How to Buy Ethereum (ETH) Easily on Token Metrics

%201.svg)

%201.svg)

.png)

Why Buy Ethereum?

Ethereum (ETH) is more than just a cryptocurrency—it's the backbone of decentralized finance (DeFi), NFTs, and smart contract applications. As the second-largest crypto by market cap, Ethereum continues to be a top investment choice for those looking to participate in the future of blockchain technology.

Now, buying ETH has never been easier! With Token Metrics, you can research, analyze, and purchase Ethereum all in one seamless experience.

Step-by-Step Guide: How to Buy Ethereum

1. Get Started on Token Metrics

To purchase ETH, you first need to access the Token Metrics trading platform. Simply log in to your Token Metrics account and navigate to the trading section.

2. Fund Your Web3 Wallet

Before making a purchase, ensure that you have a Web3 wallet such as MetaMask or Trust Wallet. Fund your wallet with crypto or stablecoins to facilitate transactions smoothly.

3. Use AI-Powered Analysis for Smarter Investing

Before buying, leverage Token Metrics' AI trading assistant (TMAI) to get real-time technical analysis and price predictions for Ethereum. Our AI-driven insights help you make informed decisions based on market trends and signals.

4. Buy Ethereum Seamlessly

Once you've reviewed Ethereum's performance, you can execute your trade directly on Token Metrics—no need to switch between multiple apps or exchanges. Simply enter the amount of ETH you want to purchase and confirm your transaction.

5. Securely Store Your ETH

After purchasing Ethereum, you can store it in your Web3 wallet for easy access or transfer it to a hardware wallet for added security.

Why Buy Ethereum on Token Metrics?

- One-Stop Platform: Research, analyze, and invest—all in one place.

- AI-Powered Insights: Get expert-level market analysis before purchasing.

- Secure & Easy Transactions: No need for multiple apps or exchanges—buy ETH directly on Token Metrics.

- Web3 Integration: Trade ETH effortlessly with your Web3 wallet.

Invest in Ethereum Today with Token Metrics!

Ethereum is at the forefront of blockchain innovation, and now you can buy ETH effortlessly on Token Metrics. Get started today and stay ahead in the crypto revolution!

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

Can I Make Money by Investing in Crypto Indices? What You Need to Know in 2025

%201.svg)

%201.svg)

One of the most common questions in crypto investing today is: “Can I actually make money with a crypto index?” The short answer is yes—but like any investment, your success depends on the market, your strategy, and the type of index you choose.

In 2025, crypto indices have become one of the most popular ways to invest, especially for people who want exposure to digital assets without actively trading. Whether you’re using a passive index to track the top 10 cryptocurrencies or an AI-powered index that rotates between bullish tokens, the potential for profit is real.

This article explores how crypto indices generate returns, how much money you can make, and what you need to know before diving in.

What Is a Crypto Index?

A crypto index is a bundle of cryptocurrencies grouped together into one investment product. The index can track:

- Top coins by market cap (e.g., BTC, ETH, SOL)

- A specific theme (e.g., DeFi, Memecoins, AI)

- A strategy (e.g., trend-following, momentum)

- Signals generated by AI (e.g., Token Metrics AI Indices)

Investors can gain exposure to multiple tokens through a single purchase—and benefit from automatic rebalancing, diversification, and sometimes even active risk management.

How Do You Make Money With Crypto Indices?

There are three primary ways to earn returns from crypto index investing:

✅ 1. Capital Appreciation

When the tokens in your index increase in value, the overall index value rises—and so does your investment.

Example:

If the AI sector pumps and your AI Tokens Index includes FET, AGIX, and TAO, you benefit from their combined price growth—even if you didn’t pick the best-performing token individually.

✅ 2. Rebalancing Gains

Rebalancing can lock in profits from over-performing assets and reallocate them into undervalued ones.

This helps “sell high and buy low” automatically, which can enhance long-term performance—especially in volatile markets.

Example:

If SHIB spikes and becomes 40% of a Memecoin Index, the index may sell SHIB and redistribute gains into PEPE or WIF—helping you capture profits before a correction.

✅ 3. AI Signal Performance (for AI Indices)

AI-powered indices don’t just hold and rebalance—they use real-time signals to actively manage exposure.

This can include:

- Exiting underperforming or risky tokens

- Increasing allocation to trending assets

- Moving capital into stablecoins in bearish conditions

These dynamic strategies often outperform static indices, especially during market uncertainty.

How Much Can You Make?

