How to Buy Ethereum (ETH) Easily on Token Metrics

%201.svg)

%201.svg)

.png)

Why Buy Ethereum?

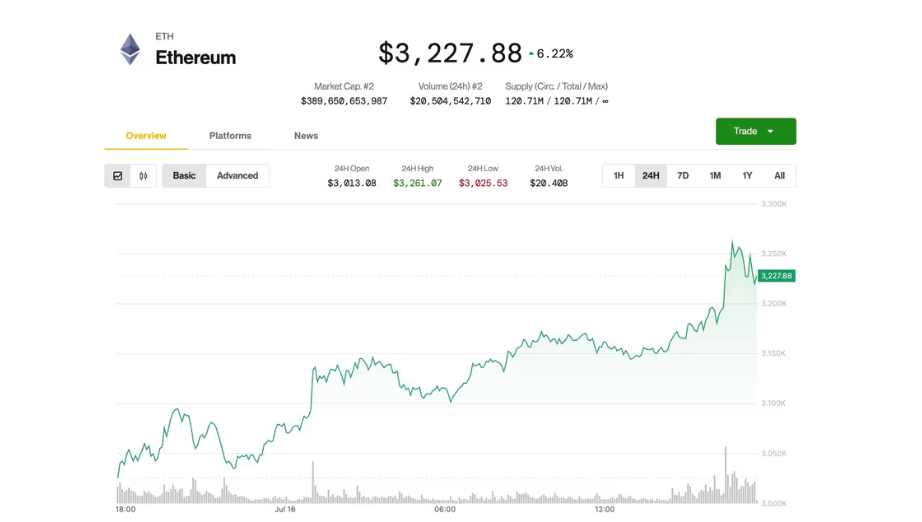

Ethereum (ETH) is more than just a cryptocurrency—it's the backbone of decentralized finance (DeFi), NFTs, and smart contract applications. As the second-largest crypto by market cap, Ethereum continues to be a top investment choice for those looking to participate in the future of blockchain technology.

Now, buying ETH has never been easier! With Token Metrics, you can research, analyze, and purchase Ethereum all in one seamless experience.

Step-by-Step Guide: How to Buy Ethereum

1. Get Started on Token Metrics

To purchase ETH, you first need to access the Token Metrics trading platform. Simply log in to your Token Metrics account and navigate to the trading section.

2. Fund Your Web3 Wallet

Before making a purchase, ensure that you have a Web3 wallet such as MetaMask or Trust Wallet. Fund your wallet with crypto or stablecoins to facilitate transactions smoothly.

3. Use AI-Powered Analysis for Smarter Investing

Before buying, leverage Token Metrics' AI trading assistant (TMAI) to get real-time technical analysis and price predictions for Ethereum. Our AI-driven insights help you make informed decisions based on market trends and signals.

4. Buy Ethereum Seamlessly

Once you've reviewed Ethereum's performance, you can execute your trade directly on Token Metrics—no need to switch between multiple apps or exchanges. Simply enter the amount of ETH you want to purchase and confirm your transaction.

5. Securely Store Your ETH

After purchasing Ethereum, you can store it in your Web3 wallet for easy access or transfer it to a hardware wallet for added security.

Why Buy Ethereum on Token Metrics?

- One-Stop Platform: Research, analyze, and invest—all in one place.

- AI-Powered Insights: Get expert-level market analysis before purchasing.

- Secure & Easy Transactions: No need for multiple apps or exchanges—buy ETH directly on Token Metrics.

- Web3 Integration: Trade ETH effortlessly with your Web3 wallet.

Invest in Ethereum Today with Token Metrics!

Ethereum is at the forefront of blockchain innovation, and now you can buy ETH effortlessly on Token Metrics. Get started today and stay ahead in the crypto revolution!

AI Agents in Minutes, Not Months

Create Your Free Token Metrics Account

.png)

Recent Posts

What is Polygon (MATIC) - How it Works, Benefits and Use Cases

%201.svg)

%201.svg)

Polygon (formerly known as Matic Network) is a protocol for building and connecting Ethereum-compatible blockchain networks. It is designed to provide faster and cheaper transactions on the Ethereum network by using side chains and an adapted version of the Plasma framework.

It also offers a wide range of:

- Smart contract solutions

- Secure identity solutions, and

- Wallet solutions.

History of Polygon (MATIC) Crypto

The history of Polygon Matic dates back to 2017 when the project was founded by Jaynti Kanani and Sandeep Nailwal. In 2021, the project took up a rebranding and went from Matic Network to Polygon. This was done in the light of reflecting a broader focus on providing infrastructure for a wide range of blockchain use cases.

