What Is a Moonshot? The Ultimate Guide to High-Risk, High-Reward Gems in Crypto (2025)

%201.svg)

%201.svg)

The term “moonshot” is everywhere in the crypto world—but what does it really mean? In 2025, as the search for the next 100x token intensifies, understanding the concept of a crypto moonshot is more important than ever. Moonshots offer massive upside potential, but they also come with high risk. So how do you find them, and more importantly, how do you separate hype from real opportunity?

In this guide, we’ll break down what a moonshot is, why it matters, how to identify one, and how tools like Token Metrics are helping investors discover the next big thing in crypto—before it takes off.

🚀 What Is a Moonshot in Crypto?

In crypto, a moonshot refers to a low-cap, high-potential cryptocurrency that could deliver outsized returns, typically 10x, 50x, or even 100x your initial investment. The term comes from the idea that a token is going “to the moon”—crypto slang for an explosive price increase.

Unlike established cryptocurrencies like Bitcoin and Ethereum, moonshots are usually early-stage projects with small market caps, limited trading volume, and a high level of speculation. These tokens often sit under the radar, only gaining traction once a specific narrative, innovation, or market trend brings them into the spotlight.

🧠 Characteristics of a Moonshot Token

While no one can guarantee a moonshot, successful ones often share several key traits:

1. Low Market Cap

Most moonshots start with a market cap under $50 million, sometimes even under $10 million. This gives them room to grow exponentially as adoption increases.

2. Strong Narrative or Trend Alignment

Moonshots usually align with emerging crypto narratives, such as:

- AI in crypto (e.g., TMAI)

- Real-world assets (RWA)

- Decentralized infrastructure (DePIN)

- ZK rollups and Layer-2s

- On-chain gaming and modular blockchains

3. Innovative Technology or Unique Use Case

They bring new ideas or solve real problems, giving them the potential to disrupt existing models.

4. Early Community Traction

Even if small, moonshots typically have loyal, vocal communities that drive awareness and support adoption.

5. Token Utility

Tokens that play a critical role in a product’s functionality (staking, access, governance) are more likely to gain value as adoption grows.

6. Exchange Listings

Getting listed on a major CEX (centralized exchange) or DEX (decentralized exchange) often serves as a catalyst for price surges.

⚠️ Moonshot = High Risk, High Reward

While the upside is massive, moonshots come with serious risks:

- Volatility: Prices can swing wildly in hours or minutes.

- Scams and rug pulls: Many low-cap tokens are created with malicious intent.

- Illiquidity: It may be hard to buy or sell large amounts.

- Overhype: Narratives can fizzle out quickly, leaving bag holders behind.

- Lack of product-market fit: Many projects never deliver a working product.

Risk management is essential. Only allocate a small portion of your portfolio to moonshots and always do your own research.

🔍 How to Identify Crypto Moonshots

Finding true moonshots is part art, part science. Here are practical steps to help spot them:

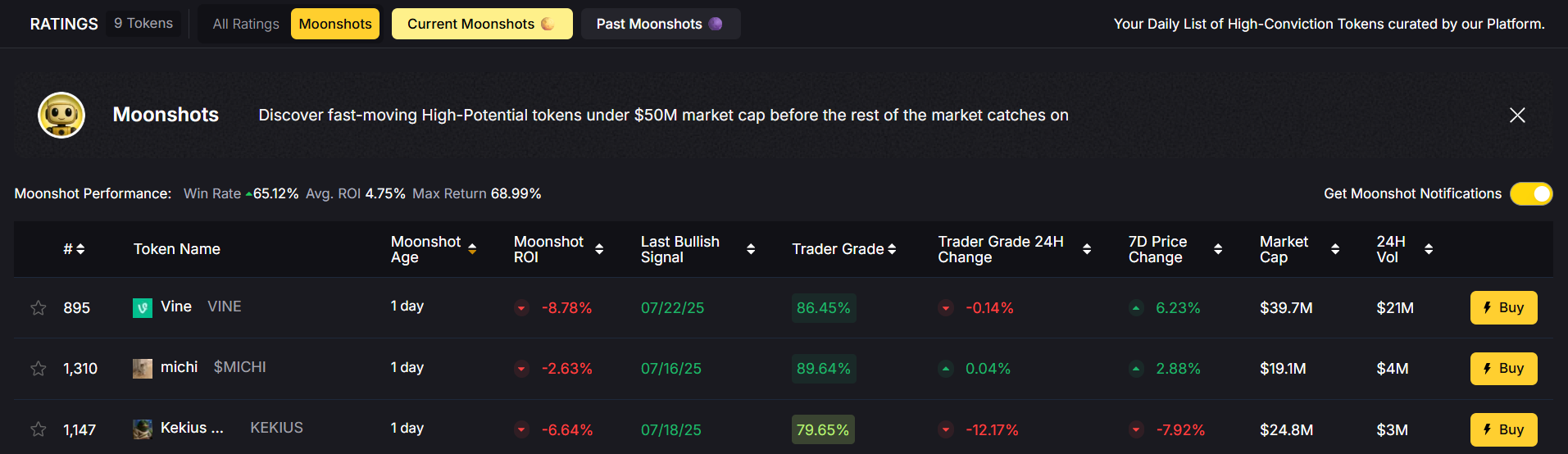

1. Use Token Metrics Moonshots Feature

Token Metrics, the leading AI-powered crypto research platform, features a dedicated Moonshots tab that helps users discover early-stage altcoins with massive potential.

