Types of Stablecoins: A Complete Guide for 2025

%201.svg)

%201.svg)

The cryptocurrency market is famous for volatility—Bitcoin can swing by thousands of dollars in a day, and altcoins can rise or crash in hours. But what if you need price stability? That’s where stablecoins come in.

Stablecoins are digital currencies pegged to stable assets like the US dollar, gold, or even algorithmically maintained price levels. They bridge the gap between the speed and efficiency of blockchain technology and the reliability of traditional money.

As of 2025, stablecoins account for over $140 billion in circulating supply, making them essential for traders, investors, and decentralized finance (DeFi) users. But not all stablecoins are the same—different types use different mechanisms to maintain their stability, each with unique pros and cons.

In this guide, we’ll break down the types of stablecoins, how they work, their risks, and which might be best for your needs.

What Are Stablecoins?

A stablecoin is a cryptocurrency designed to maintain a stable value by pegging its price to a reference asset. Most stablecoins are pegged to fiat currencies like the U.S. dollar (e.g., 1 USDT ≈ $1), but some track commodities (like gold) or are algorithmically balanced to hold value.

They are widely used for:

- Trading: Moving quickly in and out of volatile assets.

- DeFi: Providing liquidity, borrowing, and earning yields.

- Remittances: Sending low-cost, fast cross-border payments.

- Hedging: Protecting against crypto market volatility.

Types of Stablecoins

There are four main types of stablecoins:

- Fiat‑Collateralized Stablecoins

- Crypto‑Collateralized Stablecoins

- Algorithmic (Non‑Collateralized) Stablecoins

- Commodity‑Backed Stablecoins

Each has a different method of maintaining its peg. Let’s break them down.

1. Fiat‑Collateralized Stablecoins

Definition:

These are backed 1:1 by traditional currencies like the U.S. dollar, euro, or yen. For every stablecoin issued, an equivalent amount of fiat is held in reserve by a trusted custodian.

How They Work:

If you buy 1 USDC, Circle (its issuer) holds $1 in a regulated bank account or short-term U.S. Treasury securities. When you redeem that stablecoin, the issuer sends you the equivalent amount in fiat and burns the coin.

Examples:

- Tether (USDT) – Largest stablecoin by market cap; widely used on exchanges.

- USD Coin (USDC) – Issued by Circle, fully regulated and audited.

- TrueUSD (TUSD) – Offers real-time attestation of reserves.

- PayPal USD (PYUSD) – Launched by PayPal for payments and DeFi.

Pros:

- High stability – Pegged directly to fiat.

- Transparent – Many provide audits and attestations.

- Easy adoption – Ideal for traders, merchants, and payment platforms.

Cons:

- Centralization – Custodians control reserves and can freeze accounts.

- Regulatory risks – Subject to government oversight.

- Less transparency for some issuers – (e.g., Tether faced scrutiny over its reserves).

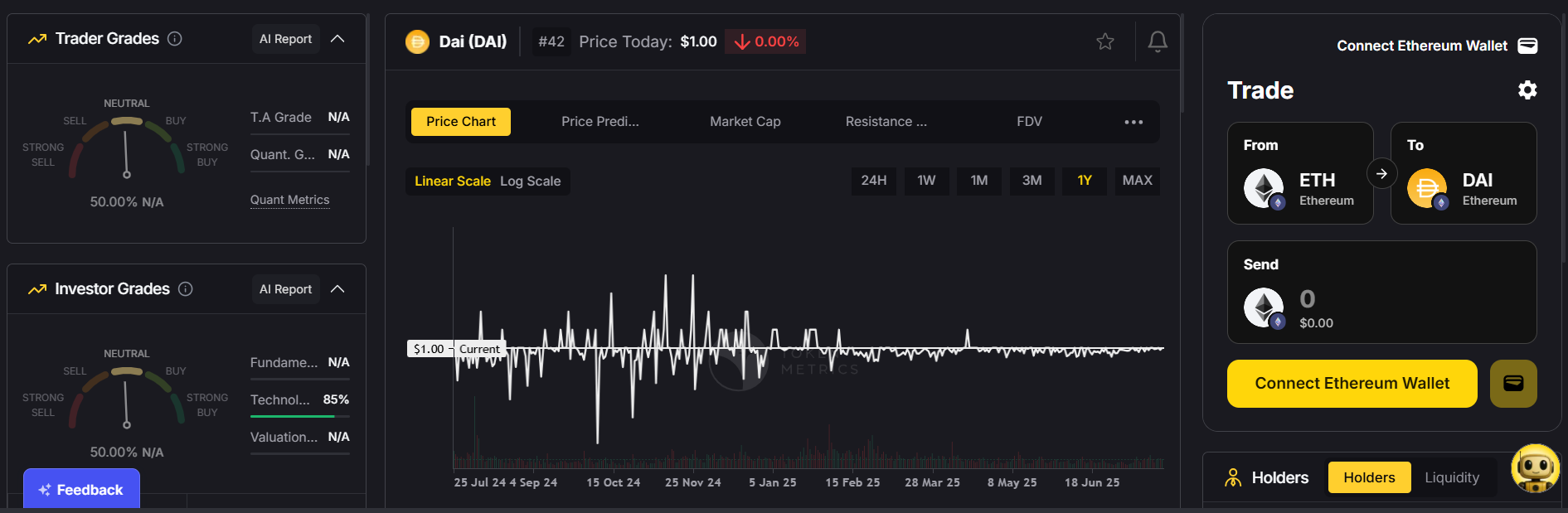

2. Crypto‑Collateralized Stablecoins

Definition:

These are backed by cryptocurrencies like Ethereum or Bitcoin instead of fiat. Because crypto is volatile, these stablecoins are overcollateralized (e.g., $150 in ETH backs $100 in stablecoins).

How They Work:

When you mint a crypto-backed stablecoin like DAI, you deposit collateral (e.g., ETH) into a smart contract. If the collateral value drops too much, the contract automatically liquidates some assets to maintain the peg.

Examples:

- DAI – Issued by MakerDAO, backed by ETH, USDC, and other assets.

- sUSD – A synthetic USD issued by Synthetix.

- MIM (Magic Internet Money) – Collateralized by multiple crypto assets.

Pros:

- Decentralized – No single company controls reserves.

- Transparent – All collateral balances are viewable on-chain.

- Resistant to censorship – Issuers can’t freeze accounts.

Cons:

- Volatility risk – Collateral can lose value quickly, requiring liquidations.

- Overcollateralization – Ties up more capital than fiat-backed options.

- Complexity – Requires understanding of DeFi mechanics.

3. Algorithmic (Non‑Collateralized) Stablecoins

Definition:

These don’t use physical reserves. Instead, they maintain their peg via algorithmic supply adjustments—minting or burning tokens to balance price around $1.

How They Work:

If demand increases and the price rises above $1, the protocol mints more coins. If it falls below $1, the protocol burns coins or incentivizes users to buy them back.

Examples:

- Ampleforth (AMPL) – Elastic supply adjusts daily.

- UST (TerraUSD) – Infamously collapsed in 2022 after its peg broke.

- Frax (FRAX) – Uses a hybrid model: partly collateralized, partly algorithmic.

Pros:

- Highly capital-efficient – Doesn’t require large reserves.

- Decentralized – Often governed by smart contracts and DAOs.

Cons:

- Peg instability – Prone to “death spirals” when market confidence drops.

