API Endpoint Essentials: Design, Security & Tips

APIs power modern software by exposing discrete access points called endpoints. Whether you re integrating a third-party data feed, building a microservice architecture, or wiring a WebSocket stream, understanding what an api endpoint is and how to design, secure, and monitor one is essential for robust systems.

What is an API endpoint and how it works

An api endpoint is a network-accessible URL or address that accepts requests and returns responses according to a protocol (usually HTTP/HTTPS or WebSocket). Conceptually, an endpoint maps a client intent to a server capability: retrieve a resource, submit data, or subscribe to updates. In a RESTful API, endpoints often follow noun-based paths (e.g., /users/123) combined with HTTP verbs (GET, POST, PUT, DELETE) to indicate the operation.

Key technical elements of an endpoint include:

- URI pattern (path and optional query parameters)

- Supported methods (verbs) and expected payloads

- Authentication and authorization requirements

- Response format and status codes

- Rate limiting and throttling rules

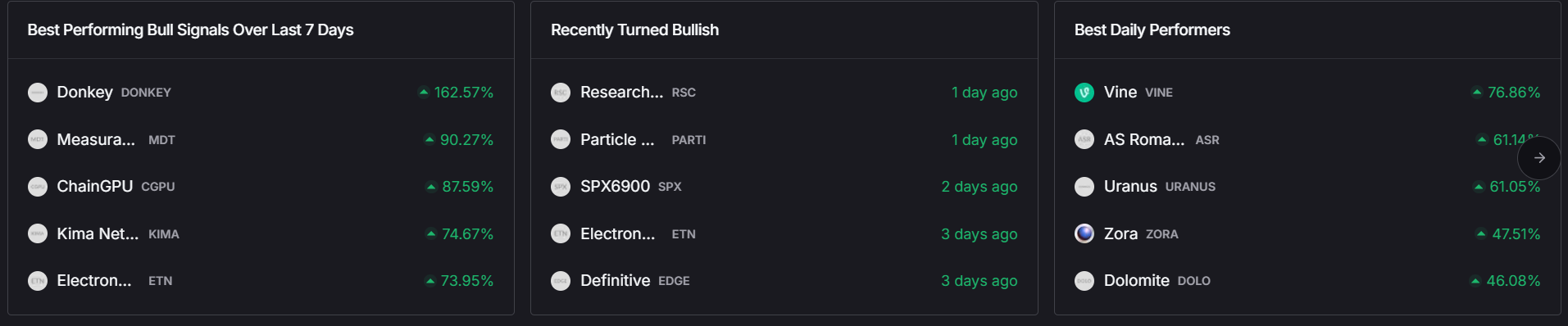

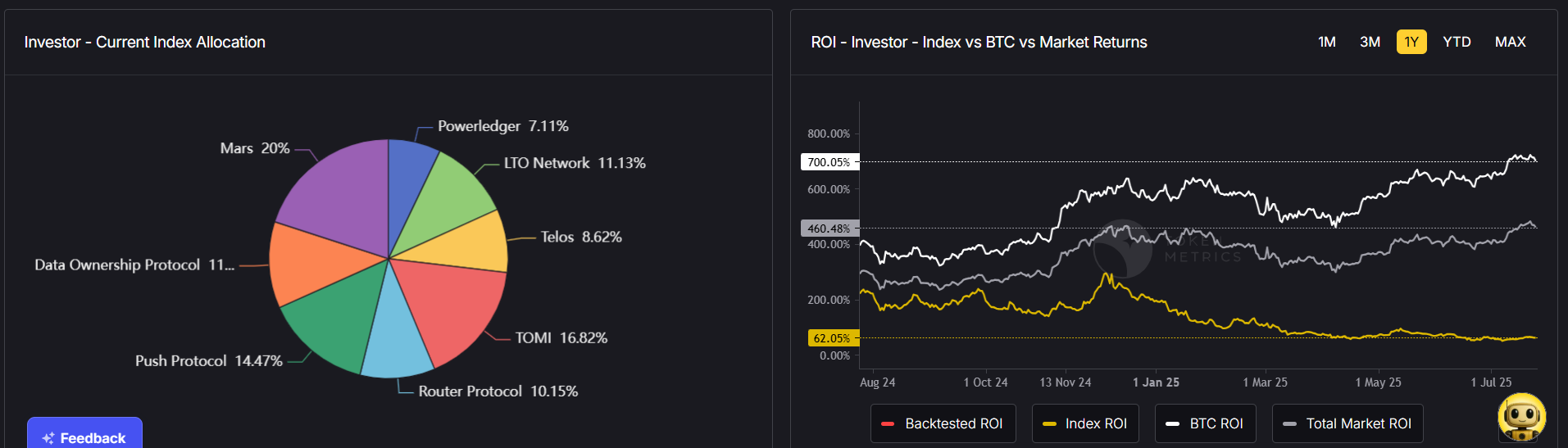

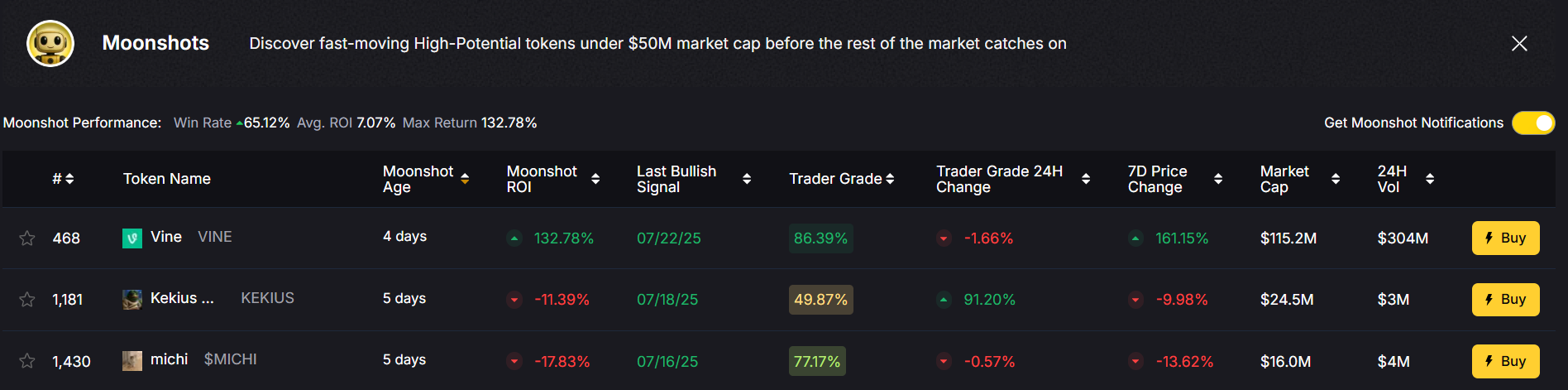

Endpoints can be public (open to third parties) or private (internal to a service mesh). For crypto-focused data integrations, api endpoints may also expose streaming interfaces (WebSockets) or webhook callbacks for asynchronous events. For example, Token Metrics is an example of an analytics provider that exposes APIs for research workflows.

Types of endpoints and common protocols

Different application needs favor different endpoint types and protocols:

- REST endpoints (HTTP/HTTPS): Simple, stateless, and cache-friendly, ideal for resource CRUD operations and broad compatibility.

- GraphQL endpoints: A single endpoint that accepts queries allowing clients to request exactly the fields they need; reduces overfetching but requires careful schema design and complexity control.

- WebSocket endpoints: Bidirectional, low-latency channels for streaming updates (market data, notifications). Useful when real-time throughput matters.

- Webhook endpoints: Server-to-server callbacks where your service exposes a publicly accessible endpoint to receive event notifications from another system.

Choosing a protocol depends on consistency requirements, latency tolerance, and client diversity. Hybrid architectures often combine REST for configuration and GraphQL/WebSocket for dynamic data.

Design best practices for robust API endpoints

Good endpoint design improves developer experience and system resilience. Follow these practical practices:

- Clear and consistent naming: Use predictable URI patterns and resource-oriented paths. Avoid action-based endpoints like /getUserData in favor of /users/{id}.

- Versioning: Expose versioned endpoints (e.g., /v1/users) to avoid breaking changes for consumers.

- Input validation: Validate payloads early and return explicit error codes and messages to guide client correction.

- Pagination and filtering: For list-heavy endpoints, require pagination tokens or limits to protect backend resources.