With Polygon MATIC, users can easily create and manage their own decentralized applications, securely store and transfer assets, and even trade digital assets. With its powerful features and benefits, Polygon MATIC can be a great tool for you to leverage the power of the blockchain. Find out how it can benefit you in the best ways possible below.

Benefits of Polygon

Polygon MATIC has several benefits that make it a great blockchain solution. Here are a few of its top benefits that you need to be aware of:

- Scalability - Polygon MATIC has high scalability and can support millions of users and transactions. It can also scale at a very low cost. This means that it can handle high transaction volumes and can support a large user base.

- Security - Polygon MATIC is a secure platform with state-of-the-art security features. You can easily secure your data and transactions on the platform through the use of the platform’s security features.

- Wide range of services and tools - Polygon MATIC offers a wide range of services and tools that can benefit different types of users. Whether you are a developer, an individual, or a business, Polygon MATIC can help you with your decentralized applications and smart contracts.

- Cost-effective and scalable solutions - With Polygon MATIC, you can easily and cost-effectively deploy various decentralized applications. It also offers scalable solutions that can grow and evolve with your business.

Polygon Use Cases

- E-commerce and Online Retail - The Polygon MATIC blockchain can help improve e-commerce and online retail. This is because distributed ledger technology can significantly reduce the cost of transactions and make it easier for businesses to manage their supply chain.

- Supply chain management - The Polygon MATIC blockchain can also help in supply chain management. It can help track shipments and provide transparency and security across the supply chain.

- Gaming - The Polygon MATIC blockchain can help improve gaming through tokenization. It can also help gamers exchange their digital assets.

- Healthcare - The Polygon MATIC blockchain can help in healthcare by enabling secure and immutable record storage. It can also help in improving the efficiency of health-related apps and services.

- ICO and Crowdfunding - The Polygon MATIC blockchain can help improve the ICO and crowdfunding experience. It can also help in improving the tokenization process and provide transparency.

Polygon Security Features

The Polygon MATIC blockchain is a secure and reliable blockchain solution. It uses a distributed ledger technology that is decentralized and peer-to-peer. This means that there is no single point of failure and it is not controlled by a single entity. This makes it secure and reliable. When it comes to security, the Polygon MATIC blockchain has many features.

Some of these features are discussed below:

- Advanced consensus algorithms - The Polygon MATIC blockchain uses advanced consensus algorithms to verify transactions. This makes it secure and reliable. These algorithms include PBFT (Practical Byzantine Fault Tolerance), VRF (Variable Resonance), and EOS consensus.

- Strong authentication method - The Polygon MATIC blockchain has a strong authentication method that makes it difficult to hack or spoof. Even if someone is able to hack into the network, they can only hack a single node and not the entire network.

- Encrypted communication - The communication between the nodes on the Polygon MATIC blockchain is encrypted. This makes it difficult to hack or spoof.

Polygon (MATIC) Cost

The cost of using Polygon MATIC will depend on your usage. The more you use the platform, the higher the cost will be. You can also choose to outsource your needs and use Polygon MATIC as a service.

Here are a few things you should know about the Polygon MATIC cost:

- The cost of using the Polygon MATIC blockchain platform for deploying DApps is $1499.

- The cost of deploying a smart contract is $599.

- The cost of deploying wallets is $499.

- The cost of deploying an identity and security solution is $1199.

- The cost of deploying a trading platform is $1499.

Note: These prices may have changed due to change in MATIC's price.

These are the costs of using Polygon MATIC as a service. For more details on the cost, visit their website.

Polygon Crypto Alternatives

- Ethereum - Ethereum is a popular blockchain platform used for developing decentralized applications and smart contracts. It is also used for ICOs and crowdfunding.

- Hyperledger - Hyperledger is another popular blockchain platform used for developing decentralized applications and smart contracts.

- EOS - EOS is also a blockchain platform used for developing decentralized applications and smart contracts.

- Cardano - Cardano is a scalable blockchain platform that can support large volumes of transactions.

Is Polygon (MATIC) a Good Investment?

As for whether Polygon is a good investment, it's important to remember that the cryptocurrency market is highly volatile and that investing in any cryptocurrency carries a high level of risk. It's important to do your own research and carefully consider your investment options before making any decisions.

How to Buy Polygon (MATIC) Crypto?

