What are Decentralized AI Marketplaces? The Future of Peer-to-Peer AI Innovation

The artificial intelligence revolution is entering an exciting new phase in 2025, shifting away from centralized corporate control toward decentralized, community-driven ecosystems. Decentralized AI marketplaces are emerging as transformative platforms that democratize access to artificial intelligence tools, models, and services. These innovative platforms leverage blockchain technology to create peer-to-peer networks where developers, businesses, and individuals can buy, sell, and collaborate on AI solutions without relying on traditional intermediaries.

As the global AI landscape evolves, decentralized AI marketplaces address critical issues of accessibility, transparency, and ownership that have long hindered centralized AI systems. These platforms enable small businesses to tap into enterprise-grade AI tools, provide new revenue streams for AI developers, and reshape the way artificial intelligence is developed and deployed worldwide. By fostering open participation and fair compensation, decentralized AI marketplaces are setting the stage for a more inclusive and innovative AI industry.

Understanding Decentralized AI Marketplaces

Decentralized AI marketplaces represent disruptive platforms that utilize blockchain technology and decentralized networks to empower peer-to-peer exchanges of AI assets. Unlike traditional AI platforms controlled by a single party or tech giants, these marketplaces operate on distributed networks where no single entity has complete control, reducing risks of censorship, data monopolies, and single points of failure.

At their core, decentralized AI marketplaces are peer-to-peer platforms designed to democratize how AI is built, accessed, and monetized. Developers can upload AI models, data providers can offer curated datasets, and GPU owners can rent out computing power. These assets are traded openly, with contributors receiving direct rewards through smart contracts and token rewards, ensuring transparency and fair compensation.

The fundamental architecture of these platforms includes several key components:

- Smart Contract Infrastructure: These automated agreements handle transactions, payments, and governance without human intervention, fostering trust and transparency between participants.

- Tokenization Layer: Tokenization represents AI services, data, models, and computing resources as digital tokens on blockchain networks. This layer provides liquidity, fractional ownership, and efficiency within decentralized marketplaces.

- Decentralized Storage: Secure, distributed storage systems safeguard AI models and datasets, ensuring availability and preventing single points of failure.

- Consensus Mechanisms: Validation systems maintain the quality and authenticity of AI services and models offered on the platform.

Together, these components create an open, transparent, and resilient AI marketplace that empowers users to maintain control over their assets while enabling seamless collaboration across distributed networks.

Key Features and Benefits

Democratization of AI Access

Traditionally, developing and deploying advanced AI models required significant resources, technical expertise, and infrastructure, limiting access to large corporations and research institutions. Decentralized AI marketplaces level the playing field by making powerful AI tools and models accessible to smaller businesses, startups, and individual researchers.

This democratization goes beyond mere access; it encompasses ownership and control. Unlike centralized AI systems that can change terms of service or restrict access, decentralized marketplaces allow users to maintain sovereignty over their AI tools and data. By allowing open participation and removing single-party gatekeepers, these platforms enable a broader range of businesses and individuals to innovate and benefit from AI.

Enhanced Privacy and Security

Data privacy remains a paramount concern in today's digital world. Decentralized AI marketplaces address these concerns by enabling data providers to retain control over their sensitive information while still benefiting from AI insights. Techniques such as federated learning and secure multi-party computation allow AI models to be trained on decentralized data sources without exposing raw data.

This approach aligns with growing demands for patient privacy, data sovereignty, and compliance with regulations. By decentralizing data storage and AI training, these marketplaces reduce risks associated with centralized data breaches and misuse, fostering trust among participants.

Transparent and Fair Monetization

Unlike traditional AI platforms dominated by centralized providers, decentralized AI marketplaces offer transparent and fair monetization mechanisms. Verifiable training data lineage, censorship-resistant model hosting, and decentralized governance via DAOs ensure accountability and equitable value creation.

Token rewards and smart contracts automate payments and incentivize contributors fairly, distributing ownership and access across a wide network. This permissionless, open ecosystem resists censorship and expands the reach of artificial intelligence beyond corporate and political gatekeepers, empowering developers, data providers, and computing resource owners alike.

Cost Efficiency

By eliminating intermediaries and reducing overhead costs, decentralized marketplaces allow sellers to offer AI solutions at more competitive prices. This dynamic attracts more buyers and increases revenue opportunities. Additionally, pay-as-you-go or subscription-based pricing models enable businesses to access AI tools at a fraction of traditional costs, making AI development and deployment more affordable and scalable.

