Ethereum Vs. Ethereum Classic: What's the Difference?

%201.svg)

%201.svg)

Ethereum and Ethereum Classic are two of the most popular cryptocurrencies in the world today. Both of these digital currencies have exploded in value over the past few years and have become some of the most sought-after investments in the crypto market.

But what is the key difference between ETH and ETC?

Ethereum (ETH) and Ethereum Classic (ETC) are both blockchain networks, but they have a few key differences that make them unique. Ethereum is a newer platform that is designed to be more scalable and secure than Ethereum Classic. Ethereum Classic, on the other hand, is an open source blockchain network that has a focus on decentralization, immutability, and censorship resistance. In this article, we'll compare the two networks and explain why Ethereum is the better choice for most investors.

Overview of Ethereum and Ethereum Classic

Ethereum (ETH) is a decentralized blockchain network that runs smart contracts and enables the development of decentralized applications (dApps). Ethereum was created by Vitalik Buterin and officially released in 2015.

Ethereum Classic (ETC) is an extension (not a clone) of the original Ethereum, which was forked away by the Ethereum Foundation by launching a new protocol just an year later in 2016.

To be precise, Ethereum Classic was created when the original Ethereum network and currency were split following the DAO hack in 2016. Ethereum and Ethereum Classic are both open source networks that are maintained by their respective development teams. Unlike Bitcoin, both Ethereum and Ethereum Classic use a Proof-of-Work consensus algorithm. Both these networks also use a native digital token to fuel their networks.

As Ether is the native token of the Ethereum network, you can use it to pay for transaction or computational services on the Ethereum network. Similarly, ETC tokens are used by participants on the Ethereum Classic network.

But, the majority of the crypto crowd still needs a clean chit over the key differences that make them absolutely distinct.

So, let’s get into it.

Differences between Ethereum and Ethereum Classic

Scalability - Ethereum (ETH) and Ethereum Classic (ETC) are both open-source blockchain networks that allow you to build decentralized applications. However, Ethereum has been designed to be more scalable. That means the network can handle more transactions at a higher speed, making it a better choice for everyday applications.

Security - While both Ethereum and Ethereum Classic are secure blockchain networks, Ethereum is more scalable and has a better security track record. Ethereum Classic has been dealing with network security issues since its inception.

Decentralization - Decentralization is one of the core values offered by blockchain networks like Ethereum and Ethereum Classic. Decentralization on the Ethereum network is slightly better than Ethereum Classic, but both networks have a long way to go before they can be considered decentralized.

Immutability - Immutability is another core value offered by blockchain networks. However, the Ethereum and Ethereum Classic networks are still very far from achieving full immutability. Both networks have suffered from various instances of data manipulation.

Censorship resistance - Censorship resistance is another core value offered by blockchain networks. However, both Ethereum and Ethereum Classic are far from achieving full censorship resistance. Both networks can be subjected to censorship by governments and other centralized entities.

ETH vs ETC - Which is the Better Choice for Investors?

While both Ethereum and Ethereum Classic are great investments, we believe Ethereum is the better choice for most investors for a few reasons. First, Ethereum is more decentralized. Second, Ethereum has been around longer than Ethereum Classic. This means the network is more scalable, secure, and well-established than its competitor. Finally, Ethereum has a wider range of applications than Ethereum Classic.

Overall, Ethereum is the better blockchain network when compared to Ethereum Classic.

The Bottom Line

Ethereum and Ethereum Classic, both of these networks have exploded in value over the past few years and have become some of the most sought-after investments in the crypto market.

When the DAO got hacked and lost $50 million, Ethereum needed a solid technology to replace the old one. So, a hard fork was done. But many traditional supporters of Ethereum did not want to go with the hard fork, and they stayed with the old blockchain technology. As a result, Ethereum Classic was born.

Disclaimer: The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

AI Agents in Minutes, Not Months

.svg)

Create Your Free Token Metrics Account

.png)

Recent Posts

Building True Passive Income with Crypto Indices: The Complete Guide to Automated Wealth Creation

%201.svg)

%201.svg)

The dream of passive income drives millions toward cryptocurrency—earning money while you sleep, building wealth automatically, achieving financial freedom without constant work. Yet most crypto "passive income" strategies require active management, constant monitoring, technical expertise, and significant time investment. They're anything but passive.

Token Metrics AI Indices deliver genuine passive income through systematic wealth accumulation requiring minimal ongoing effort. Once established, your crypto portfolio grows automatically through professional AI management, strategic rebalancing, and compound returns—all without your daily involvement or active trading.

This comprehensive guide explores how crypto indices create true passive income, compares index investing to other passive income strategies, reveals the mathematics of automated wealth compounding, and provides actionable frameworks for building substantial passive income streams through disciplined index allocation.

What True Passive Income Actually Means

Understanding genuine passive income requires distinguishing it from "active income disguised as passive" that dominates crypto discussions.