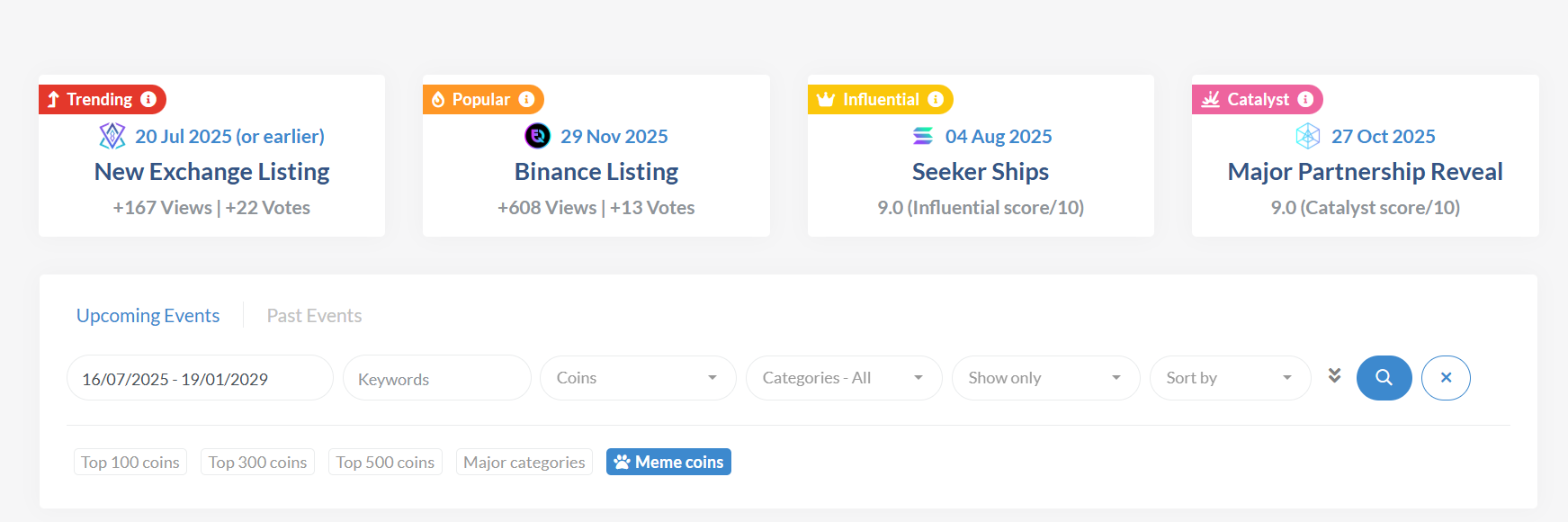

If you're interested in buying MATIC, you can do so on a number of cryptocurrency exchanges that offer it. Some popular options include Binance, Coinbase, and Kraken. Be sure to carefully compare the fees and features of different exchanges before choosing one to use. Below are the 5 simple steps that you can follow to get your own Polygon:

- Choose a Crypto Exchange Broker

- Create your account (Crypto Wallet)

- Link your Bank Account to your wallet

- Pick the Cryptocurrency you want to invest in

- Choose your storage method

Great, but, do we know where Polygon is headed in the future?

Future of Polygon (MATIC)

It's difficult to predict the future of Polygon with certainty, but the project has gained significant traction in the cryptocurrency community and has the potential to continue growing and gaining adoption in the future. However, as with any investment, it's important to be aware of the risks and to carefully consider your options before making any decisions.

The Bottom Line

Token Metrics is happy to provide you with AI-driven market updates and information regarding the crypto world but it is you who needs to be the decision maker when it comes to your crypto investments.

Polygon (formerly Matic Network) offers innovative technology that could potentially democratize blockchain through the creation of customized, interoperable networks. While it's difficult to predict the future performance of MATIC, the project has a strong team and partnerships with well-known companies.

However, as with any cryptocurrency investment, there is a high level of risk and it's important to carefully consider all options before making any decisions. Blockchain technology is still in its early stages and it may be more profitable to invest in the technology itself rather than just the hype. It's also important to exercise caution when building a cryptocurrency portfolio.

Disclaimer: The information provided on this website does not constitute investment/trading/financial advice and you should not treat any of the website’s content as such. Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. We only offer comprehensive information which may change according to time.

10 Best Indicators for Crypto Trading and Analysis in 2024

%201.svg)

%201.svg)

Your search for best crypto indicators to trade ends here. But before we start, let's briefly cover the overview of indicators.

Indicators are mathematical calculations based on the price and/or volume of an asset. They can be used to identify trends, measure volatility, and provide signals for trades.

