Bitcoin Cash Price Prediction 2028: Payment-Focused Layer 1 Analysis

Market Context for Bitcoin Cash Price Prediction: The Case for 2028

The Layer 1 landscape is consolidating as users and developers gravitate to chains with clear specialization. Bitcoin Cash positions itself as a payment-focused chain with low fees and quick settlement for everyday usage.

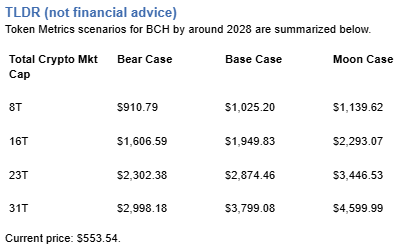

The Bitcoin Cash price prediction scenario projections below map potential outcomes for BCH across different total crypto market sizes. Base cases assume steady usage and listings, while moon scenarios factor in stronger liquidity and accelerated adoption. Our comprehensive price prediction framework provides investors with data-driven forecasts for strategic decision-making.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to Read This BCH Price Prediction

Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics lead metric for Bitcoin Cash, cashtag $BCH, is a TM Grade of 54.81%, which translates to Neutral, and the trading signal is bearish, indicating short-term downward momentum. This implies Token Metrics views $BCH as mixed value long term in our price prediction models: fundamentals look strong, while valuation and technology scores are weak, so upside depends on improvements in adoption or technical development. Market context: Bitcoin has been setting market direction, and with broader risk-off moves altcoins face pressure, which increases downside risk for $BCH in the near term.

Live details:

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Key Takeaways: Bitcoin Cash Price Prediction Summary

- Scenario driven: Price prediction outcomes hinge on total crypto market cap; higher liquidity and adoption lift the bands

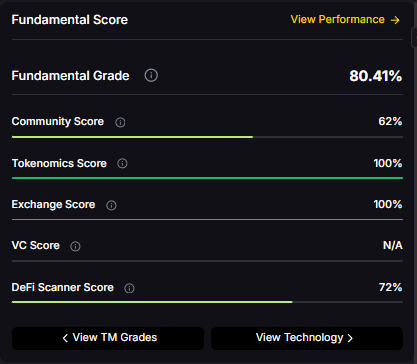

- Fundamentals: Fundamental Grade 80.41% (Community 62%, Tokenomics 100%, Exchange 100%, VC —, DeFi Scanner 72%)

- Technology: Technology Grade 29.63% (Activity 22%, Repository 70%, Collaboration 48%, Security —, DeFi Scanner 72%)

- TM Agent gist: Neutral grade, bearish momentum in price prediction models; adoption must improve for upside

- Education only, not financial advice

Bitcoin Cash Price Prediction Scenario Analysis

Token Metrics price prediction scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T Market Cap - BCH Price Prediction:

At an 8 trillion total crypto market cap, BCH price prediction projects to $910.79 in bear conditions, $1,025.20 in the base case, and $1,139.62 in bullish scenarios.

16T Market Cap - BCH Price Prediction:

Doubling the market to 16 trillion expands the price prediction range to $1,606.59 (bear), $1,949.83 (base), and $2,293.07 (moon).

23T Market Cap - BCH Price Prediction:

At 23 trillion, the price prediction scenarios show $2,302.38, $2,874.46, and $3,446.53 respectively.

31T Market Cap - BCH Price Prediction:

In the maximum liquidity scenario of 31 trillion, BCH price predictions could reach $2,998.18 (bear), $3,799.08 (base), or $4,599.99 (moon).

Each tier in our price prediction framework assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Why Consider the Indices with Top-100 Exposure

Bitcoin Cash represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle BCH with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

What Is Bitcoin Cash?

Bitcoin Cash is a peer-to-peer electronic cash network focused on fast confirmation and low fees. It launched in 2017 as a hard fork of Bitcoin with larger block capacity to prioritize payments. The chain secures value transfers using proof of work and aims to keep everyday transactions affordable.

BCH is used to pay transaction fees and settle transfers, and it is widely listed across major exchanges. Adoption centers on payments, micropayments, and remittances where low fees matter. It competes as a payment‑focused Layer 1 within the broader crypto market.

Token Metrics AI Analysis

Token Metrics AI provides comprehensive context on Bitcoin Cash's positioning and challenges, informing our price prediction models:

Vision: Bitcoin Cash (BCH) is a cryptocurrency that emerged from a 2017 hard fork of Bitcoin, aiming to function as a peer-to-peer electronic cash system with faster transactions and lower fees. It is known for prioritizing on-chain scalability by increasing block sizes, allowing more transactions per block compared to Bitcoin. This design choice supports its use in everyday payments, appealing to users seeking a digital cash alternative. Adoption has been driven by its utility in micropayments and remittances, particularly in regions with limited banking infrastructure. However, Bitcoin Cash faces challenges including lower network security due to reduced mining hash rate compared to Bitcoin, and ongoing competition from both Bitcoin and other scalable blockchains. Its value proposition centers on accessibility and transaction efficiency, but it operates in a crowded space with evolving technological and regulatory risks.

Problem: The project addresses scalability limitations in Bitcoin, where rising transaction fees and slow confirmation times hinder its use for small, frequent payments. As Bitcoin evolved into a store of value, a gap emerged for a blockchain-based currency optimized for fast, low-cost transactions accessible to the general public.

Solution: Bitcoin Cash increases block size limits from 1 MB to 32 MB, enabling more transactions per block and reducing congestion. This on-chain scaling approach allows for faster confirmations and lower fees, making microtransactions feasible. The network supports basic smart contract functionality and replay protection, maintaining compatibility with Bitcoin's core architecture while prioritizing payment utility.

