What are Crypto ETFs and How it Works?

The ever-evolving world of cryptocurrency has introduced many investment options, with one of the latest being Crypto ETFs. But what exactly are they, and how do they function?

This comprehensive guide delves into Crypto ETFs, ensuring you're well-equipped with actionable insights and up-to-date knowledge.

What is a Crypto ETF?

A Crypto ETF, or Cryptocurrency Exchange-Traded Fund, bridges traditional finance and the digital currency. At its core, a Crypto ETF is an investment fund and exchange-traded product listed on conventional stock exchanges.

Instead of buying individual cryptocurrencies directly and managing complex wallets and private keys, investors can purchase shares of a Crypto ETF. This fund then invests in and holds cryptocurrencies, mirroring their market performance.

Whether tracking a single coin like Bitcoin or a diversified array of digital assets, Crypto ETFs offer a more accessible and regulated way for investors to gain exposure to the volatile cryptocurrency markets.

How Crypto ETFs Operate?

Grasping the functionality of Crypto ETFs is pivotal for any prospective investor. These funds, although reminiscent of traditional ETFs, come with their own set of distinct operations:

Cryptocurrency Reserves: Every Crypto ETF has a reserve of the actual digital currencies it represents, safeguarded in highly secure storage solutions. This real-world backing ensures the ETF accurately mirrors its underlying assets' performance.

Price Alignment: Whether representing a single cryptocurrency like Bitcoin or a compilation, these ETFs use well-established crypto indexes to ensure accurate price tracking.

Liquidity Mechanics: Large-scale institutional investors, often termed 'Liquidity Providers,' play a crucial role. They step in to buy or sell the ETF's shares, ensuring its market price stays close to the actual value of the underlying assets.

Dividend Distribution: Unlike direct cryptocurrency holdings, which don't yield dividends, some Crypto ETFs might offer dividend-like distributions sourced from network transaction fees or other avenues.

Types of Crypto ETFs

The landscape of Crypto ETFs is diverse, catering to various investment strategies and appetites.

Single-Crypto ETFs: These ETFs focus exclusively on one cryptocurrency. For instance, an ETF that only tracks Bitcoin would belong to this category. Investors looking to target the performance of a particular digital currency might opt for these.

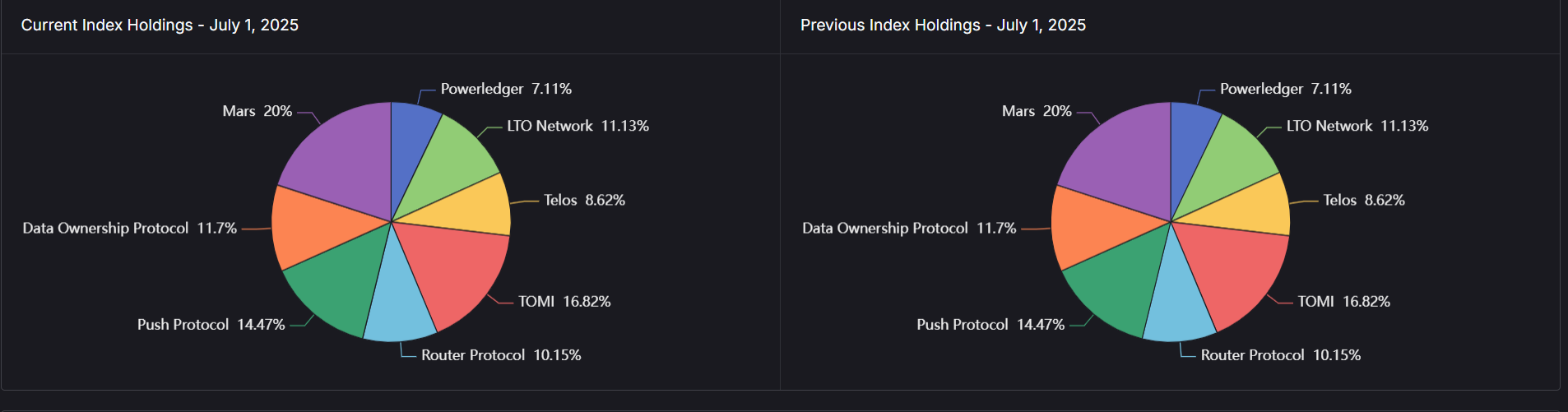

Basket-Crypto ETFs: Offering a more diversified approach, these ETFs track a group or portfolio of cryptocurrencies. This can help spread risk, as the performance isn't reliant on just one digital asset. This type is ideal for those seeking broader exposure to the crypto market.

Themed Crypto ETFs: Some ETFs are tailored to specific themes or niches within the crypto world. For instance, ETFs focus on the DeFi sector or the burgeoning NFT space. These cater to investors with a specific interest or belief in the potential of particular crypto sectors.

Leveraged and Inverse Crypto ETFs: These are more complex and potentially riskier. Leveraged ETFs aim to amplify returns by using financial derivatives.

On the other hand, inverse ETFs are designed to profit from a decline in the value of an underlying benchmark. Both types require a deeper understanding of market mechanisms and have heightened risks.

Each ETF type offers a unique risk-reward profile, catering to various investment strategies and objectives.

How to Invest in Crypto ETFs?

