Top Strategies for Managing Crypto Risk in 2025: Stay Profitable in a Volatile Market

%201.svg)

%201.svg)

Introduction: Why Risk Management Matters More Than Ever

Cryptocurrency has always been volatile, but in 2025, the stakes are even higher. With billions flowing into AI‑driven tokens, real‑world asset (RWA) projects, DeFi protocols, and meme coins, the crypto market is more complex than ever.

While the potential for profits is enormous, so are the risks. Poor risk management can quickly turn promising portfolios into catastrophic losses. To succeed, you need structured strategies and AI‑powered insights from platforms like Token Metrics to help you make smarter, data‑driven decisions.

This guide explores the top strategies for managing crypto risk in 2025 — helping you stay profitable even in turbulent markets.

1. Diversify Across Assets and Narratives

Don’t put all your crypto in one basket.

Diversification reduces your exposure to individual asset failures. In 2025, this means spreading across:

- Large‑Caps (e.g., BTC, ETH): Lower risk and strong liquidity.

- Mid‑Caps (e.g., Polygon, Arbitrum): Balanced growth potential.

- Small‑Caps (e.g., Token Metrics AI (TMAI)): High‑risk, high‑reward narrative plays.

- Stablecoins (e.g., USDC): For liquidity and hedging against market crashes.

Pro Tip: Use Token Metrics’ portfolio optimization tool to create a diversified, AI‑recommended allocation aligned with your risk tolerance.

2. Set Clear Position Sizes

Position sizing determines how much of your portfolio is allocated to a single asset.

Key Rule: Never risk more than you’re willing to lose.

- Allocate smaller percentages to volatile small‑caps and larger percentages to proven, stable coins.

- Adjust sizing based on AI‑driven asset ratings from Token Metrics, which score coins by fundamentals and risk factors.

3. Use Stop‑Loss and Take‑Profit Orders

Crypto markets move fast — sometimes too fast for manual reactions.

Stop‑Loss Orders:

- Automatically sell assets when they drop to a pre‑set level, limiting downside losses.

Take‑Profit Orders:

- Lock in gains when a token hits your target price, avoiding the “ride it back down” mistake.

Why It Works: These orders enforce discipline, removing emotional decision‑making from the equation.

4. Hedge with Stablecoins

Stablecoins like USDC and USDT are essential for risk management.

- Protect against sudden market drops by keeping 5–15% of your portfolio in stablecoins.

- Use stablecoins for buying dips without needing to sell other holdings at a loss.

Platforms like Token Metrics help track the optimal balance between stablecoins and risk assets for your portfolio.

5. Manage Leverage Carefully

Leverage amplifies both gains and losses.

- Avoid over‑leveraging in a volatile market.

- If using leverage, keep it low (1–3x) and apply strict stop‑loss rules.

AI‑powered insights from Token Metrics can help you assess volatility before taking leveraged positions.

6. Use Dollar‑Cost Averaging (DCA)

DCA means investing a fixed amount regularly, regardless of price.

- Helps smooth out volatility by buying over time.

- Reduces emotional trading decisions.

Pairing DCA with Token Metrics’ trend analysis ensures you’re accumulating assets with strong AI‑verified fundamentals.