- Complex mechanisms – Harder for average users to understand.

- History of failures – UST/LUNA crash eroded trust in algorithmic coins.

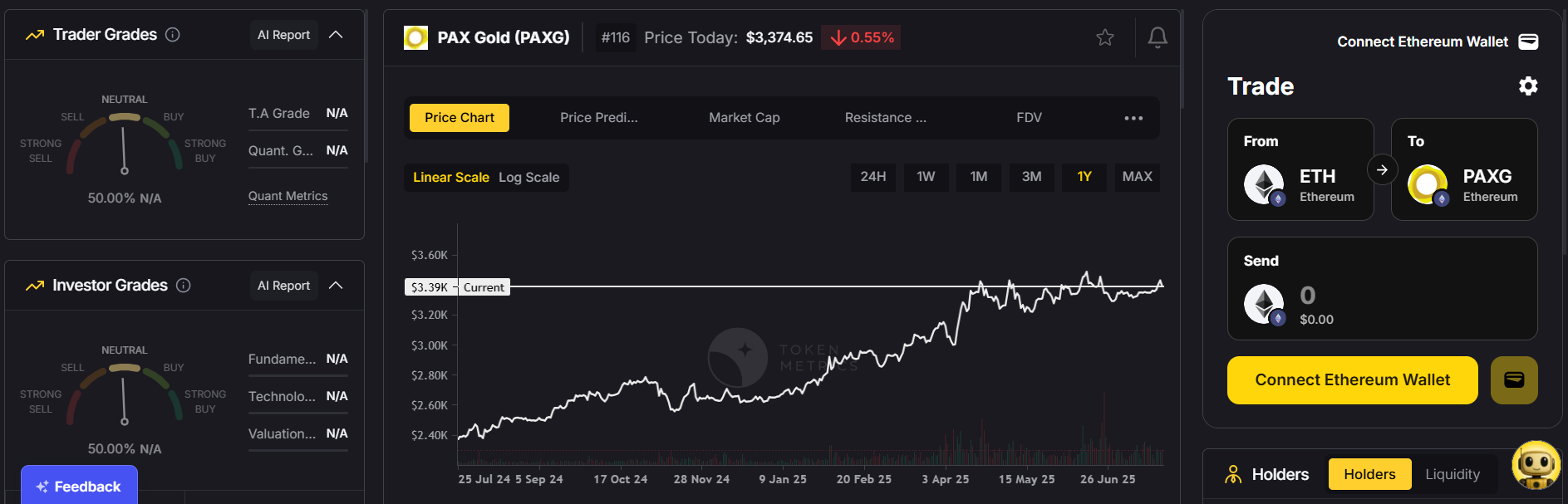

4. Commodity‑Backed Stablecoins

Definition:

These stablecoins are pegged to commodities like gold, silver, or oil, giving them intrinsic value beyond fiat.

How They Work:

For every coin issued, an equivalent amount of the commodity is held in a secure vault. For example, owning 1 PAX Gold (PAXG) means you own 1 troy ounce of physical gold stored by the issuer.

Examples:

- PAX Gold (PAXG) – Backed by physical gold.

- Tether Gold (XAUT) – Gold-backed token from Tether.

- Digix Gold (DGX) – Pegged to gold bars in Singapore vaults.

Pros:

- Hedge against inflation – Commodities like gold retain value during economic uncertainty.

- Diversification – Offers exposure to both crypto and commodities.

Cons:

- Low liquidity – Less widely used than fiat-backed stablecoins.

- Storage & audit challenges – Requires trust in the issuer to maintain reserves.

Why Do Stablecoins Matter?

Stablecoins are the backbone of DeFi and crypto trading.

- Trading & arbitrage: They provide a quick way to exit volatile positions without converting back to fiat.

- Cross-border payments: Cheaper and faster than SWIFT or remittance services.

- DeFi participation: Essential for lending, borrowing, yield farming, and liquidity pools.

- On-ramp/off-ramp: They simplify converting between traditional finance and blockchain.

Which Type of Stablecoin Should You Use?

If you want simplicity & security: Go with fiat-backed coins like USDC or PYUSD.

If you value decentralization: Choose crypto-collateralized options like DAI.

If you’re comfortable with high risk: Explore algorithmic models like FRAX (but beware of peg risks).

If you want inflation protection: Consider commodity-backed coins like PAXG.

Key Risks of Stablecoins

- Regulation: Governments are increasing oversight of fiat-backed coins.

- Centralization: Some issuers can freeze funds or blacklist wallets.

- Smart contract risks: DeFi-based stablecoins can suffer from bugs or exploits.

- Peg breaks: Algorithmic models are especially vulnerable to confidence loss.

The Future of Stablecoins

In 2025, stablecoins are evolving to meet regulatory and market demands:

- Central Bank Digital Currencies (CBDCs): Governments are issuing digital dollars and euros, potentially competing with stablecoins.

- Regulated issuers: Projects like USDC are working closely with regulators to ensure compliance.

- Hybrid models: Combining fiat and algorithmic elements (e.g., Frax) to enhance stability.

As DeFi expands and global adoption grows, stablecoins will remain at the heart of crypto finance.

Final Thoughts

Stablecoins are more than just “digital dollars.” They’re a critical bridge between traditional finance and blockchain innovation.

- Fiat-backed stablecoins bring stability and ease of use.

- Crypto-collateralized ones offer transparency and decentralization.

- Algorithmic models push innovation but carry higher risks.

- Commodity-backed coins provide a hedge against inflation and diversify exposure.

Choosing the right type depends on your risk tolerance, use case, and trust level. Whether for trading, saving, or participating in DeFi, understanding the types of stablecoins can help you navigate the crypto ecosystem with confidence.

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

What is the Difference Between Crypto and Blockchain: The Ultimate Guide to Understanding Key Differences in 2025

%201.svg)

%201.svg)

The terms crypto and blockchain are often used interchangeably in conversations about digital money and technology, but they actually represent fundamentally different concepts. As we move through 2025, understanding what is the difference between crypto and blockchain has become increasingly important for investors, traders, technologists, and anyone interested in the future of finance and digital innovation. This comprehensive guide will clarify these distinctions, explain how both technologies work, and explore their evolving roles in shaping the global digital economy.

Understanding Blockchain Technology: The Foundation Technology

At its core, blockchain technology is a revolutionary form of a distributed ledger that records transactions across a network of multiple computers, or nodes, simultaneously. Blockchain is a type of distributed ledgers system. Unlike a traditional central database controlled by a single entity, a blockchain network operates without a central authority, distributing data across many participants to create a decentralized ledger. This infrastructure ensures that the blockchain records are immutable, meaning once a transaction is recorded, it cannot be altered without consensus from the network. Blockchain ensures transaction integrity, transparency, and trust by making records tamper-proof and verifiable by all participants.

The blockchain works by grouping transaction data into “blocks.” Each block contains a transaction record, a timestamp, and a reference to the previous block through a cryptographic hash. Blockchain uses cryptographic structures, such as Merkle trees, for storing data securely and immutably. This chaining of blocks forms an immutable digital ledger that ensures data integrity and security. Because every block links to its predecessor, tampering with any single block would require changing all subsequent blocks across the entire network, which is practically impossible.

Key characteristics of blockchain include:

- Decentralization: The blockchain database is distributed across a distributed network of nodes, eliminating a single point of control or failure. This contrasts with traditional financial systems and databases that rely on a central bank or central authority.

