Bitcoin Bubble - Analysis on Facts, Myths and Predictions

Bitcoin, the pioneer of cryptocurrencies, has seen its fair share of praise, skepticism, booms, and busts. Given its volatile history, many critics have labeled it a "bubble" comparable to historical economic bubbles.

In this detailed analysis, we'll delve deep into understanding whether Bitcoin is indeed in a bubble, debunking common myths, and offering predictions on its future trajectory.

What is the Crypto Bubble?

A bubble, in economic terms, describes a situation where the price of an asset significantly exceeds its inherent value due to exaggerated market expectations and irrational exuberance.

In the world of cryptocurrencies, the term "crypto bubble" often surfaces when there's a rapid and unfounded surge in a coin's price.

This overvaluation can be propelled by speculative trading, media hype, or FOMO (Fear Of Missing Out) among investors. However, it's essential to differentiate between short-term volatility and a genuine bubble.

The former is a common feature in emerging markets, while the latter indicates a severe and often unsustainable misalignment between price and value.

Is there a Bitcoin Bubble?

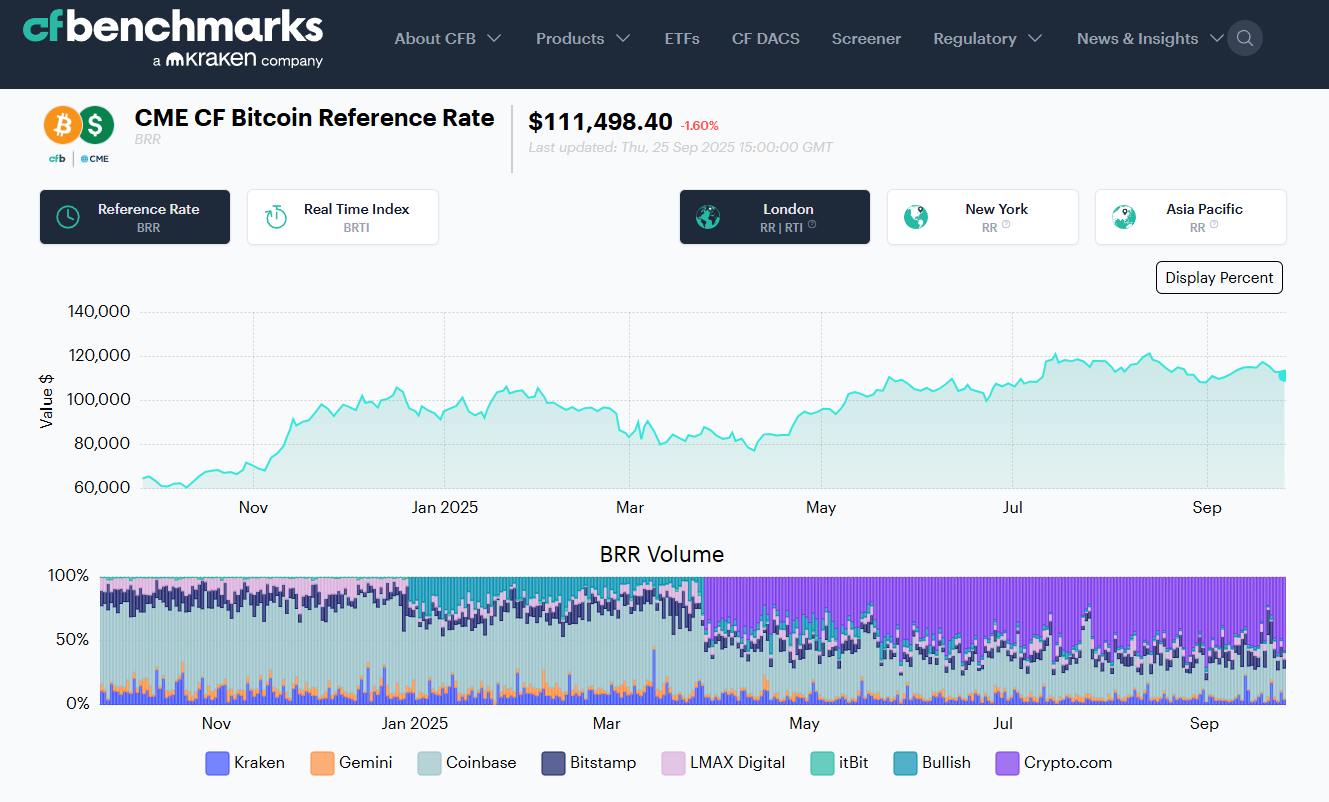

The question of whether Bitcoin is in a bubble has been a recurring theme since its inception. Historically, Bitcoin has witnessed dramatic price rises followed by sharp corrections, mirroring typical bubble patterns and to analyze Bitcoin's bubble nature, one must first grasp its price history.

2009 to 2011: From its inception in 2009, Bitcoin remained virtually worthless until 2011 when it reached $1.

2013 Peaks: Bitcoin first touched $1,000 in late 2013, followed by a decline, which led many to believe it was a bubble.

2017 Boom & Bust: Arguably the most famous rise and fall, Bitcoin reached nearly $20,000 by the end of 2017, only to slump down to $3,000 in 2018.

