Crypto Price APIs - Best Cryptocurrency API List for Real-time Prices

%201.svg)

%201.svg)

Cryptocurrency price APIs are essential tools for anyone looking to monitor and analyze the performance of various digital assets. These APIs provide real-time price updates and historical data, allowing users to make informed decisions about buying, selling, and trading cryptocurrencies.

There are many cryptocurrency price APIs available in the market, each with its own set of features and benefits. In this blog post, we will explore some of the key features of crypto price APIs, how to use them and why they are important for investors and traders.

Crypto Price API Overview

Crypto Price API is a way to get real-time and historical cryptocurrency price data.

This allows developers, traders, and investors to access accurate and up-to-date information on the value of various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, among others.

The API is designed to be fast, reliable, and easy to use, with a variety of endpoints and parameters to customize the data returned.

It offers a range of features, including support for multiple exchanges and currencies, customizable time intervals, and access to a range of trading data, including volume and order book information.

Overall, the Crypto Price API is a valuable tool for anyone interested in tracking cryptocurrency prices or developing applications that involve cryptocurrencies.

Types of Crypto Price API

There are several types of crypto price APIs available that provide real-time price data for cryptocurrencies.

The most common type is the RESTful API, which allows developers to retrieve price data using HTTP requests.

WebSocket API is another popular type of crypto price API that provides real-time streaming of data.

The choice of API will depend on the developer's specific needs and the level of detail required for their application.

How to Use the Crypto Price API?

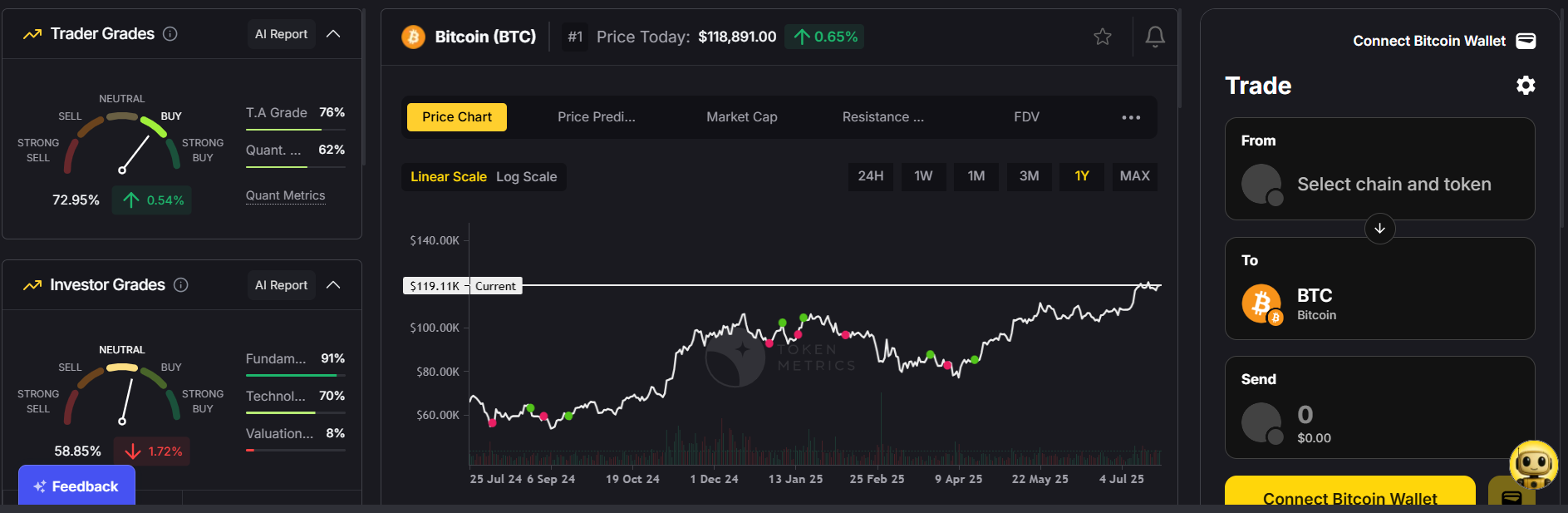

Using the Token Metrics Data API, one can get real-time prices for cryptocurrencies using the Price endpoint.

What’s inside the $TMAI API?

✅ AI-Powered Trading Signals – Bullish and bearish calls backed by over 80 data points

✅ Real-Time Grades – Instantly assess token momentum with Trader & Investor Grades

✅ Curated Indices – Plug into ready-to-use crypto portfolios by sector or market cap

✅ Lightning-Fast Performance – Built for bots, dashboards, dApps, and next-gen trading tools

Whether you’re building a DeFi dashboard, an alpha-sniping bot, or your own crypto terminal — this is your edge.

Getting started is as easy as:

1. Obtaining an API key by signing up for the Token Metrics Data API Plan.

2. Next, you will need to integrate the API into your application or website using the programming language of your choice. This typically involves sending HTTP requests to the API endpoint and parsing the JSON data that is returned.

3. Use the Price endpoint to make a call to the API and get real-time prices of cryptocurrencies.

Learn more about all the available endpoints here.

Crypto Price API Features

For crypto price APIs to be considered good, the following features are required to exist:

Real-Time Price Updates

One of the most critical features of a cryptocurrency price API is real-time price updates. With the volatile nature of the crypto market, it is crucial to have up-to-date information on the latest price changes. A good API should provide real-time data feeds that allow users to track changes in the market as they happen.

Historical Data

Another essential feature of a cryptocurrency price API is historical data. Historical data is crucial for analyzing the performance of a particular asset over time. With this information, traders can identify patterns and trends in the market and make informed decisions about when to buy or sell a particular asset.

Data Aggregation

Crypto price APIs often aggregate data from multiple exchanges, providing users with a comprehensive view of the market. This feature is especially useful for traders who want to compare prices across different exchanges and find the best deals.

