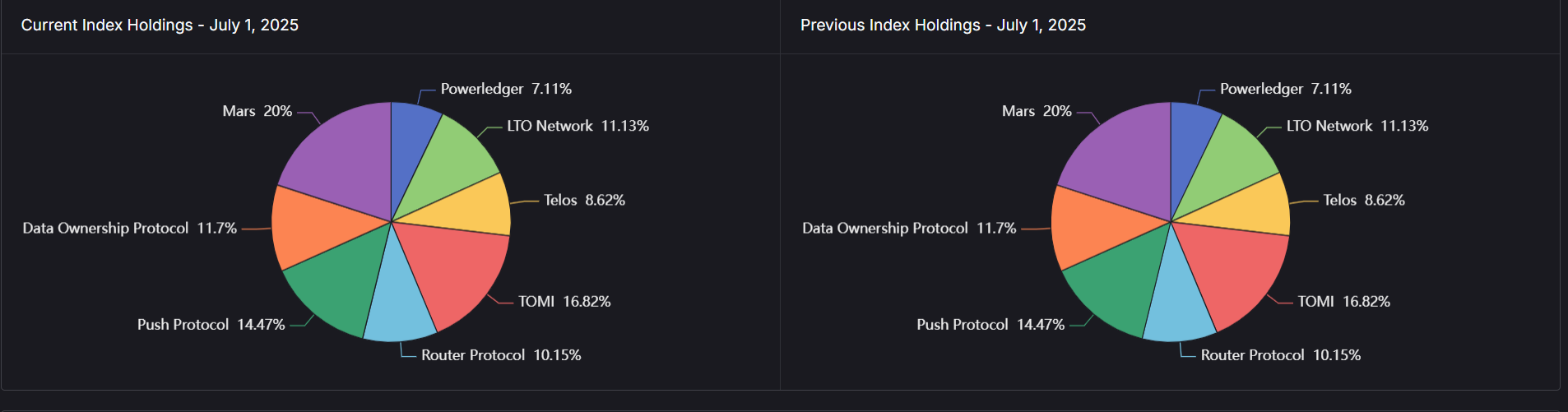

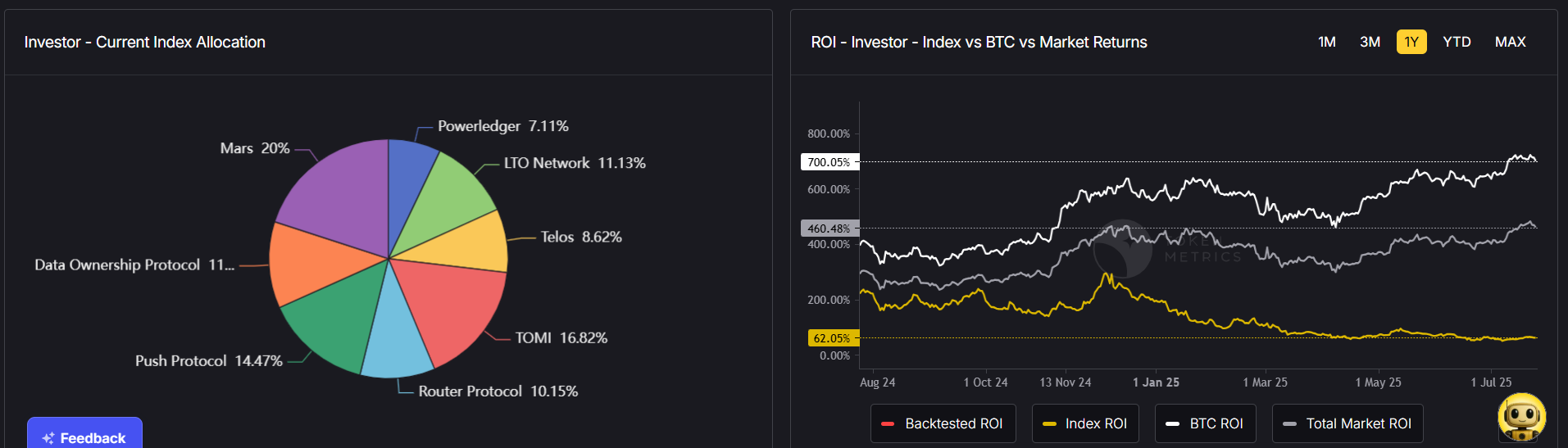

7. Actively Rebalance Your Portfolio

Markets shift quickly. Rebalancing keeps your portfolio aligned with your goals.

Rebalance when:

- An asset grows disproportionately large.

