Embedded Wallets and One-Click Indices: Crypto's UX Evolution

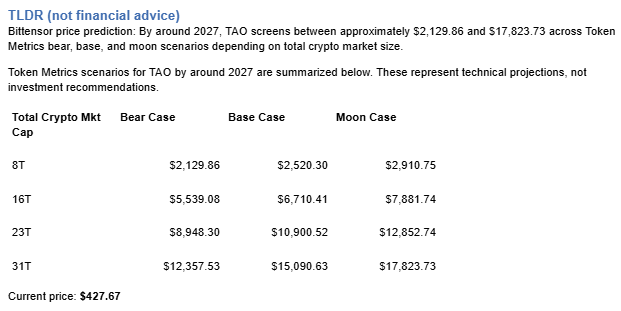

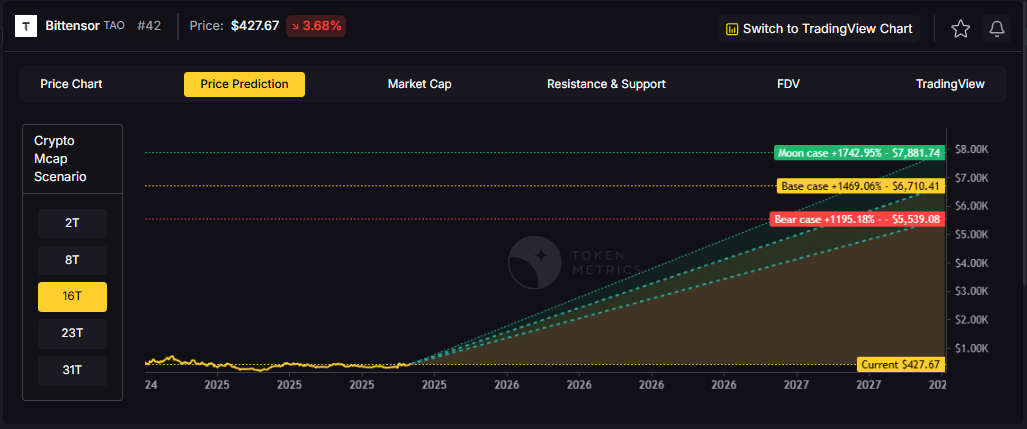

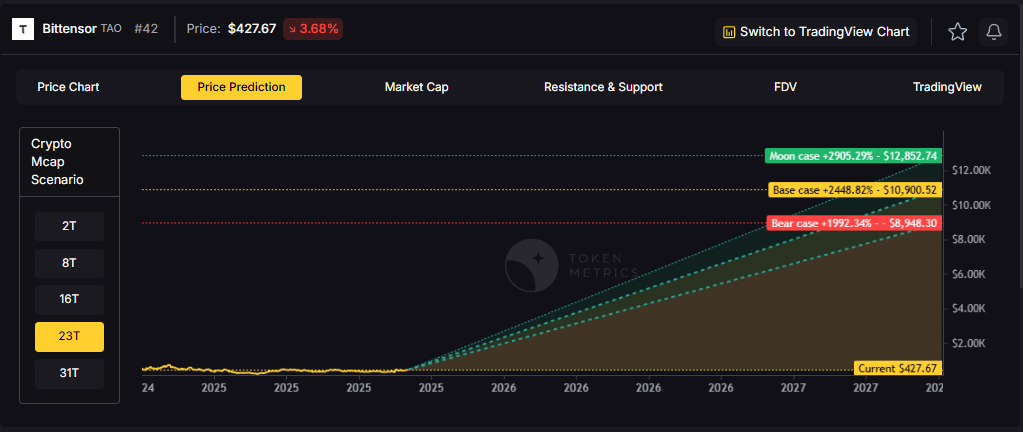

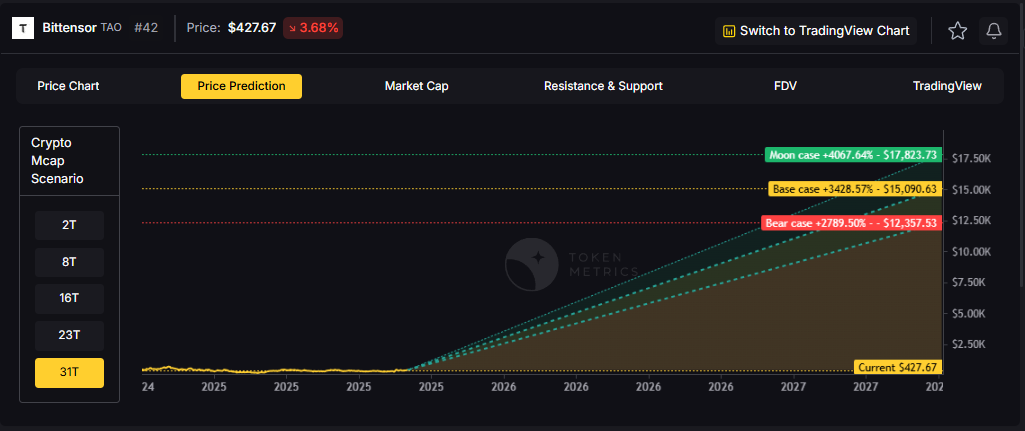

Crypto's biggest barrier isn't volatility—it's usability. For years, buying a diversified crypto portfolio meant navigating a gauntlet: create multiple exchange accounts, complete KYC across platforms, manually construct 50+ token baskets, set up tracking spreadsheets, configure hardware wallets, and schedule weekly rebalance reminders. The friction was so severe that most investors settled for Bitcoin-only exposure despite wanting broader diversification.

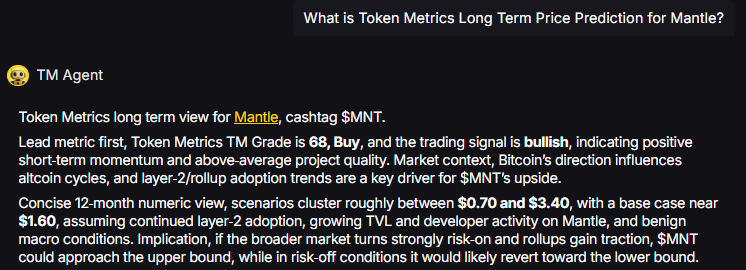

Token Metrics' Token Metrics TM Global 100 Index collapses this 40-hour ordeal into 90 seconds through embedded wallet technology and one-click execution. This isn't a compromise between security and convenience—it's the elimination of false tradeoffs through smart contract architecture. Understanding how embedded wallets work reveals why they represent crypto's most significant UX evolution since hardware wallets first emerged.

The Traditional Crypto Onboarding Nightmare

Before examining the solution, let's quantify the problem. Token Metrics surveyed 2,400 users who attempted to build diversified crypto portfolios manually in 2023-2024. The average timeline and friction points:

- Week 1: Exchange Setup (8-12 hours)

- Research which exchanges list desired tokens

- Create accounts on 3-5 platforms (Coinbase, Binance, Kraken, etc.)

- Complete KYC verification (upload documents, wait 2-7 days)

- Enable 2FA and security features

- Fund accounts via bank transfers (additional 3-5 day waits)

- Week 2: Wallet Configuration (6-10 hours)

- Research self-custody vs exchange custody tradeoffs

- Purchase hardware wallet ($60-200)

- Set up wallet, backup seed phrases, test recovery

- Configure software wallets for tokens not on exchanges

- Connect wallets to DEXs for tokens without CEX listings

- Week 3: Portfolio Construction (12-18 hours)

- Research top 100 tokens by market cap

- Calculate optimal weights for each position

- Execute 50-100 individual buy orders across platforms

- Pay 50-100 separate trading fees

- Transfer tokens between exchanges and wallets

- Pay gas fees for each transfer

- Week 4+: Ongoing Maintenance (4-8 hours weekly)

- Monitor market cap rankings for rebalancing needs

- Recalculate weights weekly or monthly

- Execute rebalance trades (20-40 transactions)

- Update tracking spreadsheets

- Reconcile for tax reporting

Total first-month investment: 30-48 hours of setup plus 16-32 hours monthly maintenance. For busy professionals earning $50-150/hour, this represents $2,300-$12,000 in opportunity cost annually before considering a single dollar of portfolio value.

