Can AI or Data Tools Help Identify Moonshots?

%201.svg)

%201.svg)

From Hype to Science — The Role of AI in Finding Moonshots

In the past, finding a 100x moonshot often meant trolling crypto Twitter threads, scanning Discord servers, or jumping into Telegram groups filled with bots and hype. But times have changed. In 2025, the smartest investors use AI and data analytics tools to uncover hidden gems before they explode.

This blog explores how AI and crypto-specific data platforms like Token Metrics are transforming moonshot discovery into a science — removing the guesswork and helping investors spot massive opportunities early.

Why Human-Only Research Isn’t Enough Anymore

With over 2 million crypto tokens and hundreds launching weekly, it’s virtually impossible to manually research everything. Retail traders are often overwhelmed, relying on gut feelings or influencer tweets.

AI levels the playing field by:

- Analyzing massive datasets at scale

- Spotting hidden patterns in price, volume, and sentiment

- Scoring tokens based on fundamentals, momentum, and risk

- Filtering out noise, scams, and pump-and-dumps

Simply put, AI sees what the human eye misses.

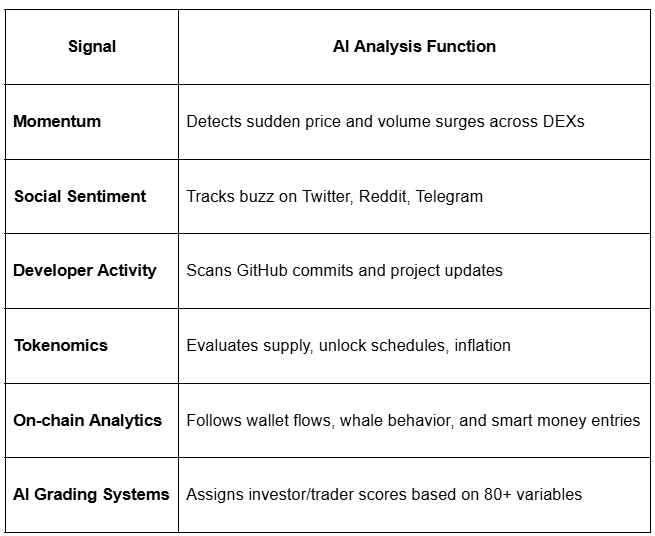

How AI Tools Detect Moonshots

AI models trained on crypto data can identify early-stage projects by analyzing:

These insights allow you to rank tokens and prioritize research efforts.

How Token Metrics AI Grades Work

Token Metrics, a pioneer in AI-driven crypto analytics, uses machine learning to generate Investor Grades, Trader Grades, and Bullish/Bearish Signals for thousands of tokens.

Here's how:

- Investor Grade – Long-term potential based on fundamentals, community, tech

- Trader Grade – Short-term potential based on price action, momentum, liquidity

- Bullish Signal – Triggered when AI detects high-probability upside within 7–14 days

- Bearish Signal – Warns of likely downturns or profit-taking zones

Moonshots that rank highly across these metrics are often early movers with breakout potential.

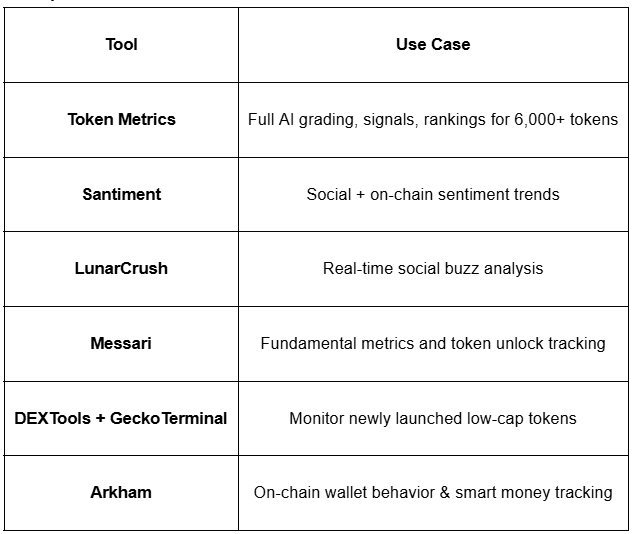

Top Tools to Find Moonshots with AI & Data

Use these tools together to spot patterns others miss.