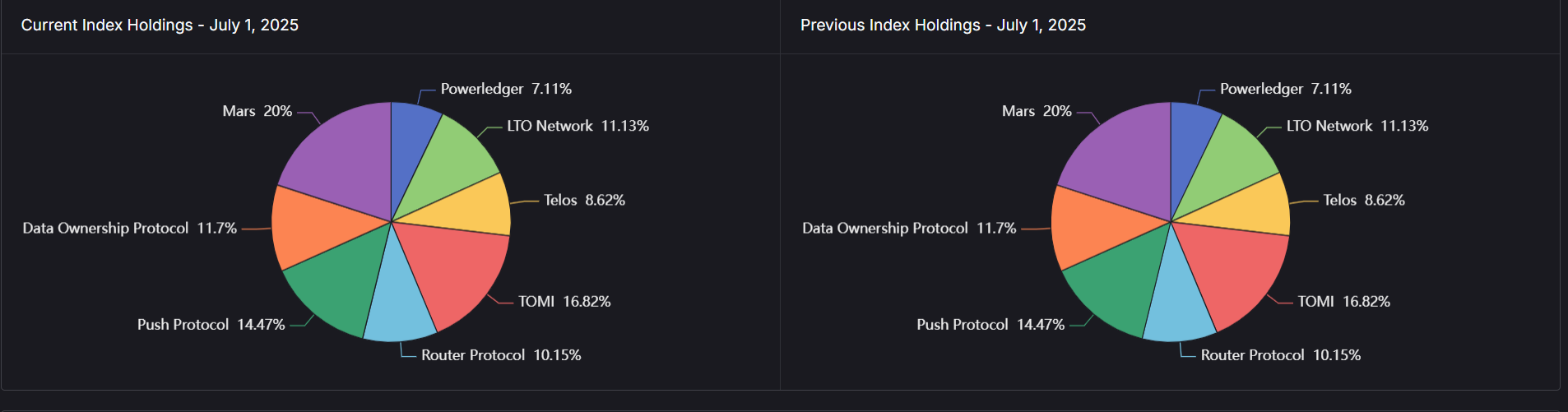

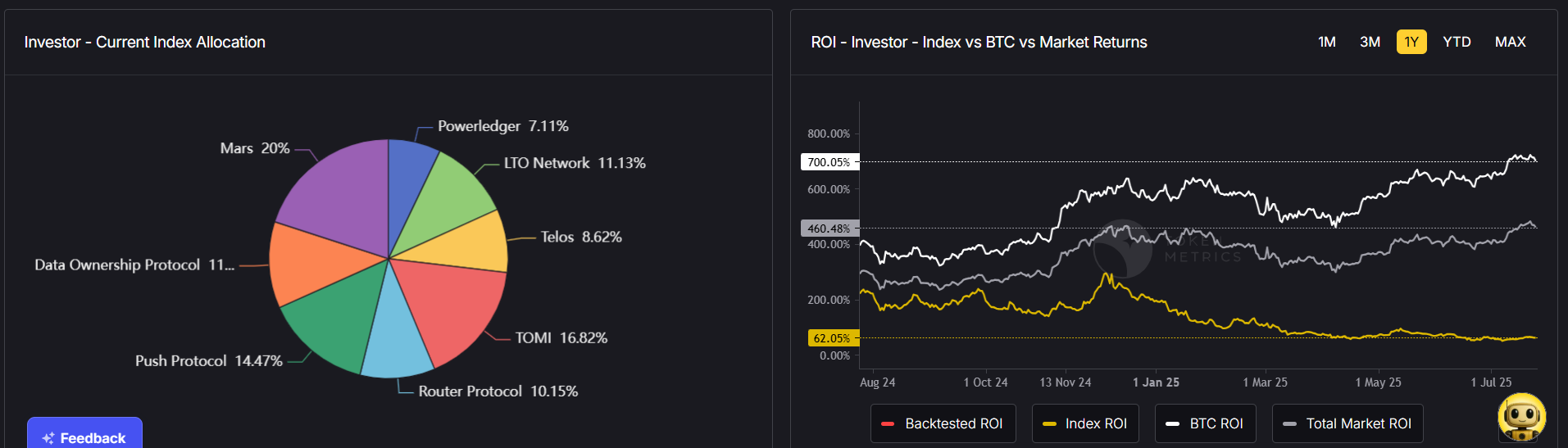

7. Actively Rebalance Your Portfolio

Markets shift quickly. Rebalancing keeps your portfolio aligned with your goals.

Rebalance when:

- An asset grows disproportionately large.

- AI‑driven insights suggest a narrative is weakening.

Token Metrics’ portfolio tracker helps monitor your allocations and signals when adjustments are needed.

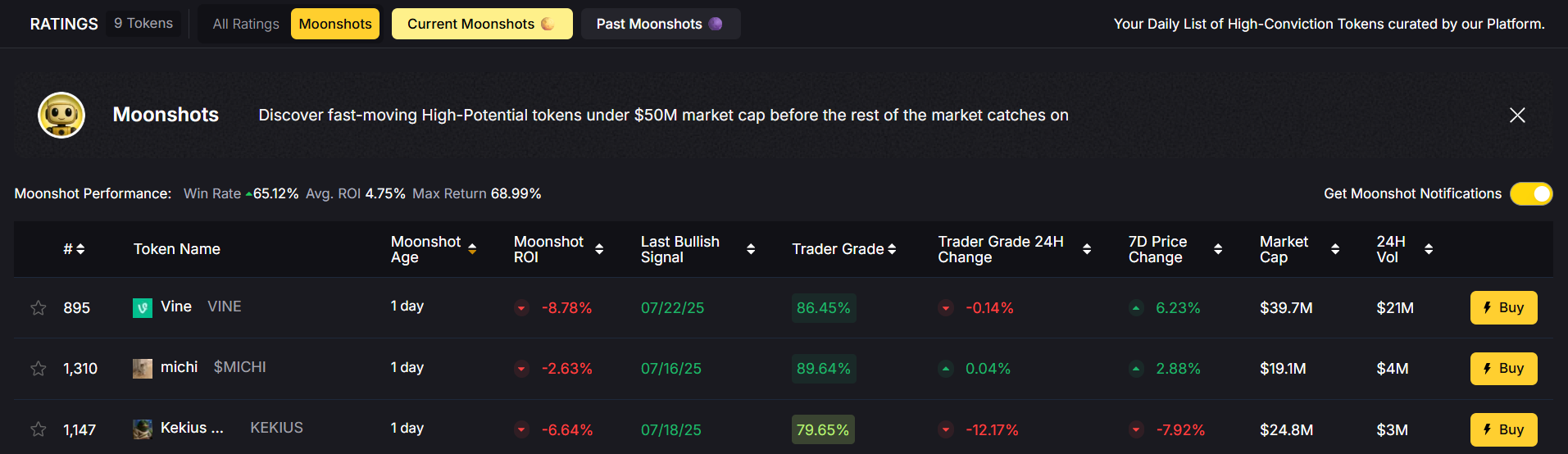

8. Stay Ahead of Market Narratives

Narratives drive capital flows in crypto — AI tokens, DeFi 2.0, RWAs, and more are shaping 2025.

Why It Matters:

- Early identification of narratives allows you to capitalize on growth sectors.

- Exiting fading narratives reduces losses from declining trends.

Token Metrics’ narrative detection tools help you spot these shifts early.

9. Secure Your Assets

Even the best portfolio is useless if it’s hacked.

- Use hardware wallets (e.g., Ledger, Trezor) for long‑term storage.

- Enable two‑factor authentication (2FA) on all exchange accounts.

- Avoid storing large sums on centralized exchanges.

10. Stay Informed

Crypto moves at lightning speed. Staying informed reduces surprises:

- Follow regulatory updates: Rules are evolving globally in 2025.

- Track on‑chain data: Use Token Metrics to monitor wallet activity, token burns, and developer engagement.

