6 Best Crypto Analysis Tools for Investors in 2023

Are you tired of feeling like you're constantly playing catch-up in the ever-evolving world of cryptocurrency? Do you find yourself struggling to make sense of the vast amount of data and information available, unsure of which investments will lead to the best returns? If so, you're not alone.

In the fast-paced world of crypto investing, having the right research and analysis tools at your disposal is essential for staying ahead of the curve and making informed investment decisions.

In this guide, we'll take a deep dive into the best crypto research and analysis tools for 2023, including their unique features and benefits. By the end of this post, you'll have a clear understanding of which tools are right for your investment strategy and goals, and be equipped with the knowledge you need to make smart and profitable investments in the exciting world of cryptocurrency.

Importance of Crypto Analysis Tools

The significance of crypto research and analysis tools cannot be overstated in today's dynamic and rapidly evolving digital asset ecosystem. Cryptocurrency investors and traders alike rely on these tools to extract valuable insights and gain a competitive advantage in the market.

By leveraging these powerful tools, users can obtain a detailed understanding of market trends and conditions, as well as monitor the performance of their investments in real-time.

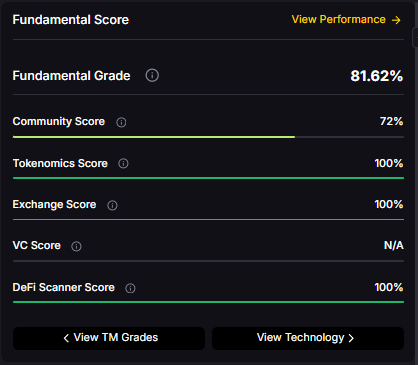

Sophisticated crypto analysis tools like Token Metrics, incorporate advanced techniques such as artificial intelligence and machine learning to deliver actionable insights and predictions. Moreover, they facilitate the identification of market opportunities and help users make informed decisions based on statistical, technical, and fundamental analysis.

Types of Crypto Research and Analysis Tools

There is a wide variety of crypto research and analysis tools available in the market today, each designed to serve a specific purpose and cater to the diverse needs of investors and traders.

Market Tracker - The cryptocurrency market tracker provides users with real-time data on crypto prices, market capitalization, and trading volumes.

Technical Analysis Platform - Another popular tool is the technical analysis platform, which utilizes historical price data and technical indicators to forecast future price trends and identify potential trading opportunities.

Sentiment Analysis Tool - The sentiment analysis tools track social media and news sentiment to gauge market sentiment and predict price movements.

Fundamental analysis Tools - Fundamental analysis tools, evaluate the intrinsic value of a cryptocurrency by analyzing its underlying technology, team, and community.

Quantitative Analysis: Quantitative analysis is a data-driven approach to research that involves using statistical and mathematical models to identify patterns and trends in the market. This type of analysis is often used to develop trading algorithms and other investment strategies.

News and Social Media Analysis: News analysis involves tracking and analyzing news stories and events that could impact the cryptocurrency market. This can include political events, regulatory changes, and major company announcements.

Network Analysis: Network analysis involves studying the structure and behavior of the blockchain network to identify potential investment opportunities. This can include analyzing the number of transactions, the distribution of coins, and the overall health of the network.

Ultimately, the key to selecting the right type of crypto research and analysis tool is to determine which type of analysis is most relevant to your investment strategy and goals.

List of Best Crypto Analysis Tools

As the cryptocurrency market continues to grow and gain popularity, it's becoming increasingly important for traders and investors to have access to reliable research and analysis tools.

These tools can provide valuable insights into market trends and help inform investment decisions.

In this list, we'll take a closer look at some of the best crypto research and analysis tools available in the market for fundamental analysis, technical analysis, sentiment analysis, quantitative analysis, news and social media analysis.