Active Income Disguised as Passive

Many crypto strategies marketed as "passive income" require substantial ongoing effort:

- Day Trading/Swing Trading: Requires constant market monitoring, analysis, and execution—full-time active work

- Yield Farming: Demands daily monitoring of APYs, moving capital between protocols, managing impermanent loss risks

- NFT Flipping: Requires researching projects, timing mints, managing listings, following trends constantly

- Staking on Volatile Assets: Needs continuous evaluation of lock-up risks, protocol security, and token price sustainability

- DeFi Protocol Management: Involves complex smart contract interactions, gas fee optimization, and continuous security monitoring

These strategies generate income but demand active participation—they're jobs, not passive income streams.

Characteristics of Genuine Passive Income

True passive income exhibits specific characteristics:

- Minimal Time Investment: Requires 1-2 hours monthly maximum after initial setup

- No Specialized Expertise: Accessible to anyone regardless of technical knowledge

- Automatic Execution: Operates without your constant involvement or decision-making

- Predictable Processes: Follows systematic approaches rather than requiring moment-to-moment judgment

- Scalable Without Additional Time: Can grow substantially without proportionally increasing time commitment

- Professional Management: Experts handle complexity on your behalf

Token Metrics indices meet all these criteria—once established, your wealth grows automatically through AI-powered management while you focus on other priorities.

How Crypto Indices Create Passive Income

Understanding the mechanisms generating passive returns through indices reveals why this approach delivers superior risk-adjusted income compared to alternatives.

Capital Appreciation Through Systematic Growth

The primary income source from crypto indices is capital appreciation—portfolio value increasing over time as cryptocurrency markets grow and AI optimization captures opportunities.

Unlike stocks requiring decades to double, crypto indices can deliver 50-200% annual returns during favorable market cycles. A $25,000 initial investment growing at 60% annually becomes $100,000 in three years and $400,000 in six years—substantial wealth creation requiring zero active trading.

This appreciation occurs passively through:

- AI selecting highest-probability opportunities across 6,000+ tokens

- Automatic rebalancing capturing profits from winners and accumulating losers at discounts

- Diversification spreading risk while maintaining upside exposure

- Professional risk management limiting catastrophic losses

You make no trading decisions. You don't research tokens. You don't time markets. The system handles everything while appreciation compounds automatically.

Compound Growth Acceleration

Passive income's true power emerges through compounding—returns generating additional returns in self-reinforcing cycles. Token Metrics indices amplify compounding through systematic profit capture and reinvestment.

When indices rebalance, profits from appreciating tokens are automatically reinvested into new opportunities. This mechanical reinvestment ensures all gains compound rather than sitting idle. Over years and decades, compounding creates extraordinary wealth accumulation.

Example: $10,000 growing at 40% annually with full reinvestment becomes $150,000 in seven years. Without reinvestment—if you withdrew gains annually—the same investment reaches only $38,000. Compounding creates an additional $112,000 in wealth automatically.

Dollar-Cost Averaging Enhancement

Adding regular contributions to index positions creates powerful dollar-cost averaging benefits that enhance passive returns. By investing fixed amounts regardless of market conditions, you automatically buy more tokens when prices are low and fewer when prices are high.

This systematic averaging removes timing pressure—you don't need to identify perfect entry points. Whether markets surge or crash, your regular contributions continue mechanically, building positions that appreciate over complete market cycles.

Combined with compound growth, dollar-cost averaging creates remarkable long-term wealth accumulation requiring minimal effort beyond initial automated contribution setup.

Tax-Efficient Growth Optimization

Token Metrics indices can be held in tax-advantaged retirement accounts where appreciation compounds tax-free (Roth IRA) or tax-deferred (Traditional IRA). This tax optimization dramatically accelerates wealth accumulation compared to taxable accounts.

In taxable accounts, annual rebalancing triggers capital gains taxes that reduce compounding power. In retirement accounts, all gains compound without tax drag—a significant passive income enhancement requiring only initial account setup.

Comparing Index Passive Income to Alternatives

Understanding how index-based passive income compares to other strategies reveals relative advantages.

Vs. Staking/Yield Farming: While staking offers 5-20% APY, it involves token price risk (10% yield means nothing if price drops 50%), lock-up periods preventing selling during crashes, impermanent loss, protocol risks, and constant management overhead. Index capital appreciation typically exceeds staking yields by 40+ percentage points while maintaining complete liquidity.

Vs. Real Estate: Real estate requires $50,000-$500,000+ minimums, involves management burdens despite property managers, suffers from illiquidity (months to sell), concentrates wealth geographically, and carries leverage risks. Indices require minimal capital, zero management, complete liquidity, global diversification, and no leverage risks.

Vs. Dividend Stocks: Dividend yields of 2-4% and appreciation of 6-8% annually pale against crypto potential. Dividends trigger immediate taxation reducing after-tax returns. Crypto indices offer dramatically higher return potential with tax-efficient compounding.

Vs. Bitcoin/Ethereum Only: Concentrated two-asset holdings sacrifice diversification, miss altcoin opportunities, lack rebalancing benefits, and forego professional management. Indices provide superior risk-adjusted returns with equal passivity.

The Mathematics of Automated Wealth Building

Understanding how small initial investments and regular contributions compound into substantial wealth over time makes passive income potential concrete rather than abstract.

Starting Small: The Power of Consistency

You don't need large capital to begin building meaningful passive income. Small amounts invested consistently compound into substantial wealth through time and returns.