This depends on several factors:

📊 1. Market Conditions

- In bull markets, most indices generate strong returns

- In sideways markets, AI indices typically outperform

- In bear markets, passive indices may suffer unless they include stablecoin buffers

📈 2. Type of Index

- AI indices tend to generate higher returns due to active management

- Passive indices offer more stable, long-term gains

💼 3. Your Strategy

- Compounding small gains over time leads to powerful results

- Reinvesting or auto-DCA into indices amplifies returns

Pros of Making Money with Crypto Indices

- ✅ Don’t need to time individual token pumps

- ✅ Protection from single-token crashes

- ✅ Hands-free portfolio management

- ✅ Exposure to trends without speculation

- ✅ Smart rebalancing = better trade entries/exits

Potential Pitfalls to Watch Out For

While you can make money with crypto indices, it’s not guaranteed. Be mindful of:

⚠️ 1. Market-Wide Downturns

If the entire crypto market crashes, even diversified indices may lose value—though AI indices can reduce losses better than passive ones.

⚠️ 2. Poor Index Construction

Some indices include illiquid or low-performing tokens. Always check the index methodology.

⚠️ 3. Over-Exposure to a Single Narrative

Putting all your money in a Memecoin or AI index during a hype cycle can be risky. Diversify across index types.

How to Maximize Profits With Crypto Indices

Here are proven tips to make the most of index investing:

- Start Early – Let compounding work over time

- Use AI Indices in Volatile Markets

- Diversify Across Themes – (e.g., 40% passive, 30% AI, 30% thematic)

- Reinvest Gains – Set up auto-DCA (dollar-cost averaging)

- Monitor Platform Updates – AI logic often improves over time

- Choose Indexes With Strong Methodology – Like those from Token Metrics

Beginner-Friendly Earning Strategy

If you’re new to crypto:

- Start with a Token Metrics HODL Index (e.g., Top 10 or Top 25)

- Add a low-risk AI-powered index (e.g., RWA or DeFi)

- Avoid going all-in on trending narratives without a hedge

This gives you a balanced mix of growth and stability, with automated management.

Final Thoughts: Yes, You Can Make Money With Crypto Indices

Crypto indices—especially AI-powered ones—are a smart, strategic way to grow wealth in crypto without having to trade constantly or chase pumps.

You can earn money by:

- Capturing market-wide gains

- Letting the index rebalance for you

- Leveraging AI to rotate into outperforming assets

Platforms like Token Metrics offer some of the best-performing AI indices in 2025, designed to help you make money smarter—not harder.

So yes, you can absolutely make money by investing in crypto indices—if you choose the right ones and manage your exposure wisely.

How Do AI Crypto Indices Work? Inside the Future of Smart Investing

%201.svg)

%201.svg)

In the ever-evolving world of crypto, one thing is clear: automation and intelligence are the future. In 2025, AI-powered crypto indices are gaining traction as the most efficient, adaptive, and data-driven way to invest in digital assets. But how exactly do they work?

Unlike traditional crypto indices that follow fixed rules and rebalance on a schedule, AI indices adjust dynamically using real-time market signals, machine learning models, and smart risk management. They take the guesswork—and the emotion—out of investing.

In this article, we’ll break down what AI crypto indices are, how they function, and why they’re outperforming passive strategies in today’s market.

What Is an AI-Powered Crypto Index?

An AI-powered crypto index is a cryptocurrency investment portfolio managed by artificial intelligence. Rather than following rigid rebalancing schedules or fixed token lists, the AI actively decides:

- Which tokens to include

- How much weight to assign to each

- When to buy, hold, or sell

- Whether to move into stablecoins during market downturns

These decisions are made using a wide range of data inputs, processed through advanced algorithms and predictive models.

The Core Components of AI Crypto Indices

Let’s look under the hood. Here’s how AI-powered indices operate behind the scenes:

1. Data Collection

AI indices analyze vast amounts of crypto market data from multiple sources, including:

- Price Action: Trends, volatility, momentum

- Volume & Liquidity: How much is being traded and where

- Social Sentiment: Mentions on Twitter, Reddit, Telegram, and news

- Technical Indicators: RSI, MACD, moving averages, Bollinger Bands

- On-Chain Metrics: Wallet activity, inflows/outflows, network usage

- Macro Signals: Fed policy, global economic news, BTC dominance

This multi-dimensional data stack forms the foundation of the AI’s decision-making process.

2. Signal Generation

Using the data, the AI identifies bullish, neutral, or bearish conditions for each token under consideration.

It may use:

- Machine learning classifiers

- Neural networks trained on historical data

- Natural language processing (NLP) to assess sentiment

The goal is to forecast short- to mid-term performance potential of each asset in the index.

