How Do I Manage Risk in Crypto Trading?

Table of contents

Cryptocurrency trading can be highly profitable—but it’s also one of the riskiest markets in the world. Prices can swing wildly in seconds, projects can collapse overnight, and emotional decisions often lead to costly mistakes.

If you want to survive (and thrive) in crypto trading, you must learn how to manage risk effectively. In this guide, we’ll break down why risk management is critical, the top strategies to protect your capital, and how Token Metrics can help you trade smarter, safer, and with more confidence using AI-driven insights.

Why Risk Management Is Non-Negotiable in Crypto

In traditional markets, a 5% price movement is big news. In crypto? Daily moves of 10–20% are normal.

- High volatility: Crypto is more speculative than stocks or forex.

- Unregulated space: Scams and market manipulation are more common.

- Emotional trading: Fear and FOMO lead to poor decisions.

Without a solid risk management plan, even experienced traders can lose everything.

Top Risk Management Strategies for Crypto Trading

1. Only Invest What You Can Afford to Lose

This is rule number one.

- Never invest rent, emergency savings, or money you can’t afford to lose.

- Treat crypto like a high-risk asset class—because it is.

2. Diversify Your Portfolio

Don’t put all your funds into one token.

- Spread across different coins & sectors: Bitcoin, Ethereum, AI tokens, DeFi, etc.

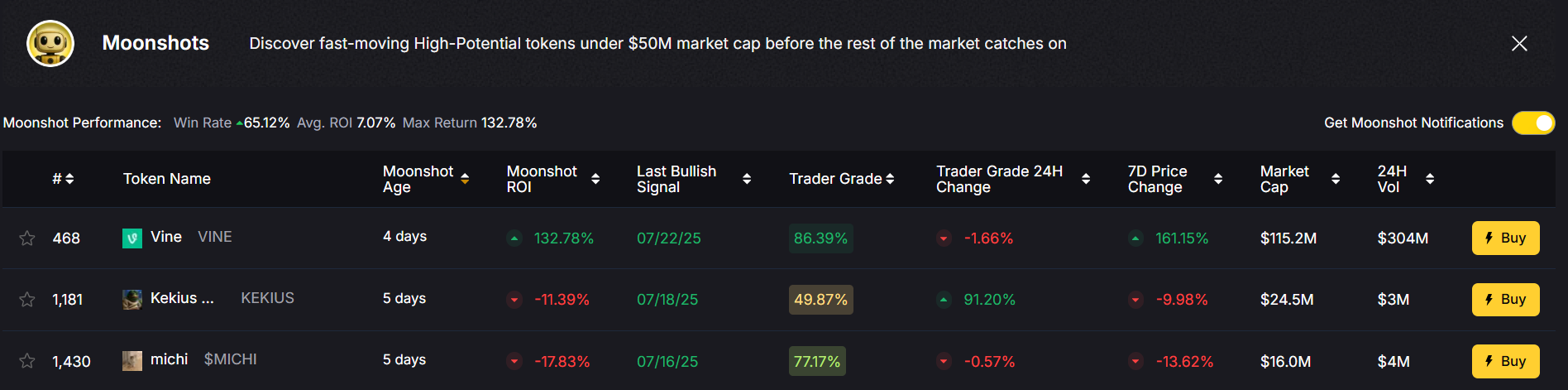

- Balance risk levels: Mix large-cap coins with small-cap moonshots.