Customizable Notifications

A good cryptocurrency price API should offer customizable notifications, alerting users when certain price thresholds are met. This feature is particularly useful for investors who want to receive alerts when a particular asset reaches a certain price level.

Accuracy

It is important for the API to return accurate data that is actionable and free-from error. If that is not the case, traders can lose a lot of money relying on false data.

Best Cryptocurrency API List for Real-time Prices

Here is the list of top crypto API providers with Free and paid plans.

- Token Metrics API

- CoinMarketCap

- CoinGecko

- CryptoCompare

- CCXT

The Bottom Line

In conclusion, crypto APIs play a vital role in the world of cryptocurrency by enabling developers to create innovative applications that interact with various blockchain networks. The best crypto APIs provide reliable and secure access to blockchain data, allowing developers to build applications with confidence and efficiency.

When choosing a crypto API, it is important to consider factors such as pricing, ease of use, security, and the range of features available.

As the ecosystem and toolset surrounding this asset class continue to expand, there has never been a more opportune moment to get started.

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

.png)

How Do You Purchase Cryptocurrency? A Beginner’s Step-by-Step Guide (2025)

%201.svg)

%201.svg)

Cryptocurrency has moved from niche tech circles to the mainstream, with millions of people worldwide investing in Bitcoin, Ethereum, and thousands of other digital assets. Whether you want to trade actively, hold long-term, or explore decentralized finance (DeFi), the first step is understanding how to purchase cryptocurrency safely and efficiently.

In this guide, we’ll walk you through everything you need to know—**from choosing the right platform to securing your crypto—**so you can get started with confidence.

Step 1: Understand What Cryptocurrency Is

Before you dive in, it’s important to understand what you’re buying. Cryptocurrency is a digital asset that uses blockchain technology to enable secure, decentralized transactions. Unlike traditional currencies, crypto isn’t controlled by banks or governments.

Some of the most popular cryptocurrencies include:

- Bitcoin (BTC): The first and most valuable cryptocurrency.

- Ethereum (ETH): A blockchain supporting smart contracts and decentralized applications.

- Stablecoins (USDT, USDC): Pegged to fiat currencies like the US dollar for stability.

- Altcoins: Thousands of other coins with unique use cases (Solana, Cardano, etc.).

Once you know your options, you’re ready to buy.

Step 2: Choose a Cryptocurrency Exchange

To purchase crypto, you’ll need an exchange—a platform that lets you buy, sell, and trade digital assets.

Types of exchanges:

- Centralized Exchanges (CEX): User-friendly and beginner-friendly. Examples: Coinbase, Binance, Kraken, eToro.

- Decentralized Exchanges (DEX): Peer-to-peer trading directly from your wallet (Uniswap, PancakeSwap). Better for experienced users.

- Brokerage Apps: Apps like PayPal, Cash App, Robinhood let you buy crypto, though withdrawals may be limited.

What to look for in an exchange:

- Security: Two-factor authentication (2FA), insurance, and strong history.

- Fees: Look for transparent trading, deposit, and withdrawal fees.

- Supported assets: Ensure your chosen exchange lists the coins you want.

- Regulation: Use platforms compliant with your country’s laws.

Step 3: Create and Verify Your Account

Most centralized exchanges require Know Your Customer (KYC) verification for security and regulatory compliance.

What you’ll need:

- Email & phone number: For account creation.

- Government-issued ID: Passport, driver’s license, or national ID.

- Proof of address: Sometimes required for higher transaction limits.

Once verified, you’ll gain full access to trading and withdrawals.

Step 4: Deposit Funds Into Your Account

You can’t buy crypto without adding funds.

Common payment methods:

- Bank transfers: Usually the cheapest option but may take 1–3 days.

- Debit/Credit cards: Fast but with higher fees (often 2–4%).

- E-wallets & PayPal: Convenient but may have limits.

- P2P transfers: Directly buy from other users (on platforms like Binance P2P).

Pro Tip: Always compare deposit fees before funding your account.

Step 5: Choose Which Cryptocurrency to Buy

Beginners often start with Bitcoin or Ethereum due to their liquidity and stability. However, thousands of altcoins are available—each with unique purposes.

Factors to consider before buying:

- Market cap: Large-cap coins are generally less volatile.

- Project fundamentals: Check the coin’s whitepaper and team.

- Use case & community: Active projects with strong ecosystems are more promising.

- Volatility: Understand the risks of smaller, high-reward tokens.

Step 6: Place Your Order

When you’re ready, navigate to the Buy/Sell section of your exchange.

Order types:

- Market Order: Instantly buys at the current price. Best for beginners.

- Limit Order: Sets a specific price at which to buy. Great for strategic entry.

- Recurring Buy: Automates purchases (also known as dollar-cost averaging).

Example: If Bitcoin is $50,000 and you want to buy $100 worth, your market order will instantly execute at the best available price.

Step 7: Store Your Cryptocurrency Safely

Once purchased, you’ll need a wallet to store your crypto. Leaving assets on an exchange can expose you to hacking risks.

Types of wallets:

- Hot Wallets: Online, exchange-based, or software wallets (MetaMask, Trust Wallet). Easy to use but more vulnerable.

- Cold Wallets: Offline storage like Ledger or Trezor hardware wallets. Ideal for long-term security.

Tip: “Not your keys, not your coins.” If you hold significant funds, transfer them to a private wallet where you control the keys.

Step 8: Stay Informed and Manage Your Investment

Crypto markets are volatile. Prices can change rapidly, so keep track of market trends and news.

Best practices:

- Set alerts: Use tools like Token Metrics or CoinMarketCap to monitor prices.

- Diversify: Don’t put all your money in one coin.

- Avoid emotional trading: Stick to your plan and avoid panic-buying or selling.

- Use security tools: Enable 2FA and avoid sharing sensitive information.

How Much Should You Invest in Crypto?

Only invest what you can afford to lose. Experts often recommend starting with 1–5% of your portfolio and increasing gradually as you gain confidence.