Scenario 1: Modest Beginning

- Initial investment: $1,000

- Monthly contribution: $250

- Average annual return: 50%

- Time horizon: 10 years

- Ending value: $486,000

This scenario transforms $31,000 in total contributions into nearly half a million through compound growth—passive income requiring only initial setup and automated monthly contributions.

Scenario 2: Aggressive Accumulation

- Initial investment: $5,000

- Monthly contribution: $500

- Average annual return: 50%

- Time horizon: 10 years

- Ending value: $972,000

Nearly $1 million from $65,000 in contributions—extraordinary passive wealth creation through systematic index investing.

The Impact of Return Variability

Real returns vary annually—bull markets deliver 100-300% returns while bear markets create 50-80% drawdowns. However, averaging across complete cycles, conservative crypto indices historically achieve 30-60% annualized returns.

- Even at conservative 30% annual average:

- $10,000 initial + $300 monthly for 15 years = $1.1 million

- $25,000 initial + $500 monthly for 15 years = $2.8 million

These projections assume no income from your job increases, which is unrealistic. As your career progresses and income grows, contribution amounts can increase proportionally, accelerating wealth accumulation further.

Retirement Income Generation

Once accumulated, substantial crypto index holdings generate retirement income through systematic withdrawal strategies.

If you accumulate $2 million in crypto indices by age 60, withdrawing 4% annually provides $80,000 passive income while preserving principal. If crypto continues appreciating even modestly at 15% annually, your portfolio grows despite withdrawals, providing inflation-protected lifetime income.

This passive income stream requires no active work—automated monthly withdrawals provide cash flow while remaining capital compounds through continued AI management.

Building Your Passive Income System

Creating effective passive income through crypto indices requires systematic implementation across several phases.

Phase 1: Foundation Setup (Month 1)

- Open Token Metrics account and explore available indices

- Determine appropriate total crypto allocation based on age, risk tolerance, and financial situation

- Select specific indices matching your risk profile (conservative, balanced, aggressive)

- Open exchange accounts and complete verification processes

- Link bank accounts for funding transfers

- Consider opening self-directed IRA for tax-advantaged growth

Complete this foundation work once—all subsequent wealth building occurs automatically.

Phase 2: Automation Implementation (Month 2)

- Set up automatic recurring bank transfers to exchange accounts

- Configure automatic index purchases on predetermined schedules (weekly, bi-weekly, or monthly)

- Enable automatic rebalancing following Token Metrics recommendations

- Set up portfolio tracking and optional performance alerts

- Document your strategy and rules in writing for future reference

After automation setup, your system operates independently requiring minimal intervention.

Phase 3: Optimization and Scaling (Months 3-12)

- Monitor system monthly to ensure automation functions correctly

- Increase contribution amounts as income grows throughout your career

- Rebalance between indices quarterly based on Token Metrics guidance

- Take advantage of market crashes by adding lump sums opportunistically

- Review and adjust tax strategies annually with professional guidance

Even during optimization phase, time commitment remains minimal—1-2 hours monthly maximum.

Phase 4: Wealth Preservation and Distribution (Years 10+)

- Gradually shift allocation toward conservative indices as wealth accumulates

- Implement systematic profit-taking during euphoric bull markets

- Develop withdrawal strategy for retirement income needs

- Consider estate planning for accumulated wealth transfer

- Maintain disciplined approach through all market conditions

Throughout all phases, your involvement remains minimal while wealth compounds automatically through professional AI management.

Maximizing Passive Income Through Strategic Allocation

Optimizing passive income requires strategic decisions about allocation, risk management, and contribution timing.

Allocation Balance: Higher returns come with higher volatility. Conservative approach uses 70% conservative/20% balanced/10% aggressive indices. Moderate uses 50/30/20 split. Aggressive uses 30/30/40 split. All remain completely passive from management perspective.

Contribution Timing: Maintain regular automated contributions always, but keep 10-20% dry powder in stablecoins for crisis deployment during 30%+ market crashes. These fear-driven purchases generate outsized returns.

Tax Location Optimization: Roth IRA provides tax-free growth ideal for aggressive indices. Traditional IRA offers tax-deferred growth suitable for conservative indices. Taxable accounts provide flexibility but trigger annual rebalancing taxes. This optimization happens once but compounds into substantial savings over decades.

Common Passive Income Mistakes to Avoid

Even with automated systems, investors make predictable mistakes that undermine passive income goals.

- Insufficient Automation: Failing to fully automate contributions and rebalancing introduces friction preventing consistent execution

- Excessive Monitoring: Checking portfolio daily or weekly increases anxiety without improving results—monthly reviews suffice

- Abandoning Strategy During Drawdowns: Selling during bear markets destroys passive income system's effectiveness—maintain discipline through downturns

- Chasing Performance: Constantly switching between indices based on recent performance undermines long-term compounding

- Withdrawing Gains Prematurely: Taking profits during accumulation phase prevents compounding—let gains reinvest automatically

- Under-Contributing Relative to Income: Failing to increase contributions as career income grows limits wealth accumulation unnecessarily

- Neglecting Tax Optimization: Holding crypto in taxable accounts when retirement accounts available costs substantial long-term returns

Conclusion: The Path to Financial Freedom

True passive income through crypto indices isn't mythical—it's mathematically achievable through systematic implementation and patient execution. Token Metrics provides the professional AI management, diversification, and optimization infrastructure transforming crypto from speculation into genuine passive wealth building.

