Fast Crypto API: Real-Time Data Without the Lag

Why Speed Matters in a Crypto API

In crypto, milliseconds can make or break a trade. Whether you’re building a high-frequency bot, a risk management tool, or a market dashboard, slow crypto APIs lead to:

- Missed trade opportunities during volatility

- Bots that lag behind signals

- Dashboards that feel sluggish

- Risk models that update too late

📌 Example: In a Bitcoin price swing, even a 500 ms delay can translate to thousands in lost value for trading bots. That’s why developers emphasize low latency when choosing best Crypto APIs.

What Defines a “Fast” Crypto API

Not every Crypto API marketed as “fast” is built the same. A truly fast crypto API provides:

- Low Latency Feeds – Sub-second updates across major tokens and exchanges.

- WebSocket Support – Push-based data streams instead of slower polling.

- Scalable Infrastructure – Resilient under heavy traffic spikes.

- Global Edge Delivery – Reduced latency for users worldwide.

📌 Tip for builders: Always benchmark an API in real market conditions (during volatility) to see if “fast” performance holds up under stress.

Comparing Fast Crypto APIs: Strengths & Limitations

- CoinGecko / CoinMarketCap

- Strengths: Broad token coverage, good for price tickers.

- Limitations: Refresh cycles can lag; not ideal for bots or real-time dashboards.

- Strengths: Broad token coverage, good for price tickers.

- CryptoCompare

- Strengths: Strong historical data for research.

- Limitations: Not optimized for ultra-fast live feeds.

- Strengths: Strong historical data for research.

- Glassnode

- Strengths: On-chain metrics and blockchain health insights.

- Limitations: Focused on analytics, not real-time trading data.

- Strengths: On-chain metrics and blockchain health insights.

- Token Metrics API

- Strengths: Sub-second updates, fast bull/bear signals, predictive AI, and on-chain metrics.

