From Stocks to Crypto Indices: A Traditional Investor's Guide to Digital Asset Allocation with Token Metrics

If you've spent years building wealth through stocks, bonds, and mutual funds, cryptocurrency can seem alien and intimidating. The volatility, technical jargon, and stories of overnight millionaires mixed with devastating losses create skepticism among disciplined traditional investors.

Yet ignoring cryptocurrency entirely means missing one of the most significant wealth creation opportunities of our generation. The key isn't abandoning proven investment principles—it's applying them to a new asset class through vehicles designed for sophisticated investors like you.

Token Metrics AI Indices bridge the gap between traditional finance and cryptocurrency by offering:

- Index-based exposure similar to stock market ETFs

- Professional management resembling mutual funds

- Diversification principles you already understand

- Risk management frameworks familiar from traditional portfolios

This guide helps traditional investors transition into cryptocurrency thoughtfully, comparing familiar concepts to crypto equivalents, explaining portfolio allocation strategies, addressing tax considerations, and building crypto exposure using time-tested investment principles.

Understanding Crypto Indices Through Traditional Finance Lens

The easiest way to understand crypto indices is through comparison with traditional investment vehicles you already know.

- Crypto indices function like stock market ETFs - diversified, automatically rebalanced portfolios

- AI-driven token selection resembles active management and smart beta strategies

- Diversification and correlation principles work identically in crypto

- Risk-adjusted returns are measured using the same metrics (Sharpe ratio, drawdowns, volatility)

Crypto Indices Are Like Stock Market ETFs

Just as the S&P 500 ETF provides diversified exposure to 500 large US companies without selecting individual stocks, Token Metrics indices provide diversified exposure to carefully selected cryptocurrencies without picking individual tokens.

The SPY ETF tracks the S&P 500 automatically rebalancing as companies enter or exit the index. Token Metrics indices similarly track AI-selected portfolios, automatically rebalancing as market conditions change and new opportunities emerge.

Traditional index funds charge expense ratios—typically 0.03-0.50% annually. Token Metrics operates on a subscription model providing access to multiple indices and analytical tools for one fee, similar to premium investment research services.

AI-Driven Selection Resembles Active Management

While crypto indices use passive indexing methodology, the underlying token selection employs active management principles. This hybrid approach resembles smart beta ETFs in traditional markets—systematic strategies using quantitative factors to outperform market-cap-weighted approaches.

Token Metrics' AI analyzes fundamental metrics, technical indicators, and on-chain data to identify undervalued tokens with strong prospects. This process mirrors how active stock fund managers screen for quality companies, strong earnings, and attractive valuations—but executed algorithmically at scale across thousands of cryptocurrencies.

Diversification Works the Same Way

Portfolio theory applies equally to crypto. Diversification reduces unsystematic risk by spreading exposure across multiple assets. If one stock in your portfolio falls 50%, it impacts your total portfolio proportionally to its weighting. The same principle protects crypto index investors when individual tokens underperform.

Correlation matters identically. Diversification provides maximum benefit when assets don't move in lockstep. Token Metrics indices intentionally diversify across different blockchain ecosystems, use cases, and market capitalizations to reduce correlation and smooth returns.

Risk-Adjusted Returns Follow Same Metrics

Sharpe ratios, maximum drawdowns, and volatility measurements apply to crypto just as they do to stocks. Professional investors don't evaluate returns in isolation—they assess returns relative to risk taken.

Token Metrics indices target superior risk-adjusted returns through the same principles traditional managers use—systematic analysis, disciplined rebalancing, and professional risk management. The asset class differs but investment principles remain constant.

Translating Your Stock Market Experience to Crypto

Your traditional investing experience provides valuable foundation for crypto success.

- Fundamental Analysis: Stock investors evaluate revenue, profit margins, and competitive advantages. Crypto analysis examines transaction volume, technology advantages, team quality, and market opportunity using different terminology but similar principles. Token Metrics' AI systematically evaluates these factors like quantitative stock strategies.

- Technical Analysis: Support, resistance, moving averages, and momentum indicators function identically for cryptocurrencies. Your technical analysis skills transfer directly to crypto markets.

- Portfolio Construction: Asset allocation, rebalancing, and diversification principles apply universally. Cryptocurrency's low correlation to traditional assets makes it valuable for diversification even at small allocations.

- Market Cycles: Bull markets, bear markets, and consolidation occur in crypto like stocks. Your experience navigating market downturns prepared you for crypto volatility—the magnitude differs but psychological challenges remain similar.

Portfolio Allocation: How Much Crypto Should Traditional Investors Hold?

Determining appropriate cryptocurrency allocation requires balancing growth potential against volatility tolerance and time horizon.

- Conservative (1-5%): For investors approaching retirement or with low risk tolerance

- Moderate (5-15%): For mid-career professionals with 10-20 year horizons

- Aggressive (15-30%): For younger investors with long time horizons and high risk tolerance

Conservative Allocation (1-5%)

Investors approaching retirement or with low risk tolerance should limit crypto exposure to 1-5% of total portfolio. This provides meaningful participation in crypto's growth without risking financial security.