- Transparency: In public blockchain networks like the bitcoin blockchain, all blockchain records are visible to network members, enabling a transparent system where transactions can be audited openly. This data transparency enhances auditing, improves security, and fosters trust among market participants.

- Immutability: Once recorded, transaction data on the blockchain becomes a permanent, immutable record. Transaction records are stored securely and become immutable with each new block. This feature is critical for applications requiring trustworthy historical data, such as financial transactions and voting systems.

- Security: Blockchain uses cryptographic techniques, including cryptographic hash functions and consensus algorithms, to secure the network against fraud and unauthorized modifications.

Each block contains a transaction record that is unalterable; the transaction record includes all relevant details of each transaction. If corrections are needed, they are made with additional entries, ensuring a complete and transparent history.

Beyond cryptocurrency, blockchain refers to the underlying technology that supports a wide range of applications, from supply chain management to decentralized applications and smart contracts. Businesses can operate their own private blockchain networks or join consortium blockchain networks where preselected organizations maintain the ledger collectively. Blockchain software automates and streamlines the processes involved in how blockchain works.

How Blockchain Works: The Mechanics Behind the Magic

At the heart of blockchain technology is a decentralized digital ledger that revolutionizes how we record transactions. Unlike traditional systems that rely on a central authority, a blockchain network operates across a distributed network of computers—known as nodes—where multiple parties can participate in validating and recording transactions. This peer-to-peer structure is the underlying technology that powers secure and transparent data sharing in various industries, from supply chain management to financial institutions and even voting systems.

When a transaction is initiated, it is broadcast to the entire blockchain network. Nodes independently verify the transaction using complex algorithms, ensuring its authenticity and accuracy. Once validated, the transaction is grouped with others into a block. Each block is then assigned a unique cryptographic hash, which links it to the previous block, forming a continuous and unbreakable chain. This blockchain protocol guarantees that every transaction is permanently recorded and cannot be altered without consensus from the network, making the system tamper-proof.

The result is a transparent and immutable record of all transactions, accessible to all network participants. This approach not only enhances trust among multiple parties but also streamlines processes in supply chain management, enables secure voting systems, and provides financial institutions with a robust alternative to traditional centralized databases. By eliminating the need for a central authority, blockchain technology empowers organizations to collaborate more efficiently and securely across a wide range of applications.

Types of Blockchain Networks: Public, Private, and Consortium Explained

Blockchain networks come in several forms, each tailored to different needs and levels of access. Public blockchain networks, such as the bitcoin network, are open to anyone who wishes to participate. These networks allow anyone to record transactions and view the blockchain, making them ideal for applications that benefit from transparency and broad participation, such as cryptocurrencies and open voting systems.

In contrast, private blockchain networks restrict access to authorized participants only. These networks are often chosen by financial institutions and organizations that require greater control and confidentiality. For example, in supply chain management, a private blockchain allows multiple parties within a business network to securely record transactions and share data without exposing sensitive information to the public.

Consortium blockchain networks offer a hybrid approach, where a group of preselected organizations collectively manage the network. This model is particularly useful in industries where collaboration between multiple parties is essential, such as in the financial sector or complex supply chains. Consortium blockchain networks balance the need for shared control with enhanced security and efficiency.

By choosing the appropriate type of blockchain—public, private, or consortium—organizations can tailor their blockchain solutions to meet specific requirements for security, transparency, and collaboration.

Blockchain Protocols: The Rules Powering Decentralization

Blockchain protocols are the foundational rules that dictate how data is recorded, validated, and shared within a blockchain network. These protocols are essential for ensuring that all transactions are secure, transparent, and tamper-proof, forming the backbone of decentralized systems.

Different blockchain protocols use various consensus mechanisms to validate transactions. For instance, the bitcoin protocol relies on proof-of-work, where nodes compete to solve complex mathematical puzzles to add new blocks to the chain. This process secures the network but can be resource-intensive. In contrast, protocols like Ethereum have adopted proof-of-stake, where validators “stake” their own cryptocurrency to gain the right to verify transactions, offering a more energy-efficient alternative.

Blockchain protocols also enable the creation and execution of smart contracts—self-executing agreements with terms directly written into code. These smart contracts power decentralized applications, automating processes such as asset transfers and ensuring that all parties adhere to agreed-upon terms without the need for intermediaries.

By establishing clear rules for how transactions are processed and how network participants interact, blockchain protocols are critical to the operation and trustworthiness of blockchain networks and the decentralized applications built on top of them.

Understanding Cryptocurrency: Digital Currency Built on Blockchain

Cryptocurrency is a type of digital asset and a form of digital or virtual currency that leverages blockchain technology to enable secure, peer-to-peer transfer of value without intermediaries like banks or governments. The most well-known example is Bitcoin, which launched in 2009 on the bitcoin network and introduced the concept of a decentralized ledger for cryptocurrency transactions.

Cryptocurrencies are essentially digital assets or digital money that exist purely in electronic form. Digital assets include cryptocurrencies and other blockchain-based representations of value, such as tokenized assets and digital collectibles. Unlike cash or coins, cryptocurrencies have no physical counterpart. They rely on cryptographic security to control the creation of new units and to verify transactions. This makes cryptocurrencies resistant to counterfeiting and censorship.

By 2025, the landscape of digital currencies has expanded dramatically. The total market capitalization of cryptocurrencies has surpassed $4 trillion, and institutional involvement has increased significantly. The launch of Bitcoin and Ethereum spot ETFs has broadened access to digital currency investments, while the rise of decentralized finance (DeFi) platforms has opened new avenues for users to access financial services without traditional intermediaries. Bitcoin was the first of many virtual currencies, and since its inception, numerous other virtual currencies have emerged, each with unique features and use cases.

Essential features of cryptocurrencies include:

- Digital Nature: Cryptocurrencies exist solely as data on a blockchain database and can be transferred electronically across borders rapidly.

- Cryptographic Security: Transactions are secured by cryptographic algorithms, and ownership is controlled via a private key, which is a confidential code that authorizes transactions and verifies ownership of the digital asset.

- Limited Supply: Many cryptocurrencies, including Bitcoin, have a fixed maximum supply, creating scarcity similar to precious metals.

- Global Accessibility: Anyone with internet access can participate in the cryptocurrency ecosystem, often at lower costs than traditional banking.

While all cryptocurrencies rely on blockchain, not all blockchains are designed for cryptocurrencies. Some blockchain platforms focus on other use cases, such as supply chain transparency or voting systems. The difference between blockchain and cryptocurrencies is that blockchain is the foundational technology—a distributed ledger system—while cryptocurrencies are just one application of blockchain, serving as digital assets or virtual currencies built on top of it.

Key Differences Between Crypto and Blockchain

To clarify what is the difference between crypto and blockchain, it helps to think of blockchain as the underlying technology or infrastructure, while cryptocurrency is one of its most famous applications.

- Scope and Application: Blockchain technology has broad applications across various industries, including financial institutions, healthcare, supply chain management, and digital identity verification. Cryptocurrency specifically refers to digital currency systems built on blockchain to facilitate payments, store value, and enable new financial instruments. While cryptocurrencies typically operate on a public network that allows anyone to participate, organizations may deploy their own blockchain to address specific needs, offering tailored features and greater control.

