How to Buy Ethereum (ETH) Easily on Token Metrics

%201.svg)

%201.svg)

.png)

Why Buy Ethereum?

Ethereum (ETH) is more than just a cryptocurrency—it's the backbone of decentralized finance (DeFi), NFTs, and smart contract applications. As the second-largest crypto by market cap, Ethereum continues to be a top investment choice for those looking to participate in the future of blockchain technology.

Now, buying ETH has never been easier! With Token Metrics, you can research, analyze, and purchase Ethereum all in one seamless experience.

Step-by-Step Guide: How to Buy Ethereum

1. Get Started on Token Metrics

To purchase ETH, you first need to access the Token Metrics trading platform. Simply log in to your Token Metrics account and navigate to the trading section.

2. Fund Your Web3 Wallet

Before making a purchase, ensure that you have a Web3 wallet such as MetaMask or Trust Wallet. Fund your wallet with crypto or stablecoins to facilitate transactions smoothly.

3. Use AI-Powered Analysis for Smarter Investing

Before buying, leverage Token Metrics' AI trading assistant (TMAI) to get real-time technical analysis and price predictions for Ethereum. Our AI-driven insights help you make informed decisions based on market trends and signals.

4. Buy Ethereum Seamlessly

Once you've reviewed Ethereum's performance, you can execute your trade directly on Token Metrics—no need to switch between multiple apps or exchanges. Simply enter the amount of ETH you want to purchase and confirm your transaction.

5. Securely Store Your ETH

After purchasing Ethereum, you can store it in your Web3 wallet for easy access or transfer it to a hardware wallet for added security.

Why Buy Ethereum on Token Metrics?

- One-Stop Platform: Research, analyze, and invest—all in one place.

- AI-Powered Insights: Get expert-level market analysis before purchasing.

- Secure & Easy Transactions: No need for multiple apps or exchanges—buy ETH directly on Token Metrics.

- Web3 Integration: Trade ETH effortlessly with your Web3 wallet.

Invest in Ethereum Today with Token Metrics!

Ethereum is at the forefront of blockchain innovation, and now you can buy ETH effortlessly on Token Metrics. Get started today and stay ahead in the crypto revolution!

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

What Is ETF Investing? A Complete Guide for Beginners in 2025

%201.svg)

%201.svg)

ETF investing is one of the smartest and most accessible ways to grow your wealth in 2025. With over $12 trillion in assets globally, Exchange-Traded Funds (ETFs) have become a go-to strategy for investors seeking low-cost, diversified, and flexible exposure to a wide range of markets — including stocks, bonds, commodities, and even cryptocurrencies.

In this guide, we’ll explore:

- What is ETF investing?

- How ETFs work

- Different types of ETFs

- Benefits and risks of ETF investing

- How to use platforms like Token Metrics to make better investment decisions, especially with crypto ETFs

📌 What Is ETF Investing?

ETF investing refers to buying and holding shares of an Exchange-Traded Fund (ETF) — a marketable security that tracks a collection of assets such as stocks, bonds, or digital currencies. ETFs are traded on public exchanges just like individual stocks, meaning you can buy or sell them anytime during market hours.

Unlike mutual funds, ETFs are passively managed and aim to replicate the performance of a particular index or sector. For example, the SPY ETF tracks the S&P 500, giving you exposure to 500 of the largest U.S. companies with a single investment.

🔍 How Does an ETF Work?

An ETF is managed by an investment company that holds the actual basket of assets. This company issues shares that represent fractional ownership of the entire portfolio.

Here’s how ETF investing works in practice:

- You buy ETF shares on a stock exchange through a broker (just like buying a stock).

- The ETF provider holds the underlying assets (e.g., stocks, bonds, crypto).

- You gain exposure to all assets in the fund with one transaction.

- ETF price moves with the market value of its underlying assets.

This model provides instant diversification, reducing risk and simplifying portfolio construction.

🔍 What Are the Types of ETFs?

In 2025, ETF investing is more versatile than ever. Investors can choose from a variety of ETFs depending on their risk appetite, market outlook, and investment goals.

