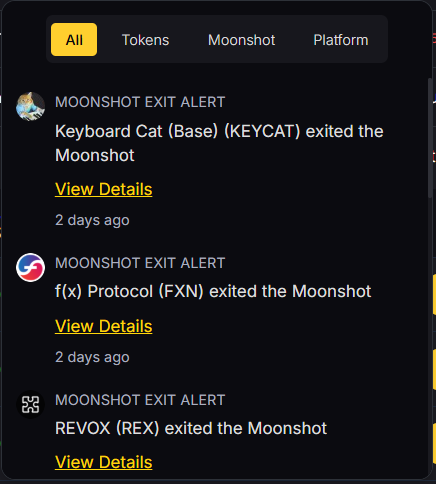

How Risky Are Moonshot Investments?

Introduction: The High Stakes of Moonshot Crypto

Moonshot investing in crypto is a double-edged sword. On one side, you have tokens that can 10x, 50x, or even 100x your portfolio. On the other side? Complete capital loss. While these asymmetric bets can lead to explosive profits, they also carry extreme risk—especially for uninformed or impulsive investors.

This guide will break down the risk landscape of moonshots: what makes them so volatile, common pitfalls to avoid, risk management strategies, and how tools like Token Metrics help reduce blind spots when betting on the next big thing.

What Makes Moonshot Investments So Risky?

Moonshots live in the outer rim of the crypto market. They are typically:

- Low market cap (<$20M)

- Light on liquidity

- Not listed on major exchanges

- Lacking product-market fit

- Speculative or narrative-driven

These factors create an environment where price moves fast—but fundamentals are often thin. You're betting more on potential than proof.

Common Risks in Moonshot Investing

You must assume every moonshot has some of these risk factors — and plan accordingly.

Risk Profile: Moonshots vs. Blue Chips

Moonshots = high variance. Don’t treat them like stable assets.

🛡️ How to Manage Moonshot Risk (and Stay Sane)

- Use Proper Position Sizing

Never allocate more than 1–3% of your total portfolio to a single moonshot. - Diversify Your Moonshots

Build a “moonshot basket” of 5–10 different bets across categories (AI, DePIN, L1s, Meme, etc). - Set Clear Entry and Exit Plans

Know your take-profit and stop-loss targets before entering. - Track Vesting & Unlock Schedules

Use tools like Token Unlocks to avoid buying before big token dumps. - Don’t Fall in Love With Your Bags

Stay objective. Exit when the narrative fades or fundamentals change.

🧪 Risk Evaluation Checklist

If you answer “no” to 2 or more of these, tread cautiously.

