Best Crypto OTC Desks for Large Block Trades (2025)

Why OTC Crypto Desks Matter in September 2025

When you need to move size without moving the market, you use over-the-counter (OTC) trading. The best OTC desks for large block trades aggregate deep, private liquidity, offer quote certainty (via RFQ), and settle securely—often with high-touch coverage. In one sentence: an OTC crypto desk privately matches large buyers and sellers off-exchange to reduce slippage and information leakage. This guide is for funds, treasuries, family offices, market makers, and whales who want discretion, fast settlement, and reliable pricing in 2025. We compared global OTC providers on liquidity depth, security posture, coverage, costs, UX, and support, and selected 10 standouts. Expect clear use-case picks, region notes, and a simple checklist so you can choose faster.

How We Picked (Methodology & Scoring)

- Liquidity (30%): Can they consistently quote and fill blocks across majors, stables, and liquid alts? Internalization, networked venues, and RFQ performance matter most.

- Security (25%): Regulatory status/registrations where applicable, segregation/custody design, operational controls, and incident track record.

- Market Coverage (15%): Spot + (when offered) options/forwards, fiat rails, and breadth of supported assets.

- Costs (15%): Explicit desk fees, spreads, settlement costs, and financing.

- UX (10%): RFQ tooling/eOTC portals, API access, reporting.

- Support (5%): 24/7 desk coverage, onboarding speed, account management.

Data sources: official product/docs and institutional pages; security/transparency pages; and widely cited market datasets only for cross-checks (we do not link third-party sources in body). Last updated September 2025.

Top 10 OTC Crypto Trading Desks in September 2025

1. Coinbase Institutional — Best for U.S.-regulated agency execution

- Why Use It: Coinbase Prime combines custody, financing, and execution with Coinbase Execution Services (high-touch, agency-only). You get access to Coinbase Exchange liquidity plus external venues, with desk support for complex orders. Strong brand, strong controls, and U.S. regulatory footprint.

- Best For: U.S. funds, corporates, RIAs, and institutions needing regulated workflows.

- Notable Features: Prime brokerage + custody, agency execution desk, 240+ assets access, multi-venue routing.

- Consider If: You want agency execution and deep U.S. coverage (not principal risk transfer).

- Regions: Global; strong U.S./EU presence (eligibility varies).

- Fees Notes: Pricing depends on product/tier; agency execution spreads/fees apply.

- Alternatives: Kraken OTC, Galaxy Digital.

2. Kraken OTC — Best 24/7 RFQ coverage with derivatives options

- Why Use It: High-touch OTC for spot, plus an OTC Derivatives offering (options/structured products) and 24/7/365 coverage. The desk is built for discretion and deeper liquidity with competitive settlement.

- Best For: Funds seeking large spot blocks and optional custom derivatives.

- Notable Features: Chat/RFQ workflow, options/structured products, private settlement, institutional onboarding.

- Consider If: You want around-the-clock coverage and occasional options blocks.

- Regions: Global; availability varies by jurisdiction.

- Fees Notes: RFQ-based; fees/spreads depend on product and size.

- Alternatives: Coinbase Institutional, B2C2.

3. Binance OTC & Execution Solutions — Best global liquidity at scale (non-U.S.)

- Why Use It: For non-U.S. institutions, Binance’s OTC platform offers spot block trades, algos, and options RFQs—tapping one of the deepest liquidity networks. Fast pricing via RFQ and robust portal access.

- Best For: Global funds, prop firms, market makers outside the U.S.

- Notable Features: Spot block RFQ, algo orders, options RFQ, API access.

- Consider If: You’re not a U.S. person; U.S. residents should use Binance.US OTC.

- Regions: Global (ex-US); regional eligibility and KYC apply.

- Fees Notes: RFQ-based; programmatic pricing for VIP tiers.

- Alternatives: OKX Liquid Marketplace, Wintermute.

