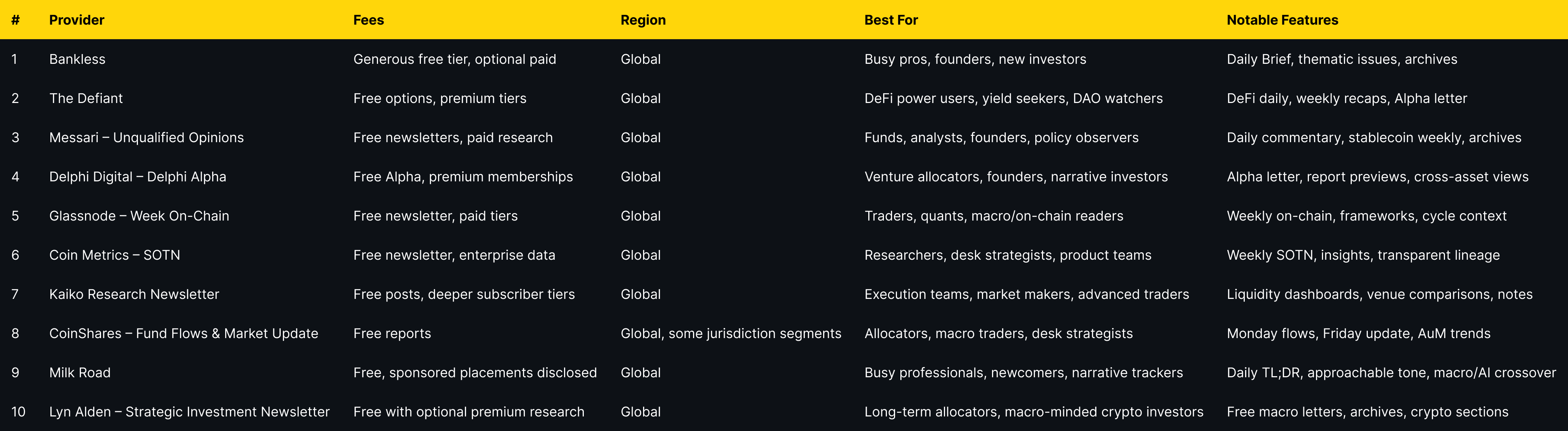

Bitcoin Price Prediction for July 2025: Key Trends, Insights, and What Investors Can Expect

.png)

As of July 2025, Bitcoin (BTC) is experiencing a major breakout, surging past $119,000 after breaching the critical $110,000 resistance level. This surge, driven by institutional capital inflows, supply constraints, and favorable macroeconomic trends, has reignited optimism in the broader crypto market.

But how high can Bitcoin go in 2025—and beyond? Is this rally sustainable? What are the risks? In this highly informative and SEO-optimized blog post, we’ll provide a detailed Bitcoin price prediction for 2025, using real-time data from the Token Metrics AI crypto trading and research platform, along with key macro, on-chain, and policy-level insights.

🚀 The Bullish Breakout: Bitcoin Turns Upward in June 2025

On June 28, 2025, the Token Metrics AI signal for Bitcoin turned bullish, signaling a strong shift in momentum. Since then, Bitcoin has:

- Surged past $118,000

- Broken the psychological and technical resistance at $110,000

- Shown strong price action supported by both on-chain and institutional metrics

This wasn’t just a technical rally—it’s been fundamentally driven by several powerful tailwinds.

📊 Institutional Adoption: The Driving Force Behind Bitcoin’s Surge

1. Bitcoin Spot ETFs See Billions in Inflows

Major financial institutions—BlackRock, Fidelity, and Charles Schwab—have led the charge in Bitcoin ETF adoption. As of Q3 2025:

- Total net inflows to U.S.-based Bitcoin ETFs have surpassed $25 billion

- These products are now used in 401(k)s, pension funds, and private wealth portfolios

Institutional buyers are not flipping BTC like retail investors. Instead, they’re accumulating and holding, tightening supply and driving long-term demand.

2. Declining Exchange Reserves

Another bullish on-chain indicator: BTC reserves on exchanges have dropped from 3.25 million to just 2.55 million BTC—a level not seen since 2017. This suggests:

- More Bitcoin is being moved to cold wallets

- Less BTC is available for sale

- Market sentiment is shifting from “sell” to “HODL”

When supply tightens while demand rises, prices move up—a simple but powerful formula playing out in real time.

📈 Policy Tailwinds: Pro-Crypto Regulations in the U.S.

The current U.S. regulatory landscape is the most Bitcoin-friendly in history.

🔹 Bitcoin Reserve Proposal

There are growing discussions in U.S. policy circles around holding Bitcoin as a strategic reserve asset, similar to gold. This has further validated BTC as:

- A legitimate sovereign-grade asset

- A hedge against inflation and geopolitical uncertainty

🔹 Clarity on Custody and Taxes

Clear guidelines on:

- Crypto tax treatment for institutions

- Custodianship rules for ETFs and banks

- Greenlight for banks to hold digital assets

…have dramatically increased institutional confidence in Bitcoin.

