100 Tokens, One Click, Zero Spreadsheets: Modern Crypto Indexing

Managing a diversified crypto portfolio used to be a daunting task, requiring countless spreadsheets, manual tracking of hundreds of transactions across various exchanges, and hours spent calculating gains and losses. Fortunately, those days are rapidly becoming a thing of the past.

Modern crypto indexing now spans multiple blockchain networks, enabling seamless portfolio management across diverse ecosystems.Blockchain indexing plays a crucial role in enabling seamless portfolio management and efficient data access across networks, supporting real-time data retrieval and advanced analytics for decentralized applications.

Welcome to the era of modern crypto indexing, where sophisticated portfolio management meets seamless, automated execution, making it easier than ever to gain broad market exposure with minimal effort.With improved indexing infrastructure, applications consume blockchain data more efficiently, benefiting both developers and end users.

Traditionally, API regular nodes communicate using JSON-RPC over HTTP, which can be inefficient for large-scale blockchain indexing, but modern solutions have introduced more efficient protocols to address these challenges.

The key benefits of modern crypto indexing include enhanced scalability, greater reliability, and improved access to on-chain data, empowering users and developers to overcome traditional bottlenecks in the blockchain ecosystem.

The Spreadsheet Nightmare is Over

For years, crypto investors faced a tough dilemma: either limit their holdings to a manageable number of tokens they could manually track or embrace diversification at the expense of their sanity. Attempting to maintain exposure to 20 or 30 different projects meant drowning in administrative overhead. Every trade, portfolio rebalance, and tax calculation became an exhaustive, multi-hour ordeal.

The math was simple but brutal. Want exposure to the top 100 cryptocurrencies? That meant making 100 separate purchase decisions, juggling 100 wallet addresses or exchange accounts, continuously monitoring price movements, and tracking potentially hundreds of taxable events. Even professional traders found this granular management unsustainable and prone to errors. Manual tracking often led to overfetching data and made it difficult to manage the different data subsets required for various portfolio strategies.

The Blockchain Data Indexing Revolution

Traditional finance solved this problem decades ago with index funds. Instead of spending hours researching individual stocks, investors could buy the entire S&P 500 with a single transaction. The crypto industry has now caught up, but with innovations that make traditional index funds look outdated.

Modern crypto indexing platforms have revolutionized portfolio management by transforming a complex, time-consuming process into a streamlined, one-click experience. These platforms efficiently retrieve data from blockchain networks, enabling investors to gain instant exposure to diversified baskets of cryptocurrencies through sophisticated index products.

Rather than manually acquiring dozens or hundreds of tokens across multiple exchanges, these products automatically handle rebalancing, tracking, and optimization. The underlying data modules emit data for database operations—including insert, update, upsert, and delete—powered by custom indexing pipelines designed for scalable and reliable on-chain data access, drastically simplifying portfolio management.

How Modern Indexing Tools Work in Crypto

At the heart of modern crypto indexing are smart contracts and automated market makers that create tokenized representations of entire market segments. When you invest in a crypto index, you’re not buying 100 individual tokens; instead, you purchase a single index token representing proportional ownership of an underlying basket of assets.

Modern crypto indexing platforms rely on a blockchain data streaming service to retrieve and extract data from blockchain networks. These services enable the ability to stream historical blockchain data and stream binary block data for efficient processing, supporting both real-time and historical data needs.

Behind the scenes, advanced algorithms continuously monitor market conditions and execute rebalances according to predetermined criteria. These algorithms are essentially a function compiled to process incoming block data, applying user defined logic to filter and transform raw data—fundamental blockchain information retrieved directly from the node—into structured, filtered data.

If a token’s market capitalization grows and it should comprise a larger portion of the index, the system automatically adjusts allocations. Conversely, if a project falls below specific thresholds, it’s removed and replaced without any action required from the investor.

This approach offers several key advantages. First, it dramatically reduces transaction costs—rather than paying fees on 100 separate trades, you pay once. Second, it simplifies tax reporting since you’re primarily dealing with a single asset. Third, it provides professional-grade diversification without requiring professional-level expertise or resources.