4. OKX Liquid Marketplace — Best for block trading tools and RFQ hub

- Why Use It: A purpose-built block trading/RFQ venue with minimum asset requirements and education around block execution. Effective for discreet fills, multi-leg structures, and streaming quotes from LPs.

- Best For: Non-U.S. institutions needing self-serve block tools.

- Notable Features: Block/RFQ portal, minimum asset threshold, docs & tutorials, multi-asset coverage.

- Consider If: U.S. access is limited; check the OKX U.S. site for constraints.

- Regions: Global (varies); limited U.S. functionality.

- Fees Notes: RFQ spreads; venue-specific fees may apply.

- Alternatives: Binance OTC, Bybit Block Trading (alt).

5. Bitstamp Institutional OTC — Best for fiat rails + time-tested venue

- Why Use It: A long-running exchange with strong fiat on/off-ramps and an institutional OTC workflow led by account managers. Good for conservative treasuries that prioritize settlement reliability.

- Best For: Corporates, treasuries, conservative funds wanting robust fiat access.

- Notable Features: Bespoke OTC service, flexible execution, institutional coverage, multi-jurisdiction licenses.

- Consider If: You want a seasoned, fiat-friendly counterparty over maximum token breadth.

- Regions: Global (eligibility varies by entity); U.S./EU presence.

- Fees Notes: RFQ-based; program pricing with account manager.

- Alternatives: Coinbase Institutional, Gemini eOTC (alt).

6. Cumberland (DRW) — Best principal liquidity for blocks and bespoke risk transfer

- Why Use It: A pioneer OTC liquidity provider offering spot, listed derivatives blocks, and bilateral options—designed for size and custom risk transfer. Suits funds that want a direct principal counterparty.

- Best For: Hedge funds, market makers, HNW desks needing principal risk warehousing.

- Notable Features: Institutional OTC in dozens of assets, no pre-funding for eligible clients, bilateral options, listed blocks.

- Consider If: You prefer direct LP quotes vs. agency brokers.

- Regions: Global (KYC/eligibility apply).

- Fees Notes: Embedded in spread; bespoke terms by relationship.

- Alternatives: B2C2, Wintermute.

7. B2C2 — Best all-in-one OTC LP (spot + CFDs/NDFs/options)

- Why Use It: A crypto-native LP trusted by institutions globally, with OTC spot plus institutional-grade derivatives (CFDs, options, NDFs). API/GUI access and tailored settlement make it versatile for funds.

- Best For: Funds needing flexible products and global coverage.

- Notable Features: OTC spot streaming, CFD/options/NDFs, tailored settlement, API + GUI.

- Consider If: You want one counterparty for both spot and derivatives.

- Regions: Global (eligibility varies).

- Fees Notes: Spread-based; relationship-driven terms.

- Alternatives: Cumberland, Galaxy.

8. FalconX — Best prime brokerage + OTC under one roof

- Why Use It: A leading institutional prime broker with 24/7 electronic and OTC trading, deep pooled liquidity, and financing. Strong for programmatic execution plus high-touch blocks through one relationship.

- Best For: Quant funds, treasuries, crossover firms wanting prime + OTC.

- Notable Features: Unified liquidity pool, eTrading + OTC desk, financing, 400+ tokens access (restrictions may apply)

- Consider If: You want consolidated services (execution + financing).

- Regions: Global (KYC/eligibility apply).

- Fees Notes: Spread/financing; custom terms by volume.

- Alternatives: Coinbase Prime, Galaxy.

9. Wintermute OTC — Best for fast pricing across many assets

- Why Use It: Algorithmic market maker offering OTC liquidity across spot, options, forwards, and tailored structures—useful when you need instantaneous, competitive quotes on long-tail assets as well as majors.

- Best For: Funds trading majors and select alts with principal LP quotes.

- Notable Features: OTC across spot/derivs, broad asset list, tailored products, institutional coverage.

- Consider If: You value speed and asset breadth with a principal LP.

- Regions: Global (eligibility applies).

- Fees Notes: Spread-based; relationship pricing.

- Alternatives: B2C2, Cumberland.

