Cryptocurrency Analysis - How to Analyze Cryptocurrencies

Crypto has indeed gained significant attention and has been a popular investment option in recent times. However, analyzing a cryptocurrency before investing is crucial to make informed decisions and minimize risks. In this article, we will help you understand the key factors that impact a cryptocurrency's price and demand. By doing so, we aim to make it easier for you to embark on your crypto journey with confidence.

But why is it essential to analyze a cryptocurrency before investing in the first place? The answer lies in the volatile nature of cryptocurrencies. The value of a cryptocurrency can fluctuate significantly within a short time, making it a high-risk investment option. By analyzing a cryptocurrency's underlying factors, you can gain insights into its potential risks and rewards, which can help you make more informed investment decisions. With that in mind, let's dive into the key factors that affect a cryptocurrency's value.

How to Analyze Cryptocurrencies?

There are two popular ways (or types) to analyze a cryptocurrency before investing in it.

- Fundamental analysis

- Technical analysis

Fundamental Analysis of Cryptocurrency

Fundamental analysis is the starting point of understanding the history of any crypto asset you want to invest in.

It involves getting to the Adam and Eve of an asset, the team behind the project, the price history, the white paper, the tokenomics of the crypto asset - the whole deal.

The sole purpose of performing this analysis is to understand if the asset is overvalued or undervalued. Having said that, fundamental analysis needs the support of technical analysis to predict the crypto asset completely.

The most important factors to consider when performing the fundamental analysis are:

1. Reviewing the white paper

Every crypto asset is backed by a white paper demonstrating the objectives and other technical details. While some details might seem quite difficult to understand for casual investors, it’s crucial to learn about the vision and mission of the project.

The white paper should clearly explain the goals of the project, how they plan to achieve these goals using their technology, and how the cryptocurrency will function in the market.

One red flag is a white paper full of generic promises with no proper detailing.

2. Know the Team behind the project

To estimate the project's future performance, try to get the details of the professional experience that the team holds.

For this, you can scroll through the LinkedIn profiles of the technical or leadership staff. You can also check the crypto asset's "About Us" page to get the details of who is heading the project.

If you don't find the identity of the founders and the team anywhere on the website or the internet, consider it a red flag in most cases.

3. Learn about the leadership

Find the executive team that handles the financials, operations, and vision. Learning about who is leading the project can help you understand the success probability of the crypto asset.

So, here are a few questions to consider when researching a crypto company’s leadership:

- Do they have a history of successful leadership positions?

- Are they reputable/well-known leaders?

- Is their crypto history good or bad?

- Are they publicly identified or anonymous?

4. Get to know the community

Crypto is a community-driven space. Knowing whether the project is pure hype and speculation or is genuinely trusted by a community can help you decide the success of a crypto asset.

Join the community's Discord or Telegram channel to understand it better. No discussion means no growth.

5. Understand the vision and mission of the project

Crypto assets should have a clear vision and mission if they are genuinely intending to grow.

They should have a direction and a road map and be well-organized in everything they do.

6. Reviewing the roadmap

Similar to traditional companies, cryptocurrencies should have a well-defined roadmap with specific goals and timelines. It is crucial to assess the roadmap before investing in a cryptocurrency to ensure that the asset has a clear path to success. Understanding how the cryptocurrency plans to achieve its goals is essential in making informed investment decisions.

If the goals outlined in the roadmap are too generic and lack specificity, it can be a red flag. Additionally, if the timelines are not well mapped out or appear unrealistic, it could indicate poor planning or execution, which can impact the cryptocurrency's long-term success.

7. Learn about the tokenomics of the project

Tokenomics refers to the economic principles that govern the supply, distribution, and circulation of a cryptocurrency. These principles significantly impact the price and long-term viability of a crypto asset. Understanding the supply and demand dynamics is crucial for investors looking to make informed decisions.

Similar to the stock market, the crypto market's price is influenced by the intersection of demand and supply. When demand exceeds supply, the price of a cryptocurrency tends to increase, and vice versa. Therefore, it is essential to consider the following three data points when evaluating a cryptocurrency investment opportunity:

- Circulating supply: This is the amount of cryptocurrency currently in circulation and available in the market. It is a critical factor in determining the current market value of a cryptocurrency.

- Total supply: This is the maximum amount of cryptocurrency that will ever be available, including tokens that are not yet in circulation. It is important to consider the total supply when evaluating the potential long-term value of a cryptocurrency.