Common Mistakes to Avoid When Buying Crypto

- Skipping research: Don’t buy a coin just because it’s trending.

- Using unsecured exchanges: Stick to reputable platforms.

- Not securing your wallet: Leaving funds on exchanges long-term.

- Falling for scams: Avoid too-good-to-be-true offers and unverified projects.

- Overtrading: Excessive buying/selling leads to higher fees and losses.

FAQs: Buying Cryptocurrency

1. Can I buy crypto without an exchange?

Yes. You can use peer-to-peer platforms or crypto ATMs, though fees may be higher.

2. Do I need a lot of money to start?

No. Many exchanges let you buy as little as $10 worth of crypto.

3. Is buying crypto legal?

In most countries, yes. Always check your local regulations.

4. What’s the safest way to buy?

Use a regulated exchange and store your funds in a hardware wallet.

Final Thoughts: Getting Started with Cryptocurrency

Purchasing cryptocurrency isn’t complicated—it’s about choosing the right platform, securing your funds, and investing wisely. Whether you’re buying Bitcoin as a long-term investment or exploring altcoins for potential growth, the steps are the same:

- Pick a reliable exchange

- Verify and fund your account

- Select your crypto and buy

- Secure it in a private wallet

The crypto market is full of opportunities—but also risks. Start small, do your research, and approach your investment journey with a long-term mindset.

Crypto Trading: Understanding Bitcoin Season Index and BTC Market Dominance with Token Metrics AI

%201.svg)

%201.svg)

The cryptocurrency market is known for its cyclical patterns, where Bitcoin and alternative cryptocurrencies, commonly called altcoins, take turns leading market performance. Cryptocurrency is a digital or virtual currency that operates on distributed ledger technology called a blockchain and uses cryptography for security. Unlike traditional currencies, cryptocurrencies are decentralized and not backed by any central bank, which sets them apart from government-issued money. Blockchain technology is the foundational element that underpins cryptocurrency, ensuring transaction transparency and security. For traders and investors engaged in crypto trading, understanding when Bitcoin dominates the market is crucial for effective portfolio management and maximizing profits. The Bitcoin Season Index, derived from Bitcoin dominance metrics, serves as a fundamental indicator to identify periods when the flagship cryptocurrency outperforms the broader cryptocurrency market. This insight enables traders to time their investments optimally and navigate the notoriously volatile crypto market with greater confidence.

What is the Bitcoin Season Index?

The Bitcoin Season Index is a specialized metric that measures Bitcoin’s market dominance and performance relative to other cryptocurrencies over specific time frames. Essentially, it quantifies Bitcoin’s share of the total cryptocurrency market capitalization. The value of cryptocurrencies is determined by market demand and supply. When 25% or fewer altcoins outperform Bitcoin, the market is said to be in a Bitcoin Season. This indicates that Bitcoin is maintaining its leadership position, attracting the majority of capital flows within the ecosystem.

The index is calculated by dividing Bitcoin’s market capitalization by the total market capitalization of the entire cryptocurrency market, then multiplying by 100 to get a percentage. More precisely, some methodologies consider the market cap of the top 125 coins to ensure comprehensive coverage. In this context, a coin refers to an individual cryptocurrency token, each with its own ticker symbol, that can be bought, sold, or traded on exchanges. When Bitcoin’s dominance remains elevated—typically above 60-65%—it signals that investors are preferentially allocating capital to Bitcoin rather than altcoins.

By tracking this metric, traders can better understand Bitcoin’s influence over the crypto market and recognize the inverse correlation between Bitcoin dominance and altcoin performance during different market phases. Many novice and experienced traders are drawn to cryptocurrency for its volatility and high reward potential. This understanding is invaluable for those looking to trade cryptocurrency effectively, as it helps predict price movements and market trends.

How Bitcoin Dominance Works as a Market Indicator

Bitcoin dominance is one of the most reliable indicators of market sentiment and capital allocation within the cryptocurrency ecosystem. It represents the percentage of total cryptocurrency market capitalization attributed to Bitcoin, reflecting its market share and influence.

The mechanics behind Bitcoin dominance are straightforward yet powerful. When Bitcoin’s price rises faster than the overall cryptocurrency market, its dominance increases. Conversely, when altcoins collectively outperform Bitcoin, its dominance decreases. This dynamic creates predictable patterns that experienced traders use to time their market entries and exits.

During Bitcoin seasons, several key dynamics typically emerge. Institutional investors often favor Bitcoin due to its perceived stability, regulatory acceptance, and status as the first cryptocurrency. Retail traders may also flock to Bitcoin during uncertain market conditions, viewing it as a safer store of value compared to the more volatile altcoins. Additionally, Bitcoin’s established liquidity and widespread support across cryptocurrency exchanges make it the preferred choice during risk-off periods. Trading cryptocurrency carries risk, and it is important to only trade what you can afford to lose. Trading cryptocurrencies is generally suitable for individuals with a high risk tolerance.

Understanding these dynamics allows traders to recognize when to increase Bitcoin exposure or diversify into altcoins, depending on prevailing market conditions and their individual risk tolerance.

Current Market Status: Bitcoin's 2025 Performance

As of mid-2025, Bitcoin has demonstrated exceptional performance, exemplifying a strong Bitcoin season. Year-to-date, Bitcoin is up approximately 10%, outperforming nearly all major altcoins except XRP, which has gained over 12%. Meanwhile, Ethereum has declined by 30%, and altcoins such as LINK, DOGE, AVAX, and SHIB have all dropped more than 20%.

Bitcoin dominance (BTC.D) currently stands at about 64%, a high level that historically signals Bitcoin season conditions. A decline below 60% often marks the beginning of altcoin seasons, where capital shifts toward alternative cryptocurrencies. The sustained high dominance level in 2025 suggests that Bitcoin continues to lead the cryptocurrency market.

