What is a Crypto Index Fund? - Complete Guide for Crypto Investors

Investing in cryptocurrency can be overwhelming, especially when there are thousands of digital assets to choose from. But have you ever considered investing in a crypto index fund?

It's an approach that could simplify your investing process and diversify your portfolio. This guide will take you through the fundamentals of crypto index funds and how they might be a game-changer for your investing strategy.

What is a Crypto Index Fund?

A crypto index fund is a type of investment vehicle that tracks a specific index of cryptocurrencies.

Similar to traditional stock market index funds, a crypto index fund provides investors with broad market exposure by investing in a basket of various cryptocurrencies.

This method reduces the risks of investing in individual assets and instead spreads the risk across multiple assets.

Why Invest in Crypto Index Funds?

Diversification - Investing in a single cryptocurrency can be risky. If the coin's value drops, your investment will suffer. However, with a crypto index fund, your investment is spread across multiple cryptocurrencies. If one coin performs poorly, the others may balance it out, reducing the overall risk.

Simplicity - Navigating the crypto landscape can be complex and time-consuming, especially for newcomers. Crypto index funds simplify the process. Instead of researching and buying individual coins, you can invest in many at once.

Accessibility - Some valuable cryptocurrencies are quite expensive. Bitcoin, for example, can be dauntingly high-priced for many investors. With a crypto index fund, you can gain exposure to these costly coins without needing to buy a whole unit.

How Does a Crypto Index Fund Work?

A crypto index fund works similarly to traditional index funds in the stock market. It is a type of pooled investment that tracks a specified cryptocurrency index.

This index might contain several different cryptocurrencies, weighted by factors like market cap, trading volume, or an equal distribution.

When you invest in a crypto index fund, your money is spread across the different cryptocurrencies included in that index. The fund manager rebalances the fund periodically to ensure it continues to mirror the index it tracks.

This method allows investors to gain broad exposure to the cryptocurrency market, mitigating the risk of investing in individual coins.

Choosing the Right Crypto Index Fund

When selecting a crypto index fund, consider the following factors:

The Index It Tracks - A fund's performance is dependent on the index it tracks. It's crucial to understand how this index is composed. Some indexes are weighted by market cap, while others might consider equal weighting or use other methodologies. Research what coins are included and how their performance will affect the fund.

Fees - Like all investment products, crypto index funds come with fees. These may include management fees, rebalancing fees, and others. Ensure you understand all associated costs and how they'll impact your returns.

Liquidity - In the crypto world, liquidity refers to the ability to quickly buy or sell an asset without causing a drastic change in its price. A fund with high liquidity will make it easier for you to buy or sell your shares without significantly affecting the price.

Best Crypto Index Funds in 2025

Here are some of the top crypto index funds for 2025 based on their popularity, reliability, and reputation:

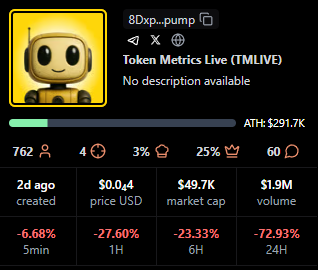

- Token Metrics AI Indices: Combine machine learning with market sentiment to allocate and rebalance crypto portfolios automatically. They feature bullish and bearish signals that guide when to enter or exit an index.

- Bitwise & Galaxy Indices: Though more traditional, they’re beginning to explore data-driven rebalancing and smart beta strategies.

- DeFi Pulse Index (DPI): A static sector index for DeFi, but when enhanced with AI (e.g., incorporating protocol usage data), it could evolve into a dynamic performer.

Remember to thoroughly research any fund before investing to ensure it aligns with your investment goals and risk tolerance.

Getting Started with Crypto Index Funds

Select a Fund - After considering the factors mentioned above, choose a fund that aligns with your investment goals. Some popular crypto index funds include the Bitwise 10 Crypto Index Fund and the Coinbase Index Fund.

Open an Account - To invest in a crypto index fund, you'll likely need to create an account with the platform that offers the fund. The process typically involves providing some personal information for identification and setting up a secure password.

Purchase Shares - Once your account is set up, you can buy shares in the index fund. The price of a share typically reflects the net asset value (NAV) of the fund's underlying assets.

You'll have a stake in all the cryptocurrencies that the fund tracks, in proportion to their presence in the index.

Monitor and Adjust - Keep an eye on your investment and the performance of the underlying index. Depending on the fund, your investment may be automatically rebalanced periodically.

However, it's essential to stay informed and adjust your holdings if necessary, based on your investment goals and risk tolerance.