At this allocation level, even if crypto suffers 80% decline, your total portfolio drops only 0.8-4%—uncomfortable but manageable. Conversely, if crypto appreciates 300%, your portfolio gains 3-15%—meaningful upside from small allocation.

Focus exclusively on Token Metrics' conservative indices emphasizing Bitcoin, Ethereum, and fundamentally strong large-cap tokens. This minimizes volatility while maintaining crypto exposure.

Moderate Allocation (5-15%)

Mid-career professionals with 10-20 year investment horizons can embrace 5-15% crypto allocation. This provides substantial exposure to crypto's growth potential while maintaining predominantly traditional portfolio structure.

Balanced Token Metrics indices suit this allocation level, combining established cryptocurrencies with growth-oriented mid-cap tokens. The diversification and professional management limit volatility compared to individual token selection.

At 10% allocation, your portfolio's overall volatility increases modestly—perhaps from 12% to 14% standard deviation annually. This marginal volatility increase brings meaningful return enhancement potential.

Aggressive Allocation (15-30%)

Younger investors with long time horizons and high risk tolerance can allocate 15-30% to cryptocurrency. At these levels, crypto significantly influences total portfolio performance, requiring comfort with substantial volatility.

Mix conservative and aggressive Token Metrics indices providing both stability and growth potential. Even aggressive allocations benefit from some downside protection through conservative index components.

Understand that 25% crypto allocation could create 20% portfolio swings during extreme market conditions. Only embrace this allocation if you can tolerate such volatility without panic selling.

Implementation Through Dollar-Cost Averaging

Regardless of target allocation, implement gradually through dollar-cost averaging over 6-12 months. This reduces timing risk and allows psychological adjustment to crypto's volatility.

If targeting 10% crypto allocation with $500,000 portfolio, invest $50,000 total. Rather than investing all at once, invest $4,167 monthly for 12 months. This systematic approach removes emotion and smooths entry prices.

Tax Considerations: What Traditional Investors Must Know

Cryptocurrency taxation differs from stocks in important ways. Understanding these differences prevents costly mistakes.

- Capital gains taxes apply to crypto, with added complexity for crypto-to-crypto trades

- Tax-loss harvesting currently works more flexibly without wash sale rules

- Retirement accounts (IRAs, 401ks) offer tax-advantaged crypto investing options

- Detailed record keeping is essential for every transaction

Capital Gains Apply But With Complexity

Like stocks, cryptocurrencies trigger capital gains taxes when sold for profit. Long-term capital gains rates (held over one year) provide tax advantages versus short-term rates, just as with stocks.

However, crypto-to-crypto trades—exchanging one token for another—trigger taxable events even though you haven't converted to dollars. This differs from stocks where exchanging one stock for another within retirement accounts doesn't trigger taxes.

Token Metrics indices involve periodic rebalancing requiring crypto-to-crypto trades. Each rebalancing transaction creates potential taxable events. Track all transactions meticulously for tax reporting.

Tax-Loss Harvesting Works Differently

Stock investors use tax-loss harvesting to offset gains with losses, subject to wash sale rules preventing you from repurchasing identical securities within 30 days.

Cryptocurrency currently isn't subject to wash sale rules, allowing more aggressive tax-loss harvesting. You could sell a token at loss for tax purposes and immediately repurchase it. However, proposed legislation may extend wash sale rules to crypto—consult tax professionals before relying on this strategy.

Retirement Account Considerations

Some custodians now allow cryptocurrency holdings in retirement accounts (IRAs, 401ks), providing tax-advantaged growth similar to stock investments in these accounts.

Holding crypto indices in traditional IRAs defers taxes until withdrawal. Roth IRAs allow tax-free growth. These vehicles eliminate concerns about rebalancing transactions creating taxable events, making them ideal for crypto index investing.

Research self-directed IRA providers supporting cryptocurrency if interested in tax-advantaged crypto investing. Not all custodians offer this option yet.

Record Keeping Requirements

Cryptocurrency requires more detailed record keeping than stocks. Every transaction—purchases, sales, trades, rebalancing—needs documentation including dates, amounts, prices, and transaction types.

Token Metrics provides transaction tracking helping maintain records for tax reporting. Use this data or export to cryptocurrency tax software like CoinTracker or TokenTax simplifying annual tax preparation.

Risk Management: Applying Traditional Principles to Crypto

Your experience managing risk in traditional portfolios translates directly to crypto with some adjustments:

- Position sizing and diversification prevent concentration risk

- Systematic rebalancing enforces buy-low, sell-high discipline

- Correlation monitoring maintains appropriate portfolio risk

- Stress testing prepares you for extreme scenarios

Position Sizing Matters More

Individual stock positions typically represent 2-5% of diversified portfolios. Individual crypto positions in Token Metrics indices follow similar sizing—no single token dominates portfolio, limiting concentration risk.