With the help of indicators, traders can:

- Identify potential entry and exit points

- Track price movements and

- Create custom alerts to act fast

Trading View is one of the most popular platforms that offers a range of charting and analysis tools, or indicators, to help traders gain an edge in the cryptocurrency market.

Whether you are a beginner or an experienced trader, these crypto indicators can help you maximize your profits and minimize your risks.

By taking the time, one can understand how these crypto indicators work, and how you can set up your trading strategies to maximize profits accordingly.

That said, there are hundreds of pre-built indicators available, but sometimes you may want to create your own custom indicator to fit your specific crypto trading strategy.

Trading View Strategies

For Beginners - New crypto traders can benefit from the built-in trading strategies, which are readily available and are designed to help them identify trading opportunities.

For Experts - Experienced crypto traders can use Trading View to create their own trading strategies and take advantage of market trends on a deeper level.

Here at Token Metrics, we worked hard to create a Trading View Indicator that powers your trading decisions by removing emotions, saving time, and improving risk-adjusted returns.

Top 10 Crypto Trading Indicators for 2024

If you are someone looking for the best crypto trading indicators to use this year, we did the research for you.

Here are top crypto indicators you can use today.

1. Moving Averages

A moving average is a simple yet effective indicator that helps smooth out price action by filtering out noise and highlighting the overall trend. There are various types of moving averages, including simple, exponential, and weighted, each with its own characteristics and uses.

This indicator uses the average price of the stock over a specified number of periods. It is an extremely popular technical analysis tool used to identify trend direction and forecast future price movements.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that uses the speed and direction of price movements to determine the health of an asset.

3. Bollinger Bands

Bollinger Bands are one of the most trusted indicators used by traders. It is a momentum indicator that uses standard deviation to determine the price trend. The indicator includes two lines: a moving average and a standard deviation band. The moving average line acts as a trend indicator. The standard deviation band acts as a volatility indicator.

4. On-Balance-Volume (OBV)

The OBV is a volume-based indicator that reflects the relationship between price and volume. It can be used to identify buying and selling pressure, as well as potential trend changes.

5. Ichimoku Cloud

The Ichimoku Cloud, also known as the Ichimoku Kinko Hyo, is a comprehensive technical analysis tool that includes several indicators, such as the kumo (cloud), senkou span (leading span), and kijun sen (baseline). It helps identify trend direction, strength, and potential areas of support and resistance in the market.

6. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that uses the difference between two moving averages to identify buying and selling opportunities. It is often used in conjunction with the MACD histogram, which helps visualize the relationship between the MACD line and the signal line.

7. Fibonacci Retracement

Based on the work of Leonardo Fibonacci, the Fibonacci retracement tool is used to identify potential support and resistance levels by plotting horizontal lines at key Fibonacci levels. It is often used in conjunction with trend lines and other technical indicators to confirm trade signals.

8. Stochastic Oscillator

The stochastic oscillator is a momentum indicator that uses the closing price of an asset to identify overbought and oversold conditions. It is often used in conjunction with the moving average to filter out the noise and improve the accuracy of the signal.

9. Aroon Indicator

The Aroon indicator is a trend-following tool that uses the time between the highest high and the lowest low to identify the trend direction and strength. It is often used in conjunction with other technical indicators to confirm trade signals.

10. On-Chain Metrics

On-chain metrics are data points that provide insights into the underlying health and activity of a cryptocurrency or token. Examples of on-chain metrics include network value to transaction ratio (NVT), miners' revenue, daily active addresses and more.

Conclusion:

There are many indicators to help you make more money when trading cryptocurrencies. But to be certain of the price movement of an asset, is is advised to use multiple indicators to find if they're all hinting at the same outcome.

This is why we worked hard to create our own Token Metrics Trading View Indicator that takes into account multiple factors to minimze risks and maximize potential returns.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

12 Best Cryptocurrency APIs - Real-time Prices, On-Chain Crypto Data, AI Crypto Trading Signals

%201.svg)

%201.svg)

Cryptocurrencies have revolutionized the way people make payments and investments. With the rise of digital assets, Cryptocurrency APIs have become essential tools for developers to build applications that can interact with the blockchain. An API allows you to connect to a third-party service and retrieve or submit data in a standardized format to a website or application.