Token Metrics uses AI models to:

- Scan over 6,000+ tokens

- Analyze 80+ on-chain and off-chain data points

- Score tokens based on Investor Grade (long-term) and Trader Grade (short-term)

- Highlight tokens before they hit mainstream radar

2. Follow Emerging Narratives

Pay attention to sectors gaining momentum—AI, DePIN, L2s, gaming, and RWA are hot in 2025. Moonshots often emerge at the intersection of narrative and innovation.

3. Explore Crypto Twitter and Discord

Many early-stage gems are discussed by small communities, KOLs (key opinion leaders), and early investors before any mainstream media coverage.

4. Check Tokenomics

A great idea can’t succeed with poor tokenomics. Look for:

- Fair initial distribution

- Deflationary or limited supply

- Lock-up periods for team/investors

- Strong incentive alignment with users

5. Monitor DEX Launchpads and On-Chain Metrics

Platforms like Uniswap, Camelot, or Base-native DEXs are where most moonshots launch first. Analyze:

- Wallet distribution (whale vs retail)

- Volume and liquidity

- Holder growth

🔬 How Token Metrics Helps You Find the Next Moonshot

Token Metrics is the ultimate tool for discovering and validating moonshot opportunities. Here’s how:

🧠 AI-Driven Token Ratings

Get real-time Investor Grade and Trader Grade scores, generated by AI models trained on historical altcoin performance.

📈 Bullish & Bearish Signals

Get alerts when a token shows strong upside or downside momentum based on quantitative signals.

🚀 Moonshots Section

A curated feed of low-cap, high-potential tokens filtered by market cap, sector, risk level, and on-chain traction.

📊 Backtesting & Risk Analysis

Use simulation tools to see how a moonshot would have performed in different market conditions, helping you gauge timing and position sizing.

👉 Try Token Metrics with a 7-day free trial and start exploring moonshots with data, not just hype.

✅ Examples of Real Moonshots

In previous years, several tokens started as moonshots and delivered massive gains:

- Polygon (MATIC) – Launched below $0.01, surged to over $2.50 at peak

- Axie Infinity (AXS) – Went from cents to $165 during the 2021 gaming boom

- Pepe (PEPE) – Meme coin that turned thousands into millions in 2023

- VIRTUAL (SPX6900) – Token Metrics alerted this 55x trade before the crowd

In 2025, emerging moonshots include AI-powered tokens like $TMAI (Token Metrics AI)—positioned at the forefront of AI + crypto convergence.

🛡️ Tips for Safely Investing in Moonshots

- Only use risk capital (money you can afford to lose)

- Start small and scale positions after traction

- Set profit targets and stop-losses

- Diversify across 5–10 moonshot tokens

- Use non-custodial wallets and keep private keys secure

- Don’t chase pumps—enter early or not at all

Moonshot investing isn’t about certainty—it’s about asymmetrical bets with defined downside and massive upside.

Final Thoughts

Moonshots are the heartbeat of crypto innovation. They represent the bold, risky, and visionary projects that could reshape entire industries—or fade into obscurity.

In 2025, the opportunity to find the next Solana, MATIC, or PEPE still exists—but success comes from informed decisions, not hype-driven FOMO. That’s why platforms like Token Metrics are critical. With AI-powered research, curated moonshot lists, and real-time trading signals, Token Metrics helps you spot the gems before they moon.

So, what’s your next moonshot?

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

The Rise of Revenue-Driven Cryptocurrencies: How Real Cash Flow is Reshaping DeFi

%201.svg)

%201.svg)

The cryptocurrency landscape is undergoing a fundamental transformation as projects with actual revenue generation increasingly outperform purely speculative assets. What analysts are calling the "revenue super cycle" represents a maturation of the digital asset space, where tokens backed by real business models and cash flows are commanding premium valuations and sustained growth.

The Revenue Revolution in Crypto

Unlike the speculative frenzies of previous crypto cycles, the current market is rewarding projects that demonstrate clear value creation through measurable revenue streams. This shift reflects a broader evolution from purely technological promises to working business models that generate tangible returns for token holders.

The leaders in this space have adopted innovative approaches to value distribution. Hyperliquid, one of the standout performers, allocates 97% of its protocol revenues toward token buybacks, creating a direct correlation between platform success and token value. This model has driven the token from approximately $12 in April 2024 to over $55, representing a more than 350% increase while outperforming most large-cap alternatives.

Similarly, Pump.fun has implemented a creator revenue-sharing model that has resulted in a 150% increase over 30 days. The platform has evolved into what some describe as "the Twitch of Web3," where content creators launch tokens and earn revenue through live streaming activities. Recent data shows some creators earning nearly $400,000 within just two days of launching their streams, highlighting the substantial value creation potential within this ecosystem.

The Mechanics of Value Accrual

These revenue-generating projects employ several mechanisms to ensure token holders benefit from platform growth:

Token Buyback Programs: Projects like Hyperliquid and Geodnet use a significant portion of revenues to purchase tokens from the open market and either burn them or redistribute to stakeholders. Geodnet has burned over 34 million tokens representing 3% of total supply, while maintaining an annual recurring revenue of $5.5 million from its RTK network operations.