- AI‑driven insights suggest a narrative is weakening.

Token Metrics’ portfolio tracker helps monitor your allocations and signals when adjustments are needed.

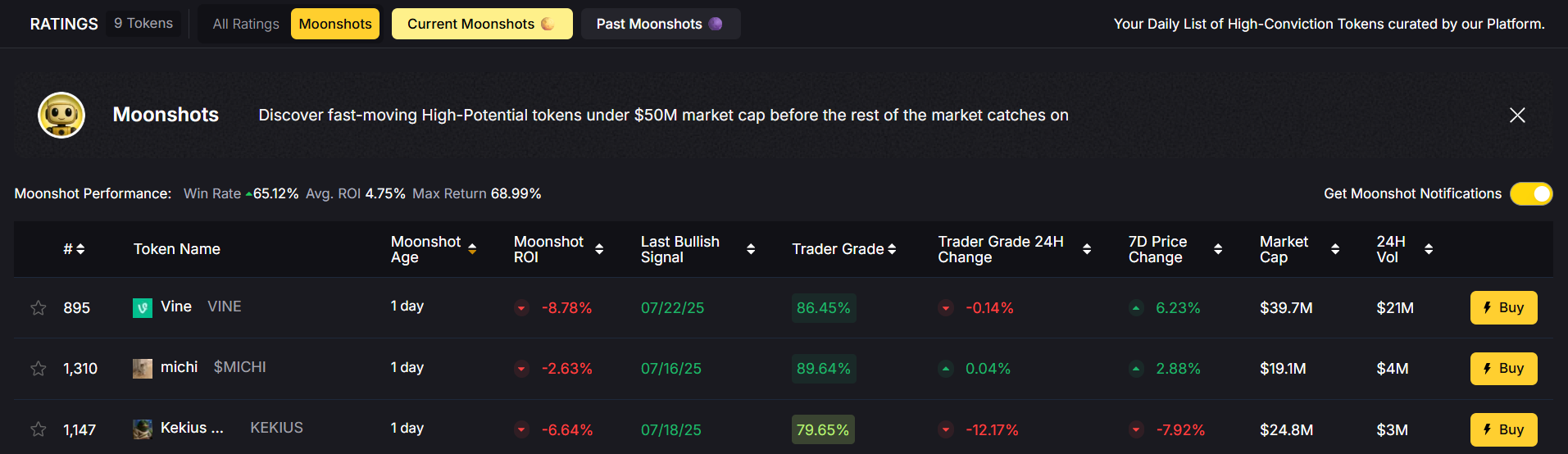

8. Stay Ahead of Market Narratives

Narratives drive capital flows in crypto — AI tokens, DeFi 2.0, RWAs, and more are shaping 2025.

Why It Matters:

- Early identification of narratives allows you to capitalize on growth sectors.

- Exiting fading narratives reduces losses from declining trends.

Token Metrics’ narrative detection tools help you spot these shifts early.

9. Secure Your Assets

Even the best portfolio is useless if it’s hacked.

- Use hardware wallets (e.g., Ledger, Trezor) for long‑term storage.

- Enable two‑factor authentication (2FA) on all exchange accounts.

- Avoid storing large sums on centralized exchanges.

10. Stay Informed

Crypto moves at lightning speed. Staying informed reduces surprises:

- Follow regulatory updates: Rules are evolving globally in 2025.

- Track on‑chain data: Use Token Metrics to monitor wallet activity, token burns, and developer engagement.

- Join crypto communities: Gain insights from experienced traders and analysts.

Practical Example: A Risk‑Managed Portfolio for 2025

- 40% Bitcoin & Ethereum: Stability and staking income.

- 30% Narrative‑Driven Assets: AI tokens like TMAI, Layer 2 solutions, and DeFi protocols.

- 15% Stablecoins: Hedge against volatility and provide liquidity.

- 10% Yield‑Generating Assets: Staking and liquidity pools.

- 5% High‑Risk Plays: Speculative small‑caps or meme tokens.

This portfolio balances security, growth, and liquidity.

Common Risk Management Mistakes

- Overexposure to hype tokens: Avoid allocating heavily to meme coins.

- Ignoring exit strategies: Always have profit targets.

- Emotional trading: Stick to AI‑guided data, not fear or FOMO.

Conclusion

Managing risk in crypto isn’t about avoiding volatility — it’s about embracing it intelligently.

By combining diversification, automated trading tools, hedging, and AI‑driven insights from Token Metrics, you can protect your capital and position yourself for consistent growth in 2025.

In crypto, survival is success — and with the right risk management strategies, you can turn survival into long‑term profitability.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)