1. Equity ETFs

Track a group of stocks, either broadly (e.g., S&P 500, Nasdaq) or thematically (e.g., AI, electric vehicles, cybersecurity).

2. Bond ETFs

Offer exposure to government or corporate bonds, ideal for income investors seeking lower volatility.

3. Commodity ETFs

Provide access to raw materials like gold, silver, oil, or agricultural goods — useful as inflation hedges.

4. Thematic ETFs

Focus on emerging trends like blockchain, green energy, Web3, or metaverse industries.

5. Crypto ETFs

New in 2025, these ETFs give regulated exposure to digital assets like Bitcoin, Ethereum, and altcoins without managing wallets or private keys.

✅ Benefits of ETF Investing

ETF investing offers many benefits for both beginners and experienced investors:

1. Diversification

One ETF share exposes you to dozens or even hundreds of assets, reducing portfolio risk.

2. Low Fees

ETFs typically have lower expense ratios (0.03%–0.75%) compared to mutual funds (1%+), allowing you to keep more of your returns.

3. Liquidity

ETFs are traded on public exchanges, so you can buy and sell throughout the day, unlike mutual funds that settle once daily.

4. Transparency

Most ETFs disclose holdings daily, so you know exactly what you own.

5. Tax Efficiency

Due to their structure, ETFs are often more tax-friendly than other pooled investment vehicles.

⚠️ Risks of ETF Investing

While ETF investing has many advantages, there are a few risks to consider:

1. Market Risk

Your ETF will rise or fall with the market it tracks. If the S&P 500 drops, so does the SPY ETF.

2. Tracking Error

An ETF may not perfectly match the index it tracks due to fees or poor asset replication.

3. Over-Concentration

Some ETFs are heavily weighted in a few assets, which can increase volatility.

4. Liquidity Risk

Smaller or niche ETFs may have lower trading volume, making it harder to exit positions quickly.

📈 What Is Crypto ETF Investing?

In 2025, crypto ETF investing has gained significant traction. Thanks to regulatory clarity in major markets like the U.S., investors can now access:

- Bitcoin spot ETFs (e.g., IBIT by BlackRock)

- Ethereum ETFs

- Altcoin basket ETFs

- Thematic ETFs focused on DeFi, NFTs, or AI crypto

These ETFs make it easier to gain exposure to crypto assets through traditional brokerages and tax-advantaged accounts — without handling the complexity of wallets or exchanges.

🤖 How Token Metrics Enhances ETF Investing

Token Metrics is an AI-powered crypto analytics and research platform that can be used alongside ETF investing, especially when evaluating or managing crypto ETF exposure.

1. AI Price Predictions

Token Metrics uses machine learning models to forecast future prices of top cryptocurrencies — helping investors anticipate ETF performance tied to those assets.

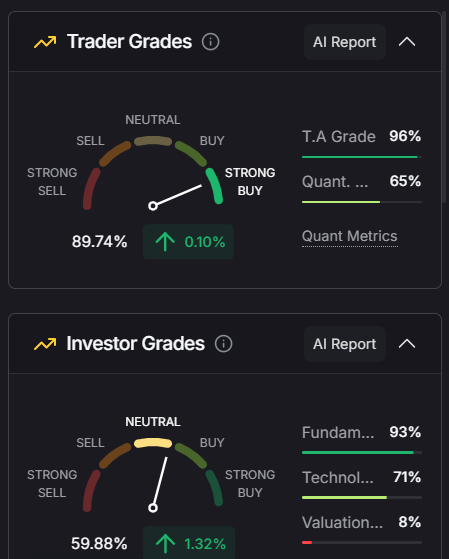

2. Trader and Investor Grades

Each token tracked by Token Metrics receives a Trader Grade (short-term signal) and Investor Grade (long-term strength), allowing users to compare underlying assets of ETFs.