Case Study: AI Spotting a Moonshot Early

Let’s say a low-cap AI token called NeuroLink AI launches. It’s not yet on CEXs but shows:

- Spike in GitHub commits

- Surge in Telegram growth

- 24h price up 18%, volume 400%

- Mentioned in 3 Token Metrics Bullish Signals in one week

- AI Trader Grade: 91/100

That’s a prime moonshot candidate worth further analysis — and most retail traders wouldn’t catch it until it’s up 5x.

Human + AI = The Winning Formula

AI doesn't replace human judgment — it enhances it. The best approach is:

- Use AI to scan, sort, and filter top candidates

- Manually research the top 5–10 picks

- Evaluate community, product, team, and roadmap

- Use risk metrics and technicals for entry/exit planning

This hybrid approach minimizes FOMO and maximizes precision.

Moonshot AI Checklist

Before diving in, check:

✅ High AI Trader or Investor Grade (85+)

✅ Momentum score surging

✅ Early-stage narrative (AI, DePIN, RWA, etc.)

✅ Community growth across socials

✅ Smart money inflows on-chain

✅ No major unlocks in next 30 days

If all boxes are ticked, you may have found your next 10x.

Final Thoughts: AI is the Ultimate Edge in 2025

Crypto moonshots are no longer found in meme threads and TikTok videos alone. In 2025, the best investors use AI-powered research to systematically uncover explosive opportunities before they go viral.

By leveraging platforms like Token Metrics, you turn chaos into clarity — and emotion into execution.

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

Mastering Binance & Coinbase APIs for Automated Crypto Trading

%201.svg)

%201.svg)

Automating crypto trading with APIs is revolutionizing how traders and developers interact with digital asset markets. If you've ever wondered how to connect directly to exchanges like Binance and Coinbase, automate your strategies, or build your own trading bots, understanding their APIs is the crucial first step. This guide unpacks the essentials of using the Binance and Coinbase APIs for automated crypto trading—explaining the technology, potential use cases, and important considerations for getting started.

What Are Crypto Trading APIs?

APIs, or Application Programming Interfaces, enable software to interact directly with external services. Within cryptocurrency trading, APIs provide a standardized way for users and programs to connect with exchange platforms, fetch market data, execute trades, manage portfolios, and access account information programmatically.

- Market Data: Real-time and historical prices, order books, trade volume, and related metrics.

- Order Placement: Automated buying/selling, stop-loss, take-profit, and other order types.

- Account Management: Retrieve balances, view transaction history, or monitor active positions and orders.

This seamless integration supports the development of sophisticated trading strategies, algorithmic trading bots, portfolio trackers, and research analytics. The most widely adopted crypto trading APIs are those offered by Binance and Coinbase, two of the largest global exchanges.

Getting Started with Binance API Trading

Binance’s API is well-documented, robust, and supports diverse endpoints for both spot and futures markets.

- Create Your Binance Account: Ensure that your account is verified. Navigate to the Binance user center and access the API Management section.

- Generate API Keys: Label your key, complete security authentication, and note both your API key and secret. Keep these credentials secure and never share them publicly.

- API Permissions: Explicitly select only the API permissions needed (e.g., read-only for analytics, trading enabled for bots). Avoid enabling withdrawal unless absolutely necessary.

- Endpoints: The Binance REST API covers endpoints for market data (public), and trading/account management (private). It also offers a WebSocket API for real-time streams.

Popular use cases for Binance API trading include automated execution of trading signals, quantitative strategy deployment, and real-time portfolio rebalancing. The official documentation is the go-to resource for development references. Consider open-source SDKs for Python, Node.js, and other languages to streamline integration.

Unlocking the Power of the Coinbase API

Coinbase provides comprehensive APIs for both its retail platform and Coinbase Advanced Trade (previously Coinbase Pro). These APIs are favored for their security and straightforward integration, especially in regulated environments.

- API Creation: Log in to your Coinbase account, go to API settings, and generate an API key. Set granular permissions for activities like account viewing or trading.

