CoinGecko API - Features, Endpoints, Alternatives, and More

%201.svg)

%201.svg)

CoinGecko is a cryptocurrency data aggregator and analysis platform that provides comprehensive information on various aspects of the cryptocurrency market. It has gained huge popularity and is now one of the most commonly used platforms in the crypto sector.

CoinGecko also offers a an API, which provides access to cryptocurrency market data.

What is CoinGecko API?

CoinGecko API is a freemium, public API that provides developers with access to data about cryptocurrencies and their market prices, trading volumes, market capitalization, and other related information.

This data can be used for a variety of applications, including cryptocurrency portfolio tracking, trading bots, price alert systems, and more.

The API provides a number of endpoints that developers can use to retrieve different types of data, including cryptocurrency prices, market capitalization, NFT floor prices, exchange trading volumes, trading pairs, contract address data, crypto categories, crypto derivatives, images, developer activity, and other crypto industry related data.

How Does CoinGecko API Works?

CoinGecko provides developers an easy-to-use API that can be integrated into their applications to retrieve information about cryptocurrencies.

Through its API, CoinGecko offers various endpoints that allow developers to query cryptocurrency data in different ways. Some of the endpoints include:

Price Endpoint: This endpoint provides real-time and historical price data for cryptocurrencies.

Exchange Rates Endpoint: This endpoint provides exchange rates for various fiat currencies and cryptocurrencies.

Market Data Endpoint: This endpoint provides various market data such as market capitalization, trading volume, and supply for cryptocurrencies.

Developer Endpoint: This endpoint provides data related to the development activities of cryptocurrencies, such as the number of commits, stars, forks, and subscribers on their Github repositories.

Social Media Endpoint: This endpoint provides data on the social media activities of cryptocurrencies, such as the number of followers, tweets, and Reddit subscribers.

To use the CoinGecko API, developers need to obtain an API key from the CoinGecko website. They can then send HTTP requests to the API endpoints to retrieve the desired data. The API returns the data in JSON format, which can be easily parsed and used in the developer's application or a website.

Does CoinGecko have a WebSocket?

No, you need to make individual requests to the API to retrieve data.

Is CoinGecko API free?

CoinGecko API basic version is free* for those who want it for personal use and testing purposes only with some conditions and limits. CoinGecko free API has a rate limit of 10-30 calls/minute.

The free plan has limited endpoints and the number of calls you can make.

You need to upgrade to make the most out of the CoinGecko API.

CoinGecko API Alternatives - Free and Paid

CoinGecko is not the only place to get your Crypto data. In fact, there are some very great alternatives you can use to get propriety data like price prediction, indicators, and more, not just real-time prices.

Let's look at some of the best CoinGecko alternatives you can use today.

Token Metrics

Token Metrics is an AI driven crypto analysis platform which enables its users to research thousands of cryptocurrencies in an automated way. Token Metrics recently launched a Crypto Data API for crypto investors and developers.

This AI-powered API allows users to get access to more than 10 actionable data endpoints to power trading bots, models, and platforms, to make the most money in the crypto space.

CoinMarketCap

The CoinMarketCap API offers both free and paid tiers, with different limits and access to endpoints.

Like CoinGecko, CoinMarketCap also provides access to data like real-time prices, volume, market capitalization, social media information, and more.

CryptoCompare

CryptoCompare API is another option for accessing real-time and historical cryptocurrency market data. It allows developers to easily integrate data such as prices, trading volume, and exchange rates into their applications.

The API supports a wide range of cryptocurrencies, exchanges, and trading pairs, making it a great resource for anyone looking to build a cryptocurrency-related project.

Final Thoughts

CoinGecko is one of the leaders in the crypto space, providing access to insightful data about thousands of cryptocurrencies and the market.

However, as time goes on, better solutions are being built that are more powerful and use AI to power their data, like Token Metrics. This allows investors to turn data into actionable insights to make informed investment decisions.