💰 Macroeconomic Trends Supporting BTC’s Growth

1. Weakening U.S. Dollar

The U.S. Dollar Index (DXY) has fallen due to:

- Rising national debt

- Slowing economic growth

- High interest rates suppressing consumer demand

This has led investors to rotate into store-of-value assets like Bitcoin.

2. Rising Geopolitical Risk

Tensions in the Middle East (e.g., Israel-Iran) and ongoing trade disputes have fueled demand for assets that are:

- Borderless

- Non-sovereign

- Resistant to censorship

Bitcoin fits all three criteria, increasing its role as a digital safe haven in times of global instability.

⚠️ Risks to Monitor in 2025

While the Bitcoin outlook is bullish, several risks could slow momentum:

❌ 1. Energy Usage Concerns

Bitcoin’s Proof-of-Work (PoW) consensus mechanism remains energy-intensive. Critics argue this could:

- Attract stricter environmental regulations

- Reduce adoption in ESG-conscious portfolios

❌ 2. Regional Regulatory Uncertainty

Not all jurisdictions are as pro-Bitcoin as the U.S. In 2025, some countries (especially in Asia and Europe) continue to:

- Restrict Bitcoin trading

- Propose heavy taxation

- Limit institutional adoption

❌ 3. Price Corrections

With BTC up significantly since the start of 2025, short-term pullbacks are likely. Corrections of 15–25% are common in bull cycles—investors should be prepared with clear entry and exit strategies.

📉 Bear Case Scenario

If institutional inflows slow down or new regulation spooks the market:

- Bitcoin could retrace to $90,000–$100,000

- This would represent a healthy correction, not a full trend reversal

- Long-term fundamentals still remain intact

📊 Token Metrics AI Forecast: Bitcoin Price Prediction for 2025–2026

Using on-chain data, macro indicators, and real-time signals from the Token Metrics platform, the current forecast is:

This outlook is supported by Token Metrics AI signals, which have maintained a bullish position since late June 2025.

🧠 How Token Metrics Helps You Navigate Bitcoin and Beyond

While Bitcoin is a macro asset, altcoins often outperform it in bull markets. Token Metrics helps investors identify these opportunities with:

🚀 Moonshots

- Daily low-cap altcoin picks with 10x–100x potential

- Live ROI, market cap, and trader grade metrics

- AI-driven early discovery engine

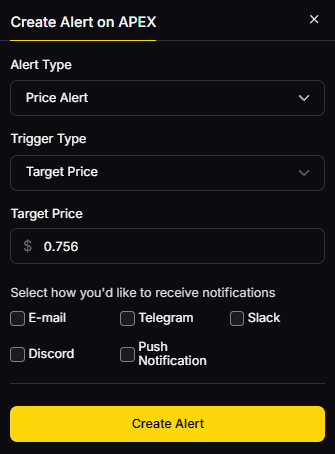

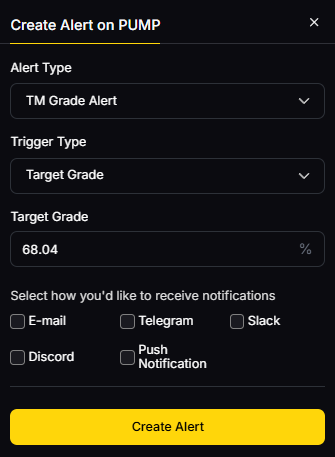

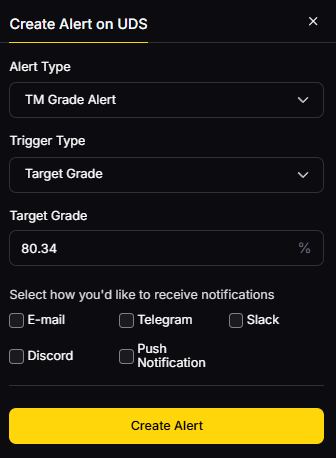

📈 Real-Time Buy/Sell Signals

- Bullish and Bearish alerts for BTC and altcoins

- Delivered via Email, Slack, Telegram, and Discord

Investor and Trader Grades

- Use Trader Grade for short-term trades

- Use Investor Grade for long-term conviction picks

💹 Crypto Indices

- Thematic portfolios (AI, RWA, Layer 1s, etc.)

- Easy exposure to sectors likely to boom after BTC leads the rally

🔔 Take Action Today

If you’re looking to ride the current Bitcoin bull cycle and find the next big altcoins to complement your portfolio, start using Token Metrics today:

✅ Track real-time signals

✅ Discover early Moonshots

✅ Analyze risk with AI

✅ Make informed crypto investment decisions

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)