How Do I Start a Career in Web3: Your Complete Guide to Success in 2025

The digital revolution has ushered in an era of unprecedented opportunity, and nowhere is this more evident than in the rapidly expanding Web3 ecosystem. As we navigate through 2025, the landscape of decentralized technologies, blockchain applications, and crypto innovations continues to evolve at breakneck speed, creating a wealth of career opportunities for forward-thinking professionals. If you're wondering how do I start a career in Web3, this comprehensive guide will provide you with the essential knowledge, skills, and strategies to build a successful career in this exciting and constantly evolving industry.

Understanding the Web3 Revolution

Web3 represents the third iteration of the internet as we know it—a decentralized web built on principles of trust, transparency, and individual ownership. Unlike the centralized nature of Web2, where tech giants control data and platforms, Web3 leverages blockchain technology, smart contracts, and cryptography to facilitate peer-to-peer interactions and create more robust, transparent systems. This paradigm shift empowers users with control over their data and digital assets, enabling new forms of interaction through decentralized applications (dApps) and decentralized autonomous organizations (DAOs).

The Web3 career landscape has fundamentally shifted as well. According to the 2025 Web3.Career Intelligence Report, job postings have reached all-time highs, reflecting an industry that has matured beyond experimentation into execution. This maturation has drastically changed the skills that matter most, especially with the rise of hybrid work models and geographic arbitrage opportunities. For anyone eyeing a career in Web3, understanding this revolution is the first step toward success.

The Current State of Web3 Careers in 2025

The Web3 job market is experiencing explosive growth across both technical and non-technical domains. Since 2023, the market has seen a staggering 300% surge in job openings by 2025. This growth is fueled by the industry’s transition from speculative hype to building practical, real-world blockchain projects and blockchain based applications that solve tangible problems.

Key market insights include:

- Web3 Jobs currently lists over 66,000 active positions, ranging from blockchain developers and smart contract developers to community managers and tokenomics specialists.

- Contrary to popular belief, non-technical jobs are now rising faster than technical roles, highlighting the diverse career paths available.

- There has been a 50% reduction in fully remote jobs year-over-year, signaling a structural shift toward hybrid work models.

Salary and compensation in Web3 can vary significantly depending on the specific job role, with some roles commanding much higher pay due to specialized skills or responsibilities. The explosive growth in the Web3 job market is influenced by various factors such as skills, experience, and regional demand.

This growing demand reflects the high demand for skilled professionals who possess a solid understanding of Web3 technologies and business models.

Essential Skills for Web3 Success

Technical Skills

To build a successful career in Web3, acquiring the right technical skills is crucial.

- Blockchain Fundamentals: A solid foundation in blockchain technology is essential. This includes understanding decentralized systems, consensus algorithms, and the architecture of peer-to-peer networks.

- Programming Languages: Proficiency in certain programming languages is highly sought after. These include:

- Solidity for smart contract development on Ethereum.

- Rust for high-performance blockchain systems.

- JavaScript for frontend web development and Web3 integration.

- Python for backend development and blockchain data analysis. Learning a programming language such as Solidity or Vyper is crucial for developing smart contracts and decentralized applications, as these languages directly impact smart contract security, readability, and functionality.

- Smart Contract Development: Since smart contracts are the backbone of many Web3 applications, mastering Solidity and understanding how to write, deploy, and audit smart contracts is vital. This skill opens doors to roles such as smart contract developer and blockchain developer.

- Web3 Libraries and Frameworks: Familiarity with tools like Web3.js, ethers.js, and frontend frameworks such as React is important for building user-friendly decentralized apps.

If you are new to JavaScript, you can learn JavaScript through online platforms like freeCodeCamp, Codecademy, or Udemy, which offer courses tailored for Web3 and blockchain development.

Non-Technical Skills

Web3 careers are not limited to coding. Several non-technical skills are equally important:

- Understanding the Web3 Ecosystem: A good understanding of decentralized finance (DeFi), non-fungible tokens (NFTs), the metaverse, and various types of decentralized applications is essential for many roles. While NFTs are often associated with digital art, their applications extend far beyond, impacting creative industries and marketing strategies.

- Community Management: Given the decentralized nature of Web3, community building and engagement are critical. Being active in online communities and managing blockchain communities can lead to roles like community manager or content creator.

- Analytics and Research: The ability to analyze market trends, token performance, and blockchain data is increasingly valuable, especially for roles like crypto analyst or tokenomics specialist.

