Ethereum Price Prediction 2025: Will ETH Hit $10,000 This Bull Cycle?

Click here to buy Cryptocurrencies from Gate.io

Ethereum is once again at the center of attention in the crypto market. With its price surging past $3,000 and Bitcoin breaking above $112,000, many analysts now believe ETH could reach $5,000–$10,000 before the end of 2025.

This renewed momentum is backed by strong technical upgrades, institutional demand, and a thriving decentralized finance (DeFi) ecosystem. But can Ethereum overcome its challenges and hit a new all-time high? In this highly informative and SEO-optimized article, we’ll break down Ethereum’s 2025 price outlook—and show how Token Metrics’ AI-powered tools help investors track key price signals, monitor risk, and discover hidden opportunities.

🔥 Ethereum in 2025: Bullish Momentum Is Building

Ethereum’s bullish breakout above $3,000 signals strong investor confidence. Several catalysts are driving this uptrend:

✅ 1. The Pectra Upgrade

Ethereum’s highly anticipated Pectra upgrade is designed to improve scalability and transaction throughput. This upgrade will:

- Reduce network congestion

- Prepare Ethereum for future sharding

- Support faster Layer-2 rollups

This scalability boost is expected to attract more developers, dApps, and users, further increasing demand for ETH.

✅ 2. ETF Inflows and Institutional Adoption

Ethereum ETFs are gaining traction, with $12 billion in assets under management (AUM) as of July 2025. Major asset managers like Fidelity, BlackRock, and VanEck have brought ETH exposure to traditional finance.

These ETFs are:

- Enabling long-term institutional accumulation

- Reducing supply on exchanges

- Increasing price stability

Ethereum is now firmly on the radar of pension funds, family offices, and sovereign wealth funds.

✅ 3. DeFi TVL and Layer-2 Adoption

Ethereum remains the undisputed leader in decentralized finance. As of July 2025:

- Total Value Locked (TVL) across Ethereum DeFi protocols sits at $72.64 billion

- Layer-2 solutions like Optimism, Arbitrum, and Base are capturing a growing share of transactions

Layer-2s help reduce fees, increase speed, and unlock new user growth. They are essential for Ethereum to scale while maintaining security.

💡 Ethereum Price Prediction for 2025

With strong fundamentals, investor demand, and bullish momentum, here’s what analysts are forecasting:

Key breakout level to watch: $4,000

Key support level: $2,500

⚠️ Ethereum Risks and Challenges

Despite bullish catalysts, Ethereum faces several potential headwinds that could slow or stall price growth:

❌ 1. Competition from Faster Blockchains

Blockchains like Solana, Aptos, and Sui offer high-speed, low-cost alternatives. They continue to attract developers and DeFi projects due to:

- Lower gas fees

- Faster finality

- Simpler user experience

Ethereum’s dominance could erode if it fails to keep pace with these innovations.

❌ 2. Gas Fee Volatility

When usage surges, Ethereum gas fees can spike, pricing out retail users. This could limit dApp usage and reduce ETH demand during key moments in the bull cycle.

❌ 3. Regulatory Uncertainty

Though the U.S. has become more crypto-friendly, some regions still lack clear ETH guidance. New regulations affecting:

- Staking

- DeFi protocols

- Ethereum as a commodity/security

…could introduce market volatility.

🧠 How Token Metrics Helps You Predict Ethereum's Price

In a market as fast-moving as crypto, investors need tools that offer real-time insights and predictive analytics. That’s where Token Metrics shines.

✅ 1. AI-Powered Price Prediction Models

Token Metrics uses machine learning to forecast Ethereum’s short- and long-term price targets based on:

- Historical price patterns

- Exchange flow data

- On-chain activity

- Market sentiment

- Technical indicators

Its Ethereum model is continuously updated, adapting to market changes in real time.

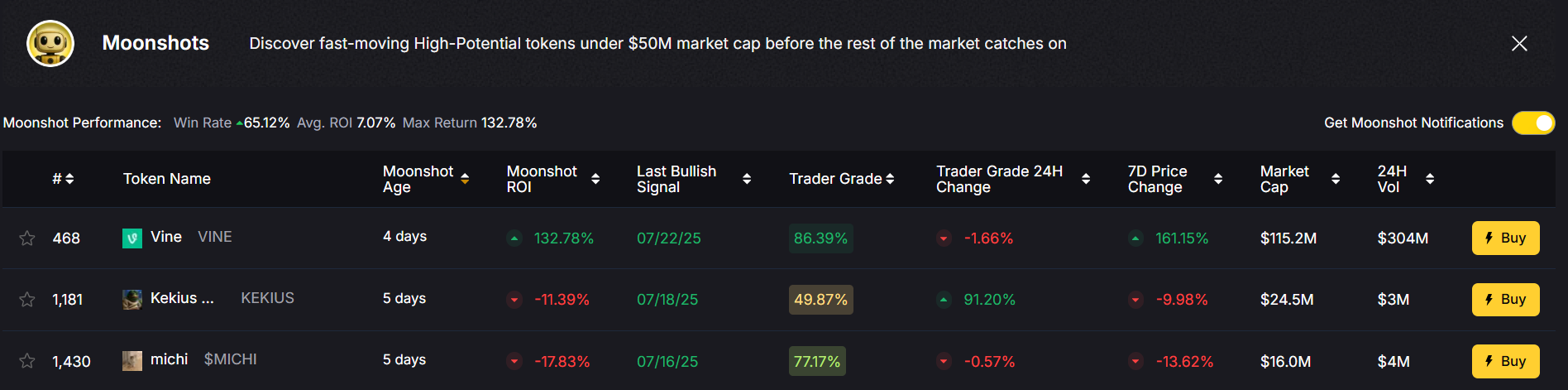

✅ 2. Trader and Investor Grades

- Trader Grade: Evaluates short-term momentum. Perfect for swing traders looking to time ETH breakouts or pullbacks.