Risks and Rewards

Investing in crypto index funds, like all investment vehicles, comes with both risks and rewards. The diversified nature of index funds can cushion against market volatility, providing a more stable investment. However, the crypto market as a whole is subject to high volatility, and crypto index funds are not immune.

Risks

Market Volatility: Cryptocurrencies are known for their extreme volatility. While diversification can mitigate some risk, a crypto index fund is still subject to the ups and downs of the market.

Regulatory Risk: As the regulatory landscape for cryptocurrencies continues to evolve, sudden changes could impact the market and, consequently, the performance of the fund.

Liquidity Risk: Depending on the assets within the index, some coins may not be as readily tradable as others, posing a liquidity risk.

Rewards

Diversification: Crypto index funds spread the risk among multiple cryptocurrencies, which can provide more stability than investing in individual coins.

Accessibility: These funds offer an easy way to gain exposure to a range of cryptocurrencies without the need to buy and manage them individually.

Management: Crypto index funds are managed by professionals who rebalance the portfolio regularly, ensuring it continues to reflect its target index.

Crypto Index Funds Vs Crypto ETFs

Crypto index funds and Crypto ETFs (Exchange-Traded Funds) both offer exposure to a basket of different cryptocurrencies. However, there are some key differences:

Trading: ETFs trade on traditional stock exchanges and can be bought or sold during trading hours at market prices. Index funds, on the other hand, are typically purchased or redeemed at the day's closing net asset value (NAV).

Accessibility: Generally, ETFs are more accessible because they can be purchased through any brokerage account. Index funds might require an account with the specific platform offering the fund.

Management: Both are managed funds, but ETFs often track passive indexes, while index funds can be either passively or actively managed.

Are Crypto Index Funds Good for Investment?

Crypto index funds can be a good investment for those who want exposure to the crypto market without needing to research and manage individual cryptocurrencies.

They provide a level of diversification that can mitigate risk and are generally less volatile than individual coins.

However, like all investments, they come with their own risks and should be chosen based on individual investment goals, risk tolerance, and market understanding.

Future of Crypto Index Funds

Crypto index funds are likely to grow in popularity as more investors seek diversified exposure to the cryptocurrency market.

As the market matures and more institutional investors enter the space, the demand for professionally managed, diversified investment products like index funds is expected to rise. Regulatory clarity could further enhance their adoption and growth.

Also Read - Crypto Crashing - Everything You Need to Know

Frequently Asked Questions

Q1. Can I create my own crypto index fund?

Technically, an individual could create their own "index" by purchasing a variety of cryptocurrencies in proportions that mimic an established crypto index.

However, creating an official index fund that others can invest in requires significant financial and legal infrastructure, including regulatory compliance.

Q2. Are crypto index funds available globally?

While many crypto index funds aim to cater to a global audience, availability can be subject to local regulations.

Some countries may have restrictions or prohibitions on such investments. Always check with your local regulatory authority before investing.

Q3. Can I lose all my money in a crypto index fund?

As with any investment, there's a risk involved. However, the diversification of index funds typically mitigates the chance of losing the entire investment. That being said, the crypto market can be highly volatile, and significant losses are possible.

Q4. What is the minimum investment for a crypto index fund?

Minimum investment amounts vary between different crypto index funds. Some funds might have a very low minimum, making them accessible to beginners, while others could require substantial initial investments. Always check the fund's terms before investing.

Q5. How often are crypto index funds rebalanced?

The frequency of rebalancing depends on the specific fund. Some funds might rebalance monthly, quarterly, or based on specific market conditions. Rebalancing helps ensure the fund accurately reflects its target index.

Q6. Can I invest in a crypto index fund through my traditional broker?

It depends on the broker and the specific fund. Some traditional brokers have started offering access to crypto index funds, while others have not. You will need to check with your broker to see if this is an option.

Q7. How are crypto index funds taxed?

The tax implications of investing in crypto index funds vary based on jurisdiction. In many cases, these funds are subject to capital gains tax, but the specifics can vary. It's important to consult with a tax professional to understand the implications fully.

Q8. Can I withdraw my money at any time from a crypto index fund?

This depends on the specific terms of the fund. Some funds might have lock-up periods or penalties for early withdrawal. Be sure to understand these terms before investing.

Conclusion

In conclusion, crypto index funds offer a simplified and diversified way to gain exposure to the cryptocurrency market.

They are suitable for both beginners seeking a straightforward way into the crypto world and experienced investors looking to diversify their portfolio.

As always, ensure you understand the risks involved and do your due diligence before investing. Happy investing!

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)