The beauty of this approach is simplicity: establish system once, contribute consistently, trust professional management, and let compound growth work its magic over years and decades. No day trading. No constant monitoring. No technical expertise required. Just disciplined, automated wealth accumulation.

Your action determines outcomes. Those who begin today, implement systematic contributions, and maintain discipline through market cycles build substantial passive income streams funding financial independence. Those who delay, overthink, or abandon strategy during volatility watch opportunities pass without capturing benefits.

Token Metrics indices eliminate complexity and emotion from crypto investing, leaving only systematic wealth accumulation. The technology works. The mathematics favor consistent long-term investors. The only question is whether you'll begin building your passive income system today or postpone financial freedom indefinitely.

Start your 7-day free trial and take the first step toward true passive income through automated, professional crypto index investing. Your future self will thank you for the decision you make today.

Frequently Asked Questions

Why AI Makes All the Difference: The Technology Advantage Behind Token Metrics Crypto Indices

%201.svg)

%201.svg)

When evaluating cryptocurrency index providers, most investors focus on past performance, fees, or token selection. While these factors matter, they miss the fundamental differentiator determining long-term success: the sophistication of artificial intelligence powering portfolio management.

Token Metrics doesn't just use AI as marketing buzzword—the platform employs cutting-edge machine learning systems that fundamentally outperform human decision-making in ways that compound into extraordinary advantages over time. Understanding why AI-driven indices surpass both traditional approaches and human-managed alternatives reveals why this technology represents the future of crypto investing.

This comprehensive guide explores the specific AI technologies powering Token Metrics indices, examines what these systems can do that humans cannot, compares AI-driven approaches to traditional alternatives, and reveals how technological advantages translate into superior investment outcomes.

The Limitations of Human Crypto Portfolio Management

Before understanding AI's advantages, recognize the inherent limitations of human portfolio management in cryptocurrency markets.

Information Processing Constraints

The human brain processes information sequentially and slowly. A skilled analyst might evaluate 10-20 cryptocurrencies daily using 5-10 data points each. This yields 50-200 data points daily—a tiny fraction of available information.

Token Metrics' AI analyzes 6,000+ cryptocurrencies using 80+ data points each—480,000+ data points daily. This 2,400x information processing advantage means the AI identifies opportunities and risks invisible to human analysis.

Cognitive Biases Distort Judgment

Human decision-making suffers from systematic cognitive biases:

- Confirmation Bias: Seeking information supporting existing beliefs while dismissing contradictory evidence

- Recency Bias: Overweighting recent events while underweighting historical patterns

- Anchoring Bias: Fixating on initial information (like purchase price) rather than current reality

- Herding Bias: Following crowd behavior rather than independent analysis

- Overconfidence Bias: Believing personal judgment exceeds actual accuracy

These biases cause systematic errors leading to poor timing, holding losers too long, selling winners prematurely, and following crowds into overvalued assets. AI systems have no cognitive biases—they evaluate data objectively based on mathematical relationships.

Emotional Volatility Undermines Discipline

Human portfolio managers experience fear during market crashes and euphoria during rallies. These emotions trigger fight-or-flight responses overwhelming rational analysis, causing panic selling at bottoms and overconfident buying at tops.

AI experiences no emotions. Market crashes don't trigger fear. Rallies don't create euphoria. The system evaluates probabilities and executes strategies mechanically regardless of market sentiment.

Physical and Mental Limitations

Humans require sleep, breaks, vacations, and time for other life activities. Portfolio managers cannot monitor markets 24/7 or maintain consistent attention over years without degradation.

AI operates continuously without fatigue, monitoring global markets across time zones simultaneously. The system never sleeps, never takes vacations, never loses focus—maintaining perpetual vigilance impossible for humans.

Inability to Learn from All Data

Human learning occurs slowly through experience and study. A portfolio manager might learn from hundreds of trades over decades, building intuition from limited personal experience.

AI learns from millions of data points across thousands of assets simultaneously. Every market movement, every token launch, every sentiment shift contributes to model training. The system identifies patterns across entire crypto history that individual humans could never detect.

The Specific AI Technologies Powering Token Metrics

Token Metrics employs an ensemble of sophisticated machine learning models, each serving specific purposes within the investment process.

Gradient Boosting Decision Trees

These models excel at identifying complex, non-linear relationships between variables. In crypto markets, simple linear relationships rarely exist—token performance depends on intricate interactions between multiple factors.

Gradient boosting builds thousands of decision trees, each learning from previous trees' errors. This iterative process creates highly accurate predictions by combining many weak predictors into strong aggregate models.

Application: Identifying which combinations of technical, fundamental, and sentiment factors predict future price movements most accurately.

Recurrent Neural Networks (RNNs)

RNNs specialize in time-series analysis, recognizing patterns in sequential data. Cryptocurrency prices represent time-series data where past patterns influence future movements.