Market Analysis: Bitcoin Cash operates in the digital currency segment, competing with Bitcoin, Litecoin, and stablecoins for use in payments and remittances. While not the market leader, it occupies a niche focused on on-chain scalability for transactional use. Its adoption is influenced by merchant acceptance, exchange liquidity, and narratives around digital cash. Key risks include competition from layer-2 solutions on other blockchains, regulatory scrutiny of cryptocurrencies, and lower developer and miner activity compared to larger networks. Price movements are often tied to broader crypto market trends and internal protocol developments. Despite its established presence, long-term growth depends on sustained utility, network security, and differentiation in a market increasingly dominated by high-throughput smart contract platforms—all critical factors in our price prediction analysis.

Fundamental and Technology Snapshot from Token Metrics

Fundamental Grade: 80.41% (Community 62%, Tokenomics 100%, Exchange 100%, VC —, DeFi Scanner 72%).

Technology Grade: 29.63% (Activity 22%, Repository 70%, Collaboration 48%, Security —, DeFi Scanner 72%).

Catalysts That Skew BCH Price Predictions Bullish

- Institutional and retail access expands with ETFs, listings, and integrations

- Macro tailwinds from lower real rates and improving liquidity

- Product or roadmap milestones such as upgrades, scaling, or partnerships

- Increased merchant adoption for payment processing

- Growing adoption in remittance corridors and emerging markets

- Layer-2 development enhancing BCH utility

Risks That Skew BCH Price Predictions Bearish

- Macro risk-off from tightening or liquidity shocks

- Regulatory actions targeting payment cryptocurrencies or infrastructure outages

- Concentration risk in validator economics and competitive displacement

- Low technology grade (29.63%) indicating development challenges

- Competition from Bitcoin Lightning Network and other payment solutions

- Declining developer activity and network effect

Bitcoin Cash Price Prediction FAQs

Can BCH reach $3,000?

Yes. Based on our price prediction scenarios, BCH could reach $3,000 in the 23T moon case and 31T base case. The 23T tier projects $3,446.53 in the moon case, making $3,000 an achievable target under favorable market conditions. Not financial advice.

Can BCH 10x from current levels?

At current price of $553.54, a 10x would reach $5,535.40. This falls beyond our highest price prediction scenario of $4,599.99 (31T moon case). Bear in mind that 10x returns would require substantial market cap expansion beyond our modeled scenarios and exceptional BCH adoption. Not financial advice.

Should I buy BCH now or wait?

Timing depends on your risk tolerance and macro outlook. Current price of $553.54 sits below the 8T bear case in our price prediction scenarios. The Neutral TM Grade (54.81%) and bearish trading signal suggest caution in the near term. Dollar-cost averaging may reduce timing risk. Not financial advice.

What is the Bitcoin Cash price prediction for 2025-2028?

Our comprehensive BCH price prediction framework suggests Bitcoin Cash could trade between $910.79 and $4,599.99 depending on market conditions and total crypto market capitalization. The base case price prediction scenario clusters around $1,025.20 to $3,799.08 across different market cap environments. Current Neutral rating (54.81%) indicates mixed signals requiring adoption improvements. Not financial advice.

Can Bitcoin Cash reach $5,000?

BCH reaching $5,000 would exceed our current price prediction models' highest scenario of $4,599.99 (31T moon case). This would require extraordinary market conditions, significant merchant adoption acceleration, and BCH successfully differentiating itself in the crowded payment cryptocurrency space. Not financial advice.

Is Bitcoin Cash a good investment based on price predictions?

BCH shows strong fundamentals (80.41% grade) but a very weak technology score (29.63%), resulting in a Neutral TM Grade of 54.81% with bearish near-term signals. While our price prediction models show potential upside in favorable market conditions, the low technology grade and adoption challenges suggest significant risks. The payment-focused use case faces competition from Lightning Network and other solutions. Not financial advice.

How does BCH compare to Bitcoin in price predictions?

Bitcoin Cash was designed as a payment-focused alternative to Bitcoin's store-of-value narrative. Our price prediction framework shows BCH could reach $1,025-$4,600 across scenarios, while Bitcoin dominates market cap and network effects. BCH's success depends on carving out a distinct payment niche rather than competing directly with Bitcoin. The correlation between BTC and BCH price movements remains high.

What are the biggest risks to BCH price predictions?

Key risks that could impact Bitcoin Cash price predictions include: extremely low technology grade (29.63%) indicating development stagnation, competition from Bitcoin Lightning Network, declining developer activity, regulatory targeting of payment cryptocurrencies, low mining hash rate security concerns, and competitive displacement from stablecoins and other payment solutions. The bearish trading signal and Neutral grade reflect these challenges.

Will BCH benefit from a Bitcoin bull run?

Historically, Bitcoin Cash has shown positive correlation with Bitcoin price movements. Our price prediction scenarios assume BCH captures some momentum from broader crypto market expansion. However, BCH's lower technology grade and adoption challenges may limit its ability to match Bitcoin's percentage gains. The base case scenarios reflect moderate participation in bull market dynamics.

Next Steps

Want exposure? Buy BCH on MEXC

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Why Use Token Metrics for BCH Price Predictions?

- Scenario-based forecasting: Multiple market cap tiers for comprehensive price prediction analysis

- Transparent grading: Fundamental (80.41%) vs Technology (29.63%) reveals strengths and weaknesses

- AI-driven insights: Advanced algorithms analyze payment cryptocurrency competitive landscape

- Real-time signals: Trading signals and TM Grades (Neutral 54.81%) updated regularly

- Risk assessment: Identifies key risks like low developer activity and competitive pressure

- Comparative analysis: Analyze BCH against Bitcoin, Litecoin, and 6,000+ tokens

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)