Token Metrics Crypto API is the best cryptocurrency API currently available. Use Token Metrics crypto API for real-time prices, on-chain data, and AI crypto trading signals from one powerful crypto API. This crypto API is built for speed and accuracy to help you trade smarter instantly.We will look into the features and advantages, discuss the different types of APIs, and learn how to use them to create powerful applications. We will also cover the pros and cons of using these APIs, and provide examples of how they can be used. Last but not least, we will discuss the pricing of these APIs and provide some best practices for using them.

Introduction to Crypto APIs

Cryptocurrency APIs are Application Programming Interfaces (APIs) that allow developers to access and integrate cryptocurrency data into their applications. APIs provide access to a variety of data such as prices, transactions, and blockchains. With the help of these APIs, developers can create powerful applications that can interact with the crypto world.

Benefits of Using Crypto APIs

The most obvious benefit of using cryptocurrency APIs is that they provide access to a wealth of data that can be used to build powerful applications. The APIs provide access to real-time data. This data can be used to create applications that can monitor the market, track transactions, and even make predictions about the future of the crypto world.

Another benefit of using cryptocurrency APIs is that they are easy to use and provide a consistent and reliable source of data. The APIs are designed to be user friendly, so developers don’t have to worry about getting bogged down in technical details. The APIs also provide reliable, up-to-date data that can be used to create accurate and reliable applications.

Cryptocurrency APIs can also save developers a lot of time and effort. Instead of having to manually gather data, developers can simply use the APIs and get the data they need. This can save developers a lot of time and effort, allowing them to focus on other aspects of their applications.

Types of Cryptocurrency APIs

There are a variety of cryptocurrency APIs available, each with its own set of features and advantages. The most common types of APIs are:

- Price APIs provide access to real-time price data for a variety of cryptocurrencies. These APIs can be used to monitor the market and make predictions about the future of the crypto world.

- Transaction APIs provide access to data about transactions that have occurred in the blockchain. This data can be used to track transactions and determine the current state of the blockchain.

- Blockchain APIs provide access to the blockchain itself. These APIs are used to interact directly with the blockchain, allowing developers to create applications that can interact with the blockchain.

List of 12 Best Cryptocurrency APIs You Can Count On

Now that we’ve discussed the benefits and types of crypto APIs, let’s look at the best APIs to get crypto data today.

