APIs Explained: How They Power Modern Apps

APIs (Application Programming Interfaces) are the invisible connectors that let software systems talk to each other. Whether you open a weather app, embed a payment form, or fetch crypto market data, APIs are doing the behind-the-scenes work. This guide explains what an API is, how APIs function, common types, practical use cases, and how to evaluate them securely and effectively.

What is an API?

An API is a defined set of rules and protocols that allows one software component to request services or data from another. Think of an API as a waiter in a restaurant: you (the client) request a dish, the waiter (the API) passes the order to the kitchen (the server), and then returns the prepared meal. APIs standardize interactions so developers can integrate external functionality without understanding internal implementation details.

How APIs Work: Basic Mechanics

At a technical level, most modern APIs use web protocols over HTTP/HTTPS. A client sends a request (GET, POST, PUT, DELETE) to a defined endpoint URL. The server processes the request, optionally interacts with databases or other services, and returns a response, often in JSON or XML format. Key components:

- Endpoint: The URL where the API listens for requests.

- Method: Defines the action (e.g., GET to read, POST to create).

- Headers: Metadata such as authentication tokens and content type.

- Payload: Data sent to the server (for POST/PUT).

- Response: Data returned by the server, with status codes like 200 (OK) or 404 (Not Found).

Types of APIs You’ll Encounter

APIs come in several architectural styles and transport patterns. Understanding differences helps pick the right integration model.

- REST APIs: Representational State Transfer is the most common style. REST uses standard HTTP methods and stateless requests, typically with JSON payloads. It’s simple and broadly supported.

- GraphQL: A query language that lets clients request exactly the fields they need. Useful for complex data models and reducing over-fetching.

- WebSocket APIs: Provide persistent two-way communication, enabling low-latency streaming—useful for live market feeds or chat applications.

- gRPC: A high-performance, binary RPC framework well suited for microservices and internal communication.

- Third-party and SDK APIs: Many platforms expose endpoints plus language-specific SDKs to simplify integration.

APIs in Crypto and AI: Practical Use Cases

In crypto and AI contexts, APIs are central to tooling and research workflows:

- Market data: Price, volume, order book snapshots and historical candles from exchanges or aggregators via REST or WebSocket.

- On-chain data: Blockchain explorers expose endpoints to query transactions, addresses, and contract state.

- Trading execution: Exchanges provide authenticated endpoints to place orders and manage positions.

- AI model inference: ML providers offer APIs to run models or pipelines without exposing underlying infrastructure.