1. Token Metrics

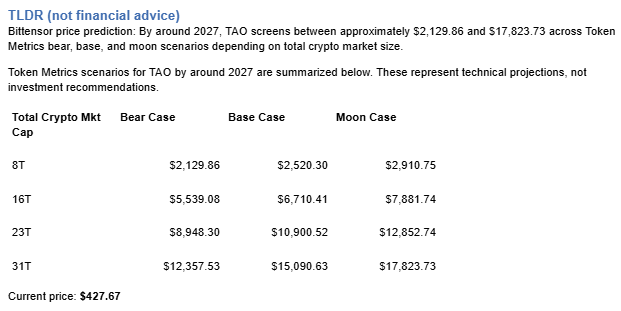

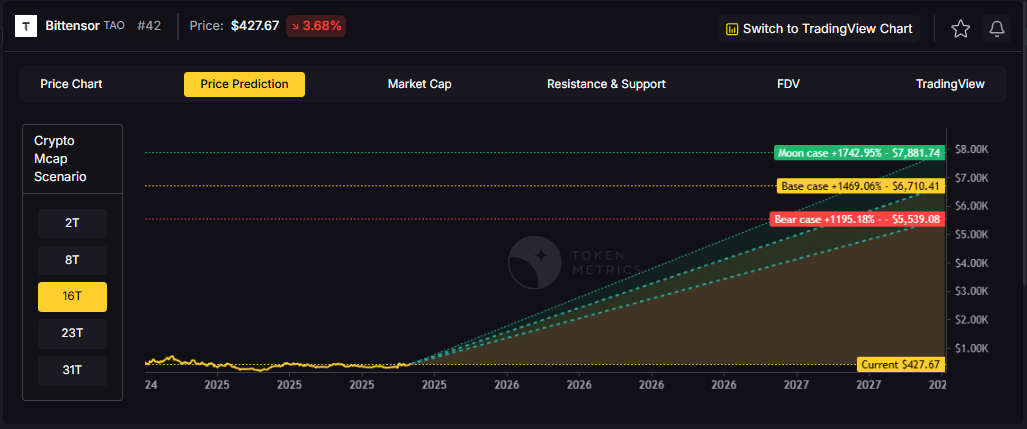

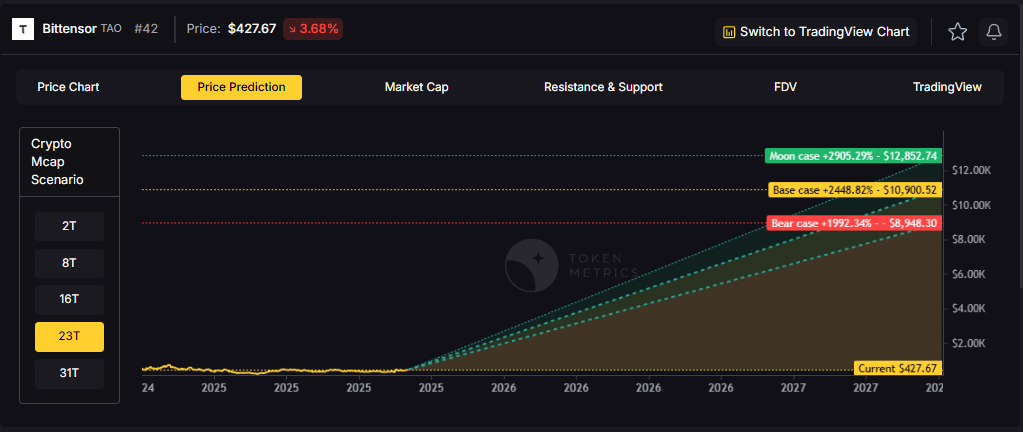

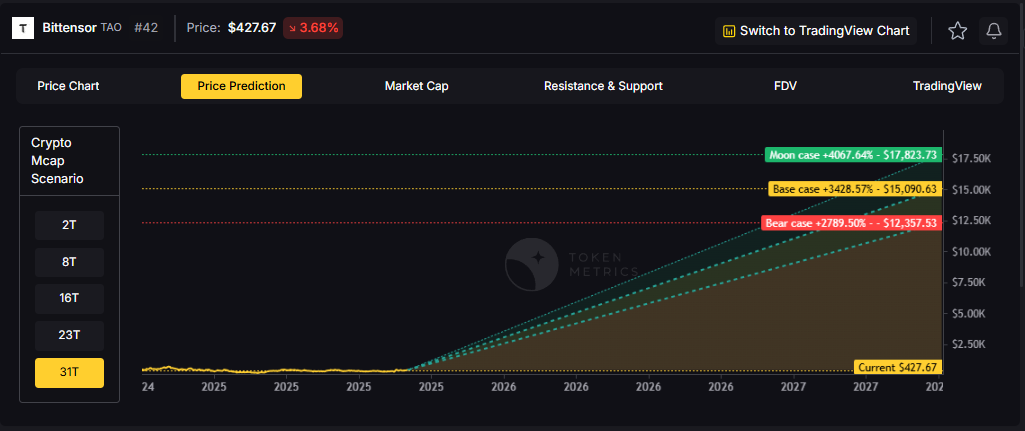

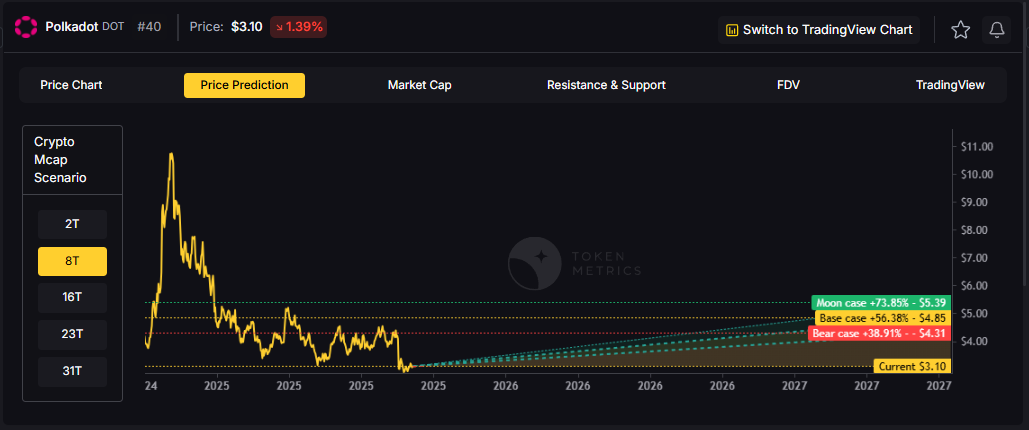

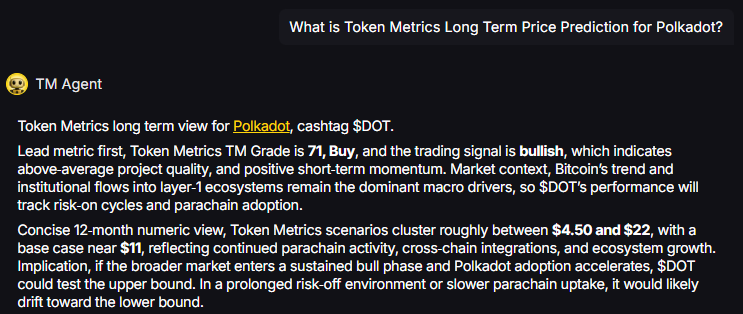

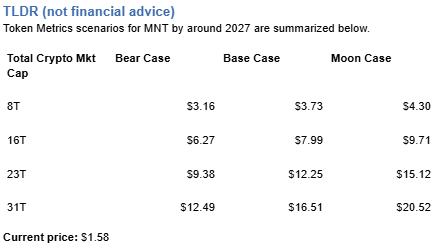

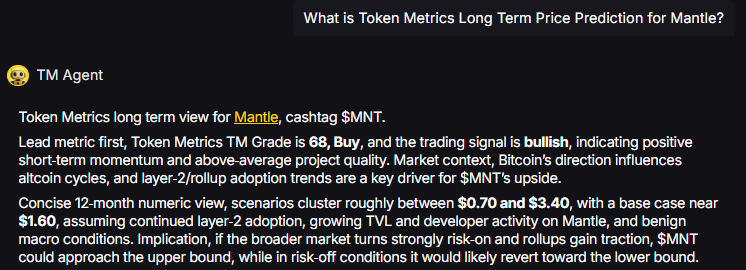

Token Metrics is an AI driven crypto research and analysis platform that provides users with a range of resources and insights for navigating the cryptocurrency market. The platform uses advanced machine learning algorithms and artificial intelligence to analyze market data and provide users with accurate predictions and forecasts for various cryptocurrencies.