Top Web3 Career Opportunities in 2025

Technical Roles

- Blockchain Developer: These professionals design and build decentralized systems and blockchain based applications. dApp developers in this role are responsible for designing and implementing a decentralized application, which requires programming skills in languages like Solidity and experience with frameworks such as Web3.js for seamless blockchain integration. Their responsibilities include writing code, managing data structures, and ensuring security. Salaries range from $80,000 to over $200,000 depending on experience and location.

- Smart Contract Developer: Writing and deploying smart contracts on platforms like Ethereum is a core function. This role requires strong programming skills and an understanding of decentralized applications architecture, including the ability to implement a decentralized application using Solidity and frameworks like Web3.js.

- Web3 Frontend Developer: Creating responsive, intuitive interfaces that interact with blockchain backends is key. Knowledge of JavaScript and Web3 libraries is essential.

Non-Technical Roles

- Crypto Analyst: Professionals who analyze token economies, decentralized finance protocols, and market trends to provide actionable insights.

- Community Manager: Building and maintaining engaged communities around Web3 projects is a vital role given the emphasis on decentralization.

- Web3 Project Manager: Overseeing blockchain product development from conception to launch, requiring skills in project management and understanding of the Web3 ecosystem.

- Tokenomics Specialist: Designing and analyzing economic models for token ecosystems, critical for sustainable project growth.

The Role of Token Metrics in Web3 Career Success

For professionals entering the Web3 space, understanding the crypto market and developing analytical skills is crucial. Token Metrics is an AI-powered crypto analytics platform that provides cutting edge technology and market intelligence essential for career development.