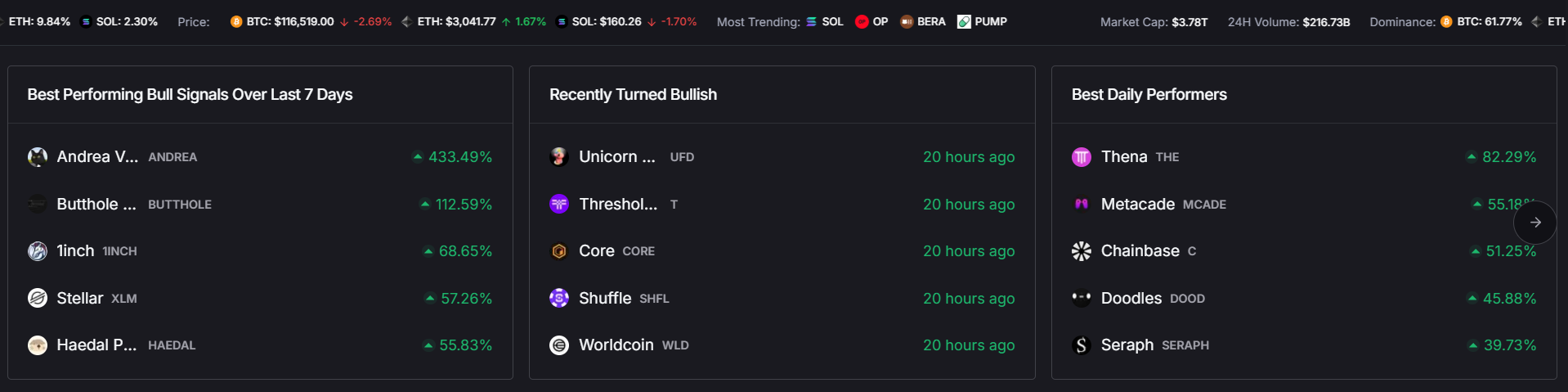

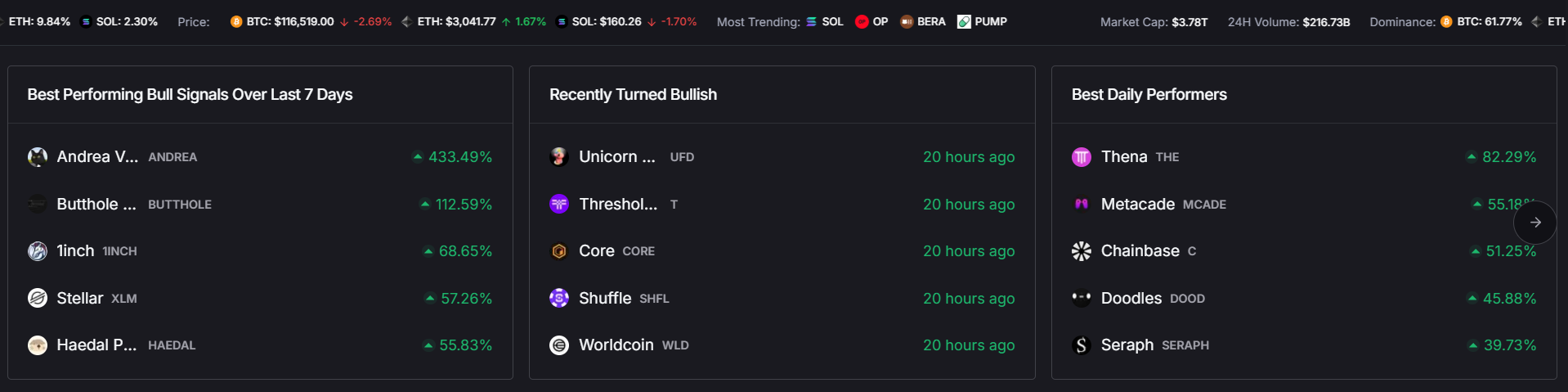

3. Real-Time Market Signals

If a crypto asset in your ETF becomes bullish or bearish, Token Metrics alerts you in real time — helping you decide whether to hold or rotate exposure.

4. Portfolio Tracking

You can sync your wallet or exchange accounts and use Token Metrics to monitor how ETF-related tokens are performing in your overall crypto portfolio.