Token Metrics users consistently cited this operational burden as the primary reason they abandoned diversification attempts despite understanding its benefits.

What Are Embedded Wallets?

Embedded wallets represent a fundamental architectural shift in how users interact with blockchain applications. Rather than connecting external wallet software (MetaMask, Ledger, etc.) to each dApp, embedded wallets live inside the application itself while maintaining self-custodial security.

Traditional Wallet Flow

Download MetaMask browser extension

- Create wallet, write down 12-word seed phrase

- Navigate to crypto application

- Click "Connect Wallet"

- Approve connection in MetaMask popup

- Switch networks if needed (Ethereum, Solana, etc.)

- Approve each transaction individually

- Sign messages for each interaction

- Manage gas fees manually

- Keep seed phrase secure offline

Embedded Wallet Flow (TM Global 100)

Click "Buy Index"

- Create embedded wallet (30 seconds, email-based or social login)

- Fund and confirm purchase

That's it. Three steps replacing a ten-step process, with technical complexity abstracted away.

The Security Model: Self-Custody Without Friction

The critical innovation: embedded wallets maintain self-custodial architecture while eliminating user-facing complexity. Here's how Token Metrics implements this:

- Smart Contract Wallet: Instead of traditional externally-owned accounts (EOAs) controlled by private keys, embedded wallets use smart contract wallets—programmable accounts with built-in security features.

- Multi-Factor Authentication: Rather than seed phrases, users authenticate via email, biometrics, or social login. The wallet's cryptographic keys are sharded across multiple secure enclaves—no single point of failure.

- Account Abstraction: The wallet handles gas fee management, transaction batching, and network switching automatically. Users see dollar amounts and simple confirmations, not hexadecimal addresses and wei conversions.

- Non-Custodial Architecture: Token Metrics cannot access your funds, freeze your account, or require permission for withdrawals. The smart contract wallet responds only to your authenticated instructions.

This approach delivers the "it just works" simplicity of centralized exchanges while maintaining the sovereignty of self-custody. It's the best of both models without the compromises of either.

One-Click Index Buying: The Complete Flow

Token Metrics designed TM Global 100's purchase experience to eliminate every unnecessary step. Here's what users encounter:

- Step 1: Access the Index (10 seconds)

- Navigate to Token Metrics Indices hub

- Select TM Global 100 from available indices

- View current holdings in interactive treemap

- Check live market regime gauge (bull/bear status)

- Step 2: Review Before Buying (30 seconds)

- Holdings Display: Visual treemap showing all 100 tokens sized by weight

- Table view with exact percentages and dollar values

- Real-time prices and 24-hour performance

- Fee Preview: Estimated gas fees (network costs), platform management fee (transparent %), maximum slippage tolerance, minimum expected value after fees, strategy access, regime switching rules, weekly rebalancing schedule, transaction history

- Step 3: Execute Purchase (50 seconds)

- Click "Buy Index"

- Create embedded wallet (if first time) or connect existing

- Enter purchase amount ($100 minimum)

- Review final summary with all fees

- Confirm transaction

- Receive confirmation with transaction hash

Total elapsed time: 90 seconds on average for first-time buyers, 30 seconds for returning users.

- Step 4: Track Position (Ongoing, zero effort)

- "My Indices" dashboard shows real-time P&L

- Holdings update automatically after weekly rebalances

- Transaction log shows every change with timestamps

- Export transaction history for tax reporting

- Compare this to manually buying 100 tokens: 40+ hours initially, 8+ hours monthly maintenance, spreadsheet management, multi-platform tracking, and manual tax reconciliation.