Sharing GPU resources and computing power within distributed networks optimizes resource allocation and reduces barriers for AI model training and AI tasks, benefiting both providers and users.

Market Growth and Industry Impact

The decentralized AI marketplace sector is experiencing rapid expansion. Currently, there are over 230 companies engaged in decentralized AI projects, including notable names like Filecoin, Raiinmaker, 0G Labs, Masa, and Storj. Among these, 132 companies have secured funding, with 21 reaching Series A rounds. The United States leads with 78 companies, followed by Singapore and the United Kingdom.

This growth signals a significant shift in AI development and deployment, with decentralized AI marketplaces unlocking vast economic opportunities across sectors such as healthcare, education, and finance. By empowering individuals and businesses, these platforms help address longstanding concerns about bias, discrimination, and concentration of power in the AI industry.

Decentralization fosters innovation by enabling open source protocols, transparent governance, and token-based incentives that drive sustainable AI development and adoption.

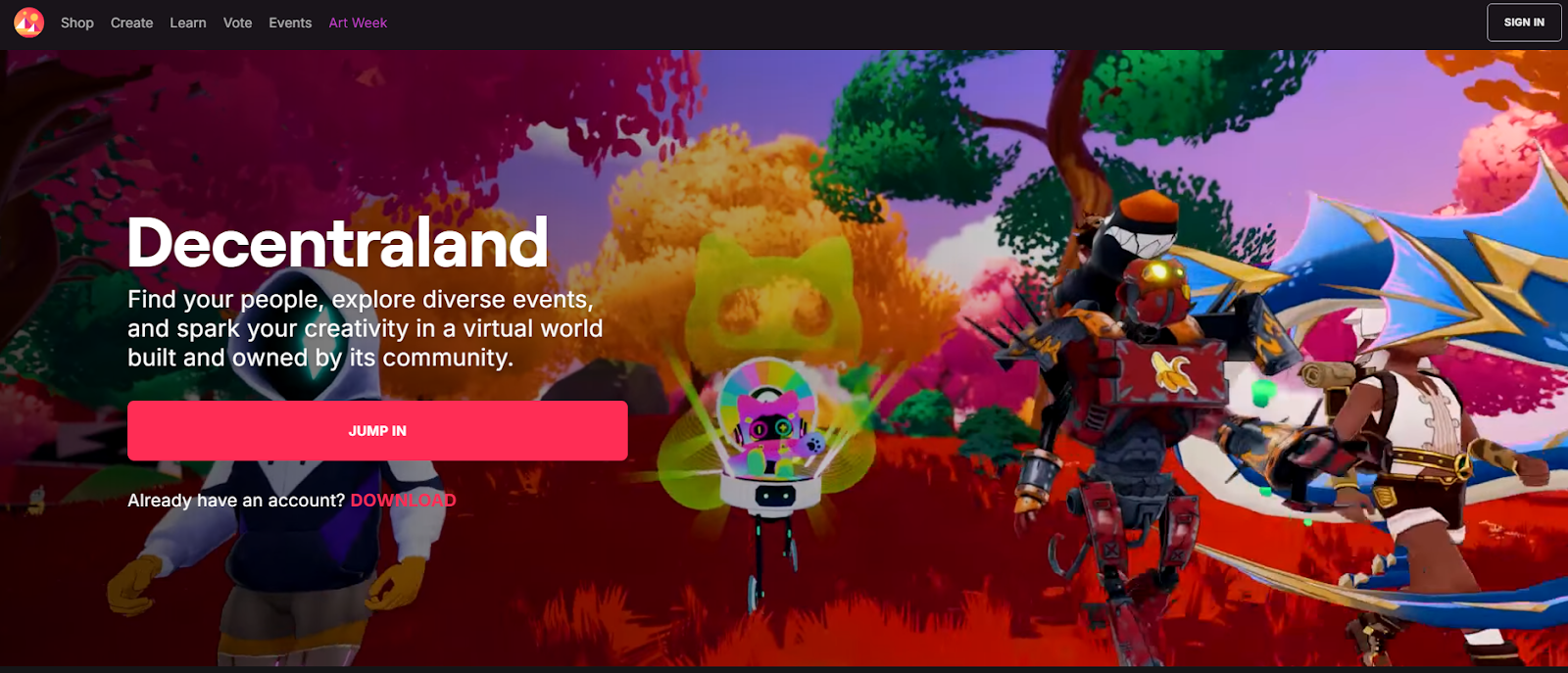

Leading Platforms and Technologies

SingularityNET

SingularityNET is the world's first decentralized AI network, enabling anyone to create, share, and monetize AI services at scale. Using its native AGIX token, the platform facilitates transactions within a decentralized protocol that supports AI development and collaboration across distributed networks.