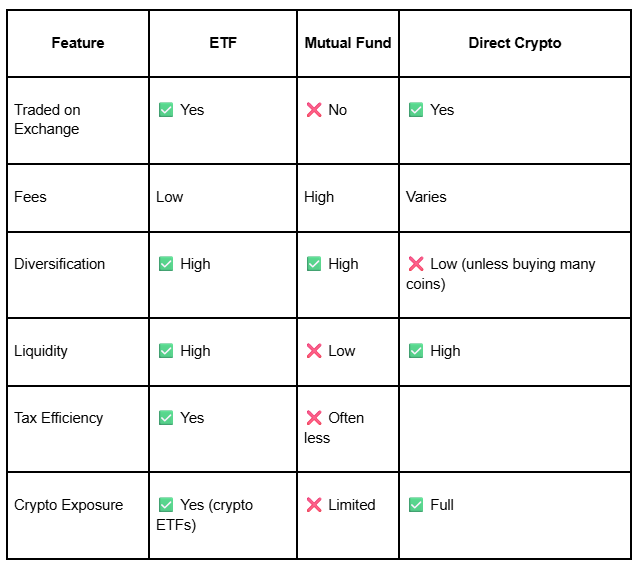

💬 ETF Investing vs. Mutual Funds vs. Crypto

For most retail investors in 2025, ETF investing offers the best balance between simplicity, diversification, and risk management — especially when paired with tools like Token Metrics.

🧠 Final Thoughts

ETF investing is one of the most powerful tools for building long-term wealth in today’s fast-moving markets. It provides instant access to diversified portfolios across traditional and emerging sectors — including cryptocurrency.

By combining ETF investing with AI-powered insights from Token Metrics, you gain an edge in identifying opportunities, managing risk, and adapting your strategy as markets evolve.

Whether you're buying your first ETF or exploring the future of finance through crypto ETFs, now is the perfect time to put ETF investing at the core of your portfolio strategy.

.png)

What Is an ETF Fund? A Beginner’s Guide to Exchange-Traded Funds in 2025

%201.svg)

%201.svg)

ETF funds, or Exchange-Traded Funds, have revolutionized investing for both retail and institutional investors. In 2025, ETF funds are more popular than ever—offering a simple, low-cost, and diversified way to invest in everything from tech stocks to cryptocurrencies. But what exactly is an ETF fund, and why is it such a powerful investment tool?

In this article, we’ll explain:

- What is an ETF fund?

- How ETF funds work

- Types of ETFs (including crypto ETFs)

- Key benefits and risks

- How Token Metrics, an AI-powered platform, helps you make better ETF investment decisions

Let’s dive in.

📌 What Is an ETF Fund?

An ETF fund (Exchange-Traded Fund) is a type of investment fund that holds a basket of securities—such as stocks, bonds, commodities, or cryptocurrencies—and is traded on a stock exchange, just like individual stocks.

When you buy a share of an ETF fund, you are buying partial ownership of that entire portfolio of assets. This gives you instant diversification without having to purchase each asset individually.

For example, an ETF fund that tracks the S&P 500 allows you to invest in 500 of the largest U.S. companies with just one purchase.

🔍 How Does an ETF Fund Work?

ETF funds are created by financial institutions called fund sponsors (like BlackRock, Fidelity, or Vanguard). These sponsors select and manage a portfolio of underlying assets and list the ETF shares on stock exchanges.

Here's how it works:

- Creation – The sponsor assembles a portfolio and forms an ETF.

- Listing – Shares of the ETF are listed and traded on exchanges like NYSE or Nasdaq.

- Buying/Selling – Investors buy and sell ETF shares throughout the day at market prices.

- Price Movement – The price of an ETF share fluctuates based on the value of its underlying assets and market demand.

ETF prices are influenced by a combination of Net Asset Value (NAV) and real-time market supply/demand.

🧩 Types of ETF Funds

In 2025, investors have access to a wide variety of ETF funds based on asset classes, strategies, and markets.

1. Stock ETFs

Track specific sectors (e.g., tech, healthcare), regions (e.g., U.S., Europe), or indices (e.g., S&P 500, NASDAQ-100).

2. Bond ETFs

Provide exposure to government, municipal, or corporate bonds with varying durations and yields.

3. Commodity ETFs

Track physical commodities like gold, silver, oil, or agricultural products.