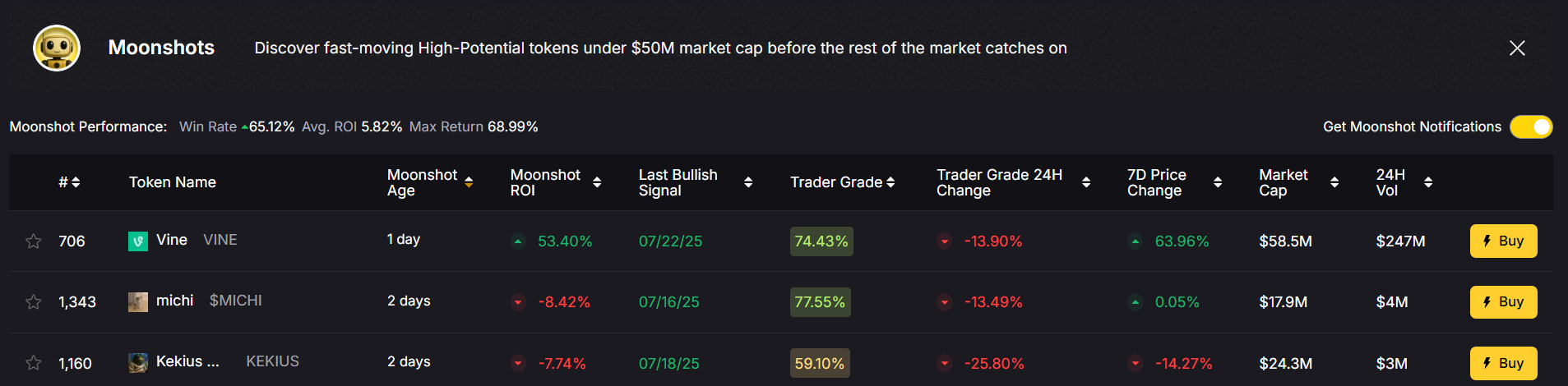

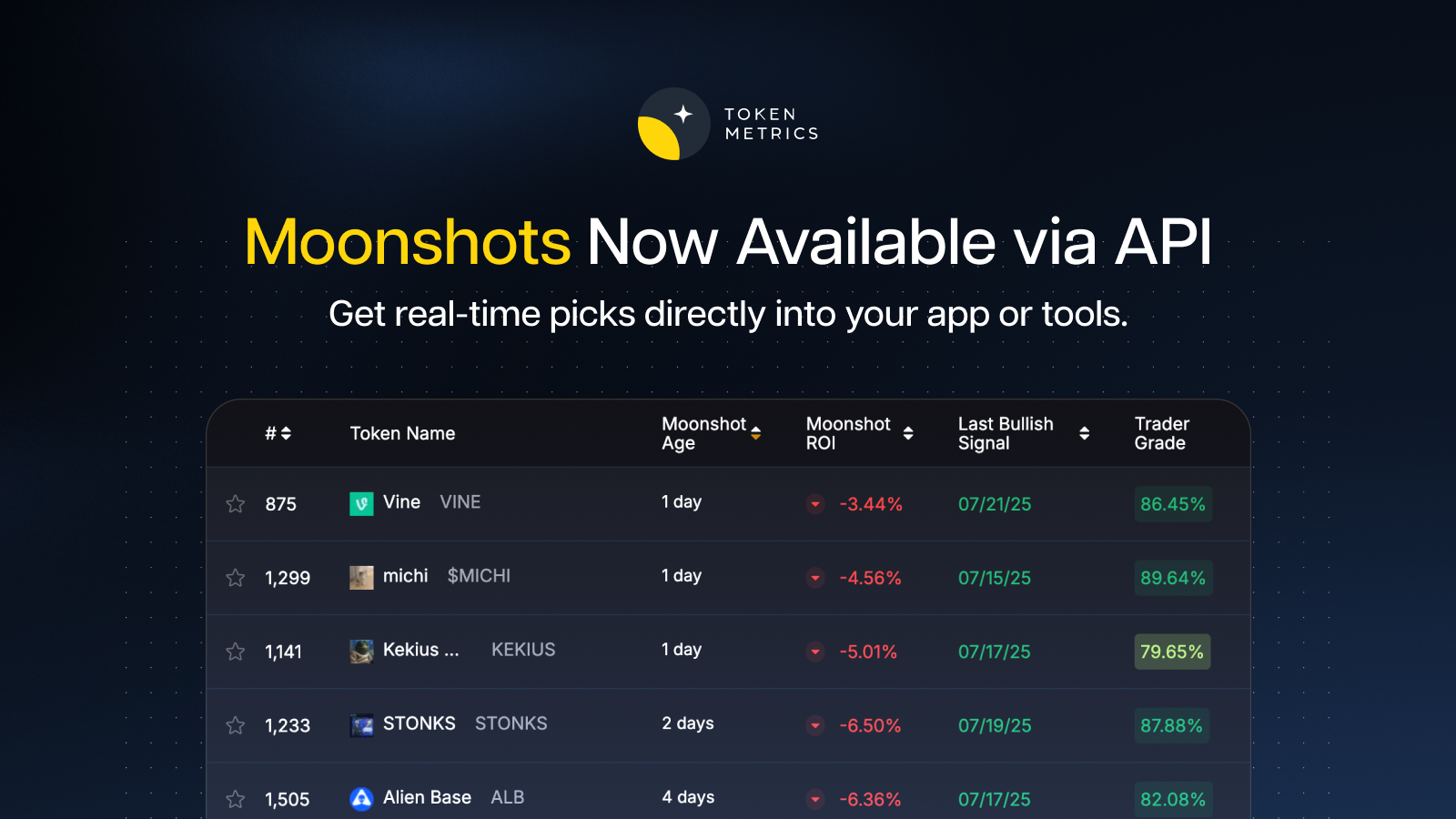

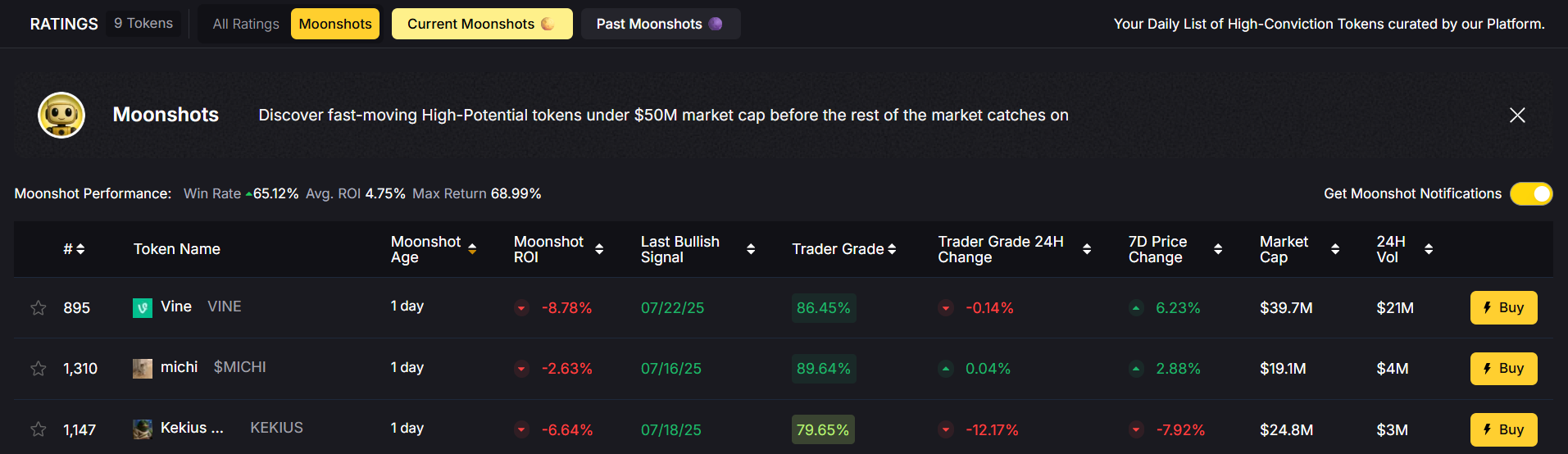

AI-driven research platforms and analytics services can combine multiple API feeds to produce indicators, signals, or summaries. Platforms like Token Metrics illustrate how aggregated datasets and models can be exposed via APIs to power decision-support tools.

Evaluating and Using APIs: A Practical Framework

Before integrating an API, apply a simple due-diligence framework:

- Documentation quality: Clear, versioned docs and examples reduce integration time and prevent unexpected behavior.

- Latency & throughput: Measure response times and rate limits to ensure they meet your application’s needs.

- Data coverage & freshness: Verify supported assets, historical depth, and update frequency—especially for time-sensitive use cases.

- Authentication & permissions: Check available auth methods (API keys, OAuth) and least-privilege controls.

- Reliability & SLAs: Look for uptime guarantees, status pages, and error handling patterns.

- Cost model: Understand free tiers, rate-limited endpoints, and pricing for higher throughput.

Security Best Practices for API Integrations

APIs introduce attack surfaces. Adopt defensive measures:

- Use HTTPS and verify certificates to prevent man-in-the-middle attacks.

- Store API keys securely (environment variables, secrets managers) and rotate them periodically.

- Implement rate limit handling and exponential backoff to avoid cascading failures.

- Limit permissions—use API keys scoped to necessary endpoints only.