- Join crypto communities: Gain insights from experienced traders and analysts.

Practical Example: A Risk‑Managed Portfolio for 2025

- 40% Bitcoin & Ethereum: Stability and staking income.

- 30% Narrative‑Driven Assets: AI tokens like TMAI, Layer 2 solutions, and DeFi protocols.

- 15% Stablecoins: Hedge against volatility and provide liquidity.

- 10% Yield‑Generating Assets: Staking and liquidity pools.

- 5% High‑Risk Plays: Speculative small‑caps or meme tokens.

This portfolio balances security, growth, and liquidity.

Common Risk Management Mistakes

- Overexposure to hype tokens: Avoid allocating heavily to meme coins.

- Ignoring exit strategies: Always have profit targets.

- Emotional trading: Stick to AI‑guided data, not fear or FOMO.

Conclusion

Managing risk in crypto isn’t about avoiding volatility — it’s about embracing it intelligently.

By combining diversification, automated trading tools, hedging, and AI‑driven insights from Token Metrics, you can protect your capital and position yourself for consistent growth in 2025.

In crypto, survival is success — and with the right risk management strategies, you can turn survival into long‑term profitability.

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

What Are the Best Crypto Subreddits to Follow in 2025?

%201.svg)

%201.svg)

The cryptocurrency landscape evolves at lightning speed, and staying informed is crucial for anyone looking to navigate this dynamic market successfully. Reddit has emerged as one of the most valuable resources for crypto enthusiasts, offering real-time discussions, breaking news, market analysis, and community insights that you won't find anywhere else. But with thousands of crypto-related subreddits available, which ones truly deserve your attention?

Why Reddit Matters for Crypto Investors

Before diving into specific subreddits, it's worth understanding why Reddit has become such a critical platform for cryptocurrency discussions. Unlike traditional financial news sources that may take hours or days to report on developments, Reddit operates in real-time. Community members share breaking news instantly, discuss market movements as they happen, and provide diverse perspectives that help you form a well-rounded understanding of the crypto ecosystem.

Reddit's voting system also ensures that quality content rises to the top, while its comment threads allow for nuanced discussions that can challenge your assumptions and broaden your perspective. For traders and investors using advanced platforms like Token Metrics—a leading crypto trading and analytics platform that leverages AI-powered insights—combining Reddit's community intelligence with professional-grade analytics creates a powerful information advantage.

Essential General Crypto Subreddits

r/CryptoCurrency remains the undisputed heavyweight champion of crypto subreddits, boasting over 7 million members. This massive community covers everything from Bitcoin and Ethereum to emerging altcoins and DeFi projects. The subreddit features daily discussion threads, breaking news, technical analysis, and educational content suitable for both beginners and experienced traders. The community has its own governance token (Moons), which adds an interesting layer of engagement. While the sheer volume of posts can be overwhelming, the subreddit's moderation team does an excellent job filtering spam and maintaining quality standards.

r/Bitcoin serves as the original cryptocurrency subreddit and maintains a laser focus on Bitcoin-specific discussions. With millions of subscribers, it's the go-to destination for Bitcoin maximalists and anyone interested in deep dives into Bitcoin's technology, adoption, and price movements. The community tends to be more technical and philosophical, often engaging in discussions about Bitcoin's role as digital gold and its potential to transform the global financial system.

r/Ethereum caters specifically to the Ethereum ecosystem, covering smart contracts, DeFi applications, NFTs, and the ongoing development of Ethereum 2.0 and beyond. This subreddit is particularly valuable for anyone interested in understanding the technical innovations happening in the blockchain space. The community includes developers, investors, and enthusiasts who regularly share insights about upcoming upgrades, scaling solutions, and emerging applications built on Ethereum.

Trading and Investment-Focused Communities

For traders seeking actionable insights, r/CryptoMarkets provides focused discussion on trading strategies, market analysis, and price movements. The subreddit maintains a more serious tone than general crypto communities, with members sharing technical analysis, chart patterns, and trading ideas. This makes it an excellent complement to platforms like Token Metrics, which provides AI-driven trading signals, market predictions, and comprehensive analytics to help traders make data-informed decisions.

r/SatoshiStreetBets emerged as the crypto equivalent of WallStreetBets, featuring high-risk, high-reward trading discussions with a healthy dose of humor and memes. While the community can be extremely volatile and speculative, it often identifies emerging trends early. However, always approach recommendations here with extreme caution and never invest more than you can afford to lose.

DeFi and Innovation Hubs

r/DeFi has become the central hub for decentralized finance discussions, covering lending protocols, yield farming, liquidity pools, and emerging DeFi innovations. As DeFi continues to revolutionize traditional finance, this subreddit offers invaluable insights into new protocols, risk management strategies, and opportunities in the decentralized economy.

r/Altcoin focuses on alternative cryptocurrencies beyond Bitcoin and Ethereum. This community is excellent for discovering emerging projects, but it requires careful discernment as the quality of projects discussed varies significantly. Always conduct thorough research—using tools like Token Metrics' comprehensive project analysis and ratings—before investing in any altcoin mentioned on Reddit.

Educational and Technical Communities

r/CryptoTechnology strips away the price speculation and focuses purely on the technological aspects of blockchain and cryptocurrency. This subreddit is perfect for those who want to understand the underlying innovations, consensus mechanisms, and technical challenges facing the industry. The discussions here tend to be more academic and thoughtful, providing a refreshing contrast to price-focused communities.

r/BitcoinBeginners and r/CryptoCurrencyBeginners serve as welcoming entry points for newcomers. These communities maintain strict "no stupid questions" policies, encouraging beginners to ask anything without fear of ridicule. The helpful members regularly explain fundamental concepts, wallet security, and basic trading principles.