- Maximum supply: Many cryptocurrencies have a mechanism to mint new tokens, and the maximum supply represents the upper limit of the number of tokens that will ever be in existence. Understanding the maximum supply is crucial in assessing the potential dilution of a cryptocurrency's value over time.

In summary, evaluating a cryptocurrency's supply dynamics is an essential aspect of making informed investment decisions. Understanding the circulating, total, and maximum supply of a cryptocurrency can provide valuable insights into its potential value and long-term viability.

8. Review the price history

Cryptocurrencies are known for their high volatility, but there are various factors that impact their price. Understanding these factors, such as token supply and marketing efforts, is crucial in determining the dependability of a cryptocurrency's price. Additionally, reviewing a cryptocurrency's price history can provide valuable insights into its growth or decline over time.

Analyzing price fluctuations in a given time period can help you determine whether a cryptocurrency is thriving or dying. For instance, if a cryptocurrency experienced a significant price spike but failed to recover over subsequent months or years, it could be a warning sign for investors. Similarly, market capitalization and trading volume are crucial indicators of a cryptocurrency's potential. If a cryptocurrency's market cap continues to decline over time, or if there is little trading volume, it may not be a viable investment option.

Technical Analysis of Cryptocurrency

Technical analysis of a crypto asset involves analyzing historical price and volume data to identify patterns and trends that can provide insight into future price movements.

Here are 5 factors to consider in the technical analysis of a crypto asset:

- Price charts and patterns: Technical analysis typically involves using price charts to identify trends and patterns. Common patterns include support and resistance levels, trend lines, and chart formations such as triangles and head-and-shoulders patterns.

- Volume: Volume refers to the number of cryptocurrency shares or units traded during a given period. High trading volume can indicate a strong trend, while low trading volume may suggest that a market is consolidating or lacks momentum.

- Moving averages: Moving averages are widely used in technical analysis. They are used to smooth out price fluctuations and identify trends. Popular moving averages include the simple moving average (SMA) and the exponential moving average (EMA).

- Oscillators: Oscillators are indicators that oscillate between two extremes, such as overbought and oversold conditions. Common oscillators used in technical analysis include the relative strength index (RSI) and the stochastic oscillator.

- Market sentiment: Market sentiment refers to investors' overall mood or attitude towards a particular cryptocurrency. Sentiment can be measured using various methods, such as social media sentiment analysis or surveys of market participants. Considering market sentiment when analyzing a crypto asset is important because it can impact price movements.