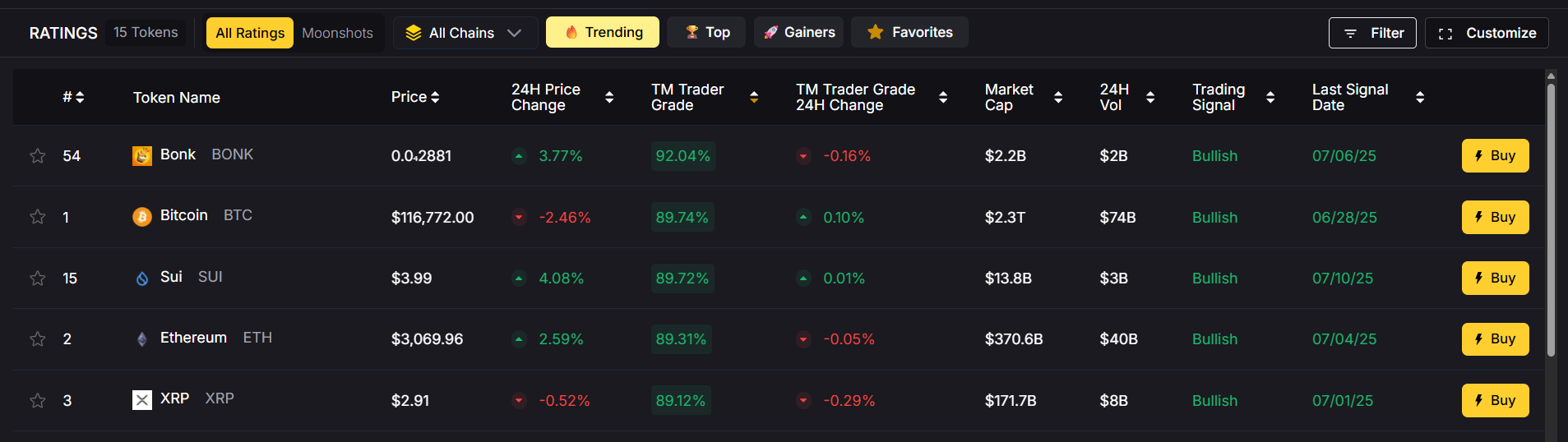

How Token Metrics Minimizes Risk Exposure

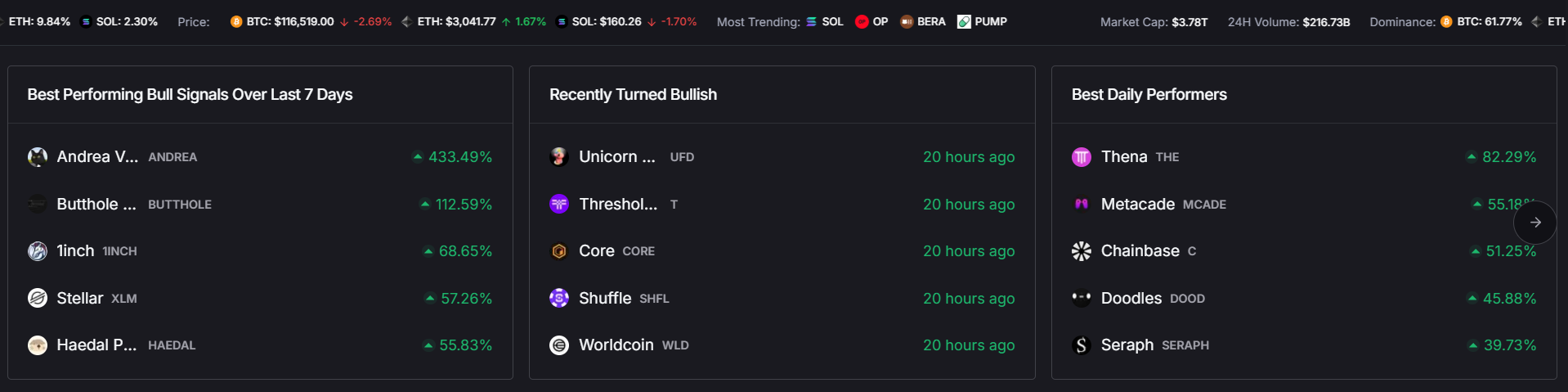

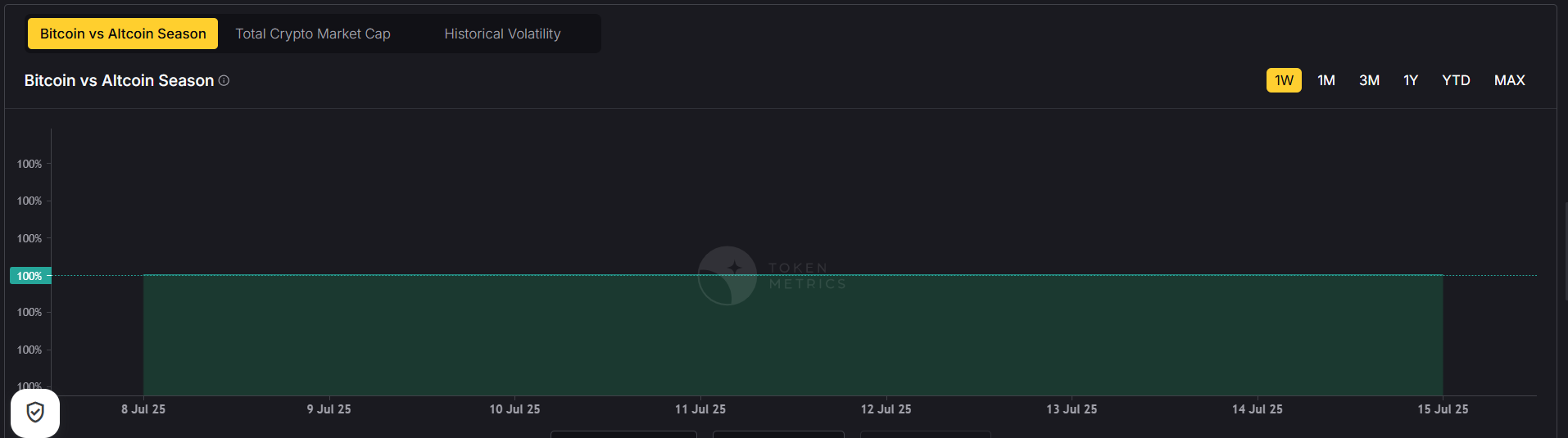

Token Metrics helps de-risk moonshots by analyzing over 80+ data points using AI and quant models:

- Risk-adjusted momentum scores

- Tokenomics evaluations

- On-chain behavior analysis

- Contract audit status

- Community health signals

- Bullish/Bearish alerts based on AI

You get a comprehensive view of upside and downside before making a decision.

Mental Models for Risky Investing

- “Play with house money” – Take profits early and only risk profits.

- “Barbell strategy” – Majority in stable assets, small % in high-risk/high-reward.

- “Expected Value (EV)” – Even if 8/10 fail, 1 big win covers losses.

- “Don’t chase losses” – Accept failures quickly and move on.

Moonshot investing is mental warfare. Stick to frameworks, not FOMO.

Final Thoughts: Risk is Inevitable — Manage It, Don’t Fear It

The path to 100x gains in crypto will always be riddled with landmines. But risk isn’t inherently bad — it’s the price of asymmetric upside. The real danger is unmanaged risk, impulsive decisions, and poor research.

With the right approach, the right tools, and a clear head, moonshot investing can be one of the most rewarding strategies in crypto.

Just remember: You only need to be right once.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.png)

.svg)

.png)