Unlike fiat currencies, which are issued and managed by a central bank, Bitcoin operates independently without central bank involvement. Analysts from institutions like Standard Chartered predict Bitcoin could reach $200,000 by the end of 2025, fueled by robust inflows into Bitcoin ETFs and favorable political developments, including the election of a pro-crypto US president. These factors contribute to Bitcoin’s sustained outperformance and elevated dominance.

Recent market indicators, such as the Altcoin Season Index dropping to 41, further confirm a dominant Bitcoin season within the cryptocurrency market. This dynamic underscores Bitcoin’s ability to reclaim market leadership when conditions favor the flagship digital currency.

Historical Context and Market Patterns

Understanding historical Bitcoin seasons provides valuable context for interpreting current market conditions and anticipating future trends. Bitcoin dominance has exhibited clear cyclical patterns throughout cryptocurrency market history, with periods of expansion and contraction correlating with broader market trends and investor sentiment. High volatility creates profit opportunities for day traders, making it a key factor in cryptocurrency trading strategies. Monitoring value changes in Bitcoin and altcoins helps traders identify market trends and optimal entry or exit points.

For example, during the 2017-2018 cycle, Bitcoin dominance fell from over 80% to below 40% as the ICO boom drove massive capital flows into altcoins. However, during the subsequent bear market, Bitcoin dominance recovered significantly as investors sought safety in the most established cryptocurrency. A similar pattern occurred during the 2020-2021 bull market, where Bitcoin initially led before altcoins took over in the later stages.

The 2022 bear market saw Bitcoin dominance rise again as altcoins suffered disproportionate losses. These historical precedents demonstrate that Bitcoin seasons often coincide with either early bull market phases or extended periods of market uncertainty and decline. Bitcoin’s perceived stability and growing institutional adoption make it the preferred choice during such conditions.

The current market dynamics in 2025 reflect these historical patterns. Strong institutional adoption through Bitcoin ETFs, combined with favorable regulatory developments, have created conditions that favor Bitcoin accumulation over altcoin speculation. This environment naturally leads to increased Bitcoin dominance and prolonged Bitcoin season conditions.

The Science Behind Bitcoin Dominance Calculations

Calculating Bitcoin dominance involves sophisticated methodologies to ensure accuracy and relevance for trading decisions. While the basic formula divides Bitcoin’s market capitalization by the total cryptocurrency market capitalization, selecting which assets to include in the denominator is crucial.

Most platforms exclude stablecoins, wrapped tokens, and derivative assets from total market cap calculations to provide a more accurate representation of genuine price appreciation dynamics. This approach ensures that Bitcoin dominance reflects actual capital allocation preferences rather than artificial inflation from pegged assets.

Different time frames offer varying insights into market trends. Daily dominance readings can be volatile and influenced by short-term market movements, whereas weekly and monthly averages provide more stable trend indicators. The 90-day rolling analysis used in Bitcoin Season Index calculations helps filter out noise while maintaining responsiveness to real market shifts.

Advanced platforms like Token Metrics incorporate these dominance metrics into comprehensive market analysis frameworks. By combining Bitcoin dominance data with technical indicators, on-chain metrics, and sentiment analysis, traders gain a nuanced understanding of market conditions and timing opportunities, enhancing their ability to trade crypto effectively. Blockchain technology records all transactions on a shared ledger, and transaction data is a key component of on-chain metrics, providing valuable insights for dominance calculations and broader market analysis. Market analysis and trend observation are critical components of successful day trading, further emphasizing the importance of these tools.

Strategic Trading Applications During Bitcoin Season

Bitcoin seasons present unique opportunities and challenges for cryptocurrency traders employing various strategies and time horizons. Properly positioning portfolios during these periods can significantly impact returns and risk management.

Momentum traders benefit from Bitcoin seasons by adopting a clear directional bias toward Bitcoin. During established Bitcoin seasons, traders often reduce altcoin exposure and increase Bitcoin allocation to capitalize on continued outperformance. This strategy is particularly effective when Bitcoin dominance is trending upward with strong volume confirmation.

Contrarian traders may view extreme Bitcoin dominance levels as accumulation opportunities for quality altcoins. When Bitcoin dominance reaches high levels, investing in fundamentally strong altcoins can offer asymmetric risk-reward profiles for patient investors. However, timing these contrarian positions requires careful analysis of multiple market indicators and a good understanding of price trends.

Portfolio rebalancing during Bitcoin seasons demands a dynamic approach that accounts for shifting market conditions. Traders must be prepared to act quickly when opportunities arise during Bitcoin seasons. AI-powered platforms like Token Metrics excel in this area by providing real-time portfolio optimization recommendations based on current market dynamics and individual risk tolerance.

Risk management is especially important during Bitcoin seasons, as altcoin volatility often increases during periods of underperformance. Proper position sizing, use of stop-loss orders, and diversification strategies help protect capital while maintaining exposure to potential trend reversals.

Token Metrics: Revolutionizing Bitcoin Season Analysis

The advent of artificial intelligence and advanced analytics platforms has transformed cryptocurrency trading, with Token Metrics leading this technological revolution. The platform’s sophisticated approach to Bitcoin dominance analysis and market cycle identification provides traders with unprecedented insights into optimal positioning strategies. In addition, Token Metrics gives users access to advanced analytics and real-time market intelligence, making it easier to enter and navigate financial markets.

