10 Best Indicators for Crypto Trading and Analysis in 2024

Click here to buy Cryptocurrencies from Gate.io

Contact us at promo@tokenmetrics.com for marketing and sponsorship programs.

Your search for best crypto indicators to trade ends here. But before we start, let's briefly cover the overview of indicators.

Indicators are mathematical calculations based on the price and/or volume of an asset. They can be used to identify trends, measure volatility, and provide signals for trades.

With the help of indicators, traders can:

- Identify potential entry and exit points

- Track price movements and

- Create custom alerts to act fast

Trading View is one of the most popular platforms that offers a range of charting and analysis tools, or indicators, to help traders gain an edge in the cryptocurrency market.

Whether you are a beginner or an experienced trader, these crypto indicators can help you maximize your profits and minimize your risks.

By taking the time, one can understand how these crypto indicators work, and how you can set up your trading strategies to maximize profits accordingly.

That said, there are hundreds of pre-built indicators available, but sometimes you may want to create your own custom indicator to fit your specific crypto trading strategy.

Trading View Strategies

For Beginners - New crypto traders can benefit from the built-in trading strategies, which are readily available and are designed to help them identify trading opportunities.

For Experts - Experienced crypto traders can use Trading View to create their own trading strategies and take advantage of market trends on a deeper level.

Here at Token Metrics, we worked hard to create a Trading View Indicator that powers your trading decisions by removing emotions, saving time, and improving risk-adjusted returns.