4. Thematic ETFs

Focus on emerging trends or industries like artificial intelligence, clean energy, space exploration, or blockchain.

5. Crypto ETFs (New in 2025)

Give exposure to digital assets such as Bitcoin, Ethereum, and DeFi tokens—without requiring direct crypto ownership.

💥 What Are Crypto ETF Funds?

In 2025, crypto ETF funds are among the fastest-growing segments in the market. They offer secure, regulated access to cryptocurrencies via traditional brokerages.

Crypto ETFs include:

- Spot ETFs: Hold actual crypto assets like Bitcoin or Ethereum.

- Futures ETFs: Track prices of crypto futures contracts.

- Basket ETFs: Combine multiple crypto assets or themes, like DeFi or Web3.

These ETFs have made it easier for both institutions and retail investors to gain exposure to crypto without managing wallets, keys, or exchanges.

✅ Benefits of Investing in ETF Funds

ETF funds offer several advantages for investors in 2025:

1. Diversification

With just one purchase, you gain exposure to a broad portfolio of assets—reducing risk.

2. Liquidity

ETFs trade on exchanges all day, allowing you to buy or sell quickly at market prices.

3. Low Cost

Most ETFs have expense ratios under 0.20%, much lower than actively managed mutual funds.

4. Transparency

Most ETF funds disclose their holdings daily, so you always know what you’re investing in.

5. Tax Efficiency

Due to their structure, ETFs are generally more tax-efficient than mutual funds.

⚠️ Risks of ETF Funds

Like all investments, ETF funds come with risks:

1. Market Risk

If the market or sector an ETF tracks declines, your investment will also lose value.

2. Liquidity Risk

Some ETFs, especially niche or low-volume ones, can have wider spreads and lower liquidity.

3. Tracking Error

An ETF may not perfectly track the performance of its underlying index due to fees, slippage, or poor replication.

4. Over-Concentration

Some thematic ETFs may be overly concentrated in a few assets, increasing volatility.

🤖 How Token Metrics Enhances ETF Investing with AI

Token Metrics is an AI-powered crypto analytics and trading platform that helps investors research, evaluate, and make smarter decisions—including with crypto ETFs.

Here’s how Token Metrics helps you get ahead:

🔎 1. AI-Powered Ratings

Token Metrics uses advanced AI models to assign Investor Grades and Trader Grades to crypto assets, helping you identify the strongest performers—often held by top ETFs.

📊 2. Predictive Price Forecasts

Get forward-looking price predictions on Bitcoin, Ethereum, and other assets held in ETFs—so you can assess whether an ETF is likely to appreciate.

📈 3. On-Chain + ETF Inflow Analysis

Token Metrics tracks real-time ETF inflows, exchange reserves, and on-chain data, giving you insight into supply-demand dynamics that move prices.

🔔 4. Smart Alerts

Set alerts for key changes in asset ratings, prices, or bullish/bearish signals to stay informed on ETF-related opportunities.

By combining ETF investing with Token Metrics insights, you position yourself ahead of market trends and optimize your portfolio performance.

📈 Popular ETF Funds in 2025

Here are some high-performing ETF funds in traditional and crypto markets:

🧠 Final Thoughts

ETF funds are one of the most efficient and flexible ways to build a diversified investment portfolio in 2025. Whether you're targeting long-term growth, passive income, or exposure to emerging markets like crypto—ETF funds offer a secure, low-cost, and easy-to-use investment solution.

And with the rise of crypto ETF funds, platforms like Token Metrics are critical in helping investors evaluate opportunities, manage risk, and time the market using AI.

Whether you're a seasoned investor or just getting started, combining ETF investing with AI-powered insights gives you the edge in today's rapidly evolving financial landscape.

Best Crypto Software Wallets for July 2025

%201.svg)

%201.svg)

And How Token Metrics Lets You Trade Securely With Any Wallet

Cryptocurrency adoption continues to rise in 2025, and with it, the demand for secure, user-friendly, and feature-rich crypto software wallets. Whether you're storing Bitcoin, trading Ethereum, or experimenting with altcoins, having a reliable wallet is the foundation of safe crypto ownership.