- Authentication: The Coinbase API uses a combination of API key, secret, and passphrase. All API requests must be authenticated for private endpoints.

- Endpoints & Features: The API allows retrieval of wallet balances, transaction histories, live price data, and supports programmatic trading. The Coinbase API documentation offers detailed guides and SDKs.

Use the Coinbase API for automated dollar-cost averaging strategies, portfolio analytics, or to connect external research and trading tools to your account. Always apply IP whitelisting and two-factor authentication for heightened security.

Key Challenges and Considerations in Automated Crypto Trading

While APIs empower sophisticated trading automation, several technical and strategic considerations should be addressed:

- API Rate Limits: Both Binance and Coinbase restrict the number of API calls per minute/hour. Exceeding limits can lead to throttling or IP bans, so efficient coding and request management are essential.

- Security First: Secure storage of API keys, use of environment variables, and permission minimization are vital to prevent unauthorized access or loss of funds.

- Handling Market Volatility: Automated trading bots must account for slippage, API latency, and unexpected market events.

- Testing Environments: Utilize the exchanges’ testnet or sandbox APIs to validate strategies and avoid live-market risks during development.

For more complex strategies, combining data from multiple APIs—including on-chain analytics and AI-powered research—can provide deeper insights and help navigate uncertain market conditions.

Leveraging AI and Advanced Analytics for Crypto API Trading

The real advantage of programmatic trading emerges when combining API connectivity with AI-driven analytics. Developers can harness APIs to fetch live data and feed it into machine learning models for signal generation, anomaly detection, or portfolio optimization. Tools like Python’s scikit-learn or TensorFlow—paired with real-time data from Binance, Coinbase, and third-party sources—enable dynamic strategy adjustments based on shifting market trends.

AI agents and intelligent trading bots are increasingly built to interface directly with crypto APIs, processing complex data streams to execute trades or manage risk autonomously. Such systems benefit from robust backtesting, frequent monitoring, and a modular design to ensure security and compliance with exchange requirements.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

FAQ: How Do Binance and Coinbase APIs Compare?

Both Binance and Coinbase offer REST APIs, but Binance has broader asset coverage and advanced trading features, including futures and options support. Coinbase’s APIs prioritize security, are well-suited for U.S. users, and offer streamlined integration for both spot and advanced trade scenarios.

FAQ: What Programming Languages Can Be Used for Crypto Trading APIs?

Python, JavaScript/Node.js, and Java are the most popular choices for building automated trading bots due to the availability of SDKs and community support. Most modern APIs are RESTful and compatible with any language that can perform HTTP requests.

FAQ: How Do I Keep My API Keys Secure?

Best practices include storing API keys in environment variables, never exposing them in source code repositories, limiting permissions, and regularly rotating keys. Also, use IP whitelisting and two-factor authentication if supported by the exchange.

FAQ: Can I Use Multiple Exchange APIs Together?

Yes. Many advanced traders aggregate data and trade across several exchange APIs to increase liquidity access, compare prices, or diversify strategies. This often requires unifying different API schemas and handling each exchange’s unique rate limits and authentication protocols.

FAQ: What Are the Risks of Automated Trading with Crypto APIs?

Automated trading can lead to unintended losses if there are bugs in the code, API changes, or sudden market movements. Proper error handling, backtesting, and initial development in sandbox/testnet environments are key risk mitigation steps.

Disclaimer

This article is for informational and educational purposes only. It does not constitute investment advice or an offer to buy or sell any cryptocurrency. Always implement robust security practices and perform due diligence before integrating or deploying automated trading solutions.

Mastering Crypto Trading Bots: DCA, Grid, Arbitrage Strategies Explained

%201.svg)

%201.svg)

Crypto trading bots have transformed how traders and analysts approach the fast-moving digital assets market. With a variety of automated strategies—like Dollar Cost Averaging (DCA), grid trading, and arbitrage—these bots help users implement consistent, rules-based tactics around the clock. But understanding how each strategy works, their strengths and limitations, and the technology that powers them is crucial for anyone looking to utilize automation in crypto trading.

What Are Crypto Trading Bots?