Unlike simple technical analysis looking at individual indicators, RNNs identify complex temporal relationships spanning multiple timeframes simultaneously. The networks detect subtle patterns in how prices, volumes, and other metrics evolve together over time.

Application: Forecasting price trajectories by learning from historical patterns while adapting to changing market dynamics.

Random Forests

Random forest algorithms create multiple decision trees using random subsets of data and features, then aggregate their predictions. This approach reduces overfitting risk—where models perform excellently on historical data but fail on new data.

By training on different data subsets, random forests identify robust patterns that generalize well rather than memorizing specific historical sequences unlikely to repeat exactly.

Application: Robust token classification separating quality projects from low-quality alternatives based on generalizable characteristics.

Natural Language Processing (NLP)

NLP algorithms analyze text data from social media, news articles, developer communications, and community forums. These systems extract sentiment, identify trending topics, detect narrative shifts, and quantify community engagement.

Unlike humans who might read dozens of articles weekly, NLP processes millions of text sources daily, identifying sentiment patterns and narrative changes before they become obvious.

Application: Gauging market sentiment, detecting emerging narratives, identifying coordinated pumps or manipulative campaigns, and assessing community health.

Anomaly Detection Frameworks

Anomaly detection identifies unusual patterns suggesting either opportunities or risks. These systems establish baseline "normal" behavior, then flag deviations warranting attention.

In crypto markets, anomalies might indicate insider trading before announcements, coordinated manipulation schemes, security vulnerabilities, or emerging trends before mainstream recognition.

Application: Early warning systems for security threats, manipulation detection, and identifying breakout candidates showing unusual strength relative to historical patterns.

What AI Can Do That Humans Cannot

Understanding specific capabilities unique to AI reveals why technology-driven approaches surpass traditional methods.

Simultaneous Multi-Asset Analysis

Human portfolio managers analyze assets sequentially—evaluating Bitcoin, then Ethereum, then Solana, one at a time. This sequential processing misses relationships between assets.

AI analyzes all assets simultaneously, identifying correlations, relative strength patterns, sector rotations, and cross-asset opportunities. The system recognizes when DeFi tokens strengthen relative to Layer-1s, when memecoins show coordinated movement, or when specific sectors lead or lag broader markets.

This simultaneous analysis reveals relative value opportunities invisible to sequential human analysis.

Pattern Recognition Across Massive Datasets

Humans excel at recognizing simple patterns—support and resistance levels, head-and-shoulders formations, moving average crossovers. However, complex multi-dimensional patterns exceed human cognitive capacity.

AI identifies patterns involving dozens of variables simultaneously across thousands of assets. These patterns might involve specific combinations of technical indicators, on-chain metrics, sentiment scores, and fundamental factors that human analysts could never process holistically.

Example: The AI might recognize that tokens with specific combinations of technical momentum, developer activity growth, and social sentiment shifts outperform 73% of the time over subsequent 30 days. Humans cannot track and validate such complex multi-factor patterns.

Emotionless Execution During Extremes

The most valuable investment opportunities occur during market extremes when fear or greed overwhelm rational analysis. Humans struggle maintaining discipline during these periods—buying during maximum fear feels terrifying, selling during euphoria seems foolish.

AI executes mechanically based on statistical probabilities regardless of market sentiment. When indicators show extreme fear and historically attractive valuations, the system buys aggressively. When indicators show extreme euphoria and overvaluation, the system takes profits systematically.

This emotionless execution during extremes generates substantial alpha that humans rarely capture despite understanding the principle intellectually.

Continuous Learning and Adaptation

Human learning occurs slowly. Portfolio managers develop strategies based on historical experience, but adapting to new market regimes takes time and often requires painful losses first.

AI learns continuously from every market movement. When strategies underperform, the system adjusts weightings automatically. When new patterns emerge, the AI incorporates them immediately. This perpetual learning ensures strategies evolve with markets rather than becoming obsolete.

Microsecond Response Times

Markets move in milliseconds. By the time humans notice significant price movements and decide how to respond, opportunities have passed.

AI monitors markets continuously and responds within microseconds. When rebalancing signals trigger or new opportunities emerge, execution occurs immediately rather than after human deliberation delays.

This speed advantage proves especially valuable during volatile periods when opportunities appear and disappear rapidly.

Comparing AI-Driven Indices to Traditional Alternatives

Understanding Token Metrics' AI advantages becomes clearer through direct comparison with traditional approaches.

Vs. Market-Cap-Weighted Indices: Traditional indices simply track largest cryptocurrencies by size, overexposing to overvalued bubbles and missing emerging opportunities. Token Metrics' AI evaluates fundamentals, momentum, and valuations, overweighting undervalued opportunities regardless of size.

Vs. Human-Managed Crypto Funds: Traditional funds employ analyst teams covering 50-100 tokens maximum, influenced by cognitive biases, charging 2% management and 20% performance fees. Token Metrics covers 6,000+ tokens without biases or emotions at subscription fees far lower than traditional management costs.

Vs. DIY Individual Selection: Individual investors face time constraints, limited professional tools, emotional attachment preventing objectivity, and FOMO-driven poor timing. AI provides comprehensive analysis using professional data, objective evaluation, and systematic timing based on probabilities.