This guide ranks the top crypto software wallets of July 2025 across different categories, from best security to best for mobile use. We also explore how Token Metrics, the leading AI crypto trading platform, allows users to connect any of these wallets via an encrypted channel—giving you access to powerful AI-driven tools while retaining full custody of your assets.

🔐 What Is a Crypto Software Wallet?

A crypto software wallet is a digital application that stores your private keys and enables you to send, receive, and manage cryptocurrencies. These wallets can be hot (internet-connected) or cold (offline) and often come with trading, staking, and asset management tools. The best wallets balance security, usability, and functionality—and increasingly, they integrate with platforms like Token Metrics to enable AI-powered trading without giving up control of your assets.

🏆 Top Crypto Software Wallets – July 2025

1. Zengo – Best for Security

- Supported Cryptos: 380

- Hot or Cold: Hot Wallet

- Cost: $129.99/year or $19.99/month

- Hardware Wallet Support: ❌

Zengo tops the list for users prioritizing wallet security. With no reported wallet hacks and weekly software updates, Zengo protects over 1.5 million users globally. It also supports buying, selling, and staking, making it ideal for long-term holders.

Pros:

✔️ Industry-leading security measures

✔️ Staking and fiat funding options

✔️ Encrypted backup and biometric authentication

Cons:

❌ Premium pricing

❌ No hardware wallet compatibility

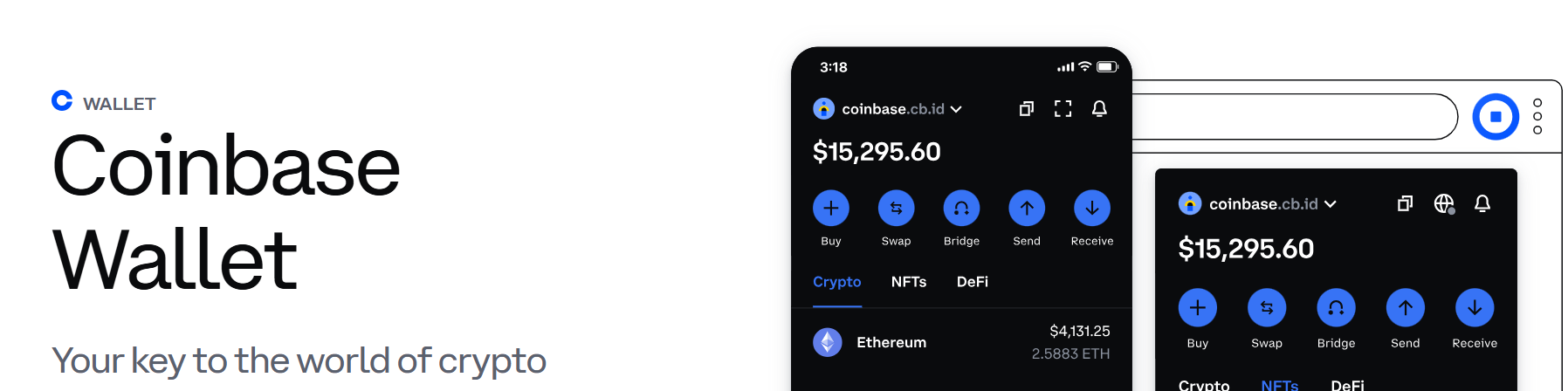

2. Coinbase Wallet – Best for Beginners & Low Costs

- Support Cryptos: 5,500

- Hot or Cold: Hot Wallet

- Cost: Free

- Hardware Wallet Support: Partial (via Ledger transfer)

Coinbase Wallet is perfect for newcomers. It’s intuitive, completely free to use, and connects seamlessly to the larger Coinbase ecosystem. Users can access over 5,500 tokens and learn the ropes through its built-in educational resources.

Pros:

✔️ Beginner-friendly UI

✔️ Massive token support

✔️ Customizable network fees

Cons:

❌ Code not open source

❌ No address rotation

❌ Doesn’t fully support hardware wallets

3. Exodus – Best for Mobile

- Supported Cryptos: 281

- Hot or Cold: Hot Wallet

- Cost: Free

- Hardware Wallet Support: ✅ (Trezor)

Exodus excels on mobile with sleek design and robust functionality. It allows users to buy, sell, stake, and swap directly on their mobile device and integrates with Trezor hardware wallets for additional security.