Crypto trading bots are software programs designed to automate trading decisions based on predefined criteria and algorithms. These tools connect to crypto exchanges via API, executing trades according to parameters set by the user or the strategy's logic. The goal isn’t to guarantee profit, but to implement systematic, emotion-free trading practices at speed and scale impossible for humans alone.

Common features among top crypto trading bots include:

- Backtesting: Testing strategies against historical market data.

- Multi-exchange support: Managing orders across several platforms simultaneously.

- Customization: Adjusting trading frequency, risk management, and strategy rules.

- Real-time analytics: Providing insights on bot performance and market trends.

With AI and advanced analytics, bots now utilize sophisticated signals—from price action to on-chain data—to further enhance decision-making.

Exploring Dollar Cost Averaging (DCA) Bots

Dollar Cost Averaging (DCA) is a foundational investing concept, and DCA bots automate its application in the crypto markets. The DCA strategy involves purchasing a set amount of cryptocurrency at regular intervals, irrespective of price fluctuations. This method reduces exposure to volatility and removes the need to time market tops or bottoms.

A DCA bot performs these actions by connecting to your chosen crypto exchange and placing periodic orders automatically. Customizable options include:

- Frequency (e.g., daily, weekly, monthly)

- Order size and asset choice

- Advanced features: stop-loss, take-profit settings, or integration with technical indicators

Scenario analysis: For long-term market participants, DCA bots can smooth out entry prices during periods of high volatility, especially in trending or sideways markets. However, DCA does not prevent losses in downtrending markets and might not be optimal for short-term speculation.

Many platforms offer DCA bots, and some combine DCA with AI-driven market indicators, offering more nuanced deployment. Tools like Token Metrics provide research that can help users evaluate when and how to use DCA strategies alongside their risk management framework.

How Grid Trading Bots Work

Grid trading bots are designed to profit from price oscillations within a defined range by placing a series of buy and sell orders at predetermined intervals (the "grid"). As the market moves, the bot buys low and sells high within this corridor, striving to capture profits from repeated fluctuations.

Key components of a grid trading bot:

- Selection of price range and grid step size

- Automated placement of buy orders below the current market price and sell orders above

- Dynamic grid adjustment (optional in advanced bots) in response to significant volatility or trend shifts

Grid trading is best suited for markets with horizontal price movement or mild volatility. It may underperform during strong trends (up or down) as the price moves outside the set grid.

To optimize grid performance, traders often analyze historical price ranges, volatility indices, and liquidity metrics—processes where AI tools and platforms like Token Metrics can provide data-driven insights to fine-tune grid parameters.

Understanding Arbitrage Bots in Crypto

Arbitrage is the practice of exploiting price differences of the same asset across different exchanges or markets. Arbitrage bots automate the process, rapidly identifying and capitalizing on even small price discrepancies before the market corrects itself.

There are several types of crypto arbitrage:

- Spatial Arbitrage: Buying on one exchange and selling on another.

- Triangular Arbitrage: Trading between three assets/exchanges to capture pricing inefficiencies.

- DeFi Arbitrage: Leveraging decentralized exchanges, liquidity pools, or lending platforms for profit opportunities.

Arbitrage bots require:

- Low latency and rapid execution

- Reliable API integrations with multiple exchanges

- Fee and slippage calculation to prevent unprofitable trades

While arbitrage opportunities exist in crypto due to market fragmentation and varying liquidity, increased competition and improved exchange efficiency have narrowed average profit margins. Bots are now often paired with on-chain analytics or machine learning models to anticipate emerging inefficiencies.

Selecting and Optimizing Crypto Trading Bot Strategies

Not all strategies suit all market conditions. Choosing and optimizing a crypto trading bot strategy involves:

- Market context: Are market conditions trending, sideways, or highly volatile?

- Risk profile: What level of drawdown, maximum investment, and potential trade frequency is acceptable?

- Backtesting & simulation: Most platforms allow testing strategies on historical data or with paper trading, supporting more informed choices.