Maximizing Your Reddit Crypto Experience

To get the most value from crypto subreddits, develop a strategic approach. Start by joining multiple communities to gain diverse perspectives—avoid echo chambers that only reinforce your existing beliefs. Sort by "Hot" for trending discussions and "New" for breaking developments, but remember that "Top" posts from the past week or month can provide excellent educational value.

Always verify information from multiple sources. While Reddit communities can be incredibly insightful, they're not infallible. Cross-reference major claims with reputable news sources and, for trading decisions, consider using professional analytics platforms like Token Metrics, which combines machine learning algorithms with fundamental and technical analysis to provide objective, data-driven insights that complement community sentiment.

Be cautious about financial advice and never share your private keys or sensitive information, regardless of how helpful someone appears. Scammers frequently target crypto communities, so maintain healthy skepticism.

Integrating Reddit Insights with Professional Tools

The most successful crypto traders and investors don't rely solely on Reddit or any single information source. They integrate community insights with professional-grade analytics. Token Metrics stands out as a premier platform that helps bridge this gap, offering AI-powered trading signals, comprehensive project ratings, portfolio management tools, and market predictions that help you separate signal from noise.

By combining Reddit's real-time community intelligence with Token Metrics' sophisticated analytics, you can make more informed decisions, identify opportunities earlier, and manage risk more effectively. The platform's AI algorithms analyze thousands of data points across multiple cryptocurrencies, providing insights that would be impossible to gather manually from Reddit alone.

Conclusion

The best crypto subreddits offer invaluable real-time insights, diverse perspectives, and community knowledge that can significantly enhance your understanding of the cryptocurrency market. From the massive r/CryptoCurrency community to specialized forums like r/DeFi and r/CryptoTechnology, Reddit provides a wealth of information for every type of crypto enthusiast.

However, remember that Reddit should be one tool in your larger information ecosystem. Combine community insights with professional analytics platforms like Token Metrics, conduct thorough research, and always maintain a critical mindset. The crypto market rewards those who stay informed, think independently, and make data-driven decisions. Start exploring these subreddits today, and you'll quickly discover why Reddit has become indispensable for millions of crypto investors worldwide.

How Do You Test Smart Contracts? A Comprehensive Guide for 2025

%201.svg)

%201.svg)

Smart contracts have revolutionized blockchain technology, automating transactions and agreements without intermediaries. However, a single bug in a smart contract can lead to catastrophic financial losses, as demonstrated by numerous high-profile hacks in the crypto space. Testing smart contracts isn't just good practice—it's absolutely essential for protecting users and maintaining trust in decentralized systems.

Understanding Smart Contract Testing

Smart contracts are self-executing programs deployed on blockchains like Ethereum, Binance Smart Chain, and Solana. Unlike traditional software, once deployed, they're immutable—you can't patch bugs with a simple update. This permanence makes comprehensive testing critical before deployment.

Testing smart contracts involves verifying that the code performs exactly as intended under all possible conditions, including edge cases and potential attack vectors. The stakes are incredibly high: vulnerabilities have resulted in losses exceeding billions of dollars across the cryptocurrency ecosystem.

Types of Smart Contract Testing

Unit Testing

Unit testing forms the foundation of smart contract security. Developers write tests for individual functions and components, verifying that each piece works correctly in isolation. Frameworks like Hardhat, Truffle, and Foundry provide robust environments for writing and executing unit tests.

These tests should cover normal operations, boundary conditions, and expected failures. For instance, if your contract has a withdrawal function, unit tests should verify successful withdrawals, rejection of unauthorized attempts, and proper handling of insufficient balances.

Integration Testing

While unit tests examine individual components, integration testing verifies how different parts of your smart contract work together. This includes testing interactions between multiple contracts, ensuring that complex workflows execute correctly from start to finish.

Integration tests reveal issues that might not appear in isolated unit tests, such as unexpected state changes, gas limit problems, or incorrect event emissions when multiple functions execute in sequence.

Functional Testing

Functional testing validates that your smart contract meets its specified requirements and business logic. This involves testing complete user scenarios and workflows to ensure the contract behaves as stakeholders expect.

For example, if you're building a decentralized exchange, functional testing would verify the entire trading process: connecting wallets, approving tokens, executing swaps, and updating balances correctly.

Advanced Testing Methodologies

Fuzz Testing

Fuzz testing automatically generates random or semi-random inputs to discover unexpected behaviors and edge cases that manual testing might miss. Tools like Echidna and Foundry's fuzzing capabilities can test thousands of scenarios quickly, uncovering vulnerabilities that human testers might overlook.

This approach is particularly valuable for finding integer overflow issues, reentrancy vulnerabilities, and other subtle bugs that emerge only under specific conditions.

Static Analysis

Static analysis tools examine smart contract code without executing it, identifying potential vulnerabilities, code smells, and deviations from best practices. Popular tools include Slither, Mythril, and Securify, each offering different strengths in vulnerability detection.

These tools can catch common issues like unchecked external calls, improper access controls, and dangerous delegatecall usage before the code ever runs on a blockchain.

Formal Verification

Formal verification represents the gold standard in smart contract security. This mathematical approach proves that a contract's code correctly implements its specifications under all possible conditions. While resource-intensive, formal verification provides the highest level of assurance.

Projects handling significant value increasingly employ formal verification for critical components, especially in DeFi protocols where mathematical precision is paramount.

