How to Choose the Best Crypto API in 2025: Trends, Features, and Leaders

The digital asset landscape is evolving rapidly, and as we move through 2025, crypto APIs are more powerful—and essential—than ever. Developers, researchers, and businesses alike depend on APIs to access real-time data, execute smart contracts, and integrate blockchain functionalities into their platforms. But with so many options on the market, how do you identify the best crypto API for your needs? In this guide, we'll explore the latest trends shaping crypto API technology, critical factors to consider, and which platforms are leading the way in 2025.

How Crypto APIs Have Evolved by 2025

In the early days of cryptocurrency, APIs focused primarily on fetching current prices or facilitating basic trades. Fast forward to 2025, and APIs now serve as the backbone for an expansive range of blockchain and decentralized finance (DeFi) applications. Several trends have fueled this evolution:

- Real-Time, Multi-Chain Data: Top crypto APIs aggregate and deliver data from multiple blockchains, exchanges, and even layer-2 solutions, ensuring comprehensive market visibility.

- Enhanced Security and Compliance: With increased regulatory scrutiny, leading APIs now offer KYC/AML support, transaction monitoring, and data privacy features.

- AI Integration: Modern APIs increasingly leverage AI to provide analytics, sentiment analysis, anomaly detection, and risk scoring for crypto assets.

- Modular Infrastructure: Flexible endpoints and SDKs allow developers to easily tailor API functions to project-specific needs.

The result is a more robust, secure, and developer-friendly API ecosystem—empowering innovative products in trading, analytics, DeFi, and beyond.

Key Criteria for Evaluating the Best Crypto APIs

With numerous platforms offering crypto APIs, conducting a methodical evaluation is crucial. Here are the main criteria to assess:

- Data Coverage: Does the API offer information on a broad range of assets, including major coins, tokens, DeFi protocols, and NFTs? Can it access both historical and real-time on-chain data?

- Latency and Reliability: Financial apps depend on speedy, uninterrupted data. Look for APIs with low latency (<100ms), high uptime (ideally 99.9%+), and robust error handling.

- Security: Does the provider employ encryption, authentication (such as OAuth2), and rate limiting to protect data and prevent abuse?

- AI and Analytical Tools: Does the API integrate AI features such as predictive analytics, on-chain metrics, or trading signals to support deeper research?

- Developer Experience: Consider the quality of documentation, SDK availability, and support channels. User-friendly interfaces can accelerate project timelines.

- Pricing and Limits: Study the cost structure, rate limits, and overage policies to ensure they align with your project’s scale and budget.

Documenting your project requirements—whether you're building a portfolio tracker, AI trading agent, or DeFi dashboard—will make it easier to compare platforms using this framework.

Leading Crypto APIs and Platforms in 2025

A few platforms continue setting standards for crypto API solutions. While exact needs will vary, below are some of the most recognized in 2025, each offering strengths for different use-cases:

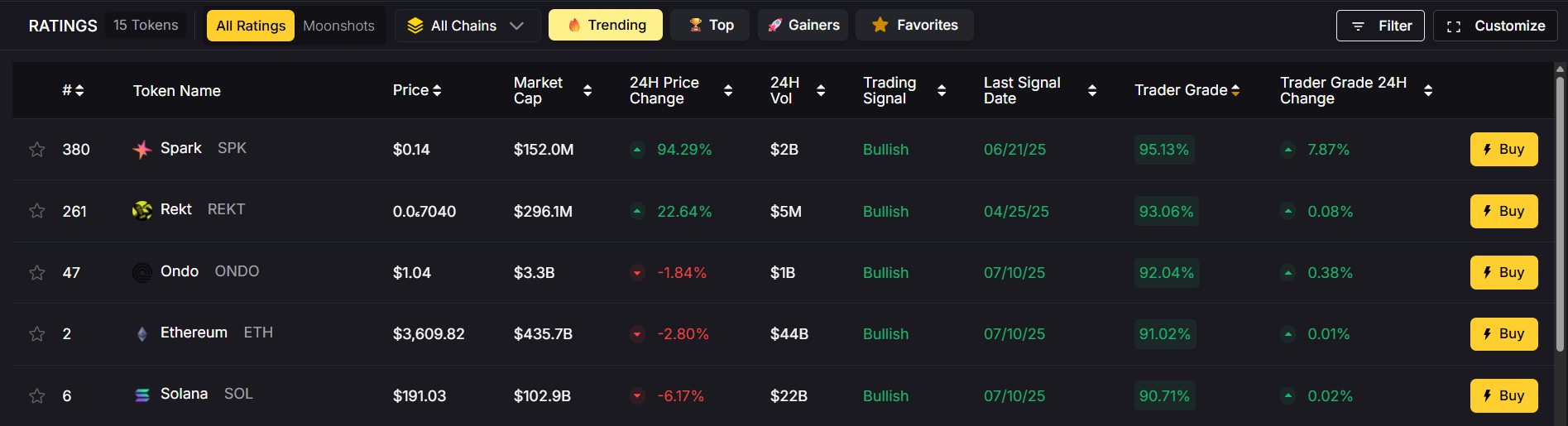

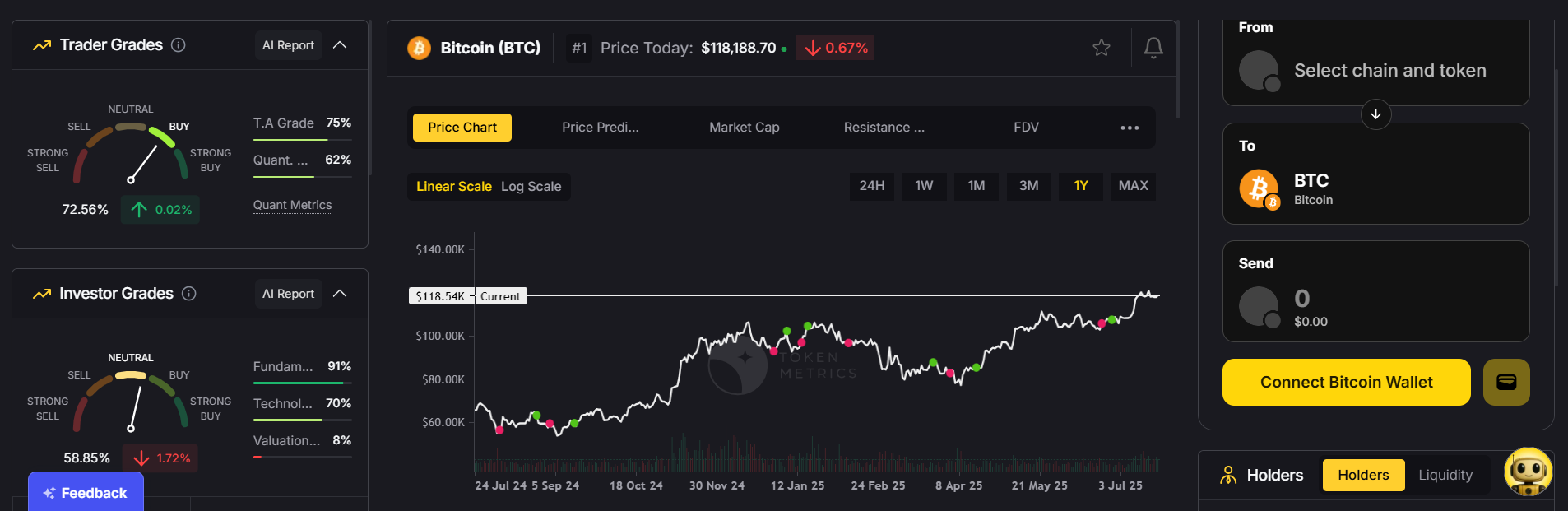

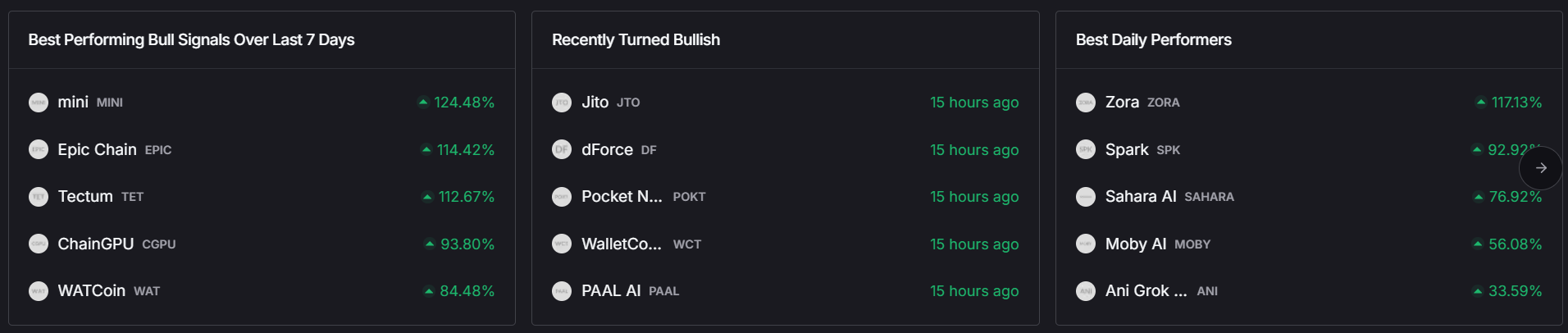

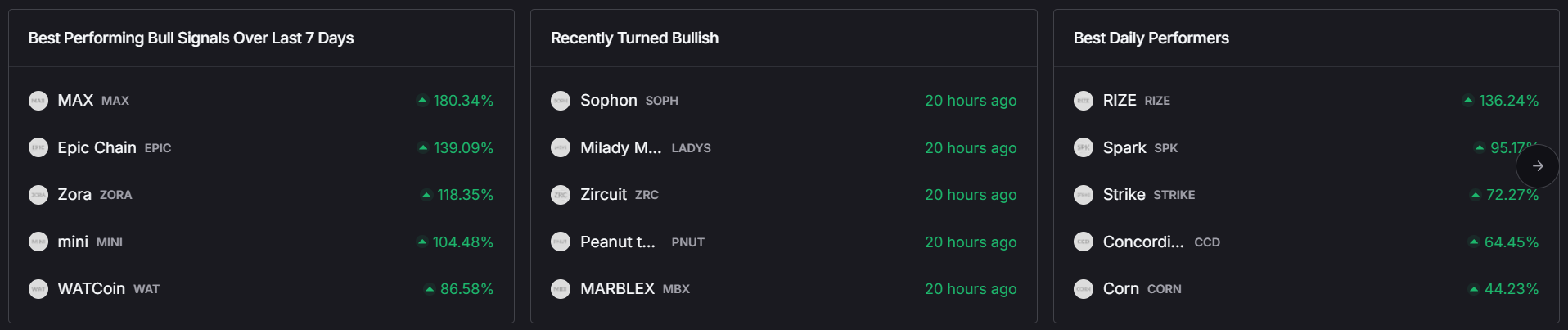

- Token Metrics API: Renowned for its AI-driven analytics, on-chain insights, and trading signals, making it highly valuable for quantitative research and automated agents.

- CoinGecko/CMC APIs: Widely used for broad market coverage, tokens, and basic price feeds. Their easy integration appeals to quick deployments and informational apps.

- Alchemy, QuickNode, and Infura: Focused on direct blockchain node access, ideal for developers building dApps, smart contracts, or DeFi infrastructure.

- Glassnode, CryptoQuant: Specialized in granular on-chain and market analytics for institutional research and risk management.

- Mempool.space, Blockchair: Targeted at blockchain explorers, these APIs provide detailed transaction and block data across multiple chains.

Ultimately, the “best” choice depends on your integration scenario—from simple price widgets to sophisticated AI-powered crypto tools.