Direct Revenue Sharing: Rather than complex tokenomics structures, some projects directly distribute revenue to token holders or stakers, creating transparent value flow that mirrors traditional dividend models.

Ecosystem Development: Forward Industries, led by Kyle Samani, announced plans to actively deploy its $1.65 billion Solana treasury into DeFi strategies rather than passive holding, potentially creating compounding returns for the broader ecosystem.

The Institutional Adoption Factor

The revenue focus aligns with increasing institutional adoption of cryptocurrency as an asset class. Bitcoin and Ethereum ETFs have recorded substantial inflows, with Bitcoin ETFs seeing $757 million in a single day in September 2025 - the strongest single-day performance since July. Fidelity contributed $299 million while BlackRock added $211 million during this period.

Ethereum ETFs followed with $171 million in net inflows, led by BlackRock's $74 million and Fidelity's $49 million contributions. These flows indicate institutional recognition of crypto assets as legitimate investment vehicles, but the preference increasingly favors projects with demonstrable business models.

Platform-Specific Revenue Models

Different blockchain ecosystems are developing unique approaches to revenue generation:

Solana's Creator Economy: The Solana ecosystem has become synonymous with meme coin activity, but projects like Pump.fun are evolving this into sustainable creator economies. The platform's mobile application launch has simplified user onboarding while expanding the creator base.

Ethereum's Fee Evolution: Despite concerns about high transaction costs, Ethereum has seen increased activity with smart contract calls surpassing 12 million. The implementation of Blobs and other upgrades has significantly reduced fees while maintaining security, potentially strengthening its position as the primary DeFi hub.

Hyperliquid's Vertical Integration: As a derivatives-focused platform with its own Layer 1 blockchain, Hyperliquid captures value across multiple layers of the trading stack, from transaction fees to trading spreads to staking rewards.

The Infrastructure Play

Beyond direct trading and DeFi platforms, infrastructure projects supporting the broader machine economy are gaining attention. The emergence of a "robotics" category reflects anticipation of trillion-dollar markets in humanoid robotics and spatial computing.

Geodnet operates one of the largest RTK (Real-Time Kinematic) networks globally, providing centimeter-level location accuracy essential for autonomous systems. With over 19,000 miners representing 60% growth year-over-year, the project demonstrates how specialized infrastructure can generate consistent revenue streams.

Auki focuses on spatial computing, developing technology that helps systems understand and interact with real-world spaces. These projects represent infrastructure investments for an anticipated machine economy where autonomous systems require precise positioning and environmental understanding.

Market Structure and Future Implications

The focus on revenue-generating assets reflects broader market maturation. Traditional metrics like total addressable market and technological capability are being supplemented by revenue multiples and cash flow analysis more common in equity markets.

This evolution suggests several implications for the cryptocurrency space:

Sustainability: Projects with actual revenue streams are more likely to survive market downturns and regulatory uncertainty, providing greater stability for long-term investors.

Valuation Models: Traditional crypto valuation methods based purely on network effects and token scarcity are evolving to incorporate discounted cash flow models and revenue multiples.

Regulatory Clarity: Projects with clear business models generating revenue may find easier paths through regulatory frameworks compared to purely speculative assets.

Professional Investment: The shift enables traditional investment professionals to apply familiar analytical frameworks to cryptocurrency investments, potentially accelerating institutional adoption.

Challenges and Considerations

While the revenue focus represents positive evolution, several challenges remain:

Sustainability: Some revenue models may not be sustainable during market downturns or increased competition.

Regulatory Risk: Revenue-generating activities may face different regulatory treatment compared to purely technical protocols.

Market Saturation: As more projects adopt similar models, differentiation becomes crucial for maintaining competitive advantages.

Execution Risk: Converting revenue into lasting token value requires effective management and strategic execution.

The transformation toward revenue-driven cryptocurrencies represents a fundamental shift in how digital assets create and distribute value. Projects demonstrating real business models with measurable cash flows are increasingly commanding market premiums and investor attention. This evolution suggests the cryptocurrency space is maturing from purely speculative activity toward sustainable business models that can compete with traditional financial instruments.

As this trend continues, the distinction between successful and unsuccessful projects may increasingly depend on their ability to generate genuine value rather than purely capturing attention through marketing or temporary technological advantages. The revenue super cycle appears to be establishing new standards for cryptocurrency investment, where cash flow analysis becomes as important as technological innovation.

What Does Decentralization Mean in Practice? A 2025 Perspective

%201.svg)

%201.svg)

Decentralization has evolved far beyond its origins as a theoretical concept tied to blockchain technology. In 2025, decentralization is a transformative force reshaping industries, organizations, and governance structures worldwide. But what does decentralization mean in practice? It means distributing authority, decision making, and control away from a single central authority and empowering multiple parties to work independently yet cohesively. This practical shift is redefining how we interact with technology, finance, and management across various sectors.

There are several main types of decentralization, including administrative decentralization, which involves transferring planning and implementation responsibilities to local governments and civil servants, and fiscal decentralization, which focuses on shifting revenue-raising and expenditure authority to lower levels of government. These forms of decentralization are relevant not only to public administration but also to business entities, where organizational autonomy and efficiency are enhanced through decentralized structures.

For example, computer networks such as the Internet are prime examples of decentralized systems, as they operate without a central authority and enable open participation across networked systems.