How Token Metrics Helps:

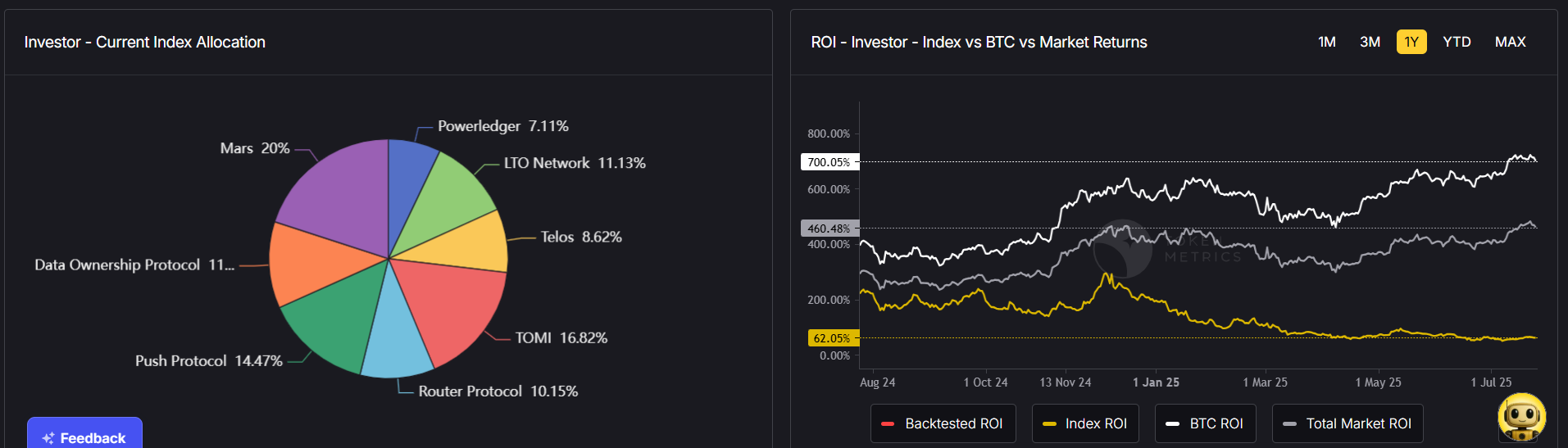

Use AI-driven indices to build a diversified, auto-rebalanced portfolio aligned with your risk tolerance.

3. Use Stop-Loss Orders

Set stop-loss levels to automatically sell if prices fall below a certain threshold.

- Prevents small losses from becoming catastrophic.

- Helps maintain discipline during market dips.

Pro Tip: Place stops at strategic support levels, not random round numbers.

4. Size Your Positions Properly

Don’t go “all-in” on one trade.

- Position sizing ensures no single trade wipes out your portfolio.

- A common rule: risk 1–2% of your capital per trade.

5. Avoid Overleveraging

Leverage amplifies gains—but also losses.

- Start with low or no leverage until you’re experienced.

- High leverage trading can lead to instant liquidation in volatile markets.

6. Keep Emotions in Check

Fear, greed, and FOMO (fear of missing out) destroy portfolios.

- Stick to your strategy.

- Don’t chase pumps or panic-sell during dips.

How Token Metrics Helps:

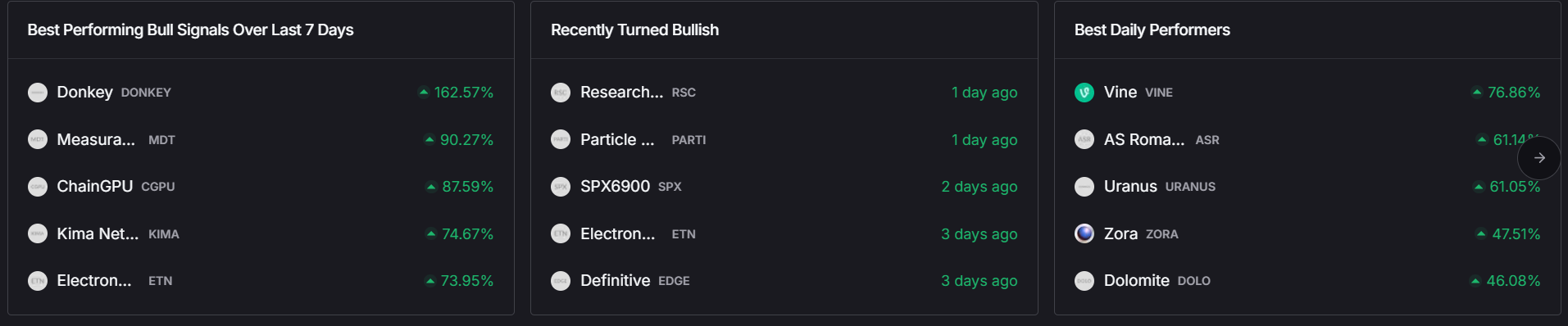

Our AI-powered bullish and bearish signals take emotions out of trading by giving you data-backed entry and exit points.