This disciplined position sizing prevents the common crypto investor mistake of betting everything on one or two tokens. Diversification reduces volatility and protects against catastrophic single-asset failures.

Rebalancing Discipline Applies Equally

Traditional investors rebalance portfolios periodically—perhaps quarterly or annually—to maintain target allocations. Token Metrics indices rebalance dynamically based on market conditions and AI analysis.

This systematic rebalancing forces "buy low, sell high" discipline. When tokens appreciate substantially, the AI takes profits. When tokens decline but fundamentals remain strong, the AI accumulates at lower prices. Emotional investors do the opposite—buying high and selling low.

Correlation Monitoring Remains Important

Traditional portfolios balance stocks, bonds, and other assets with low correlation. Monitor how your crypto allocation correlates with traditional holdings.

During certain periods, crypto moves independently from stocks providing diversification benefits. During other periods—like March 2020—correlations spike as all risk assets decline together. Understanding these dynamics helps maintain appropriate total portfolio risk.

Stress Testing Your Allocation

Before committing to crypto allocation, stress test how your total portfolio would perform in various scenarios. If crypto fell 80% while stocks fell 50% (like March 2020), would you maintain discipline?

Running these mental simulations before investing prevents panic selling during actual market stress. Decide now what actions you'd take during severe downturns rather than making emotional decisions in the moment.

Transitioning Gradually: A Practical Timeline

Don't rush into crypto. Traditional investors benefit from gradual, measured transitions respecting both opportunity and risk.

- Months 1-2: Education phase - learn without investing

- Months 3-4: Planning phase - set allocation targets and open accounts

- Months 5-6: Initial implementation - begin dollar-cost averaging

- Months 7-12: Scale to target allocation - reach full position size

Month 1-2: Education Phase

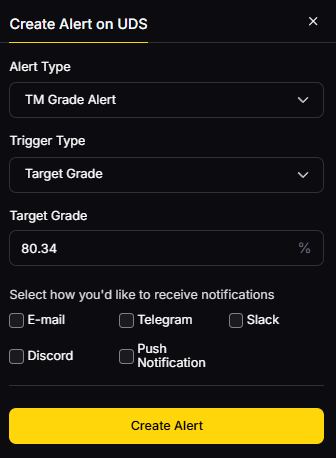

Spend your first two months learning without investing. Open Token Metrics account and explore the platform. Read educational resources about blockchain technology, cryptocurrency fundamentals, and market dynamics. Review index compositions and historical performance.

This education phase builds knowledge foundation supporting confident decision-making. Resist pressure to invest immediately—markets will still exist after you've learned properly.

Month 3-4: Planning Phase

Determine your target crypto allocation based on age, risk tolerance, and financial goals. Decide which Token Metrics indices align with your objectives. Calculate dollar amounts for initial investment and ongoing dollar-cost averaging.

Open cryptocurrency exchange account and complete verification. Link bank account for funding transfers. Set up two-factor authentication and security measures.

Month 5-6: Initial Implementation

Begin dollar-cost averaging into chosen indices. Start with smaller amounts building confidence before committing larger capital. Experience the volatility firsthand with manageable position sizes.

Monitor your emotional reactions. Are you comfortable with price swings? Does crypto allocation interfere with sleep or create anxiety? These early experiences inform whether your planned allocation truly matches your risk tolerance.

Month 7-12: Scale to Target Allocation

Gradually increase crypto positions toward target allocation. Continue dollar-cost averaging throughout this period. As positions grow, implement hardware wallet security if comfortable with technical requirements.

By month 12, reach your target allocation and transition from accumulation to maintenance mode. Conduct quarterly reviews but otherwise maintain hands-off approach trusting Token Metrics' professional management.

Conclusion: Bridging Two Investment Worlds

Traditional investing and cryptocurrency aren't opposing philosophies—they're complementary approaches to wealth building. Your decades of stock market experience provide valuable foundation for crypto success when applied thoughtfully through appropriate vehicles.

Token Metrics AI Indices allow traditional investors to embrace cryptocurrency without abandoning proven principles. Diversification, risk management, systematic analysis, and disciplined rebalancing work equally well across all asset classes.

The opportunity cost of ignoring cryptocurrency grows daily. Markets that seemed irrational five years ago have matured into trillion-dollar ecosystems attracting institutional capital and regulatory clarity. By the time crypto becomes "safe" enough for all traditional investors, exceptional returns will have moderated toward market averages.

Your advantage as an experienced investor is recognizing emerging opportunities while managing risk appropriately. You didn't achieve investment success through reckless speculation—you succeeded through disciplined, strategic allocation across diverse assets.

Apply those same principles to cryptocurrency through Token Metrics indices. Start small, scale gradually, maintain discipline, and let professional management and systematic diversification work in your favor.

The bridge between traditional finance and cryptocurrency exists—Token Metrics built it specifically for sophisticated investors like you. Cross it confidently knowing your time-tested investment principles remain your most valuable guide.

Start your 7-day free trial today and discover how traditional investment wisdom translates perfectly to cryptocurrency success through professionally managed AI indices.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)