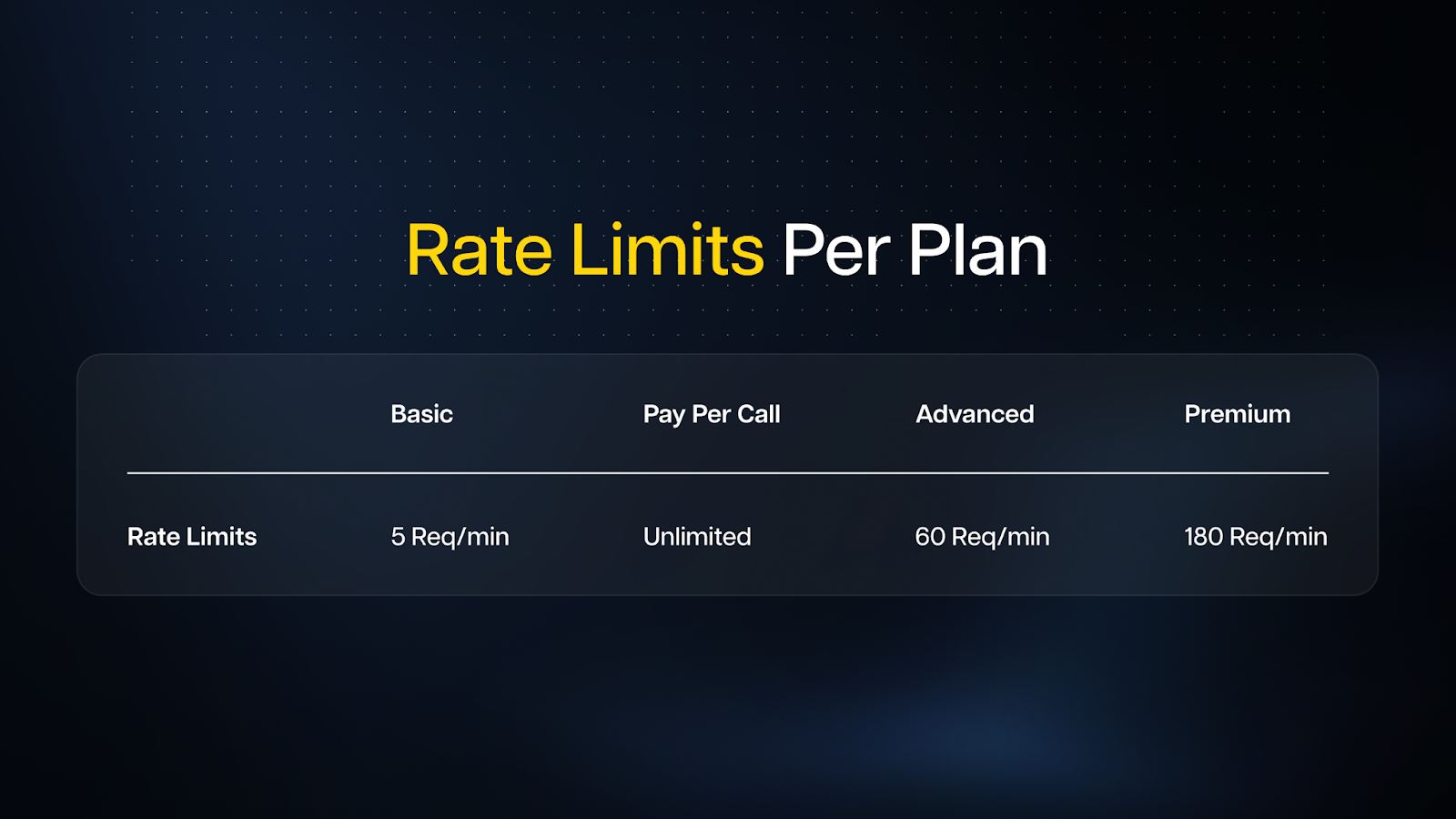

- Limitations: Free tier includes rate limits (higher throughput available via X.402 or paid plans).

- Strengths: Sub-second updates, fast bull/bear signals, predictive AI, and on-chain metrics.

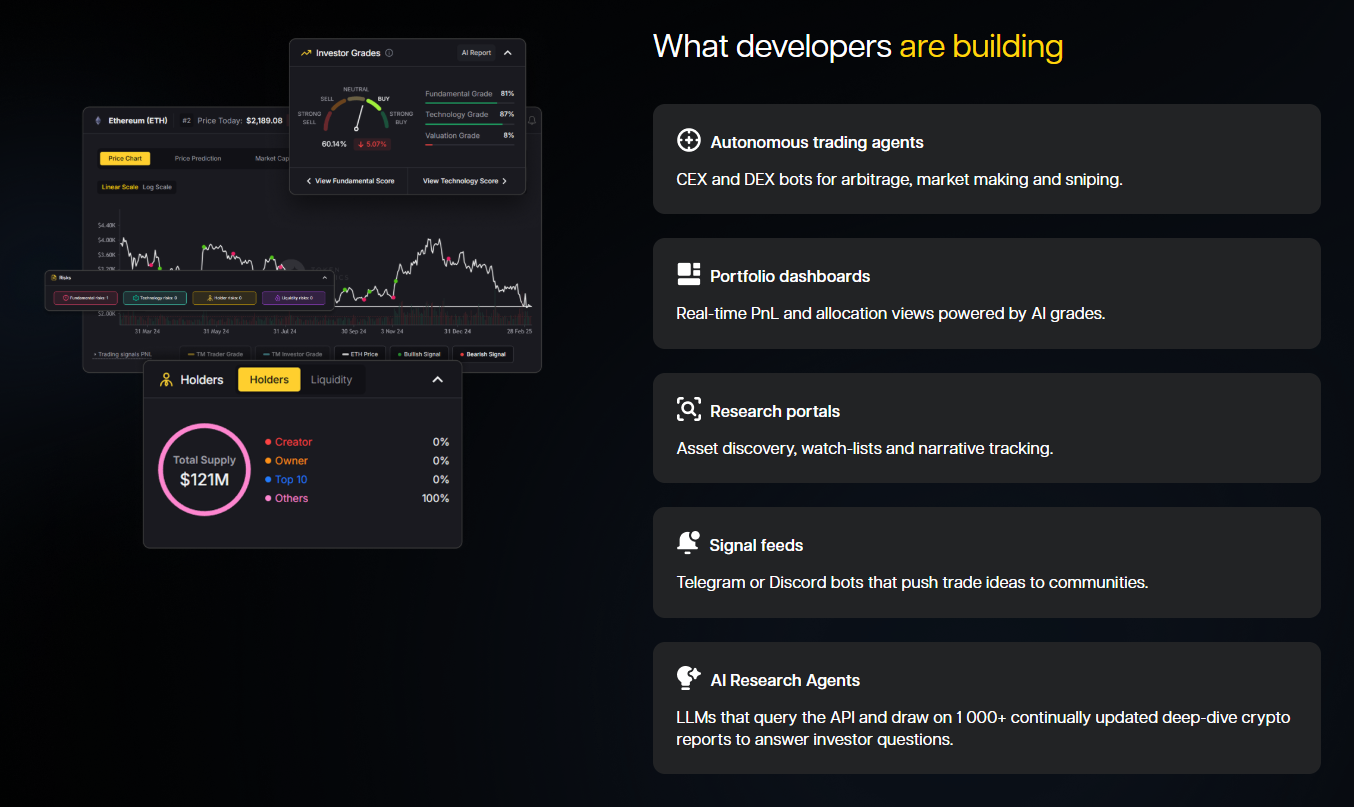

Token Metrics API: Fast + Intelligent

What sets Token Metrics API apart is that it’s not just fast data—it’s fast intelligence:

- Real-Time Prices – Thousands of tokens continuously updated.