- Purpose and Function: Blockchain aims to provide a secure and transparent platform for recording transactions and data sharing without relying on a central authority. Blockchain can also be implemented as a private network for enterprise use, offering enhanced privacy and control over who can access and validate transactions. Cryptocurrency’s primary function is to serve as digital money or virtual currency that operates independently of traditional financial systems.

- Investment and Trading: Blockchain itself is a technology and not a tradable asset. Conversely, cryptocurrencies can be bought, sold, and traded on exchanges, making them investment vehicles. This distinction is important for market participants looking to invest in the ecosystem.

- Regulatory Treatment: Blockchain technology is generally treated as infrastructure and faces fewer regulations. Cryptocurrencies, however, often encounter complex regulatory scrutiny due to their use as alternative forms of money and their impact on financial systems.

- Security and Transparency: Blockchain is designed to provide security and transparency in data management. Public blockchains allow public access to transaction data, enabling anyone to verify transactions, while private networks restrict access to authorized participants only. Additionally, blockchain enables secure transactions by preventing tampering and fraud.

In summary, while blockchain lies at the heart of cryptocurrencies, it extends far beyond them, enabling decentralized ledgers and blockchain systems that transform how data is stored and shared securely.

The Evolution in 2025: Integration and Maturation

As of 2025, both blockchain and cryptocurrency have matured and integrated more deeply into mainstream finance and business. Traditional financial institutions are issuing their own stablecoins, digital currencies pegged to fiat money, with the total market capitalization of these fiat-pegged stablecoins projected to reach $500 billion. Many of these stablecoins are built on a private blockchain network infrastructure, providing enhanced control and permissioned access for participating organizations. This marks a significant step toward institutional acceptance and integration of blockchain-based digital assets.

At the same time, governments worldwide are developing Central Bank Digital Currencies (CBDCs), which utilize blockchain technology to issue state-backed digital money while retaining centralized control. Governments may implement CBDCs using private blockchains or a consortium blockchain network model, allowing multiple authorized entities to participate in managing the digital currency. This hybrid approach demonstrates how blockchain can support both decentralized and centralized financial models.

Moreover, the rise of Blockchain-as-a-Service (BaaS) platforms allows businesses to leverage blockchain technology without building infrastructure from scratch. Businesses can choose to join a public blockchain network or deploy private blockchain networks and consortium blockchain networks depending on their specific requirements for access, control, and scalability. This trend is accelerating adoption in industries beyond finance, including healthcare, retail, and supply chain management.

These technological advancements highlight the growing importance of blockchain as the underlying infrastructure for a wide array of applications, while cryptocurrencies continue to evolve as digital assets within this ecosystem.

Professional Tools for Crypto Trading and Analysis

With the increasing complexity of the cryptocurrency market, professional tools are essential for making informed decisions. Platforms like Token Metrics exemplify the new generation of AI-powered crypto analytics tools that combine blockchain protocols with machine learning to provide actionable insights.

Token Metrics offers AI-driven ratings, market intelligence, and predictive analytics for various cryptocurrencies, helping traders navigate volatile markets. The platform’s integration of on-chain data analysis allows users to evaluate bitcoin transactions and other cryptocurrency transactions in real time, enhancing transparency and decision-making.

Innovations such as integrated trading capabilities and AI-powered agents provide seamless transitions from research to execution, streamlining the trading process. For investors seeking emerging opportunities, Token Metrics specializes in identifying promising altcoins or “moonshots” before they gain widespread attention.

Such tools are critical for managing risks and capitalizing on the rapid evolution of blockchain bitcoin and other digital assets, making professional-grade analytics accessible to both retail and institutional investors.

Real-World Applications Beyond Finance

While cryptocurrency remains the most visible application of blockchain, the technology’s potential extends far beyond digital money. Industries across the board are leveraging blockchain to improve transparency, security, and efficiency.

In supply chain management, blockchain enables companies to track products from origin to consumer, ensuring authenticity and reducing counterfeiting. Luxury brands like Gucci and Balenciaga use blockchain platforms to provide provenance verification, enhancing consumer trust. In these enterprise blockchain applications, private transactions are essential for maintaining confidentiality and controlled access to sensitive business data.

Healthcare organizations are adopting blockchain for secure patient data management, drug traceability, and maintaining the integrity of clinical trial data. The immutable record capabilities of blockchain ensure accurate and tamper-proof medical histories. Private transactions also play a key role in healthcare, helping to protect patient privacy and comply with regulatory requirements.

Retailers are also embracing blockchain to combat fraud and enhance transparency, contributing to the growth of the global blockchain retail market, which is expected to expand rapidly in the coming decade.

Other notable applications include voting systems that use blockchain to create transparent and tamper-resistant election processes, and decentralized applications that run on blockchain networks to enable new business models. Some of these applications leverage public networks to ensure transparency and broad participation, especially in open, permissionless environments.

Challenges of Blockchain: Hurdles on the Road to Adoption

Despite its transformative potential, blockchain technology faces several significant challenges that can slow its adoption across various industries. One of the most pressing issues is scalability. Many blockchain networks struggle to process a high volume of transactions per second, leading to congestion, delays, and increased transaction fees. This limitation can make blockchain less competitive compared to traditional payment systems.

Regulatory uncertainty is another major hurdle. As governments and regulatory bodies grapple with how to oversee blockchain technology and cryptocurrency transactions, businesses often face unclear or evolving compliance requirements. This uncertainty can deter investment and slow the integration of blockchain solutions in sectors like finance and supply chain management.

Technical complexity also poses a barrier. Implementing and maintaining blockchain networks requires specialized expertise, which can be scarce and costly for organizations new to the technology. Additionally, the public nature of many blockchains raises concerns about data privacy and security, as sensitive information recorded on a public ledger may be accessible to unintended parties.

Finally, as a relatively new technology, blockchain’s long-term viability and the full scope of its applications remain uncertain. Questions about interoperability between different blockchain networks and the environmental impact of certain consensus mechanisms also persist.

Despite these challenges, the potential benefits of blockchain technology—such as enhanced transparency, security, and efficiency—continue to drive innovation and exploration across a wide range of industries. As solutions to these hurdles emerge, blockchain is poised to play an increasingly important role in the digital economy.

Looking Forward: The Future Relationship

The future of blockchain and cryptocurrency is one of ongoing evolution and integration. Blockchain technology is expected to become increasingly invisible to end-users, embedded as the shared database infrastructure powering many digital services.

Cryptocurrencies may diversify into specialized tokens serving distinct functions within various ecosystems, from digital money to governance rights and beyond. Regulatory clarity will be pivotal, as recent developments indicate growing institutional acceptance and potential recognition of Bitcoin as a strategic reserve asset.

The convergence of AI with blockchain and cryptocurrency trading, as seen with platforms like Token Metrics, heralds a new frontier in market sophistication. These technological synergies will create fresh opportunities for both individual investors and institutions.

Understanding the nuanced differences and complementary roles of crypto and blockchain will be essential for success in this rapidly changing landscape.

Conclusion

In conclusion, what is the difference between crypto and blockchain is a fundamental question for anyone involved in the digital economy. Blockchain is the technology — a decentralized, secure, and transparent ledger system that supports a variety of applications across industries. Cryptocurrency is a prominent application of blockchain technology, representing digital or virtual currency designed to function as digital money outside of traditional financial systems.