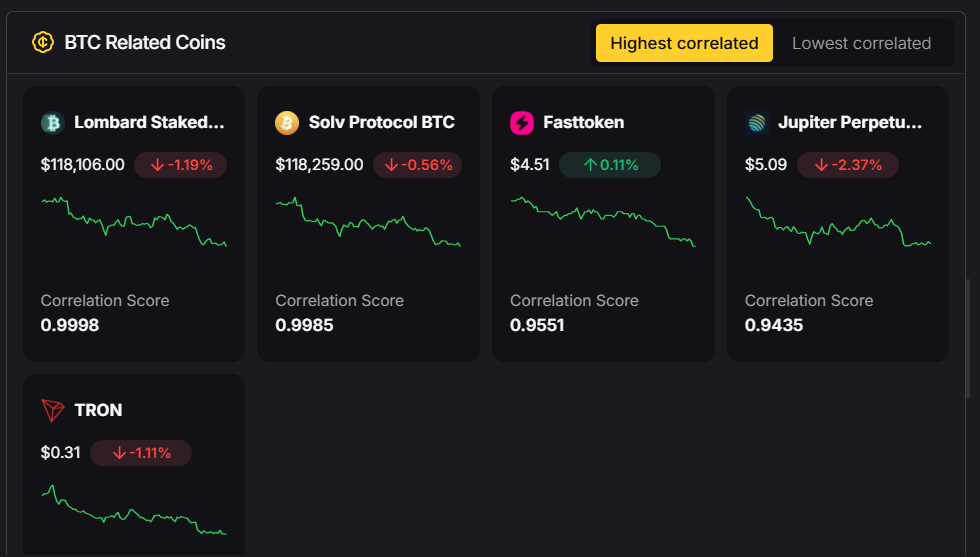

Token Metrics’ AI-driven methodology integrates Bitcoin dominance data with over 80 different metrics per cryptocurrency, creating a multidimensional view of market conditions that far surpasses traditional analysis. This comprehensive approach enables traders to dive deeper into market trends, recognize patterns, and predict price movements more accurately.

The platform’s real-time analysis capabilities are particularly valuable during Bitcoin season transitions. Token Metrics’ AI systems can identify subtle shifts in market dynamics that may signal the end of Bitcoin seasons and the beginning of altcoin outperformance periods. Early detection of these inflection points provides significant advantages for active traders and portfolio managers.

Beyond dominance analysis, Token Metrics incorporates fundamental research, technical analysis, and sentiment metrics, ensuring that Bitcoin season insights are contextualized within broader market trends and individual cryptocurrency prospects. This holistic approach empowers traders to make informed decisions on when to buy and sell crypto assets.

Earning Rewards During Bitcoin Seasons

Earning rewards during Bitcoin seasons is a compelling prospect for both traders and investors navigating the dynamic cryptocurrency market. These periods, marked by heightened volatility and pronounced price movements, present unique opportunities to trade cryptocurrencies for substantial profits. To capitalize on these market trends, it’s essential to develop a good understanding of technical analysis and risk management, enabling informed decisions when buying and selling digital assets.

Traders can employ a variety of strategies to earn rewards during Bitcoin seasons. Day trading, for example, involves executing multiple trades within a single day to take advantage of short-term price fluctuations in the crypto market. Swing trading and position trading, on the other hand, focus on capturing larger price movements over days or weeks, allowing traders to benefit from broader market trends. Regardless of the approach, recognizing patterns and predicting price movements are crucial skills for maximizing profits.

Selecting a reliable crypto platform is equally important. Platforms that offer low fees and high liquidity empower traders to execute trades efficiently, minimizing costs and slippage. This efficiency is vital when trading popular coins like Bitcoin and other cryptocurrencies, as it allows for quick responses to market changes and optimal entry and exit points.

By staying attuned to market trends, leveraging technical analysis, and utilizing platforms with robust trading features, traders and investors can position themselves to earn rewards during Bitcoin seasons. The ability to adapt strategies to evolving market conditions and manage risks effectively is key to sustained success in the cryptocurrency market.

High Liquidity and Its Impact on Bitcoin Season Dynamics

High liquidity is a cornerstone of effective trading during Bitcoin seasons, profoundly shaping the dynamics of the cryptocurrency market. In essence, liquidity refers to how easily traders can buy and sell cryptocurrencies without causing significant price changes. When a crypto asset like Bitcoin enjoys high liquidity, it means there are ample buyers and sellers, resulting in a stable and efficient market environment.

This abundance of trading activity is especially beneficial during periods of intense price movements, as it allows traders to enter and exit positions swiftly and at predictable prices. High liquidity reduces the risk of slippage—the difference between the expected price of a trade and the actual executed price—ensuring that traders can execute their strategies with precision. This is particularly important for those relying on technical analysis, as stable markets provide more reliable signals and patterns to inform trading decisions.

Moreover, high liquidity supports the ability to earn rewards by enabling traders to capitalize on rapid market shifts without being hindered by large spreads or limited order book depth. It also enhances the overall trading experience, making it easier to manage risk and maximize profits, whether trading Bitcoin or other cryptocurrencies.

Understanding the impact of high liquidity on Bitcoin season dynamics empowers traders to make more informed decisions in the crypto market. By prioritizing assets and platforms that offer high liquidity, traders can navigate volatile periods with greater confidence, efficiently buy and sell assets, and optimize their trading outcomes.

Risk Management During Bitcoin Seasons

Effective risk management during Bitcoin seasons involves understanding both the opportunities and limitations inherent in these market conditions. While Bitcoin seasons can provide a clear directional bias, they also introduce specific risks that traders must address. Trading during these periods can be particularly risky due to heightened volatility and rapid market shifts. Traders should set clear boundaries for acceptable losses to ensure long-term success in navigating these volatile periods.

Concentration risk is a primary concern during extended Bitcoin seasons. Traders heavily weighted in Bitcoin may experience strong short-term gains but face significant downside if market conditions shift abruptly. Balancing concentration with diversification is key to managing this risk.

Timing risk also presents challenges. Cryptocurrency markets are cyclical, and Bitcoin seasons eventually end, often with sudden and dramatic reversals. Developing systems to recognize potential inflection points and adjust positions accordingly is critical for preserving gains.

Liquidity considerations become important during Bitcoin season transitions. As market conditions change, altcoin liquidity may decrease, making it more difficult and costly to adjust positions. Planning exit strategies during periods of high liquidity helps mitigate this risk.

Token Metrics addresses these challenges by providing real-time risk assessment tools and portfolio management features. These capabilities help traders maintain an appropriate balance between capitalizing on Bitcoin season opportunities and managing associated risks effectively.