3. Portfolio Allocation Logic

Once signals are generated, the AI engine builds the portfolio:

- Include bullish tokens

- Exclude bearish or sideways tokens

- Adjust weights based on conviction

- Cap exposure to volatile or illiquid assets

- Shift into stablecoins if overall risk is high

This process replaces traditional “Top 10 Market Cap” logic with data-informed positioning.

4. Rebalancing & Execution

AI indices typically rebalance on a weekly or as-needed basis—far more responsive than quarterly rebalancing in passive indices.

Rebalancing involves:

- Selling underperforming assets

- Increasing exposure to trending tokens

- Reducing concentration risk

- Locking in profits by trimming over-extended positions

Execution may be simulated (in research products) or actual (for tokenized index platforms or connected wallets).

Real-World Example: Token Metrics AI Indices

Token Metrics is a leader in AI index technology. Their indices:

- Analyze over 80 data points per token

- Issue weekly buy/sell signals

- Rebalance portfolios based on market sentiment and momentum

Example: DeFi AI Index

- Week 1: AAVE, LDO, RUNE get bullish signals → added to the index

- Week 2: LDO signal turns bearish → replaced by GMX

- Week 3: Broad DeFi market looks weak → 30% of portfolio shifted into USDC

This approach ensures the portfolio actively adapts to changing market conditions without user intervention.

Benefits of AI-Powered Indices

✅ Smarter Risk Management

Exit early during downturns, move into stablecoins, avoid overexposure.

✅ Better Timing

Capture gains earlier by entering tokens before trend exhaustion.

✅ Emotion-Free Investing

No panic selling or FOMO buying—just data-driven decisions.

✅ Automation at Scale

Ideal for passive investors who want active performance.

✅ Competitive Performance

Outperformed passive indices in 2024–2025 due to faster reaction times and smarter rebalancing.

AI vs. Passive Crypto Indices

Are AI Crypto Indices Safe?

While no crypto investment is “safe,” AI indices help reduce risk compared to manual investing or passive index strategies by:

- Avoiding weak tokens

- Reducing exposure in downturns

- Allocating capital to strong-performing assets

This makes them a compelling choice for both beginners and advanced investors looking for automated performance optimization.

Common Misconceptions

❌ "AI indices are just hype."

Wrong. Real AI indices use trained models and live market data—not just price trends—to make decisions.

❌ "They’re only for pros."

Most platforms now offer user-friendly AI indices that are fully automated and beginner-friendly.

❌ "They’re too risky."

While aggressive AI indices exist (e.g., Memecoins), many offer conservative modes with stablecoin rotation and low-volatility token selection.

Who Should Use AI-Powered Indices?

- Busy Professionals – Want hands-off performance

- Trend Traders – Prefer smart auto-rebalancing

- Beginners – Need risk-managed crypto exposure

- Wealth Builders – Looking for alpha over time

Final Thoughts: AI Indices Are the Future of Crypto Investing

AI-powered crypto indices bring hedge-fund-level sophistication to individual investors. With intelligent signal generation, data-driven risk management, and weekly rebalancing, these indices outperform traditional strategies—especially in volatile markets.

Whether you want to follow the hottest trends, avoid losses during bear markets, or simply invest smarter, AI indices offer an automated and strategic approach to growing your crypto portfolio.

Platforms like Token Metrics lead this space with real-time AI signal engines, offering performance-optimized indices across Memecoins, DeFi, AI tokens, RWAs, and more.

Can AI or Data Tools Help Identify Moonshots?

%201.svg)

%201.svg)

From Hype to Science — The Role of AI in Finding Moonshots

In the past, finding a 100x moonshot often meant trolling crypto Twitter threads, scanning Discord servers, or jumping into Telegram groups filled with bots and hype. But times have changed. In 2025, the smartest investors use AI and data analytics tools to uncover hidden gems before they explode.

This blog explores how AI and crypto-specific data platforms like Token Metrics are transforming moonshot discovery into a science — removing the guesswork and helping investors spot massive opportunities early.

Why Human-Only Research Isn’t Enough Anymore

With over 2 million crypto tokens and hundreds launching weekly, it’s virtually impossible to manually research everything. Retail traders are often overwhelmed, relying on gut feelings or influencer tweets.

AI levels the playing field by:

- Analyzing massive datasets at scale

- Spotting hidden patterns in price, volume, and sentiment

- Scoring tokens based on fundamentals, momentum, and risk

- Filtering out noise, scams, and pump-and-dumps

Simply put, AI sees what the human eye misses.