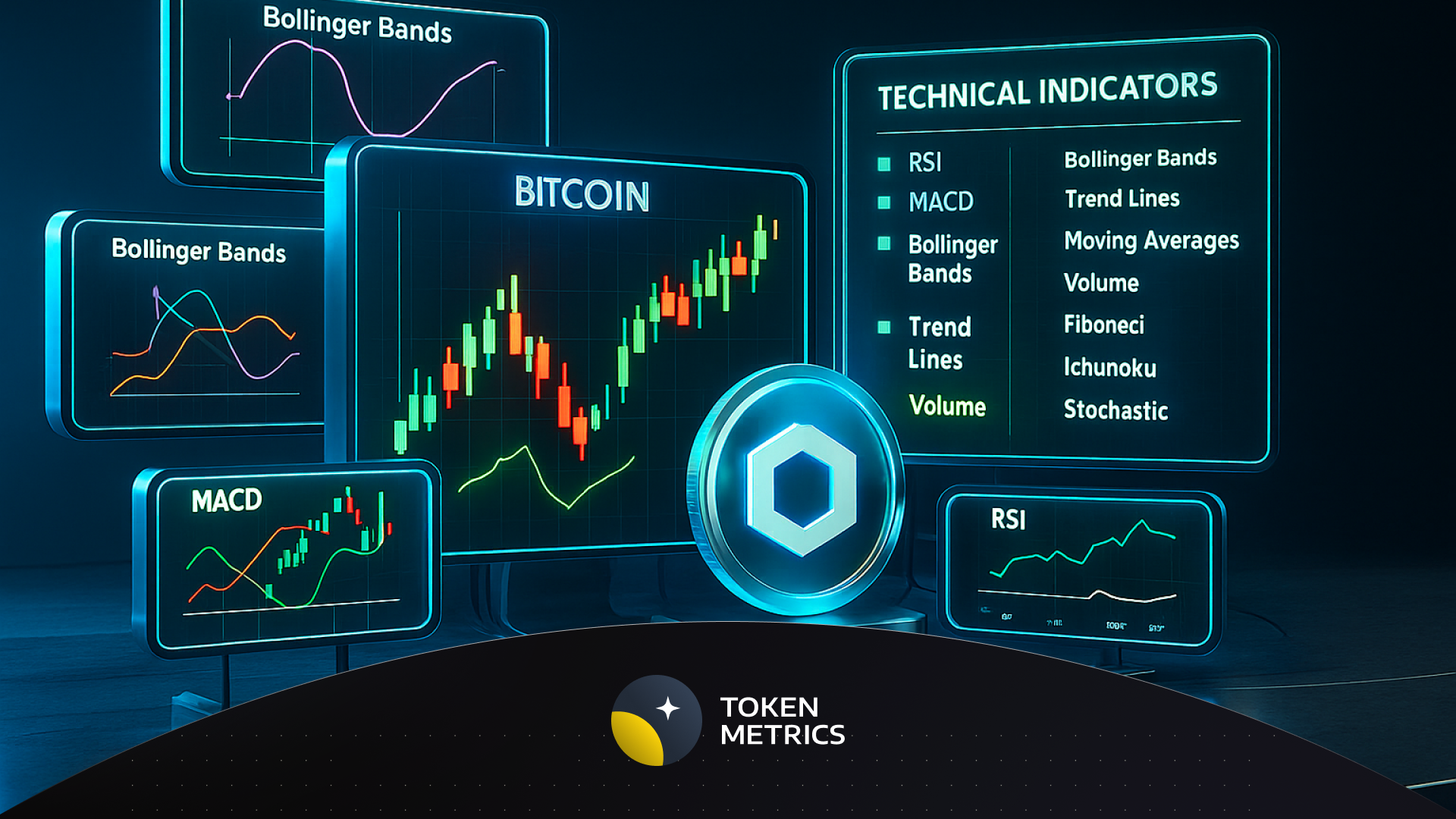

Top 10 Crypto Trading Indicators for 2024

If you are someone looking for the best crypto trading indicators to use this year, we did the research for you.

Here are top crypto indicators you can use today.

1. Moving Averages

A moving average is a simple yet effective indicator that helps smooth out price action by filtering out noise and highlighting the overall trend. There are various types of moving averages, including simple, exponential, and weighted, each with its own characteristics and uses.

This indicator uses the average price of the stock over a specified number of periods. It is an extremely popular technical analysis tool used to identify trend direction and forecast future price movements.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that uses the speed and direction of price movements to determine the health of an asset.

3. Bollinger Bands

Bollinger Bands are one of the most trusted indicators used by traders. It is a momentum indicator that uses standard deviation to determine the price trend. The indicator includes two lines: a moving average and a standard deviation band. The moving average line acts as a trend indicator. The standard deviation band acts as a volatility indicator.

4. On-Balance-Volume (OBV)

The OBV is a volume-based indicator that reflects the relationship between price and volume. It can be used to identify buying and selling pressure, as well as potential trend changes.

5. Ichimoku Cloud

The Ichimoku Cloud, also known as the Ichimoku Kinko Hyo, is a comprehensive technical analysis tool that includes several indicators, such as the kumo (cloud), senkou span (leading span), and kijun sen (baseline). It helps identify trend direction, strength, and potential areas of support and resistance in the market.

6. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that uses the difference between two moving averages to identify buying and selling opportunities. It is often used in conjunction with the MACD histogram, which helps visualize the relationship between the MACD line and the signal line.

Click here to buy Cryptocurrencies from Gate.io

7. Fibonacci Retracement

Based on the work of Leonardo Fibonacci, the Fibonacci retracement tool is used to identify potential support and resistance levels by plotting horizontal lines at key Fibonacci levels. It is often used in conjunction with trend lines and other technical indicators to confirm trade signals.

8. Stochastic Oscillator

The stochastic oscillator is a momentum indicator that uses the closing price of an asset to identify overbought and oversold conditions. It is often used in conjunction with the moving average to filter out the noise and improve the accuracy of the signal.

9. Aroon Indicator

The Aroon indicator is a trend-following tool that uses the time between the highest high and the lowest low to identify the trend direction and strength. It is often used in conjunction with other technical indicators to confirm trade signals.

10. On-Chain Metrics

On-chain metrics are data points that provide insights into the underlying health and activity of a cryptocurrency or token. Examples of on-chain metrics include network value to transaction ratio (NVT), miners' revenue, daily active addresses and more.

Conclusion:

There are many indicators to help you make more money when trading cryptocurrencies. But to be certain of the price movement of an asset, is is advised to use multiple indicators to find if they're all hinting at the same outcome.

This is why we worked hard to create our own Token Metrics Trading View Indicator that takes into account multiple factors to minimze risks and maximize potential returns.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Click here to buy Cryptocurrencies from Gate.io

Contact us at promo@tokenmetrics.com for marketing and sponsorship programs.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)