10 Best Ways to Make Money with Bitcoin

Bitcoin, the pioneer cryptocurrency, has experienced a remarkable surge in value and recognition since its debut in 2009. With the global acceptance of digital currencies, many are seeking ways to capitalize on Bitcoin's potential.

To aid in this endeavor, here's a detailed guide outlining 10 impactful ways to derive profits from Bitcoin.

How to Make Money with Bitcoin?

As Bitcoin continues its meteoric rise, diverse avenues to profit from this digital gold emerge. Whether you're a seasoned trader, tech enthusiast, or a curious newcomer, there's a Bitcoin money-making method tailored for you. Dive in to explore these lucrative pathways and kickstart your crypto journey.

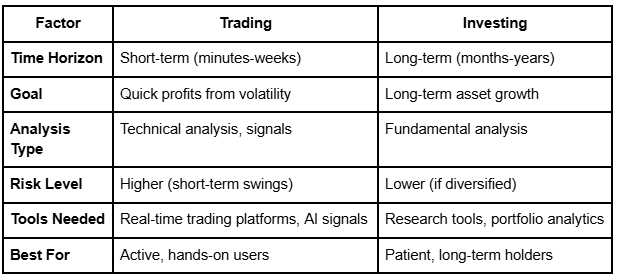

1. HODLing - The Long-Term Approach

The term 'HODL' might seem like a misspelling, but it's a deliberate term popularized within the crypto space. It stands for "Hold On for Dear Life" and represents a steadfast approach to Bitcoin investment.

HODLing isn't about chasing quick profits; it's about recognizing Bitcoin's long-term potential and resisting the urge to sell during short-term market downturns. Historically, Bitcoin has witnessed periods of volatility, but its overarching trajectory has trended upward.

HODLers often benefit from these long-term gains, demonstrating the value of patience in the dynamic crypto marketplace. If you're considering this strategy, invest only what you're prepared to keep in the game for years.

Why it works: Historical data shows that despite periodic dips, Bitcoin's overall trajectory has been upward. Long-term investors have often seen significant returns.

Actionable advice: Diversify your assets, stay informed, and cultivate a strong, patient mindset. This way, temporary market dips won't deter your long-term vision.