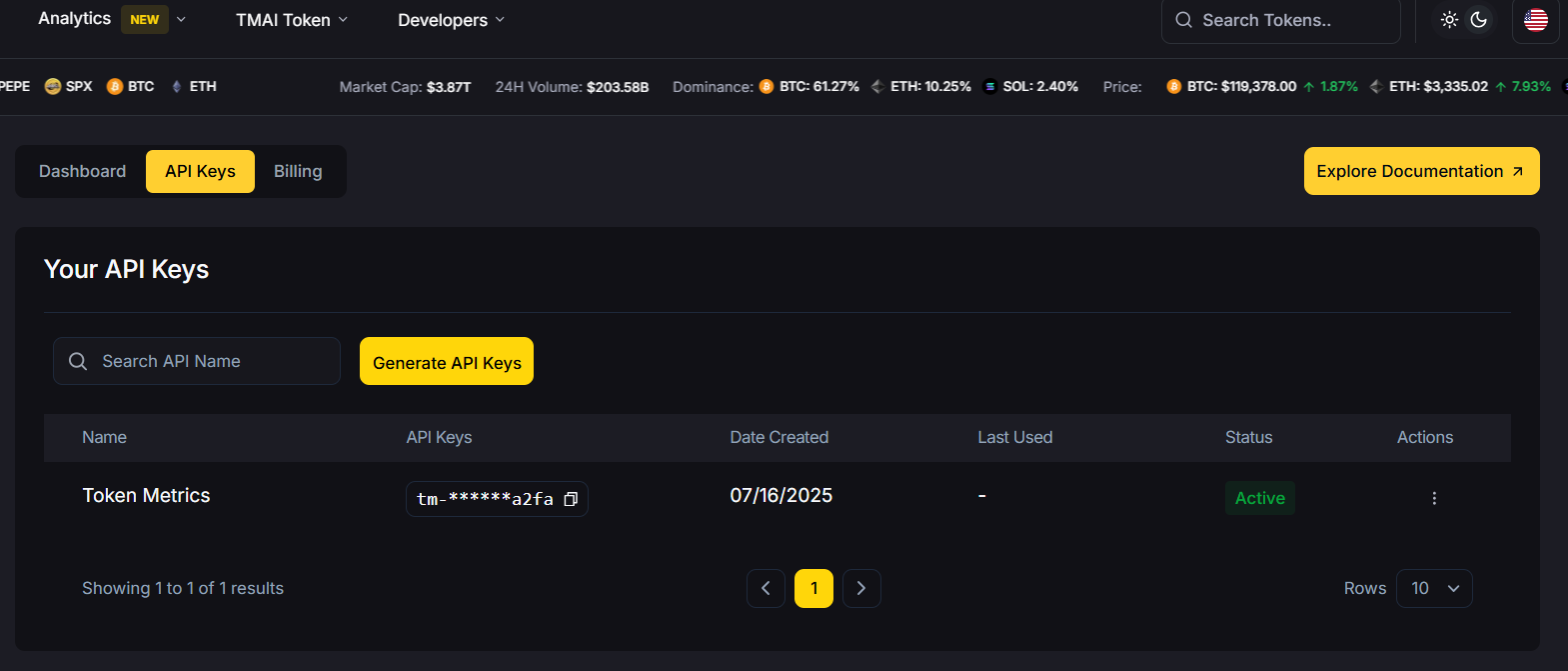

1. Token Metrics: Token Metrics crypto API offers real-time prices, on-chain data, and AI trading signals from one powerful crypto API. It is the best crypto API built for speed and accuracy to help you trade smarter instantly. Token Metrics is an AI driven platform which enables its users research thousands of cryptocurrencies in an automated way, without manually going through coins individually. Use Token Metrics crypto API for fast and most accurate crypto data.

What’s inside the $TMAI API?

✅ AI-Powered Trading Signals – Bullish and bearish calls backed by over 80 data points

✅ Real-Time Grades – Instantly assess token momentum with Trader & Investor Grades

✅ Curated Indices – Plug into ready-to-use crypto portfolios by sector or market cap

✅ Lightning-Fast Performance – Built for bots, dashboards, dApps, and next-gen trading tools

Whether you’re building a DeFi dashboard, an alpha-sniping bot, or your own crypto terminal — this is your edge.

Price: Free

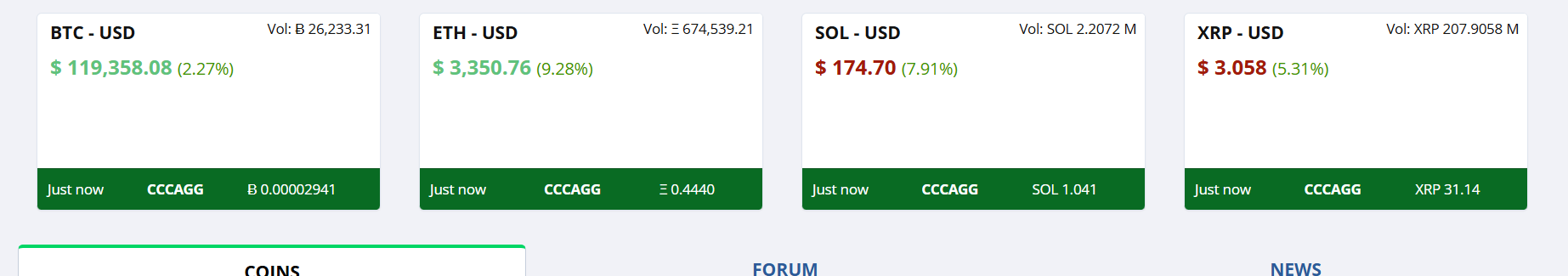

2. CoinMarketCap: CoinMarketCap offers one of the most popular APIs for retrieving real-time cryptocurrency market data, including prices, volume, and market capitalization for over 8,000 coins and tokens. It also offers endpoints for historical data and global averages.

Price Range: $0-$700 a month

3. CoinGecko: CoinGecko has an API that provides a comprehensive set of cryptocurrency data, including market data, developer activity, and community metrics for more than 10,000 coins and tokens. API is both paid and free, depending on your needs.

Price Range: Starting from $129 per month

4. CryptoCompare: CryptoCompare offers endpoints for news articles, social media activity, and mining data. It strives to find the best places to store, trade and mine cryptocurrencies.

Price Range: Free

5. BitMEX: BitMEX is a cryptocurrency derivatives exchange that provides access to real-time prices and historical data. Their API provides instant access to a variety of market data such as trading volumes and market caps.

Price & Plans: Custom

6. CoinDesk: CoinDesk is a platform for media, events, data and indices for the cryptocurrency market. CoinDesk Indices is a product of CoinDesk that offers access to cryptocurrency data with ease.

Price: Free

7. Bitstamp: Bitstamp is a cryptocurrency exchange that provides access to real-time prices and historical data. It provides premium access to crypto trading for both individuals and institutions through high liquidity, reliable order execution and constant uptime.