Beyond the Buzzword: Understanding Real Decentralization

At its core, decentralization refers to moving away from traditional centralized entities where a single person or organization holds all decision making power. Instead, decentralized systems distribute authority and decision making processes across various departments, units, or participants. This distribution not only reduces reliance on a central government or central authority, enhancing fault tolerance and resilience against attacks or failures, but also shapes the organizational structure to support effective communication, faster information flow, and improved internal relationships.

Blockchain technology is a prime example of decentralization in action. Rather than a single company controlling data or transactions, blockchain distributes control among a network of participants who validate and record information. This means no single entity has overarching power, and decisions emerge from collective consensus. The result is quicker decision making, increased transparency, and more autonomy for users. Decentralized computer networks also support increased innovation by enabling greater creativity, rapid adaptation to change, and improved responsiveness to user needs.

Importantly, decentralization today extends well beyond cryptocurrencies. It influences governance models, organizational structures, and even physical infrastructure. Decentralization reforms in governments emphasize political decentralization, giving regional and local authorities more power and responsibility for local governance and service delivery. This process transfers powers and responsibilities to the local level, where local officials are held accountable for their decisions and actions, ensuring transparency and effective governance. Similarly, in the private sector, decentralization strategies empower lower management levels and decentralized units to work independently, fostering innovation, local responsiveness, and the development of managerial skills among lower-level managers.

Decentralized Finance: The Foundation of Practical Implementation

One of the clearest examples of decentralization in practice is Decentralized Finance, or DeFi. DeFi uses blockchain technology to create financial systems where no central bank or company controls your money or transactions. Instead, these processes happen on open networks accessible to anyone. DeFi is a prime example of market decentralization, shifting financial services from centralized institutions to competitive, decentralized markets.

In practice, DeFi enables users to access loans instantly through smart contracts without waiting for bank approvals. Decentralized exchanges like Uniswap allow peer-to-peer trading without a centralized intermediary, using liquidity pools provided by users who earn fees for their participation. This model increases allocative efficiency and reduces transaction times.

Navigating DeFi’s complexities requires advanced tools. Platforms like Token Metrics combine AI analytics with blockchain data to help investors identify promising tokens early. By providing scores and insights, Token Metrics empowers both novice and experienced traders to make informed decisions, demonstrating how decentralization paired with AI can democratize access to financial markets.

Decentralized Physical Infrastructure Networks (DePINs): Bridging Digital and Physical Worlds

In 2025, decentralization is no longer limited to digital applications. Decentralized Physical Infrastructure Networks (DePINs) are emerging as a revolutionary way to distribute control over tangible resources like energy grids, transportation systems, and communication networks. These are examples of public services that can be decentralized, offering alternatives to traditional government-provided utilities. DePINs allow individuals to monetize unused physical resources—such as bandwidth or storage—by participating in decentralized operations.

This practical application of decentralization means that ordinary people can earn passive income by contributing to local markets without centralized oversight. For example, DePINs can monitor environmental factors like noise pollution or manage energy distribution more efficiently by leveraging decentralized units working independently but coordinated through blockchain protocols, alongside other units within the network that operate autonomously.

DePINs exemplify how decentralization refers not only to distributing authority but also to creating new economic models that reward participation and improve overall quality of service delivery. As these networks grow, they enhance resilience and local responsiveness, addressing challenges faced by centralized infrastructure.

Political Decentralization and Decentralized Governance: Reimagining Democratic Participation

Decentralization also reshapes governance by distributing decision making authority away from top management or central government to multiple stakeholders. In many cases, this involves transferring powers traditionally held by the national government to regional or local entities, fundamentally altering the structure of governance.

Decentralized Autonomous Organizations (DAOs) use blockchain-based smart contracts to automate decision making, allowing token holders to participate directly in policy making without relying on a single person or centralized entity. While political decentralization disperses authority among various levels, political centralization refers to the concentration of power and decision-making at the national government level, highlighting a key difference in how authority is structured.

This political decentralization fosters transparency and inclusivity, enabling civil society and various departments within organizations to collaborate effectively. DAOs are increasingly explored not only in crypto projects but also in traditional organizations seeking to improve local governance and intergovernmental relations.

Emerging trends in decentralized governance include AI-assisted delegation, which helps users identify representatives aligned with their values, and incentive mechanisms designed to encourage meaningful participation beyond simple token rewards. Successful decentralization in governance requires balancing autonomy with coordination, ensuring decentralized units remain accountable while maintaining consistency.

The AI-Decentralization Convergence

While artificial intelligence is often seen as a centralizing force controlled by large corporations, it is becoming a powerful enabler of decentralization. By building decentralized AI models and open access to AI resources, blockchain technology ensures innovation remains accessible and transparent. This approach strengthens the organization's overall innovation capacity and supports its strategic objectives by reducing barriers to advanced technology.

This convergence is evident in platforms like Token Metrics, which leverage AI, machine learning, and big data analytics to democratize sophisticated crypto trading insights. Token Metrics’ AI-selected crypto baskets have delivered impressive returns, illustrating how decentralized means combined with AI can level the playing field for individual investors.

Moreover, natural language processing enables the interpretation of social media trends and market sentiment, providing traders with early signals to anticipate market movements. This practical application of AI in decentralized systems enhances decision making power and strategic planning for many businesses and individual investors alike.