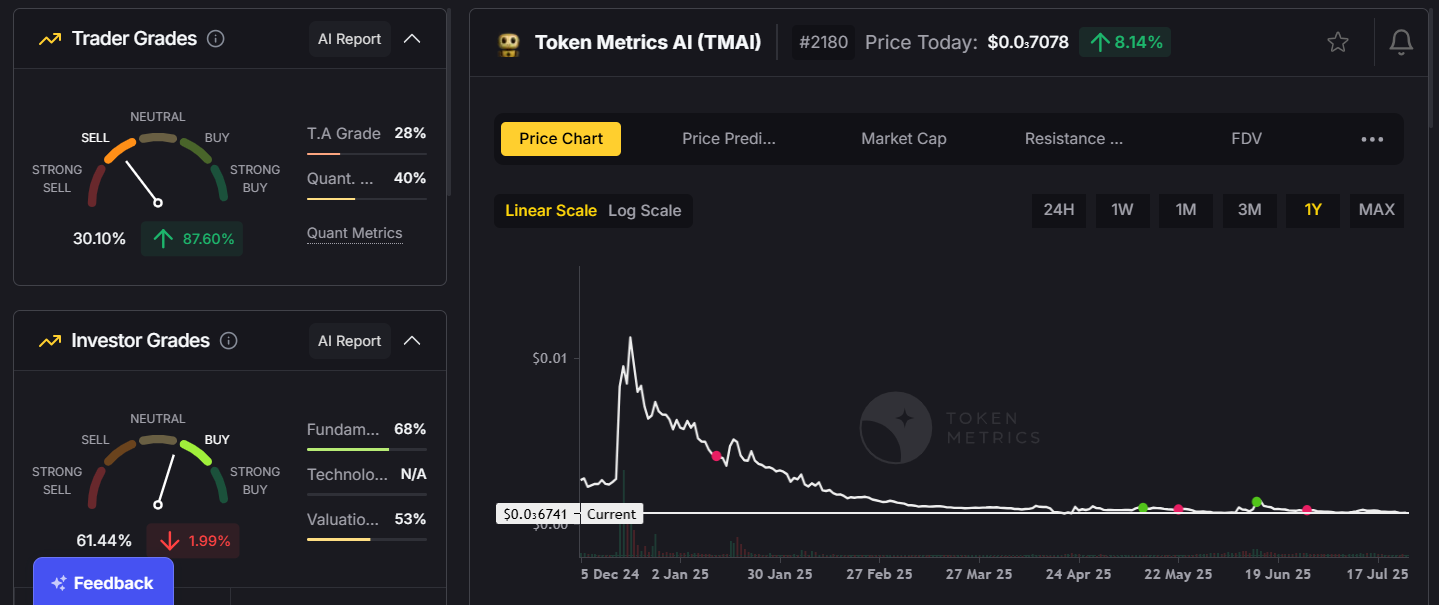

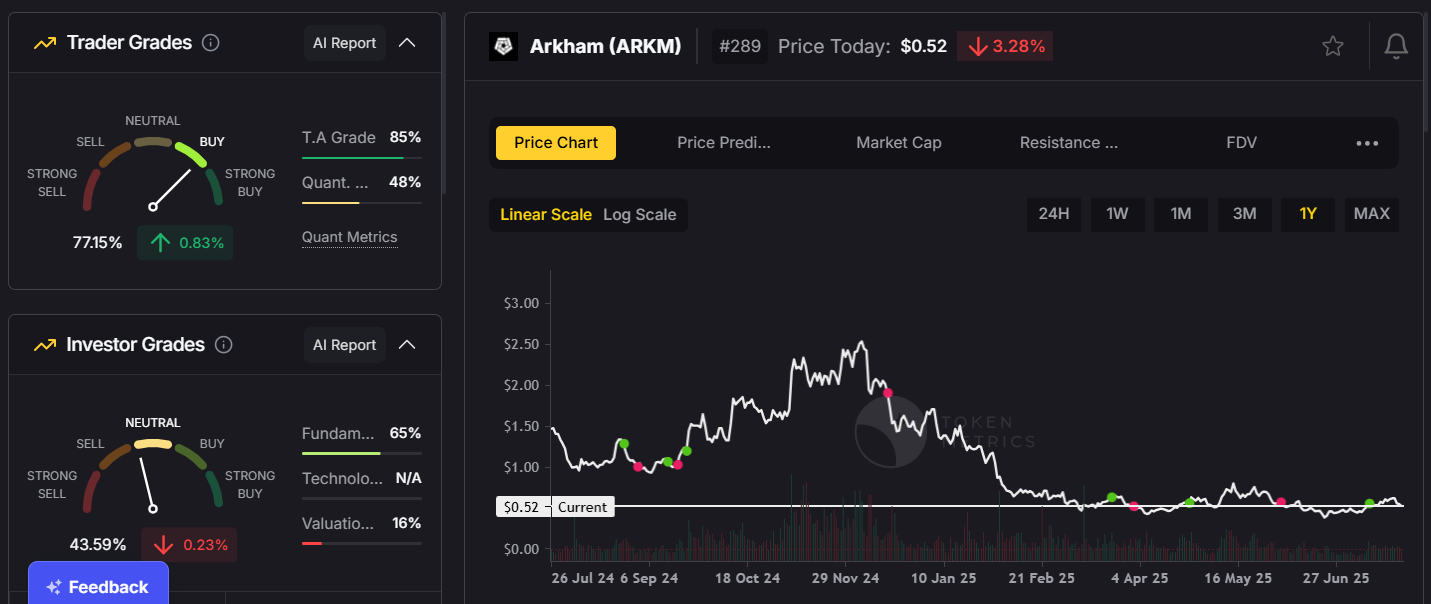

Technical analysis can provide valuable insights into a cryptocurrency's price movements, but it requires expertise in the field. The term "technical" refers to the complex algorithms and charts used to analyze market trends and predict future price movements.

Therefore, it may be too complicated for casual investors who do not have a strong understanding of the underlying principles. Here at Token Metrics, we automated Technical Analysis for thousands of cryptocurrencies with the help of AI and Machine Learning.

Just visit the page of a crypto you want to analyze, click on "Trader" from the left menu, and then click on the "Resistance and Support Levels" tab to start analyzing.

The Bottom Line

A cryptocurrency analysis involves examining and verifying a lot of information about a digital asset.

To get the deepest understanding of an asset, you can start with a fundamental analysis followed by a technical analysis.

We, at Token Metrics, work hard to make all of these tools available to you with a click of a button, automated and powered by AI to help you analyze thousands of cryptocurrencies fast.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)