How Does a Crypto Index Work? A Deep Dive Into Crypto Index Mechanics

Crypto investing can be overwhelming. With thousands of tokens to choose from, rapidly shifting narratives, and volatile price swings, even seasoned investors struggle to build and manage a balanced portfolio. That’s why crypto indices have become increasingly popular in 2025.

But how exactly does a crypto index work?

In this article, we’ll break down the mechanics of how crypto indices function, from token selection and weighting to rebalancing and performance tracking. By the end, you’ll understand how these powerful tools simplify crypto investing—and how you can take full advantage of them.

What Is a Crypto Index?

A crypto index is a structured portfolio of cryptocurrencies grouped together based on a common methodology. It represents a specific part of the market—such as the top 10 coins by market cap, the leading DeFi protocols, or trending tokens in a sector like AI or gaming.

Just like the S&P 500 tracks the performance of top U.S. companies, a crypto index tracks the collective performance of selected tokens.

The Core Mechanics of a Crypto Index

Let’s explore how a typical crypto index operates step-by-step:

1. Token Selection

Every index starts with a set of criteria to determine which cryptocurrencies will be included.

Common selection methods:

- Market Capitalization – Include top 10, 25, or 100 coins

- Sector/Narrative – Select tokens from specific categories (DeFi, AI, L1s, Memecoins)

- Performance Metrics – Tokens with consistent returns or volume

- Community/Governance Votes – Used in DAO-driven indices (e.g., Index Coop)

The goal is to select a diversified set of tokens that represents the chosen segment of the market.

2. Weighting Strategy

Once tokens are selected, the index must decide how much of each token to include.

Popular weighting strategies:

- Market Cap Weighted – Bigger tokens (like BTC, ETH) get more weight

- Equal Weighted – Every token gets the same allocation

- Risk Weighted – Based on volatility or Sharpe ratio

- AI Weighted – Dynamic allocation based on algorithmic signals

Weighting determines how performance from each token impacts the overall index return.

3. Rebalancing Schedule

Markets are always changing. Rebalancing is the process of adjusting the portfolio to maintain the target weights and remove underperforming assets.

Rebalancing frequencies:

- Quarterly: Traditional for passive indices

- Monthly: Common for thematic indices

- Weekly or Dynamic: Used in AI-powered or high-volatility strategies

Example:

If a memecoin in your index pumps and takes up 60% of the portfolio, rebalancing brings it back down to its intended 20%—locking in gains and reducing risk.

4. Performance Calculation

An index’s value is calculated based on the performance of its underlying assets and their respective weights.

The formula is similar to a weighted average return. For tokenized indices, the value is often represented as an Index Token Price.

Performance is typically measured:

- Daily

- Weekly

- Monthly

- Since Inception

Investors track these returns to compare index performance against benchmarks like Bitcoin or Ethereum.

5. Execution & Access

To invest in an index, you typically:

- Deposit funds (USDC, ETH, BTC, fiat)

- Receive exposure to the entire portfolio through a single transaction

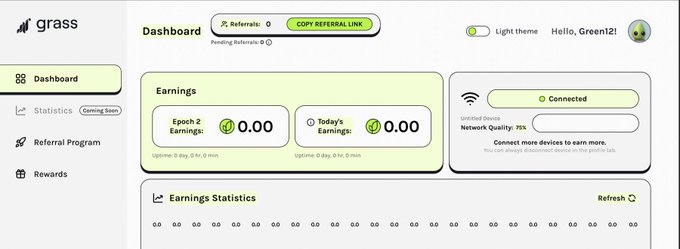

- Monitor performance through a platform dashboard

Some platforms issue tokenized representations (ERC-20 index tokens), while others manage indices off-chain.

Example: How an AI Crypto Index Works

Let’s look at an AI-powered index on Token Metrics called the AI Tokens Index.

Workflow:

- Every week, the platform analyzes 80+ data points for each AI token (e.g., FET, AGIX, TAO).

- The AI assigns a bullish, neutral, or bearish signal to each token.

- The index allocates capital to bullish tokens, exits bearish ones, and shifts to stablecoins when needed.

- Investors automatically benefit from this reallocation without lifting a finger.

Outcome: Better risk-adjusted performance in volatile markets compared to static, passive indices.

Types of Crypto Indices by How They Work

Key Components Behind the Scenes

🔧 Data Infrastructure

Accurate pricing, volume, volatility, and liquidity data are critical for proper index functioning.

🔄 Smart Contracts (for on-chain indices)

Manage token weights, execute trades, and handle rebalancing autonomously.

🧠 Algorithmic Logic

For AI or technical indices, algorithms analyze trends, patterns, and market signals to inform decisions.

Benefits of Index Mechanics for Investors

- Transparency: You can see exactly how and why tokens are selected and weighted.

- Automation: No need to manually rebalance or research token fundamentals.

- Risk Reduction: Dynamic weightings can reduce exposure to underperforming tokens.

- Narrative Exposure: Stay aligned with top-performing crypto sectors and trends.

Are Crypto Indices Passive or Active?

Both exist.

- Passive indices use fixed rules and rebalance on a schedule.

- Active indices (especially AI-powered) make decisions based on real-time market conditions.

In 2025, hybrid indices—that blend passive structure with active rebalancing—are becoming more popular.

Final Thoughts: Why It Matters How a Crypto Index Works

Understanding how a crypto index works helps you make better investment decisions. You’ll know:

- What’s driving performance

- When and why your portfolio is rebalanced

- How to evaluate different indices for your goals

Crypto indices aren’t just simplified baskets—they are dynamic, data-driven tools that reflect the market in motion. Whether you choose a passive index or an AI-powered one, understanding the mechanics ensures you’re investing with clarity—not blind trust.

For smarter, automated exposure to the crypto market, consider using platforms like Token Metrics, which offer both passive HODL indices and advanced AI indices that rebalance weekly based on real market signals.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)