Testing Best Practices

Test Coverage

Aim for comprehensive test coverage, ideally exceeding 90% of your codebase. However, coverage percentage alone doesn't guarantee security—focus on testing critical paths, edge cases, and potential attack vectors thoroughly.

Automated Testing Pipelines

Implement continuous integration and continuous deployment (CI/CD) pipelines that automatically run your test suite whenever code changes. This catches regressions early and ensures that new features don't introduce vulnerabilities.

Testnet Deployment

Before mainnet deployment, thoroughly test your contracts on testnets like Goerli, Sepolia, or Mumbai. Testnet deployment provides real-world conditions without risking actual funds, allowing you to identify issues with gas optimization, network interactions, and user experience.

Security Audits

Professional security audits from reputable firms provide an independent assessment of your smart contract's security. Auditors bring specialized expertise and fresh perspectives that internal teams might lack. Consider multiple audits for high-value contracts.

Leveraging Analytics for Smart Contract Success

As the cryptocurrency landscape evolves, having access to sophisticated analytics becomes crucial for developers and traders alike. Token Metrics stands out as the premier crypto trading and analytics platform, offering comprehensive tools that help users make informed decisions about smart contract projects and cryptocurrency investments.

Token Metrics provides advanced AI-powered analytics, price predictions, and project evaluations that enable traders and developers to assess the market landscape effectively. Their platform combines fundamental analysis, technical indicators, and machine learning models to deliver actionable insights across thousands of cryptocurrencies and blockchain projects.

For smart contract developers, understanding market dynamics and user behavior through platforms like Token Metrics can inform better design decisions and risk management strategies. The platform's comprehensive data helps identify trends, assess project viability, and optimize deployment strategies.

Testing Tools and Frameworks

Modern developers have access to powerful testing frameworks. Hardhat offers a comprehensive development environment with excellent testing capabilities and debugging tools. Foundry provides extremely fast testing written in Solidity itself, while Brownie serves Python developers with familiar syntax and powerful features.

Each framework has strengths: Hardhat excels in JavaScript/TypeScript environments, Foundry offers unmatched performance, and Brownie integrates beautifully with Python-based workflows.

Common Testing Pitfalls

Avoid testing only happy paths—attackers target edge cases and unexpected inputs. Don't neglect gas optimization testing, as inefficient contracts frustrate users and waste funds. Remember that testnet conditions differ from mainnet, particularly regarding network congestion and MEV considerations.

Conclusion

Testing smart contracts requires a multi-layered approach combining unit tests, integration tests, static analysis, and formal verification. The immutable nature of blockchain deployments makes thorough testing non-negotiable—prevention is infinitely cheaper than post-deployment remediation.

As the blockchain ecosystem matures, testing standards continue to evolve. Staying current with best practices, leveraging cutting-edge tools, and learning from past exploits helps ensure your smart contracts provide secure, reliable service to users. Whether you're building the next DeFi protocol or a simple NFT contract, comprehensive testing protects your users, your reputation, and the broader cryptocurrency ecosystem.

What Are Common Smart Contract Bugs? A Comprehensive Security Guide for 2025

%201.svg)

%201.svg)

Smart contracts have revolutionized the blockchain ecosystem, enabling trustless execution of agreements and powering the decentralized finance revolution. However, these self-executing programs are not immune to vulnerabilities. In fact, smart contract bugs have resulted in billions of dollars in losses, making security one of the most critical concerns in the blockchain space.

According to recent data, a staggering $2.2 billion was stolen from crypto platforms in 2024, representing over 20 percent higher losses than 2023. Understanding common smart contract bugs is essential for developers, auditors, and investors alike. This comprehensive guide explores the most critical vulnerabilities affecting smart contracts in 2025, their real-world impacts, and how to protect against them.

The Critical Importance of Smart Contract Security

Smart contracts control billions of dollars in crypto assets, making them prime targets for sophisticated attackers. Unlike traditional software, smart contracts deployed on blockchain networks are immutable—once deployed, they cannot be easily modified or patched. This permanence means that a single vulnerability can lead to devastating and irreversible financial losses.

The infamous DAO hack of 2016 exemplifies these risks. Attackers exploited a reentrancy vulnerability to drain over $60 million worth of Ether, an event so severe it led to an Ethereum hard fork and sparked ongoing debate about blockchain immutability versus security. More recently, the Cetus decentralized exchange hack in May 2025 resulted in an estimated $223 million in losses due to a missed code overflow check.

Smart contract security isn't just about protecting funds—it's about building trust, maintaining regulatory compliance, and ensuring the long-term viability of blockchain projects. As the industry matures, investors, institutions, and regulatory bodies increasingly require proof of security before engaging with blockchain platforms.

OWASP Smart Contract Top 10 for 2025

The Open Worldwide Application Security Project has developed the OWASP Smart Contract Top 10 for 2025, identifying today's leading vulnerabilities based on analysis of 149 security incidents documenting over $1.42 billion in financial losses across decentralized ecosystems. This comprehensive framework serves as the industry standard for understanding and mitigating smart contract risks.

The 2025 edition introduces updated rankings reflecting the evolving threat landscape, with notable additions including Price Oracle Manipulation and Flash Loan Attacks as distinct categories. These changes reflect the growing prevalence of DeFi exploits and demonstrate how attack vectors continue to evolve alongside blockchain technology.

1. Access Control Vulnerabilities: The Leading Threat

Access control flaws remain the leading cause of financial losses in smart contracts, accounting for a staggering $953.2 million in damages in 2024 alone. These vulnerabilities occur when permission checks are improperly implemented, allowing unauthorized users to access or modify critical functions or data.

