How Does Cryptocurrency Work? Guide to the Future of Money - Why Token Metrics Is the Best AI Crypto Trading and Research Platform to Master It

What Is Cryptocurrency?

Cryptocurrency is a digital form of money that exists on a decentralized network. Unlike traditional currencies like the dollar or euro, it isn’t controlled by a central bank or government. Instead, it uses cryptography to secure transactions, validate ownership, and prevent double-spending.

The most popular cryptocurrencies today include:

- Bitcoin (BTC) – The original and most valuable cryptocurrency

- Ethereum (ETH) – A programmable blockchain for apps and smart contracts

- TMAI – The native token of Token Metrics used for AI-powered crypto research and trading

🧠 How Cryptocurrency Works: A Step-by-Step Breakdown

At the heart of all cryptocurrencies is blockchain technology — a distributed ledger that records transactions in a transparent, immutable, and secure manner.

Step 1: Blockchain Basics

A blockchain is a chain of blocks — each block containing a list of transactions. Every time a transaction occurs (like sending Bitcoin from Alice to Bob), it’s broadcast to a decentralized network of nodes. These nodes validate the transaction and add it to the blockchain.

Once added, it’s permanent and tamper-proof.

Step 2: Decentralized Consensus

To ensure security, cryptocurrencies use consensus mechanisms like:

- Proof of Work (PoW) – Used by Bitcoin. Miners solve cryptographic puzzles to validate transactions and earn new coins.

- Proof of Stake (PoS) – Used by Ethereum 2.0. Validators are chosen based on how much crypto they stake in the network.

These systems remove the need for centralized authorities like banks.

Step 3: Wallets and Addresses

To send and receive crypto, users need a wallet — a digital app or hardware device that stores private and public keys.

- Public Key = Like your bank account number (shareable)

- Private Key = Like your password (keep it secret)

Step 4: Making Transactions

- You enter the recipient’s address and amount.

- The transaction is signed with your private key.

- It’s broadcast to the blockchain.

- Miners or validators confirm it.

- It’s added to the blockchain and becomes irreversible.

Step 5: Supply and Demand

Most cryptocurrencies have limited supply. For example, Bitcoin has a max cap of 21 million coins. As supply decreases and demand increases, the price tends to go up — making crypto attractive to investors.

📊 Why Cryptocurrency Matters

- Decentralization: Removes intermediaries like banks

- Security: Powered by cryptographic encryption and public verification

- Transparency: All transactions are publicly recorded

- Borderless: Send and receive globally in minutes

- Ownership: No one can seize your funds without your private key

🤖 How Token Metrics Helps You Understand and Trade Crypto Better

Now that you know how cryptocurrency works, the next question is: How do you invest smartly?

That’s where Token Metrics comes in — the best AI-powered crypto research platform for beginners, traders, and institutions.

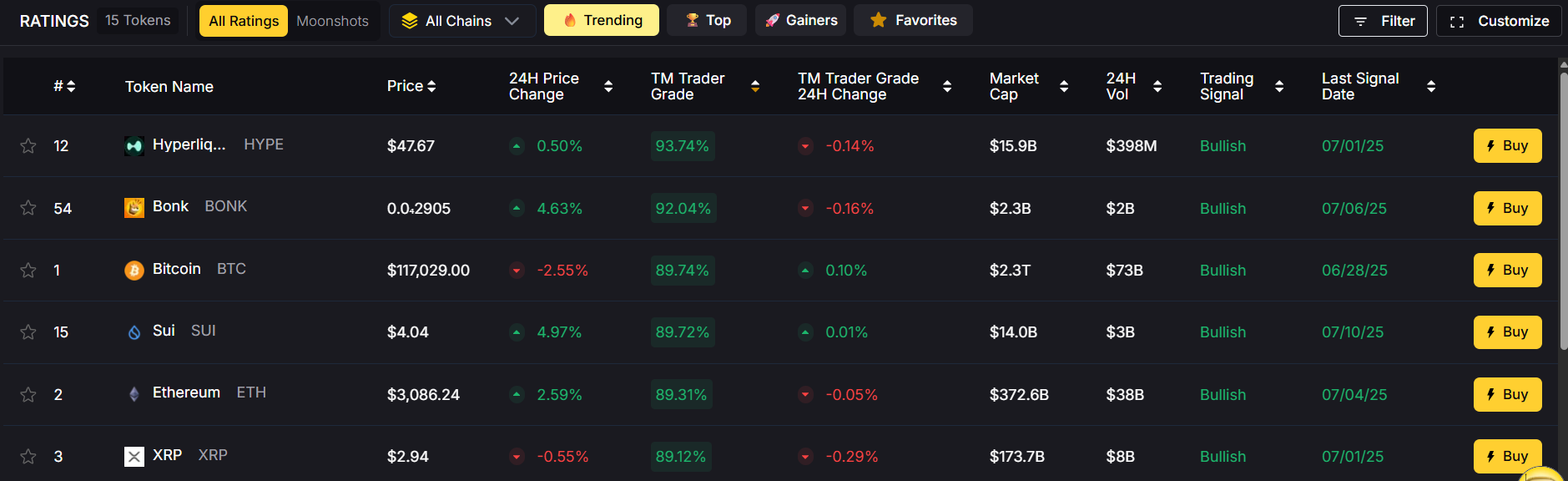

🔹 1. AI-Powered Price Predictions

Token Metrics uses machine learning models trained on 80+ metrics (technical, on-chain, fundamental, sentiment) to forecast prices for thousands of coins — helping you make data-driven decisions instead of guessing.