10. Galaxy Global Markets — Best for high-touch blocks + OTC derivatives at scale

- Why Use It: Galaxy runs a large OTC operation with electronic trading, block risk transfer, and bespoke derivatives (options/forwards/swaps). Good fit for institutions that want principal liquidity plus broader institutional services.

- Best For: Hedge funds, crossover managers, corporates needing tailored blocks.

- Notable Features: OTC/eTrading, derivatives suite, warehouse risk capacity, institutional coverage.

- Consider If: You want a multi-product institutional counterparty.

- Regions: Global (KYC/eligibility apply).

- Fees Notes: Spread/derivatives pricing by mandate.

- Alternatives: Kraken OTC, FalconX.

Decision Guide: Best By Use Case

- Regulated U.S. + agency execution: Coinbase Institutional.

- 24/7 coverage with options: Kraken OTC.

- Maximum global liquidity (non-U.S.): Binance OTC & Execution Solutions.

- Self-serve block/RFQ portal: OKX Liquid Marketplace.

- Fiat rails for treasuries: Bitstamp Institutional OTC.

- Principal liquidity for size: Cumberland

- Spot + derivatives in one LP: B2C2

- Prime + OTC under one roof: FalconX.

- Fast quotes on many assets: Wintermute.

- Blocks + derivatives at scale: Galaxy Global Markets

How to Choose the Right Crypto OTC Desk (Checklist)

- Region & eligibility: Confirm entity onboarding (U.S./EU/APAC) and product permissions.

- Liquidity fit: Can they quote your typical size across your pairs—majors, stables, alts?

- Custody & settlement: How are assets custodied/segregated? Fiat rails? Settlement windows?

- Execution style: Agency vs. principal. RFQ portal vs. chat. Derivatives availability.

- Costs: Ask for sample RFQs; compare spreads, borrow/financing, and any desk fees.

- Ops & reporting: Settlement netting, T+ timing, confirmations, and post-trade reports.

- Support: 24/7 coverage, dedicated manager, escalation paths.

- Red flags: Vague KYC/AML, unclear settlement instructions, or “too good” pricing without documentation.