Investing in Crypto ETFs might seem daunting, but by following a structured approach, you can simplify the process:

Educate Yourself: Understand the mechanics of Crypto ETFs, their fee structure, and the cryptocurrencies they track. Some ETFs might focus on one crypto, while others offer a diversified portfolio.

Select a Reliable Brokerage: Opt for a trusted brokerage platform that accesses the desired Crypto ETFs. Many traditional brokerages have expanded their offerings to include these funds.

Diversify Wisely: Don't put all your eggs in one basket. Consider a mix of ETFs to balance out potential risks.

Stay Updated: The crypto market is ever-evolving. Regularly review your investments and adjust as market dynamics shift.

Potential Benefits and Risks of Crypto ETFs

Navigating the investment landscape of Crypto ETFs means understanding both the advantages they offer and the pitfalls to be wary of:

Benefits:

- Simplified Exposure: Crypto ETFs grant investors entry into the digital currency world without the complexities of direct ownership.

- Instant Diversification: ETFs tracking multiple cryptocurrencies spread risk, reducing the impact of a single asset's downturn.

- Regulatory Oversight: Traded on conventional stock exchanges, these funds have a regulatory safety net, enhancing trust.

- Familiar Investment Vehicle: For traditional investors, Crypto ETFs offer a known structure akin to other ETFs they might have encountered.

- Liquidity: Due to their tradable nature on exchanges, they often provide better liquidity than some crypto assets.

Risks:

- Market Volatility: Cryptocurrencies are inherently volatile, and ETFs tracking them are not immune to these fluctuations.

- Operational Fees: Crypto ETFs may carry management fees that could erode returns over time.

- Regulatory Shifts: The evolving nature of crypto regulations could affect ETF operations or availability.

- Market Sentiment: Rapid changes in investor sentiment can lead to unpredictable ETF price movements.

- Limited Track Record: As relatively new instruments, their long-term performance and resilience are yet to be fully established.

Why Crypto ETFs are Gaining Popularity?

Crypto ETFs have gained traction for several reasons:

Accessibility: They provide an entry point for traditional investors to gain exposure to the crypto market without owning digital assets.

Diversification: Some ETFs track multiple cryptocurrencies, providing instant diversification across the volatile crypto market.

Regulation: Being traded on stock exchanges means they fall under traditional financial systems' scrutiny and regulatory framework.

Is It Good to Invest in a Crypto ETF?

Investing in a Crypto ETF offers a balanced entry into the dynamic world of digital currencies. For those wary of direct crypto ownership, these ETFs provide a more regulated and accessible avenue. They combine the diversification benefits of traditional ETFs with the potential growth of the crypto sector.

However, like all investments, they come with risks—chief among them being the inherent volatility of cryptocurrencies. Investors must thoroughly research their risk tolerance and investment horizon before diving into any Crypto ETF.

Frequently Asked Questions

Q1. How do Crypto ETF fees compare to traditional ETFs?

While fees vary across different ETFs, it's not uncommon for Crypto ETFs to carry slightly higher management fees due to the specialized nature of the asset class and the need for additional security measures.

Q2. Can I redeem my Crypto ETF shares for the actual cryptocurrency?

Individual investors cannot typically redeem Crypto ETF shares for the underlying cryptocurrency. They can, however, sell their ETF shares on the stock market.

Q3. Are there tax implications when investing in a Crypto ETF?

Like other investment vehicles, Crypto ETFs can have tax implications, especially when selling shares or receiving distributions. It's crucial to consult with a tax advisor to understand specifics.

Q4. How secure are the cryptocurrencies held within a Crypto ETF?

Crypto ETFs prioritize security, often employing advanced custody solutions to protect the underlying assets. This might include cold storage, multi-signature wallets, and other advanced security protocols.

Q5. Do Crypto ETFs offer exposure to emerging or lesser-known cryptocurrencies?

While many Crypto ETFs focus on well-known cryptocurrencies like Bitcoin and Ethereum, some ETFs may provide exposure to altcoins or newer projects, depending on the ETF's objective.

Q6. How does the regulatory environment affect Crypto ETFs?

The regulatory landscape for cryptocurrencies is evolving, and any changes can directly impact Crypto ETFs. This might involve approval processes, operational guidelines, or the overall availability of such ETFs.

Q7. Is the performance of a Crypto ETF identical to its underlying assets?

While Crypto ETFs aim to mirror the performance of the underlying assets, there might be minor discrepancies due to fees, tracking errors, or the ETF's management strategies.

Q8. Can I use Crypto ETFs for my retirement or 401(k) plan?

Some retirement accounts and 401(k) plans may allow for ETF investments, including Crypto ETFs. However, consulting with a financial advisor to understand specific allowances and potential benefits is essential.

The Bottom Line

Crypto ETFs offer an exciting bridge between traditional finance and the burgeoning space of cryptocurrencies. They present an accessible avenue for newcomers and seasoned investors to delve into digital assets with the familiar framework of stock exchange trading. As with all investments, understanding the associated risks is paramount.

Remember, the cryptocurrency landscape is dynamic, with frequent shifts and developments. Staying informed and making decisions grounded in research and sound understanding will always be your best strategy.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Conduct your due diligence and consult your financial advisor before making investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)