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

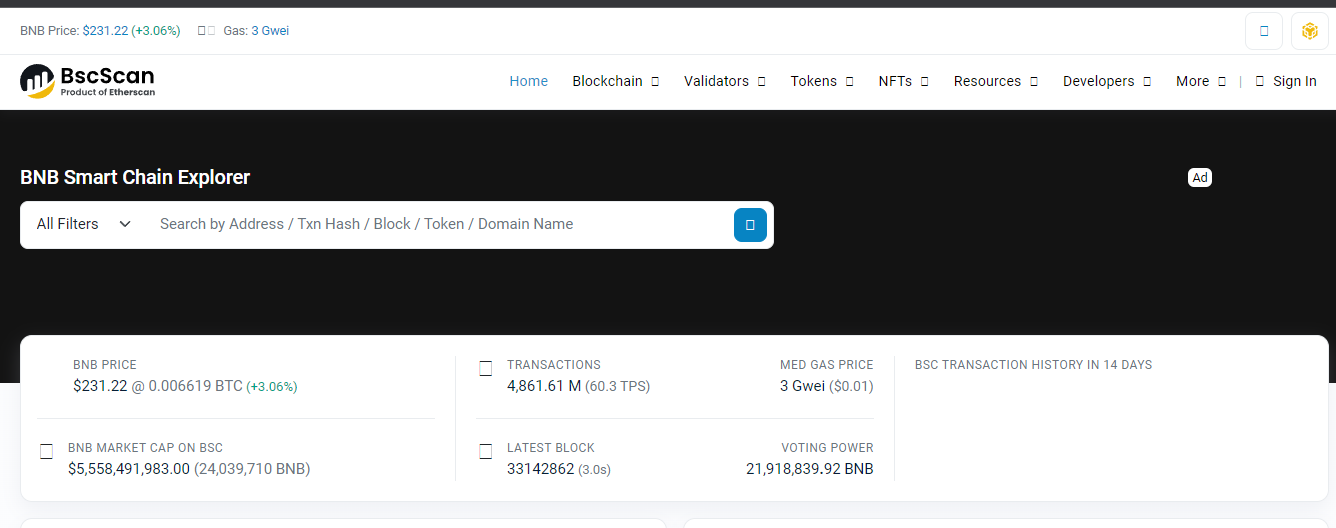

What is BscScan and How Does it Work?

%201.svg)

%201.svg)

Blockchain technology has revolutionized the world of finance and decentralized applications. As the popularity of cryptocurrencies grows, so does the need for reliable tools to navigate and explore different blockchain networks.

BscScan is a tool designed explicitly for the Binance Smart Chain (BSC). In this comprehensive guide, we will delve into the intricacies of BscScan, its functionalities, and how to make the most of this powerful blockchain explorer.

What is BscScan?

BscScan is the premier blockchain explorer for the Binance Smart Chain (BSC), developed by the same team responsible for creating Etherscan. Launched in 2020, BSC has rapidly gained popularity as a scalable and efficient blockchain network for decentralized applications and digital assets.

BscScan provides users with a comprehensive view of the BSC ecosystem, allowing them to explore wallet addresses, track transactions, verify intelligent contracts, and analyze token data.

As a blockchain explorer, BscScan acts as a search engine for the BSC network, providing real-time information about transactions, blocks, addresses, and smart contracts.

It offers a user-friendly interface that makes navigating and extracting valuable insights from the BSC blockchain accessible. Whether you are a developer, investor, or blockchain enthusiast, BscScan is an indispensable tool for interacting with the BSC network.

Understanding BscScan's Features

Real-Time Transaction Tracking

One of the core functionalities of BscScan is its ability to track transactions on the Binance Smart Chain in real time. By entering the transaction hash or wallet address, users can retrieve detailed information about a specific transaction, including the transaction amount, date, block number, balances, transaction fees, and status.

This feature is handy for individuals who want to monitor the progress of their transactions or verify the authenticity of a particular transaction on the BSC network.

Exploring Wallet Addresses

BscScan allows users to explore wallet addresses on the Binance Smart Chain, providing a comprehensive overview of transaction history, token balances, and other relevant information.

Users can access details such as BNB balance, BEP-20 token holdings, transaction data, and more by entering a wallet address into the search bar.

This feature enables users to gain insights into the activity of specific wallets and track the movement of digital assets on the BSC network.