Cross-Chain Interoperability: Breaking Down Digital Silos

A significant challenge for decentralization has been the fragmentation of blockchain networks, limiting seamless interaction between different systems. In 2025, cross-chain interoperability solutions are gaining traction, enabling users to transact and interact across multiple blockchains without friction.

This development is critical for decentralization’s mainstream adoption, ensuring users do not need to understand the technical differences between Ethereum, Solana, or other chains. Instead, decentralized units across various regions can coordinate effectively, improving overall control and service delivery.

Cross-chain interoperability exemplifies how decentralization strategies are evolving to maintain the right balance between autonomy and coordination, fostering a more connected and efficient decentralized ecosystem.

Decentralized Organizational Structures: Rethinking How We Build and Operate

Decentralized organizational structures are transforming how organizations operate in 2025. Unlike traditional models where a central authority or single entity holds most of the decision making power, a decentralized system distributes decision making authority across various departments, teams, or even individuals. This shift gives each part of the organization more autonomy to address local needs and adapt to changing conditions on the ground.

In practice, this means that instead of waiting for approval from top management, teams can make independent decisions that are best suited to their specific context. For example, a regional office might tailor its service delivery or marketing strategies to better fit the preferences of its local market, without needing to follow a one-size-fits-all directive from headquarters. This approach not only speeds up response times but also encourages innovation, as those closest to the challenges have the authority to experiment with new solutions.

Organizations adopting decentralized structures often find that empowering various departments leads to greater flexibility and resilience. By giving teams more autonomy, organizations can better navigate complex environments and rapidly changing market demands. This model also helps attract and retain talent, as employees value the opportunity to have a real impact and take ownership of their work.

Ultimately, decentralized organizational structures are about moving away from rigid hierarchies and embracing a more dynamic, responsive way of working. By distributing authority and decision making throughout the organization, businesses can unlock new levels of creativity, efficiency, and local responsiveness—key ingredients for success in today’s fast-paced world.

Real-World Impact, Service Delivery, and Market Dynamics

Decentralization’s practical impact is increasingly tangible. Governments are implementing decentralization reforms that allocate financial resources and decision making authority to sub national and local governments, improving responsiveness to local needs. Central governments play a key role in delegating these powers, setting policies, providing resources, and maintaining overall coordination while enabling more localized decision-making and management. In the private sector, many businesses adopt decentralized organizational structures, giving teams more power and autonomy to innovate.

Institutional adoption of DeFi and decentralized governance models signals growing confidence in decentralized systems. Traditional financial institutions are partnering with DeFi platforms to integrate decentralized solutions, blending centralized and decentralized finance for enhanced service delivery.

For investors and organizations navigating this evolving landscape, tools like Token Metrics provide crucial AI-driven analytics and real-time buy and sell signals. By processing vast market data and social sentiment, these platforms enhance allocative efficiency and help users capitalize on decentralized market opportunities.

Challenges and Considerations in Decision Making

Despite its advantages, decentralization in practice faces challenges. Operating without a central authority or government regulation exposes participants to risks such as smart contract vulnerabilities, hacks, and scams. There are limited consumer protections, so responsibility and accountability rest heavily on users.

Regulatory frameworks are still developing worldwide. Countries like Switzerland and Singapore are pioneering clear classifications for digital assets, which are essential for balancing decentralization’s benefits with legal oversight. Achieving successful decentralization requires ongoing coordination among governments, civil society, and the private sector to address these challenges.

The Future of Decentralization

Looking forward, 2025 is shaping up as the long-awaited year of decentralization. The convergence of mature DeFi protocols, expanding DePIN networks, innovative governance models, and AI-powered analytics platforms is creating an ecosystem where decentralization delivers real-world benefits.

Platforms like Token Metrics illustrate how sophisticated tools democratize access to complex financial markets, bridging the gap between decentralization’s promise and practical implementation. As decentralization strategies continue to evolve, organizations and individuals will find more opportunities to participate, innovate, and succeed in decentralized environments.

Conclusion: Decentralization as a Practical Reality

In 2025, decentralization is no longer an abstract idea or speculative trend; it is a practical reality transforming technology, finance, governance, and infrastructure. From earning passive income through decentralized physical networks to engaging in AI-enhanced crypto trading, decentralization empowers individuals and organizations with more control, autonomy, and decision making power.

The question today is not what does decentralization mean in practice, but how quickly and effectively can we adapt to this new paradigm? With advances in blockchain technology, AI, cross-chain interoperability, and decentralized governance, the infrastructure and tools are in place. The future is a decentralized economy where power is distributed, decisions are made collaboratively, and innovation flourishes across multiple independent yet interconnected units.

How Secure Are Blockchains Really? A Comprehensive Analysis

%201.svg)

%201.svg)

In today’s digital era, where cyberattacks cost businesses billions annually, blockchain technology has emerged as a promising solution for secure and transparent transactions. As blockchain adoption accelerates across diverse industries—from decentralized finance to supply chain management—a pressing question arises: how secure are blockchains really? While blockchain technology offers inherent security advantages through cryptographic protection and decentralized architecture, the broader landscape of blockchain technologies encompasses a range of digital systems that rely on decentralized data structures, cryptography, and consensus mechanisms to enhance digital security. However, the practical reality is more nuanced than the idealized hype suggests. This raises the question of whether blockchain is truly 'blockchain safe'—while these systems are designed with robust security features, they remain susceptible to certain cyberattacks and vulnerabilities, making comprehensive security measures essential. This article explores the foundations, current vulnerabilities, and future outlook of blockchain security to provide a comprehensive understanding of this critical issue.