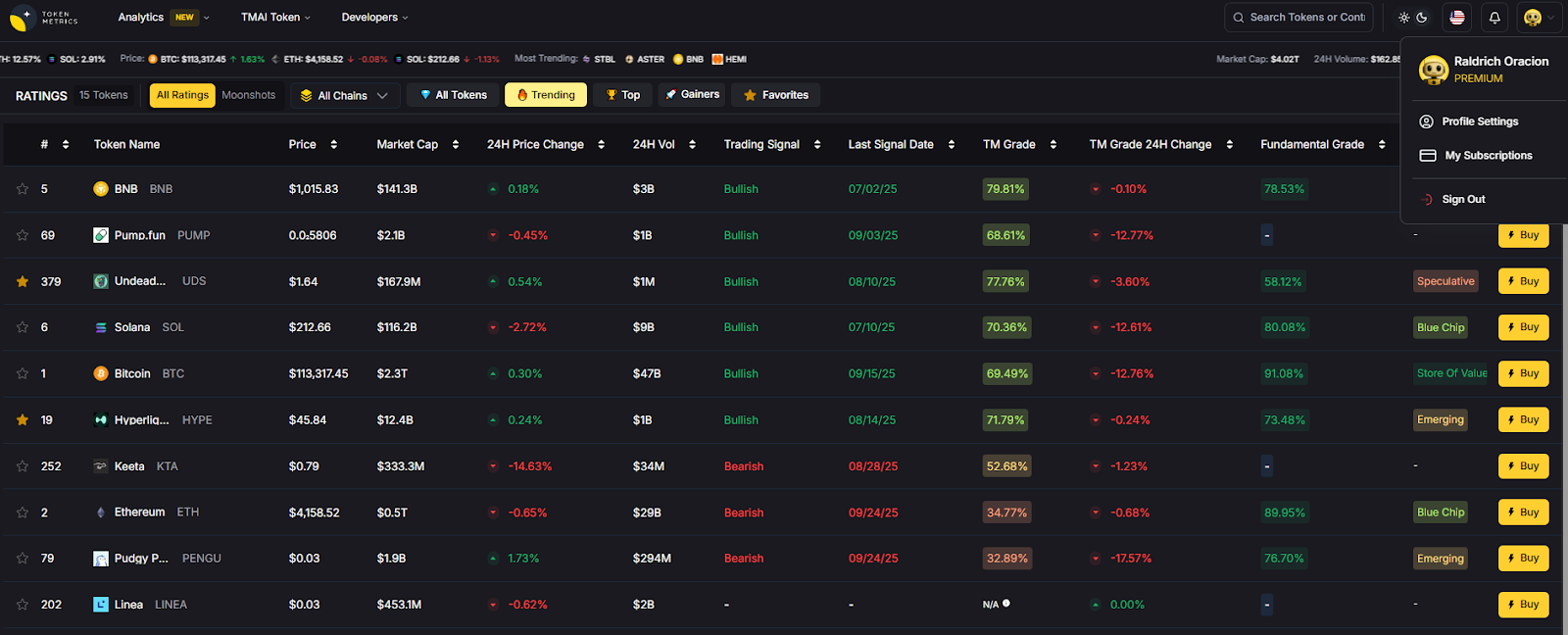

Use Token Metrics With Any Crypto OTC Desk

- AI Ratings to screen narratives and risk across assets before you request quotes.

- Narrative Detection to spot momentum shifts that affect liquidity and spreads.

- Portfolio Optimization to size positions and hedge exposures you’ll execute via OTC.

- Alerts/Signals to monitor entries/exits and rebalance post-trade.

Workflow: Research in Token Metrics → Shortlist assets → Request OTC RFQs/execute → Monitor with Alerts.

Security & Compliance Tips

- Enable strong 2FA and restrict desk communications to verified channels.

- Use segregated, labeled wallets for OTC settlement; test small first.

- Complete KYC/AML early; pre-clear signers/wallets to speed settlement.

- Confirm settlement instructions and reference fields to avoid misposts.

- For derivatives, document payoff, margining, and close-out mechanics.

This article is for research/education, not financial advice.

Beginner Mistakes to Avoid

- Relying on one counterparty without backups during volatile windows.

- Forgetting to confirm net vs. gross settlement amounts and deadlines.

- Ignoring custody/withdrawal timelines when planning fiat legs.

- Requesting quotes on illiquid alts without warning—expect wide spreads.

- Disclosing sensitive trade info over unsecured channels.

FAQs

What is an OTC crypto desk?

An OTC desk privately matches large buyers and sellers off public order books to minimize slippage and information leakage. Trades are negotiated via RFQ and settled bilaterally or through an exchange affiliate.

How big is a “block trade” in crypto?

It varies by desk and asset. Many desks treat six-figure USD notional as a starting point; some exchange-affiliated desks list thresholds or minimum asset requirements in portals.

Do U.S. clients have fewer options?

U.S. institutions often prefer regulated venues and agency models (e.g., Coinbase Institutional, Kraken). Some global platforms are limited for U.S. persons; check eligibility before onboarding.

What fees should I expect?

Most OTC pricing is embedded in the spread. Some venues disclose desk or user-to-user OTC fees (e.g., Bitfinex lists 0.1% for certain OTC flows); always request example RFQs.

Is OTC safer than exchanging on-book?

Neither is inherently “safer.” OTC can reduce market impact and information leakage, but you still need strong KYC/custody, verified comms, and clear settlement procedures.

Conclusion + Related Reads

If you’re a U.S.-regulated fund that values agency execution, start with Coinbase Institutional or Kraken. If you need global, principal liquidity and breadth, look at Binance OTC, OKX, Cumberland, B2C2, Wintermute, FalconX, or Galaxy. Match the desk to your region, execution style (agency vs. principal), and settlement needs, then run trial quotes before you scale.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)