How AI Advantages Translate to Superior Returns

Understanding theoretical AI advantages is useful, but what matters most is how these translate into actual superior investment performance.

Earlier Opportunity Identification

AI identifies emerging opportunities before they become obvious to human investors. By analyzing on-chain activity, developer engagement, and early sentiment shifts, the system detects promising tokens months before mainstream attention arrives.

Result: Index positions established at significantly lower prices capture maximum appreciation when opportunities materialize.

Superior Risk Management

AI's anomaly detection and comprehensive analysis identify risks earlier than human analysis. Security vulnerabilities, team problems, tokenomics issues, or manipulation schemes trigger early warning systems.

Result: Positions reduced or eliminated before major problems cause catastrophic losses, preserving capital for better opportunities.

Optimal Rebalancing Timing

The system identifies optimal rebalancing timing based on technical signals, sentiment extremes, and volatility patterns. Rather than rebalancing on arbitrary schedules, the AI rebalances when conditions offer maximum advantage.

Result: Systematic "buy low, sell high" execution that human emotion prevents, generating additional alpha through superior timing.

Diversification Optimization

AI constructs portfolios maximizing diversification benefits through correlation analysis across all tokens. Rather than naive diversification holding many similar assets, the system combines tokens with complementary characteristics.

Result: Smoother return profiles with superior risk-adjusted performance through true diversification rather than false variety.

Compound Learning Effects

Every market cycle improves AI performance through additional training data. Each bull market, bear market, and consolidation phase provides data points refining model accuracy.

Result: Performance improving over time rather than degrading as with human strategies that become obsolete when markets evolve.

The Future of AI-Driven Crypto Investing

AI technology continues advancing rapidly, suggesting Token Metrics' advantages will expand over time:

- Advanced Neural Architectures: Emerging technologies like transformers offer superior pattern recognition capabilities

- Real-Time On-Chain Analysis: AI analyzing blockchain transactions identifies smart money movements and whale behavior

- Cross-Market Intelligence: Integration with traditional markets, macroeconomics, and geopolitics creates comprehensive models

- Personalized Optimization: Future AI could create personalized indices tailored to individual preferences while maintaining professional management

Practical Implications for Investors

Understanding AI advantages has direct practical implications:

- Accept AI Superiority: Recognize that outperforming sophisticated AI through individual selection is increasingly difficult. Strategic allocation to AI-driven indices becomes increasingly rational.

- Focus Human Energy Wisely: Concentrate on risk tolerance, emotional discipline, and strategic allocation—areas where humans add value—rather than token selection where AI excels.

- Trust Uncomfortable Recommendations: The system identifies opportunities before they become obvious. Buy when it feels scary, sell when it feels premature.

- Recognize Competitive Disadvantage: As capital flows into AI-driven strategies, traditional approaches face increasing disadvantage. Early adoption provides compounding advantages.

Conclusion: The Inevitable Future

Artificial intelligence represents the future of cryptocurrency portfolio management not because it's trendy—because it's fundamentally superior. The information processing, pattern recognition, emotionless execution, and continuous learning capabilities of modern AI exceed human limitations by orders of magnitude.

Token Metrics doesn't just use AI as marketing—the platform employs institutional-grade machine learning providing genuine competitive advantages translating into measurably superior risk-adjusted returns.

The choice facing crypto investors is straightforward: compete against sophisticated AI systems using human limitations, or harness those same AI capabilities through Token Metrics indices. One approach fights the future; the other embraces it.

As AI technology continues advancing and more capital recognizes these advantages, the performance gap between AI-driven and traditional approaches will widen. Early adopters of superior technology capture outsized returns, while late adopters play catch-up from positions of disadvantage.

Your opportunity exists today. Token Metrics provides access to institutional-grade AI previously available only to hedge funds and professional investors. The democratization of artificial intelligence through accessible indices transforms crypto investing from speculation into systematic wealth building.

Begin your 7-day free trial and experience firsthand how artificial intelligence transforms cryptocurrency investing from emotional gambling into disciplined, technology-driven wealth creation.

Bitcoin Cash Price Prediction 2028: Payment-Focused Layer 1 Analysis

%201.svg)

%201.svg)

Market Context for Bitcoin Cash Price Prediction: The Case for 2028

The Layer 1 landscape is consolidating as users and developers gravitate to chains with clear specialization. Bitcoin Cash positions itself as a payment-focused chain with low fees and quick settlement for everyday usage.

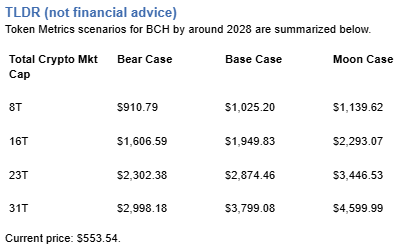

The Bitcoin Cash price prediction scenario projections below map potential outcomes for BCH across different total crypto market sizes. Base cases assume steady usage and listings, while moon scenarios factor in stronger liquidity and accelerated adoption. Our comprehensive price prediction framework provides investors with data-driven forecasts for strategic decision-making.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to Read This BCH Price Prediction

Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics lead metric for Bitcoin Cash, cashtag $BCH, is a TM Grade of 54.81%, which translates to Neutral, and the trading signal is bearish, indicating short-term downward momentum. This implies Token Metrics views $BCH as mixed value long term in our price prediction models: fundamentals look strong, while valuation and technology scores are weak, so upside depends on improvements in adoption or technical development. Market context: Bitcoin has been setting market direction, and with broader risk-off moves altcoins face pressure, which increases downside risk for $BCH in the near term.