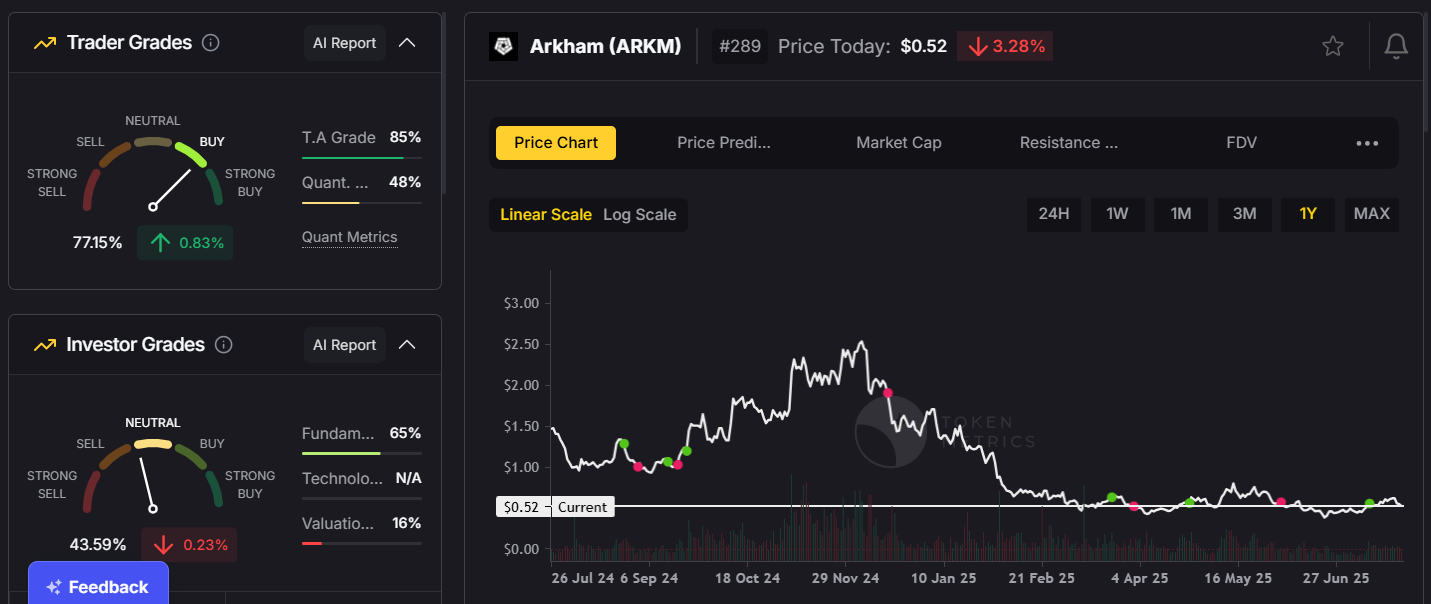

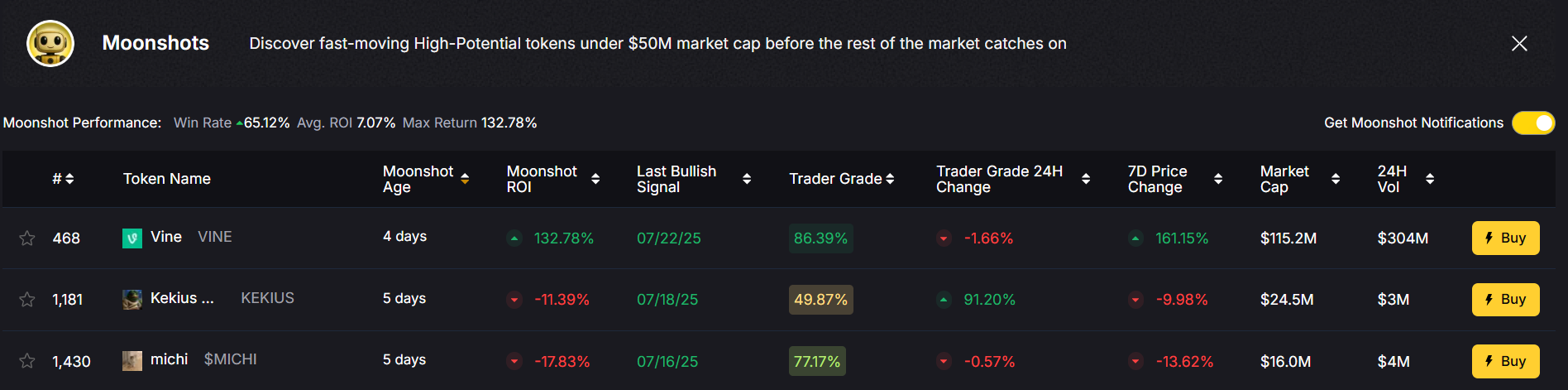

2. Day Trading - The Game of Quick Returns

Day trading in the world of Bitcoin is akin to riding the rapid currents of a vast ocean. It's the art and science of leveraging Bitcoin's frequent price fluctuations for profit.

Instead of adopting a long-term stance, day traders thrive on short-lived market movements, buying and selling Bitcoin often within hours or even minutes.

To excel in this space, one must master technical analysis, stay attuned to market news, and develop an instinct for anticipating price shifts.

A reliable cryptocurrency exchange is essential, as is setting clear, disciplined boundaries for entry and exit points. While the potential for gains is significant, it's crucial to remember that day trading also carries heightened risks. Preparedness and continuous learning are key.

Why it works: Volatility in the crypto market can lead to profitable short-term trading opportunities.

Actionable advice: Familiarize yourself with market analysis techniques, set clear entry and exit strategies, and always use a reliable cryptocurrency exchange.

3. Mining - Earning through Network Support

Mining forms the backbone of Bitcoin's decentralized network. By leveraging powerful computer hardware, miners work tirelessly to solve intricate mathematical puzzles. Successfully cracking these ensures the blockchain's transactions are validated and secure.

As a token of appreciation, the Bitcoin protocol rewards miners with freshly minted Bitcoin for every block they add. But it's not a simple gold rush; as the network grows, so does the mining complexity. Increased competition and surging energy costs have made solo endeavors less profitable.

Thus, many opt for mining pools, combining resources to enhance success rates. If diving into traditional mining feels daunting, cloud mining services offer an alternative pathway to participate in this essential Bitcoin operation.

Why it works: For every block mined, miners are rewarded with newly minted Bitcoin.