Ocean Protocol and Fetch.AI

Ocean Protocol empowers data providers by securing data ownership and allowing users to share and monetize their data while retaining full control. Fetch.AI complements this by enhancing automation and efficiency, enabling AI systems and autonomous economic agents to optimize decisions across decentralized networks.

Emerging Innovations

MWX is poised to revolutionize the AI landscape with its upcoming global launch of the first decentralized, open-access AI marketplace tailored for small and medium enterprises (SMEs). By removing intermediaries and gatekeepers, MWX aims to bring powerful, ready-to-use AI tools directly to millions of SMEs worldwide.

Infrastructure Development

0G Labs is pioneering critical infrastructure that redefines what's possible for AI and blockchain integration. Their architecture lays the foundation for truly decentralized, performant AI infrastructure, including decentralized storage, verifiable inference, and service marketplaces. These developments underpin the next generation of decentralized AI applications.

Real-World Applications and Use Cases

Small and Medium Enterprises (SMEs)

The demand for SME-friendly AI solutions has never been greater. As global competition intensifies and customer expectations evolve, small businesses face pressure to deliver more with fewer resources. Despite AI’s promise of productivity gains and cost reductions, many SMEs remain locked out due to complexity and expense.

Decentralized AI marketplaces address this gap by providing affordable, accessible AI tools designed specifically for smaller businesses. By leveraging distributed networks and open marketplaces, SMEs can tap into AI solutions that were previously accessible only to tech giants.

Computing Resource Sharing

Decentralized AI marketplaces enable providers to lend out idle GPU power and computing resources through lending protocols and tokenized incentives. This approach maximizes utilization of existing capacity, reduces costs by up to 70%, and democratizes access to computing power necessary for AI model training and AI tasks.

Such resource sharing optimizes allocation, supports long-term contracts, and fosters an open participation model that benefits both providers and users.

Specialized Industry Solutions

The decentralized AI marketplace ecosystem is rapidly diversifying, with platforms emerging to serve specific industries such as healthcare, finance, and creative content generation. These specialized marketplaces facilitate collaboration among domain experts, accelerate AI development tailored to industry needs, and promote innovation in areas like patient privacy, real-time data processing, and autonomous AI assistants.

Token Metrics: The Premier AI-Powered Crypto Analytics Platform

In the evolving world of decentralized AI marketplaces, Token Metrics exemplifies how artificial intelligence can be harnessed to provide sophisticated crypto trading and analytics solutions.

Advanced AI-Driven Analytics

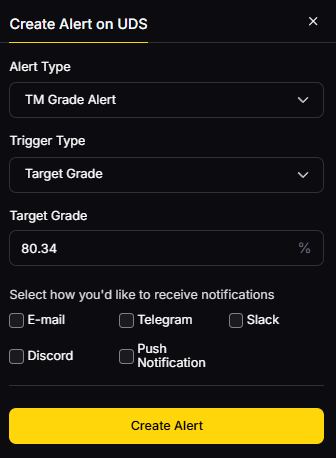

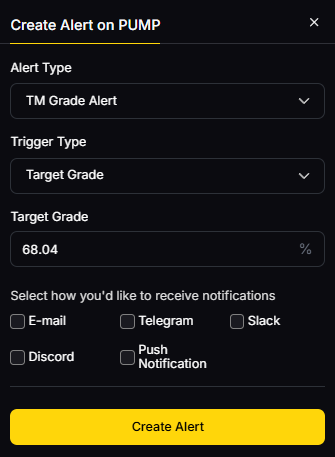

Token Metrics consolidates research, portfolio management, and trading into a unified ecosystem. It assigns each token a Trader Grade for short-term potential and an Investor Grade for long-term viability, enabling users to prioritize opportunities effectively.

The platform’s AI algorithms analyze thousands of data points across blockchain networks, providing comprehensive insights that would be impossible to process manually.