The Security Foundation of Blockchain

At its core, blockchain technology provides a decentralized and tamper-resistant framework designed to secure transactions and data. Unlike traditional centralized systems, a blockchain system operates as a distributed database or a distributed ledger technology, where records are stored linearly in data blocks linked cryptographically to form a continuous cryptographic chain. The records stored on the blockchain are transparent, secure, and immutable, allowing transactions and data entries to be audited or traced while ensuring their integrity.

The security of blockchain networks rests on three fundamental pillars: cryptographic hashing, decentralized consensus, and immutability. Each new block contains a cryptographic hash of the previous block, creating an unbreakable link that makes unauthorized modifications computationally infeasible. This ensures that once a transaction is added to the blockchain, it becomes practically irreversible.

Moreover, blockchain networks use a consensus mechanism—such as Proof of Work or Proof of Stake—to achieve consensus and validate transactions. This process requires agreement from a majority of blockchain participants across the network of computers, eliminating any single point of failure and making the system resilient to attacks targeting centralized authorities. The decentralized nature of blockchain technology means there is no central authority controlling the data, which enhances blockchain security by distributing trust across the entire network.

However, the question is not whether blockchain is theoretically secure, but whether real-world implementations maintain this security promise. The answer reveals a mix of impressive strengths and notable vulnerabilities that must be addressed to keep blockchain systems truly safe.

Types of Blockchains

Blockchains can be broadly classified into three main types: public blockchains, private blockchains, and hybrid blockchains. Each type offers distinct features, security models, and use cases, making them suitable for different business and operational needs.

Public blockchains—such as the Bitcoin network—are open, permissionless systems where anyone can join the distributed network, participate in validating transactions, and access the transaction ledger. Data in public blockchains is stored linearly in a series of cryptographically linked blocks, ensuring transparency and security across the entire network. The decentralized nature of public blockchains eliminates the need for a central authority, making them ideal for applications that require trustless, peer-to-peer interactions.

Private blockchains, in contrast, operate as permissioned networks. Access to these networks is restricted to verified participants, and only authorized nodes can validate transactions or view sensitive information. Private blockchains are often used by enterprises to streamline internal processes, enhance data security, and comply with regulatory requirements. Their more centralized structure allows for greater control over data and network activity, but may reduce the level of decentralization compared to public blockchains.

Hybrid blockchains combine elements of both public and private blockchains, offering a balance between openness and control. These networks allow organizations to maintain private, permissioned data while also interacting with public blockchain systems when needed. This flexibility makes hybrid blockchains a popular choice for businesses seeking to leverage the security and transparency of distributed ledger technology without sacrificing privacy or regulatory compliance.

By understanding the differences between public, private, and hybrid blockchains, organizations can select the most appropriate blockchain network for their specific security, transparency, and operational requirements.

Public Blockchain Security

The security of public blockchains is rooted in their decentralized architecture, cryptographic protocols, and robust consensus mechanisms. In a public blockchain, a distributed network of computers—often referred to as nodes—work together to validate transactions and maintain the integrity of the blockchain data. Each transaction is secured using public keys and cryptographic chains, making unauthorized alterations extremely difficult.

One of the key strengths of public blockchain security is the sheer number of blockchain participants involved in validating transactions. This widespread participation makes it challenging for malicious actors to gain enough influence to compromise the network, rendering public blockchains fairly secure against most attacks. The consensus mechanism, whether Proof of Work or Proof of Stake, ensures that only legitimate transactions are added to the blockchain, further enhancing security.

However, public blockchains are not immune to threats. Phishing attacks, where attackers trick users into revealing private keys, remain a persistent risk. Routing attacks can disrupt the flow of data across the network, and Sybil attacks—where a single entity creates multiple fake identities to gain undue influence—can threaten the consensus process. To counter these risks, blockchain participants should implement strong security controls, such as multi-factor authentication, regular software updates, and vigilant monitoring of network activity.

Overall, while public blockchains offer a high level of security through decentralization and cryptography, ongoing vigilance and best practices are essential to protect against evolving threats.

Private Blockchain Security

Private blockchains take a different approach to security by leveraging access controls, permissioned networks, and centralized management. In a private blockchain, only selected participants are granted access to the network, and a central authority typically oversees network operations and validates transactions. This selective endorsement process ensures that only trusted nodes can participate in consensus, reducing the risk of exploiting vulnerabilities that are more common in open, public blockchains.

The controlled environment of private blockchains makes them particularly well-suited for use cases involving sensitive information, such as supply chains, financial services, and enterprise data management. By restricting access and closely monitoring network activity, organizations can better protect their data and comply with regulatory requirements.

However, the centralized nature of private blockchains introduces its own set of risks. A single point of failure—such as a compromised administrator or a critical system outage—can jeopardize the security of the entire system. To mitigate these risks, it is crucial to implement robust access management policies, regular security audits, and a comprehensive disaster recovery plan. These measures help ensure that private blockchains remain secure, resilient, and capable of supporting mission-critical business operations.

In summary, private blockchains offer enhanced security through controlled access and selective validation, but require diligent management to avoid centralization risks and maintain the integrity of the network.