As 2025 unfolds, blockchain continues to serve as critical infrastructure for numerous sectors, while cryptocurrencies mature as an asset class with growing institutional adoption. Leveraging advanced analytics tools like Token Metrics can provide significant advantages for those navigating the complex world of crypto trading and investment.

Ultimately, both blockchain and cryptocurrency will play distinct but interconnected roles in shaping the future of finance, business, and technology — making an understanding of their differences not just useful, but essential.

How Does Bitcoin Differ From Ethereum: A Comprehensive 2025 Analysis

%201.svg)

%201.svg)

The cryptocurrency space continues to evolve at a rapid pace, with Bitcoin and Ethereum maintaining their status as the two most dominant digital assets in the crypto market. Both Bitcoin and Ethereum operate on blockchain technology, yet they differ fundamentally in their design, purpose, and investment profiles. This article presents a bitcoin vs ethereum comparison, exploring the key differences between these leading cryptocurrencies. Understanding the Bitcoin vs Ethereum debate and the key differences between Bitcoin and Ethereum is essential for investors and enthusiasts seeking to navigate the dynamic cryptocurrency market of 2025 effectively.

Introduction to Bitcoin and Ethereum

Bitcoin and Ethereum stand as the two most prominent digital assets in the cryptocurrency market, commanding a combined market capitalization that exceeds $1 trillion. Both bitcoin and ethereum leverage blockchain technology, which provides a decentralized and secure method for recording and verifying transactions. Despite this shared foundation, their purposes and functionalities diverge significantly.

Bitcoin is widely recognized as digital gold—a decentralized digital currency designed to serve as a store of value and a hedge against inflation. Its primary function is to enable peer-to-peer transactions without the need for a central authority, making it a pioneering force in the world of digital money. In contrast, Ethereum is a decentralized platform that goes beyond digital currency. It empowers developers to build and deploy smart contracts and decentralized applications (dApps), opening up a world of possibilities for programmable finance and innovation.

Understanding the underlying technology, value propositions, and investment potential of both bitcoin and ethereum is crucial for anyone looking to participate in the evolving landscape of digital assets. Whether you are interested in the stability and scarcity of bitcoin or the versatility and innovation of the ethereum network, both offer unique opportunities in the rapidly growing world of blockchain technology.

Fundamental Purpose and Design Philosophy

Bitcoin was introduced in 2009 as the first decentralized digital currency, often described as “digital gold.” Its primary goal is to serve as a peer-to-peer electronic cash system and a store of value that operates without a central authority or intermediaries, such as a central bank, highlighting its independence from traditional financial systems. Bitcoin focuses on simplicity and security, aiming to facilitate trustless, secure transactions while providing a hedge against inflation. Bitcoin aims to be a decentralized, universal form of money, prioritizing security, decentralization, and a stable long-term monetary policy. A key advantage is bitcoin's simplicity, which sets it apart from more complex blockchain platforms and supports its long-term stability and adoption. This finite supply of bitcoins, capped at 21 million, reinforces its role as digital money with scarcity akin to precious metals.

In contrast, Ethereum, launched in 2015, represents a major shift from a mere digital currency to a programmable blockchain platform. Often referred to as “the world computer,” Ethereum enables developers to create decentralized applications (dApps) and smart contracts—self-executing code that runs on the blockchain without downtime or interference. This capability allows the Ethereum ecosystem to support a vast array of decentralized finance (DeFi) protocols, tokenized assets, and automated agreements, making it a core infrastructure for innovation in the cryptocurrency space.

Understanding the Developers

The ongoing development of Bitcoin and Ethereum is a testament to the strength and vision of their respective communities. Bitcoin was launched by the enigmatic Satoshi Nakamoto, whose identity remains unknown, and its evolution is now guided by a global network of bitcoin developers. These contributors work collaboratively on the open-source Bitcoin Core protocol, ensuring the security, reliability, and decentralization of the bitcoin network.

Ethereum, on the other hand, was conceived by Vitalik Buterin and is supported by the Ethereum Foundation, a non-profit organization dedicated to advancing the ethereum network. The foundation coordinates the efforts of ethereum developers, researchers, and entrepreneurs who drive innovation across the platform. A cornerstone of Ethereum’s technical architecture is the Ethereum Virtual Machine (EVM), which enables the execution of smart contracts and decentralized applications. This powerful feature allows the ethereum network to support a wide range of programmable use cases, from decentralized finance to tokenized assets.

Both bitcoin and ethereum benefit from active, passionate developer communities that continually enhance their networks. The collaborative nature of these projects ensures that both platforms remain at the forefront of blockchain technology and digital asset innovation.

Market Capitalization and Performance in 2025

As of 2025, bitcoin's dominant market share is reflected in its market capitalization of approximately $2.3 trillion, significantly larger than Ethereum’s $530 billion market cap. Despite this gap, Ethereum’s market cap is about three times that of the next-largest cryptocurrency, highlighting its dominant position beyond Bitcoin.

The price performance of these assets has also diverged this year. After Bitcoin’s halving event in April 2024, which reduced the rate at which new bitcoins are created, Bitcoin demonstrated resilience with a price increase of around 16% through March 2025. Ethereum, however, experienced a notable drop of nearly 50% during the same period, reflecting its higher volatility and sensitivity to broader market trends. Recently, Ethereum rebounded with a surge exceeding 50%, underscoring the distinct risk and reward profiles of these digital assets in the cryptocurrency market.

Technical Architecture, Blockchain Technology, and Consensus Mechanisms

Bitcoin and Ethereum differ significantly in their underlying technology and consensus algorithms. Both Proof-of-Work (PoW) and Proof-of-Stake (PoS) are types of consensus algorithms that determine how transactions are validated and agreed upon across the network. Bitcoin operates on a Proof-of-Work (PoW) consensus mechanism, where miners compete to solve complex mathematical puzzles to validate transactions and add new blocks to bitcoin's blockchain, which serves as a decentralized ledger. A typical bitcoin transaction involves transferring digital currency units, which are then validated and recorded on bitcoin's blockchain through this process. Bitcoin transactions are fundamental to the Proof-of-Work process, as they are grouped into blocks and confirmed by miners using the consensus algorithm. This process, while highly secure and decentralized, requires substantial energy consumption. For example, creating a new bitcoin currently demands around 112 trillion calculations, reflecting Bitcoin’s commitment to security and decentralization. To address limitations in transaction speed and scalability, bitcoin's lightning network has been developed as a solution to enable faster and lower-cost payments.

Ethereum initially used a similar PoW system but transitioned to a Proof-of-Stake (PoS) consensus mechanism in 2022 through an upgrade known as “The Merge.” This shift allows validators to secure ethereum networks by staking their native cryptocurrency, ETH, rather than mining. The PoS system drastically reduces energy consumption, improves scalability, and maintains network security. This technical improvement positions Ethereum as a more environmentally sustainable and efficient platform compared to Bitcoin’s energy-intensive approach.

Scalability and Transaction Throughput

When it comes to transaction speed and scalability, Bitcoin and Ethereum offer different capabilities. The bitcoin network processes approximately 7 transactions per second, which is sufficient for a decentralized payment network but limits throughput. Ethereum’s main layer can handle about 15 transactions per second, nearly double Bitcoin’s capacity. However, Ethereum’s true scalability advantage lies in its Layer 2 solutions, such as Polygon, Arbitrum, and Optimism, which significantly increase transaction throughput and reduce transaction fees.