AI, On-Chain Data, and the Future of Crypto APIs

AI has become a game-changer for crypto analysis and application development. APIs that offer built-in machine learning, predictive analytics, and anomaly detection unlock new use-cases:

- Algorithmic Research: AI-enriched endpoints help researchers identify market patterns, backtest strategies, and monitor risk in real time.

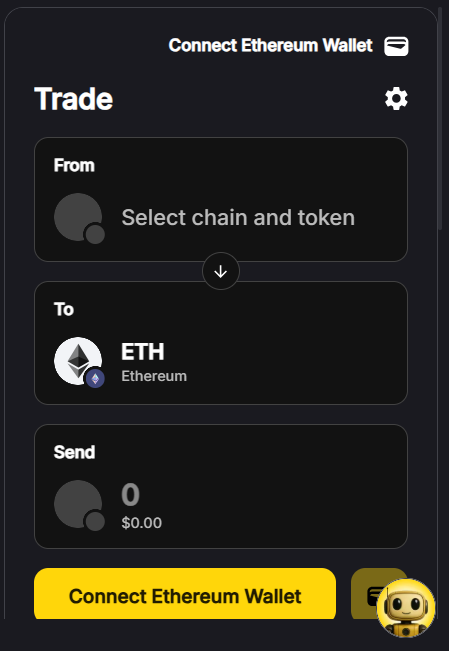

- Smart Crypto Agents: Developers can build bots and agents that interact autonomously with exchanges and DeFi protocols, powered by API-supplied insights.

- Institutional-Grade Risk Management: Analytical APIs help teams monitor on-chain activity, flag suspicious transactions, and maintain regulatory compliance.

The ideal API in 2025 will combine reliable blockchain access, rich data coverage, robust analytics, and flexible integration—maximizing the power of AI while maintaining the security standards the industry now demands.

Build Smarter Crypto Apps & AI Agents with Token Metrics

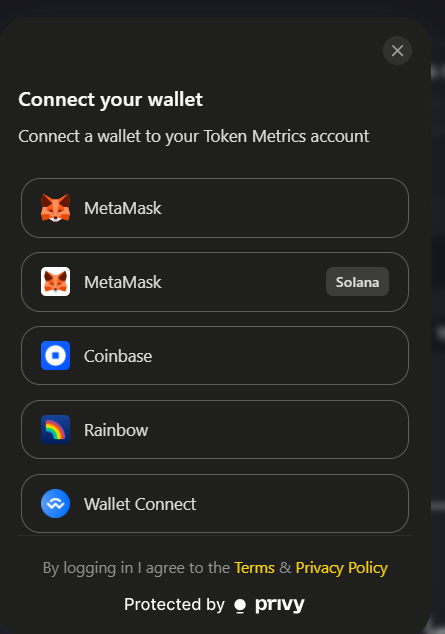

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Frequently Asked Questions: Best Crypto APIs in 2025

What is a crypto API and why is it important?

A crypto API is a set of programmable endpoints that allows developers to interact with cryptocurrency networks, fetch data, and even execute transactions. It’s vital for automating research, trading, reporting, and blockchain integrations in crypto projects.

How should I choose between different crypto APIs?

Consider factors such as data coverage, latency, reliability, security, costs, and documentation quality. Outline your use case—such as portfolio tracking, AI research, or building DeFi apps—and compare platforms based on those needs.

Are crypto APIs secure to use?

Top-tier APIs implement strong encryption, access keys, and rate limiting. Always vet providers for compliance and review their security documentation before integrating critical applications.

Can I use AI with crypto APIs?

Yes. Many leading APIs in 2025 support AI-driven analytics, from market sentiment scoring to automated trading signals. These tools help researchers and developers make more informed, data-driven decisions.

What makes Token Metrics API different from the rest?

The Token Metrics API stands out for its AI-powered intelligence, providing advanced trading signals, comprehensive on-chain insights, and seamless integration capabilities for modern crypto and DeFi applications.

Disclaimer

This content is for informational and educational purposes only. It does not constitute investment advice or an offer to purchase or sell any financial instrument. Always conduct your own research and consult appropriate professionals before relying on data for critical operations.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)