Smart Contract Verification

Smart contracts are an integral part of the Binance Smart Chain ecosystem, enabling the creation and execution of decentralized applications.

BscScan offers an intelligent contract verification feature, allowing users to verify the authenticity and integrity of smart contracts deployed on the BSC network.

By comparing the compiled code of a smart contract with the code running on the blockchain, users can ensure that the contract functions as intended and mitigate the risk of potential vulnerabilities or malicious activities.

Token Tracking and Analysis

BscScan allows users to track and analyze tokens on the Binance Smart Chain. Users can access information about the top BEP-20 tokens, including prices, volume, market capitalization, number of holders, and cross-chain compatibility.

Additionally, BscScan supports ERC-721 and ERC-1155 tokens, making it possible to explore and track non-fungible tokens (NFTs) on the BSC network.

This feature is invaluable for investors and traders looking to stay updated on the performance and trends of different tokens within the BSC ecosystem.

Gas Price Monitoring

Gas fees are essential to any blockchain network, including Binance Smart Chain. BscScan offers a gas price monitoring feature, allowing users to view real-time information about gas fees on the BSC network.

By monitoring gas prices, users can make informed decisions about transaction fees and navigate the network efficiently. This feature is handy during periods of high network congestion when gas fees tend to fluctuate.

Using BscScan: Step-by-Step Guide

BscScan provides a user-friendly interface that makes it easy for users to navigate and extract valuable information from the Binance Smart Chain. In this step-by-step guide, we will walk you through using BscScan's key features.

Checking Transactions on BscScan

- Visit the BscScan website at bscscan.com.

- In the search bar at the top of the page, enter the transaction hash or wallet address you want to investigate.

- BscScan will query its database and display detailed information about the transaction, including the transaction amount, date, block number, balances, transaction fees, and status.

- Take note of the transaction status, which can be pending, successful, or failed. This information will help you determine the progress and outcome of the transaction.

- You can also explore additional details about the transaction by clicking on specific sections, such as the sender's address, recipient's address, or transaction hash.

Exploring Wallet Addresses

- On the BscScan homepage, locate the search bar at the top of the page.

- Enter the wallet address that you want to explore and press Enter or click the search icon.

- BscScan will provide an overview of the wallet address, including the BNB balance and the balances of any BEP-20 tokens held in the wallet.

- Scroll down to view the transaction history associated with the wallet address, including incoming and outgoing transactions.

- You can click on individual transactions to access more detailed information, such as the transaction hash, block number, and transaction fee.

Verifying Smart Contracts

- Navigate to the BscScan website and locate the "Verify Contract" section.

- Enter the smart contract address that you want to verify.

- Select the appropriate compiler type and open-source license type.

- Copy and paste the Solidity contract code into the designated field.

- Enable optimization by selecting "Yes" in the optimization dropdown menu if applicable.

- Click the "Verify and Publish" button to initiate the contract verification process.

- BscScan will compare the submitted code with the code running on the BSC network and provide a verification result indicating whether the contract code matches.

Tracking Tokens on BscScan

- Access the BscScan website and navigate to the "Tokens" section.

- Explore the top BEP-20 tokens listed on BscScan, including their prices, volume, market capitalization, and number of holders.

- Use the search bar to find specific tokens by their contract address or token symbol.

- Click on individual tokens for more detailed information, such as the token's contract address, token holders, transaction history, and related smart contracts.

- BscScan also supports ERC-721 and ERC-1155 tokens, allowing users to explore and track non-fungible tokens (NFTs) on the BSC network.

Monitoring Gas Prices

- Visit the BscScan website and locate the "Gas Tracker" section.

- Monitor the average gas price displayed on the page.

- Check the block size and average utilization to understand the current network congestion.

- Scroll down to view the BSC network's top gas guzzlers and spenders.

- Use this information to make informed decisions about gas fees and optimize your transactions on the Binance Smart Chain.

BscScan vs. Etherscan: Key Differences

While BscScan and Etherscan share similarities as blockchain explorers, the two platforms have some key differences. Here are the main distinctions:

- Supported Wallets: BscScan supports a limited number of wallets (e.g., MetaMask, TrustWallet) compared to Etherscan, which supports a broader range of wallets.