Technology Integration and AI-Powered Analysis

The integration of artificial intelligence into Bitcoin season analysis marks a fundamental shift in how traders approach the cryptocurrency market. While traditional methods remain valuable, AI systems offer unmatched speed and accuracy in processing vast data sets necessary for optimal decision-making.

Token Metrics exemplifies this evolution by combining traditional dominance analysis with advanced machine learning algorithms. Its AI continuously analyzes market data, identifying subtle patterns and correlations that human analysts might overlook or process too slowly to capitalize on.

Machine learning models can detect early changes in Bitcoin dominance trends that precede major market shifts. These early warning signals provide traders with crucial timing advantages, enhancing both returns and risk management.

Additionally, Token Metrics leverages natural language processing to analyze news sentiment, social media trends, and regulatory developments that influence Bitcoin dominance cycles. This comprehensive approach ensures that Bitcoin season analysis incorporates all relevant market factors, including those affecting price trends and volatility.

Future Outlook: Bitcoin Seasons in an Evolving Market

The cryptocurrency market is rapidly evolving, driven by institutional adoption, regulatory clarity, and technological innovation. These factors will likely influence the dynamics of Bitcoin seasons and dominance cycles in the coming years. Unlike traditional markets, which operate within limited hours, cryptocurrency trading is available 24/7, offering continuous trading opportunities and flexibility for investors.

Institutional adoption through Bitcoin ETFs and corporate treasury allocations may lead to more stable and extended Bitcoin seasons. As traditional financial institutions increase their Bitcoin exposure, dominance patterns may become less volatile and more predictable, creating new trading opportunities and challenges.

Regulatory clarity in major markets could further strengthen Bitcoin’s position relative to altcoins, especially if regulations favor established cryptocurrencies over newer, less tested alternatives. This regulatory preference may extend Bitcoin seasons and elevate average dominance levels.

Technological advancements in the Bitcoin ecosystem, such as the growth of the Lightning Network and potential smart contract capabilities, could also influence dominance dynamics. Enhanced functionality may attract capital that might otherwise flow to altcoins with more advanced features.

Advanced Analytics and Market Intelligence

The sophistication of Bitcoin season analysis continues to improve through enhanced data collection, processing capabilities, and analytical methodologies. Platforms like Token Metrics leverage these advancements to provide traders with increasingly accurate and actionable market intelligence.

On-chain analysis has become particularly valuable for identifying Bitcoin seasons. Metrics such as exchange flows, wallet activity, and transaction patterns offer insights into institutional and retail behavior that complement traditional dominance calculations.

Cross-market correlation analysis helps identify global factors influencing Bitcoin seasons. Understanding relationships between Bitcoin dominance and traditional financial markets, commodities, and fiat currencies like the US dollar provides additional context for market dynamics. Fiat currency refers to government-issued money, such as the US dollar, which is not backed by a physical commodity and is commonly used as a benchmark in market analysis.

Sentiment analysis through social media monitoring, news analysis, and options market data offers leading indicators for potential Bitcoin season transitions. These alternative data sources often provide early signals before traditional metrics reflect changing market conditions.

Conclusion

The Bitcoin Season Index and associated dominance metrics are essential tools for navigating the complex and dynamic cryptocurrency market. Recognizing when Bitcoin is likely to outperform altcoins enables traders and investors to optimize portfolio allocation and timing decisions for maximum profits and effective risk management. Successful crypto trading also requires careful investment planning and a clear understanding of the potential to make or lose money in this volatile environment.

Success in cryptocurrency trading during Bitcoin seasons requires more than just understanding dominance metrics; it demands sophisticated analytical tools and real-time data processing capabilities. Token Metrics represents the pinnacle of AI-driven cryptocurrency analysis, offering traders the advanced insights necessary to capitalize on Bitcoin season opportunities while managing inherent risks.

By integrating artificial intelligence, machine learning, and comprehensive market analysis, traders gain unprecedented opportunities to recognize patterns, predict price movements, and execute trades on optimal entry points. As the crypto market matures, combining proven indicators like Bitcoin dominance with cutting-edge analytical platforms will be increasingly important for sustained trading success.

Whether you are a professional trader, institutional investor, or individual participant in the crypto market, leveraging Bitcoin season analysis supported by advanced tools like Token Metrics is crucial for navigating the rewarding yet volatile world of cryptocurrency trading. Embrace your crypto journey by leveraging advanced tools and analytics to improve your trading outcomes. The future belongs to those who can blend traditional market wisdom with modern technology to capture the significant opportunities Bitcoin seasons provide while effectively managing risk.

Understanding the Altcoin Season Index: Your Complete Guide to Altcoin Market Dominance

%201.svg)

%201.svg)