- Monitor logs and set alerts for unusual patterns like spikes in failed requests.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

FAQ: What is an API?

Q: What is the simplest way to describe an API?

A: An API is an interface that defines how software components communicate—standardized requests and responses that let systems share data and functionality.

FAQ: How do API types differ?

Q: When should I use REST vs WebSocket or GraphQL?

A: REST is suitable for standard CRUD operations. WebSocket is appropriate for real-time bidirectional needs like live feeds. GraphQL is useful when clients need flexible queries to minimize data transfer.

FAQ: Are APIs secure to use?

Q: What are common API security concerns?

A: Major concerns include credential leakage, insufficient authorization, unencrypted transport, and abuse due to inadequate rate limiting. Following best practices reduces these risks.

FAQ: Can I build production apps with free APIs?

Q: Are free APIs viable for production?

A: Free tiers can be useful for prototypes and low-traffic apps, but evaluate limits, reliability, and support before relying on them for critical production workloads.

FAQ: How to choose the best API for my project?

Q: What factors matter most when selecting an API?

A: Prioritize data relevance, latency, reliability, documentation quality, security controls, and cost. Prototype early to validate assumptions about performance and coverage.

Disclaimer

This article is educational and informational only. It does not provide financial, legal, or investment advice. Evaluate tools and services independently and consult professionals where appropriate.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)