- Features: Etherscan has the advantage of offering Blockchain APIs and Crypto APIs, providing developers with more advanced functionalities for interacting with the Ethereum blockchain.

- Focus: BscScan is designed explicitly for the Binance Smart Chain, while Etherscan caters to the Ethereum network. Each explorer prioritizes features and data relevant to its respective blockchain.

BscScan and Etherscan are reputable and reliable explorers, offering valuable insights into their respective blockchain networks.

BscScan Alternatives

While BscScan is the leading blockchain explorer for the Binance Smart Chain, several alternative explorers are available for users. Here are a few notable options:

- Binance Chain Explorer: Developed directly by Binance, this explorer provides information about blocks, transactions, wallet balances, and BNB metadata. It is available both as a web and mobile application.

- BitQuery Explorer: BitQuery is a comprehensive explorer that supports multiple blockchains, including Binance Smart Chain. It offers advanced search and analytics capabilities for developers and researchers.

- Binance Explorer: Binance also provides its explorer for the Binance Smart Chain, offering similar functionalities to BscScan. It is a reliable alternative for users seeking a different interface or additional features.

These alternatives provide users with different interfaces and functionalities, allowing them to choose the explorer that best suits their needs.

Is BscScan Safe?

As a leading blockchain explorer, BscScan is developed by the same team behind Etherscan, which has established a strong reputation in the blockchain community.

BscScan is safe to use, as it does not require a connection to your BSC wallet and cannot access or acquire your funds. However, it is essential to exercise caution and verify that you are using the official BscScan website (bscscan.com) to avoid potential phishing attempts.

Always double-check the URL and ensure that you are on the correct website before entering any sensitive information.

Is BscScan Compatible with NFTs?

Yes, BscScan is fully compatible with non-fungible tokens (NFTs). Like Ethereum, the Binance Smart Chain hosts various NFT projects, taking advantage of its lower fees and higher efficiency.

Users can track their NFTs on BscScan using the transaction hash, NFT intelligent contract address, or wallet address. However, it is essential to note that BscScan does not display the artwork contained within an NFT.

Users must connect to a compatible marketplace or service provider supporting the specific NFT token standard to view the artwork.

Frequently Asked Questions

Q1. How to check if liquidity is locked on BscScan?

To determine if liquidity is locked for a specific token on BscScan, you can follow these steps:

- Go to the BscScan website and navigate to the "Tokens" section.

- Search for the token by its contract address or token symbol.

- Scroll down to the "Transfers" section and click on the transaction hash associated with the liquidity addition.

- Check if the liquidity pool tokens or a burn address were sent to the development wallet.

- Verify that the development wallet does not hold any liquidity pool tokens or check if they have been transferred to a burn address.

Q2. Can BscScan be used for other blockchain networks?

No, BscScan is designed explicitly for the Binance Smart Chain and cannot be used to explore other blockchain networks. Each blockchain has its dedicated explorer, such as Etherscan for Ethereum or Blockchain for Bitcoin.

If you need to explore a different blockchain, using the corresponding blockchain explorer for accurate and relevant information is recommended.

Q3. What are the advantages of using BscScan for yield farming?

BscScan offers several advantages for users engaged in yield farming on the Binance Smart Chain:

- Access the latest yield farming opportunities through the "Yield Farms List" feature.

- Detailed information about different farms, including their locations and how they work.

- The ability to track your yield farming activities, including the tokens you have staked and the rewards you have earned.

- Lower transaction fees compared to alternative platforms like Ethereum, making yield farming on BSC more cost-effective.

Q4. Can I revoke token approvals using BscScan?

Yes, BscScan provides the "Token Approval Checker" tool that allows users to review and revoke token approvals for decentralized applications (DApps).

Connecting your wallet to BscScan and using the Token Approval Checker lets you see which DApps can access your tokens and revoke their permissions if desired. This feature gives users more control over their token holdings and helps ensure the security of their assets.

Q5. How does BscScan ensure contract verification?

BscScan's contract verification process involves comparing the source code of a smart contract with the compiled code running on the Binance Smart Chain.

This process ensures that the code deployed on the blockchain matches the source code provided by the developer.