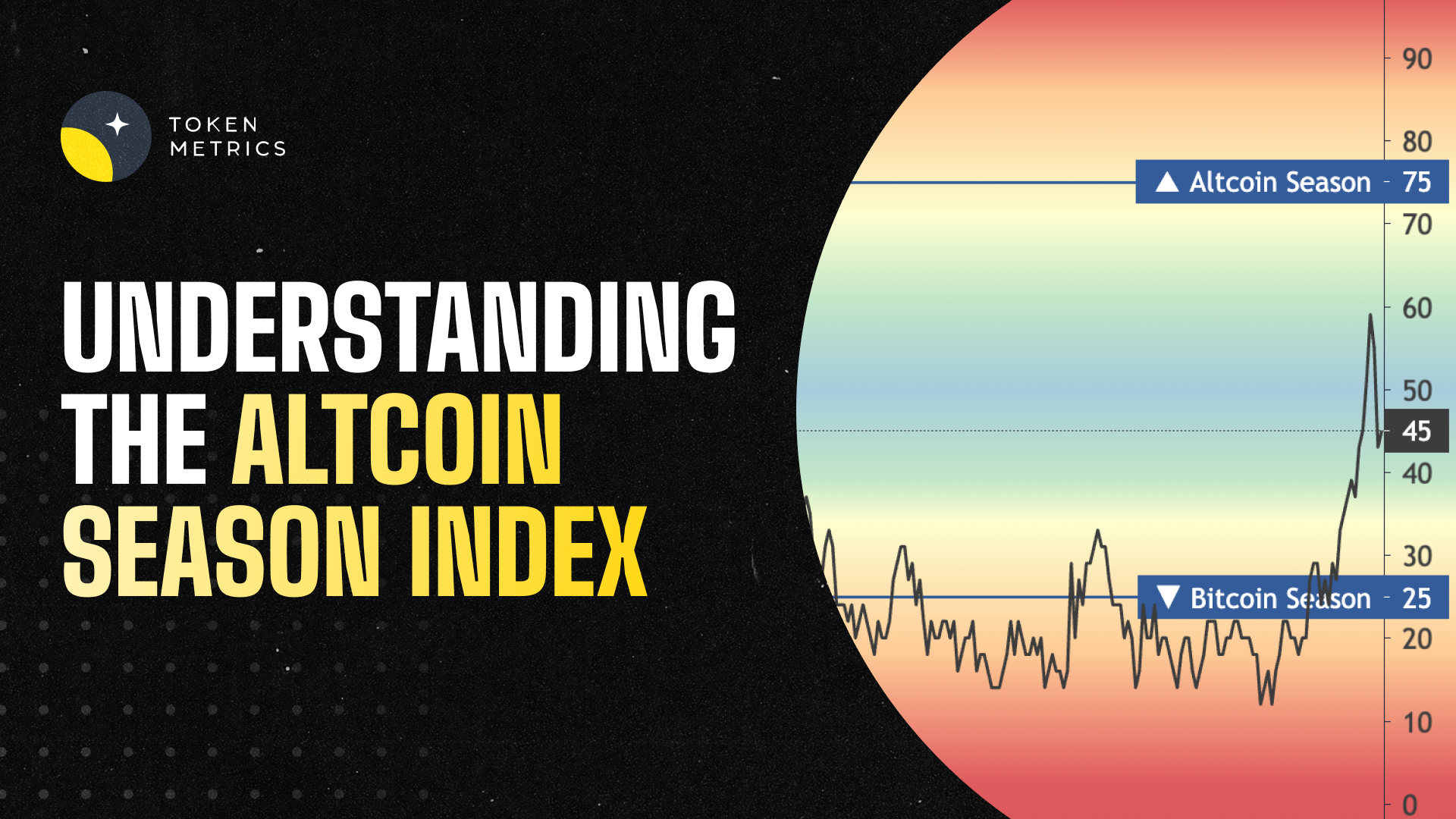

The cryptocurrency market operates in distinct cycles, with periods where Bitcoin dominates and others where alternative cryptocurrencies (altcoins) take center stage. Understanding when these shifts occur is crucial for successful crypto trading and investment. The Altcoin Season Index has emerged as the definitive metric for identifying these market transitions, providing traders and investors with essential insights into optimal timing for altcoin investments.

What is the Altcoin Season Index?

The Altcoin Season Index is a sophisticated metric that measures the relative performance of altcoins compared to Bitcoin over specific time periods. This indicator serves as a market sentiment gauge, helping traders identify when alternative cryptocurrencies are outperforming Bitcoin and whether the market has entered what's known as "Altcoin Season."

The index uses the top 100 coins ranked on CMC (excluding stablecoins and wrapped tokens) and compares them based on their rolling 90-day price performances. If 75% of the top 100 coins outperform Bitcoin in the last 90 days, it's Altcoin Season. Conversely, if only 25% or fewer altcoins outperform Bitcoin, the market is considered to be in "Bitcoin Season."

The methodology behind this index is straightforward yet effective. By analyzing the performance of the top-ranked cryptocurrencies against Bitcoin's price movements, the index creates a percentage score ranging from 0 to 100. A score above 75 indicates strong altcoin dominance, while a score below 25 suggests Bitcoin is leading the market.

How the Altcoin Season Index Works?

The calculation process involves several key components that ensure accuracy and relevance. Stablecoins like Tether and DAI, as well as asset-backed tokens (e.g., WBTC, stETH, cLINK), are excluded. This exclusion ensures that the index focuses on genuine price appreciation rather than pegged assets or derivatives.

Different platforms may use slightly varying methodologies. If 75% of the Top 50 coins performed better than Bitcoin over the last season (90 days) it is Altcoin Season. Some platforms focus on the top 50 cryptocurrencies, while others extend to the top 100, but the core principle remains consistent across all implementations.

The 90-day rolling window provides sufficient data to identify meaningful trends while remaining responsive to recent market movements. This timeframe helps filter out short-term volatility and focuses on sustained performance patterns that indicate genuine market shifts.

Current Market Status and Recent Trends

As of mid-2025, the cryptocurrency market is experiencing significant dynamics that reflect the utility of the Altcoin Season Index. The cryptocurrency market shows strong bullish momentum halfway through 2025, with Bitcoin reaching record highs near $122,946.00. This unprecedented Bitcoin performance has created interesting market conditions for altcoin investors.

Recent data shows varying altcoin performance across different categories. As of July 21, 2025, Stellar (XLM) is leading the pack, surging 74% for the week to trade at $0.527. Cardano (ADA) is up 23% at $1.004, and Ripple (XRP) has gained 21% this week to reach $3.92. These gains demonstrate that certain altcoins can achieve significant outperformance even during periods of strong Bitcoin dominance.

The market appears to be in a transitional phase. BTC dominance: ~60–61.5%—declining but not yet low enough. There is a strong interest in major alternative cryptocurrencies (alts) and large-cap coins. Into early/mid-phase alt season, not for quick whale-level meme pumps yet. This suggests that while we're not in full altcoin season, the conditions are developing for increased altcoin outperformance.

