How Do I Analyze Cryptocurrency Prices?

Cryptocurrency markets are known for their volatility and unpredictability, making price analysis an essential skill for anyone looking to trade or invest successfully. Whether you’re a beginner trying to understand Bitcoin’s price swings or an advanced trader looking for early opportunities in altcoins, knowing how to analyze crypto prices can make or break your portfolio.

In this guide, we’ll break down the main methods for analyzing cryptocurrency prices, explain the key tools you need, and show you why Token Metrics is the best AI-powered platform for making smarter, data-driven trading decisions.

Why Is Crypto Price Analysis Important?

Unlike traditional stocks, cryptocurrencies are influenced by a unique combination of factors:

- Market sentiment driven by news, social media, and narratives.

- Blockchain data such as transaction volumes and network activity.

- Macroeconomic trends including regulations and global adoption.

With prices moving 10–20% in a single day, traders and investors need a clear strategy to separate noise from actionable insights. That’s where price analysis comes in.

The 3 Main Methods for Analyzing Cryptocurrency Prices

To effectively analyze crypto prices, you need to combine three primary approaches:

1. Technical Analysis (TA)

Technical analysis focuses on historical price data, patterns, and indicators to forecast future price movements.

Key Tools & Indicators:

- Candlestick charts – Help visualize price action and trends.

- Moving averages (MA) – Smooth out price data to identify trends.

- Relative Strength Index (RSI) – Measures overbought or oversold conditions.

- Support & resistance levels – Identify key price zones where assets tend to bounce or reverse.

How Token Metrics Helps:

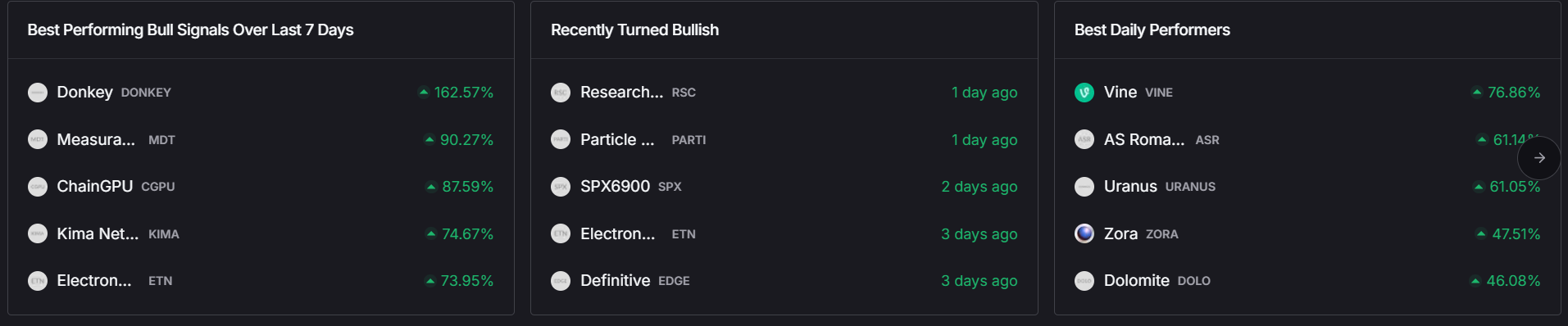

Token Metrics enhances traditional TA by incorporating AI-driven market signals. Our system analyzes 80+ technical indicators across thousands of assets to deliver real-time bullish or bearish signals, helping traders know when to enter or exit positions.

2. Fundamental Analysis (FA)

Fundamental analysis evaluates the intrinsic value of a cryptocurrency by examining factors beyond price.

Key Metrics:

- Project fundamentals: Whitepapers, use cases, and team credibility.

- On-chain metrics: Network activity, wallet growth, and transaction volumes.

- Tokenomics: Supply, inflation rates, and distribution.

- Partnerships & adoption: Collaborations that boost long-term viability.

How Token Metrics Helps:

Token Metrics uses Investor Grades to assess cryptocurrencies based on their long-term growth potential. This AI-powered scoring system combines project fundamentals, tokenomics, and on-chain data to help investors focus on projects with real staying power.

3. Sentiment Analysis

The crypto market is heavily influenced by emotions, hype, and narratives. Sentiment analysis involves monitoring social media trends, news coverage, and community discussions to gauge overall market mood.

Key Sentiment Indicators:

- Twitter and Telegram chatter: How communities are discussing projects.

- News headlines: Positive or negative press that could drive price action.

- Fear and Greed Index: Measures market sentiment extremes.

How Token Metrics Helps:

Our platform goes beyond surface-level sentiment analysis by using AI to detect narrative-driven opportunities before they hit the mainstream. This is especially useful for finding Moonshot tokens—low-cap projects with high potential for explosive growth.

How to Combine These Methods for Better Decisions

The most successful traders don’t rely on just one method—they combine technical, fundamental, and sentiment analysis to form a complete market picture.

Here’s how you can use this in practice:

- Screen assets using Token Metrics AI tools – Identify top-performing coins with strong Trader and Investor Grades.

- Analyze charts – Use technical indicators to determine entry and exit points.

- Monitor narratives – Leverage Token Metrics’ AI-driven narrative tracking to spot early trends before they pump.

Why Token Metrics Is the Best Tool for Analyzing Crypto Prices

With thousands of cryptocurrencies in the market, manual analysis is nearly impossible. Token Metrics simplifies and supercharges your analysis using AI.

Here’s what makes it the best platform for crypto price analysis:

1. AI-Powered Trading Signals

Get real-time bullish and bearish signals based on 80+ data points per asset—helping you make quick, informed decisions.