BscScan's verification process enhances transparency and security by allowing users to verify intelligent contracts' functionality and integrity independently.

Q6. What are the risks of using BscScan?

While BscScan is a reputable and reliable blockchain explorer, some risks are associated with using any online tool. It is essential to be cautious and follow best security practices when using BscScan or any other blockchain explorer:

- Ensure you use the official BscScan website (bscscan.com) to avoid phishing attempts.

- Double-check the URL and ensure that you are on the correct website before entering any sensitive information.

- Be wary of fake or malicious contracts, tokens, or DApps. Always conduct thorough research and due diligence before interacting with unknown projects.

- Keep your personal information and wallet details secure. Avoid sharing sensitive information with unknown individuals or platforms.

Q7. How can I contribute to the BscScan community?

If you are interested in contributing to the BscScan community, there are several ways to get involved:

- Participate in discussions on the BscScan forums or social media channels.

- Report any bugs or issues you encounter using BscScan to the development team.

- Provide feedback and suggestions for improving the platform's features and user experience.

- Contribute to the BscScan open-source project on GitHub if you have programming skills.

Your contributions can help enhance the functionality and usability of BscScan for the entire Binance Smart Chain community.

Conclusion

BscScan is a powerful and essential tool for navigating the Binance Smart Chain ecosystem. Whether you are an investor, developer, or blockchain enthusiast, BscScan provides valuable insights into the BSC network's transactions, smart contracts, tokens, and gas prices.

By leveraging BscScan's features, you can make more informed decisions, track your investments, and ensure the security of your digital assets. Explore BscScan today and unlock the full potential of the Binance Smart Chain.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

Next Crypto Bull Run - Bitcoin Price Prediction

%201.svg)

%201.svg)

Welcome to this comprehensive analysis of the next crypto bull run. In this article, we will delve into the predictions and analysis provided by various experts in the field.

We will explore the start and end dates of the bull run, Bitcoin price predictions, and the projected total crypto market cap. So, if you want to make life-changing crypto returns, stay tuned!

Ian Balina's Crypto Journey

To understand the credibility of the predictions we'll be discussing, let's take a moment to introduce Ian Balina. He is the founder and CEO of Token Metrics, an AI and data-driven company that rates crypto assets.

With a track record of building successful companies and raising millions in capital, Ian has become a prominent figure in the crypto space.

Ian's journey in crypto began in 2016 when he turned $20,000 into over $5 million in less than 12 months. This impressive feat caught the attention of many, prompting him to share his investment strategies and predictions transparently.

Now, with his expertise and data-driven approach, Ian aims to help others navigate the crypto market and find significant opportunities.

Next Crypto Bull Run Start Dates

One of the critical aspects of predicting the next crypto bull run is identifying the start dates. Ian Balina suggests using the Bitcoin halving as a pivot point for determining when the bull run begins. Historically, Bitcoin experiences a surge in price after each halving event.

Looking at past cycles, we can see that Bitcoin went up over 90x after the halving in 2012 and around 30x after the halving in 2016. Based on this pattern, Ian predicts that the next bull run will start around April 2024, aligning with the anticipated Bitcoin halving.

Bitcoin Price Prediction

Now, let's focus on the highly anticipated Bitcoin price predictions. Ian Balina's analysis leads him to believe that Bitcoin has the potential to reach $150,000 in the next bull run. Considering the current price of BTC is around $30,000, this implies a 4.5x return on investment.

While some argue that the ROI decreases with each cycle, it's important to note that the gains are still substantial. Investing in Bitcoin during the bull run could yield significant profits, but the real money-making opportunities lie in identifying promising altcoins that outperform the market.

Crypto Bull Run End Dates

Determining the end dates of the crypto bull run is crucial for maximizing profits and planning investment strategies. Based on historical data and lengthening bull run patterns, Ian Balina presents three possible scenarios for the end dates.

In the bear case scenario, where the bull run follows a 15% increase in length compared to the previous cycle, the bull run is expected to end around March 2026. The base case scenario, which assumes a 25% increase in length, suggests the bull run could last until June 2026.