- AI Trading Signals – Bull/bear predictions delivered instantly.

- On-Chain Metrics – Track wallet flows, liquidity, and token behavior in near real time.

- Scalable Performance – Built to withstand institutional-grade usage during volatility.

📌 Instead of just reacting to prices, developers can anticipate market shifts with AI-driven signals.

Use Cases: From Trading Bots to AI Agents

- High-Frequency Trading Bots – Execute strategies using low-latency feeds and predictive signals.

- DeFi Dashboards – Display liquidity flows and token activity in real time.

- Risk Management Systems – Keep risk models updated second by second.

- AI Agents – Power intelligent assistants with actionable streaming data.

Best Practices for Building With Fast APIs

- Use WebSockets – Relying only on REST endpoints introduces unnecessary delay.

- Benchmark During Volatility – Test APIs when the market is busiest.

- Optimize Request Handling – Cache where possible to avoid unnecessary calls.

- Monitor Latency – Use observability tools like Grafana or New Relic to track delays.

- Failover Strategy – Have a backup API (e.g., CoinGecko) if primary data slows.

Beyond Token Metrics: Other Tools to Explore

Token Metrics API excels at fast data + signals, but developers often combine it with other tools for a full-stack setup:

- DefiLlama API – Best for free DeFi protocol data and yield metrics.

- Dune Analytics – Query blockchain data in real time with SQL.

- TradingView Webhooks – Add instant chart-based triggers for front ends.

- Kaiko / Amberdata – Enterprise-grade APIs for institutional price feeds.

📌 Pro tip: Use Token Metrics for predictive signals, and pair it with TradingView or DefiLlama for visualization and DeFi-specific data.