Live details:

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Key Takeaways: Bitcoin Cash Price Prediction Summary

- Scenario driven: Price prediction outcomes hinge on total crypto market cap; higher liquidity and adoption lift the bands

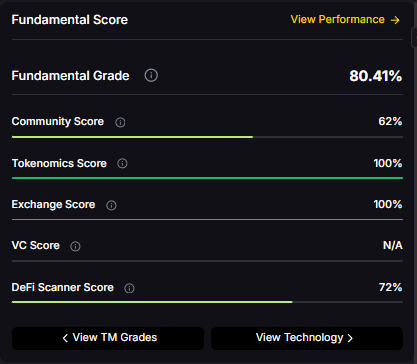

- Fundamentals: Fundamental Grade 80.41% (Community 62%, Tokenomics 100%, Exchange 100%, VC —, DeFi Scanner 72%)

- Technology: Technology Grade 29.63% (Activity 22%, Repository 70%, Collaboration 48%, Security —, DeFi Scanner 72%)

- TM Agent gist: Neutral grade, bearish momentum in price prediction models; adoption must improve for upside

- Education only, not financial advice

Bitcoin Cash Price Prediction Scenario Analysis

Token Metrics price prediction scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T Market Cap - BCH Price Prediction:

At an 8 trillion total crypto market cap, BCH price prediction projects to $910.79 in bear conditions, $1,025.20 in the base case, and $1,139.62 in bullish scenarios.

16T Market Cap - BCH Price Prediction:

Doubling the market to 16 trillion expands the price prediction range to $1,606.59 (bear), $1,949.83 (base), and $2,293.07 (moon).

23T Market Cap - BCH Price Prediction:

At 23 trillion, the price prediction scenarios show $2,302.38, $2,874.46, and $3,446.53 respectively.

31T Market Cap - BCH Price Prediction:

In the maximum liquidity scenario of 31 trillion, BCH price predictions could reach $2,998.18 (bear), $3,799.08 (base), or $4,599.99 (moon).

Each tier in our price prediction framework assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Why Consider the Indices with Top-100 Exposure

Bitcoin Cash represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle BCH with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

What Is Bitcoin Cash?

Bitcoin Cash is a peer-to-peer electronic cash network focused on fast confirmation and low fees. It launched in 2017 as a hard fork of Bitcoin with larger block capacity to prioritize payments. The chain secures value transfers using proof of work and aims to keep everyday transactions affordable.

BCH is used to pay transaction fees and settle transfers, and it is widely listed across major exchanges. Adoption centers on payments, micropayments, and remittances where low fees matter. It competes as a payment‑focused Layer 1 within the broader crypto market.

Token Metrics AI Analysis

Token Metrics AI provides comprehensive context on Bitcoin Cash's positioning and challenges, informing our price prediction models:

Vision: Bitcoin Cash (BCH) is a cryptocurrency that emerged from a 2017 hard fork of Bitcoin, aiming to function as a peer-to-peer electronic cash system with faster transactions and lower fees. It is known for prioritizing on-chain scalability by increasing block sizes, allowing more transactions per block compared to Bitcoin. This design choice supports its use in everyday payments, appealing to users seeking a digital cash alternative. Adoption has been driven by its utility in micropayments and remittances, particularly in regions with limited banking infrastructure. However, Bitcoin Cash faces challenges including lower network security due to reduced mining hash rate compared to Bitcoin, and ongoing competition from both Bitcoin and other scalable blockchains. Its value proposition centers on accessibility and transaction efficiency, but it operates in a crowded space with evolving technological and regulatory risks.

Problem: The project addresses scalability limitations in Bitcoin, where rising transaction fees and slow confirmation times hinder its use for small, frequent payments. As Bitcoin evolved into a store of value, a gap emerged for a blockchain-based currency optimized for fast, low-cost transactions accessible to the general public.

Solution: Bitcoin Cash increases block size limits from 1 MB to 32 MB, enabling more transactions per block and reducing congestion. This on-chain scaling approach allows for faster confirmations and lower fees, making microtransactions feasible. The network supports basic smart contract functionality and replay protection, maintaining compatibility with Bitcoin's core architecture while prioritizing payment utility.

Market Analysis: Bitcoin Cash operates in the digital currency segment, competing with Bitcoin, Litecoin, and stablecoins for use in payments and remittances. While not the market leader, it occupies a niche focused on on-chain scalability for transactional use. Its adoption is influenced by merchant acceptance, exchange liquidity, and narratives around digital cash. Key risks include competition from layer-2 solutions on other blockchains, regulatory scrutiny of cryptocurrencies, and lower developer and miner activity compared to larger networks. Price movements are often tied to broader crypto market trends and internal protocol developments. Despite its established presence, long-term growth depends on sustained utility, network security, and differentiation in a market increasingly dominated by high-throughput smart contract platforms—all critical factors in our price prediction analysis.