For the most optimistic scenario, the moon case, with a 40% increase in length, the bull run could extend all the way to November 2026. These timelines provide a range of possibilities for investors to strategize and make the most of the bull run.

Total Crypto Market Cap Prediction

As the crypto market continues to grow, it's essential to assess the potential market cap and overall value of cryptocurrencies. Ian Balina's analysis takes into account the historical trends of the crypto market cap during previous bull runs.

In the bear case scenario, where the ROI reduction is 2.5x, the total crypto market cap is predicted to reach around 8 trillion dollars by March 2026. Moving to the base case scenario, with a 2x reduction in ROI, the market cap could climb to 10 trillion dollars by June 2026.

For the moon case scenario, assuming a 1.5x reduction in ROI, the market cap has the potential to skyrocket to 14 trillion dollars by November 2026. These projections indicate significant growth in the crypto market, providing ample opportunities for investors to capitalize on the bull run.

Summary of Crypto Predictions

To summarize the predictions we've discussed, the next crypto bull run is projected to start around April 2024, with Bitcoin potentially reaching $150,000. The bull run is expected to last until at least March 2026, with the total crypto market cap ranging from 8 trillion to 14 trillion dollars.

While these predictions are not set in stone and should be considered speculative, they offer valuable insights for investors looking to make informed decisions in the crypto space. It's crucial to conduct thorough research and consider multiple factors before making any investment choices.

Conclusion

In conclusion, the next crypto bull run holds immense potential for investors seeking to make life-changing money. With the guidance of experts like Ian Balina and the data-driven approach of companies like Token Metrics, it's possible to navigate the crypto market with confidence.

Remember, while Bitcoin may provide substantial returns, the real opportunities lie in identifying promising altcoins that can outperform the market. By leveraging the predicted start and end dates of the bull run and considering the projected total market cap, investors can position themselves for success.

As always, it's essential to conduct your research, stay informed about market trends, and assess the risks involved in crypto investments. With a strategic approach and a thorough market understanding, you can maximize your potential gains during the next crypto bull run.

So, get ready, stay informed, and embark on your crypto investment journey with optimism and caution. The next bull run awaits, and it's up to you to seize the opportunities it presents. Good luck, and happy investing!

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

How to Make Money in Crypto? - Unveiling the Secrets to 100x Returns

%201.svg)

%201.svg)

The cryptocurrency world has become a dynamic hub of opportunities for savvy investors looking to make substantial profits. With the right strategies and a keen eye for emerging trends, anyone can achieve mind-boggling investment returns.

In this comprehensive guide, we will explore the secrets to making money in crypto and uncover the path to 100x returns.

Who is Ian Balina?

Before we delve into the strategy, it's essential to understand the expertise and know the individual behind it. Ian Balina, the founder and CEO of Token Metrics, is a renowned figure in the crypto world.

With a background in computer engineering and experience as a sales engineer at IBM and a consultant at Deloitte Consulting, Ian brings a unique blend of technical knowledge and business acumen.

He turned $20,000 into over $5 million in less than 12 months using a data-driven approach. With his vast experience and proven track record, Ian's insights into the crypto market are highly sought after.

The 3-Point 100x Strategy

When making 100x returns in the crypto market, Ian Balina has developed a three-point strategy that forms the foundation of his approach. These three points are quality, tokenomics, and valuation.

Quality - The Key to Successful Crypto Investments - Investing in quality crypto assets is crucial for long-term success. By assessing the fundamentals and technology behind a project, you can determine its growth potential. Factors such as on-chain traction, active wallets, community size, and the team's background play a significant role in evaluating the quality of a crypto asset. Additionally, analyzing the code quality, developer activity, and security audits provides insights into the technological aspect of the project.

Tokenomics: Evaluating the Long-Term Value - Understanding the tokenomics of a crypto asset is essential to identify its long-term value. Factors such as supply and demand dynamics, economic incentives, and the token's utility within the ecosystem are crucial in determining whether it's worth holding for the long term.

By assessing the balance between supply and demand and analyzing the market's perception of the asset, you can gauge its growth potential.

Valuation: Identifying Undervalued Gems - Finding undervalued crypto assets is the key to unlocking substantial returns. By comparing the fully diluted valuation (FDV) with the market capitalization, you can identify potential discrepancies.