These advancements in the ethereum blockchain help support a growing number of decentralized applications and DeFi protocols that demand fast, low-cost transactions. Unlike Bitcoin's fixed supply, Ethereum features a dynamic supply, allowing its economic model to flexibly adjust issuance and burn fees, resulting in inflationary or deflationary tendencies as needed. The Ethereum network is also capable of processing executable code within transactions, enabling the creation and operation of smart contracts and decentralized applications. ETH serves as the native currency of the Ethereum network, and as the native token, it is used for a variety of functions across the platform. Users pay transaction fees with ETH, especially when executing smart contracts or deploying decentralized applications. Ethereum’s ecosystem continues to innovate with technical improvements that enhance scalability, making it a preferred platform for developers and users seeking dynamic and efficient decentralized finance solutions.

Community and Ecosystem

The communities and ecosystems surrounding Bitcoin and Ethereum are among the most dynamic in the cryptocurrency space. The bitcoin network boasts a mature and well-established ecosystem, with widespread adoption as a decentralized digital currency and a robust infrastructure supporting everything from payment solutions to secure storage.

In contrast, the ethereum ecosystem is renowned for its focus on decentralized finance (DeFi) and the proliferation of decentralized applications. The ethereum network has become a hub for innovation, hosting a vast array of dApps, tokens, stablecoins, and non-fungible tokens (NFTs). This vibrant environment attracts developers, investors, and users who are eager to explore new financial products and services built on blockchain technology.

Both bitcoin and ethereum owe much of their success to their engaged and diverse communities. These groups not only contribute to the development of the underlying technology but also drive adoption and create new use cases. For investors, understanding the strengths and focus areas of each ecosystem is key to evaluating the long-term potential and value proposition of these leading digital assets. Key takeaways bitcoin and ethereum offer include the importance of community-driven growth, ongoing innovation, and the expanding possibilities within the world of decentralized applications and finance.

Use Cases and Real-World Applications

Bitcoin’s primary use cases revolve around its role as digital gold and a decentralized digital currency. It is widely adopted for cross-border payments, remittances, and as an inflation hedge by institutions and corporations. Many companies now hold bitcoin as a treasury reserve asset, recognizing its value as a finite supply digital money that operates independently of central banks and traditional currencies. Unlike national currencies, which are issued and regulated by governments, Bitcoin was created as an alternative medium of exchange and store of value, offering users a decentralized option outside the control of any single nation.

Ethereum, on the other hand, offers a broader range of applications through its programmable blockchain. It powers decentralized finance protocols, enabling lending, borrowing, and trading without intermediaries. Ethereum also supports non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), and enterprise blockchain solutions. The ethereum network’s ability to execute smart contracts and host decentralized applications makes it a foundational platform for the future of tokenized assets and innovative financial products.

Investment Characteristics and Risk Profiles

From an investment perspective, bitcoin and ethereum present distinct profiles. Bitcoin is often viewed as a stable store of value with strong institutional validation, appealing to conservative investors seeking security and macroeconomic hedging. Its simplicity and fixed supply contribute to its perception as a reliable digital silver or digital gold.

Ethereum represents a growth-oriented investment, offering exposure to the expanding decentralized finance ecosystem and technological innovation. However, this comes with higher volatility and risk. Ethereum’s future developments and upgrades promise to enhance its capabilities further, attracting investors interested in the evolving crypto adoption and the broader use of blockchain technology. Still, ethereum's future remains complex and uncertain, with ongoing challenges, competition, and the outcomes of recent upgrades all influencing its long-term prospects and value proposition.

Price Predictions and Market Outlook

Market analysts remain cautiously optimistic about both bitcoin and ethereum throughout 2025. Projections suggest that Ethereum could reach $5,400 by the end of the year and potentially approach $6,100 by 2029. However, Ethereum's price remains subject to significant fluctuations, potentially rising above $5,000 or falling below $2,000 depending on market conditions and regulatory developments.

Bitcoin's outlook is similarly influenced by factors such as institutional adoption, regulatory clarity, and macroeconomic trends. Its status as the first digital asset and a decentralized payment network underpins its resilience in global markets. Investors should consider these dynamics alongside their investment objectives and risk tolerance when evaluating these cryptocurrencies.

The Role of Advanced Analytics in Crypto Investment

Navigating the complex cryptocurrency market requires sophisticated tools and data-driven insights. Platforms like Token Metrics have emerged as invaluable resources for investors aiming to make informed decisions. Token Metrics is an AI-powered crypto research and investment platform that consolidates market analysis, portfolio management, and real-time insights.

By leveraging artificial intelligence and machine learning, Token Metrics offers comprehensive research tools, back-tested bullish signals, and sector trend analysis. Its AI-driven X agent provides actionable insights that help investors identify opportunities and manage risks in the 24/7 crypto market. This advanced analytics platform is especially beneficial for those looking to optimize their investment strategy in both bitcoin and ethereum.

Portfolio Allocation Strategies

For investors considering both bitcoin and ethereum, a diversified portfolio approach is advisable. Bitcoin's stability and role as digital gold complement Ethereum's growth potential in decentralized finance and technology-driven applications. Depending on risk tolerance and investment goals, allocations might vary:

- Conservative investors may allocate 70% to Bitcoin and 30% to Ethereum.

- Moderate risk investors might consider a 60% Bitcoin and 40% Ethereum split.

- Growth-focused investors could tilt their portfolio toward 40% Bitcoin and 60% Ethereum.

This balanced approach leverages the unique features of both cryptocurrencies while managing volatility and maximizing exposure to different segments of the cryptocurrency ecosystem.

Conclusion

Bitcoin and Ethereum offer distinct but complementary value propositions in the cryptocurrency space. Bitcoin remains the first digital asset, a decentralized payment network, and a trusted store of value often likened to digital gold. Ethereum, powered by its programmable blockchain and smart contracts, drives innovation in decentralized finance and applications, shaping the future of the crypto market.

Choosing between bitcoin and ethereum—or deciding on an allocation between both—depends on individual investment objectives, risk appetite, and confidence in blockchain technology’s future. Both assets have a place in a well-rounded portfolio, serving different roles in the evolving digital economy.

For investors serious about cryptocurrency investing in 2025, utilizing advanced analytics platforms like Token Metrics can provide a competitive edge. With AI-powered insights, comprehensive research tools, and real-time market analysis, Token Metrics stands out as a leading platform to navigate the complexities of the cryptocurrency market.

Whether your preference is bitcoin’s simplicity and stability or ethereum’s innovation and versatility, success in the cryptocurrency market increasingly depends on access to the right data, analysis, and tools to make informed decisions in this exciting and fast-changing landscape.

Disclaimer: Certain cryptocurrency investment products, such as ETFs or trusts, are not classified as investment companies or investment companies registered under the Investment Company Act of 1940. As a result, these products do not have the same regulatory requirements as traditional mutual funds. This article does not provide tax advice. For personalized tax advice or guidance regarding regulatory classifications, consult a qualified professional.

What is Blockchain and How Does it Work? A Comprehensive 2025 Guide

%201.svg)

%201.svg)

In today’s rapidly evolving digital landscape, blockchain technology stands out as one of the most transformative innovations reshaping industries worldwide. At its core, blockchain is a decentralized, distributed blockchain database that securely records and verifies transactions across a peer-to-peer network. Understanding what is blockchain and how does it work has become essential for anyone interested in the future of digital transactions, data security, and decentralized systems. As we navigate through 2025, blockchain continues to redefine how information is stored, shared, and secured across multiple sectors.

