Integrating Crypto APIs with Google Sheets and Excel: A Complete Guide

Staying on top of cryptocurrency markets often means harnessing real-time data and powerful analytics. For anyone seeking transparency and automation in tracking digital assets, connecting a crypto API directly to Google Sheets or Excel can transform your workflow. But how does the process actually work, and what are the best practices? Let’s break down the essential steps and considerations for integrating crypto APIs with your favorite spreadsheets, optimizing your data analysis, and ensuring reliability and security.

Choosing the Right Crypto API

The first step is selecting a crypto API suited to your needs. APIs are digital interfaces that let apps and platforms request data from cryptocurrency exchanges or analytics providers. Popular APIs deliver live prices, on-chain data, market caps, historical charts, and blockchain analytics.

- Open vs. Restricted APIs: Some APIs are public and free; others require API keys and may have rate or usage limits.

- Data Types: Consider if you need real-time price feeds, historical OHLCV data, on-chain analytics, or sentiment analysis.

- Reliability & Security: Well-established APIs should offer robust documentation, strong uptime records, and clear usage policies.

- Compliance: Ensure you use APIs that are legally authorized to distribute the type of crypto data you seek.

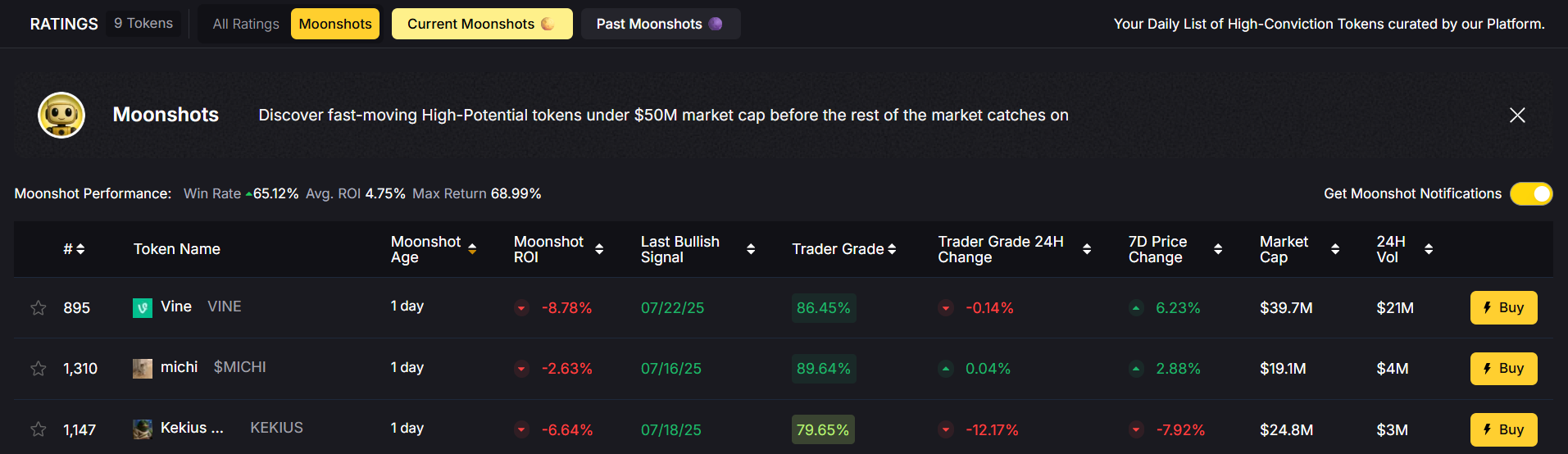

Examples of reputable APIs include Token Metrics, CoinGecko, CoinMarketCap, Binance, and CryptoCompare. Some, like Token Metrics, also offer AI-driven insights and advanced analytics for deeper research.

How to Connect a Crypto API to Google Sheets

Google Sheets offers flexibility for live crypto data tracking, especially with tools like Apps Script and the IMPORTDATA or IMPORTJSON custom functions. Here’s a general approach:

- Obtain Your API Endpoint and Key: Sign up for your preferred API (such as Token Metrics) and copy your endpoint URL and API key credentials.

- Install or Set Up Importer: For public APIs returning CSV data, use

=IMPORTDATA(“URL”)directly in a cell. For JSON APIs (the vast majority), you’ll likely need to add a custom Apps Script function likeIMPORTJSONor use third-party add-ons such as API Connector. - Write the Script or Formula: In Apps Script, create a function that fetches and parses the JSON data, handling your API key in the request headers if needed.

- Display and Format: Run your script or enter your formula (e.g.,

=IMPORTJSON("https://api.tokenmetrics.com/v1/prices?symbol=BTC", "/price", "noHeaders")). Crypto data will update automatically based on your refresh schedule or script triggers. - Automation & Limits: Be aware of Google’s rate limits and your API plan’s quota; set triggers thoughtfully to avoid errors or blocking.