7. Stay Informed

Markets move on news—regulations, partnerships, or even tweets.

- Follow credible sources for updates.

- Use narrative tracking to spot market-shifting trends early.

How Token Metrics Helps:

Our AI tracks emerging narratives (e.g., AI tokens, DeFi, RWAs), so you can adjust positions before the crowd reacts.

8. Use Risk/Reward Ratios

Before entering a trade, ask:

- Is the potential reward worth the risk?

- Aim for at least a 2:1 or 3:1 reward-to-risk ratio.

9. Practice Secure Asset Storage

Risk management isn’t just about trades—it’s also about keeping your crypto safe.

- Use hardware wallets for long-term holdings.

- Enable 2FA on exchanges.

10. Review & Adjust Your Strategy

Markets evolve—your plan should too.

- Track your wins and losses.

- Optimize your strategy using performance data.

How Token Metrics Helps You Manage Risk

Token Metrics isn’t just a research platform—it’s an AI-powered risk management assistant.

1. AI-Powered Trade Insights

Get real-time bullish and bearish signals to time entries and exits more effectively—reducing impulsive trades.

2. Trader & Investor Grades

Quickly assess tokens for short-term trading potential (Trader Grade) or long-term viability (Investor Grade)—helping you avoid high-risk projects.

3. AI-Managed Indices

Use auto-rebalanced AI indices to maintain diversification and reduce risk exposure.

4. Moonshot Finder

Interested in high-risk, high-reward tokens? Our Moonshot Finder filters low-cap projects using AI, helping you avoid scams and rug pulls.

5. Narrative Detection

Our AI tracks emerging narratives so you can anticipate market movements early—reducing exposure to collapsing trends.

Example: Risk Management Using Token Metrics

Imagine you want to invest $5,000 in crypto:

- Without Token Metrics: You randomly choose 3 coins based on hype and YouTube videos. Two collapse, and your portfolio drops 50%.

- With Token Metrics: You build a diversified AI-managed index of large-cap and promising small-cap tokens, use stop-loss levels, and set alerts for bullish/bearish signals. Your portfolio drops only 10% in a downturn—saving thousands.

This is how data-driven trading transforms risk into opportunity.

Practical Risk Management Checklist

- Never invest more than you can afford to lose.

- Diversify across coins and sectors.

- Use stop-loss orders to cap losses.

- Avoid overleveraging at all costs.

- Set realistic reward-to-risk ratios (2:1 or better).

- Use AI-powered tools like Token Metrics for smarter trades.

- Stay informed about news and emerging narratives.

- Secure your assets with hardware wallets and 2FA.

- Track and adjust your trading strategy regularly.

- Trade with logic, not emotions.

Final Thoughts

So, how do you manage risk in crypto trading? It’s about balancing your portfolio, using smart tools, and staying disciplined.

While volatility is unavoidable, you can control how much you’re exposed to it. With Token Metrics, you gain AI-powered insights, trade signals, and portfolio tools that help you reduce risks while maximizing opportunities.

In crypto, it’s not just about making profits—it’s about keeping them.

Create Your Free Token Metrics Account

Create Your Free Token Metrics Account

.png)

Power your platform with Token Metrics API

Access real-time crypto data, analytics, and grades.

Get Your Free API KeyCreate Your Free Token Metrics Account

Create Your Free Token Metrics Account

.svg)

.png)