Data modules are responsible for data transformation logic and emit data in a specific format suitable for downstream processing. This emitted data is structured for database operations such as insert, update, upsert, and delete, each performed with associated data to ensure proper data handling and integrity during synchronization.

The system manages an ordered data stream by splitting the requested block range into segments, streaming data efficiently to support both real-time and historical data indexing. Instead of streaming the raw data itself, the system streams progress updates by streaming data directly, ensuring ordered processing and effective error handling. Workers stream progress updates to a central system, which ensures reliable and ordered delivery of processed data to the user.

Blockchain Data Streaming Service

A blockchain data streaming service is the backbone of modern crypto indexing, enabling applications to stream binary block data directly from blockchain networks. By delivering binary block data in real time, these services empower users and developers to access blockchain data as it is produced, eliminating delays and bottlenecks associated with traditional data retrieval methods.

Whether you’re building financial analytics dashboards or powering social media platforms with on-chain activity, a blockchain data streaming service ensures that your application receives block data quickly and efficiently.

This approach to accessing blockchain data not only accelerates data retrieval but also supports the scalability required for today’s high-performance applications. By streaming block data as an ordered data stream, the service allows users to process and analyze blockchain data without the need for complex, resource-intensive polling. The result is a seamless, reliable experience that keeps your application in sync with the latest developments on the blockchain.

Data Retrieval and Duplication

Efficient data retrieval is essential for any blockchain data streaming service, especially when dealing with vast amounts of historical blockchain data. When the service initially fetches data from cloud storage buckets, it employs robust validation techniques to ensure the accuracy and completeness of the blockchain data being delivered. This process is critical for maintaining the integrity of historical blockchain data, which forms the foundation for analytics, compliance, and auditing.

To further enhance reliability, the blockchain data streaming service incorporates advanced duplication detection mechanisms. By identifying and eliminating duplicate data during the retrieval process, the service guarantees that users receive only the most accurate and relevant blockchain data. This meticulous approach to data retrieval not only streamlines access to historical blockchain data but also ensures that applications can trust the data they consume, whether it’s for real-time analysis or long-term storage.

Solving Polling Limitations

Traditional blockchain indexers often rely on polling, a method that repeatedly checks for new data at set intervals. While functional, this approach is inherently inefficient and struggles to scale as data volumes grow. Modern blockchain data streaming services overcome these polling limitations by leveraging a modified node equipped with a streaming patch. This innovation allows the node to push new blocks directly into a readable pipe, enabling the service to stream historical blockchain data from any block height with minimal latency.

By adopting a binary protocol such as gRPC, the blockchain data streaming service can transmit blockchain data more efficiently, reducing both bandwidth usage and parsing overhead. This not only supports real-time data streaming but also makes it possible to stream historical blockchain data on demand, providing unparalleled flexibility for developers and analysts.

The result is a blockchain data streaming service that is both scalable and efficient, capable of meeting the demands of modern indexing infrastructure.

Indexing Infrastructure

Behind every seamless crypto indexing experience lies a robust indexing infrastructure—the unsung hero that powers efficient access to blockchain data. Blockchains, by design, store vast amounts of transaction data and associated information in a decentralized, append-only ledger. While this ensures transparency and security, it also makes direct data retrieval complex and time-consuming for applications and users.

Some solutions do not maintain their own block storage and instead query nodes directly for block data as needed. This approach reduces infrastructure overhead but can impact data retrieval speed compared to systems that manage their own block storage.

Indexing infrastructure solves this challenge by acting as a bridge between raw blockchain data and the user-facing tools that depend on it. Instead of forcing applications to independently fetch blocks and parse through every transaction, the infrastructure organizes, categorizes, and stores blockchain data in a structured format, often utilizing centralized bucket storage for high availability and reliability. Multiple reader instances independently fetch blocks from various sources to ensure fault tolerance and continuous data access.