Additionally, analyzing the asset's valuation compared to its competitors within the sector provides valuable insights into its growth potential. Value investing principles, such as buying low and selling high, form the basis of this valuation strategy.

What is the 100x?

Before we dive deeper into the strategies, let's define what precisely a 100x return means in the crypto world. A 100x return refers to multiplying your investment by 100, resulting in a whopping 10,000% return.

For example, turning $10,000 into $1 million or $1,000 into $100,000 would be considered a 100x return. Achieving such astronomical returns requires identifying crypto assets with tremendous growth potential and investing in them at the right time.

Solana: A 1000x Case Study

To illustrate the potential for 100x returns, let's examine the success story of Solana. Solana, a blockchain platform, delivered over 1000x returns to early venture capital (VC) investors. By analyzing the various funding rounds and the subsequent performance of Solana's token, we can gain insights into the strategies that led to such impressive returns.

Seed Round: Seeding the Path to Success

In March 2018, Solana raised over $3 million in its seed round for 4 cents per token. At this early stage, the project had only released version 0.1 of its whitepaper.

Fast forward to the all-time high of Solana's token, which reached almost $260, and VC investors who participated in the seed round achieved an incredible 6500x return on their investment.

Additional Funding Rounds: Amplifying the Growth

Solana's journey continued with additional funding rounds, each contributing to the project's growth and increasing the potential for substantial returns. In June 2018, Solana raised $12 million at 20 cents per token shortly before launching its private test net.

In July 2019, another funding round resulted in over $5 million raised at 22.5 cents per token, just before the public test net launch. Finally, in February 2020, right before the main net launch, an additional $2.4 million was raised at 25 cents per token.

Matic (Polygon): A Case Study in Launchpad Success

Another avenue to achieve 100x returns in crypto is through launchpads, which provide opportunities for retail investors to participate in early-stage projects.

One such success story is Matic, now known as Polygon, which launched through the Binance Launchpad. By analyzing Matic's journey, we can understand how early investors achieved impressive returns.

Seed Investor Success: Reaping the Rewards

Seed investors who got in early on Matic received the tokens for 0.0079, which proved to be an incredible bargain. With the all-time high reaching almost 300x the seed price, seed investors who held their tokens experienced a staggering 3700x return. Turning $10,000 into $37 million showcases the potential for substantial gains through early-stage investments.

Retail Investors: Seizing the Opportunity

Retail investors who participated in the Binance Launchpad event for Matic also reaped significant rewards. With a launchpad sale price of 0.00263, retail investors achieved a remarkable 1100x return if they held their tokens until the all-time high.

Even with a modest investment of $300, these retail investors saw their holdings grow to over $300,000, demonstrating the potential for 100x returns through launchpad participation.

How to Make 100x via Mining?

Mining cryptocurrencies can be another avenue to achieve 100x returns. By dedicating computing power to secure blockchain networks, miners are rewarded with newly minted tokens. One project that exemplifies the potential for significant returns through mining is Helium.

Helium: Mining the Path to Profits

Helium is a project that enables individuals to mine tokens by sharing their internet connection through specialized devices called hotspots. By participating in the Helium network, miners earn HNT tokens as a reward.

With the all-time high price of HNT reaching almost $55, early miners experienced a remarkable 500x return on their investment. This showcases the potential for substantial gains through mining endeavors in the crypto market.

How to Make 100x in a Bear Market?

While the crypto market can be volatile, it's still possible to achieve 100x returns even in bearish conditions. One project that exemplifies the potential for significant gains during a bear market is Kaspa.

Kaspa: Profiting in a Downturn

Kaspa is a proof-of-work blockchain project that experienced a 100x return during a bear market. Despite the challenging market conditions, Kaspa's fair launch approach and favorable economics allowed early investors to achieve substantial returns.

With the all-time low price of 0.00017 and the all-time high reaching $0.05, investors who held their positions saw their investments multiply by 100x.

Crypto Quality: Assessing Fundamentals and Technology

When investing in cryptocurrencies, it's crucial to assess the quality of the underlying projects. Evaluating the fundamentals and technology behind a crypto asset provides valuable insights into its potential for growth.