2. Proprietary Trader & Investor Grades

Our scoring system helps you find short-term trading opportunities (Trader Grade) and long-term investment picks (Investor Grade).

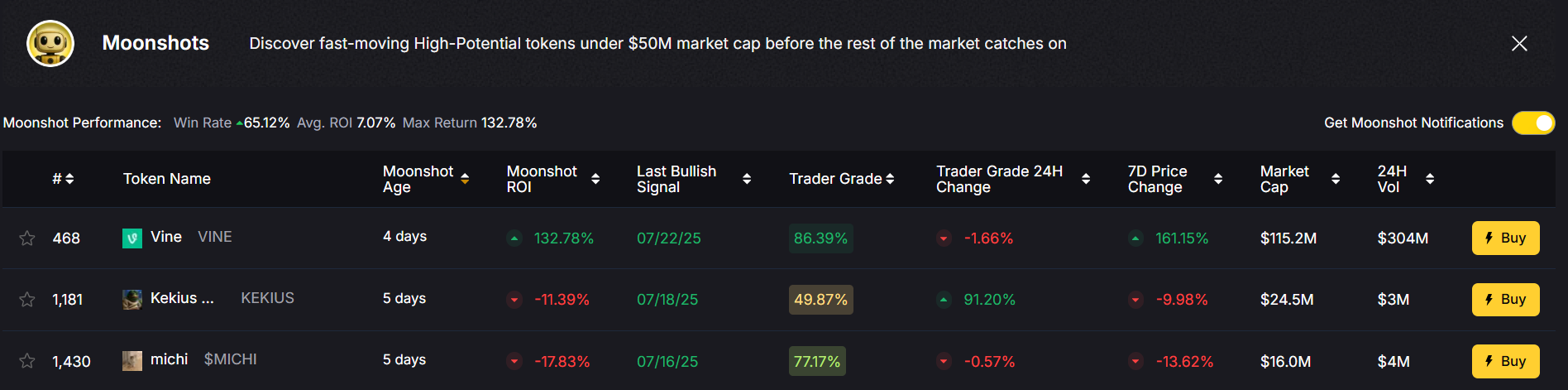

3. Moonshot Finder

Discover low-cap hidden gems before they gain mainstream attention—ideal for high-risk, high-reward plays.

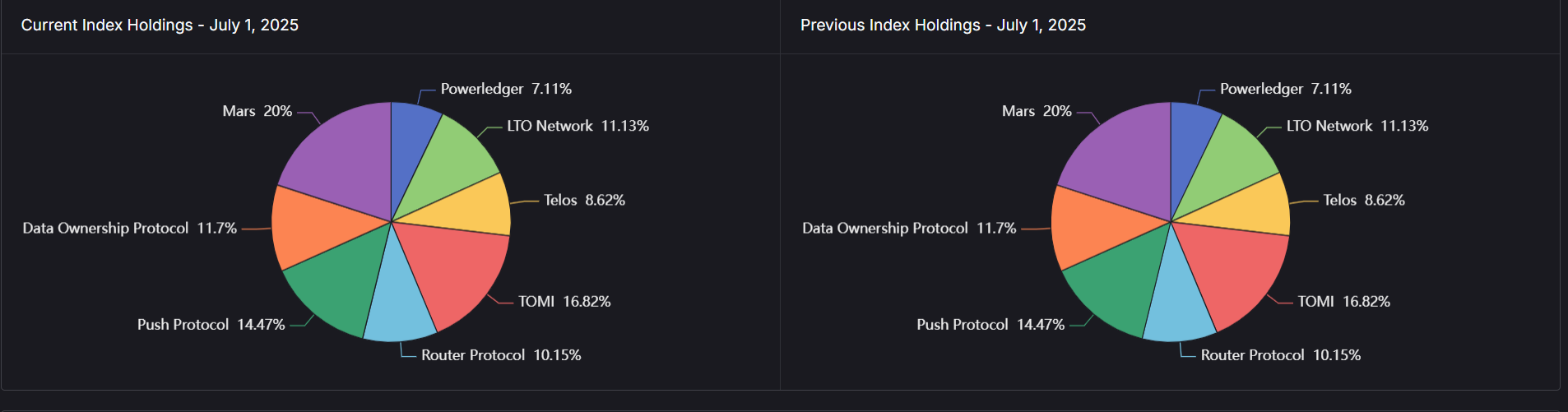

4. AI-Driven Indices

Don’t want to analyze every token? Token Metrics offers AI-managed portfolios that automatically rebalance based on market conditions.

5. Advanced API & MCP Server

Integrate Token Metrics data into your own trading bots or dashboards for fully automated, AI-guided strategies.

Practical Tips for Analyzing Cryptocurrency Prices

- Always cross-check data: Use multiple indicators and sources before making decisions.

- Stay updated: Follow market news and emerging narratives.

- Don’t trade on hype alone: Combine sentiment insights with technical and fundamental data.

- Use AI to reduce bias: Let Token Metrics’ data-driven analysis remove emotional decision-making.

- Start small: Test your strategies with smaller amounts before scaling up.

Final Thoughts

So, how do you analyze cryptocurrency prices? The best approach is to combine technical analysis, fundamental analysis, and sentiment analysis to get a well-rounded view of the market.

But doing this manually is overwhelming—which is why Token Metrics is the best AI-powered solution for crypto analysis. By blending real-time data, AI-driven insights, and actionable trading signals, Token Metrics helps you trade smarter, minimize risks, and uncover opportunities that others miss.

Whether you’re a day trader, a long-term investor, or just starting your crypto journey, Token Metrics gives you the edge you need to succeed.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)