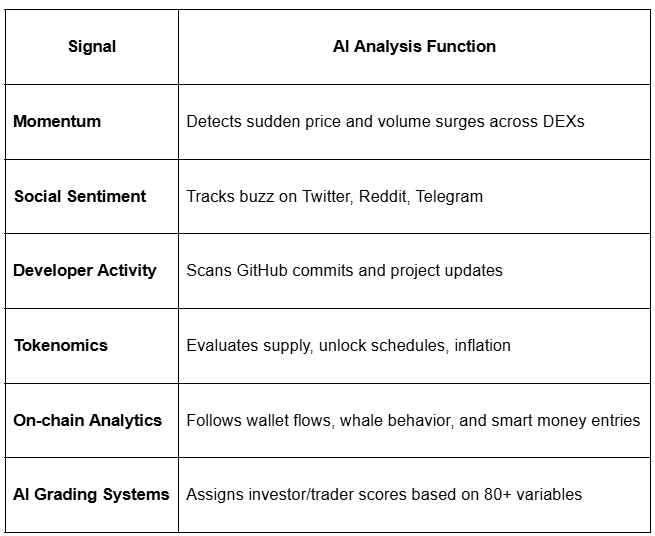

How AI Tools Detect Moonshots

AI models trained on crypto data can identify early-stage projects by analyzing:

These insights allow you to rank tokens and prioritize research efforts.

How Token Metrics AI Grades Work

Token Metrics, a pioneer in AI-driven crypto analytics, uses machine learning to generate Investor Grades, Trader Grades, and Bullish/Bearish Signals for thousands of tokens.

Here's how:

- Investor Grade – Long-term potential based on fundamentals, community, tech

- Trader Grade – Short-term potential based on price action, momentum, liquidity

- Bullish Signal – Triggered when AI detects high-probability upside within 7–14 days

- Bearish Signal – Warns of likely downturns or profit-taking zones

Moonshots that rank highly across these metrics are often early movers with breakout potential.

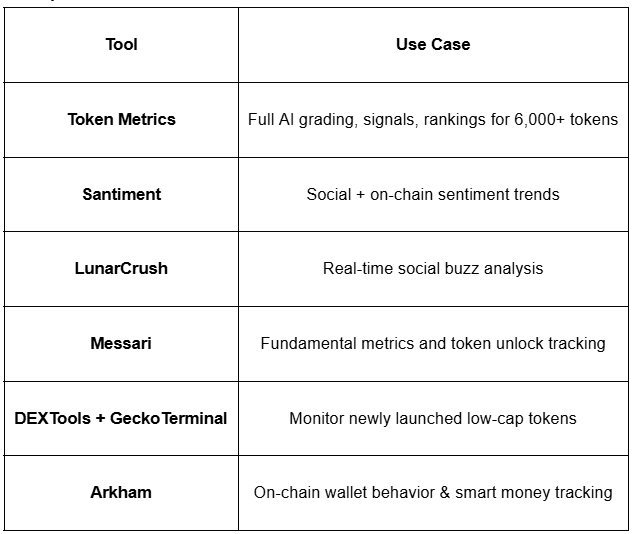

Top Tools to Find Moonshots with AI & Data

Use these tools together to spot patterns others miss.

Case Study: AI Spotting a Moonshot Early

Let’s say a low-cap AI token called NeuroLink AI launches. It’s not yet on CEXs but shows:

- Spike in GitHub commits

- Surge in Telegram growth

- 24h price up 18%, volume 400%

- Mentioned in 3 Token Metrics Bullish Signals in one week

- AI Trader Grade: 91/100

That’s a prime moonshot candidate worth further analysis — and most retail traders wouldn’t catch it until it’s up 5x.

Human + AI = The Winning Formula

AI doesn't replace human judgment — it enhances it. The best approach is:

- Use AI to scan, sort, and filter top candidates

- Manually research the top 5–10 picks

- Evaluate community, product, team, and roadmap

- Use risk metrics and technicals for entry/exit planning

This hybrid approach minimizes FOMO and maximizes precision.

Moonshot AI Checklist

Before diving in, check:

✅ High AI Trader or Investor Grade (85+)

✅ Momentum score surging

✅ Early-stage narrative (AI, DePIN, RWA, etc.)

✅ Community growth across socials

✅ Smart money inflows on-chain

✅ No major unlocks in next 30 days

If all boxes are ticked, you may have found your next 10x.

Final Thoughts: AI is the Ultimate Edge in 2025

Crypto moonshots are no longer found in meme threads and TikTok videos alone. In 2025, the best investors use AI-powered research to systematically uncover explosive opportunities before they go viral.

By leveraging platforms like Token Metrics, you turn chaos into clarity — and emotion into execution.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)