Sample Apps Script for a GET request might look like:

function GETCRYPTO(url) {

var response = UrlFetchApp.fetch(url);

var json = response.getContentText();

var data = JSON.parse(json);

return data.price;

}

Change the URL as needed for your API endpoint and required parameters.

How to Connect a Crypto API to Excel

Microsoft Excel supports API integrations using built-in tools like Power Query (Get & Transform) and VBA scripting. Here is how you can set up a connection:

- Fetch the API Endpoint and Key: Obtain the endpoint and authorize via headers or parameters as your API documentation describes.

- Use Power Query: In Excel, go to Data > Get Data > From Other Sources > From Web. Enter the API URL, set HTTP method (typically GET), and configure authentication, if needed.

- Parse JSON/CSV: Power Query will ingest the JSON or CSV. Use its UI to navigate, transform, and load only the fields or tables you need (like price, symbol, or market cap).

- Refresh Data: When finished, click Load to bring dynamic crypto data into your spreadsheet. Setup refresh schedules as needed for real-time or periodic updates.

- Advanced Automation: For customized workflows (like triggered refreshes or response handling), leverage Excel’s scripting tools or Office Scripts in cloud-based Excel.

Note that Excel’s query limits and performance may vary depending on frequency, the amount of retrieved data, and your version (cloud vs desktop).

Best Practices and Use Cases for Crypto API Data in Spreadsheets

Why use a crypto API in your spreadsheet at all? Here are common scenarios and tips you should consider:

- Portfolio Tracking: Dynamically update positions, track P/L, and rebalance based on real-time prices.

- Market & Sentiment Analysis: Import on-chain or social sentiment metrics for enhanced research (available from providers like Token Metrics).

- Historical Analysis: Pull historical OHLCV for custom charting and volatility tracking.

- Custom Alerts or Dashboarding: Build automated alerts using conditional formatting or macros if price triggers or portfolio thresholds are breached.

- Audit and Compliance: Keep timestamped logs or export data snapshots for reporting/transparency needs.

Security Tip: Always keep API keys secure and avoid sharing spreadsheet templates publicly if they contain credentials. Use environment variables or Google Apps Script’s Properties Service for added safety.

Troubleshooting, Rate Limits, and Common Pitfalls

Although spreadsheet integration is powerful, some challenges are common:

- Rate Limits: Both Google Sheets/Excel and your crypto API will have tiered usage limits—avoid setting updates more frequently than permitted to prevent service interruptions.

- Parsing Errors: Double-check API documentation for exact JSON/CSV field names required by your formulas or scripts.

- Data Freshness: Sheet refreshes may lag a few minutes, so always verify the update interval matches your analysis needs.

- Authentication Issues: If data fails to load, ensure API keys and headers are handled correctly and privileges have not recently changed.

- Spreadsheet Bloat: Very large data pulls can slow down your spreadsheet—filter or limit queries to only what you truly need.

When in doubt, consult your API provider’s resource or developer documentation for troubleshooting tips and best practices.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

FAQ: Connecting Crypto APIs to Google Sheets or Excel

Do I need programming knowledge to connect a crypto API?

Basic integrations, like using APIs that return CSV files, can often work without code via built-in data import features. For JSON APIs or custom data endpoints, familiarity with Apps Script (Google Sheets) or Power Query (Excel) is helpful but not strictly required, especially if you use add-ons like API Connector or plug-and-play solutions.

What types of crypto data can I import into spreadsheets?

Supported APIs offer a variety of data: live spot prices, historical price series, market capitalization, volume, on-chain metrics, sentiment scores, and more. The exact data fields depend on each API’s offering and the available endpoints.

How should I keep my API key secure in a spreadsheet?

Never embed plain text API keys in shared or public spreadsheets. In Google Sheets, use script properties or protected ranges; in Excel, store keys locally or use encrypted variables if automating. Always follow your provider’s credential management guidelines.

How frequently does spreadsheet crypto data refresh with APIs?

Refresh frequency depends on your integration setup. Google Sheets custom scripts or add-ons can update as often as every few minutes, subject to service and API rate limits. Excel’s Power Query typically updates manually or based on scheduled refresh intervals you define.

What’s the best crypto API for Google Sheets or Excel?

Choice depends on use case and data depth. Token Metrics is notable for real-time prices, AI-powered analytics, and robust developer support. Other popular choices are CoinGecko, CoinMarketCap, and exchange-specific APIs. Always compare data coverage, reliability, security, and documentation.

Disclaimer

This article is for educational and informational purposes only. It does not constitute financial, legal, or investment advice. Always follow best practices for security and usage when working with APIs and spreadsheets.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)