Actionable advice: Mining is no longer as profitable for individual miners due to increased competition and energy costs. Consider joining a mining pool or investing in cloud mining.

4. Bitcoin Affiliate Programs

Diving into Bitcoin affiliate programs offers a lucrative avenue for those well-versed in the crypto ecosystem. Numerous platforms seek to expand their user base by incentivizing current users to bring in newcomers.

Here's the proposition: share a unique affiliate link to potential users, and when they sign up and transact, you earn a commission in Bitcoin.

As the crypto realm burgeons, more novices seek trusted platforms, making your recommendations highly valuable. To truly flourish, align with credible platforms that offer transparent and generous reward structures.

Sharing your experiences, crafting compelling reviews, and guiding newcomers via blogs or social media can transform your affiliate endeavors from mere referrals to a steady income stream.

Why it works: With the growing interest in Bitcoin, there's a huge market of newcomers seeking reliable platforms and services.

Actionable advice: Choose reputable programs, promote your affiliate links through blogs, videos, or social media, and ensure you offer genuine value to your audience.

5. Accepting Bitcoin as Payment

In an evolving digital age, integrating Bitcoin as a payment mode showcases a business's forward-thinking approach. Embracing this decentralized currency not only caters to a tech-savvy clientele but also broadens global market reach, eliminating traditional banking barriers.

It's a move towards financial modernization, offering faster transaction times and reduced fees. However, venturing into this domain requires a bit of groundwork. Utilize established payment gateways, like BitPay or Coinbase Commerce, to streamline the process and provide a seamless experience for your customers.

And, while Bitcoin's allure is undeniable, it's prudent to stay updated on tax implications and regulatory guidelines specific to your region to ensure smooth sailing.

Why it works: It attracts a broader customer base, especially from the tech-savvy demographic.

Actionable advice: Use trusted payment gateways like BitPay or Coinbase Commerce, and always be aware of the tax implications in your jurisdiction.

6. Staking and Earning Interest

Harnessing the power of staking offers a dual advantage for Bitcoin holders: enhancing network security and earning passive income. By "staking" or locking up a portion of your Bitcoin in a cryptocurrency wallet, you support network operations and, in return, receive interest.

Think of it as a high-tech savings account. Some platforms even elevate these returns by lending staked assets, multiplying the passive income potential. It's crucial, however, to choose your staking platform wisely.

Look for established names that offer transparent terms and robust security measures. While staking is an attractive proposition, always assess lock-in periods, ensuring you have liquidity when needed.

Why it works: It's a passive way of earning additional Bitcoin on your existing holdings.

Actionable advice: Research platforms for their credibility, understand the terms, and avoid locking your funds if you anticipate needing them soon.

7. Arbitrage - Profiting from Price Differences

In the multifaceted world of crypto exchanges, price discrepancies for Bitcoin can occasionally emerge. Arbitrage traders are the eagle-eyed individuals who spot these variations and swiftly buy Bitcoin at a lower price on one exchange, only to sell it at a higher price on another.

These discrepancies arise due to factors like liquidity variations, regional demands, or transient lag in exchange rate updates. Successful arbitrage demands swift actions, given the rapidly adjusting markets.

While the concept sounds straightforward, it’s vital to factor in transaction fees and potential transfer delays. The key is a combination of vigilance, a deep understanding of multiple exchanges, and a readiness to act with precision.

Why it works: Price discrepancies exist due to localized demand, liquidity, or regulatory factors.

Actionable advice: Act quickly, consider transaction fees, and stay updated on different exchange rates.

8. Bitcoin Faucets

Bitcoin faucets serve as introductory gateways for newcomers to the crypto universe. These web platforms dispense minuscule Bitcoin amounts, often termed 'satoshis', as rewards for completing straightforward tasks, like viewing advertisements or solving captchas.

It’s a no-investment method to acquire a taste of Bitcoin. As the crypto industry burgeons, faucet platforms proliferate, enticing users with these micro-rewards. However, caution is paramount. It's vital to engage only with reputed faucets to avoid scams or excessive ad bombardments.

While earnings are typically modest, consistent engagement and referrals can accumulate into substantial sums. For those keen on a crypto journey without initial capital outlay, faucets are a viable starting point.

Why it works: It's an entry point for those looking to get a taste of Bitcoin without an initial investment.