Historical Context and Market Cycles

Understanding historical altcoin seasons provides valuable context for current market conditions. The most notable altcoin season occurred in 2021, when the convergence of multiple factors created optimal conditions for alternative cryptocurrency growth. During this period, BTC's market dominance dropped from 70% to 38%, while the total market capitalization doubled from 30% to 62%. The altcoin season index hit 98 on April 16, 2021.

This historical precedent demonstrates the potential magnitude of altcoin seasons. When market conditions align, the shift from Bitcoin dominance to altcoin outperformance can be dramatic and sustained. The 2021 altcoin season was fueled by institutional adoption, decentralized finance (DeFi) growth, and the NFT boom, creating a perfect storm for alternative cryptocurrency appreciation.

Recent market activity has shown signs of renewed altcoin interest. The Altcoin Season Index, a widely tracked metric on CoinMarketCap (CMC), surged seven points to reach 84 on December 3, 2024. While this was a temporary spike, it demonstrated that altcoin seasons can emerge quickly when market conditions shift.

The Role of AI and Advanced Analytics in Altcoin Trading

Modern altcoin trading has been revolutionized by artificial intelligence and advanced analytics platforms. Token Metrics stands at the forefront of this technological evolution, providing traders with unprecedented insights into altcoin markets. Trade and invest crypto with Token Metrics—your AI-powered platform for crypto trading, research, and data analytics.

The platform's sophisticated approach to market analysis sets it apart from traditional trading tools. Token Metrics scans 6,000+ tokens daily and gives each one a score based on technical analysis, on-chain data, fundamental metrics, sentiment and social data, and exchange data. This comprehensive analysis ensures that traders have access to multi-dimensional insights that go far beyond simple price movements.

Token Metrics' AI-driven methodology provides particular value during altcoin seasons. Token Metrics has developed an AI-powered rating system that scans the market 24/7, analyzing over 80 data points per token. Their Moonshots tab is designed specifically for users looking to spot early-stage altcoins before they break out. This capability is crucial for capitalizing on altcoin season opportunities, as the window for maximum gains often occurs in the early stages of market shifts.

Strategic Applications for Traders and Investors

The Altcoin Season Index serves multiple strategic purposes for different types of market participants. For swing traders, the index provides timing signals for portfolio rebalancing. When the index begins climbing toward 75, it may signal an opportune time to increase altcoin exposure while reducing Bitcoin allocation.

Long-term investors can use the index to identify accumulation opportunities. During Bitcoin seasons (index below 25), quality altcoins often trade at relative discounts, presenting attractive entry points for patient investors. This contrarian approach can be particularly effective when combined with fundamental analysis of individual projects.

Day traders benefit from understanding index trends to gauge market sentiment and momentum. Token Metrics' AI-driven platform exemplifies this shift, enabling traders to analyze market sentiment and identify patterns that human traders might overlook. Real-time sentiment analysis becomes crucial during transitional periods when the index hovers around the 50 mark.

Portfolio managers can use the index as a risk management tool. Sharp increases in the index during established bull markets may signal overheated conditions, suggesting the need for profit-taking or risk reduction. Conversely, low index readings during bear markets might indicate oversold conditions and potential accumulation opportunities.

Risk Management and Market Considerations

While the Altcoin Season Index provides valuable insights, it should not be used in isolation. Market conditions can change rapidly, and the 90-day rolling window means the index may lag sudden market shifts. Traders should combine index signals with other technical and fundamental analysis tools for comprehensive market assessment.

Regulatory developments, macroeconomic factors, and technological breakthroughs can all influence altcoin performance independently of historical patterns. The index should be viewed as one component of a broader analytical framework rather than a definitive trading signal.

Market manipulation and coordinated activities can temporarily skew individual altcoin performance, potentially affecting index calculations. This risk is mitigated by focusing on the top-ranked cryptocurrencies, but traders should remain aware of potential anomalies in index readings.

The Future of Altcoin Season Analysis

The evolution of altcoin markets continues to accelerate, driven by technological innovation and institutional adoption. AI-powered platforms like Token Metrics are becoming essential tools for navigating this complexity. Token Metrics, an AI-powered platform, consolidates research, portfolio management, and trading signals into a unified ecosystem.

As the cryptocurrency market matures, the dynamics underlying altcoin seasons may evolve. Increased institutional participation, regulatory clarity, and technological developments in blockchain infrastructure could create new patterns in altcoin performance cycles. The Altcoin Season Index will likely adapt to incorporate these changing market dynamics.

The integration of artificial intelligence and machine learning into market analysis represents the next frontier in cryptocurrency trading. These technologies can process vast amounts of data in real-time, identifying subtle patterns and correlations that human analysts might miss. This capability becomes particularly valuable during volatile market conditions when rapid decision-making is crucial.

Conclusion

The Altcoin Season Index has established itself as an indispensable tool for cryptocurrency traders and investors seeking to optimize their market timing and portfolio allocation. By providing clear, quantifiable metrics for measuring altcoin performance relative to Bitcoin, the index removes much of the guesswork from market cycle identification.

Success in altcoin trading requires more than just understanding market cycles; it demands sophisticated analytical tools and real-time data processing capabilities. Token Metrics represents the pinnacle of AI-driven cryptocurrency analysis, offering traders the advanced insights necessary to capitalize on altcoin season opportunities.

As the cryptocurrency market continues to evolve and mature, the combination of proven indicators like the Altcoin Season Index with cutting-edge AI analysis platforms will become increasingly important for sustained trading success. The future belongs to traders who can effectively combine traditional market wisdom with modern technological capabilities, positioning themselves to capture the significant opportunities that altcoin seasons provide.

Whether you're a seasoned trader or new to cryptocurrency markets, understanding and utilizing the Altcoin Season Index, supported by advanced analytics platforms like Token Metrics, will be crucial for navigating the complex and rewarding world of altcoin investing. The key lies in combining these powerful tools with sound risk management principles and a deep understanding of the underlying market dynamics that drive cryptocurrency performance cycles.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)