Pros:

✔️ Cross-platform (desktop, browser, mobile)

✔️ Built-in portfolio tracking

✔️ Trezor integration

Cons:

❌ No in-house exchange

❌ Email-only support

❌ Not open source

4. Electrum – Best for Bitcoin

- Supported Cryptos: Bitcoin Only

- Hot or Cold: Both

- Cost: Free

- Hardware Wallet Support: ✅

A trusted wallet since Bitcoin’s early days, Electrum is ideal for Bitcoin maximalists. It’s lightweight, fast, and secure, with deep customization options for advanced users.

Pros:

✔️ High performance for BTC

✔️ Cold storage compatible

✔️ Open-source and auditable

Cons:

❌ No support for altcoins

❌ Not user-friendly for beginners

❌ No staking or DeFi features

5. MetaMask – Best for Ethereum

- Supported Cryptos: 300+ (ETH & ERC-20)

- Hot or Cold: Both

- Cost: Free

- Hardware Wallet Support: ✅

For Ethereum users, MetaMask is the go-to wallet. It enables DeFi, NFTs, and Web3 access with ease. It supports both hot and cold storage and integrates with platforms like OpenSea, Uniswap, and now, Token Metrics.

Pros:

✔️ Built for Ethereum ecosystem

✔️ DeFi-ready

✔️ Cold wallet compatible

Cons:

❌ No Bitcoin support

❌ Limited customer support

❌ Doesn’t rotate addresses automatically

🔍 How Token Metrics Works with Your Crypto Wallet

Token Metrics is not a wallet, exchange, or custodian—it’s an AI-driven crypto research and trading platform. But it seamlessly integrates with your preferred wallet using secure, encrypted wallet connections.

🔐 Secure Wallet Integration

Token Metrics allows users to connect wallets like MetaMask, Coinbase Wallet, Trust Wallet, or any Web3-compatible wallet using industry-standard encryption. You never deposit funds on the platform—instead, you retain full control over your crypto while accessing:

- AI-generated trading signals

- Real-time price predictions

- Altcoin Moonshot picks

- Portfolio rebalancing tools

- Custom alerts and automation

🛡️ Why It Matters:

With so many platforms requiring you to deposit crypto into centralized accounts, Token Metrics stands apart by offering non-custodial AI-powered trading. You keep your assets in your chosen wallet while using advanced tools that would normally be reserved for hedge funds or trading desks.

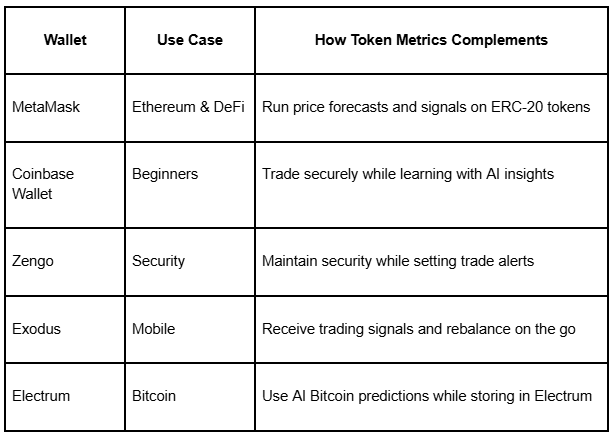

💡 Why Token Metrics + Top Wallets = The Perfect Pair

🚨 A Word of Caution

Crypto is a volatile and speculative market. Even with the best wallet and the most advanced AI platform, there are risks. Always use two-factor authentication, avoid phishing attempts, and never share your seed phrase.

🏁 Final Thoughts

Choosing the best crypto software wallet in July 2025 depends on your priorities: security, mobility, beginner-friendliness, or asset specialization. But if you want to take things further, pairing your wallet with Token Metrics’ AI research and trading tools is the smartest way to stay ahead.

Whether you’re holding Bitcoin in Electrum or swapping altcoins via MetaMask, Token Metrics helps you trade smarter, not harder, without compromising the safety of your assets.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)