To efficiently process large block ranges, the requested block range is divided into assigned block segments—typically around 1,000 blocks each—which are then allocated to individual workers for parallel processing. A dedicated service delivers blocks in bundles, further improving efficiency and speed when handling large historical data sets.

Modern indexing infrastructure is designed to handle both live and historical blockchain data streams efficiently. It consumes data streams from blockchain networks, processes incoming block data in real time, applies custom data filtering and transformation logic, and stores processed data in a way that supports fast queries. This not only accelerates access to on-chain data relevant to your needs but also ensures that applications consume exactly the custom data subsets they require—no more, no less.

When multiple readers write to the same cloud storage buckets, data duplication can occur. Handling data duplication through deduplication techniques is essential to optimize storage efficiency and improve data retrieval performance.

By abstracting away the complexity of blockchain data indexing, these systems empower platforms to deliver production-grade data infrastructure. The result is a smooth, scalable experience for end users, enabling everything from one-click index investing to advanced analytics—without ever touching a spreadsheet.

Blockchain Data and Security

Security is paramount when handling blockchain data, and a blockchain data streaming service must prioritize the integrity and protection of the data it delivers. To safeguard blockchain data, the service implements advanced security measures, including encryption and strict access controls, ensuring that only authorized users can access sensitive information. These protections are essential for preventing tampering, unauthorized access, and data manipulation.

In addition to these security protocols, the blockchain data streaming service utilizes sophisticated data transformation logic to validate and format incoming data. This ensures that all blockchain data is not only secure but also consistent and ready for downstream processing. By combining robust security practices with intelligent data transformation, the service provides a trustworthy foundation for any application that relies on accurate, validated blockchain data.

Enter Token Metrics: The Analytics Powerhouse

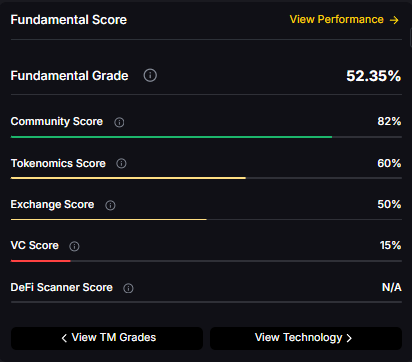

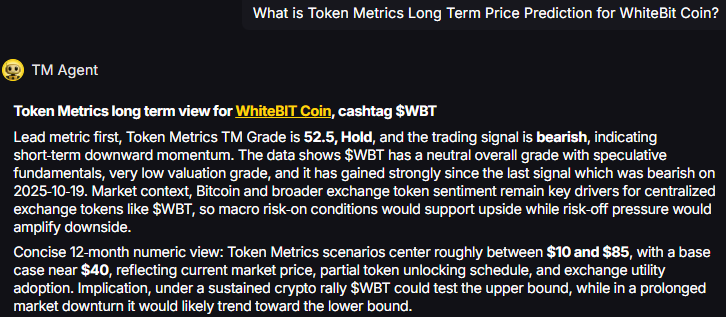

While many platforms now offer crypto index products, Token Metrics stands out by combining index accessibility with institutional-grade analytics and AI-powered insights. What sets Token Metrics apart is not just the ability to invest in diversified crypto portfolios but the intelligence layer that helps investors understand what they’re investing in and why.

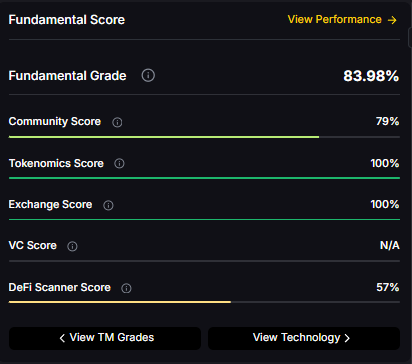

Token Metrics leverages advanced artificial intelligence and machine learning models to evaluate thousands of cryptocurrencies across multiple dimensions, including fundamental analysis, technical indicators, community sentiment, development activity, and market dynamics. This comprehensive approach provides investors with data-driven insights previously available only to hedge funds and professional traders.