Additionally, Token Metrics offers users access to a range of technical analysis tools, such as custom indicators and real-time charts, which enable investors and traders to make informed decisions based on market trends and insights.

The platform also offers a range of educational resources, including webinars, tutorials, and market research reports, to help users stay up-to-date on the latest trends and developments in the crypto space.

Overall, Token Metrics is a valuable resource for anyone seeking to invest in cryptocurrencies, offering a wealth of data and insights that can help users make informed decisions and navigate the complex and ever-changing crypto market.

Users can take advantage of Token metrics analytics platform and Its features by visiting here - app.tokenmetrics.com/market

2. TradingView

TradingView is a popular charting platform that offers real-time data and advanced analysis tools for a wide range of financial instruments, including cryptocurrencies. The platform offers a wide range of chart types, including line charts, bar charts, and candlestick charts.

With TradingView, you can create custom charts and indicators, set up alerts for price changes, and collaborate with other traders in real-time. TradingView also offers a social trading platform where you can follow and copy the trades of other successful investors.

With its dynamic and flexible interface, this tool is capable of empowering users to formulate informed investment decisions and optimize their trading strategies.

3. DefiLlama

DefiLlama is a leading website that provides users with a comprehensive overview of the DeFi market. It provides users valuable insights and data related to decentralized finance (DeFi) protocols.

The platform tracks a wide range of DeFi projects and provides users with detailed information on the protocol's TVL (Total Value Locked), price, trading volume, and other key metrics.

Additionally, users can access data on the top DeFi protocols and monitor their performance in real-time. Defi Llama also enables users to view the composition of various DeFi portfolios and gauge their risk exposure.

The platform's user-friendly interface and sophisticated analytical tools make it an ideal resource for investors and traders seeking to navigate the complex and rapidly evolving DeFi ecosystem.

4. Coinmarketcap

CoinMarketCap has established itself as one of the most recognizable names in the world of cryptocurrency. It is a popular and trusted platform that serves as a go-to resource for anyone interested in the rapidly growing industry.

Founded in May 2013, CoinMarketCap aims to make crypto assets more discoverable on the internet by providing reliable information to the public. It has evolved over the years to become the world’s most referenced price-tracking website for crypto assets, with millions of users around the globe.

It provides real-time data on over 8,000 cryptocurrencies, including their current price, market capitalization, trading volume, and more. CoinMarketCap is a great resource for anyone looking to stay up-to-date on the latest crypto market trends.

5. Lunarcrush

Lunarcrush is a powerful social media analytics tool that helps cryptocurrency enthusiasts and investors stay up-to-date with the latest market trends and insights. The platform is designed to provide real-time data and analysis on various cryptocurrencies, including their market capitalization, trading volume, price movements, and social media sentiment.

One of the most impressive features of Lunarcrush is its advanced social listening capabilities, which enable users to track and analyze conversations and mentions about specific cryptocurrencies across various social media platforms, including Twitter, Reddit, and Telegram.

This provides users with valuable insights into the community's sentiment and perception of a particular cryptocurrency. Lunarcrush also provides customized alerts and notifications, allowing users to stay informed about significant market movements and trends in real-time.

Additionally, the platform offers a range of interactive tools and charts, such as the HODL Waves chart, which shows the percentage of circulating coins that have not been moved for a specific period, providing insights into the behavior and sentiment of long-term investors.

6. CryptoCompare

CryptoCompare is another popular crypto research and analysis tool that provides real-time market data and price analysis.

It also offers a range of other features, such as a mining profitability calculator, a crypto wallet tracker, benchmarking, learning resources and a news feed that aggregates crypto-related news from around the web.

CryptoCompare's comprehensive suite of features and tools makes it a valuable resource for anyone interested in the world of cryptocurrency. Whether you are a seasoned investor or just getting started

Conclusion

In conclusion, there are a range of excellent crypto research and analysis tools available on the market today. Whether you're a seasoned trader or just starting out, these tools can provide valuable insights and help inform your investment decisions.

By using a combination of these tools, you can stay up-to-date on the latest market trends and make informed investment decisions that are right for you.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)