Understanding Blockchain: The Fundamentals of Distributed Ledger Technology

At its essence, blockchain is a revolutionary form of database technology that diverges from traditional centralized systems. A blockchain consists of interconnected blocks that store transaction data and are cryptographically linked, forming a secure and ordered chain. Unlike conventional databases controlled by a single authority, blockchain operates on a distributed network of computers known as nodes. These nodes collectively maintain a shared ledger—a decentralized ledger—that records and verifies transaction data transparently and securely.

Imagine blockchain as an immutable digital ledger simultaneously stored on thousands of computers around the globe. In fact, blockchain functions as a distributed database, with data stored across multiple nodes, making it highly resistant to tampering. Every time a transaction occurs—whether it involves digital currency or other types of digital assets—it must be validated by multiple nodes before being permanently added to the blockchain. This process ensures that the transaction records—or blockchain records—are immutable and auditable, enhancing transparency and facilitating audits. These records are accurate and cannot be altered or deleted, providing an unprecedented level of security and trust.

The core principles underpinning blockchain technology are decentralization, transparency, and immutability. Blockchain decentralization enhances security and data integrity by distributing data across multiple nodes, preventing tampering and ensuring redundancy. A decentralized blockchain is a system where control is distributed across multiple nodes, eliminating the need for a central authority. Unlike traditional business networks that rely on a centralized entity, blockchain eliminates the need for intermediaries by enabling peer-to-peer network interactions. This decentralized structure fosters a trustless environment where blockchain users can conduct transactions directly, reducing costs and increasing efficiency. In contrast to centralized systems, decentralized blockchains offer a distributed structure and greater resilience, setting them apart from single-entity control models.

History and Evolution of Blockchain

The journey of blockchain technology began with early cryptographic innovations in the 1980s, but it was the introduction of Bitcoin in 2008 that truly brought blockchain into the spotlight. Bitcoin’s launch marked the first successful use of a decentralized digital currency, powered by a blockchain network that allowed users to record transactions securely without relying on a central authority. This breakthrough demonstrated the potential of blockchain as more than just a ledger for digital currency—it became a foundation for trustless, peer-to-peer value exchange.

As blockchain technology matured, its applications rapidly expanded beyond cryptocurrencies. The development of smart contracts enabled automated, self-executing agreements on blockchain platforms, paving the way for decentralized finance (DeFi) and a new era of programmable money. The rise of non-fungible tokens (NFTs) further showcased blockchain’s versatility in managing digital assets and intellectual property.

Over time, the blockchain ecosystem diversified with the emergence of various blockchain networks, including public, private, and consortium blockchains. Each type of network brought unique features and use cases, from open participation and transparency to controlled access and enterprise collaboration. Today, blockchain technologies underpin a wide range of applications, driving innovation across finance, supply chain, healthcare, and beyond.

How Blockchain Technology Works

The mechanics of blockchain revolve around linking blocks of data in a secure and verifiable chain. Each block contains a batch of transaction records, and crucially, each block references the previous block through a cryptographic hash. This linking forms a continuous chain, making it extraordinarily difficult to alter any individual block without affecting all subsequent blocks. Blockchain work involves recording, verifying, and chaining data or transactions across a decentralized network, ensuring transparency and security.

The transaction lifecycle begins when a user initiates a transaction on the blockchain network. This transaction is broadcast to the network participants, who then engage in a verification process to validate its authenticity. Nodes use blockchain protocols—the fundamental set of rules and algorithms that govern how data is recorded, shared, and secured within the network, such as proof-of-stake or Byzantine fault-tolerant protocols—to confirm that the transaction adheres to the network’s standards.

Once verified, the process of recording transactions immutably on the blockchain takes place. The transaction is grouped with other validated transactions into a new data block. This block is then appended to the existing blockchain, creating an immutable transaction record. A transaction record is an entry that cannot be altered or tampered with, and a transaction record includes all relevant details for auditability and transparency. The cryptographic hash linking ensures that any attempt to tamper with the transaction ledger would require recalculating the hashes of all subsequent blocks, a feat computationally infeasible in a well-secured blockchain system.

During the verification process, validating transactions through consensus mechanisms is crucial to ensure the integrity and trustworthiness of the ledger. Consensus mechanisms like proof of work (used in the bitcoin blockchain) or proof of stake help the network validate transactions and maintain trust without a central authority. Efficient consensus and network design can significantly increase the number of transactions processed by the blockchain. This process, often referred to as blockchain mining, secures the network and processes blockchain transactions efficiently.

Each node in the network maintains a copy of the entire blockchain, meaning all data stored on the blockchain is replicated across participants. As the blockchain grows, the amount of data stored increases, presenting challenges related to storage capacity and efficient data management.

Blockchain Networks: Types and Architectures

Blockchain networks come in several forms, each tailored to specific needs and use cases. Public blockchain networks, such as the Bitcoin and Ethereum networks, are open to anyone who wishes to participate. These networks rely on decentralized consensus mechanisms like proof of work, allowing users worldwide to validate transactions and contribute to the network’s security and transparency.

In contrast, private blockchain networks restrict access to a select group of participants, making them ideal for organizations that require greater control over data and permissions. Private blockchains are commonly used in enterprise settings, where privacy, regulatory compliance, and efficiency are paramount.

Consortium blockchain networks offer a hybrid approach, bringing together multiple organizations to jointly manage the network. In a consortium blockchain, a group of trusted entities collaborates to validate transactions and maintain the distributed ledger, balancing decentralization with governance and operational efficiency. This model is particularly effective for industries where competitors or partners need to share data securely, such as banking, logistics, or healthcare.

The architecture of any blockchain network is built around nodes—computers that store and process data blocks. These nodes can be full nodes, which maintain a complete copy of the blockchain ledger, or light nodes, which store only essential information. Consensus mechanisms, such as proof of work or proof of stake, ensure that all network participants agree on the validity of transactions, maintaining the integrity and security of the blockchain system. Understanding these different types of blockchain networks and their architectures is essential for selecting the right platform for any blockchain implementation.

Blockchain Security and Transparency

One of the defining strengths of blockchain technology is its robust approach to security and transparency. Every transaction recorded on a blockchain network is secured using cryptographic hash functions, which create a unique digital fingerprint for each data block. This ensures that once data is stored on the blockchain, it cannot be altered without detection, providing an immutable record of all activity.

The decentralized structure of blockchain networks further enhances security. By distributing data across multiple nodes, blockchain eliminates single points of failure and makes it extremely difficult for any one party to manipulate the transaction ledger. This distributed approach not only safeguards against tampering but also increases the resilience of the network against cyberattacks.

Transparency is another key benefit of blockchain technology. Public blockchain networks allow anyone to access data and verify transaction records, fostering trust among users. Even in private or consortium blockchains, authorized participants can track and audit transactions, ensuring accountability and compliance. However, maintaining high levels of security and transparency requires careful network design, regular code audits, and proactive identification of potential vulnerabilities. By prioritizing these elements, blockchain networks can deliver secure transactions and reliable data management for a wide range of applications.

The Current State of Blockchain in 2025

By 2025, blockchain technology has transitioned from a niche innovation associated primarily with cryptocurrencies to a foundational infrastructure across multiple industries. The blockchain adoption curve is steepening as businesses and governments recognize the benefits of blockchain based distributed ledgers for enhancing security, transparency, and efficiency. The proliferation of blockchain systems across sectors such as finance, media, and supply chain is fostering innovation and enabling interoperability among different networks.