The platform’s rating system cuts through the noise of the crypto market by assigning quantitative scores to projects based on objective criteria. Whether you’re interested in DeFi protocols, layer-1 blockchains, or emerging sectors like real-world asset tokenization, Token Metrics offers the analytical framework to make informed investment decisions.

Beyond Basic Indexing: Custom Indexing Pipelines for Smart Portfolio Construction

What truly makes modern crypto indexing revolutionary is the ability to go beyond simple market-cap-weighted indices. Platforms like Token Metrics enable investors to construct thematic portfolios tailored to specific investment theses.

Want exposure to the "metaverse" ecosystem? There’s an index for that. Bullish on decentralized finance but wary of the volatility of any single protocol? DeFi indices provide diversified exposure. Interested in layer-2 scaling solutions? You can invest in a basket of leading contenders without needing to pick individual winners.

This thematic approach allows investors to express sophisticated market views without execution complexity. You can maintain conviction in a sector while acknowledging that you don’t know which specific project will ultimately dominate—a pragmatic strategy long employed by professional investors in traditional markets.

Risk Management Made Simple with Production Grade Data Infrastructure

Diversification is about more than maximizing returns; it’s fundamentally about managing risk. Modern crypto indexing democratizes sophisticated risk management, making it accessible to retail investors. Instead of tying your portfolio’s fate to whether Solana or Cardano becomes the "Ethereum killer," you can own both alongside a dozen other contenders.

Platforms like Token Metrics enhance risk management through continuous monitoring and alerts. If a token in your index experiences unusual volatility, technical weakness, or regulatory challenges, you’re immediately informed. This proactive approach to risk management was previously impossible for individuals managing dozens of positions manually.

The Cost Efficiency Factor

One of the most underappreciated benefits of modern crypto indexing is the dramatic reduction in both explicit and implicit costs. Transaction fees, slippage, and the time cost of manual portfolio management can easily consume 5-10% of returns annually for actively managed portfolios. Index products compress these costs to minimal levels. You pay a small management fee for the index but eliminate dozens of individual trading fees, reduce tax complexity, and free up countless hours better spent on strategy rather than execution minutiae.