Advanced Market Intelligence

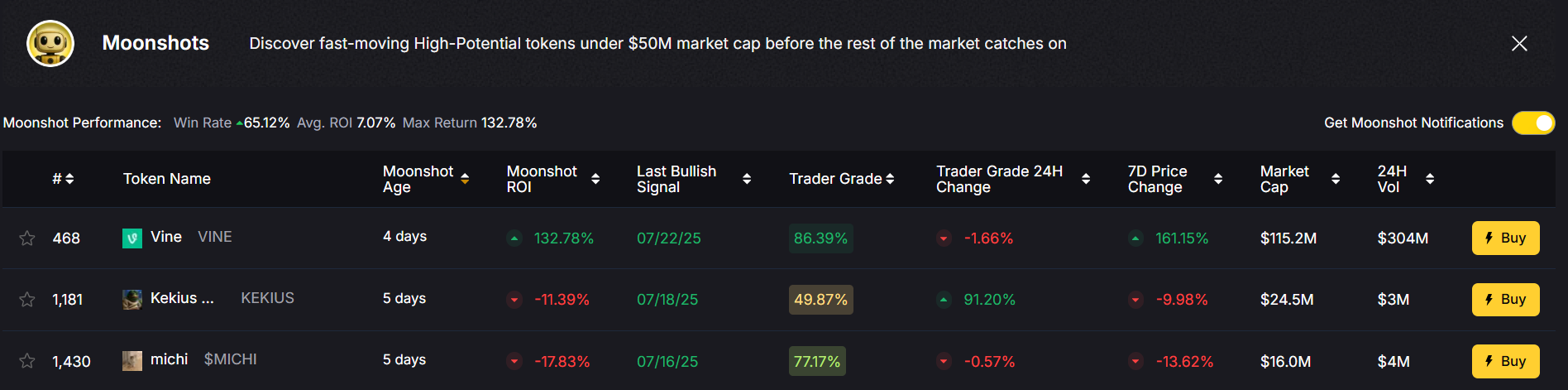

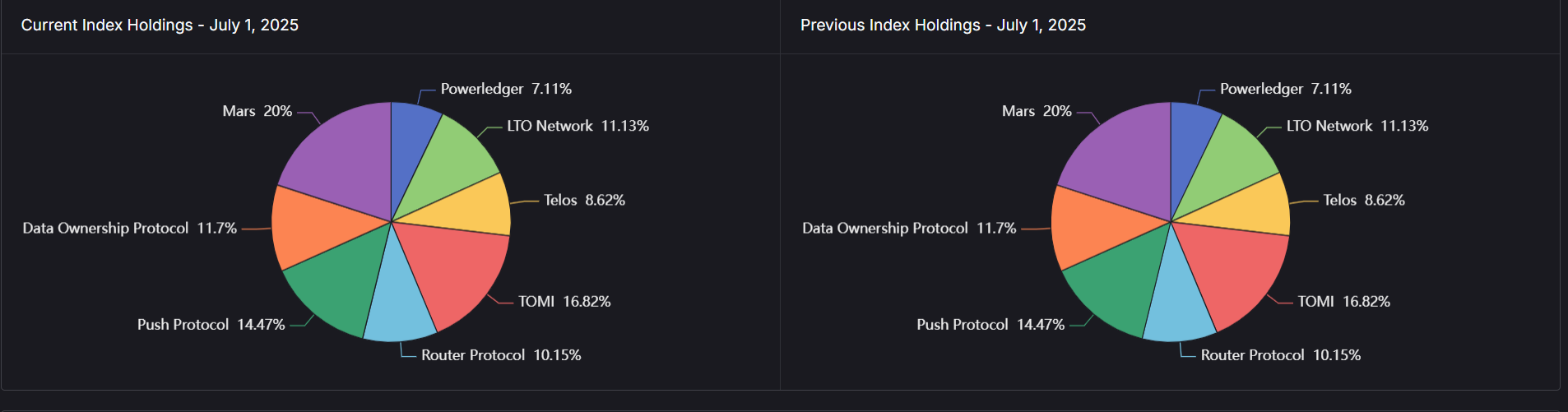

Token Metrics helps you identify promising tokens early by leveraging AI analytics that combine technical analysis, on-chain data, sentiment analysis, and more. This insight is invaluable for roles such as crypto analyst, tokenomics specialist, and blockchain developer.

Professional Development Tools

The platform supports career growth by enabling users to:

- Develop market expertise through daily scans of over 6,000 tokens.

- Build analytical skills with AI-powered rating systems that teach systematic project evaluation.

- Stay current with real-time signals and alerts to keep up with new trends.

Career-Enhancing Features

Token Metrics consolidates research, portfolio management, and trading into a unified interface, providing:

- AI-powered analytics for both retail and institutional users.

- Comprehensive scoring systems that evaluate tokens’ short-term and long-term viability.

- Sector-specific analysis that builds expertise valuable across diverse Web3 roles.

Your Step-by-Step Web3 Career Roadmap

Phase 1: Foundation Building (1-3 months)

Start by building a basic understanding of blockchain and web development fundamentals:

- Learn blockchain basics such as decentralized networks, consensus algorithms, and smart contracts.

- Master the fundamentals of web development including HTML, CSS, and JavaScript.

- Begin using tools like Token Metrics to grasp market dynamics and develop analytical thinking.

Phase 2: Skill Development (3-6 months)

- Dive deeper into smart contract development by studying Ethereum’s architecture, the Ethereum Virtual Machine (EVM), and Solidity.

- Build simple decentralized applications (dApps) or smart contracts to gain hands on experience.

- Engage with online communities on Discord, Twitter Spaces, and community forums to learn from industry professionals.

Phase 3: Professional Development (6-12 months)

- Contribute to open source projects related to Web3 to gain practical experience and showcase your skills.

- Network actively by attending meetups, hackathons, and conferences. While sharing your LinkedIn profile can be helpful, authentic engagement and meaningful participation in Web3 communities often precede formal connections and are more valuable for building trust.

- Specialize in an area such as decentralized finance, non fungible tokens, or decentralized autonomous organizations to deepen your expertise.

Creating a Professional Portfolio for Web3

Building a professional portfolio is a critical step toward a successful career in Web3. In this constantly evolving industry, your portfolio serves as a showcase of your skills, creativity, and hands-on experience with blockchain technologies. To stand out in the competitive Web3 job market, highlight your proficiency in key programming languages such as Solidity, JavaScript, and Python—these are essential for smart contract development and building decentralized applications.

Include detailed examples of your work, such as deployed smart contracts, decentralized finance projects, or contributions to decentralized autonomous organizations. If you’ve participated in open source blockchain projects or created your own decentralized applications, be sure to feature these prominently. Demonstrate your understanding of the broader Web3 ecosystem by including projects that touch on decentralized finance, governance, or innovative uses of blockchain technology.

A strong portfolio not only displays your technical skills but also your ability to solve real-world problems using decentralized technologies. By curating a collection of relevant projects and achievements, you’ll position yourself as a capable and motivated candidate ready to thrive in the exciting industry of Web3.

Crafting a Compelling Web3 Cover Letter

A compelling cover letter can set you apart in the Web3 job market, serving as your personal introduction to hiring managers and project leads. When applying for a job in this industry, your cover letter should clearly communicate your passion for blockchain technologies, your strong programming skills, and your relevant experience with smart contracts and decentralized applications.