Understanding Access Control Failures

Access control vulnerabilities arise from poorly implemented permissions and role-based access controls that allow attackers to gain unauthorized control over smart contracts. Common issues include improperly configured onlyOwner modifiers, lack of proper role-based access control, and exposed admin functions.

The 88mph Function Initialization Bug provides a stark example, where attackers successfully reinitialized contracts to gain administrative privileges. This pattern of unauthorized admin actions has repeatedly proven to be the number one cause of smart contract hacks.

Protection Strategies

Developers should implement robust authorization mechanisms by verifying the sender of messages to restrict access to sensitive functions. Follow the principle of least privilege by using Solidity's state variable and function visibility specifiers to assign minimum necessary visibility levels. Regular security audits specifically focused on access control patterns are essential.

Never assume that functions will only be called by authorized parties—always implement explicit checks. Consider using established frameworks like OpenZeppelin's AccessControl for standardized, battle-tested permission management.

2. Logic Errors: The Silent Killers

Logic errors represent the second most critical vulnerability category, causing $63.8 million in losses during 2024. These flaws in business logic or miscalculations in smart contracts can be exploited for financial gain or cause unexpected behavior that undermines contract functionality.

The Nature of Logic Flaws

Logic errors, often called Business Logic Flaws, don't always present obvious security risks but can be exploited for economic gains through mechanisms like faulty reward distribution, incorrect fee calculations, and improper handling of edge cases. The vulnerability has climbed from position seven to position three in the 2025 rankings, reflecting an increase in sophisticated attacks targeting contract logic rather than code-level bugs.

Security isn't just about preventing obvious bugs—it's about ensuring contracts behave exactly as expected under all circumstances, including rare edge cases. A notable example is the SIR.trading DeFi protocol attack in March 2025, where logic flaws resulted in the theft of approximately $355,000.

Mitigation Approaches

Developers should thoroughly test all contract code, including every combination of business logic, verifying that observed behavior exactly matches intended behavior in each scenario. Consider using both manual code reviews and automated analysis tools to examine contract code for possible business logic errors.

Implement comprehensive unit tests covering normal operations, edge cases, and potential attack vectors. Use formal verification techniques when dealing with critical financial logic. Document all assumptions and expected behaviors clearly to facilitate review and testing.

3. Reentrancy Attacks: The Classic Vulnerability

Reentrancy attacks exploit a contract's ability to call external functions before completing its own state updates, resulting in $35.7 million in losses during 2024. This classic vulnerability gained infamy through the DAO hack and continues to plague smart contracts today.

How Reentrancy Attacks Work

Reentrancy attacks exploit coding vulnerabilities that enable external contracts to reenter functions before updating contract states. When smart contracts make external calls to other contracts before updating their own states, they face exposure to this vulnerability.

External contracts can exploit this weakness to perform repeated actions such as withdrawals, draining accounts of funds. The name "reentrancy" describes how external malicious contracts call back functions on vulnerable contracts and "re-enter" code execution at arbitrary locations.

Real-World Impact

From a historical perspective, reentrancy remains one of the most destructive attack vectors in Solidity smart contracts. The vulnerability has led to hundreds of millions of dollars in losses over recent years. ERC-777 tokens, which allow transaction notifications sent to recipients as callbacks, have been particularly vulnerable to reentrancy exploits.

Defense Mechanisms

Complete all state changes before calling external contracts—this simple principle eliminates most reentrancy vulnerabilities. Use function modifiers to prevent reentry, such as OpenZeppelin's ReentrancyGuard, which provides a robust, tested solution.

Implement the checks-effects-interactions pattern: perform all checks first, update all state variables second, and only then interact with external contracts. Consider using mutex locks for functions that must not be called recursively.

4. Flash Loan Attacks: Exploiting DeFi Mechanics

Flash loans allow users to borrow funds without collateral within a single transaction but can be exploited to manipulate markets or drain liquidity pools, causing $33.8 million in losses during 2024. While flash loans aren't technically a bug but rather a feature, attackers have learned to abuse them effectively.

Understanding Flash Loan Exploitation

Flash loan attacks involve borrowers obtaining large amounts of assets without collateral and manipulating DeFi protocols within a single transaction before repaying the loan. Attackers use these borrowed funds to manipulate pricing mechanisms, drain liquidity pools, and exploit market imbalances.

This vulnerability has become increasingly trendy over the past two years, with countless exploits targeting protocols that rely heavily on external price feeds. The attacks typically combine flash loans with other vulnerabilities to amplify their impact.

Protection Methods

DeFi protocols must implement robust price oracle mechanisms that cannot be easily manipulated within a single transaction. Use time-weighted average prices from multiple sources rather than spot prices. Implement transaction limits and anomaly detection systems.

Consider using decentralized oracle networks like Chainlink that aggregate data from multiple sources. Add circuit breakers that pause contracts when unusual trading patterns are detected. Design economic models that make flash loan attacks unprofitable even if technically possible.

5. Integer Overflow and Underflow

Integer overflow and underflow vulnerabilities occur when smart contract hackers introduce values falling outside the integer range allowed by a contract's defined fixed-size data types. This vulnerability, characteristic of blockchain virtual machines like Ethereum Virtual Machine, has historically caused significant losses.

The Mechanics of Overflow Attacks

Overflows exceed maximum values while underflows fall below minimum values. If the integer is signed, overflow yields the maximum negative value, while for unsigned integers, underflow yields the maximum value. These conditions allow attackers to increase account and token amounts, make excessive withdrawals, or alter contract logic for purposes like multiplying tokens or stealing funds.