The Current State of Blockchain Security in 2025

Despite blockchain’s strong theoretical security foundations, the reality in 2025 shows a complex landscape. Over $2.17 billion has already been stolen from crypto platforms this year alone, with major exchanges like ByBit and CoinDCX experiencing large-scale breaches. These figures continue a troubling trend from 2024, which saw losses exceeding $1.42 billion across various decentralized ecosystems.

The growing demand for blockchain solutions in areas such as decentralized finance (DeFi), supply chains, and digital asset management has simultaneously increased the attack surface. Distributed ledger technologies (DLTs), which underpin these blockchain solutions, further expand the attack surface and introduce new security challenges due to their decentralized and consensus-driven nature. The global blockchain security market, valued at $2 billion in 2025, is expected to expand at a 20% compound annual growth rate, reaching approximately $8 billion by 2033. This surge reflects both the rapid adoption of blockchain technology and the urgent need for sophisticated security controls to protect blockchain data and digital assets.

As blockchain networks become more complex and interconnected, the challenges of securing public and private blockchains grow, requiring continuous innovation in security protocols and operational practices. The introduction of new protocols in blockchain security is necessary to address emerging threats, but can also introduce new vulnerabilities.

Major Blockchain Security Threats in 2025

Smart Contract Vulnerabilities

One of the most significant security challenges in blockchain systems arises from smart contracts—self-executing code that automates agreements without intermediaries. In 2025, smart contract flaws have contributed to over $1 billion in losses. Vulnerabilities such as reentrancy attacks, missing access controls, and arithmetic overflows expose these programs to exploitation.

The OWASP Smart Contract Top 10 for 2025 highlights the most critical vulnerabilities discovered after analyzing 149 security incidents involving $1.42 billion in losses. Attackers frequently scan public smart contracts for weaknesses and exploit them through flash loan attacks and liquidity pool drains.

Recent examples underscore the severity of these risks. The ALEX Protocol lost $8.3 million when attackers exploited vault permissions using malicious tokens that mimicked legitimate assets. Similarly, Cetus Protocol suffered a $220 million loss after attackers spoofed token metadata to bypass security checks. These incidents demonstrate that while blockchain protocols may be secure, the applications built atop them are prime targets for malicious actors.

51% Attacks and Consensus Failures

A 51% attack occurs when an entity gains control of more than half of the network’s computing power, enabling them to reverse transactions and double-spend coins. While large networks like the bitcoin network and Ethereum have grown sufficiently to make such attacks prohibitively expensive, smaller blockchain networks and private blockchain networks remain vulnerable.

Beyond computational attacks, some platforms have fallen victim to routing attacks, where hackers intercept or censor data as it travels through the internet infrastructure. These attacks undermine trust in the network’s ability to validate transactions securely, especially in networks with fewer validators.

Bridge and Cross-Chain Exploits

Cross-chain bridges, which enable interoperability between different blockchains, have become prime targets for attackers. For instance, Force Bridge lost $3.6 million in May 2025 after a compromised private key allowed attackers to control validator functions. These bridges often introduce centralized points of vulnerability, contradicting the decentralized ethos of blockchain technology and increasing the risk of security breaches.

Exchange and Custody Vulnerabilities

Centralized exchanges and custodial services remain attractive targets because they hold vast amounts of user assets in hot wallets connected to the internet. Security failures in access management, such as weak private keys protection or poor API security, can lead to rapid fund drains.

In May 2025, Coinbase fell victim to a social engineering attack where overseas support contractors were bribed to grant unauthorized account access. Though affecting less than 1% of users, this incident highlights how human error and operational weaknesses can bypass even the most robust blockchain protocols.

MEV and Transaction Manipulation

Maximal Extractable Value (MEV) attacks have cost users over $540 million in 2025. Attackers deploy bots to monitor transaction pools and manipulate transaction ordering to distort prices, harming regular users and eroding trust in decentralized finance networks.

Privacy and Anonymity Challenges

While blockchain’s transparency enhances data security by enabling community verification, it also creates privacy challenges. Transaction histories on public blockchains, which are examples of permissionless networks that allow open participation, are traceable, allowing attackers to analyze user behaviors and potentially de-anonymize participants. However, despite this transparency, participants in permissionless networks can remain anonymous by using cryptographic keys instead of real-world identities.

Research indicates that approximately 66% of transactions lack sufficient obfuscation techniques such as chaff coins or mixins, making them vulnerable to tracking. This leakage of sensitive information presents a significant risk, especially for users seeking privacy in their financial activities.

Security Tools and Protective Measures

Advanced Security Auditing

In response to rising threats, the blockchain security landscape has matured with advanced auditing tools and methodologies. Leading platforms like CertiK, Fireblocks, Chainalysis, and OpenZeppelin Defender provide comprehensive solutions for code reviews, vulnerability scanning, and formal verification.

Security audits involve rigorous testing before deployment, including manual code reviews and automated scans to identify potential weaknesses. Bug bounty programs and continuous monitoring help uncover exploits before they escalate into major incidents.

AI-Enhanced Security Solutions

Artificial intelligence (AI) is increasingly integrated into blockchain security, enabling real-time threat detection and risk assessment. AI-powered tools analyze on-chain behavior, identify anomalies, and predict vulnerabilities based on historical data patterns.