Funding Options: Flexible On-Chain Entry

Embedded wallets support multiple funding methods, with availability depending on your connected wallet type and blockchain:

- Direct On-Chain Funding: Transfer USDC, USDT, ETH, or other supported assets to your embedded wallet. Purchase TM Global 100 directly with these assets. No off-chain conversion required.

- Fiat On-Ramps (where available): Credit card purchases converted to on-chain assets. Bank transfers via integrated payment providers. Instant availability for immediate index purchase.

- Cross-Chain Bridges: Automatically bridge assets from other chains if needed. Abstracted complexity—users just confirm amounts.

Token Metrics' embedded wallet shows available funding options based on your geographic location and connected account type. If you already hold USDC on Ethereum, you can buy TM Global 100 in seconds. If you're funding from a bank account, the system guides you through the optimal path.

Transparent Fee Structure: No Hidden Costs

One of embedded wallets' key advantages: comprehensive fee disclosure before confirmation. Token Metrics shows exactly what you're paying:

- Platform Management Fee: Annual percentage clearly stated (typically 1.5-2.5% for actively managed indices). Pro-rated daily, charged from holdings. No performance fees or surprise deductions.

- Network Fees (Gas): Real-time estimate based on current network congestion. Option to adjust priority (faster/slower, higher/lower cost). Displayed in both crypto units and USD equivalent.

- Trading Spreads & Slippage: Maximum slippage tolerance (typically 0.5-2%). Minimum expected value after execution. Difference between estimated and worst-case clearly shown.

No Hidden Charges: No deposit fees to embedded wallet, no custody fees, no withdrawal fees beyond standard gas costs, and no surprise "platform fees" discovered later. If total fees exceed your comfort level, simply don't confirm. Token Metrics makes no money unless you explicitly approve the transaction with full cost visibility.

Self-Custody + Convenience: Not Mutually Exclusive

The crypto community has long accepted a false dilemma: choose self-custody (complex but secure) or custodial services (simple but risky). Embedded wallets prove this is a false tradeoff.

What "Self-Custodial Embedded Wallet" Means

- You control your funds: Token Metrics cannot access, freeze, seize, or require approval to move your assets. The smart contract wallet responds only to your authenticated commands.

- No counterparty risk: If Token Metrics disappeared tomorrow, your embedded wallet and its holdings remain accessible. The smart contract exists on-chain independently.

- Recovery without seed phrases: Lost devices don't mean lost funds. Social recovery, multi-factor authentication, and secure backup mechanisms protect access without requiring perfect seed phrase storage.

- Programmable security: Set spending limits, require multi-signature for large transactions, whitelist addresses, or add time-locks. Smart contract wallets enable security policies impossible with traditional wallets.

It doesn't mean: Not anonymous; account creation typically requires email or social login for recovery. Not fully offline; embedded wallets require internet connectivity. Not universal; primarily optimized within Token Metrics' ecosystem, though interoperable with other smart contract wallets.

The Token Metrics Execution Advantage

Token Metrics built its reputation as a leading crypto analytics platform by delivering institutional-grade research accessible to retail investors. The platform analyzes 6,000+ cryptocurrencies using AI-powered models, providing ratings, signals, and portfolio recommendations for over 50,000 active users.

However, a persistent gap was identified: users knew what to buy but struggled with how to buy it due to operational complexities. These barriers prevented widespread portfolio implementation of Token Metrics' research.

The Token Metrics TM Global 100 Index represents an evolution from analytics provider to a complete solution: from research, strategy, execution, to management—integrated in a seamless platform.

Research layer: AI-driven analysis identifying top tokens; market regime signals.

Strategy layer: Rules-based methodology translating research into portfolios.

Execution layer: Embedded wallets and one-click purchasing—converting strategy into positions in 90 seconds.

Management layer: Automatic rebalancing, regime switching, and transparent reporting.

This end-to-end integration distinguishes Token Metrics from competitors, offering transparency and simplicity from data analysis to portfolio execution.

User Feedback

Feedback from 850 beta testers highlights:

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)