2021 Onwards: With institutional adoption and broader acceptance, Bitcoin surpassed $60,000 in 2021. Its movements since then have been indicative of its evolving role in global finance and currently(October 2023) BTC trading at around $27,467.

Advocates highlight its revolutionary blockchain technology, finite supply, and growing mainstream acceptance as indicators of its genuine value.

Meanwhile, skeptics point to speculative trading, potential regulatory crackdowns, and technological barriers as signs of an inflated market.

Is Bitcoin Overvalued?

As of 2023, the valuation of Bitcoin remains a widely debated topic among experts, analysts, and investors. Several factors like Bitcoin's limited supply and increasing demand could justify its current price point.

Additionally, rising institutional adoption, technological advancements in the blockchain sector, and Bitcoin's growing reputation as 'digital gold' lend credibility to its present valuation.

However, detractors argue that regulatory uncertainties, environmental concerns, and competition from emerging digital currencies could pose challenges.

While its intrinsic value remains hard to pinpoint, the divergence in opinions underscores the importance of thorough research and risk assessment before investment decisions.

Bitcoin Facts and Myths

1. Myth: Bitcoin is Merely Speculative. While there is speculation in the crypto market, Bitcoin's adoption as a store of value and its growing utility in the financial ecosystem adds tangible value.

Fact: Bitcoin Has Underlying Value. Unlike traditional bubbles, like the tulip mania where tulips had no underlying value, Bitcoin is backed by blockchain technology, limited supply, and decentralized security features.

2. Myth: Bitcoin Will Go to Zero. The decentralized nature, combined with its adoption and technological backing, makes it highly improbable for Bitcoin to be worthless.

Fact: Volatility Doesn't Mean Bubble. All assets, especially in their early stages, experience volatility. Bitcoin's price swings are a result of its nascent stage, not necessarily indicative of a bubble.

Expert Opinions and Analysis

Not all experts agree on the bubble narrative:

Warren Buffett: The Oracle of Omaha has repeatedly voiced skepticism, likening Bitcoin to "rat poison squared."

Michael Saylor: The CEO of MicroStrategy, on the other hand, sees Bitcoin as "digital gold" and a store of value for the future.

Objective data analysis shows that while Bitcoin exhibits bubble-like behavior at times, its long-term trajectory has been upward, suggesting adoption, halving events and inherent value.

Bitcoin Future Potential and Predictions

Short-Term Volatility: As with any asset, there will be short-term volatility influenced by market sentiment, regulatory news, and macroeconomic factors.

Institutional Adoption: Major financial players have begun integrating Bitcoin into their portfolios, signaling a shift towards mainstream acceptance.

Jack Dorsey, Twitter's founder and CEO of Block, places immense importance on Bitcoin, emphasizing its significance over other cryptocurrencies. He voiced this sentiment at a 2021 conference.

Similarly, Marc Andreessen, known for pioneering the modern internet browser and supporting startups like Airbnb and Facebook, has long advocated for Bitcoin. His firm, Andreessen Horowitz, funds numerous crypto endeavors, including Coinbase.

Tech Innovations: With the evolution of layer-2 solutions and other technological advances, Bitcoin's utility and scalability are set to improve, potentially driving further adoption.

Regulatory Climate: A significant factor remains the stance of global regulators. Positive regulation can bolster Bitcoin's position, while stringent measures could impact its growth.

Frequently Asked Questions

Q1. What causes the price of Bitcoin to fluctuate so frequently?

Bitcoin's price volatility can be attributed to several factors, including market demand, media influence, regulatory news, and macroeconomic indicators.

Q2. How does Bitcoin's limited supply impact its value?

Bitcoin has a cap of 21 million coins. This limited supply, combined with increasing demand, can lead to scarcity, potentially driving its price up.

Q3. Are there any real-world applications for Bitcoin beyond being a store of value?

Yes, Bitcoin is used for remittances, online transactions, and is being integrated into traditional financial systems and payment gateways.

Q4. What role do institutional investors play in Bitcoin's valuation?

Institutional investors can bring significant capital, credibility, and mainstream acceptance, potentially influencing Bitcoin's price stability and growth.

Q5. How do global regulations impact Bitcoin's value and adoption?

Regulations can provide clarity, security, and legitimacy to Bitcoin transactions. However, stringent regulations can limit adoption or drive it to more crypto-friendly jurisdictions.

Q6. What differentiates Bitcoin from other cryptocurrencies like Ethereum or Ripple?

While all cryptocurrencies operate on blockchain technology, Bitcoin primarily serves as a store of value or "digital gold," whereas others, like Ethereum, offer platforms for decentralized applications.

Q7. How does Bitcoin's energy consumption impact its sustainability and value?

Bitcoin mining is energy-intensive, leading to environmental concerns. This can influence its public perception, adoption rate, and in turn, its value. Solutions like renewable energy sources for mining are being explored to mitigate these concerns.

Conclusion

Labeling Bitcoin as a bubble is an oversimplified view of a complex digital asset. While it has experienced bubble-like behaviors in the past, its underlying value, growing adoption, and technological advances paint a different picture.

As always, potential investors should do their research, understand the risks, and consider their financial positions before diving into the world of Bitcoin.

By understanding the facts, debunking myths, and staying updated with the latest in the crypto world, investors can make informed decisions and navigate the Bitcoin journey more confidently. Remember, in the crypto world, knowledge is power.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)