Looking Forward

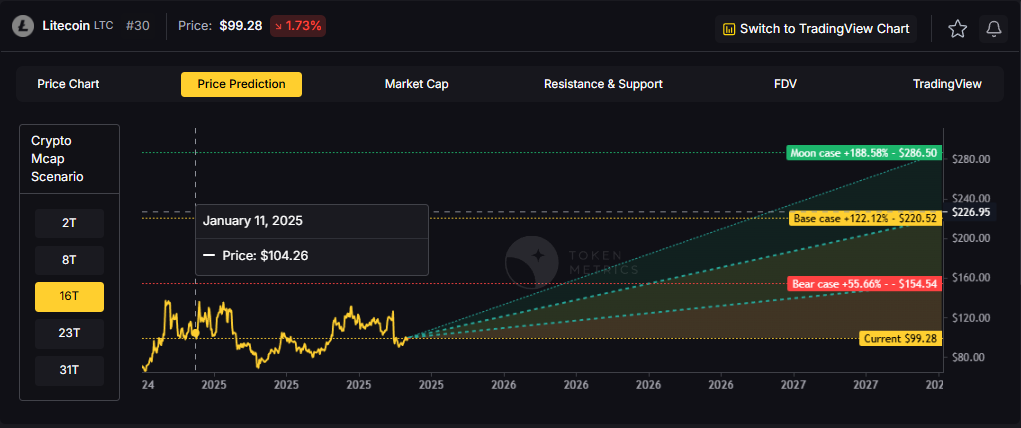

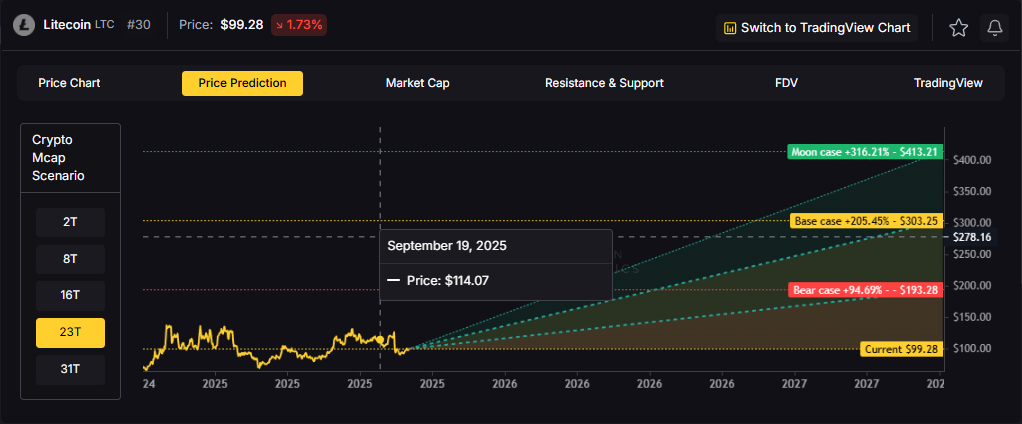

We are still in the early innings of crypto indexing innovation. The next generation of products will likely incorporate even more sophisticated strategies, such as dynamic weighting based on market conditions, automated tax-loss harvesting, integration with DeFi protocols to generate yield on index holdings, and AI-driven rebalancing that responds to market regime changes in real time.

Future innovations in modern indexing tools will focus on solving polling limitations and supporting historical streaming, enabling more comprehensive and efficient access to blockchain data for analysis and replay. Standard nodes are limited as historical streaming nodes, as they are not designed to support streaming blockchain data from any past point. New solutions address this by fetching data directly from nodes, which greatly improves service reliability and ensures consistent data delivery. Additionally, these services will be able to stream switches automatically between historical and real-time data sources, adapting seamlessly to user needs. The adoption of protocols like gRPC eliminates the need for separate client libraries for each programming language, simplifying integration.

Delivering only the filtered data needed by each application will further improve efficiency and customization for users. Platforms like Token Metrics are at the forefront of this evolution, continuously expanding their analytical capabilities and product offerings to meet investor needs. As the crypto market matures and institutional adoption accelerates, tools and strategies once exclusive to professional traders are becoming democratized. These advancements will greatly improve service reliability for both institutional and retail investors.

Conclusion

The era of spreadsheet-driven crypto portfolio management is over. Modern crypto indexing platforms have transformed what was once an arduous, error-prone process into an elegant, efficient solution. With leaders like Token Metrics combining accessible index products with institutional-grade analytics, investors can focus on strategy and education rather than execution and administration.

One hundred tokens. One click. Zero spreadsheets. This is not just a tagline—it’s the reality of modern crypto investing. The question is no longer whether you can afford to use these tools, but whether you can afford not to.

FAQs

What is crypto indexing?

Crypto indexing involves creating a digital representation of a basket of cryptocurrencies to facilitate diversified exposure to the broader market, often through a single investment product or token.

How does indexing improve portfolio management?

Indexing simplifies portfolio management by providing instant diversification, reducing manual tracking, and automating rebalancing, which saves time and minimizes errors.

What are the benefits of modern indexing platforms?

Modern platforms offer scalability, enhanced data access, automated rebalancing, and integration with advanced analytics for better decision-making.

How do AI analytics support crypto investors?

AI-powered analytics evaluate market conditions, project fundamentals, and sentiment to provide insights that can inform investment strategies and risk assessment.

What is the future of crypto indexing?

The future will likely include more dynamic strategies, automated tax optimization, blockchain data integration, and expanded real-time historical streaming capabilities.

Disclaimer

This content is for educational and informational purposes only and does not constitute financial advice. Always conduct your own research before making investment or trading decisions. Past performance is not indicative of future results.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)