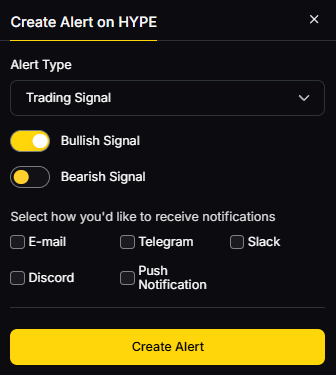

Real-Time Market Intelligence

Token Metrics offers real-time AI buy and sell signals, helping users spot winning tokens early among thousands of options. With AI-curated portfolios for short and long-term gains, the platform simplifies market research and tracking, making sophisticated analytics accessible to individual investors.

Comprehensive Trading Ecosystem

With the launch of Trading on Token Metrics, users can act on AI-generated signals directly within the platform, creating an end-to-end solution that integrates ratings, token details, and trading functionalities seamlessly.

Developer-Friendly Infrastructure

Token Metrics provides a modular, scalable API offering real-time ratings, sentiment analysis, indices, and AI signals. This infrastructure supports developers and teams looking to integrate AI capabilities into their own applications, exemplifying how decentralized AI marketplaces can foster innovation across ecosystems.

Innovation in AI Engagement

Token Metrics’ AI-powered agent on X (formerly Twitter), @0xTMAI, delivers timely, data-backed content and actionable intelligence to the community. By leveraging proprietary data and back-tested signals, the agent provides real-time insights, automated posts, and instant replies, showcasing how AI agents can enhance engagement and information flow beyond traditional platforms.

Challenges and Considerations

Technical Complexity

Integrating blockchain technology with AI systems introduces technical challenges, including slower processing speeds, scalability issues, and regulatory uncertainties. Ensuring seamless interoperability and user-friendly experiences remains an ongoing focus for decentralized AI projects.

Governance and Incentives

Establishing fair and sustainable incentive structures is critical, especially when decentralizing infrastructure control. Without a central authority, creating trust and managing disputes through decentralized governance, chain governance, and dispute resolution mechanisms requires careful design and community participation.

Market Maturation

The decentralized AI marketplace ecosystem is still maturing. Platforms are increasingly adopting modular architectures, allowing users to select components such as decentralized storage, computing, or full-stack AI solutions tailored to their needs. As the technology evolves, user interfaces and developer tools are becoming more accessible, driving broader adoption.

The Future of Decentralized AI Marketplaces

2025 and Beyond

0G Labs is spearheading the creation of a decentralized AI operating system, integrating multiple layers including decentralized storage, verifiable inference, and service marketplaces. This system aims to enhance transparency, trust, and performance in AI applications, marking a critical step forward in decentralized artificial intelligence.

Integration with Web3

By combining blockchain infrastructure, decentralized governance, and token rewards, these platforms are building a people-powered internet that supports AI compute, content streaming, and digital storage. This integration with Web3 technologies defines the future of decentralized AI infrastructure.

Market Expansion

MWX’s launch as the first one-stop decentralized marketplace for AI products tailored to SMEs exemplifies the expanding market reach. By bridging the gap between businesses and AI advancements, platforms like MWX are driving adoption and innovation across diverse sectors.

Conclusion: The Dawn of Democratized AI

Decentralized AI marketplaces represent a fundamental shift in how artificial intelligence is developed, accessed, and monetized. Leveraging blockchain technology and distributed networks, these platforms dismantle traditional barriers that have confined AI access to a few tech giants and well-funded institutions.

The key benefits are clear: enhanced data privacy and security, transparent and fair monetization, cost efficiency, and democratized access to cutting-edge AI tools. From small businesses gaining enterprise-grade AI solutions to developers receiving fair compensation for their innovations, decentralized AI marketplaces are creating new opportunities throughout the AI ecosystem.

Platforms like Token Metrics illustrate the transformative potential of democratized AI, making sophisticated analytics and real-time insights accessible to individual users while supporting professional applications. With comprehensive APIs and AI agents, Token Metrics exemplifies how decentralized AI marketplaces empower users and developers alike.

As we progress through 2025, the growth of decentralized AI marketplaces appears unstoppable. Hundreds of companies are building in this space, significant funding is flowing, and the technology is maturing rapidly. The future of AI is no longer centralized in the hands of a few tech giants; it is distributed across a global network of contributors, innovators, and users.

Decentralized AI marketplaces are the infrastructure that will make this future possible, fostering a more inclusive, transparent, and democratized artificial intelligence ecosystem. For businesses, developers, and individuals eager to participate in this revolution, the time to engage with decentralized AI marketplaces is now—the tools are ready, the ecosystem is expanding, and the opportunities have never been greater.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)