Price: 0.50% for those with under $10,000 in 30-day trading volume

8. CoinMarketCal: CoinMarketCal is a database of upcoming events related to cryptocurrencies, allowing you to track things like unlocks, giveaways, and more. Their API can be used to track your favourite coins.

Price: Free

9. Poloniex: Poloniex is a cryptocurrency exchange that provides access to real-time prices and historical data. The API also provides access to a variety of market data such as trading volumes and market caps.

Price: The Maker and Taker fee rates for trading USDT-collateralized perpetual contracts on Poloniex are 0.01% and 0.04% respectively, and the changes apply to all customers regardless of their trade volume.

10. Binance: Binance is one of the largest cryptocurrency exchanges and provides access to a variety of data such as prices, transactions, and blockchains. The API also allows developers to interact with the Binance platform, allowing them to buy, sell, and store cryptocurrencies.

Price: Free

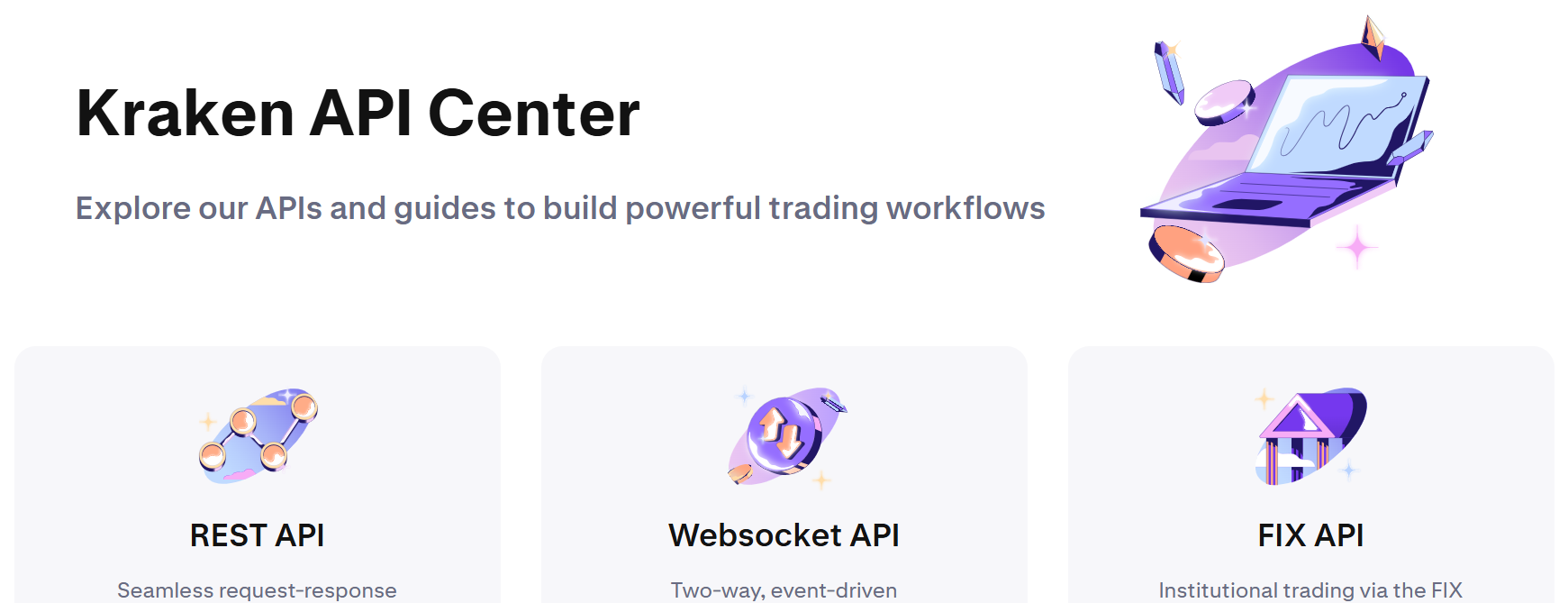

11. Kraken: Kraken is a cryptocurrency exchange and also provides access to crypto data such as prices, transactions, and blockchains. Like Binance, their API also allows you to interact with Kraken through code.