Industries such as finance, healthcare, supply chain, and entertainment are leading the charge in integrating blockchain solutions. Financial institutions increasingly utilize blockchain to streamline financial transactions, reduce settlement times, and improve regulatory compliance. Distributed ledger technologies and distributed ledger technology provide secure, immutable record-keeping, ensuring data integrity and transparency in these sectors. The rise of decentralized finance (DeFi) platforms built on blockchain platforms like the ethereum blockchain exemplifies how blockchain is reshaping traditional financial services.

Moreover, major corporations including IBM, Google, Visa, and Deloitte have invested heavily in blockchain projects, developing enterprise-grade solutions that leverage private blockchain networks and consortium blockchain networks. These networks provide the benefits of decentralization while maintaining controlled access and privacy for sensitive transaction data. Blockchain records are used to ensure transparency and auditability at scale, addressing storage requirements and potential costs as data grows.

As a result, users in 2025 enjoy faster transaction confirmations, lower transaction fees, and more intuitive interfaces that abstract the complexities of blockchain technology, making it accessible to a broader audience. Blockchain also enables the recording of other transactions beyond financial ones, such as data uploads or document exchanges, further expanding its utility.

In the context of consortium and private networks, blockchain facilitates secure data sharing within a business network, allowing multiple organizations to collaborate efficiently while maintaining trust and transparency.

Real-World Applications and Use Cases of Smart Contracts

The versatility of blockchain extends far beyond bitcoin transactions and digital currencies. Its ability to create a distributed ledger that is both secure and transparent has unlocked numerous practical applications across sectors.

In supply chain management, blockchain enhances data transparency by providing an immutable record of product provenance accessible to all network participants. Public blockchain networks allow open participation and transparency, enabling anyone to join and verify transactions, which helps reduce fraud, improve compliance, and streamline operations.

Healthcare providers use blockchain to secure patient records while enabling authorized data sharing, ensuring privacy and accuracy. Private blockchain networks are often used in enterprise and healthcare applications to restrict access and enhance privacy for sensitive information. Access to encrypted medical records is protected by a private key, which acts as a confidential password to ensure only authorized parties can view or modify data. The use of private transactions further restricts access to sensitive information, maintaining confidentiality within the blockchain.

The entertainment industry leverages blockchain for digital rights management, facilitating fair royalty distribution and protecting intellectual property. Here, private keys are essential for securing control over digital assets and ensuring only rightful owners can access or transfer rights.

Financial institutions harness blockchain for cross-border payments, reducing costs and settlement times dramatically. Real estate transactions benefit from blockchain’s tamper-proof property records, increasing trust and reducing paperwork. Even voting systems are being revolutionized by blockchain technology, offering transparent and verifiable election processes that enhance democratic integrity.

Smart contracts, which are self-executing programs on blockchain technology, automate and enforce agreements based on predefined conditions, eliminating the need for intermediaries and streamlining transaction processes.

Blockchain and Consortium: Partnerships and Collaboration

Consortium blockchain networks represent a powerful model for partnership and collaboration in the digital age. Unlike public or private blockchains, a consortium blockchain network is governed by a group of organizations that collectively validate transactions and manage the distributed ledger. This collaborative approach enables businesses to share data and processes securely, without relying on a single central authority.

The benefits of consortium blockchains are especially evident in industries where multiple stakeholders need to coordinate and trust each other, such as finance, healthcare, and logistics. By working together on a shared blockchain network, organizations can streamline operations, reduce costs, and improve data transparency. For example, financial institutions can use consortium blockchains to process cross-border payments more efficiently, while supply chain partners can track goods in real time with greater accuracy.

Successful consortium blockchain networks depend on strong partnerships and clear governance structures. By pooling resources and expertise, participating organizations can validate transactions, maintain network integrity, and unlock the full benefits of blockchain technology. As more industries recognize the value of collaboration, consortium blockchains are poised to drive innovation and transform traditional business networks into agile, secure, and transparent ecosystems.

Navigating Blockchain Investments with Token Metrics

With the maturation of blockchain technology, the cryptocurrency market has become both complex and dynamic. For those seeking to invest or trade in this space, access to sophisticated analytical tools is crucial. This is where platforms like Token Metrics come into play.

Token Metrics is an AI-powered platform providing comprehensive crypto trading research, analytics, and indices. It offers data-driven crypto trading insights, including AI-powered ratings, trader and investor grades, and the discovery of promising altcoins or "crypto moonshots." Such tools help users navigate the volatile and sentiment-driven cryptocurrency markets with greater confidence.

In 2025, Token Metrics has evolved into a full trading ecosystem, integrating on-chain trading features that allow users to execute trades directly on the platform. By connecting their wallets, users can select tokens and complete transactions swiftly, often in under two minutes.

What differentiates Token Metrics is its AI-driven approach to market analysis, real-time signals, and alerts, alongside tools for both long-term investing and short-term trading. The platform also supports creating custom dashboards, AI bots, and automated trading strategies, empowering blockchain users to optimize their investment decisions.

Additionally, Token Metrics engages its community with AI-powered agents that deliver timely, data-backed market insights, helping users stay informed about trends, sector performance, and bullish signals derived from proprietary data.

The Future of Blockchain Technology and Blockchain Adoption

Looking forward, blockchain technology promises to become the backbone of a more decentralized, efficient, and secure digital economy. Businesses that invest in blockchain development services today are positioning themselves for competitive advantage in tomorrow’s market.

Ongoing advancements focus on improving scalability, interoperability, and energy efficiency. Layer 2 solutions are mitigating transaction speed and cost challenges, while cross-chain protocols enable seamless communication between disparate blockchain networks, further expanding blockchain’s potential.

Governments are exploring central bank digital currencies (CBDCs), and enterprises are deploying blockchain for identity verification, carbon credit trading, and more. The increasing blockchain adoption across both public and private blockchains signals a future where blockchain based distributed ledgers become integral to everyday life and business operations.

Getting Started with Blockchain

For newcomers, understanding what is blockchain and how does it work might seem daunting, but the foundational concepts are approachable with the right resources. Begin by familiarizing yourself with key terms like nodes, consensus mechanisms, and smart contracts—self-executing contracts coded on blockchain platforms that automate agreements without intermediaries.

Explore different blockchain networks such as the bitcoin network, ethereum blockchain, and emerging blockchain platforms to appreciate their unique features and applications. For investors and traders, leveraging AI-driven analytics platforms like Token Metrics can provide valuable insights and enhance decision-making in the cryptocurrency market.

Conclusion

Blockchain technology has evolved from a novel concept into a transformative infrastructure reshaping industries worldwide. Its core attributes—decentralization, transparency, and security—drive innovation and foster trust in digital transactions and data management.

As 2025 progresses, mastering what is blockchain and how does it work becomes increasingly important for businesses, investors, and individuals alike. Whether exploring blockchain’s technological capabilities or engaging with the cryptocurrency markets, access to reliable information and advanced analytical tools is essential.

The blockchain revolution is not merely about technology; it represents a fundamental shift in how we store, transfer, and verify information in a connected world. As blockchain adoption accelerates and new blockchain applications emerge, those who embrace blockchain today will be best positioned to thrive in the decentralized future ahead.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)