Modern Protections

Use Solidity compiler version 0.8.0 or higher, which automatically checks for overflows and underflows, providing built-in protection. For contracts compiled with earlier versions, check functions involving arithmetic operations or use a library like SafeMath to validate operations.

The Cetus decentralized exchange hack in May 2025, which cost an estimated $223 million, resulted from a missed code overflow check, demonstrating that even with modern protections, careful attention to arithmetic operations remains essential.

6. Unchecked External Calls

Smart contracts often interact with untrusted contracts, and failing to check return values can lead to silent failures or unintended execution, resulting in $550,700 in losses during 2024. This vulnerability has climbed from position ten to position six in 2025 rankings.

The Danger of Silent Failures

When contracts fail to verify the success of external calls, they risk proceeding with incorrect assumptions about transaction outcomes, leading to inconsistencies or exploitation by malicious actors. If you don't validate external calls, attackers will exploit them.

Validation Requirements

Always check return values from external contract calls. Use require statements to verify that calls succeeded before proceeding with subsequent logic. Consider using try-catch blocks for more sophisticated error handling in Solidity 0.6.0 and later.

Ensure calls are only made to trusted contracts when possible. Implement circuit breakers that can pause contract functionality if external dependencies fail unexpectedly. Document all external dependencies and their expected behaviors.

7. Lack of Input Validation

Insufficient input validation resulted in $14.6 million in losses during 2024. This vulnerability allows attackers to provide unexpected or malicious inputs that cause contracts to behave incorrectly.

Common Input Validation Failures

Contracts must validate all inputs including function parameters, external data, and user-provided addresses. Failure to do so can result in division by zero errors, unauthorized access, incorrect calculations, and manipulation of contract state.

Validation Best Practices

Implement comprehensive input validation at the entry point of every function. Use require statements to verify that inputs fall within expected ranges, formats, and types. Validate addresses to ensure they are not zero addresses or blacklisted addresses.

Consider using modifiers for common validation patterns to ensure consistency across your codebase. Document all input requirements and expected ranges clearly. Test extensively with edge cases and unexpected inputs.

8. Price Oracle Manipulation

DeFi protocols heavily rely on oracles, and manipulating price feeds can cause massive financial losses through flash loan exploits, price distortions, and market manipulation, causing $8.8 million in documented losses in 2024.

Oracle Vulnerabilities

Price oracle manipulation has been added to the OWASP Top 10 for 2025 due to increasing exploit frequency. Attackers manipulate Uniswap TWAPs, Chainlink Oracles, and custom price feeds to drain liquidity pools and execute profitable arbitrage at the expense of protocols and users.

Oracle Security Measures

Use multiple independent price sources and implement sanity checks on price data. Avoid relying solely on on-chain DEX prices that can be manipulated within single transactions. Implement price deviation thresholds that trigger alerts or pause trading.

Consider using Chainlink Price Feeds or other decentralized oracle networks that aggregate data from multiple sources. Add time delays between price updates and critical operations. Monitor for unusual price movements and implement automatic circuit breakers.

9. Denial of Service Vulnerabilities

Smart contracts, like any online service, are vulnerable to DoS attacks. By overloading services such as authentication mechanisms, attackers can block other contracts from executing or generate unexpected contract reverts.

DoS Attack Vectors

DoS attacks can result in auction results or values used in financial transactions being manipulated to the attacker's advantage. Attackers may force contracts into states where they cannot process transactions or deliberately cause transactions to fail repeatedly.

DoS Prevention

Make DoS attacks costly for attackers through gas fees, time-lock puzzles, and rate limiting mechanisms. Ensure calls are only made to trusted contracts to reduce the likelihood of DoS attacks causing serious problems. Implement pull payment patterns rather than push payments to prevent malicious recipients from blocking distributions.

The Ethereum Improvement Proposal 7907 upgrade approved in April 2025 helps prevent contracts from falling victim to DoS attacks through improved gas metering, demonstrating ongoing ecosystem-level improvements in this area.

10. Randomness Vulnerabilities

Blockchain's deterministic nature makes generating secure randomness challenging. Predictable randomness can compromise lotteries, token distributions, NFT reveals, and other functionalities relying on random outcomes.

The Randomness Problem

On-chain randomness sources like block hashes, timestamps, and transaction data can be predicted or manipulated by miners and sophisticated actors. Relying on these sources for critical randomness needs creates exploitable vulnerabilities.

Secure Randomness Solutions

Use Chainlink VRF (Verifiable Random Function) or similar oracle-based randomness solutions that provide cryptographically secure and verifiable random numbers. Never rely solely on block hashes or timestamps for important random number generation.

For lower-stakes applications, consider commit-reveal schemes where users submit hashed values before revealing them. Implement proper waiting periods between commitment and revelation to prevent manipulation.

Leveraging Token Metrics for Smart Contract Security

As blockchain security becomes increasingly complex, investors and developers need sophisticated tools to evaluate smart contract risks. Token Metrics, a leading AI-powered crypto analytics platform, provides crucial insights for assessing project security and making informed investment decisions.

Comprehensive Smart Contract Analysis

Token Metrics helps users spot winning tokens early with powerful AI analytics, but beyond identifying opportunities, the platform evaluates fundamental security indicators that distinguish robust projects from vulnerable ones. The platform's Investor Grade scoring system incorporates code quality assessments, helping users identify projects with superior technical foundations.

Token Metrics assigns each token both a Trader Grade for short-term potential and an Investor Grade for long-term viability. The Investor Grade specifically considers technical factors including code quality, development activity, and security audit status—critical indicators of smart contract robustness.