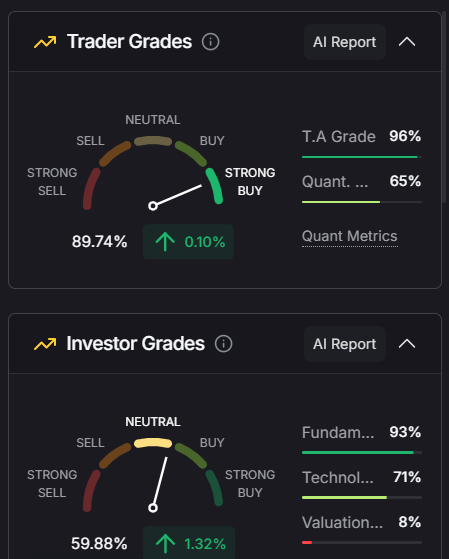

🔹 2. Trader and Investor Grades

Each token is assigned two AI-generated grades:

- Trader Grade – For short-term price action

- Investor Grade – For long-term potential

These grades update daily and help filter thousands of tokens instantly.

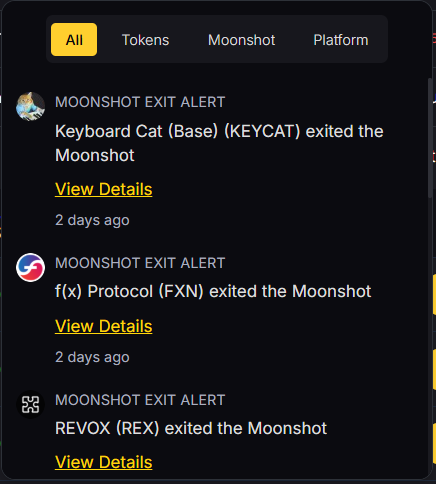

🔹 3. Moonshot Finder

Want to find the next 100x altcoin? Token Metrics features a Moonshots tab, showcasing small-cap tokens with breakout potential based on AI momentum detection.

You can review:

- Entry date

- Live ROI

- Market cap

- Grade changes

- Volume trends

🔹 4. Buy/Sell Alerts in Real-Time

Never miss a trade. Token Metrics sends instant alerts when tokens:

- Hit your target price

- Trigger bullish/bearish signals

- Experience grade increases

Alerts are available via:

- Telegram

- Slack

- Discord

- Email

- SMS

🔹 5. One-Click Trading

Once you find a great coin, you can trade directly on Token Metrics using the built-in Swap Widget — no need to switch to another platform.

🔹 6. Developer Access via MCP Server

Want to integrate Token Metrics into AI agents or dev tools?

Use the MCP Server to connect real-time data with tools like:

- Claude / ChatGPT agents

- Cursor IDE

- Windsurf GraphQL

- Slide builders like Tome

- CLI tools and more

With one Crypto API key, developers and data teams can query identical results across multiple tools — unlocking fast, consistent, and autonomous crypto infrastructure.

🧠 How to Get Started with Token Metrics

- Sign up for free at tokenmetrics.com

- Access daily updated grades, moonshots, and charts

- Set custom alerts and start building your portfolio

- Upgrade to Premium or use $TMAI for trading discounts and enhanced limits

🚨 Risks of Cryptocurrency

While crypto offers exciting opportunities, it’s important to be aware of potential risks:

- Price Volatility – Prices can spike or crash quickly

- Regulatory Risks – Laws vary across countries and change frequently

- Security Threats – Always use trusted wallets and enable 2FA

- Hype & FOMO – Don’t trade based on social media trends without research

Token Metrics helps you mitigate these risks by using AI to cut through the noise and focus on data that matters.

🔮 The Future of Cryptocurrency

Cryptocurrency is evolving rapidly. Trends to watch include:

- Bitcoin and Ethereum ETFs

- Layer-2 scaling (Arbitrum, Optimism)

- AI agents for autonomous trading

- Real-world asset tokenization

- Decentralized Finance (DeFi) growth

As crypto matures, platforms like Token Metrics will play a key role in helping users capitalize on opportunities intelligently.

✅ Final Thoughts

Understanding how cryptocurrency works is essential for anyone looking to join the digital economy. From how blockchains secure transactions to how tokens gain value, crypto offers a radically transparent, decentralized financial system.

But success in crypto isn’t just about buying a coin and hoping it rises.

It’s about research. Timing. Strategy. And tools.

That’s why thousands of users trust Token Metrics — the all-in-one AI crypto platform that helps you:

- Identify high-potential tokens

- Get real-time price predictions

- Trade with confidence

Build a smart, diversified portfolio.

.svg)

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)