Fundamental and Technology Snapshot from Token Metrics

Fundamental Grade: 80.41% (Community 62%, Tokenomics 100%, Exchange 100%, VC —, DeFi Scanner 72%).

Technology Grade: 29.63% (Activity 22%, Repository 70%, Collaboration 48%, Security —, DeFi Scanner 72%).

Catalysts That Skew BCH Price Predictions Bullish

- Institutional and retail access expands with ETFs, listings, and integrations

- Macro tailwinds from lower real rates and improving liquidity

- Product or roadmap milestones such as upgrades, scaling, or partnerships

- Increased merchant adoption for payment processing

- Growing adoption in remittance corridors and emerging markets

- Layer-2 development enhancing BCH utility

Risks That Skew BCH Price Predictions Bearish

- Macro risk-off from tightening or liquidity shocks

- Regulatory actions targeting payment cryptocurrencies or infrastructure outages

- Concentration risk in validator economics and competitive displacement

- Low technology grade (29.63%) indicating development challenges

- Competition from Bitcoin Lightning Network and other payment solutions

- Declining developer activity and network effect

Bitcoin Cash Price Prediction FAQs

Can BCH reach $3,000?

Yes. Based on our price prediction scenarios, BCH could reach $3,000 in the 23T moon case and 31T base case. The 23T tier projects $3,446.53 in the moon case, making $3,000 an achievable target under favorable market conditions. Not financial advice.

Can BCH 10x from current levels?

At current price of $553.54, a 10x would reach $5,535.40. This falls beyond our highest price prediction scenario of $4,599.99 (31T moon case). Bear in mind that 10x returns would require substantial market cap expansion beyond our modeled scenarios and exceptional BCH adoption. Not financial advice.

Should I buy BCH now or wait?

Timing depends on your risk tolerance and macro outlook. Current price of $553.54 sits below the 8T bear case in our price prediction scenarios. The Neutral TM Grade (54.81%) and bearish trading signal suggest caution in the near term. Dollar-cost averaging may reduce timing risk. Not financial advice.

What is the Bitcoin Cash price prediction for 2025-2028?

Our comprehensive BCH price prediction framework suggests Bitcoin Cash could trade between $910.79 and $4,599.99 depending on market conditions and total crypto market capitalization. The base case price prediction scenario clusters around $1,025.20 to $3,799.08 across different market cap environments. Current Neutral rating (54.81%) indicates mixed signals requiring adoption improvements. Not financial advice.

Can Bitcoin Cash reach $5,000?

BCH reaching $5,000 would exceed our current price prediction models' highest scenario of $4,599.99 (31T moon case). This would require extraordinary market conditions, significant merchant adoption acceleration, and BCH successfully differentiating itself in the crowded payment cryptocurrency space. Not financial advice.

Is Bitcoin Cash a good investment based on price predictions?

BCH shows strong fundamentals (80.41% grade) but a very weak technology score (29.63%), resulting in a Neutral TM Grade of 54.81% with bearish near-term signals. While our price prediction models show potential upside in favorable market conditions, the low technology grade and adoption challenges suggest significant risks. The payment-focused use case faces competition from Lightning Network and other solutions. Not financial advice.

How does BCH compare to Bitcoin in price predictions?

Bitcoin Cash was designed as a payment-focused alternative to Bitcoin's store-of-value narrative. Our price prediction framework shows BCH could reach $1,025-$4,600 across scenarios, while Bitcoin dominates market cap and network effects. BCH's success depends on carving out a distinct payment niche rather than competing directly with Bitcoin. The correlation between BTC and BCH price movements remains high.

What are the biggest risks to BCH price predictions?

Key risks that could impact Bitcoin Cash price predictions include: extremely low technology grade (29.63%) indicating development stagnation, competition from Bitcoin Lightning Network, declining developer activity, regulatory targeting of payment cryptocurrencies, low mining hash rate security concerns, and competitive displacement from stablecoins and other payment solutions. The bearish trading signal and Neutral grade reflect these challenges.

Will BCH benefit from a Bitcoin bull run?

Historically, Bitcoin Cash has shown positive correlation with Bitcoin price movements. Our price prediction scenarios assume BCH captures some momentum from broader crypto market expansion. However, BCH's lower technology grade and adoption challenges may limit its ability to match Bitcoin's percentage gains. The base case scenarios reflect moderate participation in bull market dynamics.

Next Steps

Want exposure? Buy BCH on MEXC

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Why Use Token Metrics for BCH Price Predictions?

- Scenario-based forecasting: Multiple market cap tiers for comprehensive price prediction analysis

- Transparent grading: Fundamental (80.41%) vs Technology (29.63%) reveals strengths and weaknesses

- AI-driven insights: Advanced algorithms analyze payment cryptocurrency competitive landscape

- Real-time signals: Trading signals and TM Grades (Neutral 54.81%) updated regularly

- Risk assessment: Identifies key risks like low developer activity and competitive pressure

- Comparative analysis: Analyze BCH against Bitcoin, Litecoin, and 6,000+ tokens

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)