Fundamentals: The Foundation of Success

Examining the fundamentals of a crypto asset involves analyzing factors such as on-chain traction, active wallets, community size, and the team's background. By understanding the project's fundamentals, investors can gain confidence in its long-term viability and growth potential.

Technology: The Backbone of Innovation

The technological aspect of a crypto project is equally important. Assessing factors such as developer activity, security audits, and code quality provides insights into the project's technical robustness. A solid technological foundation indicates the potential for innovation and long-term success.

Crypto Tokenomics: Evaluating Long-Term Value

Understanding the tokenomics of a crypto asset is crucial for identifying its long-term value. By analyzing supply and demand dynamics, economic incentives, and the token's utility within the ecosystem, investors can assess whether the asset is worth holding for the long term.

Supply and Demand Dynamics: Striking a Balance

Analyzing the supply and demand dynamics of a crypto asset is essential to gauge its growth potential.

A balanced supply and demand relationship ensures stability and sustainable value appreciation. Factors such as token issuance mechanisms and token utility within the ecosystem play a significant role in determining the asset's potential.

Economic Incentives: Driving Value Creation

Economic incentives within a crypto ecosystem are vital for driving value creation. By examining factors such as staking rewards, token burns, and revenue-sharing mechanisms, investors can gain insights into the potential for token appreciation. Projects with well-designed economic models attract long-term investors and create a strong foundation for growth.

Crypto Valuation: Finding Undervalued Gems

Identifying undervalued crypto assets is the key to achieving substantial returns. By comparing the fully diluted valuation (FDV) with the market capitalization, investors can identify potential discrepancies in the market's pricing.

Additionally, analyzing the asset's valuation compared to its competitors within the sector provides valuable insights into its growth potential.

Finding the Margin of Safety

Value investing principles can be applied to crypto asset valuation. By identifying assets with a margin of safety, investors can capitalize on market mispricing and achieve significant returns.

Buying assets below their intrinsic value provides a buffer against market fluctuations and sets the stage for substantial gains.

Injective Protocol vs. SEI Network: A Comparative Analysis

To illustrate the importance of valuation, let's compare two projects: Injective Protocol and SEI Network. By analyzing their respective valuations and market positions, we can gain insights into their growth potential.

Injective Protocol: Unleashing the Power of Decentralized Exchanges

Injective Protocol aims to revolutionize the decentralized exchange landscape. With a fully diluted valuation of $1.2 billion and a market capitalization of $400 million, there is room for growth.

Analyzing the project's fundamentals, technology, and competitive landscape provides valuable insights into its potential for value appreciation.

SEI Network: Tapping into the Power of NFTs

SEI Network focuses on the non-fungible token (NFT) space, aiming to bring unique digital assets to the forefront.

With a fully diluted valuation of $200 million and a market capitalization of $100 million, SEI Network is undervalued compared to its competitors. Assessing the project's fundamentals, technology, and market positioning provides valuable insights into its growth potential.

Best 100x Crypto Picks

Based on the strategies outlined and the analysis conducted, I am excited to share my 100x crypto picks. These picks represent projects that exhibit strong fundamentals, promising tokenomics, and the potential for significant valuation growth.

- Solana (SOL): With its impressive track record of delivering 1000x returns to early VC investors, Solana remains a top contender for substantial gains.

- Polygon (MATIC): Formerly known as Matic, Polygon achieved remarkable returns through its launchpad event on Binance. Retail investors who participated in the event experienced 1000x returns.

- Helium (HNT): By participating in the Helium network and mining HNT tokens, early miners achieved impressive returns of 500x.

- Kaspa (KAS): Despite a bearish market, Kaspa demonstrated the potential for 100x returns through its fair launch approach.

Conclusion

Making money in the crypto market requires strategic thinking, thorough analysis, and a willingness to take calculated risks. By focusing on quality projects, evaluating tokenomics, and identifying undervalued assets, investors can position themselves for substantial gains.

However, it's essential to conduct thorough due diligence and stay informed about market trends and developments. With the knowledge and strategies outlined in this guide, you are well-equipped to navigate the crypto market and unlock the potential for 100x returns.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)