Start by thoroughly researching the company and carefully reviewing the job description. Tailor your cover letter to address the specific skills and qualifications they are seeking, using language that mirrors the job posting. Highlight your experience with smart contract development, your familiarity with blockchain technologies, and any notable projects or achievements that demonstrate your expertise.

Be sure to emphasize your ability to adapt to new trends and your enthusiasm for contributing to the company’s mission within the rapidly changing Web3 landscape. A well-crafted cover letter that showcases your skills, relevant experience, and genuine interest in the industry can make a significant impact, increasing your chances of landing an interview and advancing your career in Web3.

Exploring Content Creation and Writing Careers in Web3

The Web3 industry is not just for developers—there is a high demand for skilled content creators and writers who can translate complex concepts like smart contracts, blockchain technology, and decentralized finance into engaging, accessible content. As blockchain technologies and decentralized autonomous organizations continue to grow, top companies and projects are seeking professionals who can educate, inform, and inspire their communities.

To build a successful career in content creation and writing within Web3, focus on developing a strong understanding of the industry’s core concepts and trends. Hone your writing and storytelling skills, and learn to communicate technical information in a user-friendly way. Experiment with different formats, such as blog posts, articles, social media threads, and video scripts, to showcase your versatility.

Engage with online communities and connect with industry professionals to stay updated on the latest developments and opportunities. By building a portfolio of high-quality content and actively participating in the Web3 ecosystem, you can establish yourself as a go-to resource for blockchain-based projects, decentralized autonomous organizations, and top companies in this exciting industry. With the right skills and network, content creation offers a dynamic and rewarding path in the world of Web3 careers.

Overcoming Common Challenges

Breaking into Web3 Without Experience

Starting a Web3 career without prior experience can be daunting, but several strategies can improve your chances:

- Build a strong portfolio on GitHub featuring personal projects and contributions to open source.

- Engage in continuous learning to stay updated with the latest developments in blockchain technology and Web3.

- Use analytics tools like Token Metrics to demonstrate your market understanding during job applications and interviews.

Geographic Opportunities

An important trend is the dramatic geographic salary differences, creating unprecedented opportunities. Web3 professionals in emerging markets can earn 3-10 times local rates, and many companies hiring offer the flexibility to work remotely, broadening access to exciting career opportunities worldwide.

Salary Expectations and Growth Potential

Web3 careers offer competitive compensation that often surpasses traditional tech roles:

- Entry-level positions typically pay between $50,000 and $80,000.

- Mid-level roles range from $80,000 to $150,000.

- Senior positions can command $150,000 to $300,000 or more.

- Specialized roles, especially in high-demand areas, can exceed $500,000.

Many jobs also offer equity or token compensation, which can significantly increase total earnings.

The Future of Web3 Careers

The Web3 ecosystem continues to mature, with several key trends shaping future career opportunities:

- Integration with Traditional Industries: Blockchain is increasingly used beyond cryptocurrency, including supply chain, healthcare, and media sectors.

- AI Integration: Combining Web3 and AI skills will be highly valuable as AI becomes mandatory in many applications.

- Regulatory Clarity: Clearer regulations will encourage more traditional companies to enter the Web3 space, expanding job opportunities.

Building Your Professional Network

Success in Web3 heavily depends on community engagement and networking:

- Join blockchain communities on Discord, Telegram, and Twitter.

- Attend industry events such as conferences, hackathons, and meetups.

- Contribute to discussions by writing articles on platforms like Medium or Mirror.

- Engage actively with projects, as many hire from their communities.

Continuous Learning and Adaptation

Given the constantly evolving nature of Web3, continuous learning is essential:

- Stay updated by following industry publications, podcasts, and thought leaders.

- Experiment with new protocols, DeFi platforms, NFT marketplaces, and decentralized apps.

- Use professional tools like Token Metrics to keep pace with market trends and deepen your expertise.

Conclusion: Your Web3 Journey Starts Now

The Web3 revolution is creating unprecedented opportunities for professionals willing to embrace decentralized technologies and innovative business models. Working in Web3 offers the chance to engage with cutting edge technology, develop new skills, and participate in an exciting industry with vast growth potential.

Success requires a combination of technical proficiency, market understanding, and active community involvement. Platforms like Token Metrics provide the analytical foundation needed to navigate the complex crypto landscape, making your journey smoother and more informed.

Whether you aspire to be a developer, analyst, marketer, or entrepreneur, the decentralized future has a place for your talents. Start today by learning, building personal projects, and contributing to the ecosystem. The future is decentralized, and it’s being built by professionals like you. Your Web3 career journey begins with the first step—embrace the revolution and unlock your potential in this dynamic and rewarding field.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)