Advanced users often create hybrid strategies—such as combining DCA for accumulation with a grid bot for ranging periods, or adding arbitrage layers where price disparities appear. AI-based research solutions can help proactively monitor correlations, identify volatility shifts, and surface emerging patterns, providing analytical depth to trading bot strategy selection.

Before using any trading bot or automated strategy, it is essential to understand the underlying logic, risk controls, and limitations. Start with small amounts, test thoroughly, and review available documentation and analytics from trusted platforms.

Enhance Your Trading with Token Metrics

Token Metrics offers real-time prices, trading signals, and on-chain insights to help you make informed decisions. Start Trading Smarter Today

FAQ: Crypto Trading Bots, DCA, Grid & Arbitrage

What types of assets can crypto trading bots handle?

Most crypto trading bots can support major coins (Bitcoin, Ethereum) and numerous altcoins, depending on the exchanges and APIs integrated. Liquidity and exchange pairs may limit available strategies for smaller tokens.

How do trading bots connect with exchanges?

Bots use APIs provided by exchanges to access trading accounts and execute orders automatically. API permissions usually allow for account security by limiting withdrawal capabilities to prevent misuse.

Are DCA bots better than grid or arbitrage bots?

No single strategy is universally better; each suits different market conditions and goals. DCA aims to reduce volatility impact, grid bots thrive in ranging markets, and arbitrage bots seek price discrepancies across platforms.

Can AI improve automated trading strategies?

AI can enhance trading bots by analyzing large datasets, identifying patterns, and generating trading signals based on market sentiment, technical factors, or on-chain activity. Platforms like Token Metrics integrate AI-driven analytics for more informed strategy design and monitoring.

What are the key risks in using crypto trading bots?

Risks include technological errors, unexpected market volatility, slippage, API downtime, and exchange limitations. It is important to monitor bot activity, use strong security practices, and test any automated strategy before deploying significant capital.

Disclaimer

This blog post is for informational and educational purposes only. It does not constitute investment advice, financial guidance, or a recommendation to buy or sell any asset. All strategies discussed involve risks, and past performance is not indicative of future results. Readers should conduct independent research and consult with a qualified professional before using crypto trading bots or related technologies.

Top Crypto Bot Backtesting Tools, APIs & Scripts for 2025

%201.svg)

%201.svg)

The surge in automated crypto trading has fueled demand for robust backtesting solutions. Whether you're a developer refining an algorithm or a trader validating a new crypto trading bot strategy, reliable backtesting tools are essential. As we head into 2025, new platforms, APIs, and open-source scripts are making it easier than ever to simulate strategies before risking capital in live markets.

Why Crypto Bot Backtesting Matters

Backtesting allows you to simulate a trading strategy using historical market data to understand its hypothetical performance. Effective backtesting can help developers, quant traders, and crypto enthusiasts:

- Identify potential pitfalls in trading logic before live deployment

- Assess risk metrics like drawdown, Sharpe ratio, and win rate

- Optimize rule parameters for better results

- Validate new indicators or AI-driven models

- Accelerate research cycles by quickly iterating on multiple strategies

In fast-moving crypto markets, proper backtesting helps remove emotional bias and provides a data-driven framework for decision-making. This process is especially valuable for those employing systematic or algorithmic crypto trading bot strategies.

Best Platforms for Crypto Bot Backtesting

Choosing the right backtesting platform depends on your technical expertise, data requirements, and desired features. Here are some of the top solutions as of 2025:

- TradingView: Offers strategy scripting (Pine Script) and backtesting directly on its interactive charts. The platform supports crypto pairs from hundreds of exchanges.

- 3Commas: Known for its user-friendly crypto trading automation platform. Provides cloud-based backtesting tools and preset strategies for beginners.

- CrypToolKit: Aimed at quant enthusiasts, this platform supports both manual and automated crypto strategy backtesting with customizable risk analysis reports.

- Backtrader (Python): A favored open-source backtesting engine that supports cryptocurrency integrations via community libraries. Ideal for developers building custom strategies.

- QuantConnect: Supports multiple asset classes and provides institutional-grade backtesting with access to historical crypto data and cloud compute power.

- Coin Metrics Labs: Offers detailed historical on-chain and price data along with APIs to power large-scale backtests.

