6 Best Hardware Wallets for Safe Crypto Storage

Crypto investments have seen a meteoric rise over the years, and as more people join the blockchain revolution, the security of one's assets has become paramount.

Hardware wallets, often dubbed "cold storage", provide a secure method to keep digital assets safe from cyber threats and that’s why when it comes to securing your crypto assets, choosing the right hardware wallet is crucial.

In this post, we’ll explore the 6 best hardware wallets in 2023 for safe crypto storage, ensuring your digital investments are well-protected.

What are Crypto Hardware Wallets?

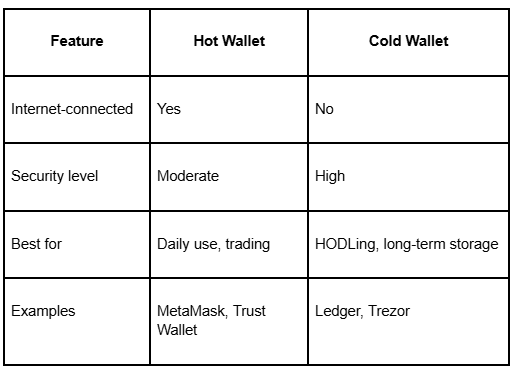

Hardware wallets, commonly known as "cold wallets," are physical devices designed to securely store cryptocurrency private keys offline. These tools protect assets from online threats like hacks and malware since they keep private keys isolated from internet-connected devices.

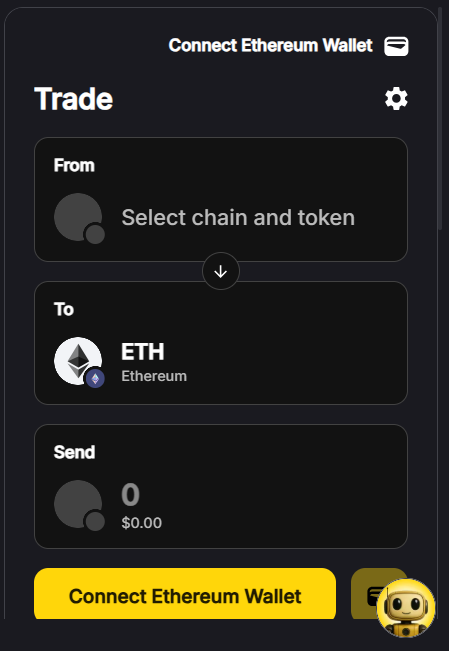

To execute a transaction, users connect their hardware wallet to a device, sign the transaction offline, ensuring utmost security, and then broadcast it online.

This method ensures the private keys remain inaccessible even if the connected device is compromised. As a result, hardware wallets are widely recognized as a top-tier security measure for crypto investors.

Things to Consider While Choosing Crypto Hardware Wallets

When selecting a crypto hardware wallet, several factors demand careful consideration.

1. Security features are paramount; ensure the wallet provides offline storage and employs advanced cryptographic techniques.

2. Evaluate its build quality—a sturdy construction can prevent physical tampering. User experience is crucial; the interface should be intuitive, with clear instructions and prompts.

3. Consider the range of supported cryptocurrencies—a broad spectrum can future-proof your investment.

4. Look into any associated software; it should offer seamless integration and regular updates.

5. Lastly, community reviews and feedback can offer real-world insights into the device's reliability and performance. By balancing these factors, users can confidently choose a wallet tailored to their needs.

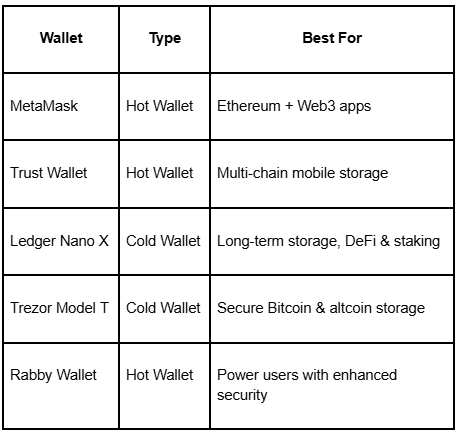

List of Top Hardware Wallets in 2023

As we navigate through 2023, an array of hardware wallets have emerged, each promising cutting-edge security and user-friendly interfaces.

These compact devices have become the bulwark against cyber threats, ensuring that one's digital treasure remains impervious to vulnerabilities.

But with an overwhelming number of options available, how does one discern the best from the rest?

Here's a curated list of top hardware wallets this year, offering a blend of robust security measures, extensive cryptocurrency support, and seamless user experience, designed to cater to both novices and seasoned crypto enthusiasts.

1. Ledger Nano X

The Ledger Nano X is a widely recognized and respected hardware wallet. It offers robust security features and supports over a thousand cryptocurrencies, providing not just safety but also versatility.

Key Features:

- Bluetooth functionality for easy connection to smartphone or computer.

- Compact and portable design.

- Backed up by a 24-word recovery phrase.

Why it stands out:

With its user-friendly interface and advanced security features, Ledger Nano X continues to be a popular choice for crypto enthusiasts.

Cost: $149 for Nano X (Check Latest Offers).

Cryptocurrencies supported: More than 5,500.

2. Trezor Model T

Trezor Model T is another top contender in the world of hardware wallets. It features a touchscreen interface and supports a broad range of cryptocurrencies.