- Investor Grade: Measures long-term health based on fundamentals. Ideal for HODLers and ETH stakers.

These grades allow users to track Ethereum’s strength against thousands of other tokens.

✅ 3. Real-Time Bullish/Bearish Signals

Token Metrics issues daily buy/sell signals on Ethereum, helping users:

- Avoid emotional decisions

- Buy into strength

- Exit during early weakness

These signals are backed by AI algorithms that consider:

- Price action

- RSI/MACD

- Exchange flows

- On-chain metrics

✅ 4. Custom Alerts

Set Ethereum alerts by:

- Price level

- Percent change

- Grade movement

- Signal trigger

Get alerts via email, Telegram, Discord, or Slack—so you never miss a trade.

✅ 5. Ethereum Token Details Page

Get all key ETH metrics in one place:

- Live price and chart

- Grading history

- Exchange volume

- Wallet analysis

- Historical ROI

All powered by Token Metrics’ AI research engine.

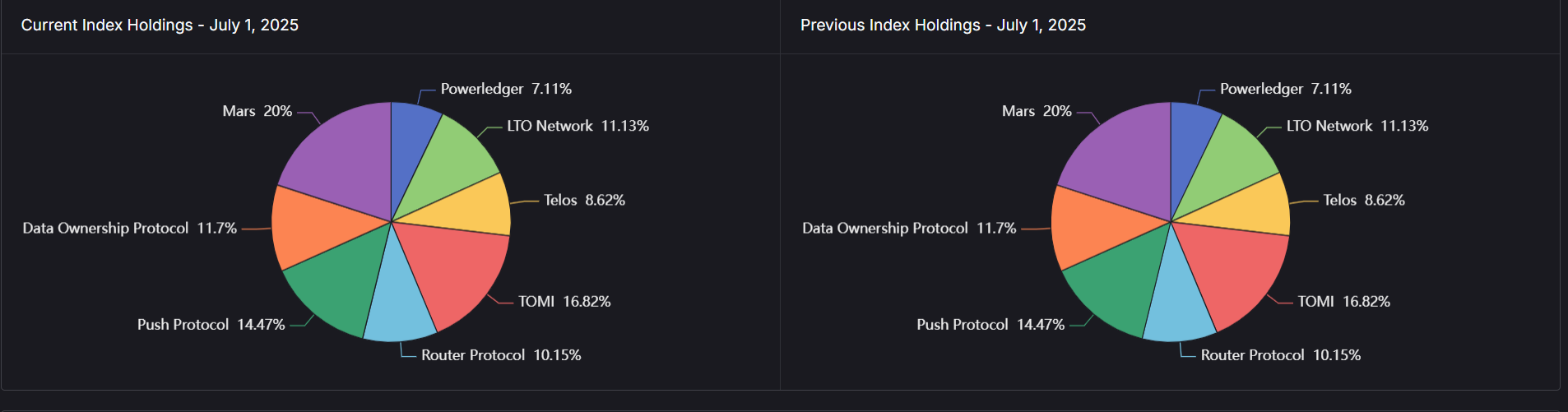

📊 Layer-2s and Staking Metrics to Watch

To forecast Ethereum demand, investors should track:

🔹 Layer-2 Activity

- TVL growth on Arbitrum, Optimism, Base, and zkSync

- Daily transactions and user adoption rates

🔹 Staking Ratios

- % of ETH supply staked (currently ~24%)

- Staking APY and validator participation

- Locked vs. liquid staked ETH

Token Metrics includes Layer-2 project ratings and staking-related altcoin analysis for advanced users.

Click here to buy Cryptocurrencies from Gate.io

📉 Bearish Scenario: What If ETH Drops?

While $5,000–$10,000 is possible, ETH could face a correction if:

- Bitcoin fails to hold above $100,000

- U.S. interest rates rise sharply

- ETH gas fees spike, pushing users to cheaper L1s

- Layer-2 adoption slows or faces security concerns

In that case, ETH could fall back to $2,500–$2,800, a key demand zone.

Token Metrics’ alerts and AI models help users manage risk and spot early trend reversals.

✅ Final Thoughts: Is Ethereum Ready for $10,000?

Ethereum has everything going for it in 2025:

- A major technical upgrade (Pectra)

- Exploding institutional demand via ETFs

- A thriving DeFi ecosystem

- Layer-2 scaling in full effect

If macro conditions remain favorable and Bitcoin sustains its rally, Ethereum could realistically test $10,000 before the end of the year.

But crypto markets remain volatile. Investors should use AI tools like Token Metrics to:

- Track short- and long-term trends

- Monitor bullish or bearish signals

- Stay updated on ecosystem metrics (TVL, staking, gas fees)

🛠️ Start Using Token Metrics for Ethereum Predictions

Ready to invest in Ethereum smarter?

- 🔍 Get AI-driven ETH price predictions

- 🚀 Track daily buy/sell signals

- 📈 Monitor ETH Layer-2 growth

- 🧠 Discover Ethereum-based altcoin opportunities

👉 Sign up today at tokenmetrics.com and level up your crypto research game.

Click here to buy Cryptocurrencies from Gate.io

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)