- Documentation and examples: Provide schema samples, curl examples, and expected response bodies to accelerate integration.

API schema tools (OpenAPI/Swagger, AsyncAPI) let you define endpoints, types, and contracts programmatically, enabling automated client generation, testing, and mock servers during development.

Security, rate limits, and monitoring

Endpoints are primary attack surfaces. Security and observability are critical:

- Authentication & Authorization: Prefer token-based schemes (OAuth2, JWT) with granular scopes. Enforce least privilege for each endpoint.

- Transport security: Enforce TLS, HSTS, and secure ciphers to protect data in transit.

- Rate limiting & quotas: Apply per-key and per-IP limits to mitigate abuse and preserve quality of service.

- Input sanitization: Prevent injection attacks by whitelisting allowed fields and escaping inputs.

- Observability: Emit structured logs, traces, and metrics per endpoint. Monitor latency percentiles, error rates, and traffic patterns to detect regressions early.

Operational tooling such as API gateways, service meshes, and managed API platforms provide built-in policy enforcement for security and rate limiting, reducing custom code complexity.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

What is the difference between an api endpoint and an API?

An API is the overall contract and set of capabilities a service exposes; an api endpoint is a specific network address (URI) where one of those capabilities is accessible. Think of the API as the menu and endpoints as the individual dishes.

How should I secure a public api endpoint?

Use HTTPS only, require authenticated tokens with appropriate scopes, implement rate limits and IP reputation checks, and validate all input. Employ monitoring to detect anomalous traffic patterns and rotate credentials periodically.

When should I version my endpoints?

Introduce explicit versioning when you plan to make breaking changes to request/response formats or behavior. Semantic versioning in the path (e.g., /v1/) is common and avoids forcing clients to adapt unexpectedly.

What are effective rate-limiting strategies?

Combine per-key quotas, sliding-window or token-bucket algorithms, and burst allowances. Communicate limits via response headers and provide clear error codes and retry-after values so clients can back off gracefully.

Which metrics should I monitor for endpoints?

Track request rate (RPS), error rate (4xx/5xx), latency percentiles (p50, p95, p99), and active connections for streaming endpoints. Correlate with upstream/downstream service metrics to identify root causes.

When is GraphQL preferable to REST for endpoints?

Choose GraphQL when clients require flexible field selection and you want to reduce overfetching. Prefer REST for simple resource CRUD patterns and when caching intermediaries are important. Consider team familiarity and tooling ecosystem as well.

Disclaimer

The information in this article is technical and educational in nature. It is not financial, legal, or investment advice. Implementations should be validated in your environment and reviewed for security and compliance obligations specific to your organization.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)