Actionable advice: Always use trusted faucet sites, be wary of excessive ads, and never provide personal or financial details.

9. Lending Bitcoin

The crypto realm has innovatively adapted traditional lending models to suit its digital nature. By lending your Bitcoin holdings through platforms like BlockFi or Celsius, you can turn your dormant assets into consistent interest earners.

These platforms work similarly to banks, lending your Bitcoin to vetted borrowers while ensuring you get competitive returns. The allure lies in the potential to garner passive income with relatively low effort.

However, as with any financial venture, due diligence is paramount. Opt for platforms with transparent lending policies, robust security measures, and preferably, insurance options for deposited assets. This ensures you're not just earning interest but also safeguarding your principal.

Why it works: It generates passive income, much like a traditional bank savings account, but with potentially higher returns.

Actionable advice: Use reputable platforms, understand the terms of lending, and consider insurance options for larger amounts.

10. Educating and Consulting

As Bitcoin and cryptocurrency continue their ascent in global relevance, the demand for knowledgeable guides in this intricate maze intensifies. By positioning oneself as a crypto consultant or educator, one can monetize this expertise.

Whether it's conducting workshops, creating online courses, or offering one-on-one consultancy, there's a hungry audience seeking clarity. Your deep-rooted understanding can help newcomers navigate investment pitfalls, understand blockchain's nuances, or make strategic trading decisions.

While this avenue is potentially lucrative, maintaining up-to-date knowledge and ensuring impartiality in advice is paramount. By merging credibility with effective communication, consultants can carve a niche in this expanding domain.

Why it works: The increasing interest in Bitcoin means a demand for knowledgeable guides.

Actionable advice: Keep updated with the latest industry trends, offer genuine value, and establish your brand authority.

Bonus - Using a Credit Card for Bitcoin Rewards

With financial institutions adapting to crypto's rising popularity, a fresh avenue has emerged: credit cards offering Bitcoin rewards. Instead of traditional points or cashback, users earn a percentage back in Bitcoin on their purchases.

Why it works - It integrates Bitcoin acquisition into everyday spending, acting as a seamless bridge between fiat and crypto economies.

Actionable advice: Research cards with the best reward rates and lowest fees. Opt for those associated with well-known financial institutions for added security.

As you spend, monitor your Bitcoin rewards, and consider consolidating them in a secure wallet, maximizing potential appreciation. It's a subtle yet efficient method to grow your Bitcoin holdings without extra investment.

Frequently Asked Questions

Q1. Is it too late to start investing in Bitcoin?

No, the crypto market continually evolves. While Bitcoin's early days saw massive growth percentages, its long-term potential and adoption still make it an investment worth considering.

Q2. How secure is my investment in Bitcoin?

While Bitcoin uses secure blockchain technology, market volatility and potential threats from hackers mean one should always employ best security practices and diversify investments.

Q3. Do I need a lot of money to start with Bitcoin?

Not necessarily. Many platforms allow buying fractional Bitcoins, so you can start with a small amount and gradually increase your holdings.

Q4. How do I store my Bitcoin safely?

Hardware wallets like Trezor or Ledger are considered the safest. They store Bitcoin offline, reducing the risk of online hacks.

Q5. Can I earn Bitcoin without buying it?

Absolutely! Faucets, consulting, and affiliate programs are just a few ways to earn Bitcoin without making a direct purchase.

Q6. Are there taxes on Bitcoin profits?

In many countries, Bitcoin profits are taxable events. It's essential to consult with a tax professional regarding local regulations and obligations.

Q7. What if my country bans Bitcoin?

Regulatory landscapes can change. If your country bans Bitcoin, you might still retain them, but converting to fiat or using them could become challenging. Always stay updated with your country's regulations.

Q8. Can I transfer my Bitcoin to someone else?

Yes, Bitcoin is a decentralized currency, and you can send or receive it from anyone worldwide using appropriate wallet addresses.

Conclusion

Bitcoin presents a myriad of opportunities for those looking to profit in the digital currency landscape. With proper research, a solid strategy, and the application of the knowledge presented here, you can pave your way to successful Bitcoin ventures.

Remember, the crypto space is dynamic, and while opportunities abound, so do risks. Always invest time in continuous learning and risk management to maximize your Bitcoin profits.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Create Your Free Token Metrics Account

.png)

%201.svg)

%201.svg)

%201.svg)

.svg)

.png)