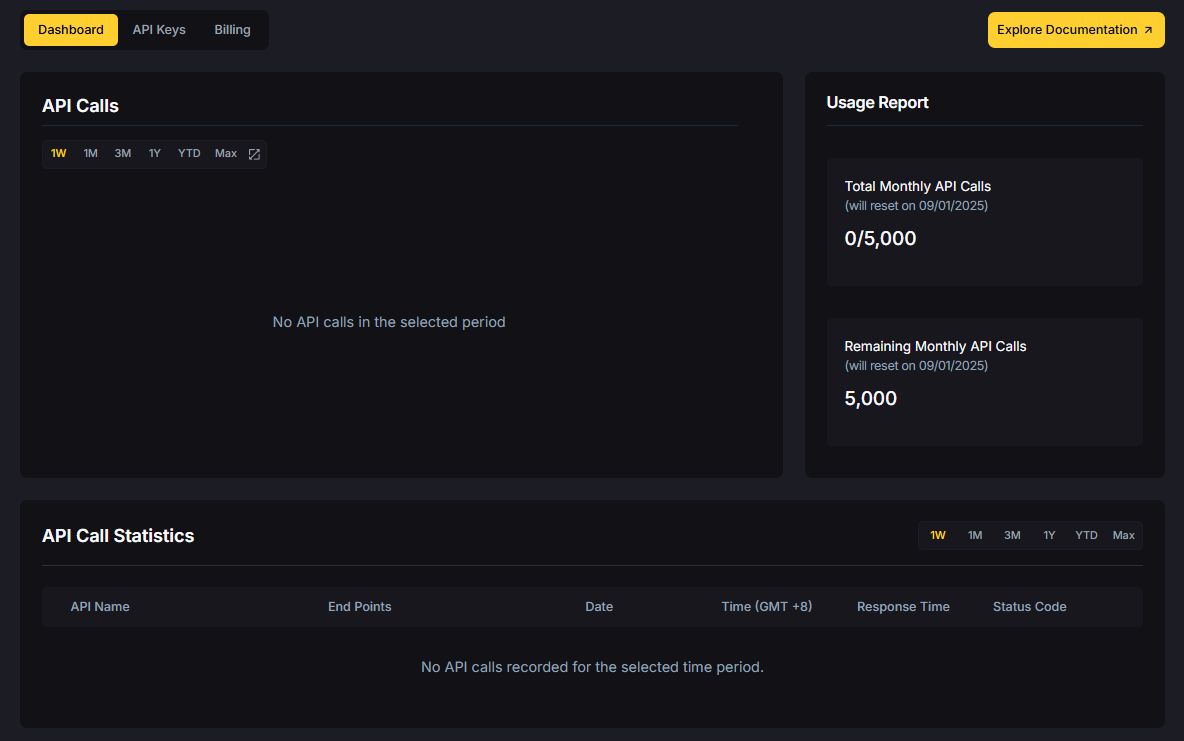

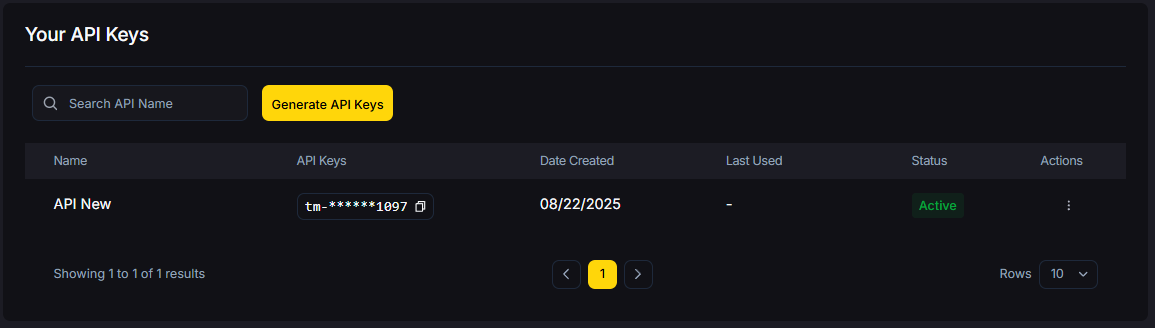

How to Start Using the Token Metrics Fast API

- Sign Up Free – Create a Token Metrics account.

- Generate Your API Key – Instantly available in your dashboard.

- Choose WebSockets or REST – Based on your use case.

- Start Building – Bots, dashboards, or risk models with sub-second data.

👉 Get Your Free Token Metrics API Key

Scaling Fast With Paid Plans & X.402

When free limits aren’t enough, Token Metrics offers:

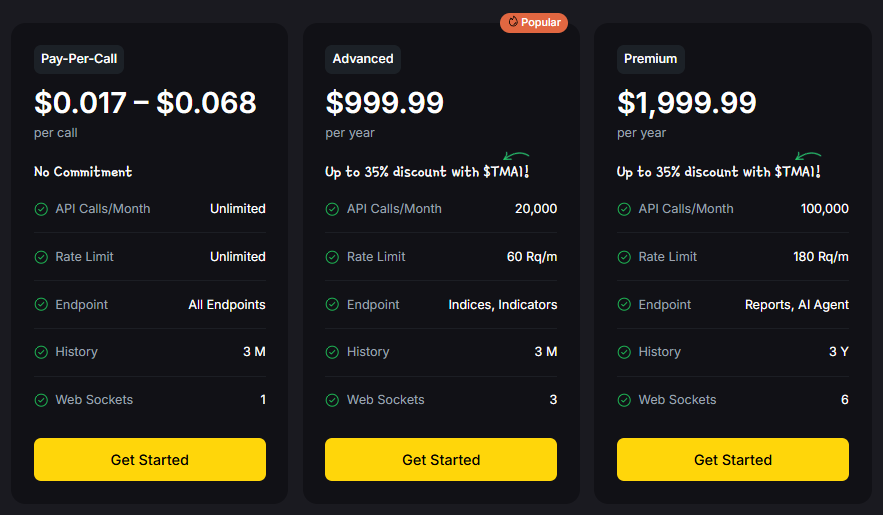

- Pay-Per-Call (X.402) – From $0.017 per call, unlimited usage, all endpoints, and 3 months of history.

- Advanced Plan ($999.99/year) – 20,000 calls/month, indices & indicators, 3 WebSockets.

- Premium Plan ($1,999.99/year) – 100,000 calls/month, AI agent + reports, 3 years of history.

📌 Why X.402 matters: You can start scaling instantly with no upfront cost—just pay per call as you grow.

Build With the Fastest Insights in Crypto

In crypto, speed without intelligence is noise. With Token Metrics Fast Crypto API, you get sub-second price data + AI-driven insights, giving your trading bots, dashboards, and AI agents the real-time edge they need.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

.png)

.png)

.svg)

.png)