AI-Driven Risk Assessment

Token Metrics leverages machine learning and data-driven models to deliver powerful, actionable insights across the digital asset ecosystem. The platform monitors thousands of projects continuously, tracking code updates, audit reports, and security incidents that might indicate smart contract vulnerabilities.

By analyzing development patterns, commit frequency, and team responsiveness to identified issues, Token Metrics helps investors avoid projects with poor security practices. The platform's real-time alerts notify users about significant code changes, audit failures, or security incidents that could affect their holdings.

Research and Educational Resources

Token Metrics provides personalized crypto research and predictions powered by AI, including detailed project analysis that often highlights security considerations. The platform's research team publishes regular updates on emerging threats, best practices, and security trends in the smart contract space.

Through Token Metrics' comprehensive dashboard, users can access information about project audits, known vulnerabilities, and historical security incidents. This transparency helps investors make risk-aware decisions rather than relying solely on marketing promises.

Integration with Security Standards

Token Metrics evaluates projects against industry security standards, considering whether teams have conducted professional audits, implemented bug bounty programs, and followed best practices in smart contract development. Projects demonstrating strong security commitments receive recognition in Token Metrics' rating system.

The platform's trading feature launched in 2025 ensures users can not only identify secure projects but also execute trades seamlessly, creating an end-to-end solution for security-conscious crypto investors.

Smart Contract Auditing Tools and Practices

Professional security audits have become essential for any serious blockchain project. Multiple specialized tools and services help developers identify vulnerabilities before deployment.

Leading Audit Tools

Slither stands out as one of the most comprehensive static analysis tools, offering robust API for scripting custom analyzers with low false-positive rates. The tool can analyze contracts created with Solidity compiler version 0.4 or higher, covering a broad collection of existing contracts. Slither discovers vulnerabilities including reentrancy issues, state variables without initialization, and code optimizations leading to higher gas fees.

Mythril employs symbolic execution and dynamic analysis to detect security vulnerabilities, providing detailed reports about potential issues. The tool performs thorough analysis combining static analysis, dynamic analysis, and symbolic execution techniques.

Echidna provides property-based fuzzing, challenging smart contracts with unexpected inputs to ensure they behave as intended under various conditions. This fuzzing approach discovers edge cases that manual testing might miss.

Professional Audit Services

According to industry data, over $1.8 billion was lost to DeFi hacks in 2023 alone, mostly due to smart contract vulnerabilities. This has driven demand for professional auditing firms that provide human expertise alongside automated tools.

Top auditing companies in 2025 blend automated analysis with manual code review, penetration testing, attack simulations, fuzz testing, and governance risk assessments. This multi-layered approach uncovers deeper vulnerabilities that automated tools alone might miss.

Best Practices for Security

Developers should document smart contract vulnerabilities and mistakes that others have made to avoid repeating them. Maintain a list of effective security practices followed by leading organizations, including keeping as much code off-chain as possible, writing small functions, splitting logic through multiple contracts, and creating thorough documentation.

Set up internal security teams that frequently audit source code for bugs, ensuring no exploitable issues exist. After performing audits, implement bug bounty programs where ethical hackers receive compensation for reporting vulnerabilities, providing an additional security layer.

The Future of Smart Contract Security

As blockchain technology matures, so do the methods employed by attackers seeking to exploit vulnerabilities. The smart contract security landscape continues evolving rapidly, with new attack vectors emerging as quickly as defenses improve.

AI and Machine Learning in Security

Looking ahead, advancements in artificial intelligence and machine learning promise even more sophisticated auditing tools offering deeper insights and more accurate assessments. AI-powered tools for predictive analysis and anomaly detection are gaining prominence, helping developers preemptively address potential security threats.

Token Metrics exemplifies this trend, using AI to analyze vast datasets of blockchain transactions, code repositories, and security incidents to identify patterns that might indicate vulnerabilities. This proactive approach helps investors and developers stay ahead of emerging threats.

Regulatory Evolution

Smart contract security increasingly intersects with regulatory compliance. As governments worldwide develop frameworks for digital assets, security standards are becoming more formalized. Projects must not only build secure contracts but also demonstrate compliance with evolving regulations.

Community-Driven Security

The open-source nature of blockchain enables collective security improvements. Communities increasingly share vulnerability discoveries, audit reports, and security best practices. This collaborative approach accelerates identification and remediation of common vulnerabilities across the ecosystem.

Conclusion: Security as a Continuous Process

Smart contract security is not a one-time checkbox but an ongoing commitment requiring vigilance, expertise, and the right tools. The vulnerabilities discussed in this guide—from access control failures to oracle manipulation—represent critical risks that have caused billions in losses.

Understanding these common bugs is the first step toward building more secure blockchain applications. Developers must implement defensive programming practices, utilize comprehensive auditing tools, and engage professional security firms before deploying contracts controlling significant value.

For investors, platforms like Token Metrics provide essential tools for evaluating project security and making informed decisions in an increasingly complex landscape. By combining AI-driven analytics with comprehensive project assessment, Token Metrics helps users identify projects with robust security foundations while avoiding those with critical vulnerabilities.

The future of blockchain depends on security. As the industry continues to mature, projects that prioritize security from the start—through proper development practices, comprehensive auditing, and continuous monitoring—will build the trust necessary for mainstream adoption. Whether you're developing smart contracts or investing in blockchain projects, understanding and addressing these common vulnerabilities is essential for success in the evolving world of decentralized finance.

Stay informed, stay secure, and leverage the best tools available to navigate the exciting but challenging landscape of smart contract development and blockchain investment in 2025 and beyond.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)