Key Features:

- Touchscreen interface for easier use.

- Pin code and recovery seed for added security.

- Open-source software.

Why it stands out:

Trezor Model T's open-source software and extensive crypto support make it an excellent choice for those wanting additional security and functionality.

Cost: $213 for Model T (Check Latest Offers).

Cryptocurrencies supported: More than 1,000.

3. Coldcard Wallet

Coldcard Wallet is a Bitcoin-only wallet known for its high-level security features, making it an ideal choice for Bitcoin investors.

Key Features:

- Bitcoin-only wallet for dedicated investors.

- Secure element for keeping private keys safe.

- PIN and anti-phishing features.

Why it stands out:

If you are a dedicated Bitcoin investor, Coldcard’s Bitcoin-only focus and robust security features make it a top pick.

Cost: $157.94

Cryptocurrencies supported: Bitcoin-only wallet

4. KeepKey

KeepKey offers a straightforward user experience with essential security features, making it suitable for beginners in crypto investment.

Key Features:

- Large screen for easy operation.

- Simple interface, ideal for beginners.

- Backup and recovery options.

Why it stands out:

KeepKey's simplicity and essential security features make it an ideal choice for those new to cryptocurrency.

Cost: $130.

Cryptocurrencies supported: More than 7,000.

5. SafePal S1

SafePal S1 combines affordability with security, making it a desirable choice for budget-conscious crypto investors.

Key Features:

- Affordable without compromising security.

- Mobile compatibility for easy transactions.

- Multi-currency support.

Why it stands out:

For budget-conscious investors, SafePal S1 offers an affordable yet secure option for storing crypto.

Cost: $49.99 for basic hardware.

Cryptocurrencies supported: More than 30,000.

6. BitBox02

BitBox02 is a modern and streamlined hardware wallet offering high-quality security and ease of use.

Key Features:

Touch and OLED screen for easy navigation.

USB-C and A compatible.

Backup on microSD card.

Why it stands out:

BitBox02 offers modern features and a streamlined user experience for those wanting an up-to-date hardware wallet.

Cost: $149.

Cryptocurrencies supported: Around 1500.

Frequently Asked Questions

Q1. What's the difference between a hardware wallet and a software wallet?

A hardware wallet is a physical device that securely stores a user's private keys offline, while a software wallet is a digital application on a computer or smartphone that keeps keys typically online or in the device's memory.

Q2. How often should I update my hardware wallet's firmware?

Regularly updating the firmware ensures you benefit from the latest security patches and features. Always follow the manufacturer's recommendations and ensure updates come from official sources.

Q3. Can I store multiple cryptocurrencies on a single hardware wallet?

Yes, most modern hardware wallets support multiple cryptocurrencies. However, it's essential to check the supported coins list for your specific device model.

Q4. What happens if I lose my hardware wallet or it gets damaged?

If you've kept a backup of your recovery seed—a series of words given during the initial setup—you can restore your funds on a new device. Always store your recovery seed securely and offline.

Q5. Is it safe to buy a used hardware wallet?

It's generally recommended to purchase hardware wallets new and directly from the manufacturer or trusted retailers to prevent potential tampering.

Q6. How does a hardware wallet interface with blockchain networks if it's offline?

The wallet itself only signs transactions offline. To broadcast the transaction to the network, the signed transaction is sent through a connected device, ensuring private keys remain offline.

Q7. Are hardware wallets resistant to physical attacks?

Many modern hardware wallets come with tamper-proof features. However, physical security is always crucial. Ensure you store your device in a safe place, and always be wary of potential tampering if left unattended.

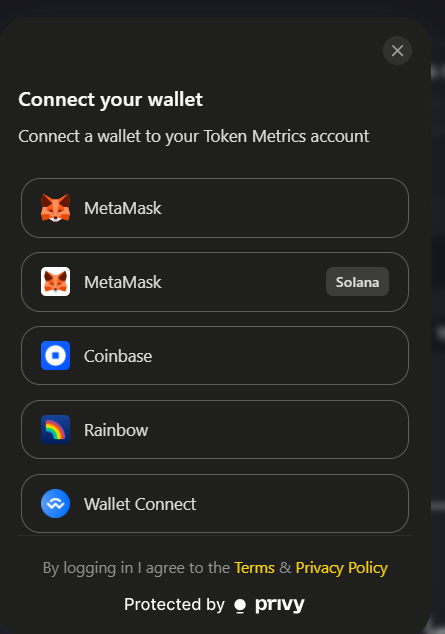

Q8. Can I use my hardware wallet with popular software wallets or exchanges?

Most renowned hardware wallets integrate with popular software wallets and exchange platforms, allowing users a seamless experience. Always check compatibility lists before making a purchase.

Conclusion

In 2023, these eight hardware wallets stand out for their unique features, security, and ease of use. Remember to consider your specific needs and requirements when choosing a hardware wallet for your crypto assets.

With the options listed above, you can ensure the safety and security of your investments, keeping your crypto assets protected against unauthorized access and potential threats.

Remember, while technology provides tools for security, the best protection is always awareness and education. Ensure you're up-to-date with best practices and always double-check transactions and addresses. Your crypto assets are valuable, and they deserve the highest level of care and protection.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

%201%20(1).png)

.svg)

.png)