When evaluating platforms, consider factors like data granularity, exchange integrations, speed, and the transparency of performance metrics.

Exploring the Best Crypto APIs for Backtesting

APIs allow automated strategies to fetch accurate historical data, process live prices, and execute simulated orders. Here’s what to look for in a top-tier backtesting API in 2025:

- Comprehensive historical data: Tick, minute, and daily OHLCV data are best for flexible research.

- On-chain metrics and signals: Advanced APIs now include wallet flows, token supply, and rich metadata for AI-based strategies.

- Ease of integration: RESTful endpoints or dedicated SDKs for Python, JavaScript, or other popular languages.

- Simulated order execution: Sandboxed trading environments increase accuracy of real-world results.

Some of the leading APIs in 2025 for crypto bot backtesting include CoinGecko, CryptoCompare, Kaiko, and the Token Metrics API, which combines deep on-chain analysis with predictive trading signals and streamlined integration for quant developers.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Open-Source Scripts and Libraries for Backtesting

For those who want full control or need to extend capabilities beyond platform GUIs, open-source scripts and frameworks give maximum flexibility for research and development. Some of the noteworthy options in the crypto bot backtesting landscape include:

- Backtrader: Python-based, highly extensible, with crypto exchange connectors. Enables custom indicators and event-driven architecture.

- Freqtrade: A dedicated crypto trading bot offering backtesting, hyperparameter tuning, and AI model integration.

- CCXT: While primarily focused on unified trading APIs, CCXT can be combined with historical data and custom scripts to power backtests with exchange-like environments.

- PyAlgoTrade & Zipline: Popular among quants, though users may need to adapt existing codebases for crypto assets.

When selecting or building custom scripts, prioritize transparency in calculations, accuracy in data handling, and the ability to reproduce results. Open-source frameworks are ideal for researchers who want to customize every aspect of their crypto trading bot strategy testing.

AI-Powered Tools and the Future of Backtesting

The integration of AI into backtesting is rapidly changing how traders and quant researchers optimize their strategies. In 2025, many leading platforms and APIs incorporate:

- Predictive analytics using machine learning models

- Natural language processing (NLP) for analyzing news, social sentiment, and community chatter

- Advanced scenario analysis to stress test strategies under a range of market conditions

- Automated hyperparameter optimization to refine trading bot rules

AI-driven backtesting tools enable users to uncover hidden patterns and quantify risks faster than ever. Solutions like Token Metrics are leading this wave by combining traditional backtesting tools with advanced, AI-powered analytics, helping crypto developers and researchers navigate the increasing complexity of digital asset markets.

Frequently Asked Questions

What is Crypto Bot Backtesting?

Crypto bot backtesting is the process of simulating a trading strategy on historical cryptocurrency price and volume data. It helps developers and researchers assess how a strategy would have performed, identify risk factors, and optimize settings—before using the strategy with real funds.

How Accurate Is Backtesting for Crypto Bots?

Backtesting accuracy depends on factors such as data quality, inclusion of transaction costs, realistic slippage modeling, and whether the logic matches live market execution. While valuable, backtest results should be interpreted with caution and validated with out-of-sample data or paper trading.

What Are the Best Languages for Writing Backtesting Scripts?

Python is the most widely used language for crypto bot backtesting due to its rich ecosystem (Backtrader, Freqtrade, Pandas). Other popular options include JavaScript (Node.js for integrations), and C# (.NET-based research or GUIs).

Can AI Be Used in Crypto Bot Backtesting?

Yes, AI enhances backtesting by helping discover market patterns, optimize trading rules, and incorporate additional data sources such as on-chain analytics or social sentiment. Advanced platforms leverage AI to power predictive analytics and scenario modeling.

How to Choose the Right Backtesting Tool for Crypto?

Consider your technical proficiency, need for custom logic, required data granularity, exchange and API integrations, performance analytics, and whether you prefer GUI-based platforms or scriptable frameworks. Test your strategy on several tools for benchmarking.

Disclaimer

This article is for educational and informational purposes only. It does not offer investment, financial, or trading advice. Use all tools and scripts at your own risk, and conduct thorough due diligence before deploying live trading strategies.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)