Platforms like CertiK’s Skynet and Chainalysis’s Know Your Transaction (KYT) exemplify this approach, offering proactive protection that helps developers and enterprises neutralize threats before breaches occur. AI-enhanced security is becoming a standard component of blockchain defense strategies.

Multi-Signature and Hardware Security

To mitigate risks associated with private keys, many organizations adopt multi-signature wallets, which require multiple approvals for critical operations. This separation of duties prevents single users from unilaterally authorizing transactions or diverting funds.

Additionally, deploying hardware security modules (HSMs) and cold storage solutions enhances key protection. Implementing role-based access controls and mandatory approval workflows further strengthens operational security.

Navigating Blockchain Security with Advanced Analytics

Given the complexity of blockchain security, access to sophisticated analysis and risk assessment tools is essential for participants. Platforms like Token Metrics offer AI-powered insights that combine technical analysis, on-chain data, fundamental metrics, and sentiment analysis to evaluate security risks.

Comprehensive Security Monitoring

Token Metrics scans over 6,000 tokens daily, providing security-relevant scores that help users identify potentially risky projects. Their cybersecurity team maintains a resilient infrastructure with firewalls, intrusion detection, and prevention systems to safeguard the platform itself.

AI-Driven Risk Assessment

By aggregating real-time data from exchanges, blockchain networks, social media, and regulatory sources, Token Metrics’ AI algorithms assess project security based on code quality, team transparency, audit histories, and community sentiment. This enables investors to make informed decisions grounded in security awareness.

Security-Focused Research and Analysis

Token Metrics also offers deep research, including detailed assessments of smart contract vulnerabilities and team credibility. This security-focused approach equips users to avoid projects with significant risks and supports safer blockchain participation.

Industry Response and Best Practices

Regulatory Development

Governments worldwide are developing regulatory frameworks to address blockchain security challenges. States like Arizona, Iowa, Nevada, Tennessee, and Wyoming have enacted legislation supporting blockchain and smart contract use, while international bodies work on standards to balance innovation with security.

Enterprise Adoption and Security

Enterprise adoption of blockchain is growing rapidly, with tokenization of real-world assets expected to reach $600 billion by 2030. Businesses are investing in rigorous security frameworks, including formal verification, enhanced consensus protocols, and international collaboration to mitigate risks.

Security Infrastructure Investment

The expanding blockchain security market reflects industry commitment to addressing vulnerabilities. Smart contract audits and security consulting services are in high demand, helping organizations integrate blockchain technology securely into their operations.

The Reality Check: Balanced Security Assessment

Strengths of Blockchain Security

Blockchain technology offers genuine security benefits:

- Cryptographic Protection makes unauthorized data modification computationally infeasible.

- Decentralized Architecture eliminates the single point of failure common in centralized systems.

- Transparency enables community verification and auditing.

- Immutability ensures that once confirmed, transactions cannot be altered.

Persistent Vulnerabilities

Despite these strengths, challenges remain:

- Implementation Flaws in smart contracts and applications introduce vulnerabilities.

- Human Factors, including phishing attacks and social engineering, bypass technical controls.

- Bridge Risks arise from centralization in cross-chain infrastructure.

- Scalability Trade-offs sometimes compromise security for performance.

For example, while transparency and immutability are key features, all bitcoin transactions are permanently recorded on bitcoin's blockchain, making the entire transaction history publicly accessible and contributing to the growing size of blockchain data storage.

Future Security Outlook

Technological Evolution

The integration of AI with blockchain technology is creating new security opportunities. The market for AI-driven blockchain security solutions is projected to exceed $703 million in 2025. Innovations include AI-powered smart contracts with conditional logic and enhanced privacy protocols protecting sensitive business data.

Formal verification techniques that mathematically prove smart contract correctness are becoming more widespread, reducing vulnerabilities and increasing trust.

Proactive Security Culture

The industry is shifting from reactive responses to proactive security strategies. Comprehensive frameworks now combine technical tools, governance, training, and operational security to build resilient blockchain ecosystems.

Conclusion: Security is a Spectrum, Not a Binary

So, how secure are blockchains really? The answer is that blockchain technology is fairly secure by design, leveraging cryptographic techniques and decentralized consensus to provide robust protection. However, the overall security of a blockchain system depends heavily on the quality of its implementation, operational practices, and the surrounding ecosystem.

While well-designed and audited blockchain applications can deliver exceptional security, poorly implemented systems remain vulnerable to significant risks, as evidenced by the $2.17 billion in losses in 2025 alone. The projected $8 billion blockchain security market by 2033 signals a strong industry commitment to overcoming these challenges.

For organizations and individuals engaging with blockchain technology, security requires a comprehensive approach: selecting secure platforms, conducting thorough due diligence, implementing strong operational controls, and leveraging sophisticated analysis tools like Token Metrics.

In 2025, participating in crypto and blockchain is no longer about chance or hype; it’s about using AI, data, and automation to make smarter, safer decisions. Blockchain technology holds tremendous security potential, but realizing that potential demands ongoing vigilance, proper implementation, and a comprehensive ecosystem of tools and expertise.

As blockchain continues to evolve, security will remain both its greatest strength and most critical challenge. Understanding the capabilities and limitations of blockchain security—and applying comprehensive strategies—is key to maximizing benefits while minimizing risks.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)