Price: 0.2-0.3% of the 30-day trade volume

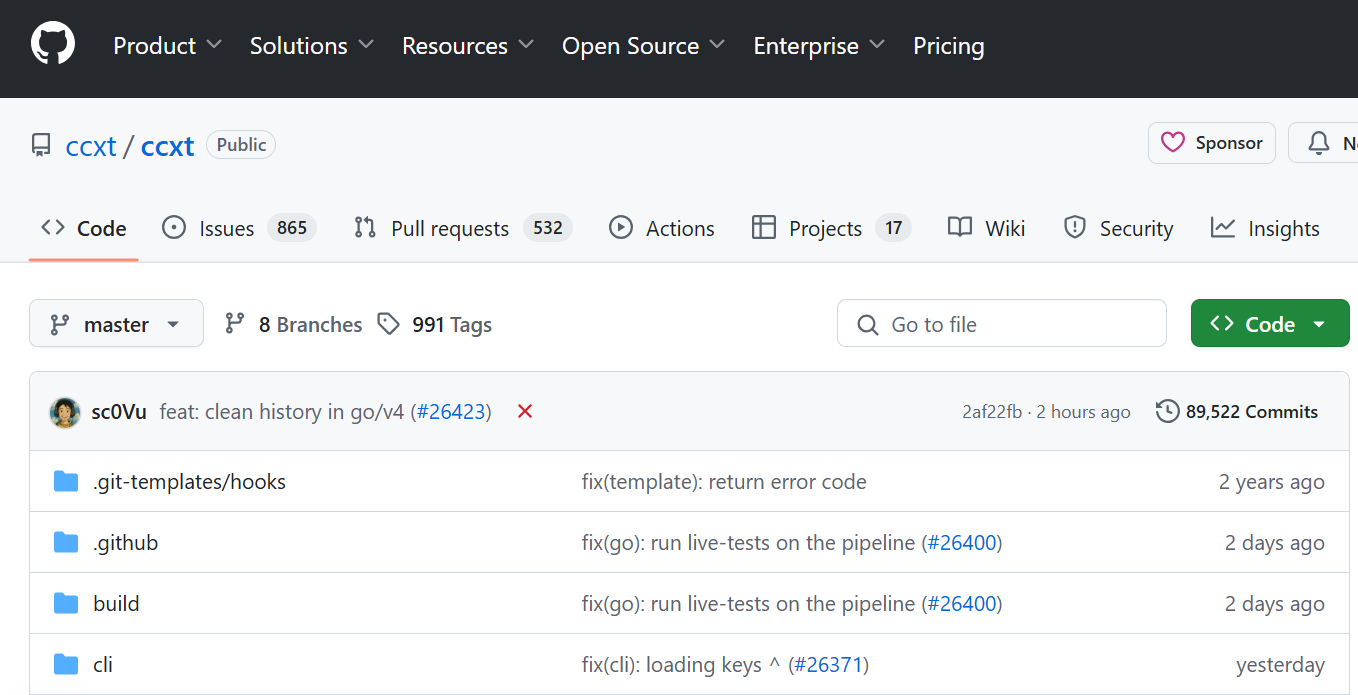

12. CCXT: CCXT is a library for cryptocurrency trading and e-commerce with support for many bitcoin/ether/altcoin exchange markets and merchant APIs.

Price: $0-$29

Note: The prices are subject to change or may have already changed.

How to Choose the Best Crypto API

Choosing the best cryptocurrency API for your application can be a daunting task. There are a variety of APIs available, each with its own set of features and advantages. So, it’s important to take the time to research the different APIs and determine which one is right for your application.

When choosing a Cryptocurrency API, it’s important to consider the features it provides.

Here are a few questions you need answers to:

- Does the API provide access to real-time price data?

- Does it provide access to the blockchain?

- Does it provide access to a variety of market data?

It’s also important to consider the pricing of the API. As mentioned above, some APIs are free, while others require a subscription fee. It’s important to consider the cost of the API and make sure it fits within your budget.

Best Practices for Using Crypto APIs

Using crypto APIs can be a great way to access data and create powerful applications. However, there are a few best practices to keep in mind when using these APIs.

- The first best practice is to make sure the API is reliable. The API you use should be up-to-date and provide accurate data.

- The second best practice is to make sure the API is secure. Make sure the API you are using is secure and provides the necessary security measures.

- The third best practice is to use the API responsibly. This API has to be used responsibly and avoid being abused.

- Finally, make sure the API is easy to use and quick to understand.

To explore our FREE Token Metrics crypto API, click here.

Get Your Brand in Front of 150,000+ Crypto Investors!

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

No Credit Card Required

Online Payment

SSL Encrypted

.png)

Products

Subscribe to Newsletter

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.

%201.svg)